This is the first article your author is writing for GreenWood – I recently became part of the team. I joined GreenWood because I share a vision with its Founder; I believe we are meant to build, grow, and take a differentiated approach to investing that will benefit not only our capital partners, but all stakeholders involved. Like many of you, I read the GreenWood Investing Manifesto, and it resonated with me to such an extent that I wanted to become a part of and help shape that community.

As a way to introduce myself, I thought it useful to discuss a hero of mine; an individual whom I believe reflects many of the same qualities we wish to exemplify at GreenWood.

Q3 hedge fund letters, conference, scoops etc

President Theodore Roosevelt (a.k.a. “Teddy” or “TR”). There is certainly no shortage of writings on Teddy, and to me, he is the quintessential ‘Most Interesting Man.’ I must confess that I think fondly of the New York-born hero due to my school trips to the Museum of Natural History, and a TR statue that stands a few blocks from my childhood home, in front of the Nassau County Legislature. However, the reality is that the more I read and learn about the man, the more I come to realize he was quite simply a total badass.

While most know TR as the 26th President of the United States (and notably the youngest to ever take the office) and his ‘Speak softly and Carry a Big Stick’ ideology, there is an incredible richness to his life that is full of lessons to be shared. Much is known about Teddy as a Soldier, President, Adventurer, Conservationist, Naturalist, Orator, and Nobel Peace Prize Laureate; what is often overlooked is the claim that he was the most well-read and well-published President of the United States (at only 24 years old, he authored The Naval War of 1812, considered to be the seminal work in its field). Additionally, he was a student of stoicism, and so it is no surprise that TR is said to have traveled with an extensive collection of books by stoic philosophers and writers during his many adventures.

If interested in a wonderfully detailed account of TR’s life, I highly recommend reading Edmund Morris’s Trilogy of Roosevelt books; however, of the significant TR literature out there, I find myself favoring Candice Millard’s “The River of Doubt: Theodore Roosevelt’s Darkest Journey.” The narrative of Teddy’s harrowing travels to Amazonia to traverse one of the most dangerous and never-before explored tributaries on Earth (today’s Rio Roosevelt, or Rio Teodoro) is a fascinating tale of a man setting out to prove himself once more after being humiliated in the 1912 Presidential election. During this trip, TR and his team faced tortuous conditions for which they were ill-prepared. Roosevelt contracted malaria and contemplated taking his own life via morphine overdose to sacrifice himself and lighten the burden on his son, Kermit, who had also contracted malaria and carried his father for days on end. This incredible journey and demonstration of willpower, makes one ask, what drives a man that has already achieved so much to risk his life (and that of his 24 year old son)?

An entertaining way of answering that question is playfully demonstrated by Robin Williams’s portrayal of Theodore Roosevelt in “Night at the Museum”, and TR’s unrelenting quest to achieve whatever goal was in front of him: “This is your moment…you gotta finish the job this time, you can’t quit.”

But perhaps a more serious way to think about the above question is to consider Roosevelt’s stoic roots. While Stoicism has recently seen a revival thanks to Tim Ferris and Ryan Holiday, etc., it comes as no surprise that this philosophy has survived the test of time. During Roosevelt’s 1913-1914 journey to the River of Doubt, TR carried a copy of A Selection from the Discourses of Epictetus with the Encheiridion, translated by George Long. Those who appreciate the study of stoicism are aware that much time is spent understanding daily struggles, accepting life’s sufferings, and learning events are very often outside of our control. The President’s stoic roots bred the rational motivation to continue moving forward, not only during his Amazonia journey, but 30 years prior when his wife and mother died 24 hours apart. It even propelled him to proceed with a 2 hour speech in Milwaukee during his 1912 Presidential run just minutes after being shot in the chest, proclaiming, “It takes more than that to kill a bull moose.”

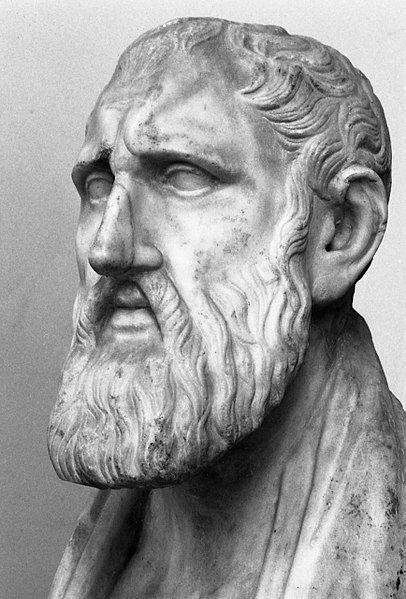

As a young man growing up with debilitating asthma, Roosevelt learned that one can transform himself via hard discipline into an uncompromising man of action. While it is naive to think TR had read the stoics from an early age, pulling one passage from Epictetus just might give a glimpse as to the life TR was trying to achieve, “But what does Socrates say? ‘Just as one person delights in improving his farm, and another his horse, so I delight in attending to my own improvement day by day.’” Thus, the only way to live was to test yourself day-in-day-out. TR’s father challenged him at a young age to whip himself into shape and undergo grueling workouts. This often included hiking miles a day to strengthen his lungs, culminating in a hike up the Swiss Alps with his father when he was just twelve. As he grew older, TR took up a strict regiment of weightlifting, boxing, and jiu-jitsu (basically training to be a modern-day MMA fighter), leading to TR’s enthusiastic claim that exercise “cured” his asthma. Roosevelt is seen below during his bare-knuckle boxing days.

But stoicism is also a philosophy I study to help frame the ups and downs of both daily life and a career in investment management. To me, the lesson is that if you rest on your laurels for just one day, the ever-evolving landscape of market competition will pass you by. While there are many who aimlessly throw themselves into work, which accounts for a significant portion of their waking lives, at GreenWood we strive to improve not only our business, but ourselves and our partners every day. GreenWood adheres to this mantra by implementing both personal and business-related OKRs (Objectives and Key Results) for each member of the team to objectively measure that each of us is moving forward, improving ourselves and the firm. To some, this may seem too invasive, or strict, but to us, this level of accountability and focus is what is needed to continuously build a business when we throw ourselves into work that consumes all aspects of our lives. We must invest time to improve ourselves, the same way we constantly critique/optimize our research skills in order to find the the best process to be successful for our investors and our business.

The quest to ever-improve is often difficult to do when life seems to be chugging along perfectly – i.e. year 10 of a bull market; however, that is exactly the period when one must double-down on self-improvement. As we enter a choppy, late-cycle market, it is crucial to remember the words of Seneca, “We say that nothing happens to a wise man against his expectation…nor do all things turn out for him as he wished but as he reckoned – and above all he reckoned that something could block his plans.” – Seneca, On Tranquillity of Mind

Investing is a business that is ever-evolving, shifting and throwing wrenches in even the best-laid plans. We have to prepare for the worst while being ready for success – in the practice of stoicism, this is called the Art of Negative Visualization. The stoic point to be made is that the world we live and invest in is a messy, unpredictable place that is ruled by external factors; we must be psychologically prepared for negative outcomes. Some might call this being a pessimist, but at GreenWood, we believe this is prudent portfolio management and we utilize our Ranking Framework as the first line of defense to prepare for a wide range of outcomes.

During a career in investment management, the only guarantee you have is that things will go wrong (even the best investors only get 6/10 right). When conducting research, we underwrite all of our investments to multiple downside scenarios to estimate capital loss in a negative ‘what if’ environment. It’s this preparation that allows us to 1) avoid unnecessary risks, and 2) avoid the misery of negative surprise when the stock moves against us. We embrace the volatility and stay calm when others panic, allowing us to respond in the smartest manner possible.

The act of buying a stock is an inherently arrogant decision as you are implying you are smarter than the individual selling to you. While we do accept that at certain times things won’t go according to plan, one thing we cannot accept is for the research to be wrong. Our research process focuses on isolating a certain few select variables that will drive our investment thesis and thus the performance of the stock. The Ranking Framework, developed by Steven and which we are evolving and improving upon since I’ve joined GreenWood, also helps us remove emotional decision making and provides a ‘truer’ picture via analytics. We fully recognize that sentiment can stay lower/higher for longer, but we are willing to see through near-term noise if confident the underlying fundamentals remain intact.

One of the more recent improvements to the Ranking Framework is a fuller composite score for Conscious Capitalism. Our goal is to find leaders and companies that have high customer satisfaction, employee satisfaction, supplier satisfaction, and positive environmental stewardship. When a company’s purpose seeks to promote the good, the true, the beautiful, and the heroic, it has a lot of stakeholders invested in its success. When mere quarterly profits become the only purpose of a company, the vitality of the business’s ecosystem is lost. As David Hawkins wrote, “success in any venture is simply the automatic consequence of being the best that one can be as a lifestyle, without looking for gain.” (Power vs Force). To me, Theodore Roosevelt is a leader GreenWood would back.

Using TR as a case study for our Conscious Capitalism framework, it should be noted that while he was born into wealth and began his career as a champion of laissez fair capitalism, TR became more frequently labeled as an “Outsider.” His life experiences, fighting of inequality, and exiting the 2-party political system by founding the Bull Moose party fueled this reputation. I take for granted (without citing specific examples) that he scored highly on customer/employee/supplier satisfaction given he was elected President in 1904 with 339 electoral votes (71% of the votes at the time). Briefly discussing some of his ‘Conscious’ successes:

- Positive environmental stewardship – TR was responsible for setting aside most of the National Parks we enjoy today. He created the present-day U.S. Forestry Service in 1905, and established ~230 million acres of public lands during his presidency. TR wanted the country to utilize and sustain its precious resources.

- Heroic – TR was the first to challenge the Robber Barons in the early 1900s and was the driving force behind splitting the intersection between Wall Street greed and the interests of the American people. This was very well documented in Larry Haeg’s “Harriman vs Hill: Wall Street’s Great Railroad War” where Hill’s Northern Securities Co., which controlled the Great Northern, Northern Pacific and Burlington railroads (essentially the predecessor to Buffett’s BNSF) was the first of the ‘Trusts’ that Roosevelt busted (due to Sherman antitrust laws) during his time in public office. I find the analogy to today’s demands to regulate Big Internet are apropos, and likely calls for another article on the subject.

- Good – TR was the first American awarded the Nobel Peace Prize in 1906, which was given for his negotiation of the Treaty of Portsmouth, ending the Russo-Japanese War.

- Beautiful – TR effectively saved American Football in 1905 by demanding that the sport be made safer (there were 18 fatalities in high school and collegiate football that year). For a flippant and hilarious synopsis of his impact, please take a few minutes to watch this entertaining storytelling on Drunk History.

- True – TR was considered to be a man of integrity, and regarding diversity he was on the right side of history, writing in 1902 about his appointment of a black man in South Carolina to a government position, “I cannot consent to take the position that the door of hope — the door of opportunity — is to be shut upon any man, no matter how worthy, purely upon the grounds of race or color.Such an attitude would, according to my convictions, be fundamentally wrong.”

I’m going to leave this audience with a favorite TR quote of mine from his 1903 essay, American Ideals – “A foolish optimist is only less noxious [than] an utter pessimist.” As stewards of your hard-earned capital, we at GreenWood strive to find the largest expectations gap between the foolish optimists and the utter pessimists. We seek to find under-covered, unloved companies which are often misunderstood, and place them under a microscope to see where there might be value and then shine a light on it. In a Twitter/CNBC-filled world where anyone with a keyboard or camera has a mouthpiece, it can be difficult to discern truth from fiction and silence the noise in order to find the Builders of our future. But in channeling the inner-TR, we at GreenWood are practical optimists, recognizing the need to plan for the worst, strive for the best, and improve every single day.

Article by Chris Torino, GreenWood Investors