Hindenburg Research‘s short report on Ormat Technologies, Inc. (NYSE:ORA).

Q4 2020 hedge fund letters, conferences and more

Ormat Technologies, Inc. (ORA)

- Today we reveal how ESG-darling Ormat, a developer and operator of geothermal power plants, has engaged in what we believe to be widespread and systematic acts of international corruption.

- We expect the blowback to these revelations to be severe, threatening Ormat’s contracts in its most lucrative markets. In fact, history is already catching up to Ormat’s senior leadership.

- Immediately prior to their work at Ormat, several senior Ormat executives and directors worked at Shikun & Binui, a leading Israeli construction company. Shikun & Binui was recently charged by Israeli prosecutors with bribing officials in what are now two of Ormat’s key markets, Kenya and Guatemala.

- Ormat’s General Counsel & Chief Compliance Officer, along with an Ormat director, are under pre-indictment in Israel. This is a formal stage of prosecution just prior to indictment. Ormat has apparently chosen not to disclose that the two are currently in the midst of a criminal prosecution. Both still serve in senior oversight roles at Ormat.

- Ormat CEO Doron Blachar’s immediate prior work experience was serving as CFO at Shikun & Binui. The CEO during Blachar’s entire tenure at Shikun & Binui was arrested in 2018 over the above-referenced bribery allegations. It is unclear whether Blachar faces near-term risk of indictment as well.

- International electricity projects contributed to 70% of Ormat’s 2020 net income—the vast majority of which is comprised of Kenya, Guatemala, and Honduras. We have uncovered evidence tying Ormat to corruption with senior government officials in this lucrative international business.

- For example, multiple former Ormat employees and business partners have revealed how Ormat routes sales of energy assets in Guatemala through an undisclosed related party entity. Guatemalan corporate records corroborate these claims.

- The entity shares an address with several Ormat subsidiaries and was set up by a former Ormat senior employee-turned “independent” consultant who answers directly to senior Ormat leadership, according to the former employees.

- Official corporate records show that the same Guatemalan entity funneled energy rights to two senior government officials who were responsible for approving Ormat’s original deal in the country; the former head of the Mines & Energy Ministry and the former head of the state utility company.

- We believe this is direct evidence tying Ormat to corruption with senior Guatemalan government officials.

- Another Guatemalan Mines and Energy Minister, who was in office when Ormat was later awarded major improvements to its contract, was fired and charged with corruption by the United Nations-created anti-corruption commission. He is currently on the run with an outstanding international arrest warrant.

- Ormat’s operations in Kenya contribute “disproportionately” to the company’s bottom line, generating an estimated ~41% of the company’s FY 2020 net income. Its customer is the Kenya state power company.

- A politically-connected businessman admitted to us that he “opened the doors” for Ormat in Kenya and got the go-ahead for the project after an in-person meeting with the Kenya Power boss (who was later charged with corruption) and former President Daniel Arap Moi, widely regarded as one of Kenya’s most corrupt leaders.

- We present documents showing that Ormat paid contractors in Kenya tied to corrupt government officials, including one run by the son of the former President Daniel Arap Moi along with others run by his documented front-men.

- The head of the Kenyan state-backed utility who oversaw the original contract with Ormat, as well as the energy minister at the time, were later found to have demanded millions of dollars in bribes to allow international power companies to do business in Kenya.

- Two former CEOs of Ormat’s Kenyan customer (the state-backed utility) were subsequently arrested in 2018 and more than a dozen top managers were arrested or accused of crimes relating to corruption.

- The same state utility customer, responsible for driving Ormat’s “disproportionate” financial success in the country, is reportedly “broke” and “technically insolvent”, posing another threat to Ormat’s most lucrative market.

- In Honduras, Ormat charges the state energy company roughly the same rate as end customers pay, virtually guaranteeing a loss for the state. These rates make no economic sense.

- The power agreement assumed by Ormat in Honduras was signed within days of other uneconomical agreements that were signed by the then head of the state utility, who is now under investigation for corruption relating to those agreements.

- We found that an opaque Panamanian entity with no public presence, formed the day after the Honduran coup, registered to unnamed nominee directors, was inserted into the deal. We have submitted a FOIA request to a U.S. agency and are awaiting imminent release of records relating to the entity.

- Ormat’s Honduran plant operates in Copan, known as drug cartel territory. A Honduran congressman told us “You can’t operate in Copan without paying the cartels, the gangs or corrupt politicians – and sometimes all three.”

- We found that Ormat’s contractor in Honduras was raided by authorities on suspicion of being a front company for drug cartels. Its owners are in jail awaiting trial.

- Ormat’s culture of corruption isn’t limited to international markets. In the U.S., Ormat settled DoJ fraud charges after whistleblowers alleged it made fraudulent misrepresentations in order to secure government clean energy loans.

- Corruption is a double edged-sword. Just as a company can win lucrative contracts through illicit means, those contracts can be pulled away once exposed. We expect a very bumpy road ahead for Ormat.

Initial Disclosure: After extensive research, we have taken a short position in shares of Ormat Technologies, Inc. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction

“Few men have the virtue to withstand the highest bidder.” – George Washington

Throughout history, those who have most loudly declared their own virtue have often been later exposed as the worst charlatans.

Perhaps one of the more painful ironies in a year filled with ironies has been the breadth and magnitude of deception purveyed by companies claiming to focus on “ESG”: Environmental, Social, and Governance concerns.

We have recently published on ESG-oriented companies like Nikola, Kandi Technologies, Loop Industries, Facedrive, and others, uncovering a slew of fake products, overhyped tech, accounting irregularities and paid stock promotion. We believe Ormat is another ESG imposter masking a different underlying issue: corruption.

Ormat’s General Counsel & Chief Compliance Officer and a Director Are Under Pre-Indictment in Israel, a Formal Stage of Prosecution, Over Extensive Allegations of Bribery, Fraud, And Money Laundering

Ormat Has Not Disclosed This To Investors. Both Currently Continue to Serve In Key Oversight Roles for Ormat

Critically, we learned through our investigation that 2 of Ormat’s senior leaders are facing pre-indictments in Israel relating to extensive allegations of bribery, fraud, and money laundering.

Pre-indictment is a formal stage of criminal prosecution in Israel whereby after prosecutors have made a decision to file criminal charges, the accused has a right to preliminary hearing to attempt to convince prosecutors not to file charges.

The prosecutions relate to Shikun & Binui, an Israeli construction firm that Israeli authorities allege to have maintained an elaborate system for bribing government officials that involved two sets of books.

Israeli prosecutors and courts allege that Shikun & Binui engaged in “systematic” “huge” bribes in Kenya and other countries, including “deliberate concealment from regulators and law enforcement”.

Israel’s State Attorney has said he will hand down indictments, pending a hearing, against Shikun & Binui’s former CEO, the heads of its overseas subsidiaries, other senior executives and against the company itself.

Media reports from mid-February indicated that Israeli authorities had officially made their decision on pre-indictments, but did not disclose the full list of names.

A statement issued by the State Attorney’s Office read:

“Prosecution was being considered subject to a hearing… The bribery was allegedly accompanied by an array of money laundering and false reporting and registration offenses, all through managers and former employees of the group, including senior executives.”

We received the full list of the suspects under pre-indictment after contacting a spokesman for the Israeli Ministry of Justice, along with a spokeswoman for Israel’s State Attorney’s Office on Tax and Economics.

The list reveals that two current Ormat senior officials are currently facing pre-indictment, unbeknownst to investors:

- Yehezkiel (Hezi) Kattan, who became Ormat’s General Counsel and Chief Compliance Officer in 2018. Immediately prior to Ormat, Kattan served as General Counsel to Shikun & Binui from 2006 to 2018.

- Ravit Barnav, who has been an Ormat board member since 2015. Previously she served as chairwoman of Shikun & Binui from 2007 to 2012.

A third Ormat leader, Doron Blachar, became Ormat CEO in July 2020, after serving as the company’s Chief Financial Officer from 2013 to 2020. Immediately prior to Ormat, Blachar served as CFO of Shikun & Binui, from 2009 to 2013. It is unclear whether Blachar also faces risk of criminal indictment, given that other Shikun & Binui senior leaders including the CEO and Chairperson face pre-indictment.

Israeli police and the Israel Securities Authority launched their investigation into allegations of Shikun and Binui corruption in February 2018. We have been told by local experts that there is no realistic way that Ormat’s GC/CCO or Director did not know that they are facing criminal indictment. Given the involvement of Ormat’s CEO in the same case, we expect that he is fully apprised as well.

It seems it is only investors who have been left in the dark.

For more details on the Shikun & Binui case and the involvement of Ormat’s leadership, please see Part V.

Background and The Ormat Bull Case: An Environmentally-Friendly “ESG” Play

Founded in 1965, Ormat has grown to one of the largest global producers of geothermal power plants. Geothermal power uses natural heat from the Earth’s core to generate steam to make electricity, fitting well into the “Environmental” part of the ESG narrative. The process is widely considered to be more environmentally-friendly than conventional fossil fuel sources.

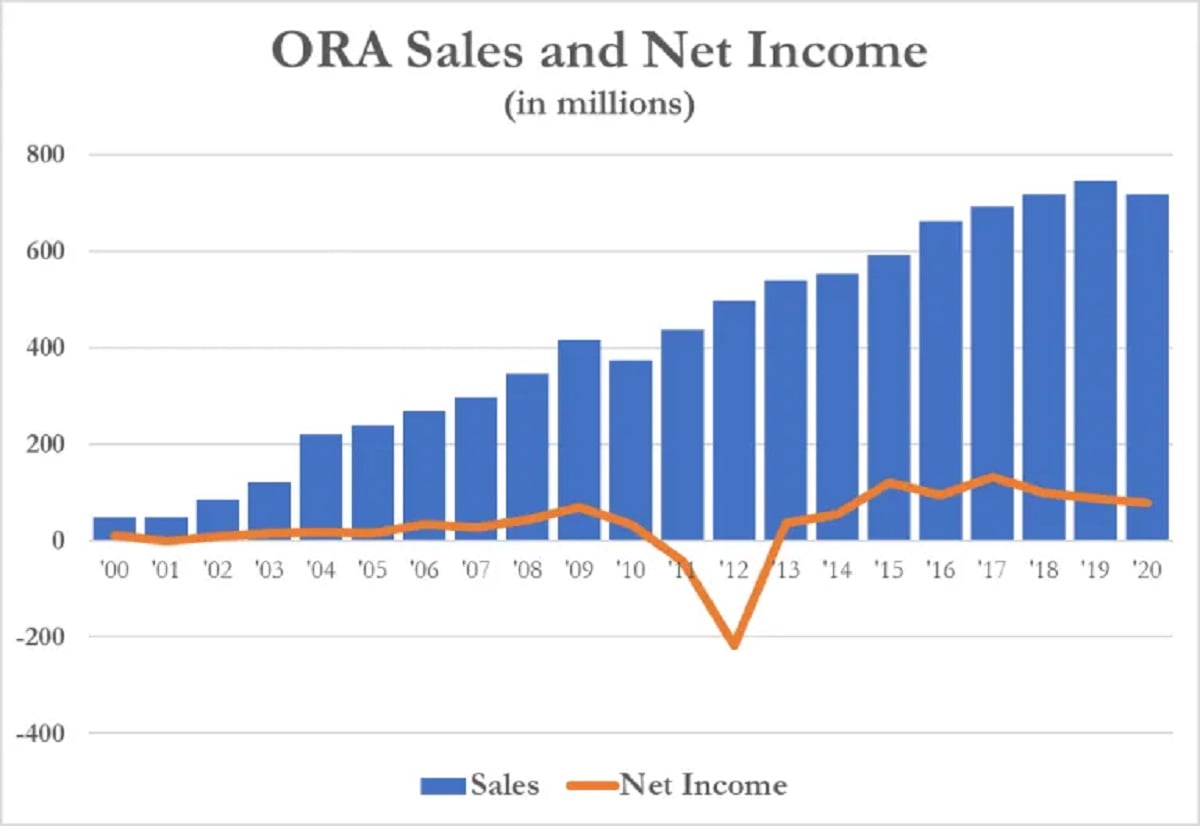

Ormat says on its website that it is “powered by nature” and “committed to ESG principles”, making it a fit for allocators looking for an ESG play with a relatively consistent historical revenue and net income stream. [Pg. 19]

The utility-like nature of Ormat’s reported income isn’t reflected in its stock price. Buoyed by ESG-mania, Ormat recently breached new all-time-highs, and is now trading up ~60% from its lows in the past year. It is now valued at ~7x sales and 63x its estimated 2021 earnings, according to FactSet.

Reality Check: Evidence Shows that Ormat’s Lucrative Deals Have Been Fueled by Corruption

Ormat’s financial health is disproportionately supported by international projects, which accounted for 70% of 2020 net income despite only comprising about 30% of Ormat’s total power generation capacity. [Pg. 59, Pg. 12]

While Ormat’s power plants are “powered by nature”, its lucrative international contracts appear to be powered by a slew of payments to senior government officials.

Our investigation has revealed specific evidence indicating payoffs to the very government officials who approved power projects in Guatemala. We have also identified red flags indicating similar dealings in Kenya and Honduras.

Our investigation into Ormat, spanning almost 9 months, included speaking to over a dozen former employees and business partners, consultation with international legal experts, multiple FOIA requests, and review of hundreds of international corporate and real estate records, including those in paper-only jurisdictions like Guatemala and Kenya.

We believe Ormat has a culture of corruption, stemming from the top, that has existed for decades and continues to this day.

The result is that Ormat appears to be plundering the nations it claims to be helping. Kenya’s state power company, for example, is on the brink of insolvency, in significant part due to its overpriced deals with Ormat. A large portion of Honduras’ crippling national debt originates from its inflated private energy deals, such as its deal with Ormat, which virtually guarantees a loss for the state.

Ormat’s counterparties have consistently expressed a desire to renegotiate or terminate its burdensome contracts. We think the consequences of our findings could result in backlash in the countries Ormat does business, along with exposure to fines and other penalties.

Ormat’s Latin American plants generate a total of 78MWs in capacity, accounting for an estimated 22% of total 2020 net income.[1] [Pg. 12]

Ormat operates two power plants in Guatemala totaling 40MWs capacity. [Pg. 12] Both plants have Power Purchase Agreements (PPAs) directly with the state energy utility company, Instituto Nacional de Electrificación (INDE).

Typically, when a company like Ormat generates electricity, it sells it directly to the local utility company.

Contrary to that normal practice, Ormat instead sells a portion of its electricity produced in Guatemala to an unnamed entity. This is visible, for example, in recent quarterly reports showing sales to state utility company INDE along with an unnamed “local purchaser”. [Pg. 36]

According to a former senior employee we interviewed, that unnamed entity is called Comercializadora Comertitlan (“Comertitlan”), formed by an individual named Yossi Shilon, an Italian-Israeli who also goes by the Italian spelling of his name Joseph Shilonne.

The former senior employee, who we consulted, said:

“Shilon joined Ormat as a manager but then became an independent consultant working for Ormat. He became a very rich man and he’s got his own power company established in Guatemala. Ormat would sell energy to Shilon and Shilon would sell it to the (public) utility. A lot of people in Ormat were astonished because Ormat could have sold directly. We didn’t know why it was being done like that and we suspected kickbacks were involved but I have no proof.”

In total, 5 former employees and business partners described the murky relationship between Shilon, Comertitlan, and Ormat. One told us Shilon answered directly to top Ormat management and that he worked in both Central America and Africa. Another former Ormat employee in Central America told us:

“It was never really clear to me what exact status Shilon had or whether he was still an employee of Ormat or not. He worked almost like an employee because of the great responsibilities he had and the confidence that the bosses deposited in him. He practically had a direct reporting line to (Ormat founders) the Bronickis.”

This appears to be a clear conflict of interest – an Ormat representative who answers to Ormat’s top management while at the same time acting as an undisclosed intermediary between Ormat and the utility it is already selling to.

Guatemala’s energy market does permit a power generator (such as Ormat) to sell excess capacity not committed in a PPA to third party resellers for sale on the spot market or to large industrial consumers.

But all production from Ormat’s Ortitlan plant is already fully committed to INDE according to the 2003 PPA. Ormat states the capacity of the plant is 20MW, and the PPA with INDE is for 20.5MW. [Pg. 12, Pg. 14]

Consequently, it is not clear why Ormat would need to channel any sales through a reseller nor what spare capacity it would even have available to sell.

We Investigated and Were Able to Corroborate the Former Employees’ Statements Through 3 Steps

1. We confirmed Ormat’s relationship to Comertitlan through references in Guatemalan corporate records, international environmental reports [Pg. 5], Ormat’s SEC filings [Pg. 16 and Pg. 146], and a Guatemalan state electricity database. Critically, the filings did not disclose any related-party link, but confirm Ormat had an energy deal with Comertitlan that appears to be ongoing to this day.

Here is one example environmental report showing sales from Ormat’s Amatitlan project to Comertitlan:

2. We confirmed Comertitlan is based out of Ormat’s address. Guatemalan corporate records reveal that Comertitlan is based out of the same address as multiple Ormat subsidiaries, evidencing what we believe is a clear undisclosed related-party link. [Pg. 1]

Per the records, Comertitlan’s office address is 13 Calle 3-40 Zona 10 Oficina 1103, 11 Nivel Edificio Atlantis, Guatemala:

We can see from the same corporate registry that 3 of Ormat’s subsidiaries in the country are based out of the exact same office suite in the exact same address. [1, 2, 3] Here is one example:

3. We confirmed through Guatemalan corporate records that Yossi Shilon/Joseph Shilonne established and ran the Comertitlan entity.

We also corroborated, through media reports that Yossi Shilon (aka Joseph Shilonne) held a senior role at Ormat before and after the time Comertitlan was formed in 2007, further confirming the undisclosed related-party link.

For a full breakdown of each step-by-step document see Appendix A.

We Visited the Comertitlan Entity’s Registered Corporate Address in Guatemala And Found No Sign of It On Site

Instead, There Was an Ormat Sign on the Door

We sent an investigator to visit the registered address for Comertitlan and the Ormat subsidiaries in Guatemala.

The online building directory shows that Comertitlan is based at its official corporate address, as one would expect:

Here is the façade of the building from the outside, in Guatemala City, from our visit:

But when we got to the 11th floor, we saw that there is no Comertitlan sign, just a sign for Ormat:

Here is a closer look:

So why does Ormat have an undisclosed related-party entity based out of its own office that it directs energy rights to?

The former employees we spoke with suggested graft as one motivation, stating that Yossi Shilon (and perhaps other unnamed beneficiaries) became rich through dealings with Ormat. Ormat’s energy deal with Comertitlan is governed by private contract, making the full details opaque.

Beyond graft, we located evidence through Guatemalan corporate records showing that Ormat channeled energy deals through Comertitlan to another entity owned by the former senior Guatemalan government and state utility officials who granted Ormat its original licenses to operate in Guatemala.

We believe this is clear evidence of corruption.

Corporate Records Show That Ormat’s Undisclosed Guatemalan Entity Funneled Energy Rights to a Different Entity Named “Geoconsa”, Controlled by The Former Mines & Energy Minister And The Former General Manager of The State Utility Company

According to corporate filings, Comertitlan signed over the rights it had negotiated with Ormat to another company called Geoconsa Energy SA.

Shown in this 2015 document included in Ormat’s Guatemalan filings, Comertitlan first signed over its rights to Geoconsa in 2012 and then modified the agreement in 2014:

According to records at the mercantile registry, Geoconsa Energy is run by Raul Edmundo Archila Serrano, former Mines and Energy Minister (2000-2004) and by Jorge Juarez Pedroza, the former general manager of state energy provider INDE (2002-2004).

After several months of requests under Guatemalan public information transparency laws, we obtained a series of documents from state utility INDE showing the officials who approved Ormat’s original deals in the country.

In February, 2003, Juarez Pedroza, then head of Guatemalan state utility INDE, signed a Power Purchase Agreement (PPA) with Ormat. He went on to sign two other contracts (a) setting out the terms of use of the geothermal resource and (b) transferring control of the resource to Ormat. [Source: 1, 2, 3, 4, 5, 6, 7, 8, 9]

Juarez Pedroza signed three contracts with Ormat including this one from April 25, 2003:

In August 2003, Archila Serrano, then Energy Minister, gave Ormat the final approval and authorization to use the geothermal resource and the surface rights to the above land. [Source: Transfer of Use Public Property Filing]

Archila Serrano also signed this contract with Ormat dated August 5, 2003:

At risk of dramatically understating this point, most companies don’t route payments through undisclosed related party entities to senior government officials who approved their lucrative contracts while in office.

Note that we only have limited visibility into the deals effected through Comertitlan, but even with that limited view, we already see multi-million-dollar sums flowing through the entity to an Ormat insider and former senior government officials. We think the full banking records for this entity would expose more revelations.

In 2014, Guatemalan Officials Enriched Ormat Through a 270% Tariff Increase

The Two Government Officials that Approved Ormat’s Deal Modification Were Later Fired, Charged With Corruption, and One Is Still On the Run

The first mention of Comertitlan signing over its rights to the former energy minister and to the former manager of the state utility was in 2012, a few months into the scandal-plagued presidency of President Otto Perez Molina, a former army general.

On January 20, 2014, President Otto Perez’s government modified Ormat’s PPA on vastly more lucrative terms for one of its power entities, Orzunil, which had originally begun operations in 1999.

The 2014 modification granted Ormat a ~270% increase in its variable energy tariff starting in 2019 – the year the original contract had been due to end. The energy tariff leapt to 6.2 cents per kwh under the new deal versus 2.3 cents per kwh under the old contract and extended the PPA agreement by 15 years. [Pgs. 16, 20].

A press release at the time stated that this was in exchange for Ormat taking over management and operating responsibilities at the plant. Ormat became responsible for additional costs to maintain the geothermal resource and the fixed capacity payments were reduced, but the modification represented a substantial improvement in terms.

The Ormat modification was signed by the then general manager of state utility INDE, Marinus Arie Boer Johannessen.

Boer Johannessen was forced to resign from the top job at INDE just three months later over separate allegations of corruption relating to his award of a contract to a Brazilian multinational to build a hydroelectric project.

The Mines and Energy Minister, simultaneously chairman of the state utility INDE, who was in office during the time the deal modification was signed, was Erick Archila Dehesa (Jan. 2013-May 2015). He was also later fired and charged with corruption by the United Nations-created anti-corruption commission. He fled the country and was subject to an outstanding international arrest warrant.

Just 11 days after the lucrative deal modification, Ormat’s undisclosed entity Comertitlan modified its agreement with the politically-connected Geoconsa, on January 31, 2014.

Given the private nature of the documents, the new terms are not entirely clear, but the close timing indicates the potential for coordination with the government’s providing a sweetened deal. Once again, we think these records would produce further revelations.

Guatemalan Officials Recently Announced a New Investigation into The Former Energy Minister In Office During the Time For “Taking $10 Million In Bribes From Foreign Energy Companies”

Finally, in December 2020, Guatemala’s anti-corruption czar Juan Francisco Sandoval, head of the Special Prosecutor’s Office Against Impunity (FECI) announced another criminal investigation against former energy minister Erick Archila for allegedly taking $10 million in bribes from foreign energy companies.

Interpol arrest warrants were issued for a group of Latin American businessmen, including Mexicans, Colombians and Hondurans, also targeted in the investigation. Sandoval said at least four people had so far been arrested including the former energy minister’s adviser and his associates who ran front companies that allegedly laundered the bribes.

In a news conference, Sandoval said of the former energy minister:

“Erick Archila led a criminal organization between 2012 and August 2016…and was indirectly paid illicit financial benefits thanks to the opportunity afforded to him by political power.”

All said, we think Ormat’s lucrative Guatemalan deals face severe risks given the clear irregularities.

Part II: Ormat’s Extensive Dealings With Corrupt Kenyan Officials

Kenya is crucial to Ormat’s financial well-being. In its 2020 annual report, Ormat disclosed that its international electricity operations accounted for 28% of revenue and 70% of net income, with a “substantial portion” coming from Kenya, which “contributed disproportionately to our gross profit and net income”. [Pg. 59]

Kenya’s lopsided contribution is despite Kenya only representing 16% of its generating capacity, suggesting that Kenya is Ormat’s most lucrative single market.[2] [Pg. 12]

This begs the question: how did such an advantageous deal for Ormat come about?

A Politically-Connected “Tycoon”, Joseph Manga Mugwe, Told Us He “Opened the Door” for Ormat and Made a Personal Appeal to Kenya’s Notoriously Corrupt President, Daniel Arap Moi

When Ormat arrived, Kenya was on the verge of a drought-fueled energy shortage and ruled by a rampantly corrupt government led by President Daniel Arap Moi that, during 24 years in power, robbed from state coffers and took billions in kickbacks from private enterprise.

Against that backdrop Ormat was able to negotiate terms so favorable that today it receives energy tariffs almost 40 percent higher than other geothermal contracts.

A partial explanation may be found in Ormat’s choice of consultants, legal teams, facilitators, contractors and partners – many of whom have or had family, business or political connections to the governments in power at the time.

We discovered through an interview with the prior landowners of part of Ormat’s Kenya operation that the company established operations in Kenya with the help of a self-described consultant with impeccable political connections, Joseph Manga Mugwe.

Described by Kenyan media as a “tycoon”, Mugwe told us in an interview that then-president Daniel Arap Moi – deemed one of Kenya’s most corrupt post-colonial rulers – personally gave approval for Ormat’s operations in Kenya.

Mugwe Acknowledged in an Interview With Us That He Used His Political Clout to Facilitate Ormat’s Entire Operation in Kenya

We had called Mugwe to ask him about his intermediation in a deal to purchase land for part of Ormat’s operations. He readily explained that his role had been much larger, claiming to have facilitated Ormat’s entire operation in Kenya.

He said by phone: “Orpower (Ormat) came to me and I helped them get a license yes, yes, yes. I’m the one who helped them through the door in Kenya.”

“I never was on the board but I was a kind of a consultant and teaching them how to move around.”

This unofficial consultancy role seems to have been a clear conflict of interest. At the same time that Manga Mugwe was facilitating Ormat’s entry to Kenya he was also a director of KenGen, the state power generation company that controlled geothermal resources at that time – including the resource it ceded to Ormat.

Despite this, he openly acknowledged that Ormat executives were referred to him by officials in the state electricity company KPLC – the company with which Ormat was about to sign a PPA and the sister company of Kengen — because of his political clout.

“They (Orpower) inquired through KPLC who could make the application for them and people said Manga Mugwe because they knew of my political connections.”

He said he regularly used to meet Ormat’s founders, Lucien and Dita Bronicki, when they came to Nairobi. He said he made a direct and personal appeal to then-president Daniel Arap Moi for Ormat to be given a contract in Kenya.

“I supported them and I even spoke to the President then, Daniel Arap Moi, and he was very receptive. And KPLC (Kenya Power) gave the go ahead.”

(To make way for geothermal development, nomadic Maasai herding communities were then forcibly displaced by internationally-funded projects from across the Olkaria geothermal field. Hardly the ESG angle that many investors believe they are getting when investing in Ormat.)

Ormat’s Contractors in Kenya: Consistently Close Ties To The Empire of Former President Daniel Arap Moi, Accused Of “Looting” Kenya Of More Than $1 Billion

Detailed in a leaked 2004 report by international security firm Kroll, former Kenyan President Moi’s sons and business cronies helped run his racket via front companies and offshore bank accounts. It was amid this climate of rampant corruption that Ormat first arrived to do business with the Moi government.

Ormat’s Kenyan plant was developed in multiple phases spanning almost 20 years and three presidencies, eventually growing from 8 MW capacity to 150 MW.

Ormat listed several contractors in a 2012 exhibit for a loan for its Kenyan Olkaria III project. From this list, we see multiple companies run by close associates to Moi, including his son.

Others were led by businessmen with close political and economic ties to the Mwai Kibaki Presidency (2002-2013), a former Moi minister who later moved into opposition. During Kibaki’s tenure, Ormat’s PPA was modified twice, allowing it to increase capacity. [Schedule 3.01 (x)]

The contractor list is not complete, but rather appears to be a snapshot of a limited timeframe between late 2011 and mid-2012. Some of the contractors, however, are known to have worked with Ormat for many years.

Overall, it paints a picture of a network of private contractors tied to Kenyan political interests, facilitating payments to politically-connected individuals:

Ormat Was Investigated in Kenya in 2017 After Whistleblowers Alleged The Company Had Overbilled Kenya’s State-Run Entity

Kenyan media outlet The Standard published an article several months ago (which now appears to have been removed) that disclosed that Ormat was investigated in 2017 by the Kenyan Ethics and Anti-Corruption Commission (EACC) over corruption allegations.

The investigation was triggered when anonymous whistleblowers claimed Ormat’s Kenya plant had misrepresented its capacity and had forced its operators to report altered daily meter readings, among other allegations.

While the commission’s report ultimately failed to bring conclusive evidence of corruption, it found certain alarming issues.

In one example, the EACC learned that the amount of power fed to the grid by Ormat’s plants was communicated verbally or through email to the National Control Center, instead of automatedly. The report identified this issue as potentially leading to “erroneous data for the invoice inputs”.

Two Former CEOs Of Ormat’s Key Kenyan Customer, Kenya Power, Were Arrested In 2018. More Than A Dozen Top Managers Were Also Arrested Or Accused Of Crimes.

Ormat’s sole customer for its 150MW capacity Olkaria III Complex in Kenya is a state-run entity called Kenya Power and Lighting. [Pg. 36]

Just as with Ormat’s utility customer in Guatemala, Kenya Power has grappled with rampant corruption. In July 2018, Kenya Power’s CEO, Ken Tarus, was arrested for “economic crimes” including “scandals involving bogus tenders and suppliers with the alleged theft of hundreds of millions of shillings by state officials from several government bodies.” [1,2]

As part of the same USD $45 million corruption case, at least 9 other Kenya Power managers and former managers were arrested, including former CEO Ben Chumo. This is the same Ben Chumo that oversaw Ormat’s approved 2014 power plant expansion, per Ormat’s SEC filings.

Later media reports in early 2020 speculated that “cartels at the company had swindled over Sh150 billion (USD ~$1.5 billion) from customers over a five year period” through overbilling. An ongoing investigation was expected to yield 15 more arrests, reports noted.

This past summer, Kenya’s main newspaper, Nation, declared that Kenya Power is now “beyond redemption” and should be privatized.

Given Ormat’s financial reliance on Kenya, a privatization or a reorganization of Kenya Power, or its financials, could have a devastating impact on Ormat’s overall financial position.

Multiple Other Key Signatories on Ormat’s Contracts in Kenya Were Later Charged With Corruption

Corruption at Kenya Power is not new. Samuel Gichuru was the longstanding head of Kenya Power (1984-2003) when Ormat signed its energy deal with the company in 1998. The contract was signed by the then Energy Minister Chris Okemu. [Pg. 393]

Gichuru was party to a letter affirming Ormat’s increase in capacity in 2000, per company filings.

Both Gichuru and Okemu were later accused by prosecutors in Jersey of money laundering the proceeds of bribes and corruption through a front company based in the UK Channel Islands.

The pair dodged extradition but the Jersey Court confiscated more than $5 million in kickbacks which had been paid to Gichuru in just two years, 1999-2001.

Recently, more assets were seized from the pair:

The court sentencing document stated:

“(Gichuru) accepted bribes from foreign businesses that contracted with KPLC during his term of office and hid them in Jersey…Contractors passed on the cost of the bribes to KPLC by inflating their charges by disguised means. Gichuru and the contractors defrauded KPLC…Windward (Gichuru’s Jersey front company) disguised the fact that money paid to Gichuru came from contractors of KPLC. This is a classic money laundering technique called layering.”

Court papers named 11 foreign companies, including Spanish, Finnish, British and Israeli entities, though Ormat does not appear.

But Jersey judicial authorities confirmed in an email to us that these were sample charges and a sample list of companies. They said the full list of foreign companies who paid bribes to Gichuru was never submitted to the court.

Kenya Power Is Reportedly “Broke” And “Technically Insolvent”, Posing a Major Risk to Ormat’s Lucrative Arrangement in the Country

The extensive historical corruption at KPLC appears to have exacted a painful price on the company and ultimately, Kenyan citizens.

A media report that first appeared in Nation in March of 2020 stated that Kenya Power is “broke and now running dangerously closer to empty”. The same article described KPLC as “technically insolvent”.

The Kenyan government owns 50.1% of the utility and shares are publicly traded on the Nairobi Stock Exchange.

KPLC’s most recent financials note that Kenya Power has “remained in a negative working capital position for the third consecutive year” with current assets of KES 44 million versus current liabilities of KES 115 million.

The financial audit notes that “strategic initiatives…undertaken to improve the financial results of the company…appear not to have yielded the intended results.”

“Broke” And “Technically Insolvent” Kenya Power Has Been Consistently Late Paying Ormat

Kenya Power’s financial hardships are starting to show up in the utility’s apparent inability to pay Ormat on time.

In Q1 2019, Ormat began reporting a late balance due from Kenya Power. The late balance has been increasing significantly since it was first disclosed, as has the average number of days Kenya Power has been in arrears.

As of December 2020, KPLC’s overdue payments averaged 78 days past due. This is up from an average of 70 days as of December 31, 2019. [3] [Pg. 107]

In Ormat’s Q3 2020 call, the CEO acknowledged that payments from KPLC had slowed over the years, saying:

“Kenya has been slowing payments for last 2 years but they’re still paying.”

Ormat says that while Kenya Power is late on its bills, it is still expected to pay the balance. As a result, Ormat has apparently not set aside an allowance for credit losses pertaining to Kenya. [Pg. 112]

Financial volatility from Kenya could immediately translate to a material negative for Ormat’s balance sheet, as well as its ongoing profitability.

We also think evidence of corruption could reduce Kenya’s willingness to continue to support Ormat’s lucrative contract in the country.

Part III: Ormat In Honduras – Further Signs of Corruption

One-Sided Deals Benefitting One of The Country’s Most Powerful Families

“After narcotrafficking, energy is the second-most profitable business in Honduras.”

– Rixi Moncada, former boss of the Honduran state energy company, in a phone interview.

Our investigation into Ormat’s business in Honduras has unearthed several glaring anomalies.

- Ormat charges the state energy company roughly the same rate as end users pay, virtually guaranteeing a loss for the state. These rates make no economic sense.

- The Power Purchase Agreement (PPA) assumed by Ormat in Honduras was signed within days of other uneconomical PPAs that were signed by the former head of the state utility, who is now under investigation for corruption relating to those agreements.

- We found that an opaque Panamanian entity with no public presence, formed the day after the Honduran coup, registered to nominee directors, was inserted into the deal. Heavily-redacted documents released by a U.S. agency in response to a FOIA request fail to shed light on exactly who runs that entity. We are awaiting release of additional records relating to the entity.

- In a sign that Ormat’s dealings might not be exclusive to politicians, we found that an Ormat contractor was raided by authorities on suspicion of being a front company for drug cartels. Its owners are in jail awaiting trial.

Ormat acquired its plant in Honduras, called Geoplatanares, from its Honduran business partner, the Larach family in 2013. [Pg. 54] The family is well known as one of Honduras’ wealthiest and most politically-connected elites.

The Larach family had already been awarded the Geoplatanares PPA in June 2010, less than a year after a military coup in the country, which members of the family supported, according to a leaked cable from the U.S. embassy. The plant began operations under Ormat in 2017.

The Former Head of the State Utility Is Under Investigation for Corruption in Two Hydroelectric Projects That Collectively Resulted in the Assassination of Multiple Community Leaders and an Internationally-Acclaimed Environmental Activist

The Same Former State Utility Head Signed the Contract Assumed by Ormat Within Days of the Other Two.

In 2010, the Geoplatanares PPA—now operated by Ormat—was approved by the former head of the state utility, Roberto Martinez Lozano. Martinez is currently under investigation for fraud and corruption relating to at least two other energy contracts that were signed within days of the Geoplatanares contract:

- One corruption case relates to a hydroelectric project in which front companies of a Honduran drug cartel were hired to carry out building work. [Pg. 47]

- Another corruption case involving a hydroelectric project resulting in the assassination of multiple community leaders and an award-winning environmental activist.

The Terms of Ormat’s Honduran PPA Appear to be in Open Violation of Honduran Law

The Former Head of the State Utility That Signed the Contract Said of the Unusual Terms “Yes You Could Say Somebody Did a Good Bit of Business There”

In addition to abnormally high rates, which we discuss below, the Geoplatanares PPA was signed for 30 years instead of 20 – in apparent violation of Honduran laws on renewable energy [Decreto 70-2007 Art. 3 (2)-e].

That “Law to Promote Energy Generation With Renewable Resources” states:

“Energy supply contracts (PPAs)…for projects whose power generation or installed capacity does not exceed 50MW will have a maximum duration of 20 years and for those that exceed that capacity, or play some role in flood mitigation, will be for 30 years.”

At 38 MW, the capacity of the Geoplatanares plant is below the 50MW stated in law. Flood mitigation is a function that may be fulfilled by some hydro-electric plants but not by a geothermal station. Hence it is unclear why Geoplatanares was given a PPA 50% longer than permissible by law.

We consulted a group of legal and energy experts who responded:

“Being below 50MW capacity the contract should have been signed for 20 years. If those conditions are not met then this could be interpreted as a contract process that did not fulfill the terms stipulated in Decree 70-2007.”

We telephoned the former head of the state utility who signed that contract, Roberto Martinez Lozano – the one under investigation for alleged corruption and fraud in two other contracts. We asked him why the duration of the Geoplatanares contract appeared to be unlawful. He said:

“Yes, yes, yes…One would have to look at the fine print. That was a bid for contracts (in 2010) so maybe there were some special conditions that didn’t follow the law. But yes you could say somebody did a good bit of business there.”

Honduras’ State Utility Pays Abnormally High Rates to Ormat. The Utility is Now Saddled with Debt And Seeking to Renegotiate its Contracts

The energy rates Ormat receives under its PPA for Geoplatanares are higher than even those for its “disproportionately” profitable Kenya business.[4]

Ormat is selling energy to the state power company, ENEE, for roughly the same cost that the government utility is charging end-consumers – around 13 U.S. cents per Kwh.

A recent audit report showed that between 1998 and 2018, Honduras’ losses on energy contracts represented a stunning 14% of GDP, making such losses one of the largest contributors to the nation’s debt.

ENEE has racked up huge debts of around $3.2 billion and is now under IMF pressure to reform. [Pg. 2]

As part of that process, Ormat says the utility is reviewing some of its energy supply contracts. We expect that any normalization of energy rates would eviscerate Ormat’s profit margins in Honduras.

Ormat Operates in the Heart of Honduran Cartel Territory. A Senior Local Politician Told Us “You Can’t Operate [There] Without Paying the Cartels”

Corrupt government officials often aren’t the only hurdle to getting deals done in Honduras.

Ormat’s Geoplatanares plant is in the northwest Copan region – an area that is home to all-powerful drug mobs handling shipments for Mexican cartels and is crisscrossed by smuggling routes for South American cocaine heading to the U.S.

In a phone interview, opposition congressman Grimaldi Paz, a member of the congressional energy committee, summed up the dangers of doing business in that corner of Honduras:

“You can’t operate in Copan without paying the cartels, the gangs or corrupt politicians – and sometimes all three.”

According to an Ormat loan document, Ormat paid the construction and transport companyInversiones Y Comercializadora Benitez (INCOBE) at least $557,503 between July 1, 2017 and April 30, 2018. The loan document provides only a snapshot, so Ormat may have paid additional amounts at different times.

In November 2019, INCOBE premises were raided by authorities on suspicion of being a front company for drug cartels and a laundering operation for more than $40 million in proceeds from narco-trafficking, one of the largest networks discovered in Honduras.

Owner Rigoberto Benitez Guerra, his wife, two sons and a daughter were all arrested on charges of money laundering for organized crime. They remain in jail awaiting trial.

Ormat Gained a Foothold in Honduras By Purchasing its Asset from A Powerful Honduran Oligarch

Why Ormat? The Company Was Able to Secure a $124 Million Non-Recourse Loan From OPIC, a U.S. Federal Agency. The Loan Represented ~75% of the Construction Costs of the Plant

But Ormat Must Hand the Plant Right Back to the Family After 15 Years – For Just One Dollar

Following Honduras’ 2009 coup, energy contracts were signed between the state utility and private interests, many of which had backed the coup.

A subsequent investigation by Honduras’ Supreme Accounting Tribunal – akin to the U.S. government GAO – found that along with paying inflated rates, the state utility contracted over 11x more power than required under its approved expansion plan for 2010, representing an absurd waste of government resources. [Pg. 44]

Of the dozens of energy contracts handed out at the time, a powerful Honduran family known as the Larach family, who reportedly backed the coup, was granted almost one-third of the total capacity.[5]

We spoke with a senior former government official about how Honduras’ energy deals went almost exclusively to powerful families such as the Laraches. He was cautious, saying:

“Maybe we’re overstepping the mark. They’ll kill us both.”

Following the awarding of the Platanares contract to the Larach family’s ELCOSA SRL energy company, Ormat stepped in several years later to build the geothermal plant and assume part of the contract.

According to the “Build, Operate, and Transfer” (BOT) agreement, Ormat will hand the plant back to the Larach family after 15 years of operations (with a possible one-year extension) – which is only halfway through the 30-year lifespan of the PPA.

During the 15 years of operation, Ormat will pay 12% royalties [Pg. 149] on gross revenues to the Larach family and Elcosa. That is 3x the average royalty payment Ormat pays across its other global operations [Pg. 94]. By comparison, in neighboring Guatemala, Ormat pays the government a 3.5% royalty per year to operate the Amatitlan plant [Pg. 47].

The Laraches also receive 50% of carbon offsets from the plant. The dollar amount is not clear.

What is clear is that after just 15 years, or 16 if Ormat asks for a permitted 12-month extension, the Larach family will have to pay just $1 to take back full ownership of a multi-million dollar plant that generates more than $34 million a year in annual energy sales. [Pgs. 16, 172]

So why bring Ormat into the deal?

In addition to its expertise in building the plants, one key reason was Ormat’s ability to secure financing from the U.S. government. Ormat secured a non-recourse loan from OPIC that covered roughly 75% of the construction costs, part of a longstanding relationship with the agency that included Ormat’s receipt of loans to build its Kenya plant.

The Carnegie Endowment for International Peace has identified this form of deal-making as being part of a “kleptocratic network”:

“Since the mid-1990s, private-sector members of Honduras’s kleptocratic network have surged into energy production, especially, in recent years, renewables…(They) focus on those economic activities that are most likely to generate and concentrate exponential returns in relatively few hands, especially by way of government favoritism, or that are most likely to attract significant international financing.”

We Submitted a FOIA Request For Records on the Murky Arrangements and Expect to Receive Records Shortly

In Particular, We Aim to Understand Why an Opaque Panamanian Entity Formed the Day After the Honduran Coup With No Public Presence Was Inserted Into the Deal

An entity called Bidle Trading Inc was incorporated the day after the 2009 Honduran coup. It was formed in the name of nominee directors with its corporate address at a Panamanian law office. Its real directors are untraceable and an internet search reveals no business history.

The entity, apparently a consultancy company, is not mentioned in Ormat’s annual or quarterly reportsbut we found it deep in one of its exhibits – the loan documents attached to Ormat’s filings relating to its Honduras deal. [Pg. 8]

The original text of the loan agreement included a section that required legal opinions for the parties privy to the deal. But an amended agreement later specifically excluded Bidle from having to undergo the scrutiny of a legal opinion:

The start date of the consulting agreement between Bidle and Ormat is the same day a trust was officially registered to manage the joint assets of Ormat and the Honduran assets, including the Geoplatanares plant and the PPA. [Pg. 5, Pg. 3]

It is unclear how Ormat found or decided to contract the consultancy services of the opaque Bidle Trading Inc., an entity that appears to exist only on paper, and why the U.S. agency OPIC, which lent the money, specifically excluded oversight of the entity.

We submitted a Freedom of Information Act (FOIA) request with the U.S. DFC (the successor agency to OPIC), and have received a partial response to our request which did not include records relating to Bidle Trading. Per conversation with DFC staff, we expect to receive additional records focused on Bidle Trading soon.

Part IV: Ormat In The US

Ormat’s issues are not limited to developing markets. The company also has a track record of misusing political influence in the United States, its largest market.

Ormat Settled DoJ Fraud Charges After Whistleblowers Alleged it Made Fraudulent Misrepresentations in Order to Secure Government Loans

In 2016, Ormat settled civil fraud charges brought by the Department of Justice (DoJ) relating to allegations that it had fraudulently inflated costs and misrepresented the viability of its Nevada plant in order to secure government loans.

The investigation was triggered by a 2013 qui tam action filed by former employees/whistleblowers, who claimed that Ormat had filed “false applications for federal clean energy grants to which they were not entitled.”

At the time of the loan deal, Nevada Senator Harry Reid had bragged about helping land Ormat’s $350 million loan. It was later discovered that Ormat’s founder had maxed out contributions to Reid’s reelection campaign, and donated to a non-profit run by Reid’s top political operative and 2 former aides.

In October of 2016, Ormat entered into a $5.5 million settlement with the Department of Justice due to unlawfully applying for, and receiving, millions in federal clean energy grants.

Part V: Ormat Executives & Contractors

Ormat’s CEO, General Counsel & Chief Compliance Officer, and a Director All Previously Held Senior Roles at Shikun & Binui, an Israeli Company Charged Criminally With Bribing Kenyan and Guatemalan Officials

Most companies hire executives because they have work experience that would prove useful to their new job.

In the case of Ormat, the prior work history for three of its senior individuals involved leadership roles at Shikun & Binui, a leading Israeli construction company now facing criminal charges over extensive allegations of corruption in Kenya and Guatemala, also two of Ormat’s key markets.

- Doron Blachar became Ormat CEO in July 2020, after serving as the company’s Chief Financial Officer from 2013 to 2020. Immediately prior to Ormat, Blachar served as CFO of Shikun & Binui from 2009 to 2013.

- Hezi Kattan became Ormat’s General Counsel and Chief Compliance Officer in 2018. Immediately prior to Ormat, Kattan served as General Counsel to Shikun & Binui from 2006 to 2018.

- Ravit Barnav has been an Ormat board member since 2015. Previously she served as chairwoman of Shikun & Binui from 2007 to 2012.

The company was recently alleged by authorities to have maintained an elaborate system for bribing government officials that involved two sets of books. Investigations uncovered what has become one of Israel’s biggest-ever corporate corruption scandals.

Israeli prosecutors and & courts allege that the company engaged in “systematic” “huge” bribes in Kenya, including “deliberate concealment from regulators and law enforcement”.

Israeli Prosecutor & Courts: Shikun & Binui Engaged In “Systematic”, “Huge” Bribes in Kenya, Including “Deliberate Concealment From Regulators And Law Enforcement”

Kenyan Police: “Senior Figures” At Shikun & Binui Knew About the Bribes, Which Involved Cash in Envelopes And “Parallel Book-Keeping”

In Kenya, an employee in Shikun & Binui’s accounting office raised objections to the company’s alleged widespread corrupt practices in 2016. According to the employee, he was summarily beaten within an inch of his life and threatened with a knife.

He then turned whistleblower and was one of the keys in breaking the case, according to media reports.

In 2018, the Israeli Securities Authority (ISA) and Israeli police, from the elite financial crime division, launched an investigation into Shikun & Binui and at least two of its subsidiaries. Four people were arrested in February 2018, including Ofer Kotler, former CEO of the company.

Kotler was put on house arrest and was forbidden from leaving the country. According to Bloomberg, Kotler was CEO from May 2008 to October 2015, covering the entire period that Blachar was CFO at the company (from 2009-2013).

Court papers obtained from Rishon LeZion Magistrate Court, near Tel Aviv, paint a detailed picture of how the bribes and corruption were carried out. Investigating police officer Superintendent Oded Arara told the court:

“The bribes were cash with no receipt. Parallel book-keeping was kept. Money was withdrawn from the bank and was handed over in envelopes. We found correspondence, charts, summaries, names. I never saw such order in bribery: public figures, money, the purpose and the benefits (expected in return).”

In that hearing, Arara was emphatic that the parent company knew exactly what was going on overseas:

“Shikun & Binui are the owners. The method is that profits stream from bottom up. Responsibility streams from top down. The purpose of the bribing was to win projects, to remove bureaucratic blockage.”

He also said senior levels of management were aware of the bribes:

“Not only did senior figures and others know, some did not prevent it, others turned a blind eye and some took an active part.”

Etty Ben Dor, prosecutor for fiscal and financial crimes at Tel Aviv district prosecutor’s office, reinforced that Shikun & Binui’s issues were part of a culture of corruption rather than the work of a few individuals. During a May 2020 hearing, he said:

“It’s a systematic set of bribe payments, approved, monitored, audited and managed like any other business. This is a corporation that for years was operating through an organizational culture of bribery. Those who don’t act by this culture, are thrown out.”

In May 2019, police sent the case to the Israeli State Prosecutor recommending a number of indictments. Kenya’s Ethics and Anti-Corruption Commission has been assisting in the investigation.

To date, Blachar has not been identified as either a suspect or witness in the case.

Israel’s attorney general has now taken the decision to indict a slew of former company executives and the company itself. According to Israeli legal proceedings, the suspects have been notified and have the right to a preliminary hearing ahead of formal indictments being issued.

It is understood investigators had been looking at least 50 suspects and 40 witnesses. The list of suspects notified that they will be indicted pending a hearing includes 12 individuals, the Shikun and Binui parent and two of its subsidiaries.

Shikun & Binui In Guatemala: Executive Arrested Over Alleged $6.1 Million Bribe Paid to Minister of Transportation

In Guatemala, a Shikun & Binui executive was arrested after prosecutors announced that several S&B officials were suspected of paying $6.1 million in bribes to the former minister of communications, infrastructure and housing between 2012 and 2015.

Prior to Shikun & Binui, Ormat’s CEO Served as VP of Finance at Teva, Which Paid $519 Million to Settle the One of the Largest Criminal Foreign Corrupt Practices Act (“FCPA”) Cases in History Over Allegations of Extensive Bribery During His Tenure

Immediately prior to Shikun & Binui, Blachar served as the VP of Finance at Teva Pharmaceuticals from 2005 to 2009, according to his official biography.

Teva faced one of the largest Foreign Corrupt Practices Act (“FCPA”) cases in history as a result of business practices while Blachar was VP of Finance at the company.

As alleged, from 2001-2012, the company bribed officials in Ukraine, Russia and Mexico in order to facilitate sales of its drugs.

Media reports in 2019 stated that former TEVA executives had contributed up to $50 million USD to the fines in the US and Israel, though the contributors were not named. Blachar was the company’s VP of Finance for 5 years during the allegation period (2005-2009).

Conclusion

It is genuinely hard to miss the signs of extensive corruption swirling around Ormat’s project portfolio. Perhaps some investors just disregard it as a necessarily evil in developing markets.

We find this view to be short-sighted. The same political forces that grant lucrative, but dodgy, contracts can just as quickly take them away. And Ormat’s survival is predicated on its too-good-to-be-legit overseas deals in cash-strapped nations where the pushback against such practices has been boiling.

Both Guatemala and Kenya have been aggressive in pursuing corruption of past political leaders, which puts Ormat in a precarious position.

We would not be surprised to see Ormat’s lucrative deals disappear or be significantly renegotiated. We also think the company’s ability to land new deals on similar terms will be hampered going forward, threatening its generally stable revenue streams.

Barring all else, as air comes out of the ESG bubble, we see significant downside to Ormat purely on a fundamental basis as it trades back in line with utility peers.

Step 1: Loan Documents, International Environmental Reports, and a Guatemalan State Electricity Database Confirm the Name of Ormat’s Unnamed “Local Purchaser” Entity as Comertitlan

We first sought to definitively confirm the unnamed “local purchaser” referenced in Ormat’s filings as Comertitlan, and found multiple documents that corroborated the link:

- In 2007, an environmental report about Ormat’s second Guatemala plant, named Amatitlan, indicated that Ormat’s plant sold electricity to Comercializadora Comertitlan S.A. (“Comertitlan”), which then sold it to state utility INDE [Pg. 5]

- Further, a Guatemalan state database shows that Comertitlan has been receiving energy from Ormat and selling it to state power company INDE for the past decade, once again corroborating the relationship, which appears to be ongoing.

- Deep within loan documents relating to Ormat’s second Guatemala plant, we found a reference to Comertitlan’s agreement to sell electricity to INDE. This is the only mention we found of Comertitlan by name in any of Ormat’s SEC documents, and it failed to disclose any related party relationship. [Pg. 16 and Pg. 146]

- Lastly, we found evidence of Ormat’s 2007 agreement with Comertitlan in documents filed by Ormat subsidiary Ortitlan, which runs Ormat’s second power plant in the country, at the Guatemalan Mercantile Register.

Step 2: Guatemalan Corporate Records Confirm that Comertitlan Is Run Out of the Exact Same Address as Multiple Ormat Subsidiaries, Indicating that it is an Undisclosed Related Party

Paper-only files kept at Guatemala’s mercantile register reveal that Comertitlan shares an office address with multiple Ormat subsidiaries, indicating that it is an undisclosed related party.

Per the records, Comertitlan’s office address is 13 Calle 3-40 Zona 10 Oficina 1103, 11 Nivel Edificio Atlantis, Guatemala:

We can see from the same corporate registry that 3 of Ormat’s subsidiaries in the country are based out of the exact same office suite in the exact same address.

Below are registration documents showing the addresses for Ortitlan Ltda and Orzunil 1 de Electricidad Ltda, the two subsidiaries that operate Ormat’s two geothermal power plants in Guatemala. A third subsidiary, Ormat Proyectos de Generacion de Energia Ltda, also shares the address:

–––––––––––––––––

–––––––––––––––––

Step 3: Guatemalan Records Show Joseph Shilonne (aka “Yossi Shilon”) Established and Ran Comertitlan

Media Reports Show That Yossi Shilon Served as VP/Guatemalan Representative at Ormat, Establishing Comertitlan as an Even Clearer Undisclosed Related Party Entity

Paper-only files kept at Guatemala’s mercantile register show Joseph Shilonne (an alternate spelling for Yossi Shilon) incorporated Comertitlan on December 29, 2006, just days before signing the deal with Ormat (as referenced in the above SEC filing screenshot).

Legal papers from 2006 listed Shilon as sole administrator and legal representative for Comertitlan.[6] By 2010, corporate records indicate that Shilon was the sole shareholder of Comertitlan. [7]

At that point, Shilon handed the administrator task to a Guatemalan attorney.[8] Subsequently in June 2014, Comertitlan filings describe Shilon as having a “special mandate with representation”.

Media reports confirm Shilon was a senior Ormat employee

Media reports published between 2006-2011 confirm that Yossi Shilon served as Ormat’s VP or representative in Guatemala during the year Comertitlan was formed (in 2007).

Reuters, local media, and trade publications corroborated that Shilon served as Ormat’s VP or representative in Guatemala.

A former company executive, however, indicated Shilon technically left his full-time staff position in the late 1990s and, by the time of these media reports was Ormat’s highly trusted consultant in the region.

Here is a local media article from 2006 and a Reuters article from 2010, for example:

–––––––––––––––––

Legal papers originally listed Shilon as sole administrator and legal representative for Comertitlan. Two other individuals were listed as shareholders of 50 percent of the company’s paid-up share capital.

We attempted to contact the other named individuals on Comertitlan’s documents in order to learn more about the purpose of the entity. We were unable to reach one of the shareholders, but we successfully contacted the second, a public accountant and auditor named Edgar Rodolfo Sanchez Quesada.

Normally when someone makes an investment, they know what the company does. That did not seem to be the case for Edgar Rodolfo however:

“(Shilon) was the one who initially set up the activities. In fact I don’t know what the primary focus was since I don’t normally dedicate myself to that kind of thing …I was (with the company) only a very short time…I withdrew completely.”

Edgar Rodolfo told us his holding in Comertitlan was short-lived. He added that he did not remember to whom he sold his shares nor exactly when. But he explained that he was introduced to Shilon by an old schoolfriend who by then was an attorney at the state energy utility INDE.

That attorney, Rodolfo Martin Garcia Villavicencio, still works at the state utility. He was also vague about details when we spoke to him. However, over the course of three phone calls he conceded he had drawn up the statutes for Comertitlan, saying it was a “freelance” job he took on outside his normal work for the state utility.

This seemed to raise a clear conflict of interest. He seemed defensive when asked about his work at state energy company INDE while simultaneously drawing up legal documents for Comertitlan, which does business with INDE. He said he “could not remember” who had contracted him to draw up the paperwork for Comertitlan.

Likewise, he did not recall if his old schoolfriend was simply acting as a frontman for any other individuals.

Neither individual could clearly articulate the purpose of the entity.

Appendix C: Ormat Has Hired Multiple Attorneys/ Representatives in Guatemala That Were Later Charged With Facilitating State Corruption

Over the years, Ormat has negotiated and renegotiated its contracts amid Guatemala’s highly-corrupt business environment. It has aligned itself with several notable facilitators of state corruption along the way.

In 1995 Swiss businessman Juerg Widmer Probst was granted a “special mandate” to act on Ormat’s behalf in Guatemala.

Widmer Probst is currently on the run from Guatemalan justice, according to media reports. He has been charged with bribing Guatemalan officials, including the vice-president, during the presidency of Otto Perez (2012-2015).

In 2005, Guatemalan attorney Juan Arturo Jegerlehner Morales, in his mid 20s at the time, was also granted a special mandate for Ormat.

Jegerlehner Morales was sentenced to three years in prison in 2017 for his part in facilitating the bribery and corruption of government officials. According to media reports, he collaborated with state justice in return for a lighter sentence and explained how he received and channeled the bribes intended for then Communications and Infrastructure Minister Alejandro Sinibaldi (Jan. 2012-Sept. 2014).

Appendix D: Ormat’s Favorable Deal For Land Situated on a Kenyan National Park, All For Nominal Considerations

Ormat was permitted to build its power plant on a 60 hectare plot in the Hell’s Gate National Park wildlife reserve, for which the Kenyan government charges negligible if any rent, described on the official title as “peppercorn (if demanded)” – a legal term that generally means a nominal, or small cash payment.

As part of its deal to build a power plant in an area declared national park since 1984, Ormat agreed to pay the government Kenya Wildlife Service a “voluntary” wildlife conservation fee.

The “donation” was set at just around $8,900 in 2001 (700,000 Kenya shillings) with annual increases of 4% – according to the “environmental management agreement” dated 2001 (a copy of which was obtained by Hindenburg).

Assuming, with compound interest, a current annual payment of around $19,500 – Ormat’s 150MW power plant would pay for its “conservation” effort in just one hour and 18 minutes of operation (based on a approximate energy tariff of 10 U.S. cents per KwH)

The agreement goes on to state:

We view that voluntary contribution for conservation as insignificant considering Ormat operates in a wildlife park and that Kenya’s wildlife-driven tourism sector is of key economic importance, contributing more than $7 billion or around 9% of GDP.

Appendix E: More Details on Ormat’s Kenyan Land Deal Involving Political Connections To Corrupt Kenyan President Daniel Arap Moi

We also investigated a three-hectare plot on the shores of Lake Naivasha – 10 km (6 miles) from the power plant — where Ormat built workers’ housing and a social club. The land for housing was first mentioned in an Ormat environmental report in 2000 [Pg. 5].

The social club is open to the public and is geotagged on Google maps. Yet it took months of searching at national and regional offices of Kenya’s Land Survey and Land Registry, and even talking to surveyors who worked in the area more than 40 years ago, to find official registration and transaction details for the plot – known as LR 26355.

Lost and misplaced files, the years-long and often delayed process of digitization and the corruption of local land officials hampered the search.

Finally though, we found that Ormat purchased the land in 2002 from the family of Joseph Kamere, a disgraced former attorney general (1982-1983) during President Moi’s administration.

The land transfer price of around $126,000, while small for a company of Ormat’s size, was seen as “too expensive” at the time by nearby farmers keen to expand their flower-growing businesses, a former surveyor familiar with the area told us.

We talked by phone to attorney Simon Kamere, the former owner’s son who handled the sale. He told us that the initial approach, on behalf of Ormat, had been made by politically-connected businessman Joseph Manga Mugwe. He said he believed Manga Mugwe was working as a “local director” for Ormat, although there is no indication he had been appointed in any official capacity.

Kamere told us:

“I dealt with one or two of the directors, one of them was Israeli and the other was local. I can only remember the name of the local Mr. Munge (sic.) Mugwe. I understood he was one of the directors.”

He added:

“I heard Mugwe had political connections but I never knew who his partner was. At the time I heard he had political connections within the Moi government.”

In addition to his own political connections, Manga Mugwe’s late wife was niece of Kenya’s first president and cousin to the country’s current leader.

Manga Mugwe has seen his share of controversy. Some of his companies have in the past been accused of fraudulent bids for cellphone license concessions, illegal land deals with the government [Pg. 100], and he was even accused in a parliamentary debate of cheating the government in a supply contract and of stealing public land.

Appendix F: Ormat Claims The Kenyan Government Will “Cover Certain Cases” Of Non-Payment, But A 2007 Agreement Reveals The Government Has No Legal Obligation To Pay

Ormat has tried to offer its investors reassurance about the growing debt owed to it by KPLC by disclosing that they are in receipt of a letter from the Kenyan government that covers “certain cases of non-payment”.

Ormat states in their most recent 10-Q:

“the Company holds a support letter from the Government of Kenya that covers certain cases of KPLC non-payment (such as where caused by government actions/political events).” [Pg. 12]

We reviewed the Olkaria III Project Security Agreement between KPLC and Ormat’s wholly owned [Pg. 4] subsidiary, Orpower 4, dated January 19, 2007. What we discovered was hardly a guaranteed backstop, but rather qualified language noting that the Kenyan Government did not have any “legal obligation” to make Ormat whole:

“If KPLC will not provide the agreed security to OrPower 4 in accordance with its contractual obligations, GOK will, following receipt of a written notification from OrPower 4, use all means within its powers to cause KPLC to provide the agreed security in the manner envisaged by its contractual obligations. This letter is not intended to create any legal obligation on the part of GOK.” [Pg. 15]

Disclosure: We are short shares of Ormat Technologies Inc. (NYSE:ORA)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Ormat doesn’t disclose net income by country, but does disclose net income contribution from Kenya, Honduras, and Guatemala collectively, along with revenue per country. International revenue accounts for 28% of total revenue and 70% of total net income [Pg. 59]. So 1% point of international revenue accounts for an estimated 2.5% of income. Honduras and Guatemala account for ~8.8% of reported total 2020 revenue [Pg. 168].

[2] Ormat states that international operations in their electric segment made up 70% of total FY 2020 net income [Pg. 59]. 28% of total FY 2020 revenue comes from the international electric segment. [Pg. 59] Ormat also states Kenya Power accounted for 16.4% of revenues in FY 2020 [Pg. 57]. Using margins for the entire international electricity segment, we estimate the Kenya Power agreement makes up 41% of Ormat’s total FY 2020 net income. The figures we used to make these estimates are only available in annual Reports, and not quarterly filings.

[3] Kenya Power owed Ormat $40.7 million in overdue payments at the end of 2019. [Pg. 55] As of December 31, 2020, the total balance grew, and KPLC owed Ormat $48.9 million in overdue payments. [Pg. 115] The utility then made a small payment, in January and February of $16.2 million (though it was not disclosed how much the balance grew in those same two months).

[4] We estimate Ormat earns 10.5 U.S. cents per Kwh in Kenya as of Dec. 2020 and calculate Ormat is currently earning an inflation-indexed energy tariff of about 13 U.S. cents in Honduras (excluding additional payments for fixed capacity).

[5] The contracts awarded to units of the IRESA Group headed by Adolfo Larach Foster were: GERSA, 12mw Chamalecon hydroelectric plant, contract number 065-2010; COHERSA 40 MW La Vegona hydro plant, contract number 085-2010; GEOPLATANARES/ELCOSA 35MW geothermal plant, contract number 086-2010; and HIDROVOLCAN 150MW hydro plant, contract number 087-2010.

[6] Two other individuals were listed as founding shareholders of 50 percent of the company’s paid-up share capital, but they appear to have held their stakes for only a short period (see appendix).

[7] Filings stated there was “total attendance of shareholders of Comertitlan at the ordinary annual shareholders’ meeting” and listed Joseph Shilonne as the only person present.

[8] The attorney’s name was Anibal Augusto Arrellano

Article by Hindenburg Research