Virtually every industry is now able to eliminate certain tasks and processes due to the rapid onset of artificial intelligence (AI).

The financial markets are no different, with even the most amateur investors able to access purpose-built trading robots. These programmes can be exceptionally useful for both rookie and experienced traders, analyzing data patterns to construct trades and increase the likelihood of success when investing in stocks.

With the market for this tech growing fast, we’ve narrowed things down with a comprehensive guide to the best AI trading bots in 2024, including Altindex, eToro and AvaTrade.

Our picks of the best AI stock trading bot or broker in 2024

Before we dive into our full reviews of the best AI trading bots, here is a brief overview of each.

- Altindex: Going beyond traditional financial data to provide more than 100,00 daily insights, and boasting a 75% win rate on stock picks.

- eToro: One of the most popular platforms in the stocks and crypto trading space. Not strictly an AI trading bot, but uses machine learning algorithms to power its ‘Smart Portfolios’ feature.

- AvaTrade: Another trusted, global brokerage. It specializes in forex and CFDs, and offers automated trading via ‘MetaTrader 5’, a third party service.

- Libertex: An award-winning, commission-free platform for stocks, crypto, forex and more, again utilizing the MetaTrader program. The platform is globally-recognized, being the official online trading partner of Bayern Munich FC.

- Trendspider: A trading platform specializing in automatic technical analysis. Trendspider uses machine learning algorithms and offers a range of features including multi-chart layouts, alert notifications, a market scanner and more.

- Trade Ideas: Premium trading platform featuring an AI assistant.

A closer look at the top AI trading bot in 2024

Here is some deeper analysis on our favorite AI trading bots, with a full review of features, fees, pros and cons.

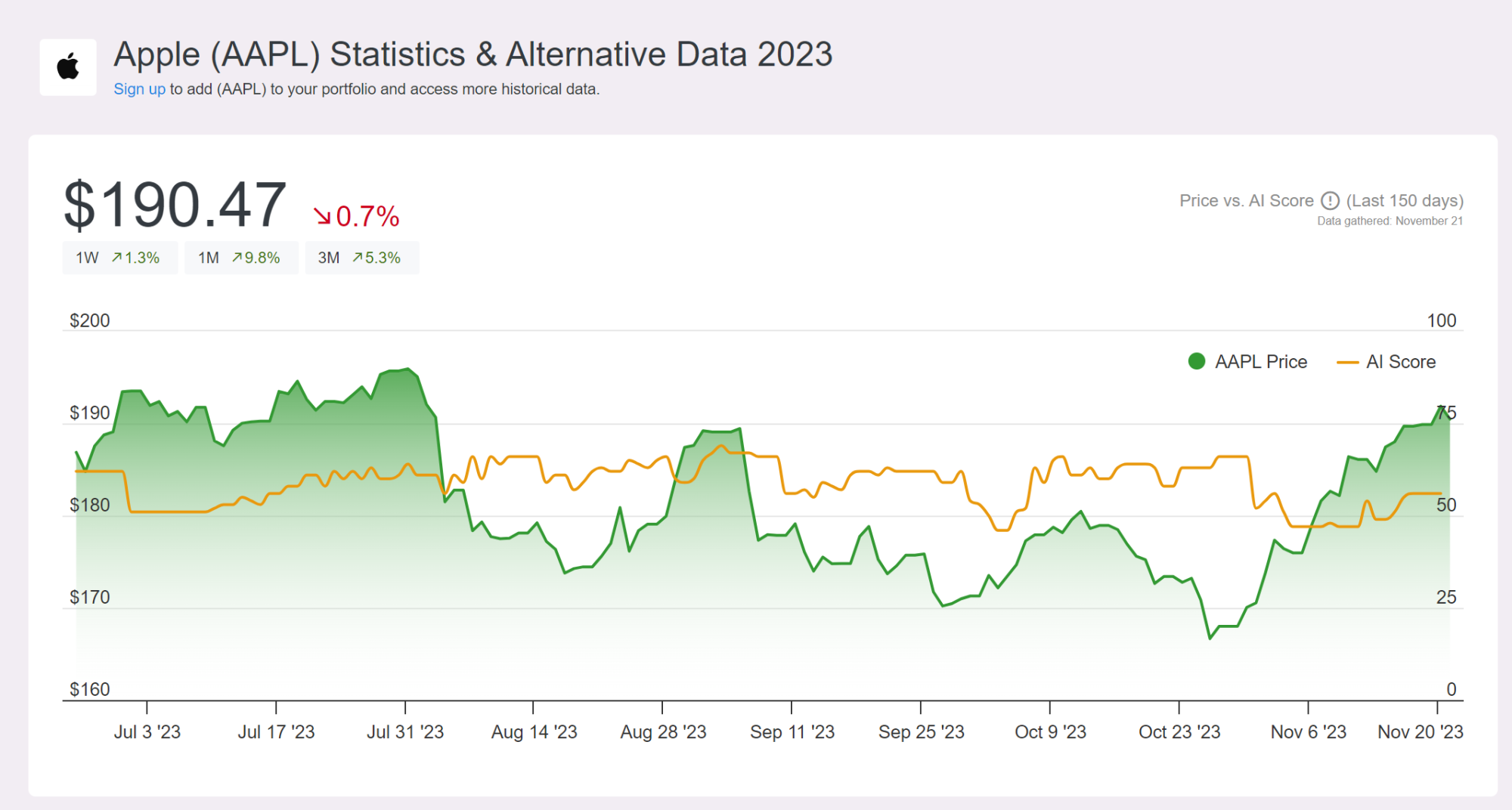

1. Altindex: Alternative data insights with an 80% win rate on stock picks

It can be easy to get bogged down in financial data when navigating the stock markets. Altindex takes this issue into consideration, usings its advanced machine learning algorithms to analyze alternative data sources such as social media and customer satisfaction rates.

For instance, in addition to the usual market performance insights, the platform can use real-time data tracking to spot a surge in popularity on Reddit for a particular stock. Altindex users can access such insights on stocks in their portfolio or watchlist by opting in to the platform’s ‘Stock Alerts’ service.

But aside from its analytics and predictive modeling capabilities, what stands out about Altindex is its accessibility. While catering to all experience levels, rookie investors are likely to feel encouraged by the platform’s simple interface, customer support, and free plan.

Perhaps most notably, the software offers a risk assessment feature, allowing more cautious users to develop an understanding of the potential risks associated with certain stocks.

That being said, a lack of educational tools means that Altindex users will need a basic understanding of how the stock markets work before using the platform.

Pros

- An alternative to the usual financial analysis

- Free plan

Cons:

- Basic level of stock market knowledge required

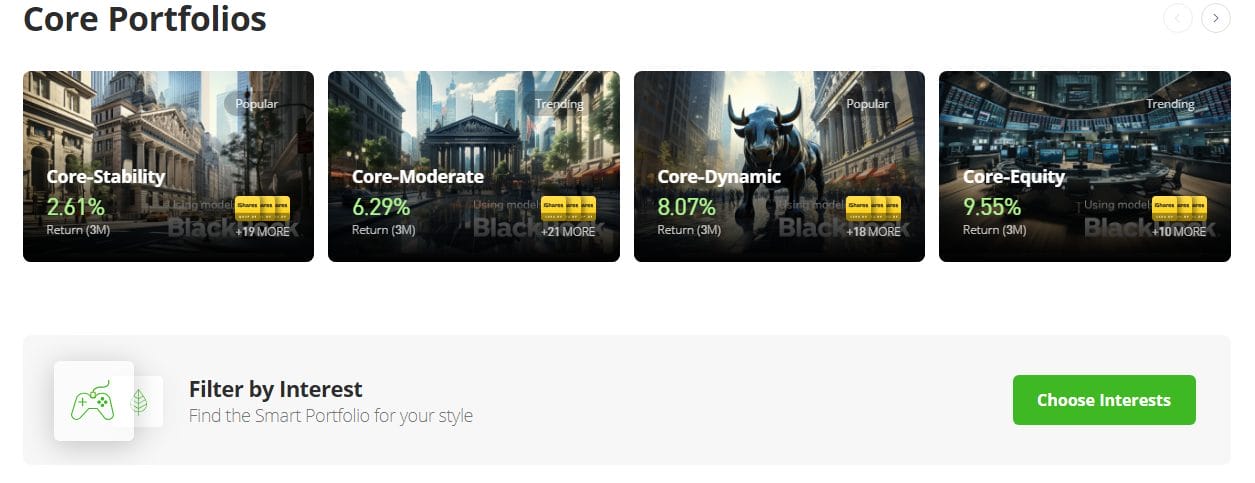

2. eToro: Market-leading broker with AI-powered features

Launched back in 2007, eToro is a highly recognizable brand with a user base exceeding 30 million.

While not strictly an AI trading bot, eToro has consistently modernized its product offering over the years, incorporating new-age technologies into its various features and services.

Perhaps the best example of this is the ‘Smart Portfolios’ feature – ready-made investment portfolios created by eToro, offering users a free and convenient way to access a range of different market strategies.

eToro’s Smart Portfolios use machine learning algorithms to provide a more robust, reliable service, and to continuously adapt and improve as the markets change.

Similarly, the broker’s Copy Trading feature uses automation to automatically replicate the trades of highly-reputable investors, allowing users to put their investment portfolios on autopilot.

However, eToro is more of a traditional online broker, with AI being used to compliment existing features rather than sitting at the heart of the platform.

Pros

- Simple and intuitive

- Wide range of features

Cons:

- Not strictly an AI trading bot

- More aimed at beginner and intermediate traders, in our opinion

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

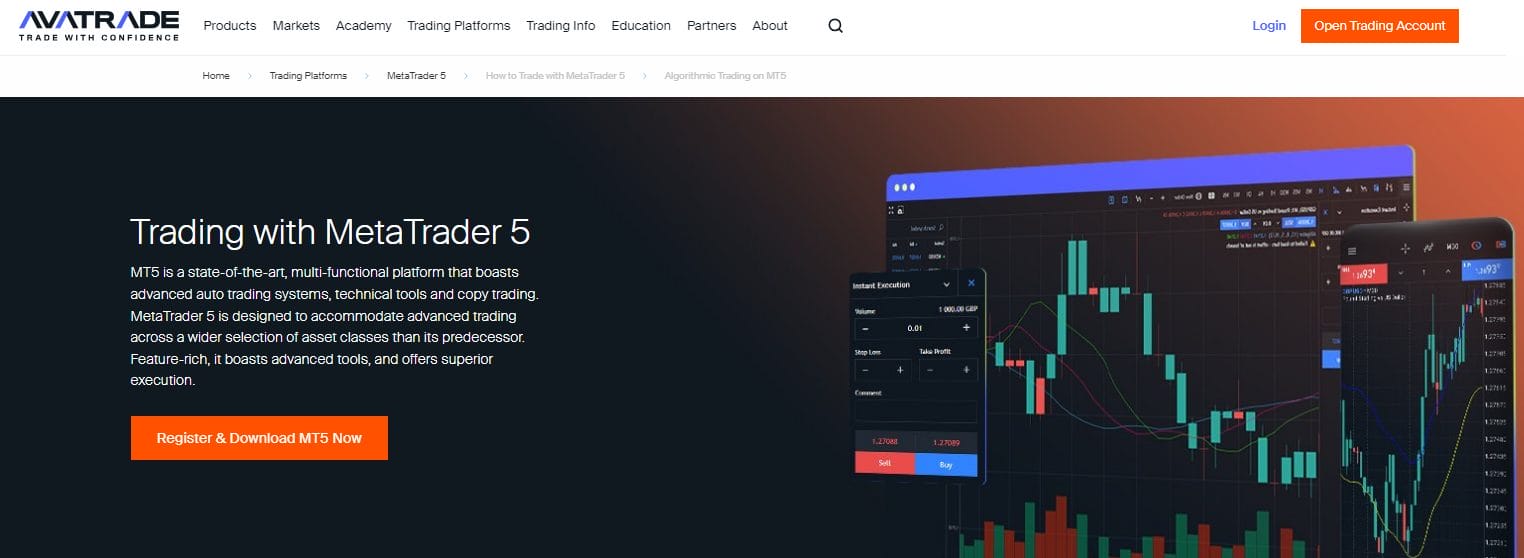

3. AvaTrade: A wide range of investment vehicles and best in-class educational resources

Like eToro, AvaTrade is another reputable, global brand. It was founded in 2006, and is one of the official partners of the Aston Martin F1 Team.

While the platform’s user base of 400,000 pales in comparison to eToro’s 30 million, AvaTrade targets a more advanced sub-set of the investment community, with an altogether more sophisticated product offering.

The brokerage is best known for its wide range of forex options and CFDs, but has also branched into the cryptocurrency markets in recent years, including Bitcoin, Ethereum, Solana, Polygon, and a handful of others.

Crucially, AvaTrade allows users to trade through a variety of platforms, including third party provider MetaTrader 5.

MetaTrader boasts a range of AI and machine learning-powered features for traders, including an automatic coding assistant and an open neural network exchange.

AvaTrade is also considered the best in class when it comes to education. The platform offers a dedicated ‘Academy’ section, containing resourced curated by both in-house experts and third parties.

While the platform is generally aimed at more advanced traders, these resources may open AvaTrade up to a broader audience.

Pros

- Reputable brand

- Excellent for educational resources

- Wide range of investment options

Cons:

- Pricing trails industry leaders

- More aimed at expert traders

4. Libertex: Highly versatile brokerage with modest fees

The official trading partner of Bayern Munich Football Club, the recipient of numerous awards, and part of a wider fintech group founded in 1997, Libertex is another established, trustworthy brand in the world of investing.

The platform sets itself apart from the competition with its wide selection of instruments, including 49 currency pairs, 18 commodities, 121 shares, 32 indices, 79 cryptocurrencies, 10 ETFs and 18 options.

Libertex also excels when it comes to trading features, with its proprietary trading platform offering more than 100 analytical tools, enabling easy technical analysis for high frequency traders. It also offers a user-friendly mobile app, available for both Android and iOS.

Like AvaTrade, Libertex also incorporates the third party MetaTrader platform, which brings a range of AI-powered features while remaining accessible to less experienced traders.

However, it should be noted that Libertex is significantly lacking in the educational resources department, making the brokerage less beginner-friendly overall.

With its combination of wide-ranging assets and highly competitive fees, Libertex is arguably best-suited for the high-frequency and high-volume trading strategies of more seasoned investors.

Pros

- Competitive fees

- Range of trading platforms on offer

Cons:

- Lacking in educational content

5. Trendspider: Automated, real-time data analysis perfect for day and swing traders

Trendspider is the first non-broker on this list, being a self-contained trading platform in its own right.

The platform uses a $149-a-month membership model, with a 7-day free trial being the only unpaid option. This hefty fee unlocks a wide range of features, including various charting abilities, trendline analysis, heatmaps, multi-timeframe analysis and more.

Crucially, Trendspider uses algorithms to automate the processes that are most prone to human error. Key examples of this include trendline analysis, fibonacci retracements and heatmaps.

In addition to being effective, this automation adds a degree of simplicity to the tools, making the platform altogether more accessible to traders lacking experience and ability in technical analysis.

Additional features include raindrop charts, multi symbol view, watch lists, a stock scanner, and a mobile app for both Android and iOS, which is thought to be even faster than the web version.

While Trendspider caters to a range of user profiles, its heavy focus on real-time data makes it perfect for day and swing traders.

Pros

- Automation adds accessibility

- Impressive range of tools

Cons:

- Premium price tag

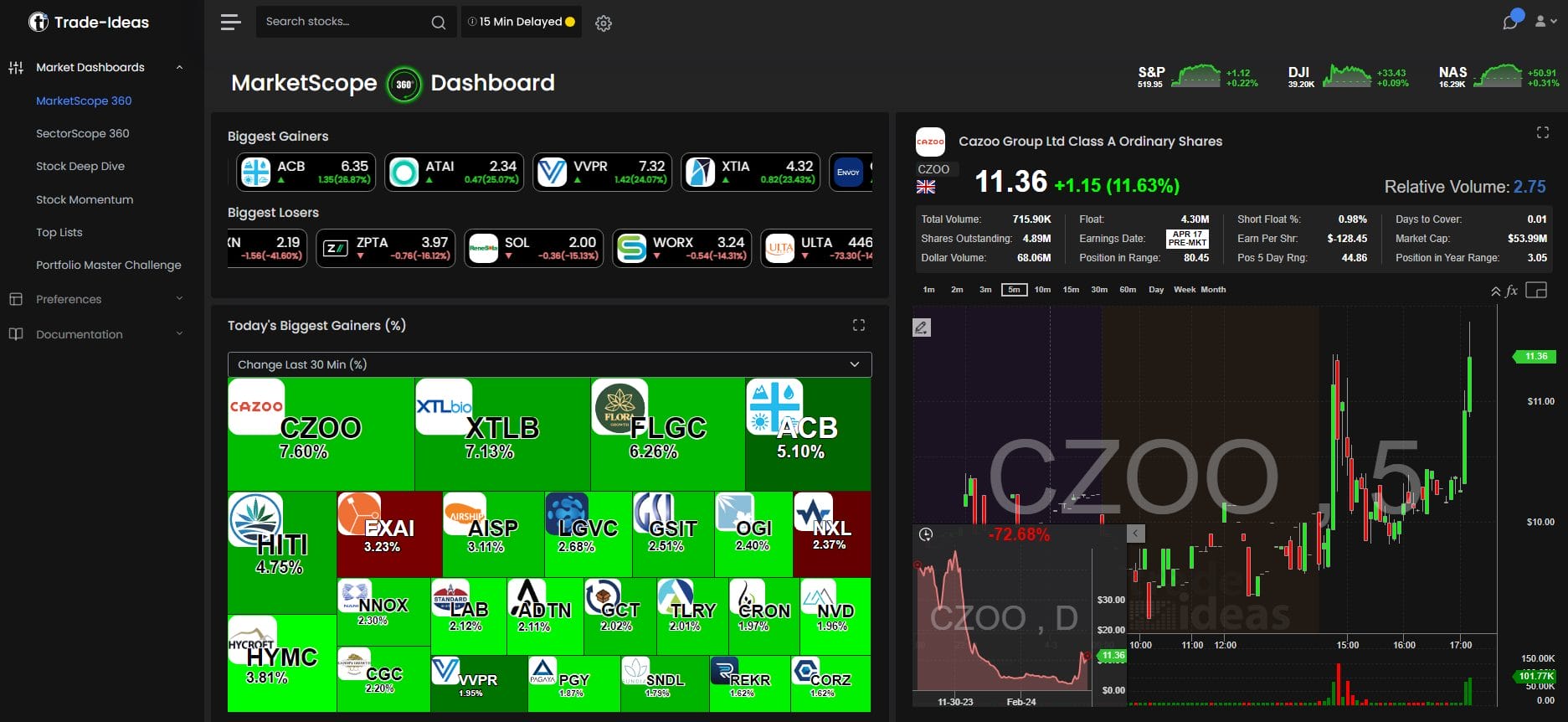

Trade Ideas is another trading platform in its own right, featuring a range of technical analysis tools primarily aimed at more advanced traders.

Like Trendspider, Trade Ideas has adopted a premium subscription model – it offers a ‘Standard’ plan at $89 per month, and a ‘Premium’ plan at a hefty $178 per month. The latter includes a handful of major additions, such as customizable multi-strategy windows, customizable stock races, a library of curated trading templates, and access ‘portfolio master challenge’ tournaments.

As expected, AI sits at the heart of Trade Ideas, with its range of stock scanning and charting features all being powered by machine learning and automation.

What sets Trading Ideas apart is the addition of “Holly”, an in-built AI assistant akin to generative AI bots such as ChatGPT. Rather than simply performing tasks, Holly is a fully-fledged personal assistant, capable of making tailored recommendations on entry and exit points, risk limits and more.

Trade Ideas’ main drawback is its limited scope, with its complex interface and advanced features likely to be most appealing to more seasoned traders.

Pros

- Unique addition of an AI assistant

- Wide-ranging automation

Cons:

- Expensive

- Potentially overwhelming for less advanced traders

Comparison table of the best AI trading platforms in 2024

| Platform | AI stock picker? | Free plan? | Mobile app? | Educational resources? | Asset classes available |

| Altindex | Yes | Yes | No | No | Stocks, ETFs, Crypto |

| eToro | No | Yes | Yes | Yes | Stocks, ETFs, Crypto, Indices, Commodities, Currencies |

| Avatrade | No | Yes | Yes | Yes | Stocks, ETFs, Indices, Commodities, Currencies, Bonds |

| Libertex | No | Yes | Yes | No | Stocks, ETFs, Crypto, Indices, Commodities, Currencies |

| Trendspider | Yes | Free trial only | Yes | Yes | Stocks, ETFs, Crypto, Indices, Commodities, Currencies |

| Trade Ideas | Yes | Yes | No | Yes | Stocks, ETFs, Crypto |

Advantages of using AI for stock trading

AI can be an incredibly powerful tool in the world of stock trading. Traders can now harness predictive analytics to inform their investment strategies, eliminating a number of tedious, manual processes.

Here are some of the key advantages of using AI trading software in the stock markets:

- Eliminating lengthy processes: AI has the power to automate tasks that would usually be very lengthy, such as sifting through multiple sources of information and crunching the data. This can provide traders with a complete picture of the market sentiment in exchange for very little effort.

- Spotting hidden patterns: AI can save you time, but it may also be able to do things that you can’t. A good example of this is spotting miniscule (but potentially important) data trends that you may have missed.

- Quick off the mark: Many AI-powered trading platforms can execute trades on your behalf, based on specific rules. This way, you can avoid missing out on good deals.

Disadvantages of using AI for stock trading

In spite of the many upsides, leaning too heavily on AI when investing could be unwise.

Here are a few pitfalls to watch out for when using AI to trade stocks.

- Scams: As the availability of technology has increased, so too has the number of online scams. This has become prominent in the world of AI trading, with countless projects creating fake datasets to entice traders.

- Volatility: The financial markets are inherently volatile, and trading bots, being based on pre-programmed rules, are prone to being tripped up by this.

- Black boxes: Many AI-powered systems are based on black box models, meaning that their underlying inputs and mechanics are not visible to the user. This can be unhelpful for committed investors who wish to understand the intricate details of their trades.

Methodology

Our panel spend a number of hours researching each product, developing a deep understanding of its features, utility, pros and cons.

While our panel is mostly made up of seasoned financial experts, some have little to no expertise in the area. This provides us with a wide range of perspectives, ensuring that our verdicts are truly objective.