Crescat Capital commentary for the month ended April 30, 2023, titled, “Whistling Past The Graveyard.”

US policymakers continue to act as if they have the stability of the financial system, the economy, and consumer prices under control. Instead, their ongoing deficit spending and debt monetization since the 2008 crisis have created a trifecta of macro imbalances:

- Historic overvaluation of long-duration financial assets;

- Systemic solvency problems posed by excessive leverage; and

- Embedded structural inflation.

This unholy trinity foreshadows both secular stagflation and a near-term hard landing. To capitalize on these imbalances, and not be run over by them, we believe investors will need to rotate out of the still-crowded and expensive securities of the last business cycle.

And move into the deeply undervalued, high-growth opportunities of the next which include the companies delivering the necessary commodities to meet the world’s basic and aspiring needs. We call this reallocation the Great Rotation. In our analysis, the shift is still in the early innings, and there is much more to play out.

Forward-thinking investors should take their cue from global central banks who have been stealth acquirers of gold over the last few years and sellers of US Treasuries. If gold is indeed on the verge of a major breakout, as we believe it is, some of the most rewarding value and growth investments to compound real wealth are likely to be found among the metals exploration companies that own the world’s critical new discoveries.

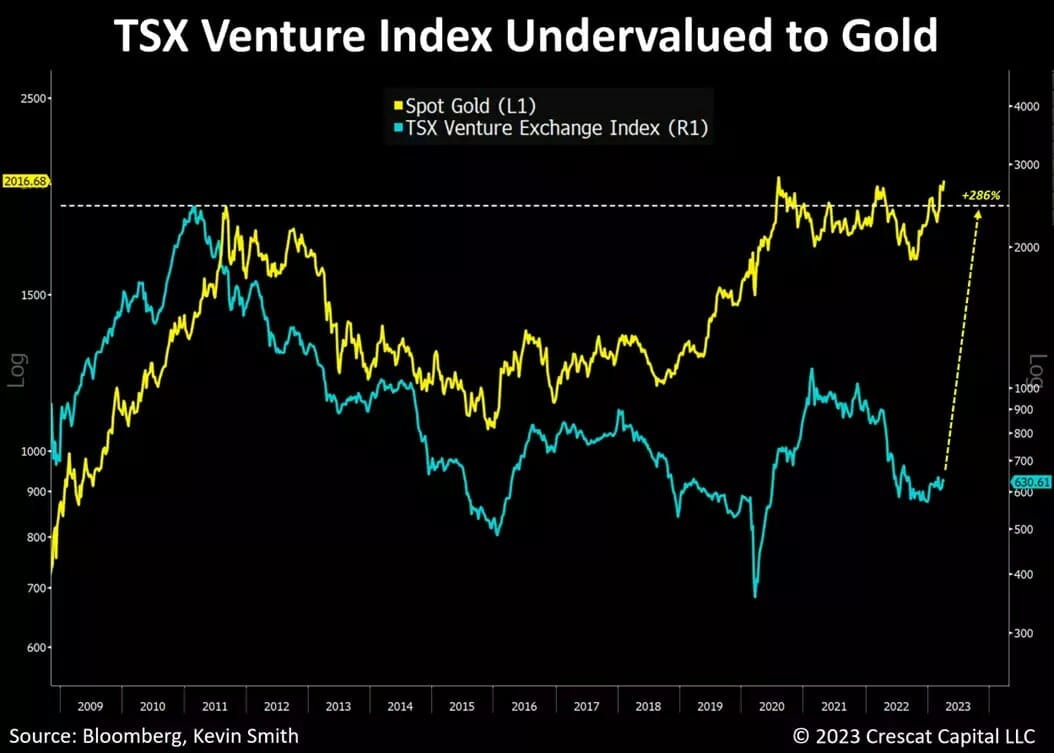

Our two charts in this section show the TSX Venture Exchange Index which is dominated by the world’s precious and base metal explorers. For this index to just get back to its 2011 highs along with gold is a 286% return opportunity.

In a broad metals bull market, the upside is likely to be much more. The bull case is particularly strong because the whole world is dependent on these firms to deliver the resources for the new industries of the energy transition, i.e., to provide the metals for solar, wind, grid infrastructure, EVs, and batteries.

The die has been cast, and the trajectory is clear. In a joint effort to combat the pressing issue of climate change, both governments and the global citizenry have charted a course toward a greener future through the adoption of renewable energy and electrification.

The problem is that the major mining companies have not built the pipeline of metal to deliver what the climate agenda requires. Over the last decade, these companies have instead been behind a declining trend in investment in resource exploration and development. The typical lead time coincidentally is an entire decade to make a new discovery, build a mine, and get it into production.

Given such a major imbalance between the world’s needs and its resources, we believe market participants have been underestimating the risk of a substantial upsurge in commodity prices that will drive another wave of structural inflation and a much-renewed interest in the explorers.

What an incredible opportunity for the whole mining industry that is likely to get flooded with capital to try to solve the resource shortage problem. We think investors at large are still way behind the curve in figuring this out.

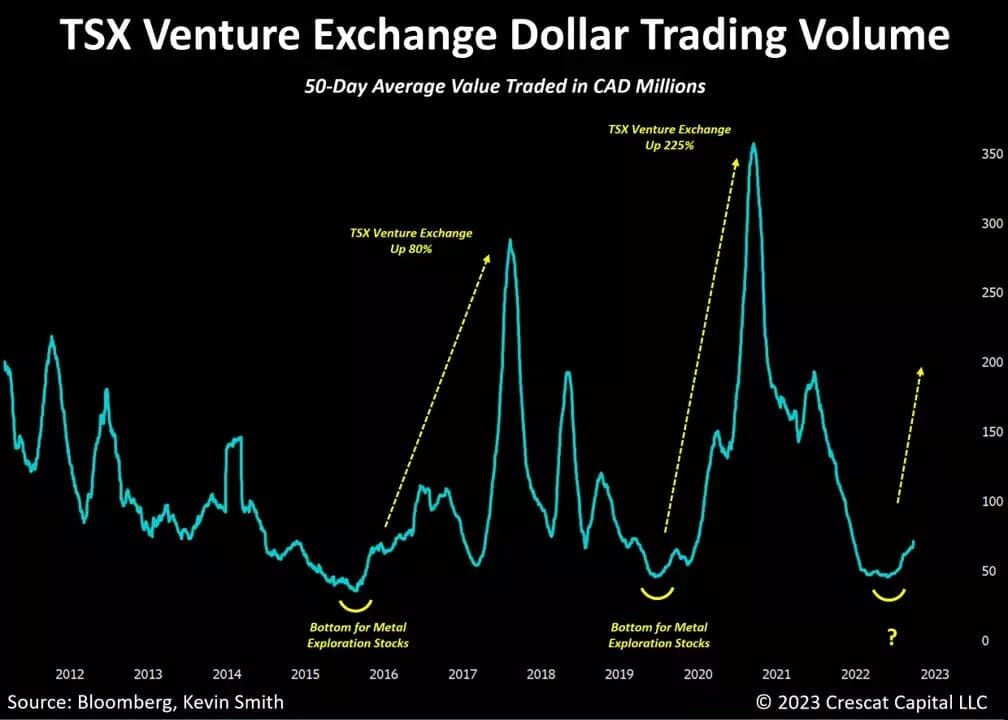

Note how the dollar trading volume in the exploration-focused companies has been unusually depressed for the last year while stock prices have shrunk. However, the market may finally be waking up as trading flows in these names appears to be turning.

When big money flows into this tiny segment of the market comprised of small and micro market cap stocks, note how it tends to correspond with outsized price appreciation. We are confident that there is an enormous value-oriented and macro growth window that is wide open now.

Surprisingly, people are only just starting to wake up to the reality of the resource imbalance. The misallocation of capital that led to broad commodity underinvestment over the last decade was an unintended policy error.

At Crescat, we have seen this coming, and so for the last three years, we have been building an expertly crafted activist portfolio of what we consider the best, new value-accretive gold, silver, copper, nickel, cobalt, lithium, and other key metal deposits on the planet.

Over the last two years, our companies have had an average of over 130 drills turning, more greenfield drilling than all the majors combined. As a result, we have built activist stakes in 79 companies with bona fide and incipient discoveries of over 300 million target gold-equivalent ounces of metal according to our geologic expert’s model.

We are confident that our activist portfolio of miners is deeply undervalued and has extraordinary appreciation potential given strong demand, short supply, and capital that is set to come pouring back into this wrongfully depressed industry.

The allure of metals for the new macroeconomic cycle is not just for monetary purists but also presents an exciting and optimistic outlook for the future in helping to build the infrastructure for a new economy.

Recent bank failures, on the other hand, point to structural and contagious problems, a bearish outlook for many still-pumped-up financial assets of a less practical era when money printing and interest rate suppression created a gross misallocation of capital with a multitude of deferred inflationary consequences.

At-risk investment categories include long-duration US Treasuries, corporate debt and mortgage-backed securities, sub-investment grade credit, megacap tech, private equity, commercial real estate, and many equities outside the materials and energy sectors.

The impending recession that Crescat’s models foresee has been precipitated by financial asset mania, excessive leverage, and inflation and is now being catalyzed by policymakers’ belated attempts to contain this three-headed monster of their own creation. Policymakers are more challenged than ever.

In our analysis, the hope of a soft landing or mild recession is a consensus delusion sucking investors into the over-crowded investments of a past era. The pied pipers responsible for the cheery backward-looking view include compromised corporate management, Wall Street, and government bureaucrats.

Shrewd investors should tune out all the whistling past the graveyard and get busy with a forward-thinking reallocation to critical commodities.

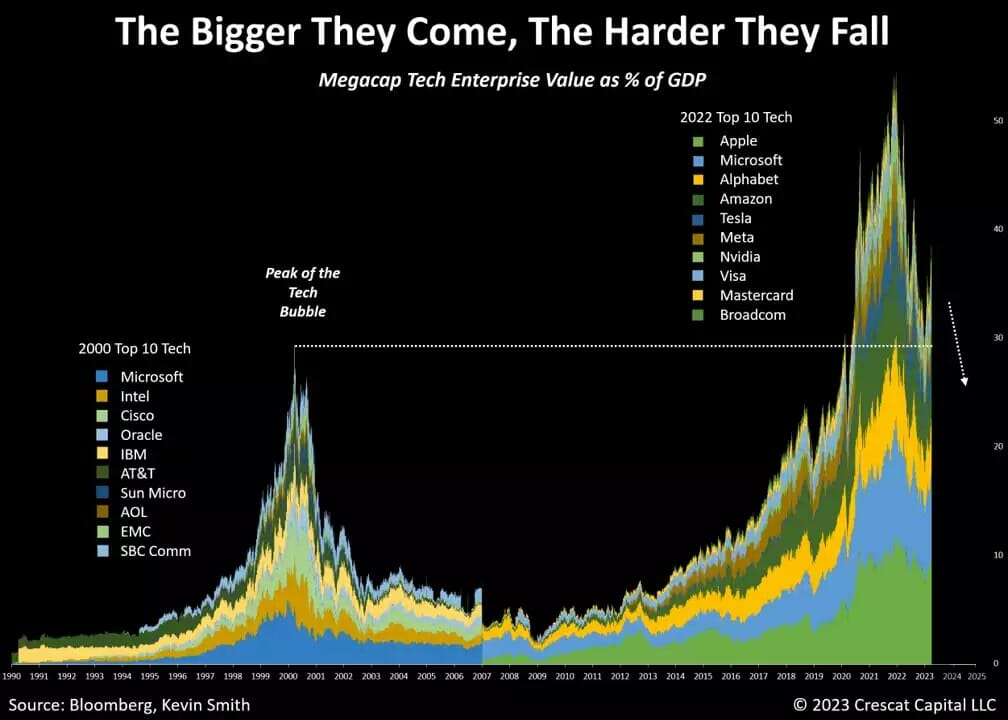

Megacap Tech

According to our equity model, growth fundamentals for the biggest tech companies have deteriorated substantially and do not support their valuations which still exceed the peak of the 2000 tech bubble. However, these stocks have rallied on the recent bank rescue package which is understandable but extremely shortsighted.

The next leg down could unfold viciously just like in the early 2000s tech bust, especially if the overall economy heads into recession on the back of system-wide tightening of lending standards, which is a high probability.

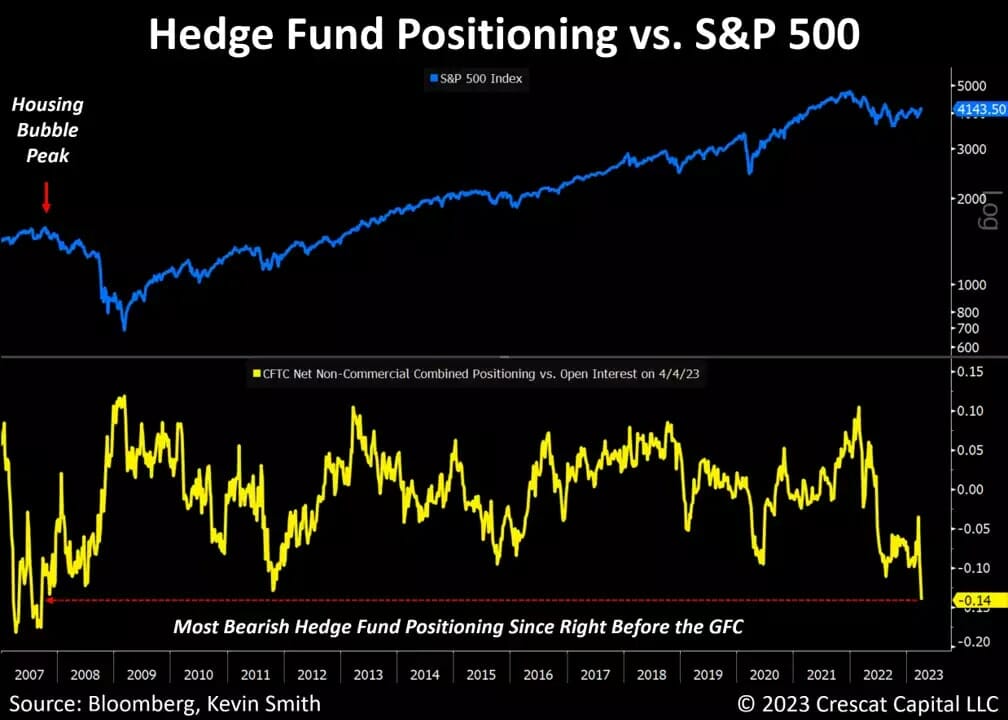

Hedge Fund Positioning

Wall Street spin doctors would have you believe that currently high hedge fund short positioning in S&P 500 futures and options is a bullish contrary indicator. The trick is they have only used data over the long bull market to support their case.

Going back further to 2007, we can see that hedge funds actually had an even larger short position 16 years ago, right before the top of the market and ahead of the Global Financial Crisis. Investors should strive to determine the fundamental and macro picture for themselves from a variety of data sources and not get sucked in by Wall Street’s sometimes compromised and twisted takes.

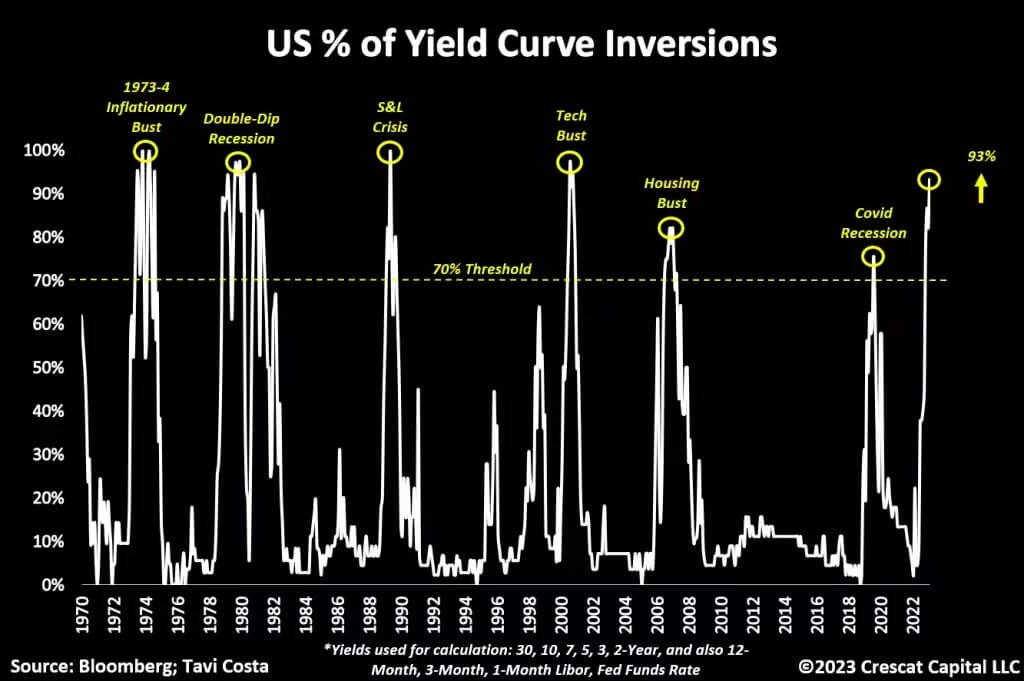

Yield Curve Out of Control

The US Treasury yield curve has generated two sets of recession-signaling inversions in just four years. The curve’s level of extreme inversion since November 2022, given still-excessive equity and fixed-income security valuations, is a blaring macro warning signal of a pending hard landing.

We highly encourage you to watch a short video that we created of the US Treasury yield curve’s transformation since 2019. Watch it a few times. It is mesmerizing. Pay attention to the inversions in 2019 that were well ahead of the pandemic.

They show that the recession that hit in 2020 was pre-destined based on already historic stock and bond market euphoria independent of Covid. However, the pandemic provided the cover for massive money printing and only a short, mild recession, despite high unemployment. It was a convenient means to extend the bubble even further.

As you watch the video, notice the zero-interest-rate policy (ZIRP) response backed by record Fed stimulus in 2020 and how the Fed overstayed those policies in 2021. Watch the steepening on the long end in 2021 even amidst all the rhetoric that rising inflation would be transitory.

See the continued rise of the long end in 2022 as inflation continued to climb in the first half of the year. Pay attention to the sharp increase in the short end in the later half as the Fed finally admitted it was wrong on inflation. Look at the extreme inversion in recent months, all at a much higher level across the curve than we were in 2019.

What the curve is signaling now is a high probability of near-term recession, this time a likely much more serious one that cannot be met with ZIRP given structural inflation. And because of still-excessive valuations, the economic downturn is likely to be combined with a serious bear market.

A Case Study on Charles Schwab

The insolvency problems recently revealed by rising interest rates that translated into runs and failures at Silicon Valley Bank and Signature Bank are merely some of the first casualties of a systemic problem that affects the entirety of the US public and private securities markets.

Management of other at-risk institutions and policymakers would have you believe those bank failures were isolated events that have already been contained, but we disagree.

As just one important case study, Charles Schwab experienced market losses on its massive portfolio of low-yielding long-duration USTs and agency MBSs of $36.7 billion in 2022. $22.6 billion of this hit was recorded straight to owner’s equity, so it did not even flow through the income statement which instead showed record profits of $7 billion.

The other $14.1 of the total $36.7 billion hit was associated with “held-to-maturity” assets so did not even get “marked-to-market” on the balance sheet.

After subtracting goodwill of $12 billion, mostly from its richly priced TD Ameritrade acquisition in 2020, the firm was left with ONLY $6.0 billion in tangible common equity at year-end. These portfolio losses essentially entirely wiped out common stockholders’ equity for a firm that boasts more than $7 trillion in client assets.

More concerning is that Schwab’s tangible common equity would be negative, i.e., insolvent, at -$8.1 billion if it had to reflect the additional $14.1 billion in market losses. Schwab has $9.9 billion of preferred equity that would absorb creditor losses in a fire sale or run, but that would still leave common equity stockholders with zero. The $12 billion in goodwill is worthless in a distressed situation like this.

Instead of adequately disclosing and discussing this issue, Schwab’s Chairman and its CEO have been aggressively painting a rosy picture of their business to both defend their stock and entice new client inflows. In a joint letter on March 23, the pair touted their “conservative approach” and “strong financial foundation” while advising shareholders and clients that it’s “very misleading” to focus on “paper losses”.

Then in a follow-up letter on April 6, the two stated that “our business is extremely robust. This March alone, we saw a strong influx of core net new client assets of over $53 billion, the second highest March results in our history.” We find it concerning that investors are this naïve to be moving money over to Schwab amidst these problems.

Investors in Schwab’s common stock should judge for themselves whether mark-to-market losses on securities portfolios are relevant or not. We absolutely think they are. It is the same problem that sank Silicon Valley Bank.

Higher interest rate and higher inflation macro regimes are ones that affect the entirety of the financial markets and are severely and negatively impactful to leveraged holders of overvalued long-duration financial assets.

The problem at Schwab that so many still appear remarkably clueless about is that it made a big bet on long-duration interest-rate assets with mismatched short-term liabilities, and it lost. It is now aggressively trying to essentially cover up these losses while luring in even more customers, creditors, and stockholders with outrageous proclamations.

At the same time, company execs have strapped themselves to the mast declaring their intent to keep this large leveraged interest rate bet intact, citing access to liquidity despite a tangible common equity insolvency problem on a marked-to-market basis. What happens if the bet continues to go sour, which is a distinct possibility?

The valuation tide for long-duration financial assets is still going out, in our view, and likely won’t be coming back anytime soon. Our concern is that there are a great many parties out there swimming naked. To say that the problem is isolated and not systemic is foolish. It is faced by all banks and brokerage firms today. Even the Fed’s own balance sheet is mismarked and overstated.

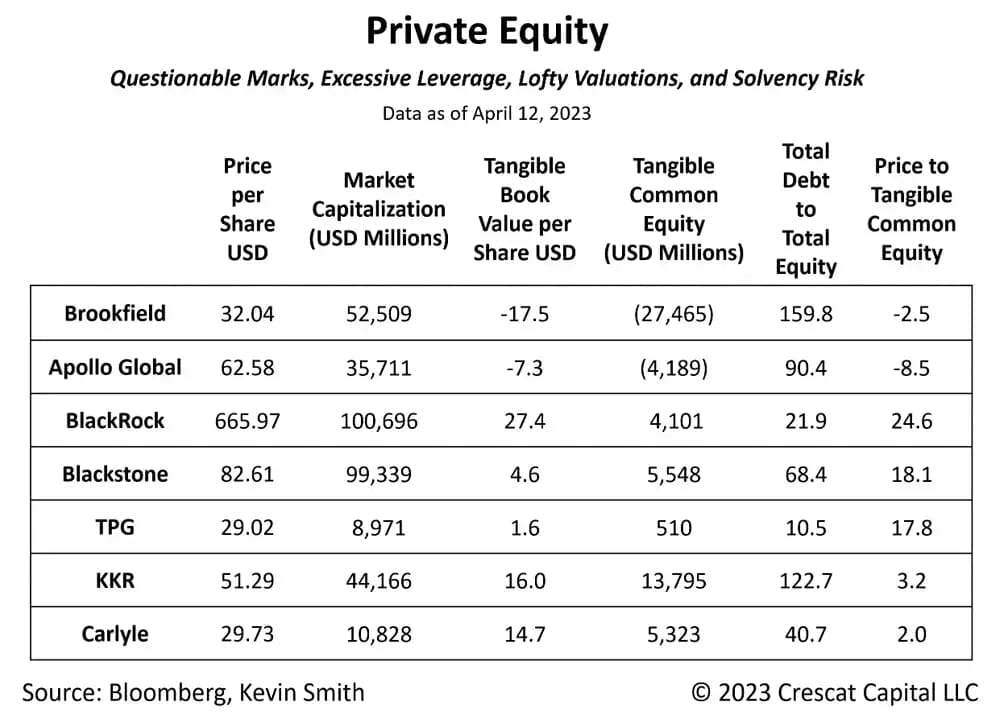

Private Equity Mismark

Private equity is another segment of the financial markets where the lack of marking to market is a systemic problem. In this case, fund managers have been allowed to apply arcane models to value their own portfolios and collect performance fees. The result has been asset values and performance trends that have diverged dramatically from real-world public mark-to-market values and trends.

With such a great industry business model, it is no surprise that valuations relative to tangible common equity and overall leverage in the private equity sponsors’ public stock prices are so large. And it is no wonder that these managers have attracted so much in client assets.

But with the tide truly going out, however, the mark-to-fantasy valuation feature is morphing into a major bug as clients realize what has really been going on. Inflows drying up and a backlog of outflows is a problem for these richly priced and highly leveraged companies with thin and sometimes negative tangible common equity.

Given private equity’s role in the broader credit markets, including corporate debt, commercial real estate, and subprime lending, it is not too difficult to understand that the systemic macro problems today are not just long-duration interest rate risk but credit risk as well.

Performance

We believe the perversions in the financial and commodity markets year to date have set up an excellent entry point for new and existing investors who are not already fully allocated to Crescat’s strategies on the unwarranted pullback.

The convulsions of a dying macro regime combined with the growing pains of a new one, in our view, have teed up a great opportunity to sell short the still speculatively valued investments of the last cycle on a bear market rally and to buy the undervalued scarce resource companies that are key building blocks of the new economy in the decade ahead.

After creating a historic financial asset mania in a ZIRP world while pretending that there are no inflationary consequences to high debts and ongoing deficit spending, policymakers have created systemic overvaluation, insolvency, and structural inflation all at once.

This trifecta of macro imbalances is a foreboding hurricane with a silver lining. Stagflation is a phenomenon that market participants have not seen in four decades. As a result, we think too many investors are ill-prepared for the transition that is already underway.

The good news, in our strong opinion, is that a robust new commodity bull market will emerge amidst further financial asset carnage still to come. This reflexive phenomenon should catalyze the impending recessionary hard landing. In the ultimately ensuing recovery, we expect critical resource industries to continue to lead as the important drivers of the new economic growth cycle to come. We are confident that it is a great time to get positioned.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

© 2023 Crescat Capital LLC