Praetorian Capital Fund commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

To The Investors Of Praetorian Capital Fund;

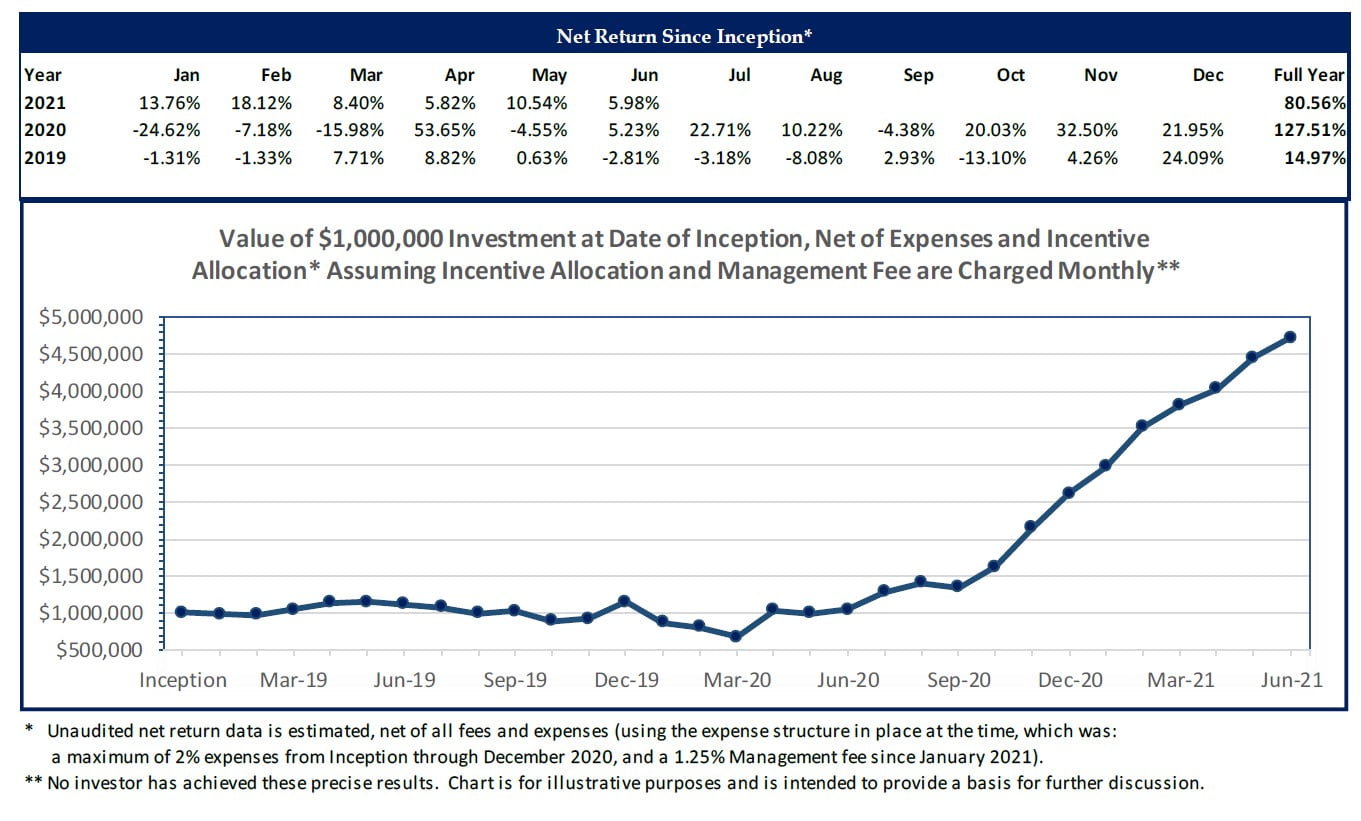

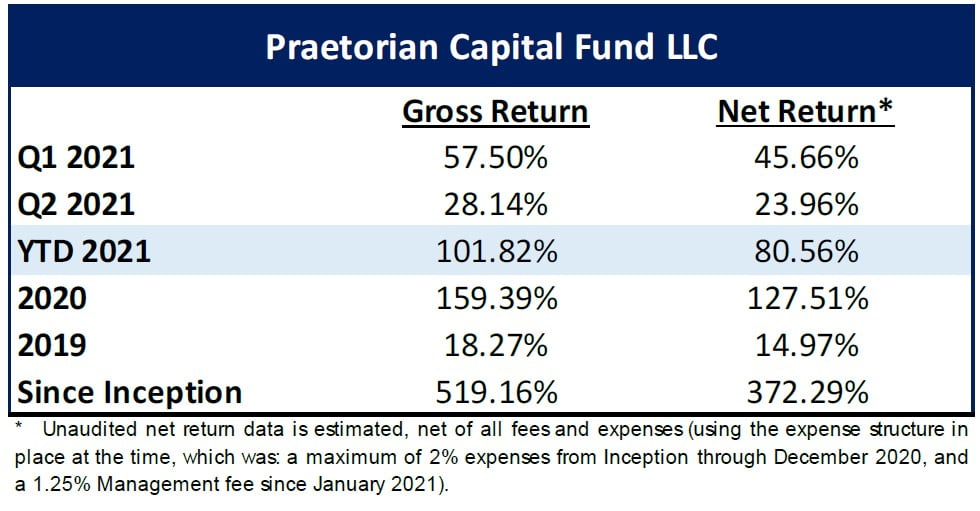

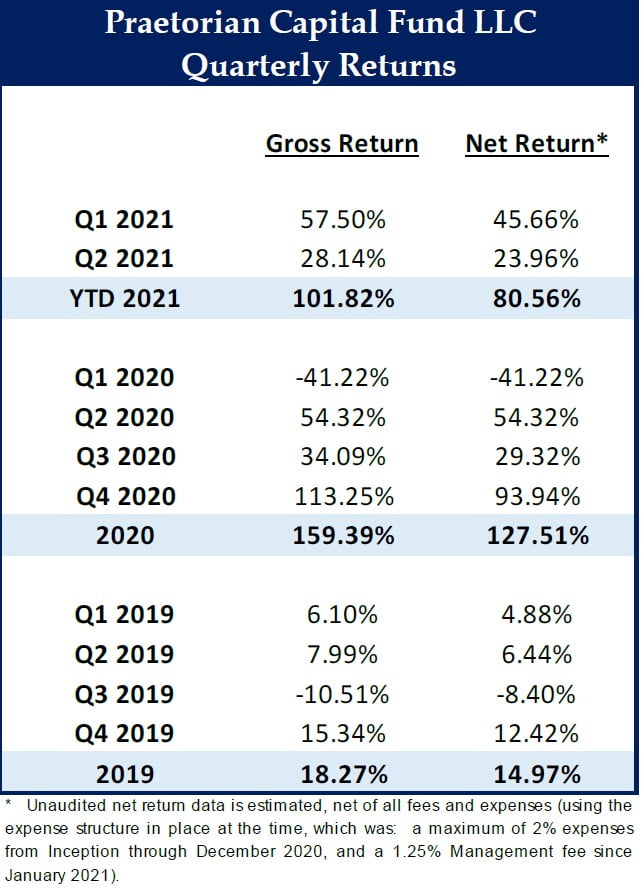

During the second quarter of 2021, the fund appreciated by 23.96% net of fees. Given the fund’s concentrated portfolio structure and focus on asymmetric opportunities, I anticipate that the fund will be rather volatile from quarter to quarter. During the second quarter, our core portfolio appreciated considerably though there was a dispersion of gains with several large positions depreciating during the quarter. This performance was further augmented by substantial gains in our Event-Driven Book, which has continued to surpass my expectations in terms of consistency and magnitude of performance results, though returns have continued to slowly compress as overall market volatility has continued to decline.

After five consecutive quarters with strong performance, I would like to caution you that returns like we have recently experienced are unlikely to be repeated in the near future—particularly as our reduced gross exposure will act as ballast on our portfolio unless we can find attractive opportunities in which to deploy capital. Unfortunately, with many securities having appreciated dramatically in the past year, I am currently finding less that attracts me from a valuation standpoint. While there are a number of thematic inflections that excite me, they all cluster into our “long inflation” theme and I am hesitant to add further inflation exposure as we are already over-exposed and playing that theme from multiple angles.

As a value investor, I intend to remain disciplined and I will not invest the fund’s capital unless I believe the opportunity is unusually attractive. At the same time, with excessive money printing, I worry about having reduced exposure, potentially waiting indefinitely for opportunities that may never appear. This is an internal debate I frequently have with myself. However, in my experience, patience usually wins out and eventually something interesting happens, creating opportunities. In the interim, our Event-Driven strategies are valuation agnostic and we continue to re-deploy capital there.

Your ESG Is Our Alpha

A few years back, the seemingly quaint notion that an increased focus on ESG (Environmental, Social and Governance) would improve long-term investment returns began to permeate thinking about public security investing. At the most basic level, companies that avoid environmental disasters, treat their communities well, and have effective board control over executives, ought to outperform those with wanton disregard for these facets.

Unfortunately, history often sees academic thought hijacked by special interests with their own pernicious agendas. In the case of ESG, voluminous case studies and back-tests showing outperformance of securities scoring strongly on ESG were ready-made for these malicious actors to manipulate and utilize. Nowhere has this been more bizarre and contemptuous of the facts than in my own profession—portfolio management.

It is well known that most portfolio managers cannot beat their benchmarks. Add in frictional costs along with fees and my industry’s track record is particularly pathetic—especially given the tremendous effort involved in producing a sub-par return. Fortunately, ESG came along and allowed these managers to move the goalposts and take credit while harming their clients. No longer is return on capital the driving goal of some asset managers, instead, it is selecting portfolios of securities that score highly on ESG rankings—rankings that often do not seem to even adhere to the core tenants of prior ESG research. Is lithium mining inherently more environmentally friendly than coal mining? Is social media (often scoring highly) making society a bit crazy? Is a board, composed so that that it checks various arbitrary boxes, better equipped to effectuate its job of putting shareholder interests first? I often look at companies scoring well on the various ESG metrics and shake my head. Charlie Munger famously quipped, “show me the incentive and I will show you the outcome.” Is it any surprise that CEOs continue to make cosmetic changes and hence score better on various ESG metrics? There are bonuses and stock options at risk otherwise. Is anything changing at the core of these businesses to benefit society or shareholders? Rarely.

As this is an investment letter, let’s return to the matter at hand. Leaving the debate about CO2’s impacts out of this discussion; it is worth acknowledging that CO2 jihadists have also hijacked the principles of ESG. Newton’s Third Law of Motion states that “for every action, there’s an equal and opposite reaction.” I often find myself drawn to this sort of logic in finance as first order effects are easy to discern but second order effects are more subtle and tend to take longer to express themselves. However, when they do, they tend to create explosive price realization events as they are so unexpected by the broader market.

I intend to posit Kuppy’s First Law of ESG: “As ESG cuts off capital to various industries and effectively restricts future supply, if demand continues to grow, those industries will experience improved returns on in-place capital.” Interestingly, this brings us to my Second Law of ESG: “As asset managers are forced to dispose of businesses scoring poorly on the ESG ranking system, this forced selling creates undervalued securities—sometimes undervalued to a bizarre degree.”

Interestingly, today we find ourselves at a unique junction of these two laws, caused by the explosion of ESG investing. Not only are prosaic, often low-return businesses earning surprisingly high and accelerating returns on their capital, but those securities are frequently priced at historically low valuations. Rarely in my investing career have I witnessed multiple industries simultaneously experience improving returns and declining valuations—it goes against all the tenants of the so-called “Efficient Market.” While I expect increased government regulation and taxes to harvest some of these excess returns, the valuations simply seem erroneous. Since we have the flexibility of ignoring an ESG mandate, we’ve been able prosper—almost directly benefitting from those portfolio managers who claim to be fiduciaries and yet are coincidentally the ones causing these aberrations in finance.

Let’s Talk Coal

The history of human advancement has been tethered to our ability to harness increasingly complex fuel sources. Much of this evolution has occurred in the past few centuries. It wasn’t too long ago that we burned cow dung to heat our homes; now we utilize uranium and solar. While it’s easy to malign coal, we forget that we are only a few generations removed from burning whale oil to illuminate our homes. Regulation could not have saved the whales, neither could a complex system of subsidies and taxes. Only scientific advancement eventually averted extinction through the free market mechanism. Coal, in the form of electricity, is what saved the whales. Humans found a cheaper and more efficient way to do something. Over a century later, coal is at the core of baseload electricity globally and despite incessant drama, demand continues to grow. Will coal be replaced by something else? Of course. When? That’s not clear. Much like with the whales, I don’t see taxes, subsidies, or regulations eliminating coal—only technological progress and the free market mechanism will accomplish this.

What goes unnoticed in the Western World is that there continues to be scientific advancement in thermal coal power plants. New plants are dramatically more efficient, using far less coal per unit of electricity. Human progress continues, even if it is mostly ignored by the public. As an investor, I try to look at the world rationally, square the facts, and increasingly look for opportunities where my two laws of ESG converge. Contrary to the popular narrative, I believe thermal coal is in a bull market.

While it is a small position for us, it’s worth reviewing our investment in Thungela Resources (JSE:TGA), South Africa’s leading thermal coal exporter. In early June, TGA was spun out to shareholders of Anglo American plc (LON:AAL), the diversified global mining company. Anglo wanted to improve its ESG score and realized that a spin-off to shareholders was the most expeditious way to move up a few ranks. When I saw the news, I asked myself a simple question, “who is the prospective buyer of a higher-cost, South African thermal coal miner with substantial underfunded environmental liabilities? Who will step in when ETFs and institutional holders of Anglo’s UK listed shares receive Johannesburg-listed Thungela shares and are forced to sell as TGA does not fit their ESG-friendly mandate? Could the valuation get somewhat silly?” Despite understanding the mechanics at play, even I was surprised by how cheaply the shares initially traded. At one point, the company was valued only a few percent above the net cash balance, despite having no debt and prodigious cash flow. By my math, the shares traded at an Enterprise Value of less than one tenth of one times forward cash flow using a $90/t benchmark price—yet the benchmark was well into the triple digits. Clearly Thungela was mispriced, and despite the shares almost doubling in the past few weeks, it is still quite cheap. To date, ESG has created opportunities that defy conventional investment logic. I see nothing that changes my view that ESG will continue to create unique opportunities like this.

To be clear, transitioning the world from coal to something else is likely better for humanity. However, prevailing militant ESG views would prefer for Thungela to disappear yesterday. To that I ask, “how do you remediate the existing underfunded environmental liabilities at Thungela if it doesn’t continue to prosper and top up those underfunded remediation trusts? Thungela employs thousands of South Africans, often in impoverished rural communities. How can you claim to care about Social aspects and then see these communities destroyed? Meanwhile, Governance is often the forgotten third letter of ESG. Shouldn’t we cheer a majority Black African board and management team successfully running one of the largest businesses in South Africa, just a generation removed from Apartheid? Why wouldn’t exposure to Thungela be the pinnacle of ESG investing?”

Sure, Thungela produces coal, but the thermal coal utilized by the newer Asian power plants that Thungela increasingly sells to are reducing C02 emissions per unit of electricity—isn’t that a good thing? Thungela would seem to check the other boxes as well—especially as those boxes existed when the initial research was done to show that companies with strong ESG tenants often out-perform. That research never took a stand as to whether coal was “bad.” The bastardization of ESG has created huge opportunities for us—I suspect that this continues until the dramatic underperformance of so-called ESG funds leads to substantial investor outflows. Until then, a good chunk of the playing field has been left to funds like ours.

Let’s Talk Oil

I like to joke that ESG really stands for Energy Stops Growing. Nowhere is this more apparent than in the oil sector where various ETFs and pension funds have colluded to ensure that environmental activists joined the board of Exxon Mobil (NYSE:XOM). The message to the industry is clear; if you continue to invest in oil, your board will get hijacked by pirates. Returning to Newton’s Law, I expect the outcome will be less oil investment and more capital squandered in lower return “green” endeavors. What does this mean to the price of oil? If demand growth accelerates due to increased fiscal stimulus globally, all else held constant, pricing likely goes higher as commodities are priced based on supply and demand.

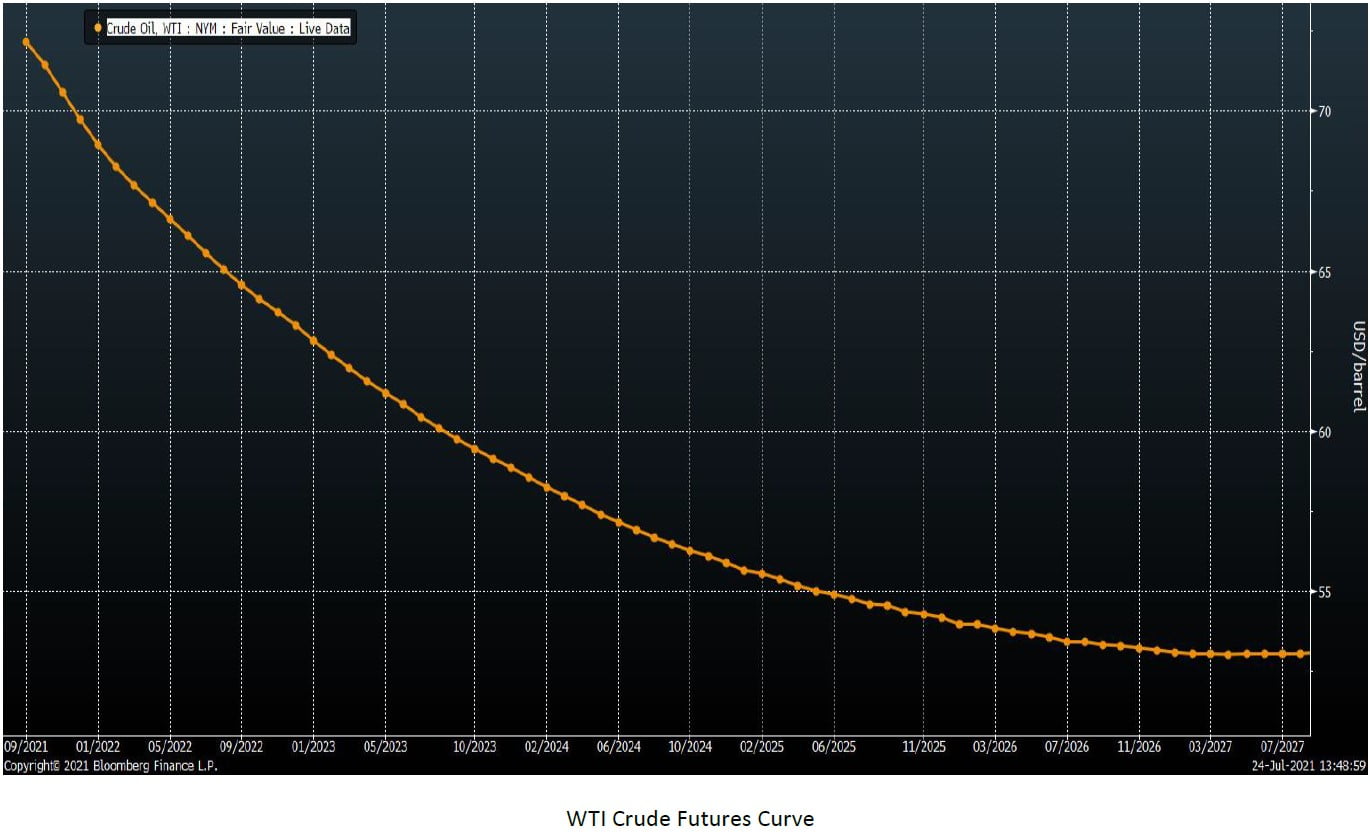

Since inception, this fund has rarely held much exposure to commodity futures. However, when it comes to oil, I think the set-up is unusually attractive. On one hand, pricing is likely headed higher. On the other hand, most investors are still fighting the prior war and anticipating a return to pricing levels that have prevailed since the proliferation of shale. A quick look at the price of oil would explain a lot about current psychology. While investors fixate on current global inventory draws, they are quite sanguine about the situation out a few years. I believe the pirate attack at XOM, along with increased US regulation has forever changed the game. We have an unusually large exposure to December 2025 futures contracts along with futures call options. This gives us time to see the dearth of capital expenditures play out against a backdrop of increased demand.

You may ask why we do not simply own producers if we think that oil is going higher. I can certainly appreciate that logic, but I tend to think that ESG forces make it painful for these businesses to operate. This pain could be in the form of arbitrary government policies or increased taxes—their pain is likely to be reflected in the future price of oil. Besides, I do not claim any specialized knowledge of geology, pipelines, or basin differentials. It simply seems easier to target the release valve of excessive fiscal stimulus and ESG restrictions—especially as the 2025 contracts have hardly even appreciated from the time when oil was trading below zero. The whole world has changed, yet these 2025 futures, increasingly exposed to future restrictions on supply, have not expressed any concern.

In Summary

We are not against ESG in its traditional form. Almost always, we invest in businesses that care about their employees, communities, and the environment. We take special notice of Governance and ensure that our management teams are working for us as shareholders. However, as ESG has evolved, it has been politicized, weaponized, and ultimately bastardized. I now see ESG as an opportunity to harvest Alpha from other portfolio managers who have succumbed to its embrace. This Alpha either comes in the form of improving businesses that have been dumped onto the markets at insane valuations (e.g. Thungela) or by taking advantage of supply bottlenecks created by ESG (e.g. crude oil). Oddly, ESG is our friend, just not in the way that most investors perceive it today.

Position Review (top 5 position weightings at quarter end from largest to smallest)

Energy Services Basket (Positions Not Currently Disclosed)

In 2020 when oil traded below zero, drilling activity ground to a halt and many energy service providers declared bankruptcy. Many of these businesses had teetered on the verge of bankruptcy for years, due to reduced demand and over-leveraged balance sheets. The bankruptcies lead to consolidation and reduced future industry capacity, removing future competition in the recovery.

With oil prices near multi-year highs, I believe that demand for drilling and other services will recover. While I believe this recovery will be somewhat anemic, we purchased many of these positions at fractions of the equipment’s replacement cost despite restored balance sheets and positive operating cash flow. As the sector recovers, I believe that this cash flow will become more apparent and this equipment will trade up to valuations closer to replacement cost.

St. Joe (JOE – USA)

St Joe (NYSE:JOE) owns approximately 175,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities. This is more than evidenced by the 122% year-over-year growth in Q1, 2021 revenue reported by the company.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE will grow revenue at 30% to 50% each year for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at a single-digit multiple on AFFO looking out to 2024, while substantial asset value is tossed in for free.

Besides the valuation, growth, and high ROIC of the business, why else do I like it? For starters, land tends to appreciate rapidly during periods of high inflation—particularly an inflationary period where interest rates are suppressed by the Federal Reserve. More importantly, I believe we are about to witness a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax stupidity will launch JOE shares higher and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

Oil Futures and Futures Options

As noted above, we have a large position in December 2025 futures and futures options on crude oil.

Newspaper Securities Basket (Positions Not Currently Disclosed)

Most global print newspapers have seen their readership decline for decades as subscribers seek out alternative digital sources of information. In response to this, newspapers have tried to build up their digital presence. Historically, this digital revenue stream was always rather negligible as it was coming from a small base, especially when compared to steep declines from the print side.

Over the past few years, digital revenue growth has accelerated to the point where I expect that the newspaper companies in our basket are within a few years of their digital revenue overtaking their print revenue—assuming recent trends hold. Digital revenue represents a higher margin and higher return on capital business when compared to the capital and manpower intensity of printing and distributing physical newspapers. My belief is that, as these digital businesses come to dominate the revenue stream, newspaper company valuations will re-rate—particularly as many of them trade as if they are dying businesses, when in reality the digital businesses are growing quite rapidly.

While many well-known global newspapers have successfully made this digital transition and seen earnings growth for a number of years, many smaller papers have continued to see earnings decline. I believe that these smaller papers are now on the cusp of an inflection to earnings growth as digital growth overtakes print declines. Should this happen, I anticipate it will dramatically change the narratives for these companies, along with their valuations, much like what occurred at more well-known papers. The fund owns a global basket of these smaller newspaper companies.

Cornerstone Building Brands (CNR – USA)

Cornerstone Building Brands Inc (NYSE:CNR) is a producer of components for the construction of residential and commercial properties. They make critical components for entry level homes along with multi-family properties. As people continue to leave chaotic cities and high-tax states, they need to go somewhere, and a lot of that new supply must be built from scratch. Cornerstone is a primary beneficiary of this as they supply everything from vinyl windows to aluminum siding, from stone façade to gutters. While none of these components are particularly sexy, the company has had strong returns on capital over the past few years—which was also a period when housing demand was somewhat slack. Now that demand is elevated, I suspect that returns on capital will improve from here. We purchased our shares for a low single-digit multiple on free cash flow. While the company is a bit more leveraged than I’d normally prefer, that leverage could dramatically increase our returns should this housing cycle continue for an extended period of time. As cash flow increases and debt gets paid down, I suspect that Cornerstone will look dramatically less leveraged in a few more quarters—which likely leads to a dramatic re-rating of the cash flow multiple.

In summary, during the second quarter of 2021, the fund experienced attractive net returns on our capital, despite a rather reduced level of exposure. With the market making new highs, I am struggling to find value stocks to invest in. As a result, we continue to pivot more of our capital into Event-Driven strategies.

From over twenty years of experience in the markets, I believe that periods without much opportunity tend not to last. At some point in the future, I expect currently overvalued stocks to once again become cheap and I can focus more of the portfolio on more traditional value investing. Until then, I believe various macro trends are unusually favorable for certain sectors with artificial ESG restrictions and we have pivoted more of our capital into those sectors during the second quarter.

Sincerely,

Harris Kupperman

Chief Investment Officer