Whitney Tilson’s email to investors discussing the Tesla equity raise: fool us again, Elon!; Tesla Inc (NASDAQ:TSLA)’s robotaxis, corner cases; WE NEED CASH; Baron Funds bull case; etc.

1) Anton Wahlman’s article today: The Tesla Equity Raise: Fool Us Again, Elon!, https://www.thestreet.com/investing/stocks/tesla-equity-raise-elon-musk-fool-me-again-14947009. Excerpt:

Q1 hedge fund letters, conference, scoops etc

Tesla is launching its combined equity and convertible debt offering today, which would bring in $2.3 billion with the shoe, assuming no upsizing from here. You can read the prospectus filed with the SEC here: To humor yourself, search for the word "autonomous." The result is... zero. Surely that is a major mistake, right? Try the word "robotaxi" instead. Same result.

Basically, per the prospectus, Tesla is not in the business of having anything to do with "autonomous" or "robotaxi." This clearly can't be part of the company's current or anticipated future business, right?

On the call about the deal, which took place a few short hours after the prospectus was filed with the SEC on May 2, the tune was completely different. CEO Elon Musk told investors to practically forget about the rest of Tesla's business, which he called "small potatoes" in comparison.

2) Here’s Glenn’s post on this:

Yes. And you will generate 75% cash on cash returns. Lever this a little and you will double your money every year. Start with one 50k car today in 8 years you will have $12 million in 8 years. Honestly does anyone believe this? Because it follows from Musk’s statements.

— Glenn Tongue (@glenntongue) April 30, 2019

A friend responded:

The whole proposition is so absurd on so many levels:

- If the returns are so big, then wouldn't supply, or the price of that supply, increase to drive down returns to something closer to 10%-15% per year?

- If the returns are so big, then why would Tesla agree to sell any of these cars? Just operate them themselves and keep all of that return.

- But of course, Level 5 cars are nowhere near a decade in happening. Not from Tesla, and not from anyone else either.

- And if they ever happened, they would be banned as a matter of national security. Can't have 5,000 lbs (or more) potential remote-controlled bombs rolling around on U.S. streets and roads.

Bonus point: What happens if a passenger exits that Model 3 and doesn't close the door? Oh wait... the car will just sit there...

Glenn noted: “There are dozens of similar corner cases I have thought up.”

The friend agreed:

The beauty of these corner cases is that there's a seemingly infinite number of corner cases. There is no limit. It think it was close to 5 years ago I met with one prominent automaker which was considered a leader in autonomous driving then (time flies...) and it had a "book" (literally, a black book) with something like 450 corner cases, a couple of hundred pages thick, where it saw great difficulty in resolving them through artificial intelligence.

3) More on this from another friend:

I did a search of the Tesla prospectus.

"Autonomous": 0

"Autonomy": 0

"Full Self Driving": 0

"Autopilot": 2

Autonomy may be part of Elon's sales narrative, but it is nowhere to be found in this legal document.

What the prospectus does say: "We intend to use the net proceeds from this common stock offering and our concurrent convertible notes offering to further

strengthen our balance sheet, ..."

Translation: WE NEED CASH

4) A friend’s comments on the TSLA cash flow spreadsheet:

* Your friend assumes 10% of S/X models will be leased, but no Model 3's will be leased. Should be changed. I believe if more model 3s are leased, that means less cash upfront but higher gross margins going forward.

* Model also assumes no growth in solar and storage. Yes, solar biz has been shrinking, but I think that is overly conservative considering the storage market is growing so fast. Granted, if that business has very low gross margins, could be irrelevant.

And Chinese demand for Model 3 could be higher than expected. Wildcard. If the gigafactory 3 is finished by September, they could start taking online reservations a few months before that and q4 could benefit for sales of Model 3 in china. Granted that is optimistic.

5) Baron Fund’s letter attached – see pages 3-4 for their bull case.

Key line:

We purchased Tesla’s stock five years ago. Tesla’s sales have since increased from $3.7 billion per year to $21 billion in 2018 and could reach an estimated $28 billion-$30 billion this year. Tesla’s share price has increased from $208 per share to $280 per share, far less than the growth of Tesla’s business. We do not expect Tesla’s share price to continue to lag the performance of its business. https://www.baronfunds.com/sites/default/files/Baron%20Partners%20Fund%20Quarterly%20Letter%203.31.19.pdf

6) From a friend:

Early on, when asked why TSLA was raising cash now, Musk stated the reason for raising cash now is, "it would be wise to have a cash buffer, to recession proof the company, cash is not being raised for operations."

That's as close as I can get to a direct quote from listening to the conference call.

Conclusion: the only time Musk tells lies is when his lips are moving............

7) Tesla Sued Over Fatal Crash Blamed on Autopilot Malfunction, https://www.bloomberg.com/news/articles/2019-05-01/tesla-sued-over-fatal-crash-blamed-on-autopilot-navigation-error

Tesla Inc. was sued over a fatal crash on a California highway allegedly caused when the Autopilot system of a 2017 Model X malfunctioned and steered the car into a concrete barrier.

8) The thing about owning a Tesla no one talks about — nightmarish repair delays: https://www.msn.com/en-us/autos/news/the-thing-about-owning-a-tesla-no-one-talks-about-%E2%80%94-nightmarish-repair-delays/ar-AAAJmmj?li=BBnbfcL

"This accident was not my fault. So even if someone else hits you, you're without a car for a long time. And I think that's crazy. Nobody would want to own a Tesla in my opinion if they knew how long it's going to take to get repaired."

9) Here are the two relevant Volvo/Polestar press releases, conveniently ignored by all Tesla bulls:

https://www.polestar.com/press-release/2019/03/06/statement-from-polestar-regarding-us-market-plans-and-pricing

https://www.polestar.com/press-release/2019/02/27/polestar-reveals-new-polestar-2

It's a Model 3 -- but with the doors that open in cold weather, and glass that doesn't crack. And with service departments and parts, in case something goes wrong and you want it fixed that same day (or week or month or...)

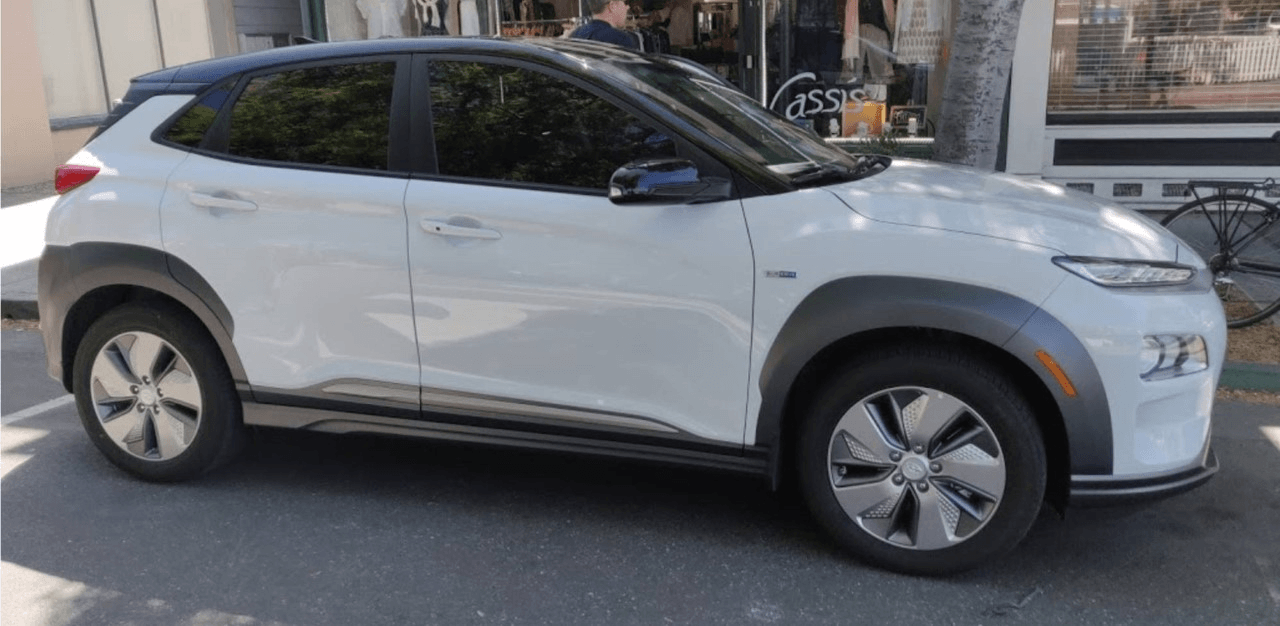

10) A pic of another competitor, the Hyundai Kona EV:

11) From a friend in the UK:

So... people seem a little pissed that the cheapest available is £40k.

They were expecting the usual $=£ rule and hoping to pay £35k.

Furthermore, Tesla are conning people by listing the price BELOW £40k, when in fact that includes a government subsidy so the "list" price is ABOVE £40k.

That's important because at any list price above £40k you have to pay an extra £1,500-ish on tax that Tesla conveniently avoid mentioning (you would buy the car and then a month or so later find a tax demand in the post).

Also, deliveries for orders placed live today are slated for June which is 1. not going to happen (again he is just conning people) and 2. REALLY annoyed all the people who put up £1,000 deposit years ago to guarantee an early delivery.

£40k is a lot for a car. If I had that burning a hole in my pocket I would be buying a nearly new convertible BMW M4 or relatively old Audi R8.

Just my 2p.

12) Article about Tesla’s proposed auto insurance: Tesla insurance product to be fronted by Markel’s State National. https://www.reinsurancene.ws/tesla-insurance-product-to-be-fronted-by-markels-state-national/

The last line is the key one: “The reinsurance treaty details are not available in the filings, so at this time we do not know who is taking on the bulk of the risk by reinsuring the program for Tesla.”

I know the Markel guys and I promise you they’re taking NO RISK here – it’s all on Tesla.