The Broad Market Index was up 0.71% last week and 45% of stocks out-performed the index.

Q2 2021 hedge fund letters, conferences and more

We are measuring one of the strongest and broadest advances in corporate growth ever. It is easy to rationalize by referring to the virus impact that created the low base for comparison last year but there is more going on that meet the eye.

Top-Line Growth Is Up

Average sales growth jumped to 20% from 8% last quarter-the biggest single quarter advance with the broadest frequency ever. Average sales growth is the highest since the peak of the tech bubble in 2000 and that peak was the highest ever.

This is the strongest and fastest consumer-durables-driven industrial acceleration we have ever measured. We at Otos.io have measured many such advances in the 54-year data record!

Consumer Sentiment Is Up

American consumers are feeling rich, interest rates have never been lower and borrowing has never been easier. Sales growth in autos is 25%, the highest ever and housing sales growth is 16% up from -6% last year.

Although these high sales growth rates are likely to moderate in the coming quarters, they are unlikely to begin their end-of-cycle decline soon. The recent policy shift to deficit spending to support 'infrastructure' and the commitment that 40% of US auto production be electric by 2030 will require large capital expenditures; some from deficit spending but most from companies and individuals.

Debt-Financed Consumption

Such a decade long frenzy of debt-financed consumption of durable goods is inconsistent with the dour UN climate report last week. The US consumer has been wound-up to this unprecedented extent by over a decade of ultra-cheap/easy money. With the participation of all the global central banks in the easy money project; the consumption culture is now worldwide.

Historically, acceleration in consumer durables is associated with higher inflation. Expanded manufacturing of autos and housing push up commodity prices and wages. Historically that would also push up inflation expectations and interest rates.

Most Surprising Now

Despite a clearly overheated economy and evident high and rising inflation - interest rates are falling still lower!

This is a crisis brewing and protecting wealth through the crisis will be our biggest challenge. Getting defensive, selling assets, moving to more stable securities will not work.

Higher interest rates will depress the value of low growth securities (stocks and bonds).

Higher interest rates with also depress the value of high growth securities if their growth is not rising.

So, What To Buy?

The best hope for defense against higher interest rates is higher growth. We must own accelerating companies, preferably with operating leverage.

These are tradition industrial/cyclical companies where fixed costs and sunk capital expenditures are high. This creates operating leverage that accelerates cash relative to sales during the up-cycle.

Shares of many of these leveraged industrial companies are depressed now and this is a good opportunity to rebalance portfolios. This makes an excellent time to rebalance portfolios to protect against the inevitable increase in interest rates.

Look at highly leveraged companies in their acceleration phase, such as Tupperware Crop:

Tupperware Corp $24.770 BUY This Rich Company Getting Better

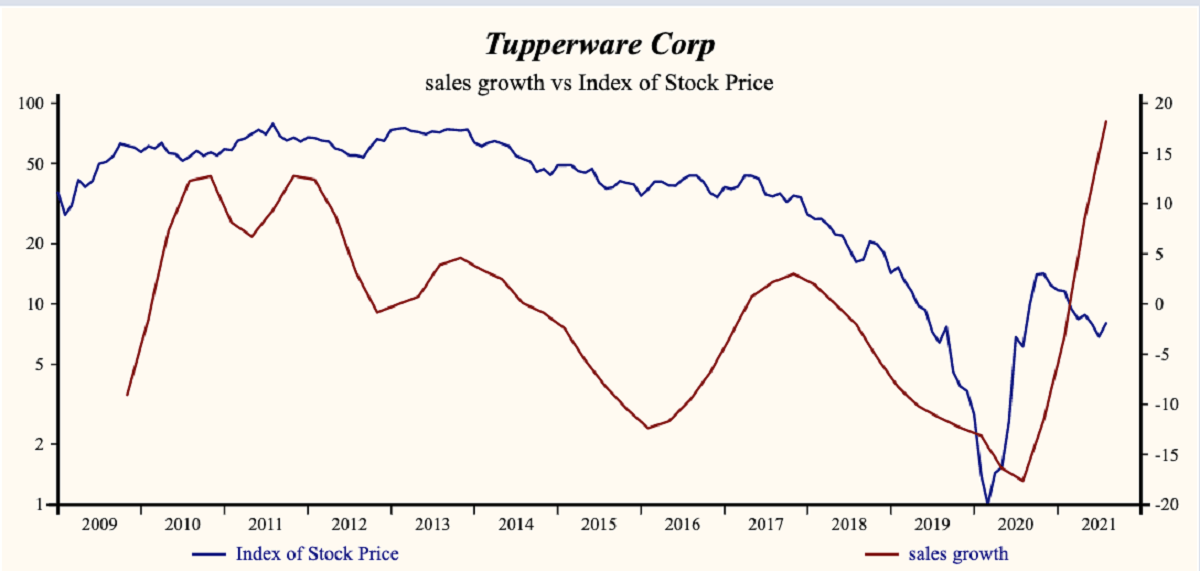

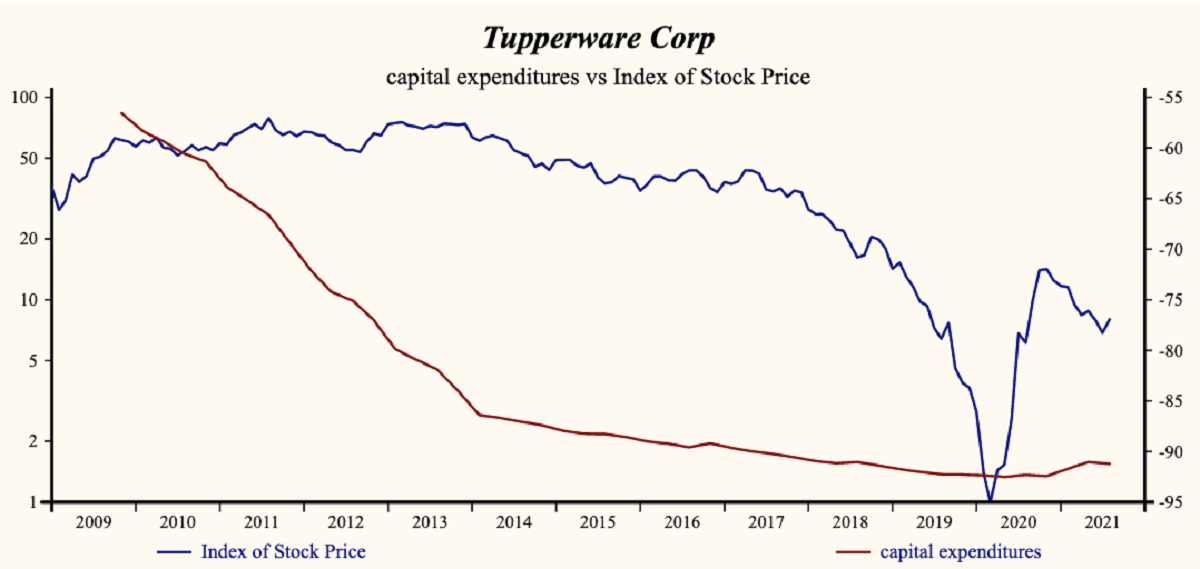

Tupperware Brands Corporation (NYSE:TUP) has been a profitable company with inconsistently high cash return on total capital of 10.7% on average over the past 20 years. Over the long term, the shares of Tupperware Corp have declined by 90% relative to the broad market index.

Currently, sales growth is 18.1% which is high in the record of the company and higher than last quarter.

Margins Are Up

Rebounding from last summer’s low, the company is now recording a high and rising gross profit margin. This is the fourth consecutive increase in the gross margin thereby putting an end to persistent decline.

Cashflow Is Also Up

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have been supporting free cash flow for quite some time. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth.

More recently, the shares of Tupperware Corp have advanced by 456% since the March, 2020 low.

The shares are trading at lower-end of the volatility range in a 17-month rising relative share price trend. The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

This provides a good opportunity to buy the shares of this accelerating industrial company.

Look for MoneyTrees with an hourglass shaped golden pot. These are highly leveraged companies in the acceleration phase.

Investors do not wait. Act now!