New research can today reveal the safest crypto exchanges keeping users protected in 2022.

To help investors navigate the risky and unregulated world of crypto, the experts at BrokerChooser have analysed the largest cryptocurrency exchanges on four main pillars*: regulation, consumer protection, market fairness and transparency to reveal the safest exchanges for investors.

Q1 2022 hedge fund letters, conferences and more

The 5 Safest Crypto Exchanges

*Each of these pillars contains four sub-categories, to give 16 sub-categories in total. These are then divided further into three different TIERS: TIER1, TIER2 and TIER3 which were assigned 5, 3 and 1 points respectively, with the best performing exchanges scoring highest.

- Coinbase - Overall safety score: 4.1/5

The safest crypto exchange overall is Coinbase, which is also the largest crypto exchange in the US by trading volume. Coinbase was ranked as a tier 1 exchange for the majority of sub-categories and is well known for its robust security features.

- FTX US Derivatives - Overall safety score: 4.0/5

In second place, FTX US Derivatives falls into tier 1 for the majority of the factors in our index. FTX US Derivatives was somewhat let down when it comes to transparency, with a score of 2.3, offering little to no financial or legal transparency and complex products.

- Bitstamp - Overall safety score: 3.8 / 5

Bitstamp keeps 98% of assets offline in cold crypto storage, which is the most secure form of crypto storage as it is protected from potential hacking breaches and hasn’t experienced any regulatory incidents in the last five years.

Further Findings Reveal

- In terms of regulation, three exchanges scored a perfect score of 5 out of 5 when it came to regulation: FTX US Derivatives, Gemini & Kraken Futures. However, two exchanges, KuCoin and Bybit, scored just 1 out of 5 when it came to regulation, the lowest possible score.

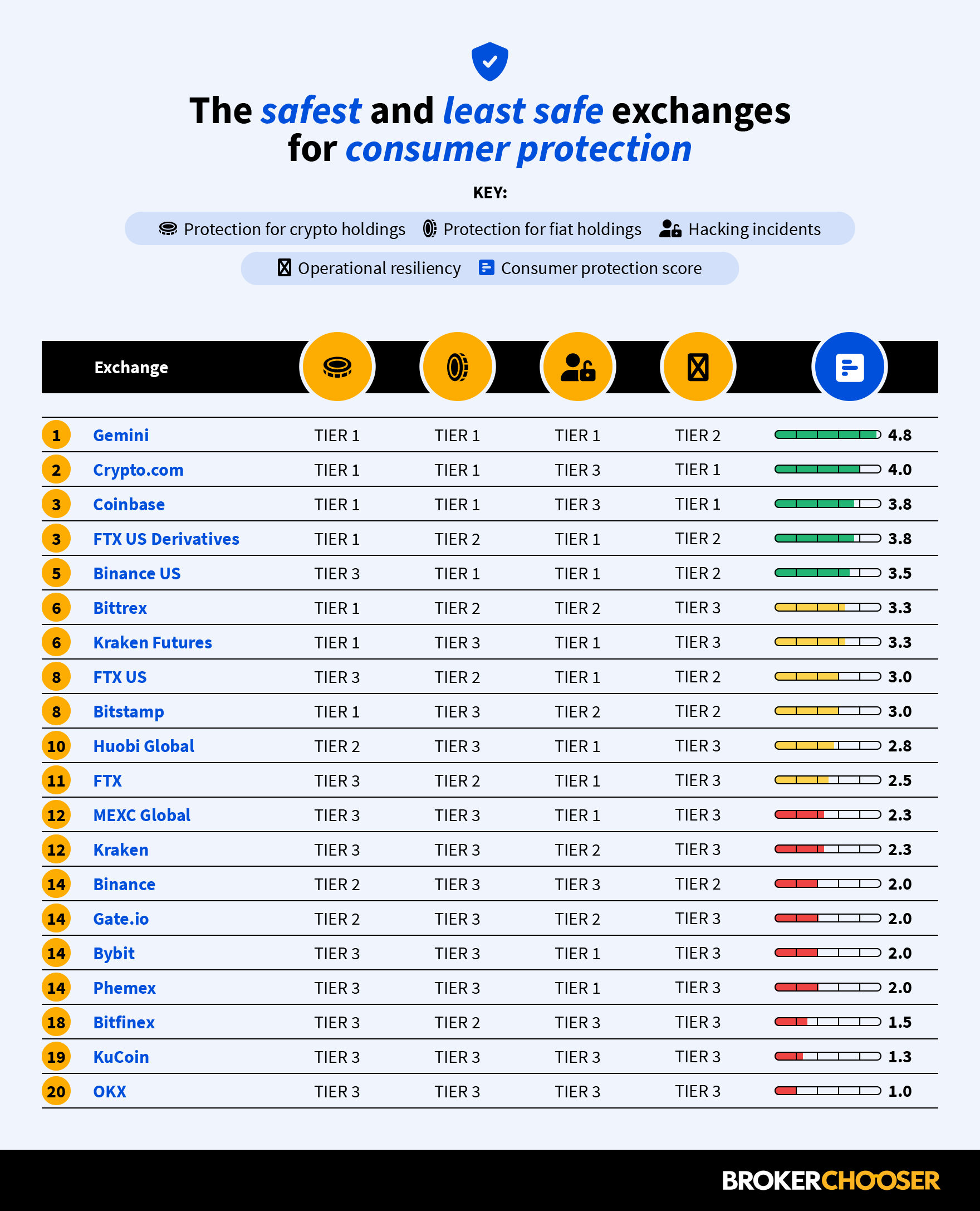

- When it comes to consumer protection, no exchange scored a perfect 5 out of 5, but the best performing exchange in this regard was Gemini, with 4.8. The worst performing exchange for protecting its users is OKX, the only exchange to score just 1 out of 5 for this pillar.

- Two exchanges got full marks when it comes to the pillar of market fairness: FTX US Derivatives and Bittrex. Again, OKX and Bybit come out as the worst-performing exchanges in this pillar and they are joined by Gate.io.

- Transparency is key to ensuring that consumers feel protected and for this pillar, Coinbase was once again the top-ranking exchange. A large number of exchanges scored poorly when it comes to a lack of transparency, with six different exchanges all scoring just 1 out of 5 for this factor, including Binance, OKX, KuCoin, Gate.io, Bybit, Phemex.

Zoltan Kormanyos, Head of Legal at international broker comparison website BrokerChooser commented on the role of crypto exchanges as gatekeepers with powers to decide which tokens are available to retail traders.

“Crypto exchanges’ gatekeeper function should ideally be a critical force in the unregulated crypto market. Due to a lack of regulatory oversight, industry best practices or meaningful self-regulation as well as transparency over coin listing criteria and asset framework, serious conflicts of interest may arise.

Strong competition as well as listing and trading fees are incentivising exchanges to list as many tokens as they can and this is eroding and undermining the protective function gatekeepers should play in the crypto ecosystem. The above mentioned regulatory deficit and opaqueness further exacerbates the problem.

In light of the above, news that Binance, the world’s biggest and probably most influential crypto exchange, ranks the popularity and mass adoption of a particular token as the most important factor in a listing decision is particularly worrisome.

Similar conflict of interest issues that emerged at the time of the listing and subsequent market timing of the Gnosis token on Binance are not new. Most important among these are the lack or the opaqueness of information about policies and internal rules governing coin listing, proprietary and employee trading at crypto exchanges. These rules are fundamental in ensuring market fairness.

Considering that these entities are largely unregulated, there is very little regulatory oversight of these documents, their implementation and enforcement (in case of Binance, one might ask which regulator should be in charge as the company has no official headquarters). In addition, there is no industry best practice and/or meaningful self-regulatory initiative in this respect.

Against this background, public assurances from Binance that there are strong policies in place and there is zero tolerance with respect to insider trading and other manipulative practices gives little comfort to investors.”