Cash back credit cards allow you to earn rebates every time you make a purchase. Rewards average 1-5% depending on the spending category and the card provider.

This guide reveals the best cash back credit card for 2024. Our methodology ranks the best cards based on cash back rewards and limits, introductory offers, APRs, eligibility requirements, and more.

Best Cash Back Credit Cards Reviewed for 2024

The best credit cards for cash back are reviewed in the sections below.

1. U.S. Bank Cash+® Visa Signature® Card: Overall Best Cash Back Card

We rate the U.S. Bank Cash+® Visa Signature® Card as the overall best cash back credit card. New members receive a $200 cash back bonus after spending just $1,000. You’ll have 120 days to reach this target and all purchases are eligible. In addition, all cardholders receive 5% cash back on selected categories.

U.S. Bank selects two different categories every quarter, such as groceries and dining. The 5% rate is capped at $2,000, meaning $100 worth of cash back when maximized. Outside of the selected categories, you’ll get up to 2% cash back on other purchases. This is also one of the best balance transfer cards.

You’ll get an introductory 0% APR for 15 months. The 0% rate also covers purchases. After the 15-month introductory period, the standard APR ranges from 19.49% to 29.74%. Additional benefits include 5% cash back when booking hotel and car rentals via the Rewards Travel Center. Cash back can be redeemed in many ways, including statement credit and a checking account deposit.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| U.S. Bank Cash+® Visa Signature® Card | $200 cash back after spending $1,000 on purchases within 120 days. 0% APR on balance transfers and purchases for 15 months. | 5% cash on selected categories, up to $2,000 every quarter. Up to 2% cash back on other purchases. | None | 19.49% – 29.74% |

- One of the best credit cards for rewards

- New members get $200 cash back after spending $1,000

- 5% cash back up to $2,000 on selected categories every quarter

- Up to 2% cash back on other spending categories

- 0% APR on balance transfers and purchases for 15 months

Cons

- One missed payment will revert to standard APRs of up to 29.74%

2. Citi Double Cash® Card: Best for Unlimited Cash Back Rewards

The Citi Double Cash® Card is one of the best options for earning unlimited cash back. Cardholders get unlimited 2% cash back on all spending categories without restrictions. This means you can use the card for all day-to-day purchases, whether that’s gas, dining, groceries, or drugstore purchases.

The only drawback is the way that cash rewards are credited. 1% is credited once you make a purchase. After the statement is paid, the other 1% is credited. Nonetheless, new members will receive an additional $200 cash after making $1,500 worth of purchases. Once again, all spending categories are eligible.

The Citi Double Cash® Card is also one of the best cash back cards for managing debt payments. You’ll get 0% APR on balance transfers for 18 months. However, the introductory offer doesn’t include purchases. The standard APR on this cash back card is 19.24% – 29.24%, so make sure you settle your statement in full every month.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. 0% APR on balance transfers for the first 18 months. | Unlimited 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 19.24% – 29.24% |

Pros

- Best cash back card for earning unlimited rewards

- 2% cash back on all purchases

- $200 cash back when spending $1,500

- 0% APR on balance transfers for 18 months

- No annual fees

Cons

- Purchases don’t benefit from the 0% introductory offer

3. Wells Fargo Active Cash® Credit Card: Best for Combining Cash Back With 0% Purchases

Wells Fargo Active Cash® Credit Card is also one of the best cash back cards for earning unlimited rewards. Purchases made on all spending categories earn 2% cash back. What’s more, new members receive a $200 cash back bonus after spending just $500.

Simply meet the spending requirement within three months to qualify. Another benefit of this card is its 0% APR introductory offer. Not only does this include balance transfers but purchases too. The 0% rate remains in place for 15 months, as long as you avoid a late payment.

To qualify for the balance transfer, you’ll need to complete the transfer within 120 days. In terms of redemption, cash back can be redeemed as statement credit. The minimum is just $1. Those with a Wells Fargo account can also redeem cash back via a bank transfer or ATM.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 20.24%, 25.24%, or 29.99% |

Pros

- One of the best flat-rate cash back credit cards

- Get $200 cash back after spending $500

- 2% cash back on all spending categories without limits

- Get 0% APR on purchases and balance transfers for 15 months

- No annual fees

Cons

- Minimum APR of 20.24% after the introductory period

4. Capital One Quicksilver Cash Rewards Credit Card: Best for Fair Credit Scores

The Capital One Quicksilver Cash Rewards Credit Card is one of the best options for ‘Fair’ credit scores. According to some sources, applicants are accepted with a credit score as low as 580. However, do note that Capital One will also look at other variables, such as your debt-to-income ratio.

This cash back card offers a simple introductory offer; simply spend $500 within three months to earn $200. What’s more, the introductory offer also includes 0% APR for 15 months. This includes both balance transfers and purchases. After the introductory period, the APR ranges from 19.99% to 29.99%.

In terms of cash back, you’ll receive 1.5% on all purchases. Although this is lower than other cash back cards, there are no limits to how much you can earn. Another benefit is that the Capital One Quicksilver Cash Rewards Credit Card comes without annual or foreign transaction fees. This makes the card ideal when traveling overseas.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Capital One Quicksilver Cash Rewards Credit Card | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 1.5% cash back on all purchases. No restrictions on spending categories. | None | 19.99% – 29.99% |

Pros

- Best cash back credit card for ‘Fair’ scores

- No annual or foreign transaction fees

- $200 cash back bonus after spending $500

- Unlimited 1.5% cash back on all purchases

- 0% APR on balance transfers and purchases for 15 months

Cons

- Late payment fee of $40

5. Alliant Cashback Visa® Signature Credit Card: Best for Low APRs

The Alliant Cashback Visa® Signature Credit Card offers one of the lowest APRs in the market. Those with an ‘Excellent’ credit score are eligible for APRs of just 17.49%. The card also comes without annual and foreign transaction fees, not to mention a $0 fraud liability guarantee from Visa.

All cardholders receive 2.5% cash back on the first $10,000 spent – every month. This means you can earn up to $250 in cash back every billing cycle. What’s more, purchases over the $10,000 limit are still eligible for cash back. Albeit, at a lower cash back rate of 1.5%.

Crucially, there are no spending category restrictions, meaning all purchases will earn cash back. The main drawback is a lack of 0% APR on balance transfers and purchases. Moreover, late payments attract a $27 fee. Nevertheless, other card benefits include roadside dispatch assistance and travel accident insurance.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Alliant Cashback Visa® Signature Credit Card | None | 2.5% cash back up to the first $10,000 every month. After that, unlimited 1.5% cash back. No restrictions on spending categories. | None | From 17.49% |

Pros

- Competitive long-term APR of 17.49%

- 2.5% cash back up to $10,000 every month

- Unlimited 1.5% cash back after the $10,000 threshold

- No restrictions on spending categories

- No annual or foreign transaction fees

Cons

- No 0% APR introductory offer

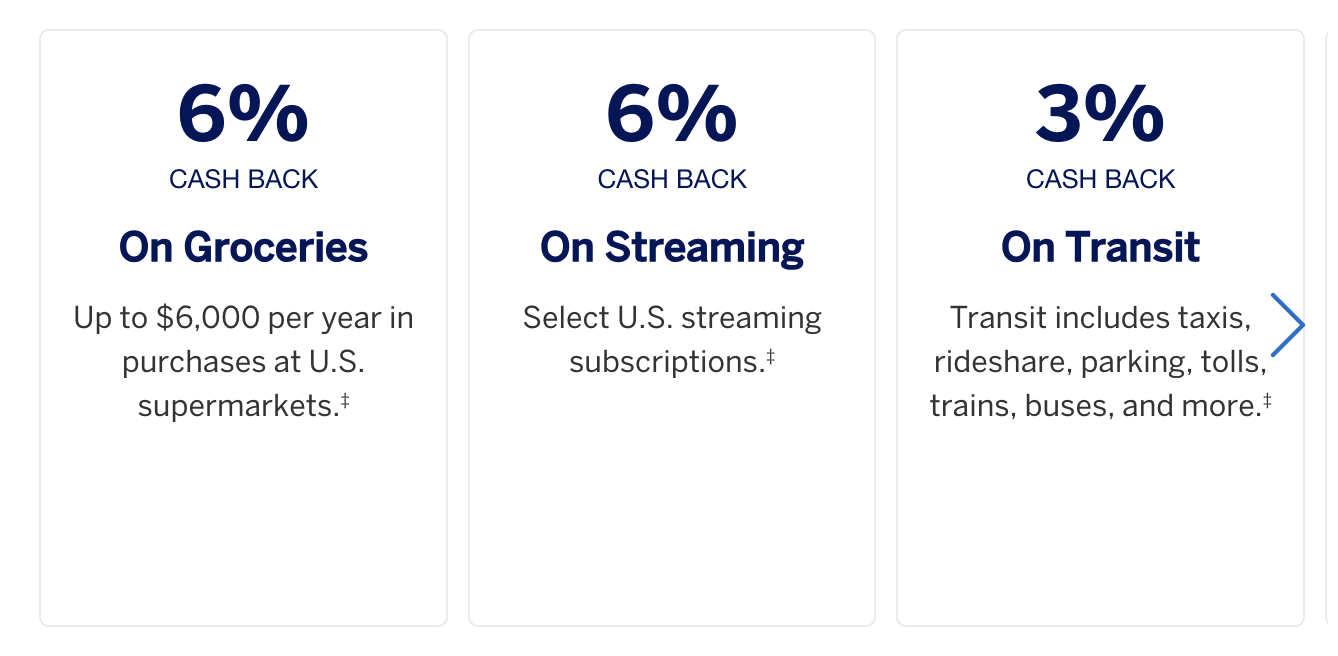

6. Blue Cash Preferred® Card from American Express: Best for High Cash Back Rates

The Blue Cash Preferred® Card from American Express is one of the best options for earning high cash back rates. You’ll get a huge 6% cash back on U.S. supermarket purchases. This is capped at $6,000 per year. After that, the cash back rate drops to 1%.

What’s more, you’ll also get 6% cash back on selected streaming service subscriptions. Cardholders also get 3% cash back on U.S. gas station purchases. New members will receive a $250 cash back bonus. To qualify, spend at least $3,000 within the first six months of opening the account.

The introductory offer also includes 0% APR for 12 months. This covers purchases and balance transfers. The standard APR on this cash back card is 19.24% to 29.99%. Although the Blue Cash Preferred® Card from American Express comes with a $95 annual fee, this is waived in the first year.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Blue Cash Preferred® Card from American Express | $250 cash back after spending $3,000 on purchases within six months. 0% APR on balance transfers and purchases for the first 12 months. | 6% cash back on supermarket (up to $6,000 annually) and streaming service purchases. 3% on gas station purchases. 1% on other spending categories. | $95 (waived in the first year) | 19.24% to 29.99% |

Pros

- Earn 6% on supermarket and streaming service purchases

- 3% cash back at U.S. gas stations

- $250 bonus cash back after spending $3,000

- 0% APR on balance transfers and purchases for 12 months

Cons

- $95 annual fee after the first year

7. Bank of America® Unlimited Cash Rewards Credit Card: Best for Preferred Rewards Members

The Bank of America® Unlimited Cash Rewards Credit Card is a great all-rounder. Cardmembers receive unlimited 1.5% cash back on all spending categories. That said, if you become a Preferred Rewards member, you can boost your cash back rewards by up to 75%.

For instance, standard members spending $50,000 annually receive $750 in cash back rewards. However, Platinum Preferred Rewards members get over $1,312.50 for the same spend. Moreover, Preferred Rewards members can redeem their cash back in a checking or savings account.

New applicants receive a $200 cash back bonus of $200. You’ll need to spend $1,000 within 90 days to qualify. There are no annual fees with this cash back card. Another benefit is the 0% APR on balance transfers and purchases for 15 months. There’s a standard balance transfer fee of 3%.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Bank of America® Unlimited Cash Rewards Credit Card | $200 cash back after spending $1,000 on purchases within 90 days. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 1.5% cash back on all purchases. | None | 18.24% – 28.24% |

Pros

- One of the best credit cards for cash back and no annual fee

- Unlimited 1.5% cash back on all purchases

- Preferred Rewards members can boost cash back by up to 75%

- $200 cash back after spending $1,000

- 0% APR on purchases and balance transfers for 15 months

Cons

- 3% foreign transaction fee when using the card overseas

8. Chase Freedom Unlimited®: Best for Gas and Supermarket Purchases

The Chase Freedom Unlimited® is a popular cash back credit card offering offering a $200 bonus to new members. To qualify, you’ll need to spend $500 within three months of being approved. Moreover, the Chase Freedom Unlimited® is the best cash back credit card for gas and grocery purchases.

You’ll earn 5% cash back on these spending categories up to the first $12,000 (excluding Walmart and Target). You’ll also earn 5% when booking travel via Chase Unlimited Rewards. Drugstore and dining purchases earn 3%. Anything outside of these categories earns 1.5%.

Cash back can be redeemed for a statement credit. Alternatively, the funds can be transferred to a checking or savings account. The Chase Freedom Unlimited also offers an introductory 0% APR for 15 months. This covers balance transfers and purchases. There are no annual fees, but standard APRs are high at 20.49% – 29.24%.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Chase Freedom Unlimited® | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on grocery and gas purchases (up to $12,000). 3% on dining and drugstore purchases. 1.5% on other spending categories. | None | 20.49% – 29.24% |

Pros

- Best cash back credit card for grocery and gas purchases – earn 5%

- Dining and drugstore purchases earn 3%

- $200 cash back bonus after spending $500

- 0% APR on balance transfers and purchases for 15 months

Cons

- Standard APRs are high at 20.49% – 29.24%

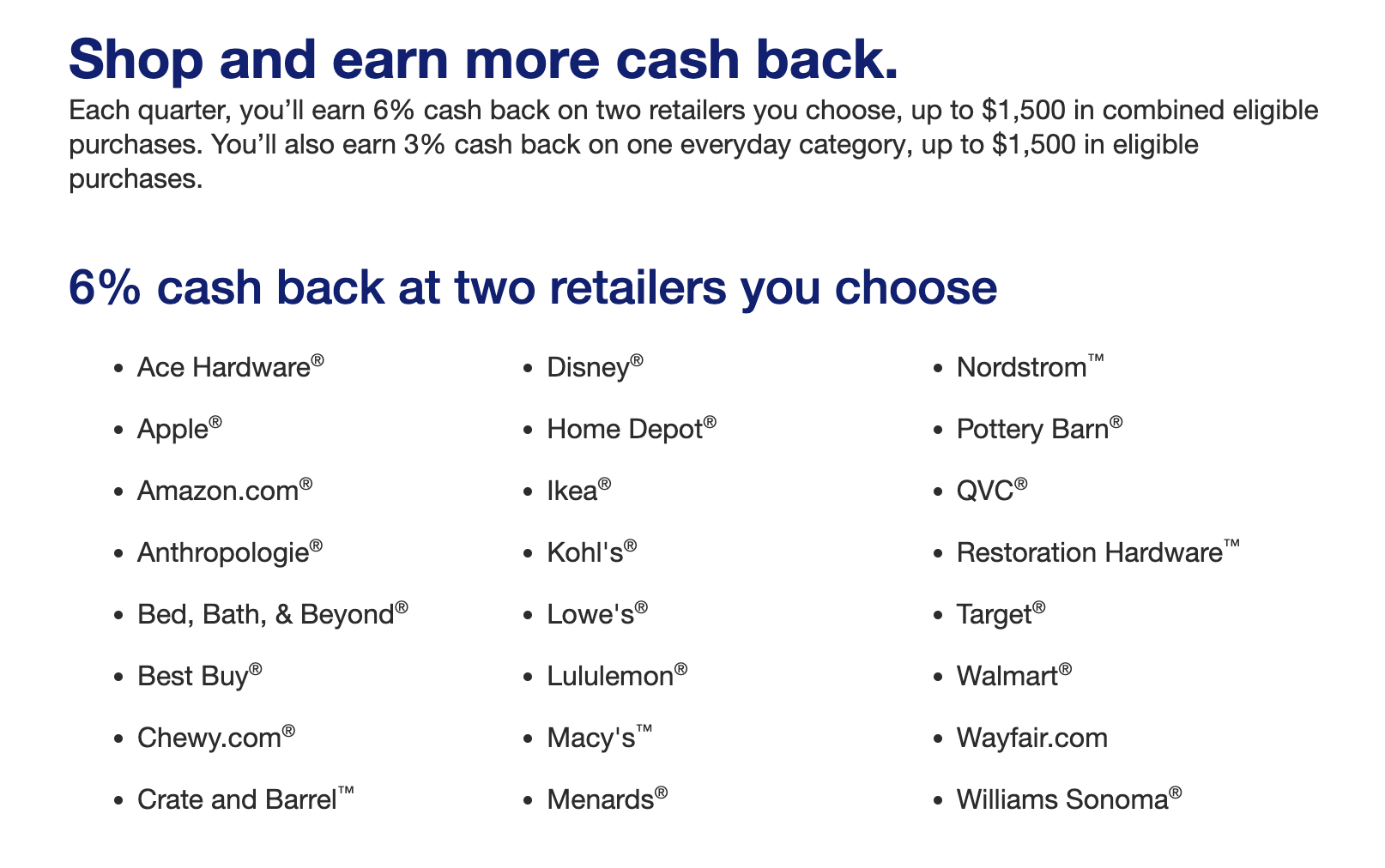

9. U.S. Bank Shopper Cash Rewards™ Visa Signature® Card: Best for Shopping Rewards

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card is the best cash back card for earning shopping rewards. Every quarter, you can select two retailers. Options include Apple, Amazon, Walmart, Target, QVC, and more. You’ll earn 6% cash back on your selected stores, up to $1,500 every quarter.

What’s more, you’ll earn 3% cash back on one selected spending category, such as utilities, gas, or EV charging. This is also capped at $1,500 per quarter. Anything outside of your selected preferences will earn 1.5% cash back. The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card also offers an introductory bonus.

You’ll earn $250 cash back after spending $2,000. This needs to be achieved within 120 days of opening the account. This cash back card comes with an annual fee of $95. This is waived in the first year. There are no 0% APR offers on balance transfers or purchases, which is a drawback.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| U.S. Bank Shopper Cash Rewards™ Visa Signature® Card | $200 cash back after spending $2,000 on purchases within 120 days. | 6% cash back on two selected retailers each quarter (up to $1,500). 3% cash back on one selected spending category each quarter (up to $1,500). 1.5% cash back on all other purchases. | $95 (waived in the first year) | 19.74% – 29.74% |

Pros

- Best cash back card for shopping rewards

- 6% cash back on two selected retailers each quarter

- Also earn 3% cash back on one selected spending category each quarter

- $200 cash back after spending $2,000

Cons

- $95 annual fee is charged from the second year

10. Discover it® Cash Back: Best for Rotating Bonus Categories

Discover it® Cash Back is one of the best cash back credit cards for rotating bonus categories. Every quarter, you can earn 5% cash back on one spending category, such as gas, dining, or groceries. All other purchases offer 1%. There are no limits on how much cash back you can earn.

Best of all, new members will receive a dollar-for-dollar match at the end of their first year. So, if you earn $1,000 in cash back, the Discover it® Cash Back Credit Card will add another $1,000. Another benefit is the 0% APR on balance transfers and purchases.

This is available for 15 months when paying at least the minimum each month. Standard APRs on this card are 17.24% – 28.24%. There are no annual fees, and the card also comes with a 0% fraud liability guarantee. This protects members who have their credit card information stolen, so is a solid perk.

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR |

| Discover it® Cash Back | Dollar-for-dollar cash back match at the end of the first year. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on one rotating spending category each quarter. 1% on all other purchases. | None | 17.24% – 28.24% |

Pros

- Dollar-for-dollar cash match after year one

- 5% cash back on one rating category each quarter

- 0% APR on balance transfers and purchases for 15 months

- Standard APRs start from just 17.24%

- One of the best cash back credit cards with no annual fee

Cons

- Non-rotating bonus cash back of just 1%

Cash Back Credit Card Comparison

The 10 best cash back credit cards are summarized in the table below:

| Cash Back Credit Card | Introductory Offer | Cash Back Rewards | Annual Fee | APR | Learn More |

| U.S. Bank Cash+® Visa Signature® Card | $200 cash back after spending $1,000 on purchases within 120 days. 0% APR on balance transfers and purchases for 15 months. | 5% cash on selected categories, up to $2,000 every quarter. Up to 2% cash back on other purchases. | None | 19.49% – 29.74% | Check Eligibility |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. 0% APR on balance transfers for the first 18 months. | Unlimited 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 19.24% – 29.24% | Check Eligibility |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 20.24%, 25.24%, or 29.99% | Check Eligibility |

| Capital One Quicksilver Cash Rewards Credit Card | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 1.5% cash back on all purchases. No restrictions on spending categories. | None | 19.99% – 29.99% | Check Eligibility |

| Alliant Cashback Visa® Signature Credit Card | None | 2.5% cash back up to the first $10,000 every month. After that, unlimited 1.5% cash back. No restrictions on spending categories. | None | From 17.49% | Check Eligibility |

| Blue Cash Preferred® Card from American Express | $250 cash back after spending $3,000 on purchases within six months. 0% APR on balance transfers and purchases for the first 12 months. | 6% cash back on supermarket (up to $6,000 annually) and streaming service purchases. 3% on gas station purchases. 1% on other spending categories. | $95 (waived in the first year) | 19.24% to 29.99% | Check Eligibility |

| Bank of America® Unlimited Cash Rewards Credit Card | $200 cash back after spending $1,000 on purchases within 90 days. 0% APR on balance transfers and purchases for the first 15 months. | Unlimited 1.5% cash back on all purchases. | None | 18.24% – 28.24% | Check Eligibility |

| Chase Freedom Unlimited® | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on grocery and gas purchases (up to $12,000). 3% on dining and drugstore purchases. 1.5% on other spending categories. | None | 20.49% – 29.24% | Check Eligibility |

| U.S. Bank Shopper Cash Rewards™ Visa Signature® Card | $200 cash back after spending $2,000 on purchases within 120 days. | 6% cash back on two selected retailers each quarter (up to $1,500). 3% cash back on one selected spending category each quarter (up to $1,500). 1.5% cash back on all other purchases. | $95 (waived in the first year) | 19.74% – 29.74% | Check Eligibility |

| Discover it® Cash Back | Dollar-for-dollar cash back match at the end of the first year. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on one rotating spending category each quarter. 1% on all other purchases. | None | 17.24% – 28.24% | Check Eligibility |

What to Know About Cash Back Cards

Cash back credit cards are a great way to earn rewards on everyday purchases. However, it’s important to know how cash back cards work before applying. This section explains everything you need to know.

What are Cash Back Credit Cards?

In a nutshell, cash back credit cards allow you to earn rewards when making purchases. In most cases, cash back is earned as a percentage of what you spend. For instance, suppose the credit card offers 2% cash back on each transaction. You spend $200 on groceries, meaning you’ll receive cash back of $4.

Groceries are a great example of maximizing cash back rewards effectively. After all, if you’re going to make the purchase anyway, it’s wise to use a cash back credit card. Although cash back rewards might seem small, they can quickly add up.

At the end of each month, the cash back is tallied up and credited against your statement balance. Some lenders allow you to redeem cash back in other ways, such as bank transfers, ATM withdrawals, and gift cards. Another benefit of cash back credit cards is that most come with introductory offers.

This usually offers bonus cash after meeting a minimum spend requirement. For instance, you might receive $200 cash back simply for spending $500 within the first three months. This is a great way to earn ‘free’ money without much effort.

You should be smart about how you use cash back credit cards. You should never use the card specifically for earning cash back. On the contrary, only use it for transactions you were going to make anyway. Moreover, it’s important to consider annual fees, reward limits, APRs, and eligible spending categories.

Types of Cash Back Credit Cards

The best cash back credit cards come in different shapes and sizes. This includes flat-rate, tiered, and rotating category cards. Let’s explore how each one works with some relatable examples.

Flat-Rate Cash Back Cards

Flat-rate cash back cards are the easiest to understand. They offer a flat percentage rebate for all spending categories. A good example is the Citi Double Cash® Card. This credit card offers 2% cash back on all purchases. This is the case regardless of how the card is used.

For instance, suppose you spend $1,000 booking a flight. You’ll receive $20 cash back. Next, you spend $500 on groceries. You receive $10 cash back. Best of all, the Citi Double Cash® Card comes without limitations. This means you can earn an unlimited amount of cash back.

This card type is best suited for everyday transactions. Meaning – you don’t have a specific category that consumes your monthly spending.

Tiered Cash Back Cards

Tiered cash back cards are also popular. The specifics work the same as flat-rate cards, as you’ll receive a percentage rebate on purchases. However, the cash back percentage you get will vary depending on the spending category.

The Chase Freedom Unlimited® is a good example of a tiered cash back card. This card offers 5% cash back on gas and grocery deliveries. However, dining, takeout, and food delivery purchases only earn 3%.

This is also the case with drugstore purchases. Any transactions outside of these categories earn just 1.5%. Tiered cards are ideal if your biggest spending category comes with the highest cash back rate.

For instance, the Chase Freedom Unlimited® is suitable if you spend most of your money on groceries and gas. However, if your largest outlay is on travel, you’d be more suited for a travel credit card.

Rotating Category Cash Back Cards

Some of the highest cash back rewards can be found with rotating category credit cards.

Here’s how it works:

- Every three months, the credit card issuer will select one spending category. This will offer the highest cash back percentage, often at 5% or more.

- For instance, suppose in the first quarter the 5% spending category is gas. This means any gas transactions throughout the quarter will receive 5% cash back. All other spending categories, such as groceries and streaming services, might only pay 1.5%.

- Then, in the second quarter, the selected spending category is groceries. Once again, any grocery purchases will receive 5% cash back. Everything else receives just 1.5%.

In most cases, you need to manually opt-in each quarter. If you don’t, you won’t be eligible for the higher rewards.

Here’s an overview of the most common bonus categories offered by rotating cash back cards:

- Dining (including takeout and food deliveries)

- Drugstores/Pharmacies

- Gas

- Groceries

- Streaming Services

- Travel

It’s important to read the terms before opting into a quarterly spending category. This is also the case with tiered cash back cards. This is because there can be restrictions on specific purchases.

For example, we mentioned that the Chase Freedom Unlimited® offers 5% cash back on groceries. However, the fine print states that Walmart purchases aren’t eligible. Considering that Walmart has the largest supermarket share in the US, this is a major drawback.

Why You Should Always Pay Your Balance in Full

Cash back credit cards are a great way to earn rewards simply for making purchases. However, we should stress that the cash back won’t be worthwhile if you’re paying fees. Meaning – if you don’t pay your monthly statement in full each month, you’ll be charged interest.

The likelihood is that this will be considerably more than the cash back you receive. Let’s look at a simplified example to explain why.

- Support you’ve got a credit card with unlimited 2% cash back on all purchases

- The card has a standard APR of 30%

- After the first month, you’ve spent $5,000. At 2%, this means you’ve received cash back of $100

- After receiving your monthly statement you decide to pay the minimum

- This means the $5,000 will attract interest. Based on an APR of 30%, this works out at 2.5%

- Therefore, while you’ve earned 2% in cash back, you’ve 2.5% in interest

The only exception is if you take out a cash back card with a 0% APR offer on purchases. For example, the U.S. Bank Cash+® Visa Signature® Card offers 0% APR on purchases for 15 months. That said, it’s not wise to accumulate debt just to earn cash back.

Instead, we’d strongly advise you to clear your balance in full each month. In doing so, not only will you remain debt-free but you’ll increase your credit score.

Choosing the Best Cash Back Credit Card

Here’s what to consider when selecting the best cash back credit card for 2024.

Personal Assessment

The first step is to perform a personal assessment of your spending habits. Not only in terms of where you generally spend your money but also how much. The best way to do this is by reviewing your recent bank statements.

For example, suppose you identify that most of your money is being spent on groceries and gas. In this instance, you’d want to find a cash back card that offers the highest rewards on these spending categories.

The Blue Cash Preferred® Card from American Express, for instance, offers 6% cash back on grocery purchases. It also offers 3% on gas purchases.

However, grocery purchases are capped at $6,000 annually. If you generally spend more than this (over $500 per month), you might prefer the Chase Freedom Unlimited®. Although the cash back on groceries and gas is slightly lower at 5%, this is capped at $12,000.

Assess the Preferred Card Type

It’s important to select the right card type when targeting cash back rewards.

- If you want a predictable flow of cash back, opt for a flat-rate card. In doing so, you’ll always know exactly how much you’re earning each month.

- However, if you’ve identified a certain spending category, a tiered cash back card might be better. These often come with higher cash back rates on specific categories, such as dining or gas.

- Alternatively, if you’re more flexible with your spending, consider a rotating category card. Every quarter, you’ll get to earn the highest rewards on selected categories, often around 5%.

Scroll up for a recap on the differences between flat-rate, tiered, and rotating category cards.

Consider Any Upcoming Large Purchases

It can make sense to take out a cash back card if you’re planning to make a large purchase. This is because the best cash back cards come with 0% APR on purchases for extended periods.

This includes the Capital One Quicksilver Cash Rewards Credit Card, which offers interest-free payments for 15 months. This is in addition to unlimited 1.5% cash back on purchases.

- For instance, suppose you’re looking to make some home renovations.

- You’ve identified that this will cost $15,000.

- Using the Capital One Quicksilver Cash Rewards Credit Card, you receive 1.5% cash back on your purchases – amounting to $225.

- This means you’re paying $14,775 instead of $15,000.

- What’s more, you can split the $14,775 payment interest-free over 15 months. As such, this amounts to 15 monthly payments of $985.

Importantly, missing just one monthly payment will mean losing your 0% APR offer. Therefore, just make sure you stay on top of your repayments. Setting up a direct debit is an effective way of achieving this.

Factor in Introductory Bonuses

Don’t forget to check whether an introductory bonus is offered by your chosen cash back card. In most cases, you’ll receive bonus cash back after meeting a minimum spend requirement.

- For example, the Blue Cash Preferred® Card from American Express offers $250 cash back after spending $3,000 within six months of opening the account.

- Beginners might prefer the Capital One Quicksilver Cash Rewards Credit Card, which offers $200 cash back after spending just $500 within three months.

We should stress that taking out a credit card just for the introductory bonus isn’t worth it. This is because bonus amounts rarely exceed $200 – $300.

One exception is the Discover it® Cash Back. It offers a huge introductory offer that lasts for 12 months. Put simply, you’ll earn up to 5% cash back on eligible purchases and, at the end of the year, you’ll receive a dollar-for-dollar match. For instance, suppose you spend $2,000 each month and receive 5% cash back.

At the end of the year, that’s $1,200. The Discover it® Cash Back doubles it, meaning you’ve earned $2,400. What’s more, the Discover it® Cash Back comes with 0% APR on purchases for 15 months.

Don’t Forget About Annual Fees

We’ve already established that you should settle your monthly statement in full to avoid paying interest. However, you should also remember that some cash back cards charge annual fees. This will impact whether or not the cash back rewards are worthwhile. Therefore, it’s important to do some calculations to assess viability.

Let’s use the U.S. Bank Shopper Cash Rewards™ Visa Signature® Card as an example, which charges $95 per year (waived in the first year). This card offers $200 cash back after spending $2,000 on purchases. It also offers 6% cash back on two selected retailers each quarter (up to $1,500).

Let’s say you maximize the cash back rewards each month. This means you’ve spent $6,000 annually and received $360 in cash back. You’ve also received $200 from the introductory offer. However, you’ve also paid $95 in annual fees.

Here’s the outcome:

- Total Cash Back: $560 ($200 + $360)

- Annual Fee: $95

- Net Benefit: $465

As you can see, paying annual fees of $95 still makes sense, as you’ve received $560 in cash back. However, this makes some assumptions. First, the U.S. Bank Shopper Cash Rewards™ Visa Signature® Card doesn’t offer a 0% introductory rate. This means you’ll need to settle the balance in full each month to avoid paying interest.

Second, it’s crucial that you were going to make the purchases anyway. If not, you’re accumulating debt simply to earn cash back, which doesn’t make financial sense.

Understand Cardholder Benefits

In addition to cash back and introductory offers, don’t forget to check what benefits your chosen card offers. Benefits should align with your lifestyle.

For example, if you’re a frequent traveler, look for a cash back card that offers 0% foreign transaction fees and free travel insurance. Alternatively, if you’re looking to improve your FICO, look for a cash back card that offers regular credit score updates.

Other common benefits include fraud protection, extended warranty protection, and expense trackers.

How to Compare Credit Cards for Cash Back

Still not sure which cash back card is right for you? This section explores how to compare the best credit cards for cash back in 2024.

Cash Back Rate and Limits

First, you’ll want to prioritize credit cards with the highest cash back rates. This will give you the best chance of maximizing your rewards. However, you also need to assess whether any limits are in place.

For example, consider the Alliant Cashback Visa® Signature Credit Card. This offers 2.5% cash back on the first $10,000 each month. After that, all other purchases earn just 1%. Suppose you spent $20,000 on purchases each month. The first $10,000 will earn $250, while the next $10,000 will earn $100. This totals $350 in monthly cash back.

Noe considers the same spending habits with the Citi Double Cash® Card. Although the cash back is slightly lower at 2%, this comes without limitations. Therefore, spending $20,000 each month would get you $400 in cash back. This is $50 more than the Alliant Cashback Visa® Signature Credit Card.

Put otherwise, you should consider how much you plan to spend each month. Then, find a cash back card that offers the highest rate for your monthly purchasing power.

Eligible Spending Category

Eligible spending categories are also important when comparing cash back cards. This is because cash back reward rates can vary depending on where you make purchases.

- For example, the Chase Freedom Unlimited® offers 3% cash back on dining and drugstore purchases. However, using your card for streaming services or gaming will reduce the cash back rewards to just 1.5%.

- Similarly, the Blue Cash Preferred® Card from American Express offers 3% on gas station purchases. However, you’ll only get 1% on dining.

This reverts to our earlier guidance on performing a personal assessment of your spending habits. You can then focus on cards offering the highest rates for your preferred categories.

That said, just remember that some cash back credit cards do come with spending category restrictions. This means you’ll always get the same rate irrespective of where you use the card. The Citi Double Cash® Card is one of the best options here, as you’ll get unlimited 2% cash back on all transactions.

Annual Percentage Rate (APR)

If you’re planning to clear your monthly balance in full each month, the Annual Percentage Rate (APR) is irrelevant. This is because you won’t pay any interest, as your balance is cleared before the required due date.

That being said, if there’s a chance you won’t be able to clear your monthly statement, look for cash back cards with the lowest APRs.

We’d suggest focusing on cards that offer an introductory APR of 0%. This means even if you don’t settle a statement in full, you still won’t pay any interest. This is on the proviso you pay at least the minimum. If you miss a payment, you’ll lose your 0% introductory rate.

Fees

The best cash back cards do not charge annual fees. However, other fees can apply, so it’s important to check this before proceeding.

For example, most cash back cards charge a 3% foreign transaction fee when using the card abroad. This can wipe out any cash back you’ve earned. Therefore, if you’re planning to use the card overseas, choose one that offers fee-free foreign transactions.

A good example is the Capital One Quicksilver Cash Rewards Credit Card, which comes without foreign transaction fees. It also comes without annual fees.

Other fees to look for include late and missed payments.

Redemption

You should also consider how your cash back rewards can be redeemed. The majority of cash back cards can be redeemed via your monthly statement.

For example:

- You’ve got a credit card paying 5% cash back

- You spend $10,000 in the first month, so receive $500 cash back

- When you receive your monthly statement, you’ll owe $9,500. This is the case even though you spent $10,000

That said, some credit cards allow you to redeem your cash back in other ways. For instance, the Wells Fargo Active Cash® Credit Card offers redemption via checking and saving accounts, plus ATM withdrawals. However, you’d need to have a bank account with Wells Fargo to qualify.

Other redemption methods include PayPal, gift cards, and charity donations.

If you’re wondering how to turn credit into cash, most cash back credit cards allow this. In most cases, you can use your card for ATM withdrawals. However, this is classed as a ‘Cash Advance’, which comes with many drawbacks. As explained by Experian, the biggest drawbacks of Cash Advances are increased interest and fees. For instance, you’ll usually pay about 3% of the withdrawal amount. What’s more, even if you’re on a 0% introductory rate, you’ll need to pay the standard APR.

Pros and Cons of Cash Back Credit Cards

Before applying for a cash back card, consider the following benefits and drawbacks:

Pros

- Earn cash rewards on everyday purchases

- Some cards offer unlimited rewards

- New members often receive a bonus cash back offer

- Top-tier cards come with 0% APR on purchases for over 15 months

- Most cash back cards come without annual fees

- Never pay interest when you settle your monthly statement in full

Cons

- You might be tempted to make purchases for the sake of earning cash back

- Some spending categories (e.g. gas and groceries) come with limits

- Applying for a cash back card can temporarily impact your FICO score

- Interest and fees can mean you’re paying more than the cash back is worth

- Some of the best cash back cards require an ‘Excellent’ credit score

Alternatives to Cash Back Credit Cards

Depending on your spending habits, there could be better alternatives to cash back cards.

This includes the following:

Cash Back vs. Travel Rewards

Cash back cards are more suited for everyday transactions, such as gas, dining, groceries, and drugstore purchases. What’s more, most cash back cards charge a 3% foreign transaction fee when using it overseas. Therefore, if you’re a frequent traveler, a travel rewards card could be the better option.

Not only do travel rewards cards offer fee-free foreign transactions, but a range of travel-related perks. This often includes airport lounge access, travel insurance, and discounts on business-class upgrades. In addition, you can earn air miles or hotel points when using a travel rewards card.

For example, the Delta SkyMiles® Gold American Express Card offers up to 2x air miles for every $1 spent. Cardholders also get in-flight discounts, priority boarding, and free checked baggage.

Another example is the World of Hyatt Credit Card. This offers up to 9 Hyatt points for every $1 spent. You’ll also get complimentary Discoverist status and a free hotel stay each year.

Cash Back vs. Low Interest

According to the Randolph-Brooks Federal Credit Union, low-interest cards are the better option when making large purchases. This is because you can spread the payment over many months without paying any interest.

- For example, suppose you’re planning to spend $20,000 on a new kitchen remodel.

- You take out a low-interest credit card offering 0% APR for 16 months.

- This would allow you to make 16 monthly payments of $1,250 without paying interest.

That said, some credit cards with the best cash back also offer 0% APR periods. For instance, the Bank of America® Unlimited Cash Rewards Credit Card and Discover it® Cash Back offer 0% on purchases for 15 months. This means you can avoid credit card interest while still earning cash back rewards.

Methodology

From the hundreds of cash back credit cards available to US consumers, we narrowed the options down to just 10. Our research methodology focused on many key metrics to achieve this goal. We initially focused on the best cash back rates in the market.

We then analyzed each cash back rate, in terms of eligible spending categories (if any) and monthly/quarterly/annual limits. We also assessed the type of cash back card, whether that’s a flat-rate, tiered, or rotating category.

In addition, our methodology focused on cash back credit cards with generous introductory offers. We prioritized cards offering bonus cash back with reasonable spending requirements. Cash back cards with 0% APR offers were also prioritized.

We also explore standard APRs, FICO eligibility requirements, fees (annual and foreign transactions), and cardholder benefits. These metrics were evaluated meticulously, allowing us to rank the 10 best credit cards with cash back for this guide.

Conclusion

With a clear strategy and an understanding of the risks, cash back cards can be a smart way to earn rewards. This is especially the case when making purchases that you would have made anyway. Overall, we found that the best cash back credit card is the U.S. Bank Cash+® Visa Signature® Card.

New members get $200 when spending $1,000 within 120 days. You’ll also get 5% cash back on selected categories, not to mention 0% APR on balance transfers for 15 months.

References

- https://www.cnbc.com/select/what-happens-when-you-miss-a-credit-card-payment/

- https://www.experian.com/blogs/ask-experian/what-happens-when-your-0-introductory-apr-ends/

- https://www.experian.com/blogs/ask-experian/is-cash-advance-good-idea/

- https://www.rbfcu.org/learn/educational-resources/which-credit-card-is-better-for-me-cash-back-or-low-interest

FAQs

How do you get 5% cash back on everything?

Most 5% cash back cards come with spending category restrictions, such as dining or gas. If you’re looking for unlimited cash back on all purchases without restrictions, you’ll get 2% with the Citi Double Cash® Card.

What credit card gives you the best cash back rewards?

The U.S. Bank Cash+® Visa Signature® Card is the best option for earning cash back. You’ll get 5% cash back on selected categories and 2% on all other purchases. You’ll also get $200 cash back after spending $1,000.

Are there any 5% back credit cards?

Yes, the Chase Freedom Unlimited® offers 5% cash back on groceries and gas up to the first $12,000. Alternatively, consider the Discover it® Cash Back, which offers 5% cash back on rotating categories every quarter.

What credit card do you get the most back?

The best cash back credit card for high spenders is the Citi Double Cash® Card, which offers unlimited 2% cash back on all spending categories. The Blue Cash Preferred® Card from American Express is also an option, offering 6% cash back on grocery purchases up to $6,000 annually.