Tollymore Investment Partners letter to investors for the month of May 2019.

Dear partners,

Three-year investment results

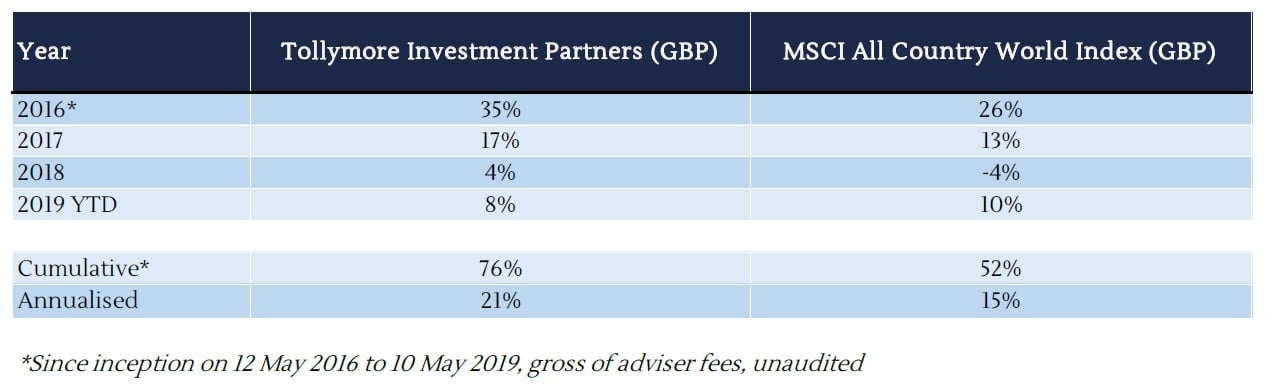

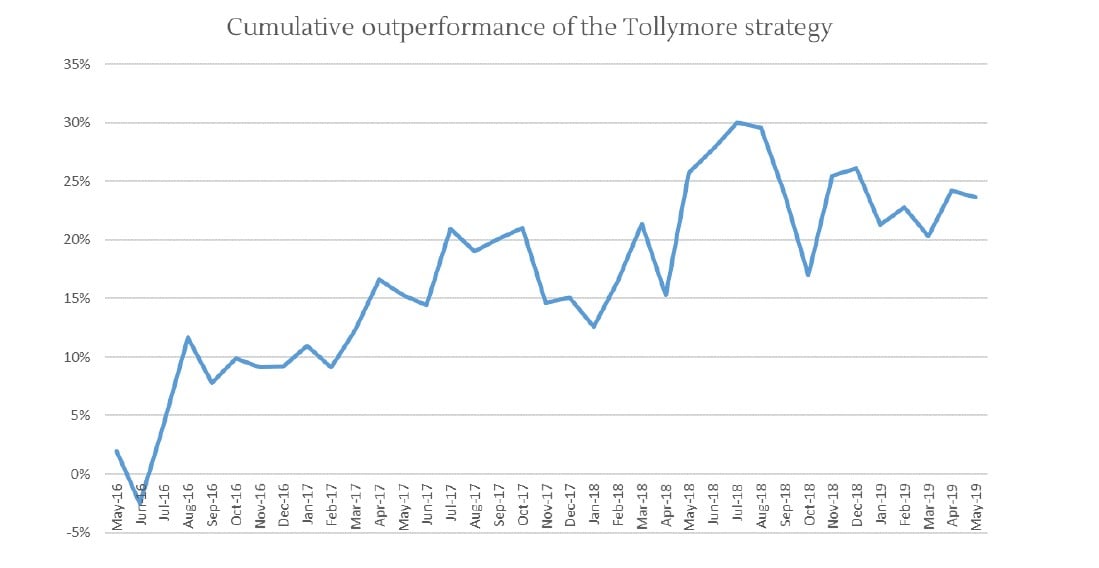

The investment portfolio managed according to Tollymore’s investment philosophy was three years old on 10 May 2019. Over that period the portfolio generated cumulative returns of +76%, and annualised returns since inception of +21% per year. The cumulative outperformance of the Tollymore strategy vs. its benchmark over the three years was 24%1.

Q1 hedge fund letters, conference, scoops etc

The six deadly sins of institutional money management

My professional experience has provided a broad overview of the institutional investment management industry. Tollymore benefits from this experience. It provides a context in which to judge our decision making and prospects for delivering acceptable investment results to our partners. Specifically, Tollymore seeks to profit from several behavioural constraints impairing institutional money managers’ execution of a sound long term investment programme.

(1) The pursuit of informational edge: Overconfidence can have profound consequences, inflating investors' valuation of their investments, leading physicians to gravitate too quickly to diagnoses, and making people intolerant of dissenting views. Studies suggest that confidence and accuracy are not highly related2. The problem with this as it relates to investing is that the extra confidence causes us to increase the size of our bets without a corresponding increase in our capacity to predict outcomes, causing us to lose money. We do not build complex financial models, designed to convey broad knowledge vs. deep understanding. We seek to shield ourselves from faulty heuristics by placing corporate access at the end of an investment process. We strive for simplicity and conduct work with the goal of gaining conviction in a handful of value drivers.

(2) The pursuit of analytical edge: The need to justify fees creates pressure to conceal rather than acknowledge ignorance, to build large teams and create the perception of deep intellectual expertise. This expertise increases the perceived validity of one’s own opinions and makes one less receptive to ‘non-experts’. Deep perceived expertise promotes trust in intuition and lowers the inclination for hard System II work. This also geometrically increases

the complexity of organisations, introduces group think, authority bias, and loss aversion by slowing down decision making. We believe teams should be small, preserving accountability for decision marking and direct communication channels. We would suggest that diverse teams, and independence of opinions, are likely pre-requisites for collectively wise decisions.

Mental flexibility, introspection, and the ability to properly calibrate evidence are at the core of rational thinking and are largely absent on IQ tests. Typical decision makers allocate only a quarter of their time to thinking about the problem properly and learning from experience3. Most spend their time gathering information, which feels like progress and appears diligent to superiors. But information without context is falsely empowering.

Tollymore’s large investment universe and concentrated portfolio obviate the need for valuation precision, which requires analytical edge.

(3) Marketing led investment strategies: Asset gathering business objectives and gold-plated cost structures magnify the imperative to grow AuM. Investment firms led by marketers rather than investment managers create strategies tailored to what will sell rather than what works4. Pressures to justify high management fees create an action bias that may be antithetical to good investment outcomes. Tollymore’s strategy is capacity constrained; our focus is on returns vs. assets and aligning the investment philosophy with the manager’s temperament and investment partners’ objectives.

(4) Short term capital: Asset gathering mandates can lead to unidirectional manager due diligence processes, misaligned investor-manager relationships and procyclical capital flows. Short term capital leads to short security holding periods, which directs investment managers’ efforts away from understanding long run business prospects and toward predicting share price movements. However, markets, unlike meteorology, are complex and reflexive; participants are second-guessing one another and the bases on which decisions are made are altered by the decisions themselves. The volatility of publicly traded securities makes it very difficult to guess short term price movements.

We do not direct our efforts to understand and analyse the market’s thoughts. We conduct independent research and focus on long term, lower volatility outcomes. As an emerging investment manager, we can develop an aligned and sympathetic investor cohort through two-way relationship building. We expect these efforts to allow us to focus on building substantial behavioural edge through an educated LP base capable of investing countercyclically over the long term. The long-term investor can purchase securities from sellers selling for non-fundamental reasons (redemptions from short term capital) or because they think news flow will be temporarily negative (they have an eight-month holding period).

Our objectives are to: build a long term aligned investor base with a business owner mentality, capable of tolerating periods of benchmark underperformance; assemble the capital and working environment that will allow us to act decisively when the odds are in our favour; create an environment that allows us to both average down and acknowledge mistakes; and surround ourselves with intellectually generous peers and investment partners.

(5) Manager/investor misalignment: Managers’ and investors’ fortunes are typically not aligned. This is a barrier to sound investment decision making. A simple way to weed out the managers that back themselves is to consider the presence and power of incentives – insider ownership and performance-weighted fee structures. Managers without insider ownership are less incentivised to limit the size of their fund, therefore limiting their achievable time weighted return. In our view, and in the case of most institutional money managers, the components of stewardship reflect a product to be sold rather than a strong belief in the strategy.

(6) Stories: Investment management professionals often have short attention spans, driving the articulation of eloquent, memorable investment theses. Stories emanate from our continuous attempt to make sense of the world. As such they serve a purpose. The problem comes when we conflate explanatory power and predictive power. Story construction itself is problematic due to self-serving bias: our predilection for favouring decisions that enhance self-esteem. This results in attributing positive events to oneself and negative events as situational. The problem is compelling stories have characteristics that are antithetical to truth finding. They are simple, ascribe outcomes to talent and stupidity vs. luck, and focus on things that happened vs. things that failed to happen.

Narrative fallacy is the backward-looking mental drive to attribute a cause-and-effect chain to our knowledge of the past. Without searching for reasons, we would go around with blinders on, one thing simply happening after another. This helps us make sense of the world despite sensory overload. However, it can cause us to make poor decisions. The power of narrative causes us to violate probabilities and logic. Tollymore seeks to profit from narrative fallacy by applying logic to anomalies. That is, by specifically seeking out stocks without good stories, or those with bad stories, and to write about the companies we own in involved, long shelf life letters to partners.

The forest and the trees: profiting from time arbitrage

Tollymore is in the business of applying logic to anomalies. Our goal is to identify mispricings that are afforded to us as long-term investors, and to exercise sound judgment when we encounter potential opportunities. The application of logic comes in the form of having the temperament, working environment and investor base to see the bigger picture. And to use noise to our advantage in lowering our cost of business ownership when appropriate, and therefore the rates of return we can enjoy as owners of publicly listed businesses. We describe below two recent examples of investment decision making under conditions of uncertainty. In both cases we used our advantage as a long-term owner to acquire more shares of materially mispriced businesses at cheaper prices. We do not direct efforts to distilling the market’s ‘thoughts’ into a concise narrative. The complexity and reflexivity of financial markets renders this a low ROI pursuit. However, in the following examples it is our view that price action was at odds with the fundamental development of the companies’ long-term economic prospects.

TripAdvisor (TRIP.US): We added modestly to our position in TRIP after 1Q19 results sent the stock down 11% to $49/share. Some of the news headlines that accompanied these results from the financial press included “Sales Declines Hit TripAdvisor”, “core hotel segment was flat, missing analyst expectations” and “TripAdvisor wasn't able to deliver the top-line growth that many were counting on seeing”. We are not trying to predict share price movements; we are therefore not focused on analyst expectations nor trying to guess how our companies will do relative to them. It is also conceivable that management commentary on the call about softer than expected international demand, leading to a cautious Q2 revenue outlook may have also caused investors to sell their interest in this business as they extrapolate these demand fluctuations5. That was the trees.

How do we see the forest? We think the current level of profitability in the hotels business can be taken as a proxy for owner earnings6. TRIP’s reduction in performance marketing spend has driven large increases in profitability; the hotels segment recorded 41% EBITDA margins vs. 30% a year ago. Yet hotel revenues still increased slightly yoy.

Meanwhile restaurants and experiences revenue grew 35% yoy7, but EBITDA losses widened to - $24mn from -$4mn as TRIP accelerated investments in adding bookable supply8, which continues to double yoy. This is the right move for a company concerned with enjoying the longterm barriers to entry of two-sided network effects. But it clearly dilutes short term profitability. Three quarters of c. $180bn9 global experiences market is booked offline. A 5% share and 20% commission would imply sales of greater than TRIP’s current total revenues. Yet experiences and dining today are just 20% of TRIP’s revenues. Long term we think it is reasonable to assume that the dining and experiences segment can enjoy profit levels at least in line with the hotels business: the customer base is more fragmented; as such attractions earn higher commissions than hotel OTAs (c. 25%).

What kind is forest is priced into the share price today? TRIP expects to deliver double digit EBITDA growth in 2019. Let’s assume the business can generate $470mn of adjusted EBITDA10. This is 8% of the current $6bn enterprise value. TRIP generated c. $350mn of reported FCF over the last 12 months despite significant and accelerated investments in growing bookable supply in dining and experiences. If we assume that the hotels business is generating a proxy for owner earnings and normalise the profitability of experiences and dining to 40% EBITDA margins, this would add another c. $80mn to post-tax owner earnings. If we also capitalise the investments in TV advertising this would add a further $90mn after tax = $520mn. These owner earnings are being generated on invested capital of less than $700mn, a 75% after-tax return, and a 9% yield to the cash-adjusted market cap. This implies an inability for TRIP to ever grow its earnings.

A high internal reinvestment rate is the right capital allocation priority for intrinsic value compounding. TRIP has been able to solve the chicken and egg problem associated with the development of strong platform business models by tapping into to its existing demand in hotel and connecting it to acquired or developed supply in non-hotel. For both restaurants and attractions, the number of reviewed items is multiples higher than the number of bookable items, and we expect low penetration rates of bookable inventory to provide a long volume growth runway.

GYM Group (GYM.LN): In March 2019 we acquired more shares of GYM at 190p/share, the same price at which we originally acquired shares in July 2017, and in the process increased our equity ownership quite meaningfully. Over that time the stock appreciated to 334p/share by August 2018, and subsequently fell back to our original purchase price. Over this same period our estimate of the owner earnings of the business has appreciated materially, and our understanding of the long-term opportunity to grow the company’s assets has not changed. As such, GYM represents a larger weighting in our portfolio today than it did back in July 2017.

What were the trees in this instance? Management commentary around price reductions in several gyms across their estate, together with the capacity expansion plans of low-cost gym operator Xercise4Less prompted the publication of cautious/negative sell-side research suggesting that market saturation and price competition are likely to erode future profits. In addition, management’s comments relating to back-end loaded gym opening plans caused analysts to reduce their near-term financial projections for the business11.

But the bigger picture remains that there is both scope for addressable market expansion (still one third of new LCG members have never been a member) and market share gains from independent and multi-site private and public gyms. GYM might represent a quarter of LCGs but is still just 2% of the total number of gyms in the UK. There are more council gyms in the UK than private independent gyms, which are typically priced materially higher than their public counterparts. We think it logical that this proposition gap shrinks as low-cost gym chains become increasingly mainstream. It is not our expectation that GYM becomes a monopoly operator of gyms; the implausibility of this as a bear case improves GYM’s investment merits as we see them.

In July 2017, we estimated GYM’s owner earnings to be c. £23mn, a 9% yield to the market cap at that time. In March 2019, our estimated owner earnings were c. £35mn, a 14% yield to the market cap. Over this time the incremental returns being enjoyed on new site investments (> 20% after tax cash on cash returns), and the capacity to reinvest mature estate cash flow into estate expansion remain largely undiminished.

New portfolio investment: Sea Limited (SE.US)

In March 2019 we acquired shares of Sea Limited at a price of $24 per share. SE is substantially owned by insiders: Forrest Li, the founder CEO, owns 31% of the business12 and Tencent owns 33%. All directors as a group own 44% of the company. Management has shown a preference to direct efforts and capital to projects that they believe will create long term value. SE operates three platform businesses in gaming, ecommerce and digital payments, primarily in seven Southeast Asian markets.

Garena distributes mobile and PC online games in its markets. Most games that Garena distributes are done so exclusively. Garena also recently had significant success with its first internally developed game, Free Fire, which was the fourth most downloaded game in the world in 2018 and was available outside of SE’s core SE Asian markets, including Europe, LatAm and Africa.

Shopee is an ecommerce marketplace which has adopted a mobile-first approach since its inception in 2015. Shopee is a platform for connecting buyers and sellers of long tail products across fashion, health and beauty, home and living, and baby products. Shopee provides tools such as payment, logistics and fulfilment.

AirPay is a digital payments provider launched in 2014. Consumers can use the AirPay app as an e-wallet to pay for products and services. AirPay is integrated into the Garena and Shopee platforms.

All three business models are platforms which require investment to drive scale and barriers to entry but have potential winner-take-most economic outcomes.

Garena’s network effects emanate from the social, multi-player nature of the games distributed. Each new gamer increases the value of the platform for existing users. This dynamic might suppress the cost of acquiring new users as the network grows in scale, as current users will tend to invite new users to the platform. Strong and long-tenured developer relationships turn the flywheel: Garena’s success in distributing games for local game players has facilitated relationships with international game developers such as Tencent, Riot Games, Electronic Arts and PUBG Corporation. This has allowed Garena to source high quality games from world class developers, many of whom work as exclusive partners in SE Asia. Management is focused on the virtuous cycle dynamics of attracting more users with high quality games, which attracts more high-quality developers. The more users they have and the more games they distribute the better they become at localising games, increasing their appeal to gamers and developers.

Shopee also has platform dynamics: as the number of buyers increases, Shopee attracts an increasing number of sellers, resulting in increases in SKU variety available on the platform, which increases the purchasing opportunities, and therefore monetisation potential, or value, for each of those buyers. Shopee was the largest ecommerce platform in SE’s region in 2018 by GMV and total orders. Shopee was also the most downloaded app in the shopping category in Southeast Asia in 2018.

The long tail products that are the focus of Shopee’s marketplace support margins due to lighter price competition vs. top-selling products. Ecommerce lends itself to long tail selling due to the capacity for predictive analytics and personalised recommendations to stimulate liquidity in niche markets. Sellers are supported through a network of payment providers and logistics partners, integrated into the platform, as well as local teams to help sellers make use of Shopee’s business management tools. Shopee provides a one stop shop allowing sellers to streamline store setup, inventory and revenue management, delivery and payment collection.

The capacity for platform businesses to create substantial barriers to profitable participation may be quite broadly understood. As is the economic characteristic that additional users in a platform business model add more value for existing users. However, in addition, platform scale strengthens the ability of the platform to offer white labelled goods and original content. Netflix uses customer preference data collected over time to deliver not just a marketplace of products, but original shows. Like Netflix, Garena intends to develop more original content while distributing third party content. Based on customer intelligence, Amazon has c. 70 private label brands, which were started in niche categories like batteries. Amazon’s marketplace dominance allows it to scrape the content of user reviews and return feedback of third-party products and use that information to create superior products that are more valuable to consumers.

Garena’s user base growth and engagement are driven by the launch of new games, the expansion of existing games into new markets, and the improvement and launch of new content in existing games. Southeast Asia is the fastest growing games market in the world; despite >60% internet penetration, the region has the most engaged mobile internet users on the planet.

Garena organises hundreds of esports events annually and operates the largest professional league in the region13. In 2019, the global esports economy will grow to $900 mn, a yoy growth of 38%. Three quarters of this will come from sponsorships and advertising. Media rights, tickets and merchandise make up the remainder. Global esports audiences, currently c. 380mn people, or 5% of the planet, have been growing in the mid-teens. 20% of the global population is now aware of esports. This growth has been driven by streaming platforms such as Amazon-owned Twitch, which attracts 15mn viewers per day each spending 100 mins per day watching live gaming.

There is evidence to support the assertion that esports is becoming increasingly mainstream:

- Personnel have been recruited from mainstream sports media. A few years ago, Activision announced that it was forming a dedicated esports division, and it hired Steve Bornstein, former CEO of ESPN and the NFL Network, to lead it.

- Broadcasting rights deals are being struck with Twitch as well as mainstream broadcasters such as Disney and ESPN.

- Sponsorship is becoming more mainstream. Esports teams have traditionally been able to pull in sponsors that are already closely associated with gaming e.g. from PC gaming companies like Razer, computer-makers HP and Intel, to Toyota and T-Mobile.

- Employment conditions of players are formalising. Guaranteed contracts with minimum salaries are becoming more common, and teams are investing in state of the art training facilities, including coaches, chefs, dieticians, and sports psychologists.

- Esports is big enough to fill an Olympic stadium. The finals of the League of Legends World Championship were held at the Beijing National Stadium. Esports are increasingly included in the thoughts of Olympic Games organisers around the world. Esports were featured at the 2018 Asian Games as a demonstration sport and will be a medal event at the 2022 Asian Games. Paris 2024 Olympic organisers were "deep in talks" about including esports as a demonstration sport at the games.

Shopee’s capital allocation priority is to build marketplace scale and liquidity, and increasingly on monetisation as GMV and market share continue to rise. It is this higher scale and liquidity that increases the rate at which the business can monetise its assets. In management’s words in the 2018 10K:

“We have made a strategic decision to invest in the growth of our Shopee marketplace by incurring sales and marketing expenses in advance of our monetisation efforts. We believe that taking a thoughtful approach to monetisation by building our user base and increasing engagement first will allow us to maximise our monetisation in the future.”

And on the FY17 conference call:

“It's very clear in our mind, and it becomes clearer with every passing day, that almost all of our markets are consolidating very quickly and more quickly than we would have anticipated that even six or nine months ago. Secondly, as a matter of principle, when given the choice to ease our spend and maintain our share or invest more heavily to expand our share, we've chosen the latter strategy. Reason being, we believe that investment is going to help us achieve dominance in the categories that are so important to us, female long-tail categories. That kind of dominance and the ability to be the go-to platform for these important and very profitable categories as we've talked about in the past should bring us to higher monetisation levels going forward. So really, just to conclude, at the end of the day, winning a merchant or a customer today in our mind is much better than having to spend more to win them in the future.” The emphasis is ours; it seems consistent with a capital allocation objective to maximise total long-term value for owners and reflects a capacity to suffer that is a desirable quality for such long-term owners.

Ecommerce penetration is materially below global averages in almost all Shopee’s markets, but ecommerce and m-commerce engagement in Indonesia, Shopee’s largest market representing almost half of GMV, is the highest in the world. The GMV of the internet economy is 2.8% of SE Asia’s GDP in 2018, up from 1.3% in 2015 — and is projected to exceed 8% by 2025. SE Asia is almost 10 years behind the U.S., in which the GMV of the internet economy was 6.5% in 2016.

The monetisation of Shopee’s customer is improving, driven by (1) higher take rates increasing the gross profitability of transactions on the platform, and (2) falling shipping subsidies driving sales and marketing leverage. Shopee’s take rate (revenues/GMV) is currently suppressed by efforts to build scale and market leadership, entrenching the network effects’ barriers to entry of the business. But the take rate has been increasing and management expects this to continue through a combination of commissions, advertising fees and value-added services. Outside of Taiwan, Shopee charges zero commissions. In Shopee’s most competitive market, Singapore, peers are charging between 3% and 30% commissions. Qoo10 charges 8-12% seller commissions in Singapore. 11street charges between 3% and 12% commissions rates to sellers in Thailand and Malaysia. In fashion, Shopee’s largest category, sellers are charged 12%. Lazada charges on average 6.5% commissions plus a 2% payment fee in its markets. In fashion, sellers are charged 12% including the payment fee. Naturally the direct profitability of Shopee’s business is driven by the take rate that Shopee can command on the GMV passing through its platform. In 2017 Shopee’s take rate was practically zero and its gross margin was -125%. In 2018 the take rate was 2.8% and the gross margin was -65%. In 4Q18 Shopee’s take rate was 3.7% and its gross margin was -52%. Even if we can expect diminishing marginal returns to higher take rates, the capacity to increase the take rate bodes well for the potential gross profitability of future transactions.

Shopee has heavily subsidised the cost of shipping for its sellers in order to build supply scale. The extent of these subsidies has been declining without any noticeable impact of GMV growth, resulting in sales and marketing expenses declining as a percentage of revenues. Shipping subsidies declined qoq in absolute dollar terms in 4Q18 as free shipping is now only available on baskets of a minimum size. This marketing efficiency improvement was achieved while GMV/orders grew 27%/31% quarter-on-quarter. Sales and marketing as a percentage of GMV for Indonesia, Shopee’s largest market, was lower than the ratio for Shopee as a whole, supporting the contention that scale drives operational leverage with respect to the cost of acquiring new customers. Management expects sales and marketing expenses to decline in absolute terms from here, signalling a potential inflection point in ecommerce profitability.

What are the counterarguments to our conclusion that this is a high-quality business with avenues for profitable redeployment of capital? Negative experiences spread quickly online, and SE’s business success is driven by customers’ trust in the platform. Customers must believe they will be protected in order to transact safely online. As the number of connections and transactions grows exponentially there is a risk that this additional complexity renders SE’s risk control measures inadequate. This might lead to negative network effects as one or both sides of the platform are driven away by unpleasant experiences. Shopee verifies sellers, screens listings and has teams dedicated to dispute resolution. Shopee also offers a ‘Shopee Guarantee’ under which buyer payment is held by Shopee until delivery of the goods, reducing settlement risks and encouraging buyers to purchase online. The huge increases in active user engagement across a variety of online services suggests consumer comfort with transacting online is increasing.

Ecommerce competition may inhibit user monetisation. Shopee may not be able to adequately monetise the transactions taking place on its platform. So far KPIs relating to the company’s monetisation progress are moving in the right direction. Take rates are increasing and subsidies are reducing without harming the company’s asset growth.

Changing gaming tastes. Garena has three- to seven-year agreements in place with multiple developers. It can use its experience as a distributor of games developed by others to improves the prospects for success in its own internal development ambitions. Free Fire is a short, but encouraging, piece of evidence that they may be able to do this successfully.

Assuming, for now, that AirPay is worth nothing, what is the implied valuation of Shopee for a range of sustainable growth hypotheses applied to Garena’s profits?

If we assume that Garena can never grow it’s EBITDA, an investor with a 10% opportunity cost of investing might be willing to pay 10x EBITDA, or c. $5.5bn to earn this opportunity cost. This would imply a valuation of Shoppe of $3.3bn, one third of SE’s current enterprise value of $8.8bn and 5x Shopee’s expected sales this year.

If we value Garena at 16x EBITDA, or less than 4% sustainable EBITDA growth, both Shopee and AirPay are priced by the market as worthless. The implied value of less than $9bn for Garena would seem conservative given the business’s demonstrated profit growth and potential.

If Shopee and AirPay burn through SE’s $2bn cash pile but fail to make progress in demonstrating the ultimate path to sustainable profitability, we might be willing to pay $9bn to own SE’s equity, c. 18% downside from today’s market cap of $10.8bn.

What assumptions does an owner of this business need to make to render his interest worthless? We could assume that Free Fire is a one hit wonder, and therefore Garena’s profitability shrinks by some 30%, and never grows again. We might also need to assume that the company’s cash balance of $2bn is used to fund investment in AirPay and Shopee which earns zero return, and that in addition SE continues to burn cash at the current rate of $750mn per year for the next five years (undiscounted). There is evidence to suggest that this is not an appropriate set of assumptions: Shopee’s take rates are improving; Shopee’s sales and marketing leverage is improving; and Shopee’s user, order and transaction growth remain strong.

If Garena can sustainably grow nominal EBITDA in line with real GDP growth in the region of c. 5%, AirPay is worth nothing and Shopee is valued at 5x 2019 revenues (making no adjustments to revenue to reflect the potentially supressed take rate), SE’s equity is worth c. $16bn, 50% higher than the current quoted market cap.

If Garena can sustainably grow nominal EBITDA modestly in excess of real GDP growth in the region of c. 5%, AirPay is worth nothing and Shopee is valued at 10x normal revenues, adjusting the estimated take rate from 4% to 10% in line with competitors in the region , SE’s equity is worth c. $37bn, 240% higher than the current quoted market cap.

Private market transactions also suggest Shopee could be materially undervalued. Tokopedia, a C2C business, like Taobao or eBay, but operating only in Indonesia, raised capital in 2018 which valued the enterprise at $7bn, c. 1.5x the estimated GMV. Flipkart, the dominant Indian ecommerce business, was acquired by Walmart at a $21bn valuation in 2018, implying an EV/GMV of 2.8x. If we apply a 4% take rate to management’s adjusted revenue guidance of $630-660mn, Shopee could be processing c. $16bn of GMV this year. At 0.5x EV/GMV Shopee is worth the entire enterprise value of Sea Limited.

Thank you for entrusting me with your capital.

With my best wishes,

Mark

This article first appeared on ValueWalk Premium