ValueWalk’s interview with Will Hershey, CFA, the Co-Founder and CEO of Roundhill Investments. In this interview, Will discusses his and his company’s background, the comapny’s product offerings, what is esports, how is esports better than gambling, what loot boxes are, the trends in gaming and eSports, if gaming-focused companies have an advantage, if being a “nerd” is cool in 2019, the leaders in esports, his favorite companies, relationship between big tech firms and gaming companies, if a recession impacts esports, and that the gaming industry is just getting started.

Interview with With Will Hershey

Q2 hedge fund letters, conference, scoops etc

Can you tell us about your background?

After graduating from Vanderbilt in 2011, I started my career in ETFs. As part of a small team at Yorkville ETF Advisors, I helped launch two energy ETFs, which marked the first two funds issued by Exchange Traded Concepts*. During my time there, I learned and studied what makes a successful ETF in terms of index development, capital markets, and marketing.

Thereafter, I spent 4 years as analyst and trader with Yorkville Capital Management, an MLP focused asset manager. As of early 2018, I was the Head Trader for Yorkville’s ~$125 million long / short MLP fund.

Energy – and more specifically MLPs – was a difficult place to be from 2015 onwards. Coupled with what I saw as a murky future in my role as an equity trader, I decided last year to start my own firm and move away from active management (and energy).

*For those who are unfamiliar, Exchange Traded Concepts is a white-label platform for ETFs. We currently work with ETC as the sub-advisor to the NERD ETF.

What about your firm?

After leaving my previous firm, my co-founder Tim Maloney and I formed Roundhill Investments in September 2018, with plans to operate as an ETF issuer. We believed that, despite thousands of ETFs in the market, there was room for innovation and disruption.

At Roundhill, we are focused on offering ETFs targeting themes** that appeal to the next generation of investors. Our thematic portfolios span across GICS classifications, allowing for investors to gain exposure to secular trends and technologies that they believe in. Our first product targets the esports industry – defined as competitive gaming in front of an audience. We believe in esports as the future of live media, sports, and entertainment.

We launched the Roundhill Global Esports Index on January 1, 2019. After receiving a venture investment from BITKRAFT Esports Ventures – a leading VC firm focused on gaming and esports – the Index was renamed the Roundhill BITKRAFT Esports Index. A month later, we launched the Roundhill BITKRAFT Esports & Digital Entertainment ETF on the NYSE, under the ticker symbol “NERD”.

** A few months ago, I wrote a blog post on our approach to thematic investing. You can read it here.

What products do you offer an ETF anything else?

Currently, we only offer our esports Index and respective ETF. We are considering additional structures to provide exposure – and believe there are potential alpha-generative strategies in the space – but are focused on growing AUM in the ETF for the time being.

We also plan to roll out additional thematic, index-based ETFs, and will do so as we identify markets where we can add value.

Can you explain to us what is esports?

Esports is the growing business of competitive gaming (i.e. playing video games) in front of an audience. Whereas historically we think of games being played in an arcade or at home, advances in streaming technology and online gaming have turned video games into spectator sports. People are watching others play online, on streaming platform’s like Amazon’s Twitch, as well as in person, at events like the Fortnite World Cup.

While this concept of watching others play may seem foreign to some, there are roughly 450 million esports viewers worldwide; that number is expected to reach more than 600 million by 2022.

As it currently stands, more people watch gaming and esports than HBO, ESPN, Netflix, and Hulu – combined.

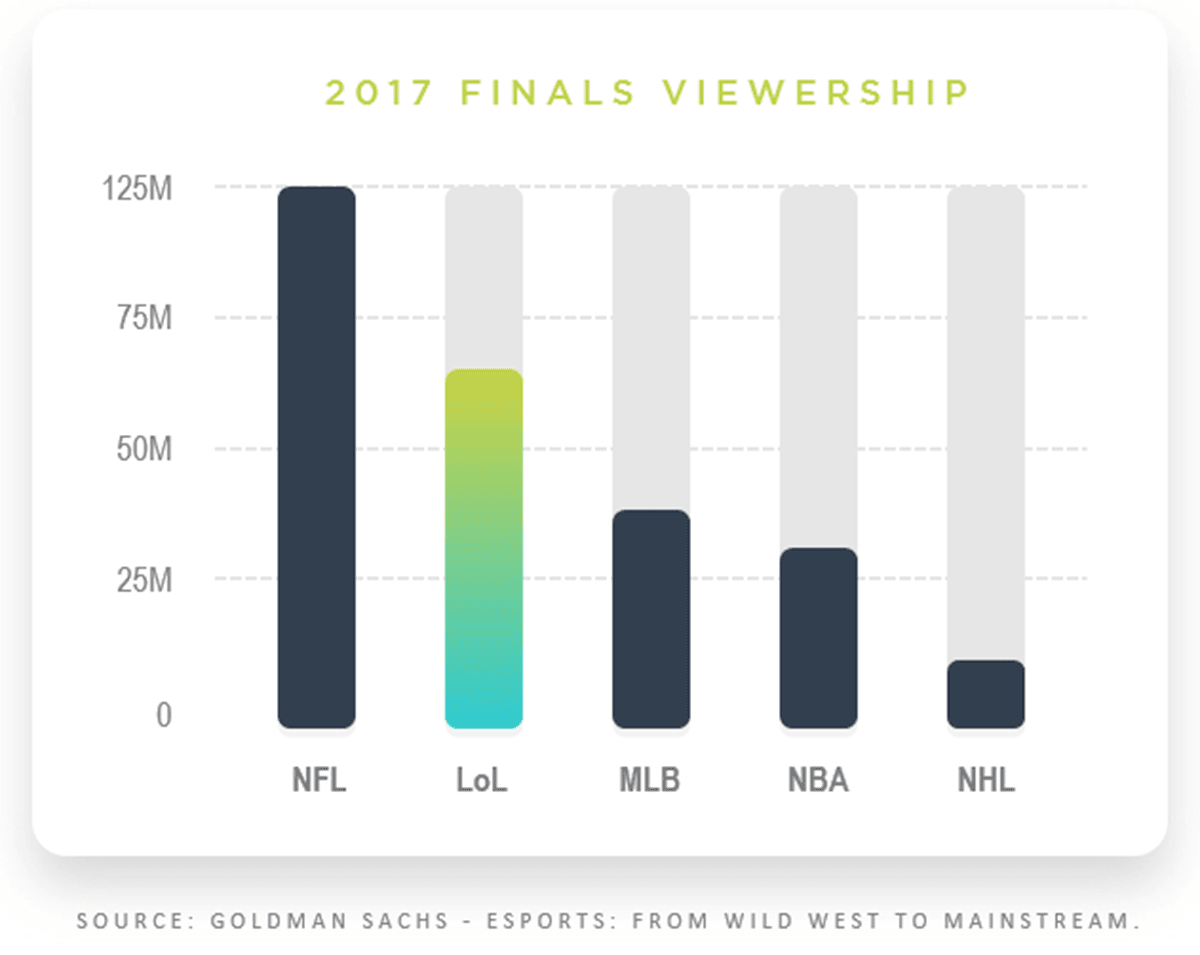

When compared to traditional sports, esports – due to their global fanbase – are seeing meaningful audiences. For 2017, only the Super Bowl had higher cumulative viewership than the League of Legends (LoL) Finals.***

*** League of Legends is owned by Riot Games, a subsidiary of Tencent.

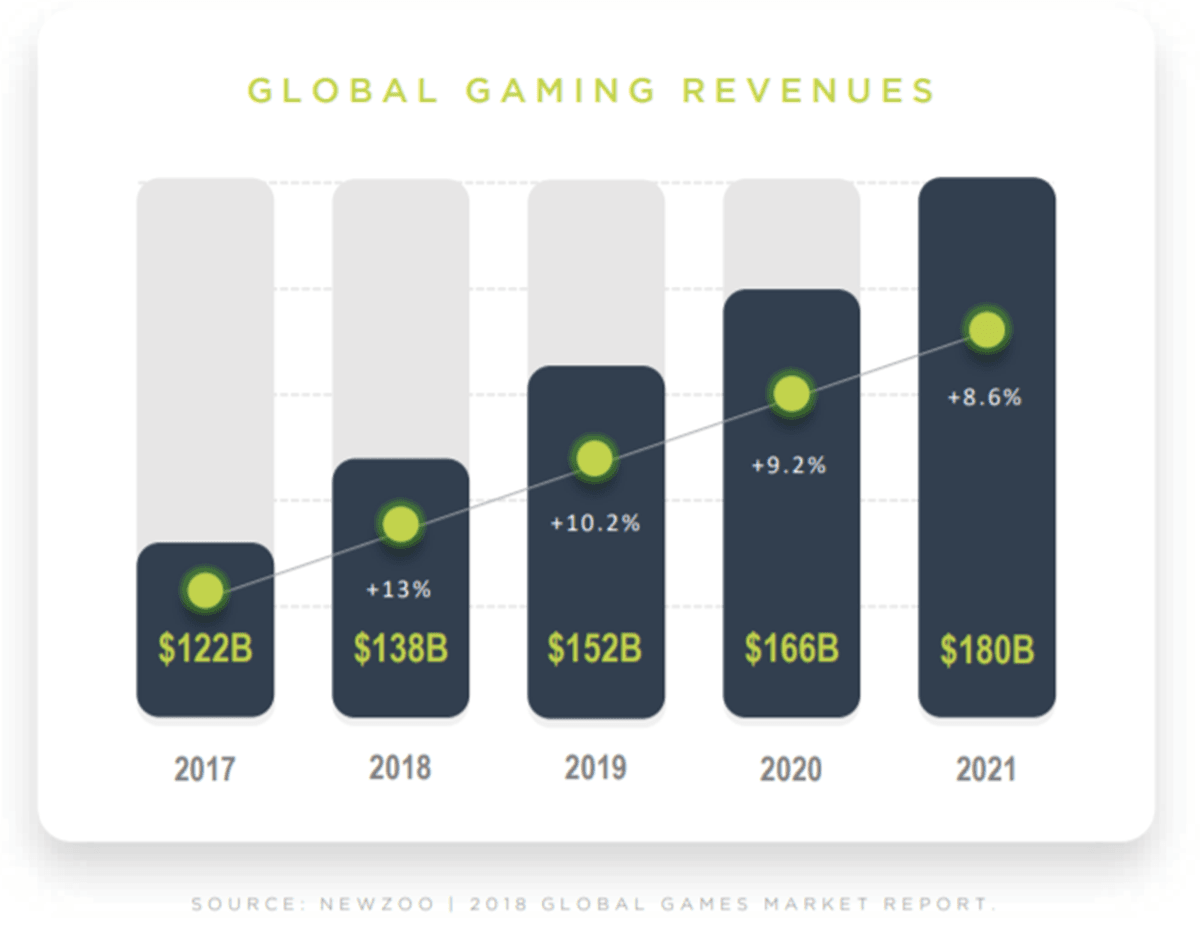

In our view, esports will be primary driver of the next leg of growth in the $150 billion global gaming industry. For reference, the gaming industry is already larger than the global film and music industries combined, growing at an expected 9.3% CAGR from 2018-2022. Meanwhile, other forms of entertainment are declining or stagnating.

How is it different than gambling?

Esports are only tangentially related to gambling, with several platforms (i.e. Unikrn) in existence that allow for dedicated esports betting. Esports is also seen as a growth area for larger, more established betting platforms and casino operators.

In my opinion, esports offer a unique proposition to world of betting. Because games are ultimately closed systems, with a finite number of possibilities and massive amounts of data, real-time esports prop betting has the potential to be done on a large scale. In the case of esports platform Skillz, everyday players can compete against one another for prizes.. The ability to bet on yourself or a friend could eventually be a big draw for esports, something that cannot be done in the world of traditional sports.

What are loot boxes?

"Loot boxes" are a form of in-game mechanics where the outcome is random and not skill-based. To provide an analogy, "loot box" mechanics are like opening a digital pack of baseball cards. You might get a Ken Griffey Jr. autograph, but you most likely won’t. Instead, you’ll end up with a pack full of no-name second basemen.

Depending on the title, “loot box” mechanics can vary in terms of prize. In some games, this can be a better player for your team (i.e. Michael Vick in Madden Ultimate Team), in others it might be a different outfit or cosmetic for your existing character. In gaming, outfits and cosmetics are commonly referred to as “skins”.

Of late, “loot box” mechanics have come under scrutiny from various legislatures regarding their classification as a form of in-game gambling. This has escalated over the past few years, as several in-game items have changed hands in exchange for “real world” dollars in addition to skins effectively acting as a form of black-market currency.

Lets get more into gaming even someone like myself who is only 34 has trouble keeping up with the latest trends how does one find out what the popular games kids are playing?

I’ll start off by reminding readers that our Index methodology is passive, meaning we aren’t attempting to pick winners and losers. Instead, we attempt to identify companies most closely tied to the theme, and package them together in a way that most closely represents the “beta” of esports. That said, there are a few strategies to employ.

- Play the games. Personally, I am a casual gamer (30 years old myself). I don’t claim to try every game, but I try and play (or watch) the major releases. Because ultimately, at the end of the day, gaming is a form of entertainment. The same way you need to watch a movie yourself to know if it’s great, you must try a game to know if it can be a hit.

- Streaming viewership. As mentioned previously, most gaming viewership is taking place online. Looking at viewership for a given game title on a platform like Twitch can point to trends before they make it into the mainstream. As an example, Twitchtracker.com provides a free API to chart which titles, streamers, and games are performing well.

- Reddit and Twitter. In the world of gaming, community is king. To better understand what the gaming community thinks, you need to spend time reading the websites they communicate on.

- Companies like SuperData offer subscription-based services to access real-time spending data. As more purchases take place via download (versus physical copy), these services will be critical for active managers to maintain an edge.

Whih companies have advantages etc?

In terms of which companies are at an advantage, it may seem obvious, but gaming-focused companies are better positioned than large technology companies. Running an efficient game developer is a highly specialized and technical business. Additionally, many of the world’s most popular games are developed from existing IPs, the same way that sequels that overtaken the film industry. This leaves existing game developers at a significant advantage.

In term of game companies, we have seen an influx of highly successful independent developers over the past several years, as technology and game engines are commoditized. However, AAA titles can cost hundreds of millions of dollars in development costs. For example, Take-Two Interactive’s Grand Theft Auto V reportedly cost $265 million to develop. This leaves well-capitalized gaming companies in a position of strength.

How does one evaluate a sector geered more towards teens?

I would argue that while the gaming industry certainly skews younger than other forms of entertainment and sport – for example the average esports fan is 31, the average MLB fan is 57 – gamers are getting older. Whereas the generation before me grew up on Atari and Pinball, I grew up on N64, Xbox, and PC. The games I played (and play) look at a lot closer to the games being played now than they do Atari. But I’m not alone – many men and women in their 30s and 40s grew up gaming and have a sense for how to view the space.

When i grew up I remember most people thought of gaming for shy kids who couldnt play sports which ties in well with your ticker NERD - has that changed?

Times have certainly changed, and our ticker is somewhat ironic in that being a “nerd” is cool in 2019. Gaming and esports have come full circle. Ninja, a popular game streamer, games on Twitch with Drake. Offset just announced ownership in FaZe clan, an esports organization. Several NBA and NFL athletes have even signed contracts to be a part of gaming teams – including Steelers WR JuJu Smith-Schuster.

Anecdotally, as a football and lacrosse player in high school (2003-2007), I always enjoyed playing Halo and Madden – this phenomenon isn’t new.

Who are the leaders in esports?

There are various types of stakeholders in the esports ecosystem, including video game publishers, streaming network operators, video game tournament and league operators/owners, competitive team owners, and hardware companies.

Currently, the leaders in esports game development are Activision-Blizzard (ATVI), Tencent (700 HK), and Valve (private). In the terms of streaming platforms, Twitch (Amazon) and YouTube Gaming (Google) are most popular in the West. In China, where these platforms are banned, Huya (HUYA) and DouYu (DOYU) own the market alongside Bilibili (BILI); in Korea, AfreecaTV (067160 KS) is the dominant platform. Modern Times Group (MTGB SS), which owns both ESL and Dreamhack, is the premier esports events and league operator globally. At current, many competitive esports organizations are privately held, however several public companies own teams (i.e. Huya, GameWith, Bilibili, NetEase), and Luminosity Gaming will begin trading in Canada later this month. Hardware tends be more fragmented, with companies like Turtle Beach (HEAR), Logitech (LOGI), and Razer (1337 HK) offering exposure. Tobii (TOBII SS) is the world’s leading in eye-tracking software, which is now being utilizing by professional gamers and teams.

You can view the full list of the holdings in the NERD ETF here.

What are your favorite companies?

Ultimately, gaming can be a hit-driven business. For that reason, I personally prefer companies that are relatively game-agnostic.

HUYA – Huya is a leading game-streaming platform in China, similar to Twitch. China’s game streaming market is roughly 5 times the size of the US, and Huya owns the market alongside its Tencent-backed sister company Douyu. Huya revenues more than doubled in 2018 and are expected to increase another 60% for 2019. The business is scalable, and Huya continues to execute on long-term strategic deals, including a recently announced partnership with ESL to bring live events to China, and a streaming deal with Team Liquid, one of the world’s most popular esports organizations. Huya also owns the Chengdu Hunters which compete in Activision Blizzard’s Overwatch League, and Royal Never Give Up, a Chinese League of Legends team.

Huya reported 144 million MAUs as of the second quarter 2019 and may prove to be an attractive long-term investment if it can continue to improve monetization of its growing user base. Additionally, the company ended the quarter with $1.3 billion in cash on its balance sheet (following a $440 million secondary in April), positioning the company to pursue strategic M&A.

700 HK – Tencent is a diversified technology company which has historically derived 40-50% of its revenues from gaming and esports. It owns stakes in a wide array of gaming-businesses, and due to its size and scope, has multiple avenues for growth. However, at a $400 billion market cap, it can be difficult to determine which properties will be most successful.

I view its 40% stake in Epic Games, the maker of Fortnite and the Unreal Engine, as a potential game changer. In December 2018, Epic Games was valued at $15 billion, implying a ~$6 billion valuation for Tencent’s stake. According the TechCrunch, Epic grossed $3 billion in profits for 2018. A large majority of its income was attributable to Fortnite, but I see the Epic Games Store (a distribution platform where Epic takes 12% of gross revenues from third-party developers) and its Unreal Engine (a game engine with 7 million users; Epic takes a 5% cut of gross revenues) as drivers for the long-term. That said, Fortnite doesn’t appear to be going anywhere anytime soon, and Epic continues to diversify its asset base through acquisition, including its recent deal to buy Psyonix, the developer behind popular esport, Rocket League.

A non-exhaustive list of Tencent’s gaming-related assets is below:

1337 HK – Razer is a global leader in gaming hardware and peripherals, including keyboards, mice, and PCs. For the first half 2019, Razer reported revenues of $357 million, a 30% increase versus the prior year. The hardware segment – the company’s core business – grew 26%, while higher margin Software & Services increased 110%. Despite concerns around cash burn, Razer ended the first half with $530 million in cash on the balance sheet, implying an enterprise value of roughly $1.1 billion. Razer continues to expand beyond hardware, recently announcing a cloud gaming deal with Tencent and fintech partnership with Visa in Southeast Asia.

NERD -- If you are looking to take a diversified approach to the space, our ETF invests in 25 companies across esports and digital entertainment. It is traded on the NYSE, ticker symbol “NERD”. Options are available on the ETF, listed on the NYSE Arca and NYSE American exchanges.

Arent the big tech firms also gaming plays like Amazon with Twitch - how correlated are the two sectors?

If Twitch was shut down permanently tomorrow, would Amazon even trade lower? We aren’t so sure. As a result, our methodology is designed to minimize exposure to large tech conglomerates. Our goal is to provide beta exposure to esports and gaming, and owning companies like Amazon or Google doesn’t get you there.

That said, in terms of correlation, the gaming sector is modestly correlated with the technology sector. In 2018, game publisher stocks underperformed as Fortnite drove concerns around market share; this followed a strong year of outperformance in 2017.

Related, is gaming mostly a play on US and Japanese consumers?

Gaming is becoming increasingly global, with more than 2.5 billion gamers worldwide in 2019. According to data provider Newzoo, the US accounted for roughly $37 billion in gaming software revenues, followed by China ($36 billion), Japan ($19 billion), Korea ($6 billion) and Germany ($6 billion).

On a per capita basis, Japan and Korea generate the most revenue, followed by the US, UK, and Canada.

Looking forward, smartphones have democratized mobile gaming. As a result, regions like India and Latin America are potentially future drivers of growth.

I would think gaming holds up well regardless of the economy, how does esports do during recessionary times?

While modern esports have been around since the late 1990s, esports have only recently taken hold in the West. Unfortunately, we therefore have little data to understand how esports perform in a recession.

That said, we would look to the broader entertainment industry as a proxy. During the Great Recession, the S&P 500 Media Index slightly underperformed to the downside, but recovered more quickly than the broad indexes.

On the other hand, do you think esports are just a fad?

I do not. I think that the gaming industry, which in many ways represents our first experience with the concept of a digital “third place”, is only getting started. In terms of esports, we are in the bottom of the first inning.

That said, I think there is a real possibility that the in-person, live events side of esports may be overhyped. You have companies like Activision Blizzard that are rolling out franchised, city-based leagues. Esports are digital. Esports are global. Why do we think that they will work in an antiquated format designed to address the limitations of physical sport? I have my reservations, and I think esports will look very different in 5-10 years time. In my opinion, the current structure of esports was intentionally designed to look and feel likes traditional sports, for the primary purpose of “being familiar enough” for large investors to get on board. Advances in technology will allow for the best viewing experience to eventually take place “in-game”. I think this limits the upside for live events outside of a handful of major events throughout a given esport year.

Final thoughts?

We covered a ton of ground. For readers interested in learning more and keeping up to date, feel free to follow us on Twitter @roundhill or visit our blog at roundhillinvestments.com/blog.