Giverny Capital commentary for the second quarter ended June 2021.

Q2 2021 hedge fund letters, conferences and more

A Strong Rebound In The Second Quarter

In aggregate, company results for the second quarter showed a strong rebound from the very difficult second quarter of 2020. Aside from one or two of our holdings (among the 25 or so in our portfolio), our companies released astounding results—beyond our expectations in the majority of cases. We anticipate, at this point, an average growth in earnings per share of our companies of approximately 30% on average for 2021.

More significantly, we estimate that the profits from our companies will be roughly 26% higher than those achieved in 2019, or around 13% annualized growth over two years. This growth rate in the profits of our companies is in line with our historical average.

Your Questions

As with every mid-year letter, we would like to answer questions from our partners.

We wish we could answer all the questions received (quite numerous) but we will try to answer those which seem to address most of your concerns. We also took the liberty of summarizing in a single question several questions regarding similar subjects.

There is a lot of talk about inflation these days. Is this a concern for Giverny Capital and how can we protect ourselves from it?

Inflation is not a recent problem and is an integral part of our capitalist system. There are years when inflation is lower and years when it is higher, but historically, the average annual inflation rate has hovered around 2-3%. So you always have to consider that as a factor. From my early days as an investor, I realized that inflation is a saver’s worst enemy and that the only solution is to own financial assets that can better counter its effect.

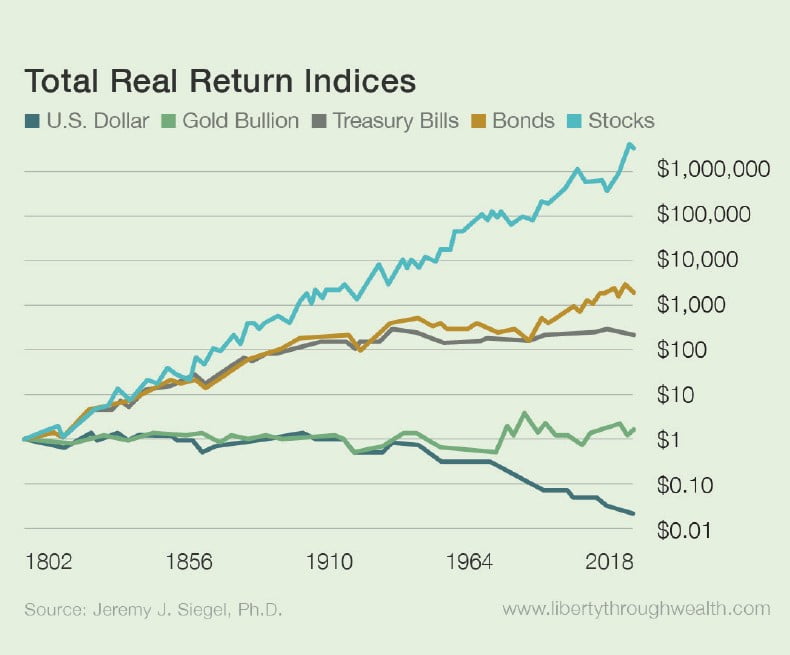

I discussed inflation in detail during the last partners’ evening but I think it would still be worthwhile to come back to it. Let’s look at the returns of various financial assets over the last two centuries:

If we look at this data in tabular form in real terms (adjusted for inflation), we can summarize as such:

Bonds have historically achieved an acceptable real return with average yields of 5%. Now imagine the situation with rates of 1.3% like the yield on the US 10-year bond currently. In a universe of more than 2% annual inflation, the real return will inevitably turn out negative. As I like to say, the only guarantee from government bonds right now is impoverishment.

The best defense against inflation is to own businesses. The source of wealth in a country is the productive capacity of its citizens, the productivity per capita, and this productivity comes from only one thing: the level of creation of products and services by the work of humans in businesses.

In addition and in our opinion, the best type of companies to own in an inflationary environment are those that require little capital and have the capacity to increase the price of their products and services. This ability is often linked to the presence of a competitive advantage.

This is why since 1993, I have always wanted to favor companies with few tangible assets on their balance sheet and which possess a solid and durable competitive advantage (like a moat protecting a castle). Keeping in mind the dangers of inflation is not new at Giverny Capital and is intrinsically linked to our investment selection process.

Autohome Inc (NYSE:ATHM) has the largest automotive information website in China.

The stock has indeed fallen considerably in recent months. The stock’s decline is partly attributable to problems we view as temporary in nature— primarily the shortage of semiconductors that has slowed the sale of new cars in China, which has resulted in weakened advertising sales for Autohome.

Autohome is also affected by an increasingly competitive environment. Indeed, Autohome’s main competitor, BitAuto, was recently privatized and it appears that BitAuto has gotten more «promotional» now than it is no longer publicly traded. In addition, Dongchedi, which belongs to the Chinese giant ByteDance, has also been gaining market share. ByteDance is the company that owns the Tiktok app which is very popular with young people.

Analysts expect lower profits this year because of these two factors.

The company has decided to also list its shares on the Hong Kong Stock Exchange in case it faces a delisting of its shares listed in the United States (ADR). This required a secondary offering of shares which was not well received by the market.

In addition, the Chinese government is scaring investors these days as it recently announced that it is considering forcing companies specializing in private education (university level or otherwise) to become non-profit entities. Shares in the educational sector have collapsed as a result.

The largest Internet companies in China (such as Alibaba and Tencent) must contend with the sometimes changing (and unpredictable) regulatory landscape created by the Chinese government. Chinese internet stocks have fallen sharply and are more out of favor these days. We have followed the Chinese market for two decades and believe that, despite the Sword of Damocles represented by a communist government, the exceptional long-term growth prospects of this market deserve to be considered for our portfolio.

While it is difficult at this time to discern what is temporary from what is more permanent, we continue to believe that Autohome is a dominant company in its industry and its competitive advantages seem solid. It also has an immaculate balance sheet with over $2.7 billion in cash in assets (versus a market capitalization of $5.1 billion). The stock’s valuation seems particularly low at 10-12 times the estimated profits in 2022. This ratio drops to less than 5-6 times if we exclude the company’s cash balance.

Autohome is a solid company in our opinion, but one which unfortunately operates in an unpredictable and volatile environment, both economically and politically. We believe that in weighing the pros and cons of this holding, the stock remains a promising investment and we have decided to hold onto our shares for now.

The stock of the insurance company, Markel (like that of Progressive), seems really undervalued relative to profits and valuation ratios. Why is this the case in your opinion?

It is indeed a bit of a mystery how little Progressive and Markel (and Berkshire Hathaway) seem to be popular with investors. It’s going with the times, as companies with strong growth and an exciting history are favored by the stock market (even if they are often far from being profitable). It reminds us a bit of late 1999 and early 2000. This is when we first bought shares of Progressive and Berkshire.

Also, Wall Street is making the simplistic shortcut that very low interest rates are bad for insurance companies (which is true, but only in part). For the second quarter, Markel and Berkshire reported excellent results and we believe Markel’s and Berkshire’s profits will hit all-time highs in 2021.

For Progressive, we continue to forecast approximately 10% annual earnings per share (EPS) growth over several years. From quarter to quarter, however, results can vary widely. For example, 2020 and 2021 are unusual in that they do not represent a normal environment for underwriting profit margins for the industry as a whole. Progressive nonetheless continues to increase its level of new insurance underwriting to more than 10% annually and is gaining market share. This bodes well over the long run.

We know that intrinsic value always wins out in the long run. If we are eventually right about the fundamentals of Markel, Berkshire and Progressive, their stocks will eventually reflect that reality on the stock market.

Did your team bet on stocks like Moderna, Pfizer, Novavax? How do you see the future following a global pandemic?

We have always followed the pharmaceutical industry and have owned several companies in this industry over the years. Our experience has not always been positive. The main challenge for the industry is the high cost of developing new drugs and the short time it takes for a patent to monetize the huge amounts invested in R&D.

The competitive advantage of a patent is therefore very solid but the second quality that we look for, durability, is not present. We recognize of course that there are strong companies in this large industry. If a company has a diverse source of income and a promising pipeline of new products, we would certainly be interested in investing. But only if shares are reasonably valued, of course.

Finding pharmaceutical companies that meet all three of these criteria is not easy. In the case of Moderna, for example, we believe the company has developed more than a vaccine against COVID-19 but a new medical technology. It’s a company that seems truly innovative and well run.

The company is expected to generate EPS of $30 this year. As the stock is currently trading at $457, this valuation seems reasonable. On the other hand, what will the company’s profitability be once the pandemic is over? Already for 2022, analysts expect its EPS to drop to $24. It therefore becomes very difficult to have any idea of the profitability of the company over the next five years, and therefore to estimate its intrinsic value.

We are following Moderna closely nonetheless.

What do you think of the speculation you see in “meme stocks” like Gamestop for example?

Some pockets of stock market speculations have historically always existed. At various times, there were stories (not really new but with a new label) that thrill speculators. And often, they lead to heavy losses once the excitement wears off.

But we have to admit that some of the more recent episodes are indeed a little weird. Investors, quite inexperienced in our opinion, naively believe that they can control the price of a stock regardless of the intrinsic value of the underlying company (in the old days, there was talk of trying to “corner a market”). It’s a bit like the musical chair game: eventually the music will stop and there won’t be enough chairs for all the speculators. But no one knows when the music is going to stop and how many chairs will remain.

Since my start in 1993, I have witnessed (from the stands) euphoria of various kinds. The best attitude to have is to stay away from these spectacles and not be affected by the siren song of short-term profit.

At Giverny, we remain true to the long-term investment philosophy that has enabled us to achieve satisfactory results for almost three decades. Our focus on risk reduction sometimes causes us to miss some winners, but overall our strategy of cautiousness has paid off so far.

François Rochon

and the Giverny Capital team