Investors looking to maximize their returns can do so with leverage. These trading platforms allow investors to amplify their gains by borrowing funds to trade with larger positions.

However, navigating the many options can take time and effort.

This article explores the top crypto leverage trading platforms. Explore their features, benefits, and risks, empowering you to make informed decisions and take advantage of market opportunities.

Binance

How it started: Founded in 2017 by Changpeng Zhao, a veteran of high-frequency trading systems, Binance has become the world’s largest crypto exchange by daily trading volume (excluding the US).

The platform caters to global users interested in altcoins, offering over 600 crypto-to-crypto trading pairs and NFT purchases.

Unique features

- Biggest crypto exchange: Binance enjoys the largest trading volumes among all centralized exchanges. Tokens that are listed on Binance benefit from strong liquidity, trust, and an uptick in price upon listing.

- SAFU: Binance utilizes a Secure Asset Fund for Users (SAFU), allocating 10% of trading fees to protect user funds. However, with over 350 cryptocurrencies available globally, only 150 are accessible in the US.

Leverage on Binance

Binance allows leveraged trading on over 600 cryptocurrencies, with perpetual futures and options available. This can amplify gains but also magnify losses.

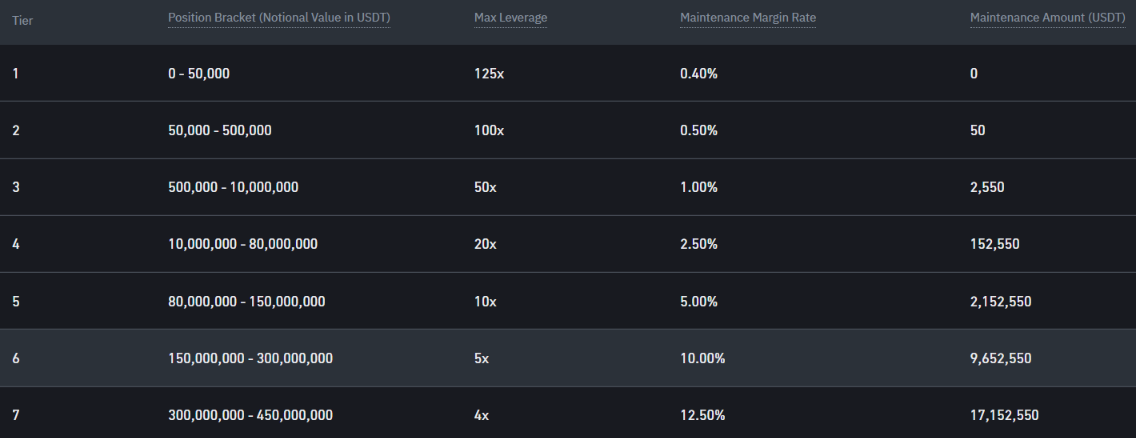

The maximum leverage is a risky 125x on BTC and ETH perpetual, with lower leverage on other coins. The higher your balance, the lower leverage the exchange will offer.

BTCUSDT perpetual leverage, source: Binance

Binance faces regulatory scrutiny in several countries, so be aware of potential restrictions.

Fees

Crypto trading fees range from 0.05% to 0.1%, but card purchases incur higher fees (1%-3%). Maker-taker fees are 0.40%-0.60%, with free Bitcoin trades under $10,000 monthly volume for Tier I pairs. (Tier I pairs include DOT/USDT, LTC/USDT, SOL/USDT)

| Margin trading | Yes |

| Fees | 0.1% |

| 24hr Spot Trading Volume (As of March 2024) | $2,454,424,058 |

| Leverage | Up to 125:1 |

| Pairs | 1,273 |

| Founded | 2017 |

Pros

- Advanced Features alongside spot, futures, margin trading, staking, and more, all backed by high liquidity for fast order execution

- Binance prioritizes security with 2FA, FDIC-insured USD balances (for Binance.US only), and cold storage/li>

Cons:

- Binance faces potential restrictions due to ongoing regulatory scrutiny

- User data privacy remains a concern for some users

Kraken

How it started: Founded in 2013 by Jesse Powell, Kraken is a global cryptocurrency exchange catering to casual and professional investors. They focus on secure trading with low fees for high-volume trades.

Unique features

- Kraken Instant Buy: Ideal for beginners, allowing quick and easy crypto purchases with fast verification.

- Kraken Pro: An advanced interface for experienced traders. It’s highly customizable and offers spot, margin, and staking features in one place.

Based on security audits by CER.live, a trusted platform, Kraken sits at number two for cryptocurrency exchange security.

Leverage on Kraken

Kraken offers leverage through margin accounts (up to 5x) and futures contracts (up to 50x). This lets you control larger positions with a smaller investment, but remember, the risk increases too.

Fees

Kraken offers two interfaces. Kraken Instant Buy charges a flat fee (0.9% for stablecoins, 1.5% for others) for simple purchases. For lower fees, use Kraken Pro, with maker/taker fees starting at 0.16% and 0.26%, respectively.

| Margin trading | Yes |

| Fees | 0% – 0.26% |

| 24hr Spot Trading Volume (As of March 2024) | $1,739,496,128 |

| Leverage | 5:1 |

| Pairs | 671 |

| Founded | 2011 |

Pros

- Kraken prioritizes security, storing 95% of deposits in offline cold storage and using secure facilities with armed guards

- Kraken Pro offers extensive customization and a one-stop shop for spot, margin, and staking

Cons:

- Kraken currently only supports only eight fiat currencies, which can be limiting for some users/li>

- While convenient, Kraken Instant Buy’s fees can be costly for frequent users

Coinbase

How it started: Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase is the largest US crypto exchange by trading volume. With 43 million users, it boasts a global presence with a remote-first work model.

Unique features

- Coinbase Earn: Learn and Earn Crypto: Coinbase encourages new investors with its “earn while you learn” program. Users watch videos and take quizzes about cryptocurrencies while earning rewards.

- Naive Wallets: Coinbase Exchange Wallet: This is the default wallet for trades on Coinbase. Private keys are stored on the exchange, reducing security. Coinbase dApp Wallet caters to Ethereum-based ERC-20 tokens. The third choice is Coinbase Wallet, a self-custody wallet stores crypto assets and NFTs, offering users more control over their holdings. (It’s a Separate app; no Coinbase account is required.)

Coinbase Wallet teamed up with Blockaid to enhance security measures and safeguard users from fraudulent activities. By integrating Blockaid technology, Coinbase successfully prevented over $75 million of funds from being stolen. The security tool analyzed 114 million transactions and DApp connections to stop nearly 800,000 wallet connections to harmful decentralized apps.

Leverage on Coinbase

Traders who meet the eligibility criteria can access maximum leverage of up to 10x. There are specific limits per contract, and the notional value for all positions is capped at $90,000.

These limits are reviewed frequently, taking into account the exchange’s order book depth, volumes, and insurance fund balances.

Fees

Coinbase fees are not displayed upfront. They depend on payment methods, order size, and market conditions. Expect fees to range from $0.99 to $2.99, with an added spread of 0.5%.

While Coinbase offers a user-friendly platform, its fees can be high compared to competitors. Consider exploring Coinbase Pro for a more transparent fee structure.

| Margin trading | Yes |

| Fees | 0% – 0.3% |

| 24hr Spot Trading Volume (As of March 2024) | $5,532,352,153 |

| Leverage | 25:1 / up to 10:1 for perpetual futures |

| Pairs | 396 |

| Founded | 2012 |

Pros

- Choose from secure storage options, including self-custody and exchange wallets

- Earn crypto rewards while learning about different currencies

- Includes FDIC insurance for USD deposits and industry-standard security features

Cons:

- Complex fee structure with variable spreads makes cost confusing for beginners

- Staking fees can be as high as 25% of the staking profits

OKX

How it started: OKX was founded in 2017 by Star Xu (current CEO), OKX has become a major player. It boasts over 50 million users and partnerships with Manchester City and the Australian Olympic Team. This Seychelles-based exchange offers a comprehensive suite of trading options.

Unique features

- Self-Trade Protection (STP): Traders who execute algorithms for trading will love this feature. STP prevents you from unintentional self-trades. API traders will benefit from STP the most.

- Trading Bots Marketplace 2.0: Crypto trading bots developers can upload their systems to the bots marketplace and enjoy a revenue share from the profits earned by the automated system.

OKX is a one-stop shop for crypto enthusiasts. Trade spot markets, simple and complex options, or delve into derivatives like margin, futures, and perpetual swaps. Explore the NFT marketplace, build trading bots, or participate in block trades.

OKX stands out with its 11 proof-of-work mining pools for Bitcoin, Ethereum, and Litecoin. Tutorials guide users through the mining process, making it easier to earn crypto.

Leverage on OKX

OKX offers more than just basic spot trading. You can use your cryptocurrency holdings to access perpetual futures and margin accounts.

Additionally, you can choose from a range of leverage options, from 10x to 100x, and depending on your risk tolerance, you can select either full or partial liquidation modes.

Fees

OKX keeps costs low. Spot trading fees start at 0.08% for limit orders and 0.1% for market orders. Futures fees are even lower, at 0.02% and 0.05% respectively. Hold OKB tokens or trade BTC and ETH for further fee reductions. Deposits are free, and OKX only charges network fees for withdrawals.

| Margin trading | Yes |

| Fees | Spot – 0.02% – 0.2%. Futures – 0.01% – 0.05% |

| 24hr Spot Trading Volume (As of March 2024) | $5,414,638,505 |

| Coins | 318 |

| Pairs | 471 |

| Founded | 2017 |

Pros

- Holding OKB tokens reduces trading fees

- Multiple Earning Avenues (Maximize profits with Dual Investment, earn stable returns with Fixed Income, or snag high-reward flash Deals)

- High Yield Earning: Stake dozens of coins for at least 1% APY, with some exceeding 100%

Cons:

- Best suited for experienced traders due to its advanced features

- Fee structure may seem confusing for beginners due to its multiple tiers and discounts

Paybis

How it started: Paybis was founded in 2014 by Innokenty Isers, Konstantin Vasilenko, and Arturs Markevich, Paybis began as an experiment and has become a global platform. Key partnerships with Simplex, a payment processor, and Kraken, a crypto exchange, fuel its services.

Unique features

- Payment methods variety: Paybis stands out with a massive variety of payment methods. Over 40 payment service providers and alternative methods, including Google Pay, Apple Pay, and credit cards, are ready. They recently launched ACH payments for faster US bank transfers.

- Refer and earn: Paybis also offers a ‘Refer and Earn’ affiliate program. By referring new users, you can earn commissions up to 45% of Paybis’s net profit on their trades. This adds another layer of earning potential for savvy users.

Leverage on Paybis

Paybis specializes in buying and selling cryptocurrency but currently does not offer leverage trading. This can be inconvenient for some, but it may be a good fit for beginners seeking a smooth entry into crypto investments.

Fees

The first crypto purchase enjoys a waived Paybis fee. Subsequent trades incur fees between 0.99% and 2.59%, depending on the payment method.

Paybis charges withdrawal fees to external wallets, and a $2 service fee may apply based on your chosen payment option.

| Margin trading | No |

| Fees | 0.99% and 2.59% |

| 24hr Spot Trading Volume (As of March 2024) | – |

| Coins | 150+ |

| Pairs | 200+ |

| Founded | 2014 |

Pros

- Users can purchase a fraction of Bitcoin for as little as $5

- Services in nine languages, over 180 countries

- Multi-layered security measures protect your funds

Cons:

- Potentially High Fees: Fees vary based on payment method

- Limited Features: No leverage trading or social features

Kucoin

How it started: Kucoin was founded in 2017, Kucoin emerged as a top destination for altcoin trading. The exchange, led by CEO Johnny Lyu, offers a massive library of over 840 cryptocurrencies.

Unique features

- P2P and staking support: The exchange supports both staking and peer-to-peer (P2P) trading, which is uncommon among major exchanges.

- Account-bound tokens: KuCoin Account-Bound Tokens (KABT) allow verified user credentials to unlock exclusive benefits within the KuCoin ecosystem, providing a revolutionary step for on-chain identity in the Web3 ecosystem.

Holders can earn passive income through KuCoin’s soft staking program and share a portion of daily exchange profits. Additionally, users receive daily cryptocurrency dividends by holding KuCoin Shares (KCS).

Leverage on Kucoin

KuCoin has increased its leverage options for Bitcoin and Tether trades, with users able to amplify gains (and losses) with up to 100x leverage. Margin trading ratios vary by coin, with some reaching 50x.

Fees

Fees are competitive. Kucoin uses a maker-taker structure, with a low 0.1% maker fee and a 0.1% taker fee with no account minimum. Holding KCS grants an additional 20% discount.

| Margin trading | Yes |

| Fees | 0.1% |

| 24hr Spot Trading Volume (As of March 2024) | $3,285,626,846 |

| Leverage | 20:1 default, up to 100:1 |

| Pairs | 1,273 |

| Founded | 2014 (Launched 2017) |

Pros

- Holders enjoy benefits such as trading fee discounts, daily crypto dividends, access to more trading pairs, exclusive exchange perks, and a share of exchange profits through staking

- Advanced Features: Staking, P2P trading, and margin trading cater to experienced users

Cons:

- The platform’s advanced features can be overwhelming for beginners

- Some altcoins may have limited liquidity, impacting trade execution

Bitmart

How it started: Bitmart was founded in 2017 by Sheldon Xia, a figure involved in blockchain initiatives, Bitmart is a centralized exchange serving over 9 million users globally. Headquartered in the Cayman Islands, it offers various services beyond trading, including staking, lending, and derivatives.

Unique features

Besides standard trading options, Bitmart distinguishes itself with features like Bitmart Earn. It allows users to earn passive income on their crypto holdings through various savings products.

- Flexible Savings: Earn interest on deposited crypto with the ability to withdraw funds anytime.

- Fixed Savings: Earn a higher interest rate by locking in your crypto for a predetermined period.

Leverage on Bitmart

For experienced users, Bitmart caters to margin trading and futures trading. Launched in 2020, the futures market allows leverage of up to 100x on certain assets.

Fees

Bitmart employs a tiered maker-taker fee structure with fees starting at 0.25% and decreasing based on 30-day trading volume and holdings of the platform’s token, BMX. Futures trading offers significantly lower fees, with maker fees at 0.04% and taker fees at 0.06%. There are no deposit fees, but withdrawal fees vary by coin.

| Margin trading | Yes |

| Fees | starts 0.25% |

| 24hr Spot Trading Volume (As of March 2024) | $2,766,179,878 |

| Leverage | up to 100:1 |

| Pairs | 1,164 |

| Founded | 2017 |

Pros

- Bitmart offers features like staking, lending, and an Earn program for generating passive income on crypto holdings

- Utilizes multi-layer and multi-cluster system architecture to enhance security

- Boasts significantly lower fees for futures trading than for spot trading, which appeals to experienced users

Cons:

- The tiered maker-taker fee structure with variable rates based on trading volume and token holdings can confuse new users

- Inconvenience can arise due to withdrawal fees that differ depending on the cryptocurrency

News: Kraken, Binance, and Coinbase are facing a lawsuit from the SEC for allegedly operating as unregistered securities exchanges, brokers, dealers, and clearing agencies.

Benefits and risks of leveraged crypto trading

Leveraged crypto trading offers the potential for amplified gains, but it also comes with significant risks. Before diving in, understand both sides of the coin.

Benefits of leveraged crypto trading

- Amplify Profits: Leverage magnifies potential returns by controlling a larger position with a smaller investment.

- Short Selling: Leverage allows traders to profit from falling crypto prices by opening short positions.

- Increased Capital Efficiency: Traders can maximize the use of their capital by controlling more assets with less upfront cost.

- Flexibility: Leverage offers greater control over trading strategies by enabling both long and short positions.

- Potential for Faster Gains: Leverage can accelerate profit accumulation when market movements align with your predictions.

Risks of leveraged crypto trading

- Magnified Losses: Leverage amplifies losses as much as profits, leading to potential financial ruin.

- Liquidation Risk: If the market moves against you, your position could be liquidated to cover losses, wiping out your initial investment.

- Volatility: The inherently volatile nature of cryptocurrencies can exacerbate losses when using leverage.

- Margin Calls: Unexpected price swings can trigger margin calls, forcing you to deposit additional funds to maintain your position.

- Psychological Pressure: The potential for magnified losses can lead to emotional trading decisions and cloud your judgment.

FAQs

Sources

- https://www.coindesk.com/business/2024/03/12/coinbase-plans-1b-bond-sale-that-avoids-hurting-stock-investors-copying-michael-saylors-successful-bitcoin-playbook/

- https://www.ft.com/content/c7e4ad29-4bf8-43e3-85dd-cf35585c6ad1

- https://www.prnewswire.com/news-releases/kucoin-unveils-account-bound-tokens-kabt-with-reward-missions-on-mocaverse-and-halo-wallet-302082424.html

- https://cointelegraph.com/news/coinbase-blockaid-security-75-million

- https://www.okx.com/learn/okx-named-official-sleeve-partner-of-manchester-city