Are you a cowboy culture lover? If yes, you might have already heard of Boot Barn. Boot Barn has provided cowboy shoes and other western items for over 70 years.

Boot Barn offers a wide variety of men’s and women’s wear. Boot Barn’s Credit Card program gets the most favor from their shoppers. Boot Barn Credit Card is worth considering with no annual fees and the best discount and reward offers!

Get your Boot Barn Credit Card to enjoy 15% off your first purchase. In this blog, you’ll discover the perks of having a Boot Barn Credit Card and how to register, apply, and log in for it. So, let’s get started!

Benefits of Boot Barn Comenity Bank Credit Card

Boot Barn Credit Cards are issued and managed by Comenity Capital Bank.

- You get free shipping on all online orders.

- No annual fees.

- You’ll get exclusive discounts and offers on using Boot Barn Credit Card.

- You get 2 points on each $1 spent. For every 250 points, you’ll receive a 15$ reward. ‘

- You get a 15% discount on your first purchase with Boot Barn Credit Card.

- Your new Boot Barn Credit Card will receive a 20% off coupon.

- You’ll get a 10% discount on purchases during your birthday month.

Note: You can only use Boot Barn Credit Card at Boot Barn stores. No balance transfer or cash advance facility is available for Boot Barn Credit Card.

Online Account Access

Boot Barn Credit Card also provides account online accessibility like other credit cards. Are you feeling lazy to get in line to pay your card bill? No worries, now you can manage your card purchases, pay your bill and check your reward points – all from your mobile phone. Online Accessibility is the best feature of credit cards in the digital world.

If you still haven’t applied for your Boot Barn Credit Card, follow these steps:

- Go to the official Boot Barn Credit Card website.

- Scroll down to the bottom and click on Apply Now button.

- On the following page, click the Sign in to B Rewarded button (if you are already a B Rewarded member).

- Click on Apply button.

- Enter the required credentials such as your Full Name, Email, Contact Number, Account Number, Zip Code, Address, and Financial Information.

- Click on Confirm Application button, and that’s it!

If you’re having trouble with the application process, reach out to Boot Barn Customer Care.

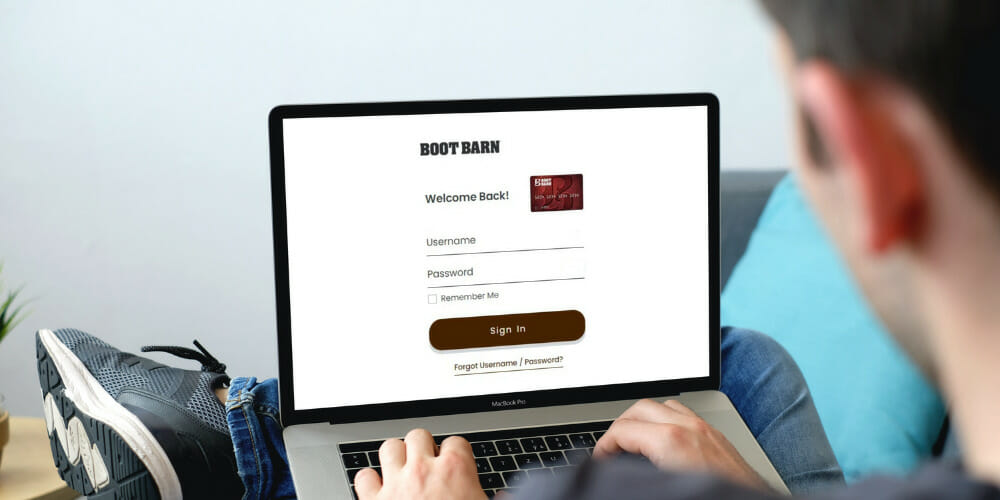

Boot Barn Credit Card Login

If you wish to access your Boot Barn Credit Card Account, follow the given instructions:

- Go to the official Boot Barn Credit Card website.

- Click on the Sign In button.

- Fill out the required information, such as your Username and Password.

- Click on the Sign In button.

Register Online

If you still haven’t registered for your online Boot Barn Credit Card account, follow the given steps:

- Go to the official Boot Barn Credit Card website.

- Click on Register Now button.

- Fill out the required details such as your Credit Card Account Number, Zip Code, and last 4 digits of SSN.

- Click on the Find My Account button.

- Comenity Bank will verify your identity.

- After verification, you can set up your account.

- Select your Username and Password and log in with it!

Forgot Password

If you, unfortunately, forget your account’s password, follow these steps to change it:

- Go to the official Boot Barn Credit Card Website.

- Click on the Sign In button.

- Under the login section, click on Forgot Password.

- Fill out required credentials such as your Username, Zip Code, and last four digits of SSN.

- Click on the Find My Account button.

- After identity verification, you can select your New Password and log in!

Forgot User ID

If you, unfortunately, forget your account’s username, follow these steps to change it:

- Go to the official Boot Barn Credit Card Website.

- Click on the Sign In button.

- Under the login section, click on Forgot Username.

- Fill out required credentials such as your Account Number, Zip Code, and last four digits of SSN.

- Click on the Find My Account button.

- After identity verification, you’ll receive your Username. Note it down and log in with it!

Boot Barn Credit Card Services

Boot Barn offers several convenient payment options for credit card holders, including online, by phone, or by mail. They also offer auto-payments for your convenience. Simply choose the method that works best for you, and you’ll be able to keep up with your payments with ease.

Boot Barn Credit Card Bill Pay Phone Number

You can also pay your Boot Barn Credit Card bill via phone number. Simply contact them at 1-855-463-0224. A representative will pick up your call and guide you about the procedure.

Boot Barn Credit Card Payment Address

Another way to pay your Boot Barn Credit Card bill is using a mailing service. Write a check in the name of Comenity Bank. Include your Account Number, Credit Card Slip, and Remittance Slip and post them to Boot Barn Credit Card Address:

Boot Barn Credit Card

P.O. Box 659834.

San Antonio, TX 78265-9134

Customer Service Hours

If you have any queries about Boot Barn Credit Card, you can contact them directly at 1-855-463-0224 for further assistance. They claim to be available 24/7. However, it may vary on holidays.

How to Pay Boot Barn Credit Card?

You can pay your Boot Barn Credit Card bill in the following four ways:

Online

If you wish to pay your Boot Barn Credit Card bill online, follow these steps:

- Go to the official Boot Barn Credit Card website.

- Login to your Boot Barn Credit Card Account by entering your User ID and Password.

- Go to the Payments section on the dashboard.

- Click on the Make Payments option.

- Enter the billing details.

- Click on Confirm Payment button.

By Phone

If you wish to pay your Boot Barn Credit Card bill via phone, follow the given steps:

- To pay your Boot Barn credit card by phone, call customer service at 1-855-463-0224.

- When prompted, enter your 16-digit credit card number.

- You will then be asked to verify your identity by entering your 4-digit Social Security number or date of birth.

- Once your identity has been verified, you will be given the option to make a payment by bank account or credit card. Choose the option that is best for you and follow the prompts to complete your payment.

- You will then be asked to confirm your payment amount and date. Make sure that all the information is correct before you confirm your payment.

You should receive a confirmation number for your payment. Keep this number for your records in case you need to contact customer service about your payment.

By Mail

If you’re like most people, you probably have a Boot Barn credit card. And if you’re like most people, you probably don’t know how to pay your Boot Barn credit card by mail.

Here’s how:

- Find your nearest post office.

- Buy stamps.

- Put the stamps on the envelope.

- Write your address on the envelope.

- Write Boot Barn’s address on the envelope:

Boot Barn Credit Card

P.O. Box 659834.

San Antonio, TX 78265-9134

- Put your credit card in the envelope.

- Seal the envelope.

- Drop the envelope in the mailbox.

That’s it! You’ve successfully paid your Boot Barn credit card by mail. Be sure to include your account number on the check or money order, and allow sufficient time for your payment to arrive and be processed.

Via the Mobile App

You can use the EasyPay app to pay your Boot Barn Credit Card bill. Open your app and go to the credit cards option. Click on Make Payments and enter your card details. Click on Confirm Transaction, and that’s it!

How to Avoid Late Fees?

Late fees ($41) can add up quickly and they can damage your credit score if you’re not careful. Follow these tips to avoid paying late fees on your Boot Barn Credit Card.

-

Understand the Terms and Conditions

Before you even get a credit card, it’s important to understand the terms and conditions of the agreement. This includes understanding grace periods, interest rates, and late fees.

-

Know When Your Billing Period Ends

Your credit card statement will list the date that your billing period ends. Make sure you pay your bill before that date to avoid late fees.

-

Know Your Credit Card’s Grace Period

Most credit cards have a grace period of 21 days. This means that you have 21 days from the end of your billing period to pay your balance in full without being charged interest. If you don’t pay your balance in full during the grace period, you’ll be charged interest on the remaining balance.

-

Use Automatic Payments

One easy way to avoid late fees is to set up automatic payments. This way, your payment will be made on time each month, and you won’t have to worry about forgetting to pay your bill.

-

Keep an Eye on Your Credit Card Balance and Make Sure You Don’t Max Out Your Credit Line

If you keep a close eye on your credit card balance, you’ll be less likely to accidentally max out your credit line and get hit with over-limit fees.

-

Contact Your Credit Card Issuer

If you’re having trouble making a payment, contact your credit card issuer right away. They may be able to work with you to set up a payment plan or waive late fees.

-

Understand the Consequences of Late Payments

Before you make a late payment, understand the consequences. Late payments can damage your credit score and leave you with costly late fees.

If you follow these tips, you can avoid paying late fees on your Boot Barn Credit Card.

FAQs

Why Is Boot Barn So Popular?

Boot Barn is a popular retailer for several reasons. First, the store offers a wide variety of western wear for both men and women. This means that there is something for everyone at Boot Barn. Second, the store has been in business for over 70 years, so it has a lot of experience in the industry.

Finally, Boot Barn is known for its great customer service. The staff is always willing to help customers find the right item and answer any questions they may have. This customer service is one of the things that keeps people coming back to Boot Barn time and time again. If you are looking for western wear, then this is definitely the place to shop.

Can You Use a Store Credit Card the Same Day You Get Approved?

Yes, you can use a store credit card the same day it is approved. Make sure to activate it beforehand by contacting customer care. It will allow you to start using your card immediately and enjoy all the benefits that come with it.

These benefits may include special financing offers, exclusive discounts, and rewards programs. Be sure to read the terms and conditions of your card before using it to avoid any unwanted surprises.

Can I Get a Refund Without a Receipt?

It can be tricky to get a refund without a receipt, but it’s not impossible. It depends on the store policy and the item you’re trying to return. A strong reason for requesting a refund is always helpful.

If you’re within the store’s return policy timeframe and you have the original form of payment, most stores will refund you without a receipt. If you don’t have the original form of payment or you’re outside the return policy timeframe, some stores may still give you a store credit.

What Credit Score Do You Need to Get a Boot Barn Credit Card?

If you’re thinking of applying for a Boot Barn credit card, you may be wondering what credit score you need to qualify. The good news is that you don’t need perfect credit to get approved for this card. In fact, you only need a credit score of 630 or above. That’s considered to be fair credit, so it’s not too difficult to achieve.

There are a few things you can do to help improve your chances of getting approved, such as making sure you have a good history of making payments on time and keeping your credit utilization low. If you’re not sure what your credit score is, you can check it for free on websites like Credit Karma.

Can I Use My Boot Barn Credit Card Anywhere?

You can only use the Boot Barn Credit Card at Boot Barn stores. It is due to the fact that the card is store-specific and is not connected to any larger financial institution. If you try to use your Boot Barn Credit Card at another store, your purchase will be declined. Therefore, if you’re looking to use your Boot Barn Credit Card outside of Boot Barn stores, you’ll need to look into a different type of credit card.

Final Considerations

Boot Barn Credit Card is an excellent addition to your wallet if you are an avid western range shopper. Boot Barn Credit Card must be your next choice with no annual fees and exclusive rewards and discounts program.

Although their APR rate is as high as 20%, as long as you pay your card bills timely, you can get the most out of Boot Barn Credit Card.