CFDs are financial instruments that track asset prices in real time. Whether you’re looking to trade stocks, forex, commodities, or cryptocurrencies; CFDs offer leverage and the ability to long or short.

This guide reveals the best CFD brokers for 2024. We rank the leading CFD platforms for low fees, supported markets, leverage limits, safety, customer support, and much more.

Top 8 CFD Brokers

Discover the best CFD brokers of 2024 below:

- XTB: We rate XTB as the best CFD broker. It supports thousands of markets, 0% commission trading, and competitive spreads. Leverage of up to 1:500 is available, and there is no minimum deposit requirement.

- FP Markets: Access over 10,000 instruments via multiple trading platforms, including MT4 and MT5. Due to investor demand, spreads were reduced for many instruments (FX pairs, gold, and indices).

- AvaTrade: An established CFD broker with 0% commission on all markets, AvaTrade supports stocks, ETFs, options, forex, cryptocurrencies, indices, and commodities. Supports MT4, MT5, and DupliTrade.

- Pepperstone: One of the best options for high-volume traders, Pepperstone offers CFD accounts with 0.0 spreads. Commissions are $3.50 for every $100,000 traded. There is no minimum deposit requirement.

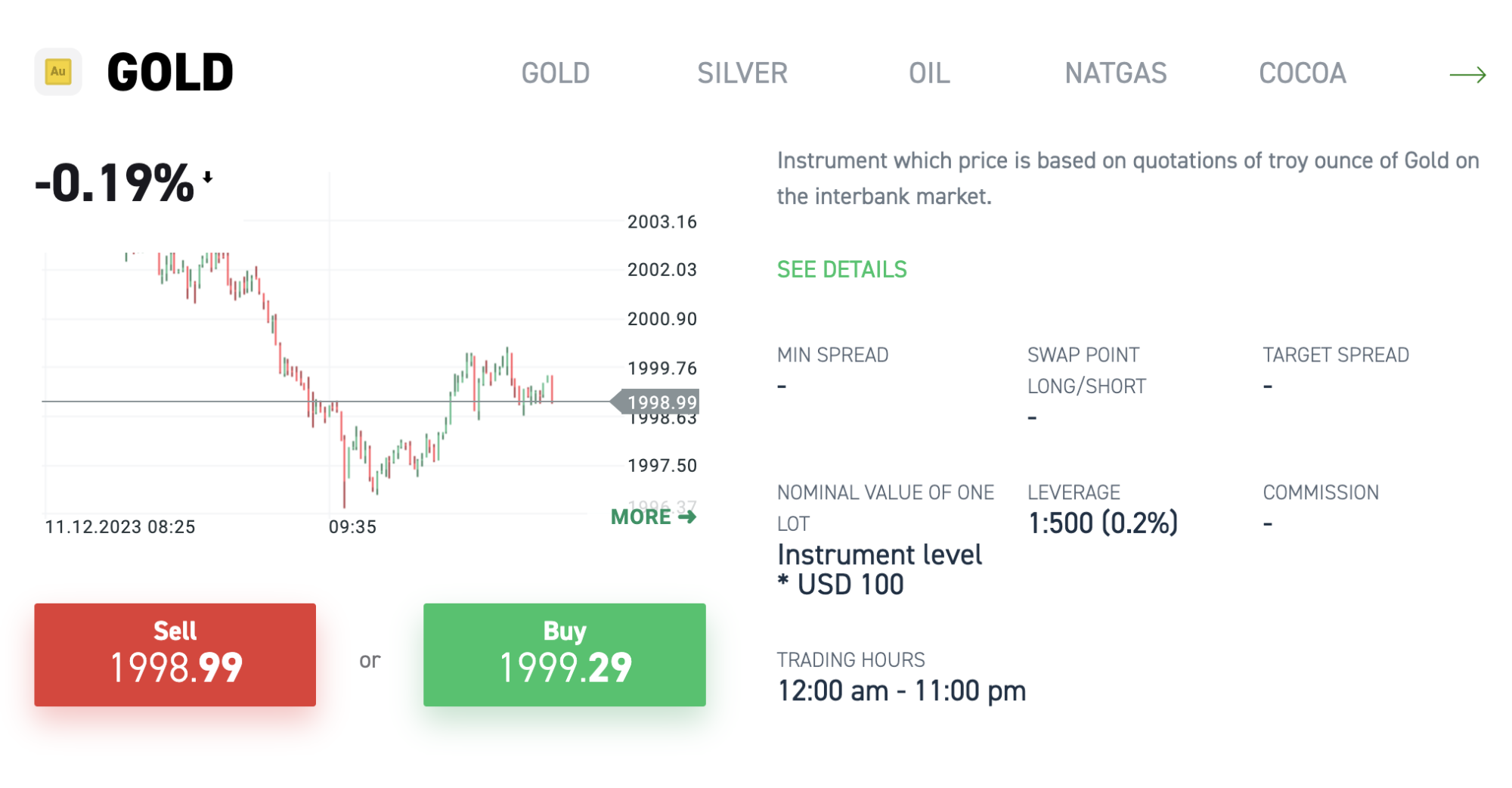

- Libertex: User-friendly CFD broker with over 3 million clients, Libertex offers more than 300 CFD instruments. Traders will find low commissions and tight spreads. The minimum trade is $20 and leverage goes up to 1:999.

- Skilling: Multi-asset CFD broker supporting cryptocurrencies, commodities, indices, stocks, and forex. Trade via the Skilling web browser or mobile app. Also supports MT4 and cTrader.

- IG: Launched in 1974, IG is a premium CFD broker that supports over 17,000 markets. Its native platform comes packed with features, including drawing tools, technical indicators, and custom alerts.

- Admiral Markets: This budget-friendly CFD broker has a minimum trade requirement of just €1. Admiral Markets lists over 3,000 stock CFDs, plus bonds, commodities, ETFs, forex, and indices.

Best Online CFD Brokers Reviewed

The best platforms for CFD trading will now be reviewed in full. Read on to choose the most suitable CFD broker for your requirements.

1. XTB – Overall Best CFD Broker for Beginners

XTB is the overall best platform for trading CFDs in 2024. It offers more than 5,500 global CFD markets across the most popular asset classes. This includes thousands of stocks from 16 international exchanges, including the US, the UK, and Germany. XTB also offers ETFs, indices, and commodities like gold, silver, and oil. You’ll also find some of the best crypto to buy.

This includes Bitcoin, Litecoin, Ripple, and Ethereum. When it comes to fees, XTB doesn’t charge trading commissions. You will, however, need to cover the market spread. For example, forex spreads start from 0.1 pips. Cryptocurrencies can be traded from 0.22% per slide. XTB spreads are dynamic and can be less competitive outside busy market hours.

XTB is also one of the best CFD brokers for leverage. Eligible clients can amplify their CFD positions by up to 1:500. However, clients in the UK, Europe, Australia, and several other countries will be capped at 1:30. XTB’s native platform – xStation 5, is available online, as desktop software, or via the mobile app.

The XTB app is rated 4.8/5 on the App Store. That said, on Google Play, XTB is rated just 4.3/5. Nonetheless, xStation 5 is feature-rich. It supports custom pricing charts, technical indicators, and other analysis tools. There is no minimum deposit requirement at XTB. Traders can deposit funds with Visa, MasterCard, Skrill, and bank wires.

Alternatively, you might consider opening an XTB demo account. This enables you to trade CFDs with a $100,000 virtual balance. Finally, we found that XTB is a safe CFD broker. It’s regulated by the FCA, meaning client funds are segregated. XTB also holds licenses with regulators in Spain, Poland, and Brazil.

| Range of CFDs | 5,500+ stocks, ETFs, commodities, cryptocurrencies, indices, and forex. |

| Pricing System | 0% commission on all assets. Dynamic market spreads. |

| Account Types | Standard and swap-free accounts. |

| Supported Platforms | Proprietary trading platform via browsers, desktop software, and an iOS/Android app. Also supports MT4. |

| Account Minimum | None |

| Max. Leverage | 1:500 |

| Standout Feature | 0% commission on all supported CFD markets. |

| Our Rating | 5/5 |

Pros

- Overall best CFD broker for 2024

- Trade 5,500 CFDs without paying commissions

- Competitive spreads (from 0.1 pips on forex)

- No minimum deposit requirement

- Native desktop software and mobile app

- Free demo account with $100,000 in virtual funds

- Maximum leverage of 1:500 for eligible clients

Cons

- $30 fee when withdrawing under $50

- Doesn’t support MT5

- No copy trading tools

2. FP Markets – Trade Over 10,000 CFDs, Including Digitial Currencies

FP Markets is our top choice for individuals who are interested in trading multiple asset classes, low spreads, and zero commissions for most withdrawal methods.

Withdrawals via a credit/debit card, domestic (AUD), and international bank (other than AUD) transfers are commission-free. FP Markets traders can trade forex (major and minor currency pairs), stocks, indices, bonds, commodities, and cryptocurrencies.

The spreads were reduced earlier in June 2024 due to investor demand, making FP Markets an attractive broker to retail traders.

XAU/USD spread in the Raw ECN account is only 0.04 (average).

The broker offers multiple platforms to choose from, from traditional MetaTrader4 (MT4) and MT5 to advanced trading environments.

IRESS trading platform is a professional trading platform with Direct Market Access (DMA) pricing.

In April 2024, FP Markets added Mottai Trader to Australian traders. The new platform offers enhanced user experience, customization, and speed.

Besides keeping up-to-date with the latest trading technology, FP Markets has been actively adding new instruments for its clients.

The latest additions were Brent, Sugar, and Cotton.

The broker is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA), and the Financial Services Authority (FSA).

| Range of CFDs | 10,000+ stocks, forex, commodities, cryptocurrencies, indices, and bonds. |

| Pricing System | Dynamic market spreads. |

| Account Types | Standard, Raw, Retail (IRESS), and Wholesale (IRESS). Islamic accounts are also available. |

| Supported Platforms | MT4, MT5, cTrader, WebTrader, IRESS, Mottai Trader, MT5 mobile app, mobile trading app. |

| Account Minimum | A$100, for IRESS account, A$1,000. |

| Max. Leverage | 30:1 for retail, 500:1 for pro |

| Standout Feature | IRESS and Mottai Trader |

| Our Rating | 4/5 |

Pros

- Spreads were reduced in June 2024

- Forex VPS is available

- Access over 10,000 CFDs from different markets

- Powerful trading platforms

- No minimum for withdrawals

- Equipped with key trading tools such as Autochartist and social trading

Cons

- High minimum deposit compared to its competitors

- Mottai Trader is only available to Australian traders

3. AvaTrade – Established CFD Broker With 0% Commissions and Support for Multiple Trading Platforms

AvaTrade is a regulated CFD broker that was launched in 2006. It holds licenses in nine countries, ensuring a safe trading experience. AvaTrade has a minimum deposit requirement of $100, which is higher than most other CFD brokers. That said, you can start with a free demo account without needing to make a deposit.

AvaTrade supports many trading platforms, including MT4, MT5, and DupliTrade. It also has a proprietary platform, which can be accessed online or via the AvaTrade app. In terms of CFD markets, AvaTrade lists stocks, ETFs, cryptocurrencies, forex, and commodities. It’s also one of the best CFD brokers for trading options.

All listed markets can be traded without paying commissions. Spreads start from just 0.9 pips when trading forex. AvaTrade offers leverage of up to 1:400 to eligible clients. We also like AvaTrade for its educational tools. This includes a fully-fledged trading academy with courses and tutorials. AvaTrade offers standard, Islamic, and professional accounts.

| Range of CFDs | 1,000+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, and options |

| Pricing System | 0% commission on all assets. Dynamic market spreads. |

| Account Types | Standard, Islamic, and professional accounts. |

| Supported Platforms | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4, MT5, and DupliTrade. |

| Account Minimum | $100 |

| Max. Leverage | 1:400 |

| Standout Feature | Huge leverage limits of up to 1:400 for eligible clients |

| Our Rating | 4/5 |

Pros

- Regulated in nine different countries

- 0% commission trading on all CFD markets

- Maximum leverage of up to 1:400

- Supports some of the best new cryptocurrencies to buy

- AvaTrade has a TrustPilot rating of 4.6/5 (8,200+ reviews)

- Multi-platform support includes MT4, MT5, and DupliTrade

Cons

- Minimum deposit of $100 is higher than other CFD brokers

- DupliTrade tool requires a $5,000 investment

- Smaller range of stock CFDs than other providers

4. Pepperstone – Minimum Spreads from 0.0 and Leverage Up to 1:500

Pepperstone is a CFD trading platform with low commissions and some of the tightest spreads in the industry. With a Razor account, you’ll pay a flat $3.50 commission per side and get spreads as low as 0.0 for the popular EUR/USD trading pair. Spreads on gold CFDs start at only 0.05. Alternatively, you can choose a commission-free account with spreads from 1.00.

Pepperstone has an outstanding selection of assets, including more than 1,200 CFDs for forex, commodities, stocks, ETFs, indices, and cryptocurrencies. The broker also recently introduced forward CFDs, which enable traders to hedge risk using futures contracts. Pepperstone offers best-in-class liquidity for all of its contracts, ensuring there’s no slippage while you trade.

Traders at Pepperstone can access a wide variety of trading platforms including cTrader, TradingView, MetaTrader 4, and MetaTrader 5. Pepperstone also has its own web trading platform and mobile apps for trading on the go, which offer access to advanced charting and risk management tools. You also get access to daily market analysis, although Peppersotone doesn’t offer copy trading or trading signals.

| Range of CFDs | 1,200+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, and forward CFDs |

| Pricing System | $3.50 commission + reduced spread or 0% commission with standard spread |

| Account Types | Standard, Razor, Islamic, and professional accounts. |

| Supported Platforms | Proprietary trading platform on browser and iOS/Android. Also supports TradingView, cTrader, MT4, and MT5. |

| Account Minimum | $0 |

| Max. Leverage | 1:500 |

| Standout Feature | Forward CFDs based on futures contract prices |

| Our Rating | 4/5 |

Pros

- Choose between 0% commission or reduced spreads

- Supports forward CFD trading

- Multiple trading platforms including TradingView, cTrader, and MetaTrader

- Daily market analysis and access to AutoChartist

- Discounts available through Active Trader program

- No minimum deposit to open an account

Cons

- Doesn’t offer copy trading or signals

- Above-average overnight funding rates

- Doesn’t support two-factor authentication

5. Libertex – Small Minimum Trade Requirements and Leverage of up to 1:999

Libertex has been offering CFD trading services for over 25 years. With over 3 million clients, Libertex is one of the most popular CFD brokers in the market. It supports over 300 CFD markets, including stocks, forex, commodities, indices, and cryptocurrencies. Although Libertex has a $100 minimum deposit, CFDs can be traded from just $20.

What’s more, Libertex offers huge leverage limits of up to 1:999. This means a $20 trade can be amplified to almost $20,000. Libertex has a native trading platform that will appeal to beginners. This is available online or via the iOS/Android app. Libertex also supports MT4 and MT5. In terms of fees, Libertex charges a small trading commission, which varies depending on the asset.

For instance, indices and forex can be traded from 0.003% and 0.007% respectively. We found that most CFD instruments come with competitive spreads. For example, EUR/USD comes with an average spread of just 0.4 pips. Libertex offers a free demo account with $50,000 in trading capital. Alternatively, you can deposit funds with a debit/credit card, e-wallet, or bank wire.

| Range of CFDs | 300+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, and bonds |

| Pricing System | Variable commissions starting from 0.003% per slide. |

| Account Types | CFD, Portfolio (real stocks), and professional accounts. |

| Supported Platforms | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4 and MT5. |

| Account Minimum | $100 |

| Max. Leverage | 1:999 |

| Standout Feature | Minimum trade size of $20 on all supported markets |

| Our Rating | 4/5 |

Pros

- More than 3 million clients and 25+ years of experience

- Trade CFDs from $20 per position

- Very low spreads on most markets

- User-friendly app for iOS and Android

- Fast account opening process

- $50,000 free demo account

Cons

- Supports just over 300 CFD markets

- Minimum first-time deposit of $100

- Charges trading commissions

Comparing the Top CFD Brokers

The table below summarizes the best CFD brokers to consider in 2024.

| Stock Broker | Range of CFDs | Pricing System | Account Types | Supported Platforms | Account Minimum | Max. Leverage | Standout Feature | Our Rating |

| XTB | 5,500+ stocks, ETFs, commodities, cryptocurrencies, indices, and forex. | 0% commission on all assets. Dynamic market spreads. | Standard and swap-free accounts. | Proprietary trading platform via browsers, desktop software, and an iOS/Android app. Also supports MT4. | None | 1:500 | 0% commission on all supported CFD markets. | 5/5 |

| FP Markets | 10,000+ stocks, commodities, bonds, cryptocurrencies, indices, and forex. | Dynamic market spreads. | Standard, Raw, Retail (IRESS), and Wholesale (IRESS). Islamic accounts are also available. | MT4, MT5, cTrader, WebTrader, IRESS, Mottai Trader, MT5 mobile app, mobile trading app. | A$100. For IRESS, the minimum is A$1,000 | 30:1 for retail, 500:1 for pro | IRESS and Mottai Trader. | 4/5 |

| AvaTrade | 1,000+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, and options | 0% commission on all assets. Dynamic market spreads. | Standard, Islamic, and professional accounts. | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4, MT5, and DupliTrade. | $100 | 1:400 | Huge leverage limits of up to 1:400 for eligible clients. | 4/5 |

| Pepperstone | 1,200+ stocks, ETFs, commodities, cryptocurrencies, indices, and forex. | Depends on the account. Razor accounts offer 0.0 spreads and a $3.50 commission. | Standard, Razor, and professional accounts. | MT4, MT5, cTrader, and TradingView | None | 1:200 | Razor accounts offer 0.0 pip trading. | 4/5 |

| Libertex | 300+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, and bonds | Variable commissions starting from 0.003% per slide. | CFD, Portfolio (real stocks), and professional accounts. | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4 and MT5. | $100 | 1:999 | Minimum trade size of $20 on all supported markets. | 4/5 |

| Skilling | 1,200+ stocks, commodities, cryptocurrencies, indices, and forex | 0% commission on all assets. Dynamic market spreads. | Standard, premium, MT4, and MT4 premium accounts | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4 and cTrader. | €25 | 1:30 | Small first-time deposit requirement of €25. | 3.5/5 |

| IG | 17,000+ stocks, ETFs, commodities, cryptocurrencies, indices, forex, options, and futures | 0% commission on all assets apart from stocks. Dynamic market spreads. | Standard and professional accounts. | Proprietary trading platform via browsers and an iOS/Android app. Also supports MT4. | $50 (debit/credit cards), $0 (bank wires) | 1:30 | Supports over 17,000 CFD markets. | 3.5/5 |

| Admiral Markets | 3,000+ stocks, ETFs, commodities, indices, forex, and bonds. | Trading commissions depend on the account type and asset. Dynamic market spreads. | Trade, Invest, and Zero accounts for both MT4/5 | Proprietary trading platform via browsers, desktop software, and an iOS/Android app. Also supports MT4 and MT5. | €25 | 1:500 | Trade CFDs from just €1 per position. | 3/5 |

What are CFDs?

Contracts-for-differences, or CFDs, are a type of financial instrument. They enable traders to go long or short without owning the respective asset. CFDs also invite leverage, meaning profits and losses are amplified.

In simple terms, CFDs track the value of real-world assets, such as gold, oil, stocks, forex, and cryptocurrencies. This means that traders can buy and sell CFDs without owning the underlying asset. In turn, CFDs are considerably cheaper to trade when compared to traditional markets.

In fact, most CFD market brokers offer 0% commission trading. This is because CFDs are created in-house, so the operational costs are minimal. CFDs are also beneficial for trading with high levels of leverage. For instance, XTB, Libertex, and Admiral Markets offer leverage of up to 1:500. So, a $100 account balance can be amplified to $50,000.

CFDs also enable traders to speculate on rising and falling markets. They enable you to go long or short without complicated terms. Simply place a buy or sell order based on your prediction. As CFDs do not provide asset ownership, many brokers offer fractional trading.

All that being said, CFDs also come with their drawbacks. For a start, CFDs are leveraged instruments, so overnight financing fees apply. This means you’ll be charged swap fees every day the CFD position remains open. Although some CFD brokers offer swap-free accounts, these come with higher spreads.

Another drawback is that CFD positions can be liquidated. This means the position will be closed by the broker if it declines by a certain percentage. The more leverage applied, the more likely liquidation becomes.

The Legalities of CFDs

We should also mention that CFDs aren’t legal in all countries. In particular, CFDs are banned in the US. As explained by the SEC, this is because CFDs do not trade through regulated exchanges (like the NYSE).

Although CFDs are legal in the UK and European Union (EU), restrictions apply. For instance, the UK’s FCA has completely banned crypto derivatives, including CFDs. While ESMA, which governs EU financial markets, limits retail clients to CFD leverage of 1:30.

Global regulators also require CFD trading brokers to be transparent on risk. This is why the best CFD brokers display a risk warning, showing the percentage of retail clients that lose money on their platforms.

How to Pick the Right CFD Trading Platform

The metrics discussed below should be considered when choosing the best CFD broker in 2024:

- Regulation and Safety: CFD brokers must be regulated in the markets they operate. Some of the most trusted regulatory bodies to look for include the FCA (UK), ASIC (Australia), and CySEC (Cyprus). These bodies ensure that client funds are segregated in tier-one bank accounts. In the event of a CFD brokerage collapse, your capital will be protected. The regulatory body you fall under will depend on your country of residence.

- Range of CFDs: The best CFD brokers support thousands of markets. At XTB, for example, you can trade over 5,500 CFDs, ranging from stocks, ETFs, and commodities to cryptocurrencies, indices, and forex. AvaTrade and IG are good choices for trading CFD options. Within each asset class, explore what specific markets are available.

- Fees: We found that most CFD brokers offer 0% commission trading. That said, you’ll need to cover the spread, which will vary depending on the asset and broader market conditions. What’s more, CFDs are leveraged financial products, meaning overnight and weekend swap fees apply. Some CFD brokers offer swap-free accounts like FP Markets, although these usually come with higher spreads. You should also consider deposit and withdrawal fees.

- Tools and Analysis: Many CFD brokers offer proprietary trading platforms that come with analysis tools. This should include technical indicators, drawing tools, and risk management orders (e.g. stop-losses). If supported, you might also consider third-party platforms like MT4 or TradingView.

- Minimum Deposit: The average minimum deposit amount required by CFD brokers is $100. This might be too high for beginners, so look for platforms with smaller minimums. For instance, there is no minimum needed at XTB or Pepperstone. Don’t forget to check the minimum trade size, as this can vary widely between CFD brokers.

- Demo Account: The best CFD brokers offer a free demo account. This enables you to test the trading platform before making a deposit. Demo accounts are also ideal for crafting new trading strategies.

- Mobile App: CFDs are designed for short-term traders, so you’ll want access to a reliable mobile app. This enables you to open and close positions at the click of a button. The mobile app should be user-friendly and offer full functionality. We like the XTB app, as it comes packed with trading and analysis tools.

- Payment Methods: CFD brokers usually accept debit/credit cards and bank wires. XTB, and several other providers also accept e-wallets. Deposits should be credited instantly where possible. Moreover, we prefer CFD brokers that process withdrawals within 24 hours. Minimums and fees can vary depending on the payment type and the underlying currency.

- Customer Service: Choose a CFD broker that offers premium support via live chat. Support is usually available 24/5, although this is worth checking before proceeding. Alternatively, if you want telephone support, consider a traditional CFD broker like IG. The support team should be able to assist with all account queries, including payments, verification, and trading.

Our Methodology for Testing CFD Brokers

We developed an in-house methodology to accurately rank the best CFD trading platforms for 2024. Our research methods are transparent and impartial, allowing readers to make informed decisions when choosing a broker. We focused on CFD brokers with strong regulatory frameworks, meaning licenses from tier-one bodies like the FCA and ASIC.

Strict licensing not only keeps your capital safe; it ensures you’re trading in fair market conditions. We also examined CFD trading fees when researching brokers. This includes trading commissions, spreads, and overnight financing. Non-trading fees, such as deposits and withdrawals, were also included in our ranking methodology.

In addition to regulation and fees, we also considered what CFD markets were supported. We gave priority to brokers with thousands of markets across many asset classes, including forex, commodities, stocks, ETFs, options, and cryptocurrencies. Within each market, we assess the minimum trade size and the maximum leverage limit.

We also tested the proprietary trading platforms offered by each CFD broker. Core metrics included user-friendliness, trading tools, and ease of access. Another important factor was customer service; we prefer brokers with 24/5 or 24/7 support via live chat. Ultimately, these research methods enabled us to create fair and reliable CFD brokers ratings.

Conclusion

We reviewed the best CFD brokers for 2024. XTB is our top pick; the broker offers over 5,500 CFD markets at 0% commission and tight spreads.

There’s no minimum deposit requirement and eligible traders can access leverage of up to 1:500. XTB offers a free demo account, so you can test it out yourself without making a deposit.

FAQs

How do I trade CFDs online?

To trade CFDs online, open an account with a regulated CFD broker and make a deposit. Search for a CFD market and choose from a buy (long) or sell (short) order.

Which is the best CFD trading platform?

We rate XTB as the best CFD trading platform. Over 5,500 CFD markets can be traded without paying commissions. XTB has a $0 minimum deposit requirement and also offers free demo accounts.

How do I choose a good CFD broker?

Make sure the CFD broker is regulated by a tier-one body like the FCA or ASIC. Other important factors include commissions, fees, account minimums, supported markets, and payment types.

How much money do I need to trade CFDs?

You’ll need to meet the minimum deposit and trade requirement set by the CFD broker. At XTB, there is no minimum deposit and the minimum trade size is 0.01 units. In most cases, you can trade CFDs with under $100.

Which CFD broker has the lowest spreads?

XTB is one of the best low spread CFD brokers; spreads start from just 0.1 pips and all markets can be traded commission-free. Alternatively, consider Pepperstone, which offers 0.0 spreads with a $3.50 commission.

How do I know if a CFD broker is regulated?

Regulated CFD brokers display their licensing information toward the bottom of their website. This should include the name of the regulatory body and the respective licensing number. You can then verify this on the regulatory’s public register.

References

- https://www.handbook.fca.org.uk/handbook/CASS/7/13.html

- https://www.sec.gov/files/litigation/complaints/2018/comp-pr2018-218.pdf

- https://www.fca.org.uk/news/press-releases/fca-bans-sale-crypto-derivatives-retail-consumers

- https://www.esma.europa.eu/press-news/esma-news/esma-renew-restrictions-cfds-further-three-months-1-may-2019

- https://asic.gov.au/about-asic/news-centre/find-a-media-release/2022-releases/22-082mr-asic-s-cfd-product-intervention-order-extended-for-five-years/