Alta Fox Opportunities Fund commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Limited Partners,

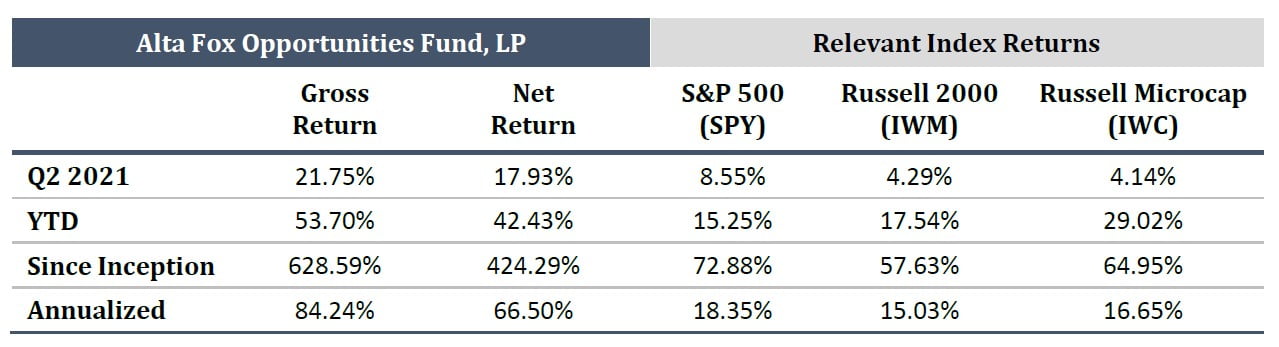

In Q2 2021, the Alta Fox Opportunities Fund (“the Fund”) produced a gross return of 21.75% and a net return of 17.93%. The Fund’s average net exposure during the quarter was 83.75%. Since inception in April 2018, the Fund has produced a gross return of 628.59% and a net return of 424.29% compared to the S&P 500’s return of 72.88%, the Russell 2000’s return of 57.63%, and the Russell Microcap’s return of 64.95%.

As always, Alta Fox strives to ignore short-term fluctuations and instead focus on the intrinsic value growth in our portfolio holdings, which over the long run should converge with portfolio performance. We encourage limited partners to do the same— both in times of outperformance and underperformance. I firmly believe that in the long run, our strategy of buying high-quality and underfollowed businesses at cheap prices will deliver attractive absolute and relative returns. Most importantly, our process will remain disciplined with strict risk controls, minimal gross leverage, and a sound research process.

Research Process Review

At Alta Fox, we are aware that it can often be difficult to objectively recognize a good investment process independent of a good outcome (and vice versa). However, we believe objective process reviews are critical to improvement as an investor over time. With this awareness, we recently reviewed trade data since inception to analyze strengths and weaknesses in our process. I’ll start with the weaknesses.

At launch in 2018, Alta Fox intended to focus primarily on small and micro-cap companies. Since inception, Alta Fox has lost money in micro-caps (<$100M market cap), and it is the only market-cap bucket that has detracted from performance on an aggregate basis. As we consistently highlight, we prefer buying companies with proven business models and durable competitive advantages. We are most comfortable when we understand an industry, the mentality of the CEOs for each of the major companies in each industry, and how we would compete with capital in that industry. While competitively advantaged microcap companies exist, they are rare. More often, these businesses are less proven and more speculative. While this realization is not a critique of micro-caps as a category, the more speculative nature of these companies makes it difficult for us to develop the level of conviction we often find in more established businesses. Accordingly, since 2018, the Fund’s exposure to micro-caps has come down significantly. This reduction has been an organic product of our process and research framework (which includes a conviction score). We expect to continue to have minimal exposure to micro-caps as we favor more proven business models.

Another common theme among our less successful investments to date has been investing alongside management teams that lacked sound capital allocation judgment. While past performance may not be indicative of future results, we have found a management team’s history of value creation in the public markets and prior endeavors to be highly correlated with future stock price performance. While it is always possible that a management team with a history of mediocre to poor capital allocation will suddenly improve its strategic decision-making, we have found this outcome much harder to predict.

At Alta Fox, we have dedicated a significant amount of time to studying greatness in public markets—the extreme outliers. Last year, we released our “Makings of a Multibagger” research, which studied some of the best-performing stocks over the five-year period from June 2015 to June 2020. More recently, we have allocated our case study time researching perennial value creators: CEOs that simply seem to succeed everywhere they go and create value well above their cost of capital and industry peers. We are in the process of creating a “Wall of Fame” in our office that will highlight some ultra-successful value creators. The display will serve as a reminder of the importance of management quality and will inspire our team to carefully be on the lookout for the next CEO worthy of a place on “The Wall.” We look forward to revealing some of the CEOs we are invested alongside that have earned Alta Fox “Wall of Fame” status through future letters and shared research.

In terms of identifiable strengths, we have invested substantial time and resources in developing a robust, systematic, and repeatable process for comparing the relative attractiveness of a vast universe of companies. This process combines our financial model estimates and our qualitative judgments to produce an output that measures relative attractiveness and encourages optimal position sizing. The final product is a fluid and dynamic portfolio and watchlist dashboard that is meticulously updated and reviewed daily. The fine-tuning of this process is one of the most impactful improvements at Alta Fox since inception. Over time, as the total number of companies we evaluate grows, this comparative evaluation framework will become increasingly valuable and should serve as a growing competitive advantage for the Firm.

The past three years have been filled with successes, lessons, and constant reminders that there are always ways to grow and improve. While we have improved our research efficiencies over time, there is a limit to how fast each analyst can conduct deep and high-quality diligence. The most frustrating thing for our research team is to see companies on our watchlist perform well and “run away from us” before we get a chance to complete our work. We are doing two things to address this concern. First, we are actively searching for additional research analysts to join our team, and even as we add analysts in the near term, we will constantly be on the lookout for top-tier talent. Our door is always open for passionate stock-pickers with a demonstrated track record of excellence and a determination to win in a collaborative environment. Our goal is to be the single best place in Texas to make a long-term investment management career for both research and operational roles. It is apparent that there is an ongoing industry-wide talent exodus from high-cost states to Texas, and we expect to be a significant beneficiary of this trend over time.

The second initiative to improve our research bandwidth and more quickly get through our watchlist is adding new technology tools to help efficiently identify, evaluate, and monitor our investments. I am generally skeptical about paid data sets widely available to all funds and eventually incorporated into security prices over time, largely eliminating any signaling effect. However, we believe we have identified opportunities for investment on the data side that will be proprietary to Alta Fox and a competitive advantage over time. With strong execution and the right application, additive data sources can help make our research process more efficient.

Business Updates

While near-term capacity remains fully committed, we have developed and are maintaining a waitlist of high-quality and aligned Limited Partners. Even in this position, we remain open to speaking with investors who understand our strategy and are long-term focused. Please note that the effective minimum initial investment is $1.0 million, and due to regulatory requirements, the Fund will only be available to Qualified Purchasers.

Conclusion

We are humbled that you have elected to invest a portion of your assets with Alta Fox. We continue to strive to improve all aspects of our research and operational processes in our pursuit of building a world-class investment firm.

Sincerely,

Connor Haley

Alta Fox Opportunities Fund