Investing in stocks can be a great way to improve your overall wealth – but it’s also easy to lose money if you’re not totally clear on how to approach it.

The best performing stocks rise in value on the back of improving investor sentiment, better-than-expected financial results or a successful product launch.

But stock prices can also quickly fall if a company fails to meet analysts’ expectations, issues a profit warning, or operates in out of favor sectors.

Here in our how to invest in stocks for beginners guide, we’ll reveal everything you need to know about entering the stock market for the first time.

- Show Full Guide

How to Start Investing in Stocks for Beginners

It can seem daunting when you first invest in stocks, but that doesn’t need to be the case, as there’s plenty of information available on how to get started.

Here we explain what investors need to know about how to earn passive income in the stock market, understanding stock exchanges, how to buy stocks and putting together an investment portfolio.

1. Determine your Investing Approach

The starting point is establishing why you’re investing and what you’re hoping to achieve. People put money away for all sorts of reasons, so what are your goals?

For example, are you looking to build a pot of money for your future, or do you need to generate a regular income to make ends meet?

Your goals will dictate your investment approach. If you don’t plan on needing the money for decades, you may prefer stocks that are focused on growth.

Alternatively, if a regular income is more important to you, then companies paying regular dividends to their shareholders will be worth considering.

When it comes to building an investment portfolio, there are also a few golden rules that must be obeyed if you want to improve your chances of success. Most notably, investors must carry out thorough research before committing any money, and avoid the temptation to risk everything on just one investment or market segment.

Finally, if in doubt, investors should always consider seeking financial advice before making investment decisions.

2. How to Invest in Stocks USA: Choosing a Brokerage

The good news is there’s no shortage of options when it comes to stock brokerages. There are literally hundreds available, so the biggest problem for investors will be deciding.

The aim is to find an online broker that best meets your aims and objectives. For example, if you’re new to the world of investing, then a platform offering educational tools may be the most suitable.

Conversely, if you’ve been trading for years and are familiar with stock markets, then customer service, advanced trading strategies and access to detailed analysis may be more beneficial.

Some platforms are better suited for the trading of particular asset classes. For example, if you’re mainly focused on equities, then opt for one specializing in this area.

In addition, when it comes to minimum deposit requirements, some brokerages are likely to have higher requirements than others, so you need to do your homework.

Finally, consider whether you will be accessing your online account from your desktop or whether brokers offering mobile phone apps are essential.

If it’s the latter, then it’s worth exploring whether these apps are actually any good. It’s an area that’s developing fast but user experiences differ.

Take your time to explore the options, paying close attention to the fees and commission levels involved, as well as trading hours and other services.

3. Verify and Fund Your Trading Account

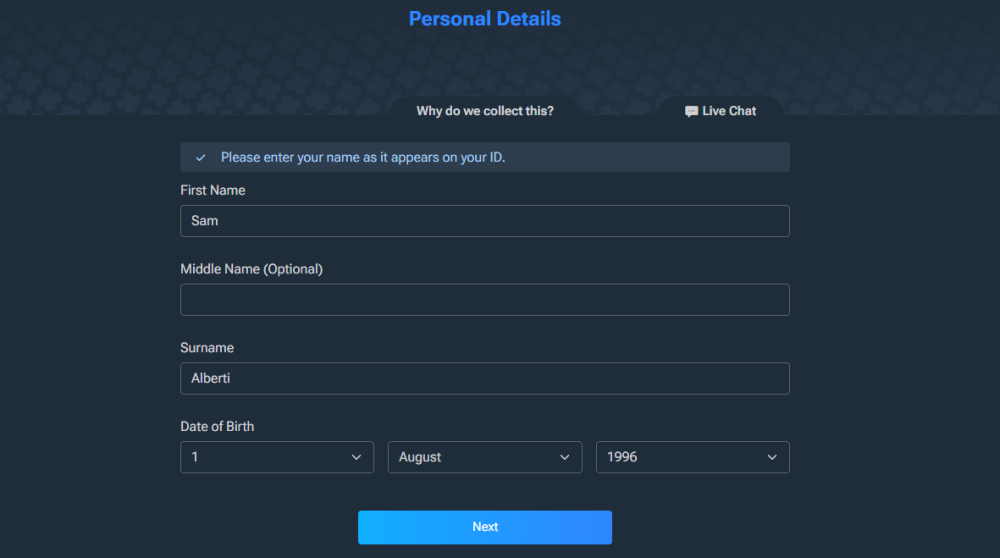

The process of setting up and verifying an online trading account may vary slightly between providers, but you should broadly expect the following.

Your first task is to visit the website and sign up. This is a quick and easy process, usually requiring your name, preferred username, email address, and a password of your choice.

The next stage will be to verify your ID – usually by uploading images of two separate ID forms – to ensure you are eligible to open an account.

Once the verification process has been completed, you can take another step towards your stock market investing journey.

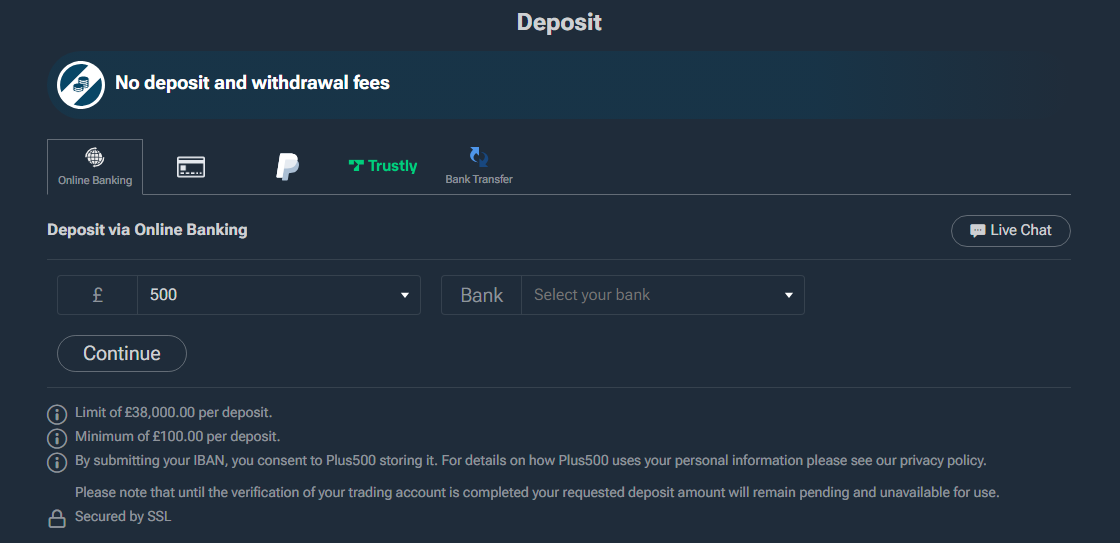

Before you can start trading, you’ll need to fund your account. Ensure you have a secure connection – public WIFI systems aren’t advisable – and follow the broker’s procedures for adding money.

4. Explore the Different Stocks and Investment Vehicles Available

Deciding where to invest your money is notoriously difficult. There are thousands of stocks available, not to mention all manner of investment products.

For example, do you prefer the idea of individual stock investing or would you consider putting your money into a mutual fund? There will be pros and cons with each approach.

Buying stocks will give you exposure to the highs and lows of those particular companies. If their share price rises, you’ll benefit. If it falls, however, you’ll share the pain.

Mutual funds, meanwhile, will invest in a wider variety of stocks. This means you get a more diversified spread of exposures and won’t be reliant on the fortunes of a handful of companies.

There are plenty of stocks and investment vehicles to consider. For example, you can opt for an exchange traded fund (ETF).

You can buy an ETF that will track the performance of an index or a ‘basket’ of stocks. This is useful if you’re wanting broad exposure to the performance of a particular area.

5: Choose a stock or fund and confirm your purchase

You may be more interested in how to invest in stocks for beginners with little money. After all, not everyone has thousands of dollars at their disposal.

The good news is that it’s possible to start investing on a relatively small scale and consider larger transactions when you are more financially able to make them.

You will also need to look at where in the world you want exposure. For example, do you want to have most of your holdings in companies listed on the New York Stock Exchange?

Many investors feel more comfortable with funds investing in household name companies with whose products they are familiar, such Apple or Netflix.

In order to make such calls, you need to be consistently improving your stock market knowledge. There are plenty of sources available, including the views of analysts, industry observers and journalists.

Remember, however, that even seasoned investors can be wrong about a particular stock. There are no guarantees in the world of investment, so do as much research as possible before making a call. Once you have decided, it’s time to confirm your purchase via your online broker.

The Basics of Stock Market Investing

Next, we cover what you need to know about stock market investing – from understanding stocks to putting together an investment portfolio and reducing risks.

What are Stocks?

A stock represents a shared ownership in a particular company. How much this stock is worth will depend on the value of the particular business, and the number of stocks available.

Lower risk investors are usually more cautious and have more assets in safer asset classes, such as fixed income products as opposed to equities.

Higher risk investors, meanwhile, are at the other end of the scale. They’re likely to have more of their assets in more volatile areas, such as emerging markets, in the hope of better returns.

So, what should investors look for when buying stocks? Firstly, if you are looking to invest in individual companies, then a good understanding of how they operate is essential.

For instance, what sector is it in? Is it competing with many rivals? What factors can affect its income? These are all important to consider by anyone looking at how to invest in stocks.

You’ll also need to take a look at the company’s recent financial results. These can be found within the investor relations section of a company’s website.

This will provide a treasure trove of data, including past revenue figures, dividend levels, and future goals. This is crucial information for anyone building their own stock portfolio.

Taxes and Regulations for Investors

The taxes and regulations applying to investors will depend on the jurisdiction in which they live. For example, stocks in the US are primarily subject to capital gains tax.

The rate for this levy will depend on how long the investor has held the position, although there are exceptions for those that have been held for less than a calendar year.

Investors have the option of offsetting any losses against any gains in order to reduce tax liabilities. However, it’s worth getting the advice of a tax or financial adviser if you’re unclear.

The regulation and taxation of stocks in the US is the remit of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

How to Reduce Risk in Your Investment Portfolio

No investment is completely risk-free. However, a diversified spread of assets can help reduce the likelihood of losing all your money.

You can diversify your portfolio in different ways. The first is by having exposure to a spread of different asset classes, such as equities, fixed income, and property.

It’s also possible to break these broad asset classes down further. For example, equities can be split by size of company, sector, and geographical location.

Then there are the businesses themselves. Fast-growing, younger firms may be combined with more stable, established businesses to give portfolios more balance.

Whatever your short and long-term objectives, a key rule is not to invest anything you can’t afford to lose as you never know when a company – or mutual fund – will encounter problems.

While no-one wants to lose money, there are two elements to consider: How much you can actually afford to potentially lose and your attitude towards stock market turbulence.

Of course, if you can’t stand the thought of any losses, even if they’re only temporary, then investing in stock markets may not be for you.

Where to Buy Stocks in 2024

Here we take a look at where to start if you want to open up a brokerage account. There is certainly no shortage of online brokers and here are some we believe are worth considering.

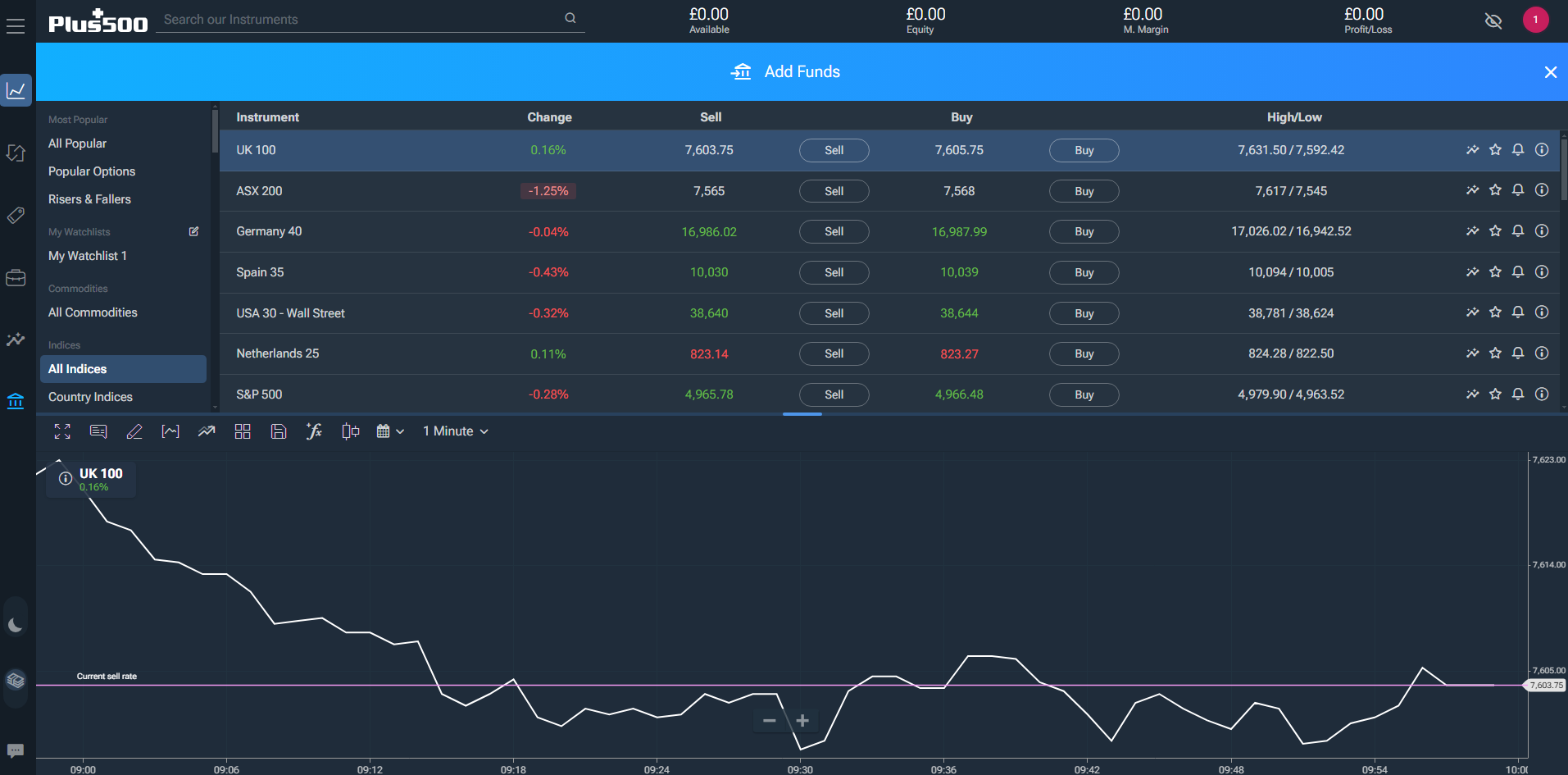

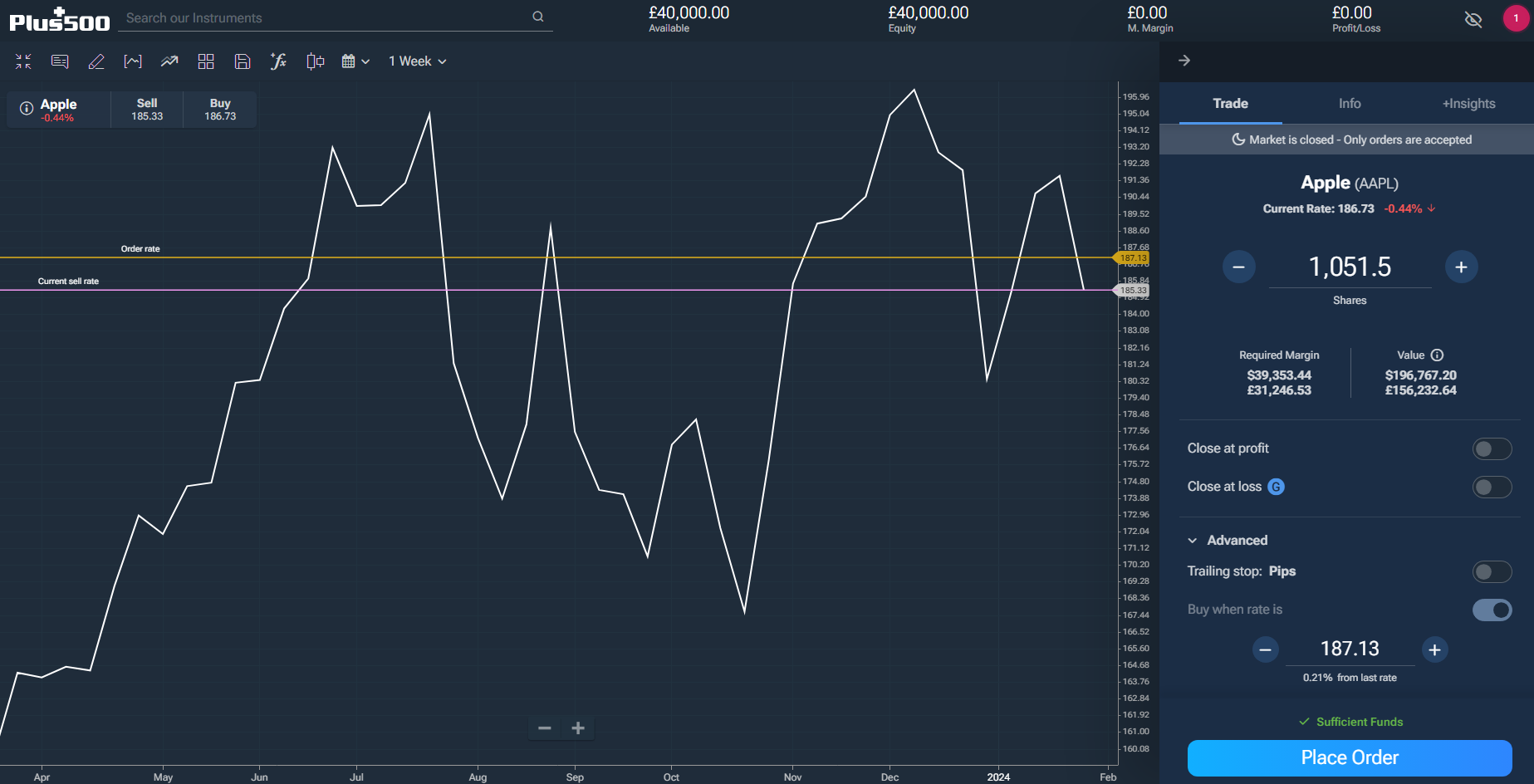

1. Plus500 – The Best Online Brokerage for Most People

Plus500, which was founded back in 2008 with the launch of a PC-based online trading platform, has been growing steadily for the past 16 years, now with more than 2,000 financial instruments on offer. This has seen the multi-asset fintech group continually expanding its core product offering to millions of users in new and existing markets.

The broker offers customers most of its services free of charge and prides itself on being upfront about the fees it does levy.

The company, which is the official partner of the Chicago Bulls, the iconic NBA basketball team, offers a range of trading products, including Contracts for Difference (CFDs), share dealing, and the ability to invest in crypto.

It also enables users to trade Exchange Traded Funds, commodities, and forex, and even other popular stock market indices around the world.

The platform has won plaudits for its simplicity and ease of use, as well as the detailed information and analytical sources that are available. For example, its trading academy explains clearly how the platform works, as well as tips on how to sharpen your trading skills with videos and an eBook.

It also regularly updates its news and market insights section, while offering an alerts service that gives real-time email, SMS and push notifications. These can be set for price alerts, percentage changes or even traders’ sentiments, to ensure users are kept up to speed with what’s happening in the market.

Warning: Your capital is at risk.

2. eToro: Simple Interface, Ideal for Beginners

Millions of traders and investors have opted to use eToro, the online broker that was first launched back in 2007. It has won acclaim for being user friendly, offering access to multiple asset classes, and providing a range of educational tools.

The interface is also very clear and appealing, with stock market and news updates, as well as charts highlighting the biggest stock movers of the day.

The screen also has easy access links to your existing portfolio, as well as a watchlist of potential assets and stocks that you are monitoring.

Being easy to navigate is a definite plus for everyone, especially those that are just starting their investment journeys and are unfamiliar with how trading platforms work.

For example, there is the eToro academy, which explains why you should consider investing and lists of terms that you really need to know.

Warning: Your capital is at risk.

3. Robinhood: Commission-Free Investing with Low Fees

Robinhood is a zero-commission trading platform that has attracted millions of investors and been praised for its intuitive user interface.

Its commission-free model also includes zero trading fees on a range of popular assets, including stocks, exchange traded funds, and options.

A nice bonus of the platform is the community-oriented feel that it creates via social trading, which is similar in approach to many of today’s popular social networks.

As far as investors are concerned – particularly those making their first forays into the area – Robinhood is seen as a cost-effective option.

This is due to its low minimum deposit, accessible fractional share trading, and the absence of account fees, which is a bonus for every investor.

Overall, such factors mean Robinhood can rightly be regarded as an affordable and easy-to-use platform for trading by even the newest investors.

Warning: Your capital is at risk.

4. Webull: A Modern and Flexible Option

Although Webull is one of the more recent arrivals to the fiercely-competitive online trading marketplace, it has already attracted plenty of users.

Over the past five years, the platform has been praised by investors for its intuitive design, advanced features, and lack of commission.

Among the benefits are the analysis tools that it offers, as well as extended trading hours and the provision of real-time market data.

This platform appears to be particularly suitable for investors wanting to trade in assets such as equities and options.

However, its commitment to commission-free trades across various asset classes includes exchange traded funds (ETFs).

Of course, today it’s very important to have an attractive and accessible mobile app for investors on the move, as well as a clear desktop platform.

Webull scores highly on both these factors, making the overall offering an attractive one for investors searching for a flexible, affordable and modern trading solution.

Warning: Your capital is at risk.

The 5 Best Stocks to Buy for Beginners in 2024

So, what is the best stock to buy for beginners? This is not an easy question to answer as this will depend on investment goals and attitude to risk.

However, we have compiled a list of popular stocks that are household names in their respective industries and loved by global investors.

As always, ensure you carry out your own research and never invest more than you can afford to lose. Remember, past performance is not an indicator of future returns.

Apple (AAPL)

The US tech giant behind the iPhone, MacBook and Apple Watch, is one of the largest companies in the world, with a market capitalization of just under $3bn.

The California-based firm has become one of the business success stories of the past half a century with a fiercely loyal international customer base.

It announced revenue of $89.5bn for the fourth quarter ended September 30, 2023, down 1% year-over-year, but a cash dividend of $0.24 per share.

Tim Cook, Apple’s chief executive, revealed it had been a September quarter revenue record for the iPhone revenue and an all-time high within services.

“During the September quarter, our business performance drove double digit EPS growth and we returned nearly $25bn to our shareholders, while continuing to invest in our long-term growth plans,” he said.

Although Apple’s stock price (AAPL) hit an all-time high in December 2023, it has lost the mantle of being the world’s most valuable company to Microsoft.

According to Reuters, investors believe Microsoft’s early lead in artificial intelligence will enable its stock market value to pull decisively ahead of Apple over the next five years.

The consensus view is that Apple stock is a ‘strong buy’, according to the views of 29 analysts compiled by NASDAQ.

Their average 12 month price target for the stock is $205.85, with the highest coming in at $250 and the lowest at $160.

NVIDIA (NVDA)

The US chip maker, which was founded back in the early 1990s, is a leading designer of graphics processing units for computing platforms.

It’s a pioneer of GPU-accelerated computing and specializes in products and platforms in growing markets, such as gaming and automotive.

The company announced record revenue of $18.12bn for the third quarter ending October 29, 2023, up 206% on the previous year.

According to Jensen Huang, its founder and chief executive, its strong growth reflected the transition to accelerated computing and generative AI.

“NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle,” he said. “The era of generative AI is taking off.”

NVDA stock is rated as a ‘strong buy’, according to the views of 39 analysts compiled by NASDAQ, with the average 12 month price target being $675.40.

The most optimistic stock market analysts believe it could reach $1,100, while the lowest estimate was for the price to sink to $560 by early 2025.

While NVIDIA is a leading name in the industry, there are concerns that rival chipmakers and tech businesses could start focusing on their own chip development.

Pfizer (PFE)

The pharmaceutical giant revealed a 41% fall in revenue to $14.2bn for the fourth quarter of 2023, which is largely down to lower sales of Covid medicines.

The disappointing news came a few weeks after Pfizer’s shares tumbled more than 8% after forecasting 2024 revenues would be below consensus estimates.

However, the company has invested billions of dollars into schemes that it believes will enhance its future growth prospects.

These include putting $10.7bn into internal research and development projects and around $43bn in transactions, such as the acquisition of Seagen Inc.

In a statement accompanying the company’s recent results, David Denton, chief financial officer and executive vice president, said the next wave of pipeline innovation would fuel Pfizer’s growth.

“In addition, we are on track to deliver at least $4bn in annual net cost savings by the end of 2024 from our cost realignment program,” he added.

Stock market analysts appear optimistic about Pfizer’s prospects. The stock is currently rated a ‘buy’, according to the views of 20 analysts compiled by NASDAQ.

Their average 12-month price target is $31.69, given the highest estimate came in at $45 and the lowest at $27.

Tesla (TSLA)

Elon Musk’s electric vehicle maker is expected to be a major beneficiary of the auto industry’s ongoing transformation – but it’s had a challenging start to 2024.

The Financial Times reported that TSLA stock fell after the company warned sales growth would be notably lower because of flagging demand, increasing competition and high interest rates.

However, the longer-term outlook is more encouraging for the broader marketplace, with the expected increase in demand for electric vehicles.

More than 10 million electric cars were sold during 2022 – and the figure for last year is expected to hit 14 million, according to the International Energy Agency.

It would mean electric vehicles’ share of the overall car market, which is being driven by global environmental concerns, has risen from 4% in 2020 to 18%.

Fatih Birol, the IEA’s executive director, said: “Electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging – and they are bringing about a historic transformation of the car manufacturing industry worldwide.”

TSLA stock is currently rated a ‘buy’, according to the recommendations of 32 analysts compiled by NASDAQ.

Their average 12 month price target for TSLA stock is for it to hit $220.98, although there’s a huge disparity between views. The highest target is $345, with the lowest estimate at just $23.53.

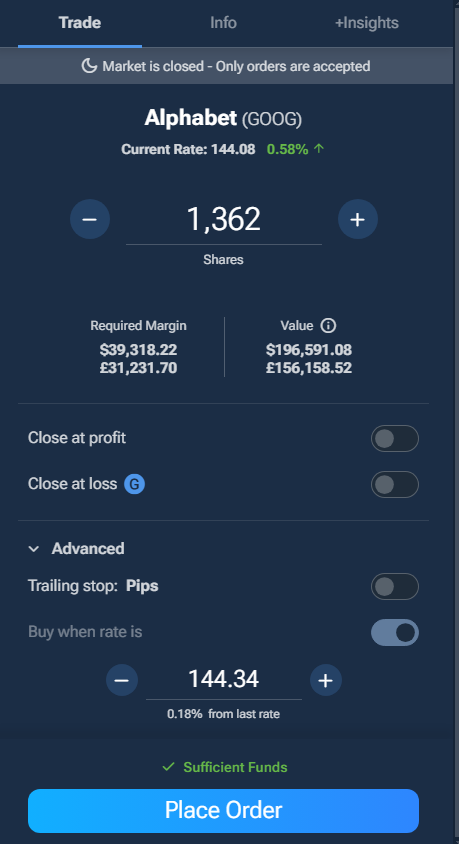

Alphabet (GOOG)

The parent company of Google, the hugely popular internet search engine, ended 2023 strongly, with fourth quarter revenues up 13% year-over-year at $86bn.

In a statement, Sundar Pichai, Alphabet’s chief executive, highlighted the growing contribution of YouTube and Cloud – and emphasized the importance of artificial intelligence.

“Each of these is already benefiting from our AI investments and innovation,” he said. “As we enter the Gemini era, the best is yet to come.”

However, the company’s shares slipped 5.5% in after-hours trading due to Alphabet narrowly missing forecasts for growth in its advertising business, according to the Financial Times.

It noted that revenue for the quarter had grown 11% to $65.5bn, which was slightly below the $66bn consensus of analysts.

Separately, a report on the Verge also highlighted how the company spent $2.1bn on severance and other expenses after laying off more than 12,000 employees during 2023.

The company’s stock is rated a ‘strong buy’, according to the opinions of 40 analysts compiled by NASDAQ.

Their average 12-month price target is $163.13. However, there is some disparity, with the most pessimistic penciling in $140, and the more optimistic suggesting it could hit $180.

Our Verdict on Stock Market Investing for Beginners

Putting money into the stock market can be a great way to increase your wealth, as long as you take the time to carry out proper research. It’s also important to remember that there are no guarantees, so only invest what you can realistically afford to lose.

If you’re happy to proceed, you’ll need to establish your investment goals and decide how much risk to take, before choosing an online broker through which you can make your transactions.

Once that’s in place, it’s down to you to put money into your account and decide what assets you’d like to begin trading. You can start your investing journey very cheaply.

It’s also worth revisiting your investment decisions regularly to ensure they’re still suitable. You can always seek the advice of a financial advisor.

FAQs

How do beginners buy stocks?

How much money do I need to invest to make $1,000 per month?

How do I invest $100 in stocks?

How much money do you need to start buying stocks?

References

- https://www.nasdaq.com/market-activity/stocks/aapl/analyst-research

- https://www.apple.com/newsroom/2023/11/apple-reports-fourth-quarter-results/

- https://www.apple.com/newsroom/pdfs/fy2023-q4/FY23_Q4_Consolidated_Financial_Statements.pdf

- https://www.macrotrends.net/stocks/charts/AAPL/apple/stock-price-history

- https://companiesmarketcap.com

- https://www.reuters.com/technology/investors-see-microsofts-stock-market-value-leaving-apple-behind-2024-01-29/

- https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-third-quarter-fiscal-2024

- https://www.nasdaq.com/market-activity/stocks/nvda/analyst-research

- https://s28.q4cdn.com/781576035/files/doc_financials/2023/q4/Q4-2023-PFE-Earnings-Release.pdf

- https://www.nasdaq.com/market-activity/stocks/pfe/analyst-research

- https://www.ft.com/content/c2a53290-2e20-41e0-a4d4-c269d96f6a29

- https://abc.xyz/assets/95/eb/9cef90184e09bac553796896c633/2023q4-alphabet-earnings-release.pdf

- https://www.nasdaq.com/market-activity/stocks/googl/analyst-research

- https://www.theverge.com/2024/1/30/24056132/google-spent-two-billion-on-layoffs-severance-fourth-quarter-earnings-2023

- https://www.ft.com/content/df2b7d62-39cd-461e-ac4f-b6ded31a6687

- https://www.ft.com/content/b37912bf-6f01-4393-85cc-df064332b10f