UP Fintech (NASDAQ:TIGR), Tencent Music (NYSE:TME) & China Internet – Painful Sell-Off Provides Generational Buying Opportunity

Q2 2021 hedge fund letters, conferences and more

Recent moves by the Chinese authorities across the Chinese internet space has triggered the worst sell-off for Chinese stocks since 2018, creating a tremendous opportunity to buy high-quality Chinese Internet assets at attractive valuations. When looking at historical multiples such as forward P/E, Chinese Internet names are trading at close to their cheapest levels since 2013, with a P/E valuation disparity of over 10 turns when compared to US Internet / Software assets (currently trading within the top 5% of their most expensive historical valuation).

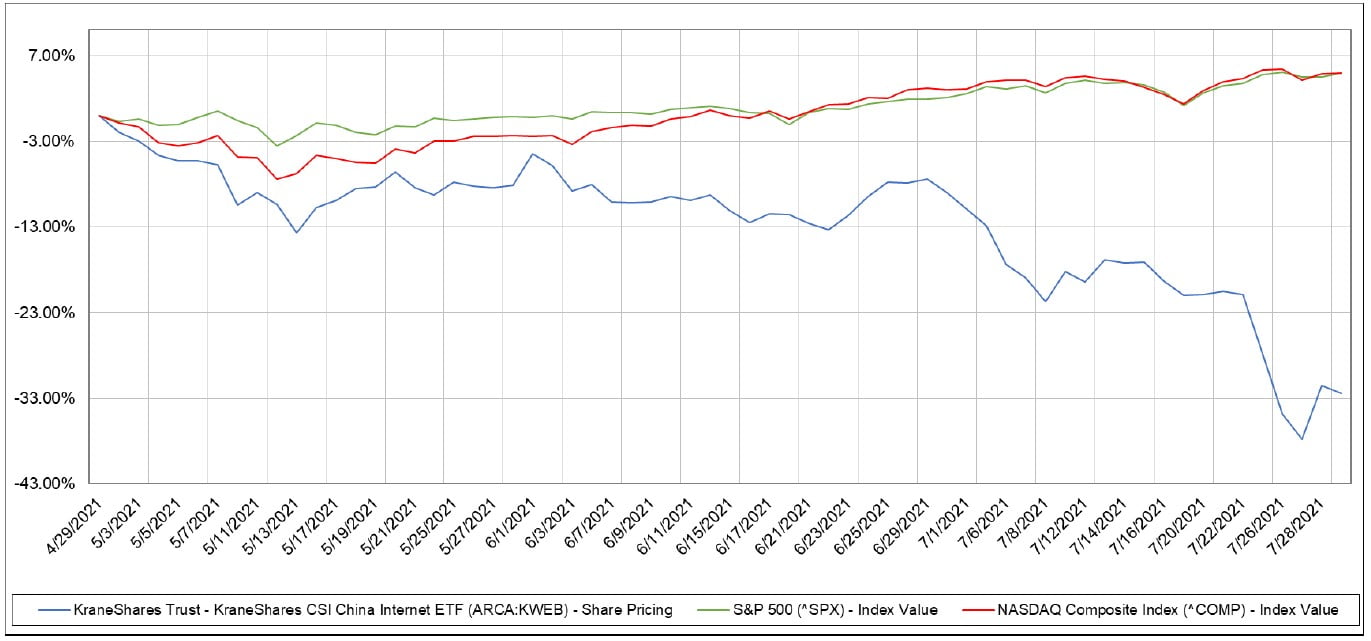

The underperformance of Chinese internet stocks relative to their peers over the past few months has been dramatic:

We have been asked for updates to our earlier writeups on UP Fintech (NASDAQ:TIGR) and Tencent Music (NYSE:TME). As panic over Chinese internet stocks has reached a fever pitch over the past month, it is a good time to reiterate our bullish views on TIGR, TME and, more broadly speaking, US-listed Chinese internet stocks.

For almost a year now, Chinese authorities have been passing directives and regulations against the most powerful Chinese internet players, with a long-term view on preventing anticompetitive practices from dominating the internet landscape. The current regulatory tightening is unprecedented in terms of both its duration and the severity of its impact. Recent actions include a crackdown on the private tutoring sector, new anti-monopoly laws aimed at Internet platforms, and intensifying measures to cool housing prices.

The dominant Chinese internet companies are great businesses which have created robust online platforms with strong network effects, and are growing at higher rates than their comparable peer group in the US while trading at lower valuation multiples. The internet’s natural ability to aggregate end users/consumers at scale while making transaction and distribution costs zero, has created dominant technology platforms and aggregators across the world with defensible business models, including in China. By owning this customer relationship and the demand-side economies of scale, the internet platforms have expanded their offerings and monetization strategies to become natural “super-apps”.

Chinese internet companies are considered national champions in China, driving a greater pace of innovation across a number of industries like retail, media, advertising, payments, and more. Key drivers of higher growth rates include growing broadband penetration (especially in rural China); an expanding middle class with growing disposable income; a fragmented, unorganized physical retail sector; higher population density driving higher relative efficiency and lower costs; and a growing willingness to pay for non-pirated content.

We believe US investor concerns about the variable interest entity (VIE) corporate structure among Chinese American Depository Receipt (ADR) listings in the US are overblown. Business fundamentals will eventually drive the long-term cash flows and valuation multiples of the Chinese internet stocks. Ultimately, the mechanics of re-listing or dual listing in Hong Kong or listing in the U.S. will not have a material impact on valuation multiples. Even if new US IPOs end, it’s unlikely that current US-listed names need to delist in any sort of disorderly fashion. We have comfort in the VIE structures – we think both US and Chinese governments will acknowledge the rightful ownership of public shareholders in all scenarios via the VIE structure, and that any transition to a more secure structure will be an orderly one. Regulatory concerns around the incompatibility of jurisdictional oversight (i.e. the Chinese government is limited in pursuing legal action against a US-listed company, and US regulators are limited in pursuing legal action against Chinese domiciled companies) are sensible, and both governments are trying to improve upon the status quo. The VIE has been a vital structure for Chinese companies to gain access to foreign capital, bringing a huge amount of economic benefit to China in terms of jobs, taxes, and innovation. The VIE structure has allowed several hundred Chinese companies to raise capital from overseas markets. Many of these companies have become leaders in technology and national champions and are key players in China’s quest to be seen as a global technology leader. The VIE structure supports the broader Chinese objectives of opening its financial markets gradually, and reducing restrictions on foreign investments. We thus see little incentive for Chinese regulators to dismantle this structure.

The increasingly frequent sharp drawdowns we’ve seen in Chinese internet stocks this year are irrational. Many of these businesses are outstanding, with bright growth prospects and attractive long-term margins. We have opted to be greedy when others are fearful.

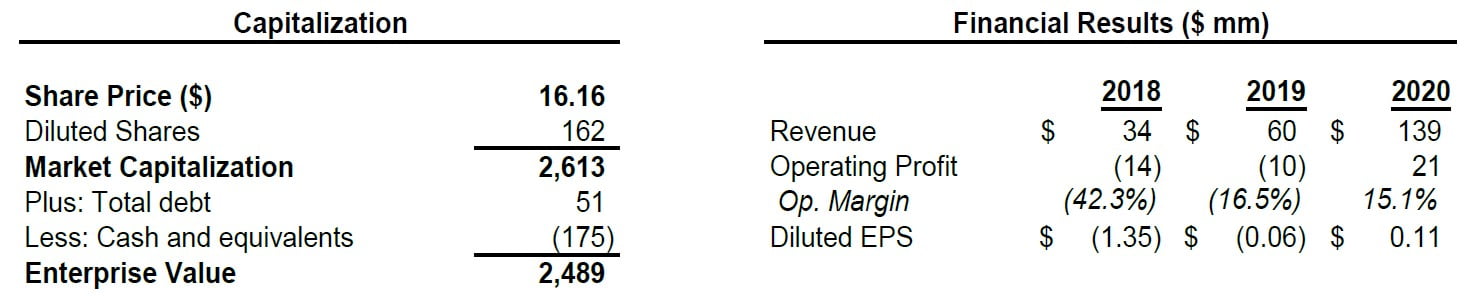

We are long shares of UP Fintech (“TIGR”), the holding company of Tiger Brokers. TIGR’s shares have retreated dramatically since early July with the recent escalation of regulatory pressure and fears brought on by DIDI’s IPO. Since the end of June, TIGR’s shares have fallen -44% and have dramatically underperformed the KWEB ETF (-26%) and its direct peer FUTU (-41%). In our view, this has left TIGR’s shares significantly undervalued (23x P/E on 2022 street numbers versus peer group average 35x) ahead of what should be strong operational results and a materially positive catalyst in the company receiving a Hong Kong securities license.

We believe Tiger has a long runway for continued growth. Though China is famous for its high savings rate, households have tended to invest in real estate and bank deposits, with equities accounting for a much smaller fraction of total wealth than in Western developed markets. But as more Chinese investors, especially young ones, become familiar with global capital markets, portfolios are shifting, freeing up a gargantuan addressable market. Already, Chinese household wealth totals $78 trillion, and we estimate that in 10 years it will exceed $200 trillion – almost twice the current US level. There will be room for multiple online brokerages worth tens of billions of dollars, and we believe Tiger – currently valued at $2.7 billion – will be one of them.

Though the business model remains fairly simple – revenue is dominated by commissions (65% of the total in the latest reported quarter) and net interest income, primarily derived from margin loans (20%), with expenses dominated by the cost of software engineers – Tiger has begun to expand into adjacent business lines, including IPO underwriting (helping its customers gain early access to newly US-listed Chinese companies) and the management of employee stock ownership plans (serving many of those same companies). To be sure, Tiger has competition, primarily from Futu, another up-and-coming China-focused low-cost online broker. But with such a large and rapidly growing addressable market, competition hasn’t stopped Tiger from consistently winning new business.

The temporary pullback in Chinese ADR IPOs is a manageable issue – other revenue, which is primarily revenue from US ADR and Hong Kong IPO underwriting, accounted for 16% of revenue in 2020, while consensus has other revenue falling to 11% of total revenue in 2021 and 8% of revenue in 2022. Even if there were no more US listings of Chinese companies, an unlikely scenario in our view, the financial impact on TIGR’s overall business would be manageable. We believe a number of these IPOs would still occur, just on the Hong Kong stock exchange instead of US exchanges. The economics of each deal would be lower for TIGR, but much better than a complete loss of revenue. We also note that the company’s FX exchange business, the smaller component of other revenue, should continue to grow due to the company’s expanding user base. Based on our analysis, even in a draconian scenario where there are no more ADR IPOs, we believe the direct hit to TIGR’s 2021/2022 revenue would only be a low- to mid-single digit percentage impact.

The issuance of a Hong Kong license is on the horizon – TIGR applied for an HK securities license in February of 2021 and remains confident that they will be granted this license before the end of the year. Being granted an HK securities license would have several positive benefits for the company’s operational and financial performance, including the ability to market to Hong Kong citizens directly and drive incremental net adds. Hong Kong is a large and lucrative brokerage market, and TIGR’s management is confident that it can be a material driver of net adds for the company. Further, TIGR’s monetization and profitability from HK securities trading and margin lending, which is currently done through a partnership with IBKR, would substantially improve. TIGR will also receive a higher allocation (and profitability) on HK IPO subscriptions.

TIGR continues to expand internationally outside of China at a rapid rate. TIGR began to expand its customer base outside China in mid-2020, and results to date have been fantastic. New international expansion outside of China is a significant driver of incremental growth and has taken over as the firm’s primary growth driver. In 1Q21, the company added a record 117k funded accounts with international accounts comprising over 50% of the total. The addition of over 59k international net adds was up dramatically from zero international accounts in 1Q20 and 18k new international accounts in 4Q20. We believe that most of the international net adds in 1Q21 were from Singapore, where TIGR launched their app relatively late in the quarter (3/13/2021). App download data for Singapore continued to be very strong throughout 2Q21, with TIGR being the #1 most downloaded iOS app in the finance category. Management guided for 350k net adds in 2021 with ~70% of those net adds coming from international arenas (mainly Singapore, USA, and Australia). We expect the contribution from geographic expansion to grow even further when TIGR gains a license to operate directly in Hong Kong and expands into new countries in Southeast Asia.

Goldman Sachs initiated coverage on TIGR with an unfair “Sell” rating on 7/14/2021 and a price target of $21.06. We believe that this analysis was predicated on backward-looking information, and fails to consider multiple positive changes to TIGR’s business which should continue to improve its growth profile and profitability levels over the next several quarters and years. Additionally, while at the time of initiation the price target was +3% above where TIGR was trading, GS’s price target today is +18% higher than the current stock price.

Goldman has an overly simplistic and erroneous view that FUTU, with its 8% market share of retail trading volume, has saturated TIGR’s HK client demographic, thus limiting potential share gain opportunities for TIGR. As a result, GS’s financial estimates in 2022 and beyond reflect minimal contribution from the company receiving an HK securities license. We note that GS is modeling 2022 net adds to be 40% below 2021 guidance, despite the expectation that the company gets access to HK. GS numbers embed minimal margin expansion despite several successful and ongoing internal initiatives to increase profitability, capture a higher share of internal self-clearing, and ongoing operational scale. GS believes that due to TIGR’s lower operational scale, TIGR will need to continue investing in R&D and marketing in order to gain market share, thus limiting margin expansion. TIGR’s ROA is currently depressed due to a lower 3bps commission take-rate vs. FUTU at 6bps due to TIGR’s partnership with IBKR. We note TIGR expects to be self-clearing over 70% of their clients by the end of CY21, a big jump from currently clearing 30% of its clients. GS’s model calls for TIGR to have 23-25% net income margins through 2025 despite peer FUTU having >50% net income margins and TIGR’s guidance that calls for 50% long-term net income margins.

Robinhood’s recent IPO signals the ongoing democratization of finance, creating a frictionless mobile experience that’s rapidly making investing a cultural phenomenon. Robinhood proved that the amount of tradeable wealth in the hands of relatively young and tech-savvy Americans was large enough to accommodate a new $30-billion player. The opportunity ahead in China’s nascent retail investing industry, with its tech-savvy millennials, is enormous. It’s time to step outside the HOOD and enter the TIGR’s den.

Tencent Music (TME) - Rock On

We are long Tencent Music Entertainment (“TME”), the leading streaming music service platform in China with over 800m active users and household brand names like QQ Music and Kugou. In addition to industry-wide regulatory scrutiny, the recent State Administration for Market Regulation (SAMR) ruling requiring TME to give up exclusivity in music content from music labels and long-term exclusivity with independent musicians has created investor uncertainty around TME’s long-term position. With a current market share of 65% in a 2-3 player market in an overall TAM growing at over 25-30%, TME is well positioned for growth even if its overall market share declines to 50%. The SAMR ruling de-risks further regulatory headwinds. We believe this presents an opportunity to acquire a leading global asset with improving unit economics driving strong operating leverage, and undergoing a transformation away from a livestreaming business to a recurring subscription-based music streaming model.

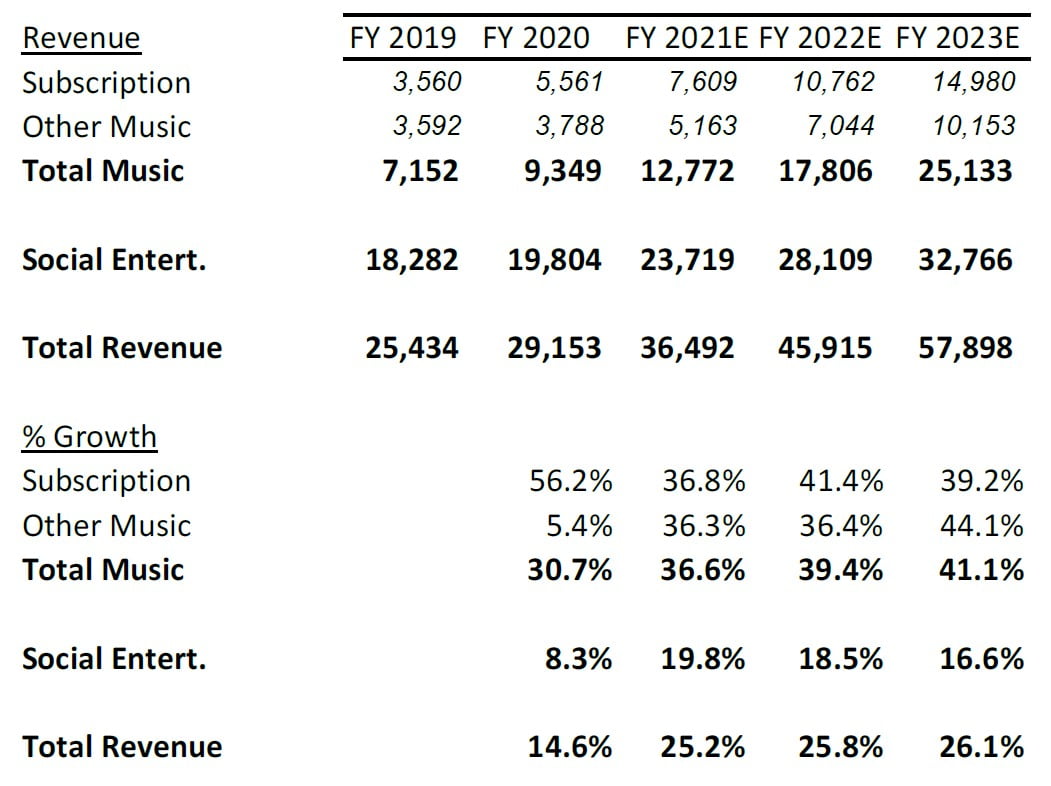

Looking ahead over the next two years, TME will benefit from several attractive growth drivers, including the number of paying subscribers growing 2x, a new ad monetization strategy driving strong ad revenue growth, and a recovery in social entertainment spending. With paid subscribers growing at a quarterly run-rate of over 5m subscribers, TME’s paying ratio (paid subscribers divided by total monthly active users) will rapidly grow to 20% over the next 12-18 months. At that level, TME would have over 130m paid subscribers and generate RMB 15b in subscription sales, up from 5.5b in 2020. Further, China’s online music paying ratio compares favorably to Indonesia (15%), Singapore (50%), US/Europe (70%) and South Korea (90%). For some additional context, in its UMG presentation Pershing Square forecast total industry-wide paid subscriber penetration in China growing from 6% in 2019 to 33% by 2030, with ARPU expected to grow at a 7% CAGR.

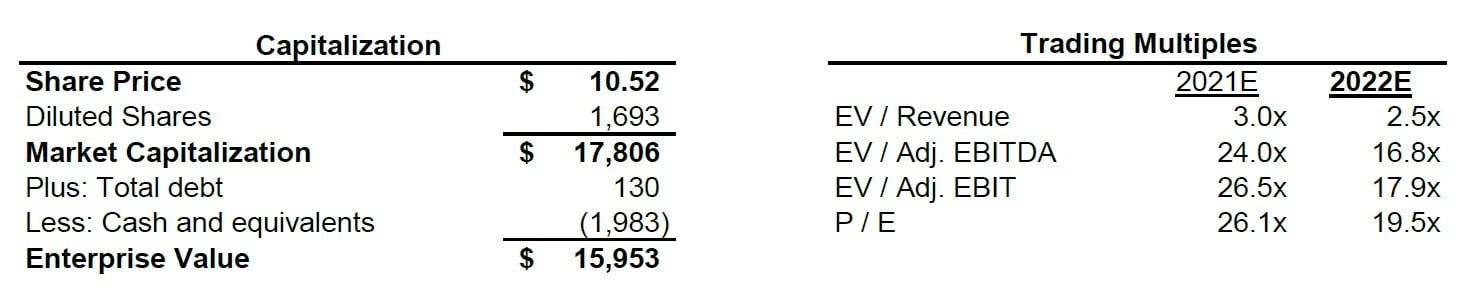

Despite growing subscription revenue at a 30% CAGR vs. Spotify (SPOT) at 15-20%, TME currently trades at less than half the EV/Revenue multiple of SPOT. If shares recover to their recent trading range of 5-6x EV/Revenue, and considering TME’s ownership stakes in SPOT, UMG and WMG currently valued at nearly $2b, TME shares are easily worth 3-4x their current trading levels. It’s time to turn up the volume and buy some Tencent Music.

Since announcing the $1B share buyback in March, TME bought back $200M in shares at $17/share over a 6-week period. We wouldn’t be surprised if they’ve been buying back additional shares through this recent turbulence, which can act as a further catalyst if it’s announced during their August earnings report. With a new CEO from Tencent, and the SVP of Strategy at Tencent (Jason Mitchell) now Chairman of TME’s compensation committee, TME will benefit from portfolio optimization within both audio and video, and greater synergies within the Tencent ecosystem. New product architecture and a streamlined portfolio are expected to be unveiled in 3Q, creating a positive optionality on how the overall business and its market opportunity is viewed externally.

SAMR’s new ruling mandates non-exclusive music contracts with consumption driven pricing, while explicitly prohibiting prepayment of contract fees. This will effectively lower industry-wide royalty payments, driving operating leverage to TME’s long-term business model. In an attempt to gain a dominant position in online music streaming, TME signed expensive and exclusive music contracts in 2017-2018 that expired this year. In contrast to the western world, the top five music labels in China only contribute 20-30% of total play counts, thus lowering the music label’s relative bargaining power. TME currently pays over 2b RMB in quarterly music licensing costs, and will meaningfully lower this cost while moving to a more variable cost structure. TME’s quarterly sub-license revenue of 200-250m RMB implies that TME is able to offset only a fraction of its contractual licensing costs. Even a 10% reduction in licensing expenses will drive a 250bps expansion to TME’s operating margin. In addition, the growth in long-form audio and internal content creation efforts will further lower costs, increase monetization opportunities, and expand gross margin over time. Note that in the near-term through 2021, gross margin likely remains pressured due to investments in long-form audio and higher revenue-sharing fees for WeSing livestreaming (to bring it in line with the industry average).

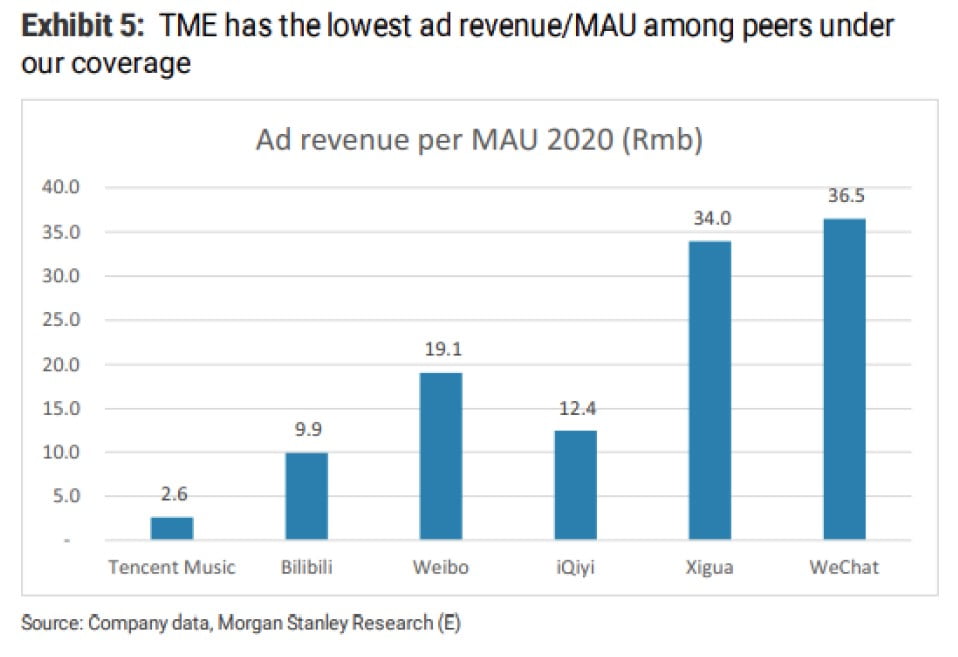

TME has also developed a nascent advertising business that is becoming a meaningful contributor to revenue. Management has improved its ad stack, expanded its sales force, and grown CPMs, resulting in advertising revenue growing at an over 100% CAGR since 3Q20. Unlocking additional app-based monetization methods is helpful in scaling user base and TME’s advertising business remains under-monetized vs. peers: it earned just RMB 2.6 per user in 2020 vs 10+ for many comparable platforms. As a result of its improvements, advertising now accounts for a majority of online music’s non-subscription revenue. Analysts estimate that advertising revenue could grow from RMB 1.5bn in 2020 to 7bn in 2023.

Long-form audio, or podcasts, offers a third driver for TME’s music business. According to iResearch, China’s long-form audio market should grow at a 40% CAGR over the next three years. This business offers higher margins than music, since long-form audio does not require hefty content fees charged by major music labels. The business is currently a drag on profitability as TME invests in its growth. But its early success is evident with penetration exceeding 20% in 1Q 2020 from 5% a year ago, already achieving management’s 2021 goals.

TME’s legacy livestreaming and social business will lap COVID comps and is poised to recover after growing only 10% in 2020 vs. the music business growing by 30-35%. According to iResearch, the overall social entertainment market is expected to grow at over a 20% CAGR through 2022. Our recent checks suggest monthly indicators like gifting volume and active anchors are recovering sequentially in 2Q21. Although TME’s still-dominant platforms for karaoke and music-related content have lost mindshare to short-form audio and apps like TikTok, TikTok cut commission rates this year, allowing churn to stabilize and TME’s WeSing MAUs to bottom and grow again. While it remains a competitive environment, the social business is rapidly learning to cope with the evolving industry landscape.

TME’s combination of a grossly under-monetized music business and a recovering social entertainment business warrants a premium valuation. TME shares historically enjoyed a premium vs. SPOT by as much as 5 turns to revenue, but are currently trading at a 50% discount despite higher growth rates and superior long-term unit economics. As shares recover towards their recent trading range of 5.0-6.0x EV/Revenue, we believe TME shares are easily worth 3-4x their current trading levels.