Engine No. 1, which has nominated four highly qualified independent director candidates to the Exxon Mobil Corporation (NYSE:XOM) (“ExxonMobil” or the “Company”) Board of Directors (the “Board”), today released a white paper by a leading energy market and policy expert analyzing the risks and opportunities facing ExxonMobil in a rapidly changing industry.

Q4 2020 hedge fund letters, conferences and more

Energy Transformations: Technology, Policy, Capital And The Murky Future Of Oil And Gas Firms

Summary

Technology and policy are transforming the industries linked to fossil energy. Large and growing shifts in capital are following. Oil and gas majors who wish to survive, let alone prosper, will need to realign their business around a low carbon future. They must become much more capable of creating and identifying transformative technologies and integrating them into new lines of business. As if that were not challenging enough, they must do this in ways that understand business evolution as a function not just of technology but also of policies that are redefining which firms will thrive in a world where emissions must shrink rapidly.

The skills needed to thrive in this new world do not come naturally to established industrial behemoths oriented for the competitive supply of mature commodities like oil and gas. The incumbent industry’s track record in identifying and integrating transformative innovations is not encouraging.

Where innovations have aligned with the core business model, big oil and gas firms have succeeded. For example, innovations in big data have made it easier to gather and process the seismic information necessary for oil exploration and drilling, and innovations in predictive maintenance and systems management have cut the costs of offshore drilling. In such settings, innovation has not much disrupted business models; oil and gas production has expanded. However, even there, the behemoth industry has failed to anticipate many important innovations that have come from outsiders, such as shale oil and gas—a striking transformation in oil and gas production that unfolded over the last two decades and an area where big firms dawdled and then rushed in only after the revolution was far advanced, with terrible financial results. The decarbonization revolution will be even more disruptive as the track record of creating and integrating profound innovation is weaker. Even where incumbent oil and gas companies have played a role in innovations that could thrive and cause big declines in oil and gas use (e.g., batteries or biofuels), they have tended to underweight these areas of investment.

As the decarbonization revolution advances, it will, most likely, radically reduce demand for oil and gas. Gone is the assumption, prevalent in the industry until just the last few years, that demand will always rise. A growing number of credible projections see steep and possibly discontinuous declines, principally due to growing pressure to cut emissions of warming gases. Indeed, about two-thirds of world emissions come from countries that have net zero targets for emissions, most of which are focused on the year 2050.

Under severe environmental pressure, the Western coal industry has already imploded. Oil is likely to feel the next blow. Policy and technological advances are creating niches of energy services that do not require oil at all—most strikingly, electric vehicles, whose market shares are climbing rapidly. The effects of vehicle electrification, other replacements for oil and the ongoing tightening of energy efficiency standards could cut demand for oil in half or more in the next two decades. Because transformative technologies, such as electric vehicles, are such a tiny share of the market today, they are easy to overlook, much as the U.S. coal industry ignored shale gas in 2005 when shale accounted for merely 2% of the U.S. gas supply—only to find themselves crushed after a decade of compound growth in shale gas production. As the technologies of the deep decarbonization revolution improve and expand outside their niche markets, the political winds will shift and so will capital. These reinforcing patterns will beget even stronger polices, bigger market shares and better technological performance.

With flattening and then shrinking demand for the incumbent product, oil, the need for new supplies will lessen. Less demand will shift supply away from the places where Western incumbent oil and gas firms have traditionally made the most of their economic returns. Similar patterns will plausibly unfold for gas but with implosion delayed. Gas is cleaner than the other fossil fuels and is exceptionally useful in electric power, an industry that will grow as the world cuts emissions. Nevertheless, even there, the conventional wisdom of a rosy future for high demand is turning darker.

Some firms, headquartered mainly in Europe where the policy pressures are most acute, have begun to respond. They have announced increasingly bold emission reduction goals, such as net zero emissions by 2050. Firms that are taking the decarbonization challenge most seriously have set goals for cutting emissions not only from their operations but also from the much larger volume of emissions that come from burning their products, such as gasoline, diesel and jet fuel. Making operations cleaner is a familiar challenge for the industry and one that many firms have already proven to be adept at doing. Making the product they sell emission-free is not.

A challenge is that no incumbent firm, no matter how seriously they are taking the decarbonization challenge, has a clear blueprint for how to thrive in a low carbon world. That information, including whether there is a role for these incumbent firms, is unknowable today.

Firms that succeed will be those that have “worked” solutions—the ability, earned through visceral experience and reorganization, to identify and integrate new technologies and business practices that allow them to compete in viable clean industries of the future. In other industries, like much of IT, this kind of disruption has often inspired strategies of “fast following”—watching the leaders bear the cost of failure and then quickly joining the slipstream by choosing the options that work. In oil and gas, where watching is less important than learning how to reorganize, that approach is likely a recipe for a fast death. By the time leaders have demonstrated effective worked models, they have moved on to explore even better prospects.

The firms that have been most aggressive in their response have redirected only about 5% of capital budgets, although the share is rising quickly. All this new investment is going into new businesses that have one (or all) of these attributes: being much riskier than the traditional business; yielding lower returns; involving much bigger roles and exposure to government policy; and being completely unfamiliar with the organizational culture of integrated oil and gas firms and their employees and investors.

Most of the reallocated capital has gone to renewables, in particular to solar and wind electric generation. This approach seems unlikely to be a winner by itself, for the solar electric industry is already highly competitive and maturing. The oil and gas industry has arrived late to the renewables revolution. Total capital investment by large oil and gas companies in solar and wind electricity was just 0.6% of the global total investment in renewable electricity in 2019. Outside of offshore wind platforms, the construction and operation of which require skills that overlap with those of offshore drilling, the incumbent oil and gas industry is struggling to find its niche.

Just a decade ago, some of the better managed oil and gas firms were seeing returns on capital that reliably exceeded 20%, with wide variation across the industry that set the best performers apart in a league of their own. Today, variation across the industry has narrowed massively, and returns have imploded. The end of supernormal returns means that the opportunity costs of change are much smaller than before. At the same time, the risks of inaction have risen.

All western oil and gas firms face a common question of how to successfully create value within an industry that is experiencing profound change. Answering that question is not merely a matter of identifying the right new lines of business—a task that will be hard enough, as the answers are unknown at present—but also a matter of reconfiguring leadership and culture within these firms. New leadership and culture must be more capable of navigating profound changes, executing well in new areas of commercial operations that are unfamiliar, and managing exposures to risk. In addition to emphasizing operational excellence, there is already a rapid increase in the need for cultures and management systems that can search for, and identify new purposes and directions for these incumbent oil and gas firms. Success will require new kinds of leadership, including board engagement, to help realign business units with new missions and aide in identifying and managing the right kinds of partnerships with collaborators outside each firm.

Oil and gas have always been capital-intensive industries. Decarbonization technologies all share the attribute that they have even lower operating costs than today’s fossil fuel systems, but, nearly everywhere, those savings in operating costs are offset by higher capital intensity. For an industry that has thrived on managing capital to avoid the stranding of assets, the challenges are now becoming significantly harder as energy systems become even more capital intensive. The assets most likely to be stranded are those that are most familiar. The assets likely to generate the greatest value amortized over long periods of reliable operation are those that are least familiar to the incumbent oil and gas industry. Brave or not, that is the new world.

Part I: The End Of An Era?

For decades, nearly all energy analysts have assumed that demand for oil and gas would rise inexorably into the future.1 A growing world population and expanding economy would need energy; most of that energy must come from fossil fuels, as it had since the 19th century. For oil in particular, a rich future was assured because the liquid had a monopoly on an essential service in the modern economy: transportation. Nobody flew airplanes powered by coal or onboard nuclear reactors; liquid jet fuel was a lot easier to store and much cheaper than all the alternatives. Electric vehicles were playthings for the rich and had been since the 19th century.2 Ships ran on oil and nothing else. Petrochemicals came from oil and, to a lesser degree, natural gas. Meetings in Davos and exhortations on op-ed pages talked about the need for an “energy transition,” but not much transitioning was actually happening, for, even now, the global economy still depends on fossil fuels for about 85% of total energy.3

For decades, nearly every oil and gas supplier subscribed to these beliefs, and the whole industry was organized to meet the inexorably rising demand. More demand meant more supply; natural declines in existing oil and gas wells meant there was a need for even more supplies to offset that decline. Since the “easy” oil and gas deposits in the world were being tapped out, more supply meant venturing into new geologies and locations with a lot more risk. Managed well, that meant more profit.

Often this belief was wrapped in a mantle of goodness and necessity. Fossil fuels were the cheapest way to power the world economy and lift humanity from poverty, as ExxonMobil’s boss from 1993 to 2005, Lee Raymond, said in a 1996 speech to the Detroit Economic Club.4 The future was hard to predict and thus laden with risk, but most people in the industry and most policy makers worried primarily that not enough capital would be mobilized for investment to meet the growing demand.

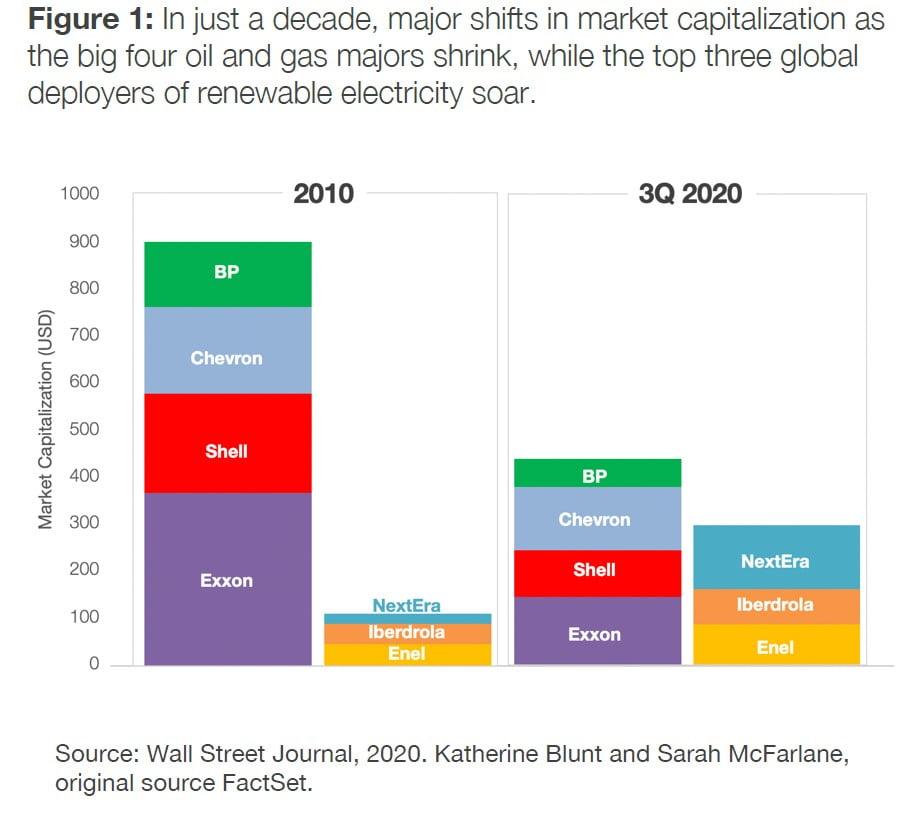

That picture is now changing. The consensus that oil and gas demand will continue to grow is ending. The markets have already seen this reality, which helps explain why, over time, the total value of large integrated oil and gas companies has been shrinking.5 Since 2010, the top four oil and gas companies have seen their market capitalization shrink more than half from $894B to $433B. At the same time, the value of the largest green energy specialists—all electric companies—has nearly tripled from $111B to $299B (Figure 1). The largest pure play supplier of green energy equipment, Tesla, has risen in market capitalization from $1.7B at its IPO in 2010 to nearly $700B at the start of 2021.

New Outlook For Oil Demand

For oil demand and prices, there is a long history of wrong forecasts.6 In the midst of the oil crises of the 1970s, most projections envisioned exponential growth in demand, only to be surprised when people had a strong incentive to become more frugal thanks to high prices and strong energy policies that kept working even when energy prices abated in the 1980s and 1990s. From the late 1990s, surprises appeared in the opposite direction: surging demand from the rapidly industrializing Asian Tigers, led by China.7 However, one thing was constant: the assumption that demand would always rise. All told, in the 35 years since 1974, which marks the end of the first oil embargo, the year-on-year consumption of oil dropped just six times, always briefly and always in the context of a global economic downturn.8 For decades, oil analysts have, for the most part, been debating about rates of growth—not whether growth would happen.

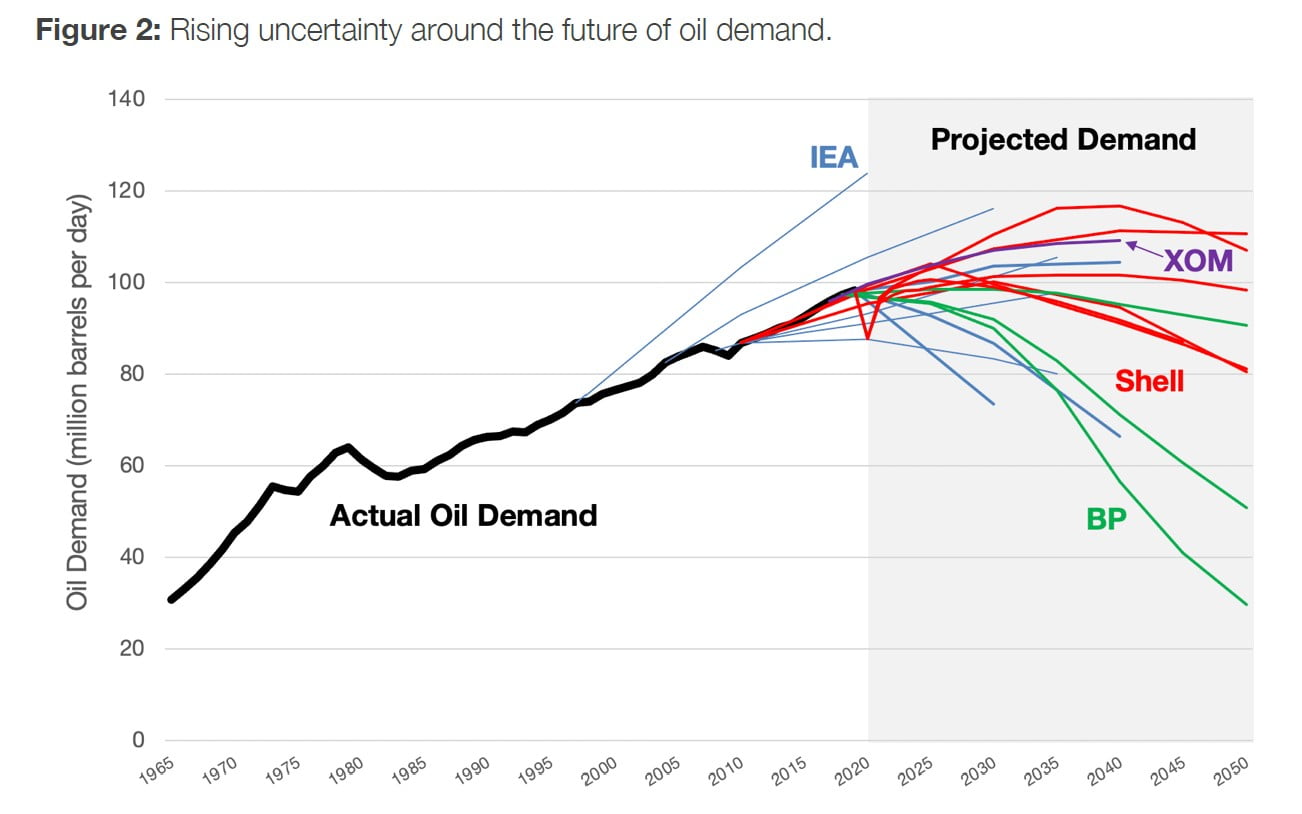

At no point since modern forecasting of oil demand began in the 1960s has the range of possible futures been wider than it is today. Figure 2 shows a history of demand forecasts, with a healthy spray of alternative futures. Today’s spray is different, for it is not just wider but includes a large number of credible projections with discontinuous steep declines, indicating implosions that could happen much faster than has been widely appreciated.9

The main figure shows the history of demand for oil (heavy black line) and projections (light colored lines) for four organizations: the International Energy Agency (selected years, including 2020 scenarios), BP (2020 scenarios), Shell (selected years, including 2021 scenarios) and ExxonMobil (2019 Outlook for Energy). At no point in the history of oil demand forecasting has the range of possible futures been larger than today, and at no point has there been more attention to rapid declines in total demand.10 Source: International Energy Agency, BP, Shell, ExxonMobil.

When concerns about oil consumption were rooted in energy security, as they were from the 1970s until recently, demand mattered less than reliable supply. Keeping demand in check was important, but the real work of energy security involved worrying about whether too much oil was coming from unsavory and unreliable places. Reliable supply meant diversity in supply, with extra weight on supplies close to home. That mindset is what created policies to support environmentally catastrophic programs, like the generation of synthetic oil from coal; this created preferential leasing and tax programs aimed at boosting supplies of oil from the deep waters of the Gulf of Mexico and from remote Alaska—all places thought to be reliable in supply. However, ultimately, ingenuity in production along with policy support meant that new supplies were always found. As Sheikh Ahmed Zaki Yamani, the Saudi oil minister from the 1960s to the 1980s, reportedly said, “The stone age did not end for lack of stone.”11 For most of modern history, that quip has been a reminder never to question the supply of stone. Today, it means something different: the end of carbon.

Fear of climate change transforms that mindset.12 No longer is the central problem adequate supply but excessive demand; policy, in this new mindset, focuses on eliminating demand where possible and switching to alternative technologies, such as electric vehicles, that serve the needs provided by oil today.

Thanks to the big decline in oil demand in 2020 as a result of the pandemic, a range of forecasts have oil demand peaking this current decade.13 Even OPEC, which has a strong interest in painting a future of higher demand, now offers credible scenarios with little growth and a steady decline in the 2030s.14 BP, which has the longest and most transparent history of sharing data and forecasts, published new projections in October 2020 that are consistent with a long and accelerating decline in oil demand. For more than a decade, the BP forecasting team envisioned rising demand; this year that consensus cracked.15 Shell has offered similar futures of waning need for oil.16

What remains is a shrinking group of oil majors, notably ExxonMobil, that still cling to old forecasting methods and results. At its annual investor day in March, 2020, which was held as the pandemic started gripping the world economy, ExxonMobil painted a future unaware of how the world of policy was changing: rising demand, a big gap in necessary investment and a litany of concerns about mobilizing the investment needed to fill that gap (see Figure 2, inset).17 Although other companies also see a continued need for new production, at least in the short term, their outlooks are much less bullish for traditional oil supply.18

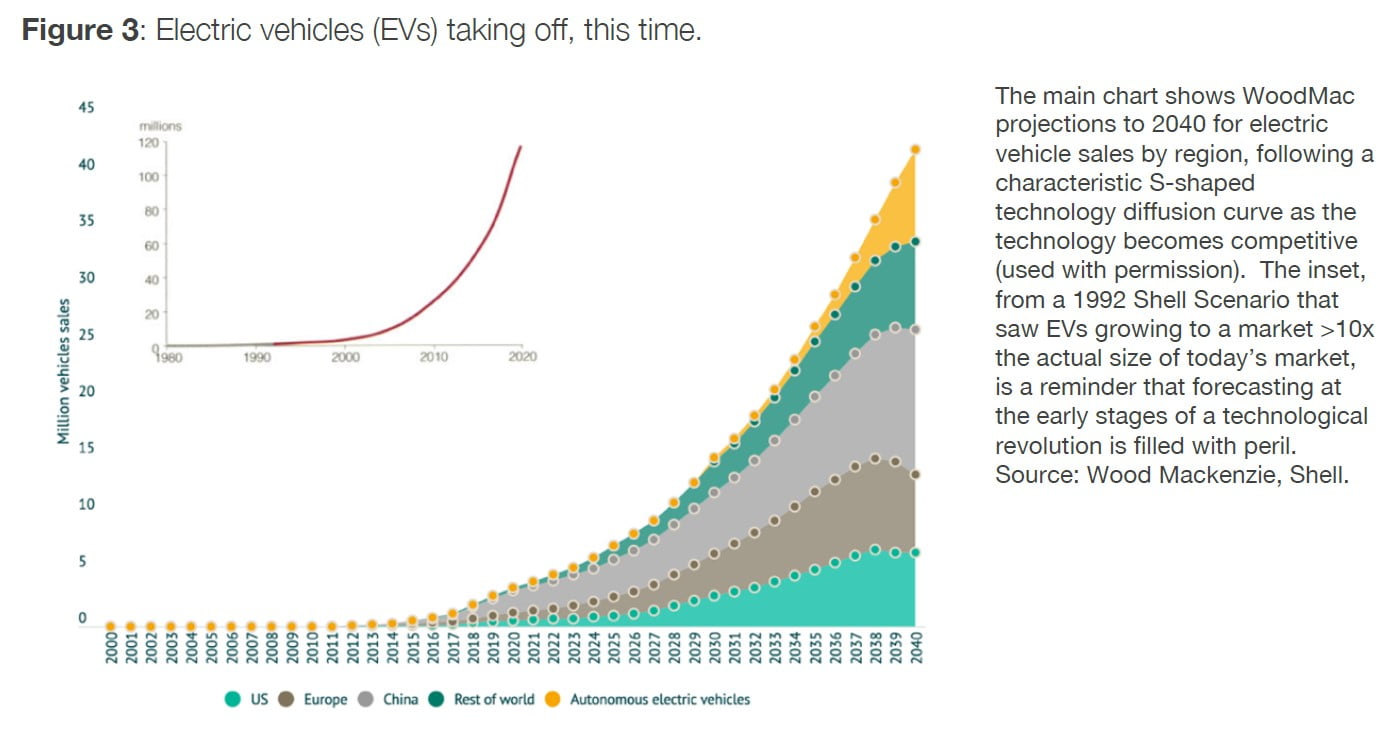

Demand implosion must be taken seriously because rapid technological change now points in the same direction as policy. The place to watch is electric vehicles, including the emergence of autonomous vehicles (which are likely to be electric). Nearly half of the global oil demand of about 100 mbd currently goes into mobility services that electrification can replace. Figure 3 shows a highly credible industry forecast, with electric vehicles accounting today for just 2.3% of global new car sales but exploding in volume and share.19 Many other projections similarly see that share rising to approximately 30% by 2030, a date by which some markets from California to major segments in Europe plan to ban new internal combustion car sales.20 General Motors recently announced that it aimed to phase out petroleum powered cars by 2035; Ford has similarly announced big shifts in its capital expenditure toward electric vehicles.

The electrification of vehicles is a marriage of technology and policy—a story that will repeat many times in the decarbonization revolution. Policy has opened market niches for electrification in which the technology—batteries principally, but also drivetrains, system controls and marketing—gained a footing and improved. Since 2013, the cost of battery packs has declined by nearly 80%, and battery systems are likely to continue getting cheaper and more reliable. In 2020 alone, for example, batteries fell 13% in cost.21 Now, in a growing number of markets, electric technology can compete on its own with little or no subsidy, which means that it will take off even faster—up the steep slope of typical S-shaped technology diffusion curves—and erase larger volumes of oil demand.

Read the full White Paper here.