Are you confused about too many store-specific cards in your wallet? If yes, then Marshalls (TJX Rewards) Card is a perfect solution for you. Marshalls Credit Card is worth considering with no annual fees and numerous rewards options on specific purchases. The best feature of Marshall’s Credit Card is that you can use it wherever Mastercards are accepted.

So, it works like a store-specific card and is commonly used by Mastercard. In this blog, you’ll know more about the features of Marshall’s Credit Card. You’ll also learn how to apply, register, and log in to your Marshalls Credit Card account. Let’s dig right into it!

Benefits of Marshalls Credit Card

Marshalls (TJX Rewards) Card is issued and managed by Synchrony bank.

- No annual fees.

- You can use it at TJX family, which includes Marshalls, Home Goods, T. J. Maxx, Sierra Trading Post and Homesense.

- You can also use it as Mastercard.

- 5% cash back every time you purchase from TJX Family.

- 10% gift coupon on signing up.

- You earn 5x points per $1 purchase on TJX Family.

- The gift cards and points can be redeemed at Marshall’s.

Note: If you fail to pay Marshall’s Credit Card bills timely, you’ll be charged a high APR of about 27.74%.

Online Account Access

The most favorable feature in this digital world is the online account access facility of Marshalls Credit Card. This facility doesn’t have to worry about your purchases and credit card bills. You can easily manage your credit card from the comfort of your couch.

Moreover, you can also enjoy rewards on signing up to your online Marshalls Credit Card account. If you still haven’t applied for your multi-purpose Marshalls Credit Card, this is your sign to do so. Follow these steps to apply for your Marshalls Credit Card:

- Go to this link to open Marshall’s Credit Card Application website.

- Enter the required information such as your Mobile Phone Number, last 4 digits of SSN, Personal Info, monthly net income, and bank account number.

- Click on the Continue button.

- Synchrony Bank will verify your identity by SMS or Call option.

- Review the terms & conditions and tick the checkbox.

- Click on Submit Application, and you’ll get your Marshalls Credit Card kit within one or two weeks.

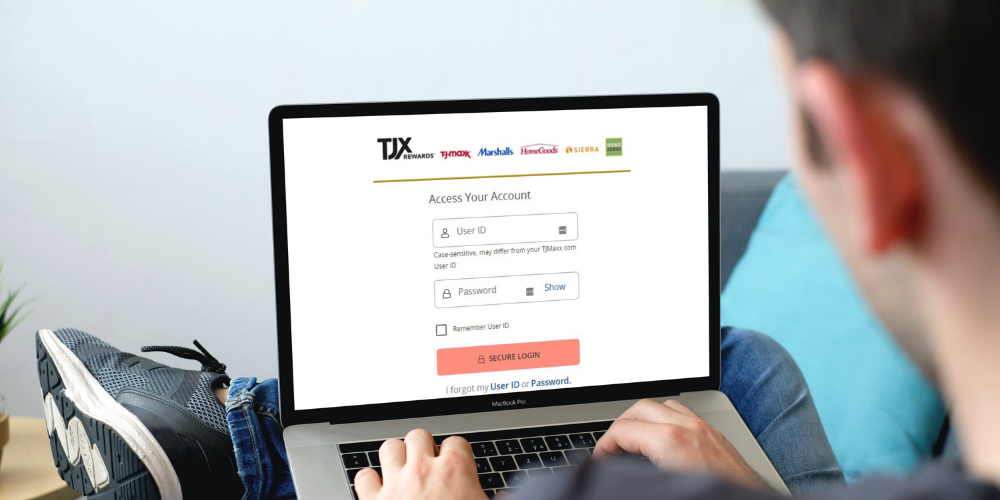

Marshalls Credit Card Login

Follow the given steps to access your account:

- Go to the official Marshalls Credit Card Account.

- Enter the required credentials, such as your User ID and Password.

- Click on the Secure Login button, and that’s it!

Register Online

If you still haven’t registered for your TJX Rewards Platinum Mastercard Online Account, follow the given steps:

- Go to the official Marshalls Credit Card website.

- Under the login section, click on the Register button.

- Enter the required information, such as your Account Number and Zip Code.

- Click Continue.

- After your identity verification, you can set up your User ID and Password and log in with it.

Forgot Password

In case you forgot your password, follow the given instructions to change it:

- Enter https://tjx.syf.com/login/ in your device’s browser.

- Under the login section, click on I forgot my Password.

- On the next page, enter the required credentials, such as your User ID and Zip Code.

- Click on the Continue button.

- Change your password and log in with it.

Forgot User ID

- Enter https://tjx.syf.com/login/ in your browser’s search bar.

- Under the login section, click on I forgot my User ID.

- On the following page, enter the required information, such as your Account Number and Zip Code.

- Click on the Continue button.

- Note down your User ID once you get it.

Marshalls Credit Card Services

Marshalls offers a variety of credit card services to make your shopping experience more convenient. You can manage your account online, choose from various payment methods, and do paperless billing. Quick transactions are also available so you can get in and out of the store quickly by scanning QR codes.

Learn more about all of the credit card services Marshalls has to offer below.

Marshalls Credit Card Bill Pay Phone Number

To make paying your credit card bills even easier, Marshalls Credit Card provides the facility of paying bills with a single phone call. Simply call at 1-877-890-3150. A representative will pick up your call and guide you about the process. Follow his instructions to pay for credit card bills from the comfort of your home.

Marshalls Credit Card Payment Address

You can also pay your credit card bill via mail service. Write a check in the name of Synchrony Bank. Include your remittance slip and invoice. Then, post it to Marshalls Credit Card mailing address:

TJX Rewards Payments

P.O. Box 530948

Atlanta, GA 30353

Customer Service Hours

If you have any queries related to the Marshalls Credit Card program, please contact them at 1-800-926-6299. Their customer service hours are: Monday – Friday, 9:00 AM – 5:00 PM (Eastern Time)

How to Pay Marshalls Credit Card?

Online

Follow the given instructions to pay your card bill online:

- Login to your Marshalls Credit Card account by entering the required credentials, such as your User ID and Password.

- Go to the Payments section.

- Click on the Make and Manage Payments option.

- Enter your billing details and transaction date.

- Click on Confirm payment, and you’re done!

By Phone

If you’re a Marshalls credit cardholder, you can make your payments by phone. Here’s how:

- Dial 1-877-890-3150 to reach the customer service number for Marshalls credit card payments.

- Enter your 16-digit TJX rewards credit card number when prompted.

- Choose whether you’d like to make a minimum payment, full payment, or another amount.

- Enter your bank routing number and account number to set up automatic payments from your checking account, if you wish.

- Follow the prompts to complete your payment.

By Mail

Paying your Marshalls credit card bill by mail is easy and convenient. Follow the steps below to ensure that your payment is received and processed quickly and efficiently:

- Gather your credit card statement and a pen or pencil. You will need both of these items in order to complete your payment.

- Get the money order or check and fill it out with your account information and the amount of your payment. Be sure to sign it.

- Mail your check and invoice to TJX Rewards Payments, P.O. Box 530948, Atlanta, GA 30353.

- Allow 7-10 days for your payment to be processed and applied to your account. You should receive a confirmation of your payment via mail or email within this time frame.

Paying your TJX credit card bill by mail is a simple process that can be completed in just a few minutes. If you have any questions about where to send your payment, you can contact Marshalls customer service for assistance.

Via the Mobile App

How to Avoid Late Fees?

It is never pleasant to get charged with a late fee, whether it’s on your utilities, credit card, or other bills. Late fees can quickly add up and put you in a financial bind. If you’re struggling to make ends meet, every penny counts. While you may not be able to avoid all late fees, there are some things you can do to minimize them.

If you have a Marshalls credit card, you may be wondering how to avoid the late fee. The late fee for Marshalls’ credit card is $38. To avoid this fee, you need to make your minimum payment by the due date each month. You can find the due date on your monthly statement.

There are a few other things to keep in mind when it comes to your Marshalls credit card and late fees.

Set Up a Reminder

It’s important to remember when your Marshalls credit card bill is due each month. You can set up a reminder on your phone or computer, or use a service like Mint or YNAB to help you keep track of your bills. This way, you’ll never miss a payment and be charged a late fee.

Set Up Auto Payments

If you know you’re going to have trouble remembering to pay your bill on time each month, set up auto payments. That way, your bill will be paid automatically and you won’t have to worry about it. You can set this up through your online account or by calling customer service.

Pay Your Bill Early

If you can’t set up auto payments, try to pay your bill a few days early. This way, even if something comes up and you can’t make the payment on the due date, it will already be paid and you won’t be charged a late fee.

Ask for a Grace Period

If you’re truly struggling to make your payments on time, call customer service and ask for a grace period. This is usually a few extra days that you have to pay your bill without being charged a late fee. Sometimes, all you need is a little bit of extra time to get the payment in.

Negotiate a Late Fee

If you’re already being charged a late fee, call customer service and try to negotiate it. Sometimes, they’ll be willing to waive the fee if you explain your situation. It’s worth a shot!

Contact Customer Service

You can contact customer service to set up a payment plan. This will allow you to spread out your payments over a longer period of time, so you don’t have to worry about making a large payment all at once. You may also be able to negotiate a lower interest rate or waive late fees if you’re experiencing financial hardship.

Following these tips will help you avoid being charged a late fee on your Marshalls credit card. If you’re struggling to make your payments, call customer service and see what options are available to you.

FAQs

Do Marshalls Have a Credit Card?

Yes, Marshalls has a credit card. The TJX family, including Marshalls, have a combined credit card (Marshall’s Credit Card). This credit card can be used at any of the TJX stores, which also include T.J. Maxx, HomeGoods, and Sierra Trading Post. With this card, cardholders can enjoy exclusive discounts and rewards. Applying for the card is easy and can be done online.

What Credit Score Do You Need for Marshalls Card?

To qualify for a Marshalls credit card, you need a credit score of at least 650. This is a good credit score, and you should be able to get approved for the card if you have it. If your credit score is lower than this, you may not be able to get this card.

If you’re not sure what your credit score is, you can check it for free on websites like Credit Karma or Credit Sesame. These sites will give you an estimate of your score, and they’ll also show you which factors are impacting your score. This can be helpful if you’re trying to improve your score so that you can get approved for a Marshalls credit card.

What Bank Owns Marshalls Credit Card?

Marshalls’ credit card is issued and managed by Synchrony Bank. You can use your Marshalls credit card to make purchases online and in-store at Marshalls locations. There is no annual fee for this card. You can also earn rewards points on your purchases, which can be redeemed for future discounts at Marshall’s.

Can You Use Marshalls Credit Card at T.J. Maxx?

Yes, you can use your Marshalls credit card at T.J. Maxx and Marshalls stores, as well as at TJX-affiliated retailers Sierra Trading Post and HomeGoods. You will need to show your card to the cashier and they will process the purchase using your credit card. Be sure to keep your receipt and credit card statement handy in case there are any discrepancies with the purchase.

Final Thoughts

Marshall’s credit card is a great option for those who are looking for a versatile and all-inclusive credit card. With its exceptional features, the Marshall’s credit card can be an excellent addition to your wallet.

If you are sick of using too many store-specific cards, Marshalls Credit Card is worth trying! Some of the key features that make Marshall’s credit card stand out include no annual fee, low-interest rates, and a wide variety of rewards.