The Soukis and their executives have always view Tellurian Inc (NASDAQ:TELL)’s share as an inexhaustible currency; Tellurian’s total cash burn has been more the $500M since 17′ and we have no reasons to believe that their equity holders will not absorb the coming leak:

Tellurian books large contracts at a loss for their Driftwood LNG project, Shell being their latest one. As they are forced to match the new contracts with the financing the concrete dam will crack and the valves will completely eject them.

Tellurian Finalizes Offtake Agreements for First Phase of Driftwood LNG- NGI

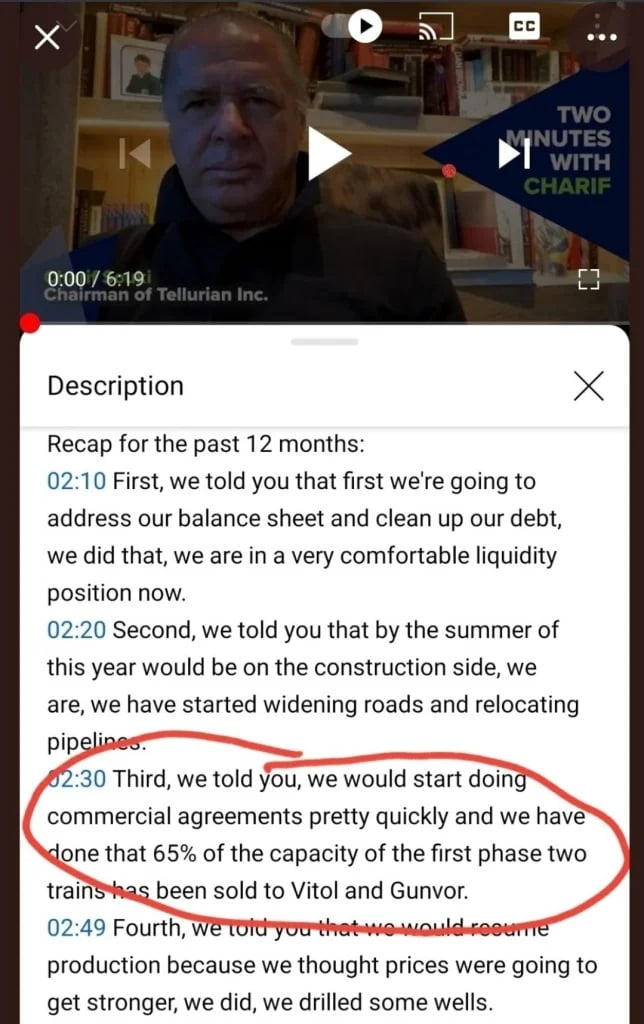

Tellurian Inc. on Thursday said it has secured enough offtake to support the first phase of its proposed Driftwood liquefied natural gas (LNG) export project in Louisiana after signing a deal with Royal Dutch Shell plc to supply 3 million metric tons/year (mmty).

The project hasn’t been sanctioned yet, but the sale and purchase agreement (SPA) with Shell, the world’s largest LNG trader, now allows it to focus on financing the 27 mmty export project.

“With these SPAs, we have now completed the sales to support the launching of the first two plants,” Tellurian CEO Octávio Simões said. “Tellurian will now focus on financing Driftwood, in order to give Bechtel notice to proceed with construction in early 2022.”

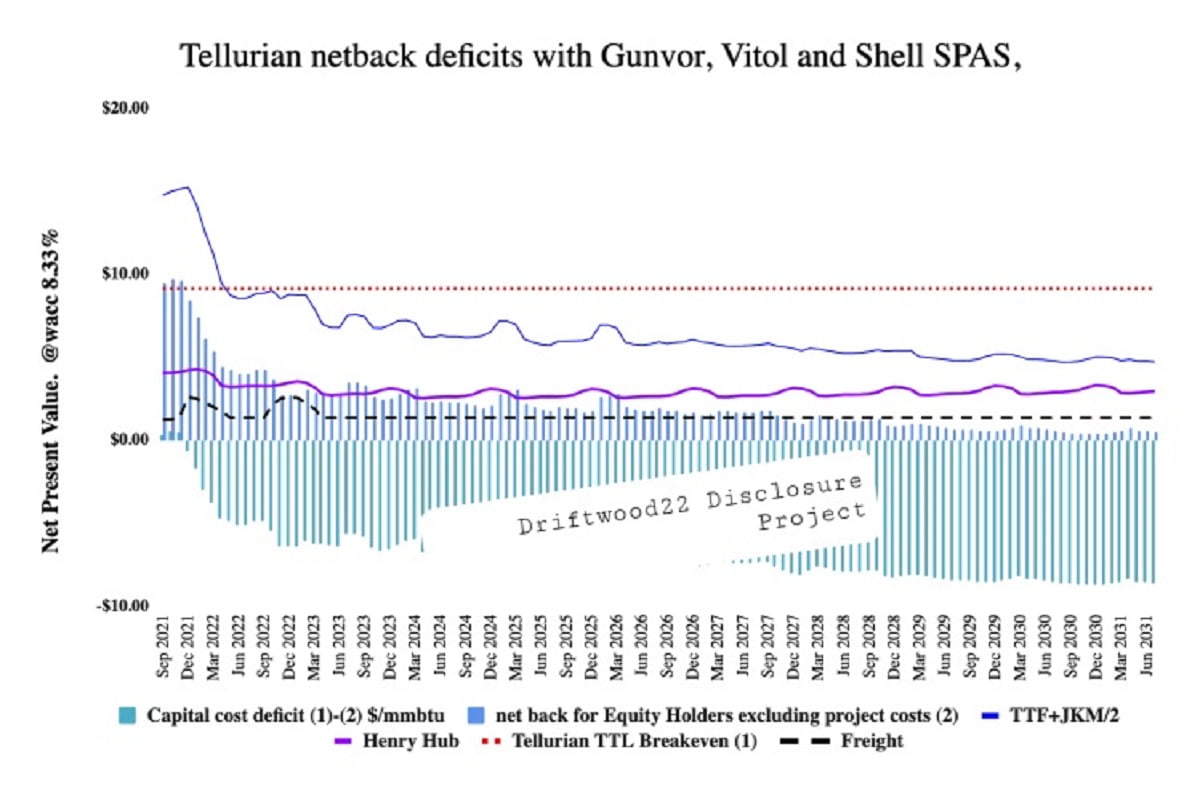

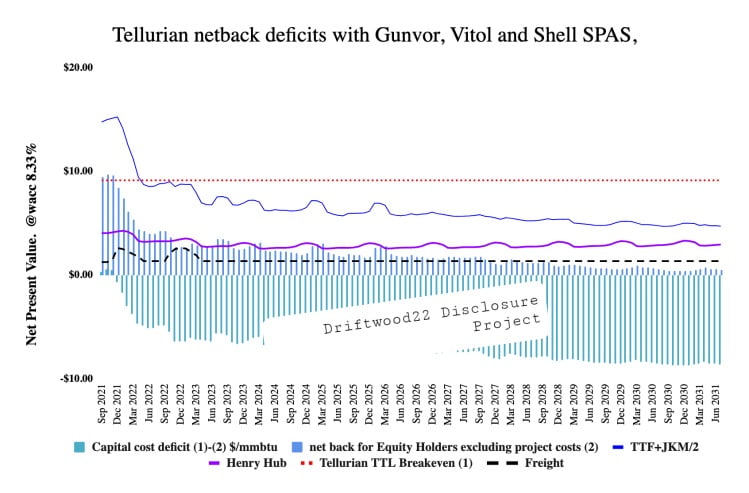

The latest deal is the third SPA finalized since May. Like the others it signed with Vitol Inc. and Gunvor Group Ltd., Tellurian would supply Shell with LNG for 10 years at prices linked to the Japan-Korea Marker (JKM) and Dutch Title Transfer Facility (TTF) benchmarks on a free-on-board basis. The JKM and TTF prices would be netted back to the Gulf Coast to exclude shipping costs.

Unlike other U.S. supply deals that pass commodity risk through to offtakers that either secure gas for liquefaction or pay prices linked to Henry Hub plus other fees***, Tellurian would be exposed to the spread between domestic prices and those overseas. While it currently produces gas in the Haynesville Shale, Tellurian doesn’t have enough reserves to completely supply the first phase of the project…

Tellurian Inc Side

-The Driftwood 22 DISCLOSURE Project

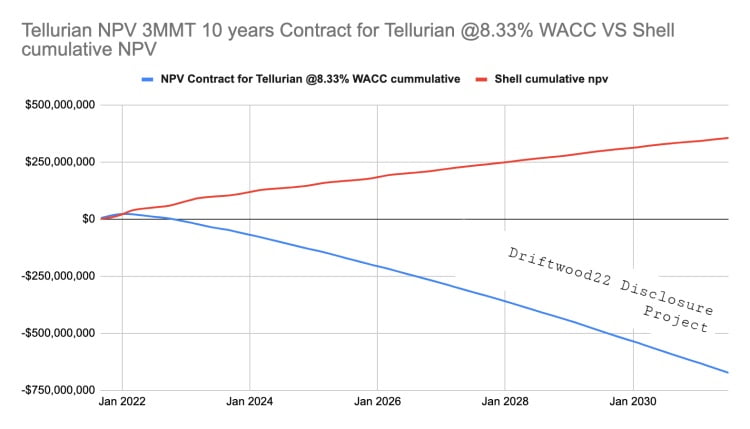

Under the formula (0.667 x TTF + 0.333 x JKM) minus freight netbacked f.o.b gulf coast pricing formula, Tellurian is at net a present value (NPV) deficit of –$672M.

We estimate that 3MMT capacity will come at $4.02B capital cost price tag.

Shell P&L Profile 10-Years

| date | TTF | JKM | Freight | Shell projected profit $/mmbtu Max(JKM,TTF)-breakeven [5] | Shell break even | Shell P&L [6] | Shell npv @8.33% wacc | Cumulative npv |

| Max(JKM,TTF)-breakeven [5] | (TTF*.6677+JKM*.0333)-Freight | ([5] * total volume/ 118 months). | -4500000 | 0.00 | ||||

| Sep 2021 | $14.42 | 15.085 | $1.24 | $1.73 | $13.35 | $2,300,063.03 | $2,298,503.96 | 2,298,503.96 |

| Oct 2021 | $14.37 | 15.585 | $1.24 | $2.10 | $13.48 | $2,787,456.30 | $2,783,678.70 | 5,082,182.65 |

| Nov 2021 | $14.24 | 15.99 | $1.40 | $2.62 | $13.37 | $3,470,316.03 | $3,463,263.88 | 8,545,446.54 |

| Dec 2021 | $14.08 | 16.385 | $2.59 | $4.18 | $12.20 | $5,545,809.82 | $5,530,788.47 | 14,076,235.01 |

| Jan 2022 | $11.85 | 16.495 | $2.50 | $5.65 | $10.84 | $7,494,369.99 | $7,469,004.57 | 21,545,239.58 |

| Feb 2022 | $8.44 | 16.635 | $2.25 | $7.77 | $8.87 | $10,304,751.89 | $10,262,913.17 | 31,808,152.75 |

| Mar 2022 | $8.30 | 14.12 | $2.00 | $5.92 | $8.20 | $7,858,150.95 | $7,820,940.85 | 39,629,093.60 |

| Apr 2022 | $8.30 | 10.555 | $1.75 | $3.29 | $7.27 | $4,358,494.51 | $4,334,915.70 | 43,964,009.30 |

| May 2022 | $8.12 | 9.32 | $1.33 | $2.16 | $7.16 | $2,863,883.94 | $2,846,460.01 | 46,810,469.30 |

| Jun 2022 | $8.12 | 8.94 | $1.33 | $1.90 | $7.04 | $2,526,193.72 | $2,509,122.37 | 49,319,591.67 |

| Jul 2022 | $8.12 | 8.995 | $1.33 | $1.94 | $7.05 | $2,575,069.94 | $2,555,934.61 | 51,875,526.28 |

| Aug 2022 | $8.49 | 9.095 | $1.33 | $1.76 | $7.33 | $2,339,417.49 | $2,320,459.34 | 54,195,985.62 |

| Sep 2022 | $8.49 | 9.19 | $1.33 | $1.83 | $7.36 | $2,423,840.05 | $2,402,568.09 | 56,598,553.72 |

| Oct 2022 | $8.49 | 9.505 | $2.10 | $2.81 | $6.70 | $3,725,061.54 | $3,689,867.06 | 60,288,420.77 |

| Nov 2022 | $7.06 | 9.985 | $2.50 | $4.48 | $5.50 | $5,944,859.11 | $5,884,700.35 | 66,173,121.12 |

| Dec 2022 | $7.06 | 10.46 | $2.60 | $4.90 | $5.56 | $6,499,607.48 | $6,429,473.87 | 72,602,594.99 |

| Jan 2023 | $6.99 | 10.47 | $2.55 | $4.90 | $5.57 | $6,503,696.32 | $6,429,157.71 | 79,031,752.71 |

| Feb 2023 | $6.99 | 10.47 | $2.25 | $4.60 | $5.87 | $6,105,789.54 | $6,031,720.03 | 85,063,472.74 |

| Mar 2023 | $5.84 | 10.02 | $1.90 | $4.72 | $5.30 | $6,256,749.56 | $6,176,659.14 | 91,240,131.88 |

| Apr 2023 | $6.24 | 7.69 | $1.33 | $2.32 | $5.37 | $3,076,412.12 | $3,034,973.44 | 94,275,105.32 |

| May 2023 | $6.24 | 7.315 | $1.33 | $2.07 | $5.25 | $2,743,165.19 | $2,704,380.91 | 96,979,486.23 |

| Jun 2023 | $6.45 | 7.09 | $1.33 | $1.78 | $5.31 | $2,358,656.86 | $2,323,732.79 | 99,303,219.02 |

| Jul 2023 | $7.96 | 7.09 | $1.33 | $1.21 | $6.32 | $1,602,242.47 | $1,577,448.46 | 100,880,667.48 |

| Aug 2023 | $7.96 | 7.165 | $1.33 | $1.22 | $6.34 | $1,619,153.51 | $1,593,017.27 | 102,473,684.75 |

| Sep 2023 | $7.60 | 7.24 | $1.33 | $1.29 | $6.13 | $1,715,383.45 | $1,686,549.90 | 104,160,234.65 |

| Oct 2023 | $5.99 | 7.525 | $1.33 | $2.37 | $5.15 | $3,148,968.10 | $3,093,939.08 | 107,254,173.73 |

| Nov 2023 | $5.70 | 7.775 | $1.33 | $2.74 | $5.03 | $3,634,802.79 | $3,568,862.93 | 110,823,036.66 |

| Dec 2023 | $5.52 | 8.325 | $1.33 | $3.23 | $5.10 | $4,280,119.05 | $4,199,623.76 | 115,022,660.42 |

| Jan 2024 | $5.52 | 8.86 | $1.33 | $3.59 | $5.27 | $4,755,551.34 | $4,662,951.83 | 119,685,612.25 |

| Feb 2024 | $5.58 | 8.86 | $1.33 | $3.55 | $5.31 | $4,706,113.20 | $4,611,348.48 | 124,296,960.73 |

| Mar 2024 | $5.64 | 8.46 | $1.33 | $3.24 | $5.22 | $4,297,091.82 | $4,207,709.29 | 128,504,670.02 |

| Apr 2024 | $5.81 | 6.67 | $1.33 | $1.92 | $4.75 | $2,549,839.05 | $2,495,108.18 | 130,999,778.20 |

| May 2024 | $6.01 | 6.34 | $1.33 | $1.57 | $4.77 | $2,079,428.42 | $2,033,415.40 | 133,033,193.59 |

| Jun 2024 | $6.45 | 6.14 | $1.33 | $1.30 | $5.00 | $1,721,793.47 | $1,682,552.82 | 134,715,746.41 |

| Jul 2024 | $6.32 | 6.14 | $1.33 | $1.32 | $4.91 | $1,750,636.71 | $1,709,579.10 | 136,425,325.52 |

| Aug 2024 | $6.25 | 6.21 | $1.33 | $1.34 | $4.89 | $1,782,740.59 | $1,739,749.98 | 138,165,075.50 |

| Sep 2024 | $6.07 | 6.275 | $1.33 | $1.49 | $4.79 | $1,971,835.62 | $1,922,980.66 | 140,088,056.16 |

| Oct 2024 | $5.91 | 6.475 | $1.33 | $1.73 | $4.74 | $2,295,304.07 | $2,236,917.43 | 142,324,973.59 |

| Nov 2024 | $5.85 | 6.695 | $1.33 | $1.91 | $4.78 | $2,537,707.62 | $2,471,478.46 | 144,796,452.05 |

| Dec 2024 | $5.82 | 7.18 | $1.33 | $2.26 | $4.92 | $2,999,293.66 | $2,919,038.04 | 147,715,490.09 |

| Jan 2025 | $5.79 | 8.545 | $1.33 | $3.19 | $5.35 | $4,232,325.74 | $4,116,284.37 | 151,831,774.46 |

| Feb 2025 | $5.77 | 8.545 | $1.33 | $3.21 | $5.34 | $4,254,334.65 | $4,134,885.16 | 155,966,659.62 |

| Mar 2025 | $5.74 | 8.16 | $1.33 | $2.97 | $5.19 | $3,939,357.78 | $3,826,156.66 | 159,792,816.28 |

| Apr 2025 | $5.70 | 6.435 | $1.33 | $1.84 | $4.60 | $2,438,657.94 | $2,366,975.32 | 162,159,791.60 |

| May 2025 | $5.65 | 6.115 | $1.33 | $1.66 | $4.46 | $2,200,938.97 | $2,134,795.90 | 164,294,587.50 |

| Jun 2025 | $5.58 | 5.925 | $1.33 | $1.58 | $4.35 | $2,093,762.25 | $2,029,463.50 | 166,324,051.00 |

| Jul 2025 | $5.47 | 5.925 | $1.33 | $1.65 | $4.28 | $2,188,174.70 | $2,119,538.90 | 168,443,589.90 |

| Aug 2025 | $5.88 | 5.985 | $1.33 | $1.42 | $4.56 | $1,885,220.22 | $1,824,849.31 | 170,268,439.21 |

| Sep 2025 | $5.83 | 6.05 | $1.33 | $1.50 | $4.55 | $1,983,162.63 | $1,918,354.07 | 172,186,793.28 |

| Oct 2025 | $5.68 | 6.24 | $1.33 | $1.72 | $4.52 | $2,286,344.05 | $2,210,128.58 | 174,396,921.86 |

| Nov 2025 | $5.50 | 6.455 | $1.33 | $1.98 | $4.47 | $2,632,171.28 | $2,542,702.92 | 176,939,624.78 |

| Dec 2025 | $5.33 | 6.925 | $1.33 | $2.41 | $4.51 | $3,199,519.87 | $3,088,672.11 | 180,028,296.89 |

| Jan 2026 | $5.29 | 8.545 | $1.33 | $3.53 | $5.02 | $4,676,404.98 | $4,511,330.32 | 184,539,627.21 |

| Feb 2026 | $5.28 | 8.545 | $1.33 | $3.54 | $5.01 | $4,689,649.36 | $4,521,040.58 | 189,060,667.79 |

| Mar 2026 | $5.29 | 8.16 | $1.33 | $3.27 | $4.89 | $4,332,977.52 | $4,174,360.85 | 193,235,028.63 |

| Apr 2026 | $5.33 | 6.435 | $1.33 | $2.08 | $4.35 | $2,764,056.21 | $2,661,067.81 | 195,896,096.44 |

| May 2026 | $5.40 | 6.115 | $1.33 | $1.83 | $4.29 | $2,421,926.05 | $2,330,104.87 | 198,226,201.31 |

| Jun 2026 | $5.49 | 5.925 | $1.33 | $1.64 | $4.28 | $2,175,543.99 | $2,091,645.01 | 200,317,846.32 |

| Jul 2026 | $5.61 | 5.925 | $1.33 | $1.56 | $4.37 | $2,065,742.79 | $1,984,732.01 | 202,302,578.34 |

| Aug 2026 | $5.81 | 5.985 | $1.33 | $1.47 | $4.52 | $1,944,780.99 | $1,867,247.33 | 204,169,825.67 |

| Sep 2026 | $5.54 | 6.05 | $1.33 | $1.69 | $4.36 | $2,236,624.22 | $2,145,999.86 | 206,315,825.53 |

| Oct 2026 | $5.50 | 6.24 | $1.33 | $1.84 | $4.40 | $2,443,778.77 | $2,343,171.48 | 208,658,997.01 |

| Nov 2026 | $5.36 | 6.455 | $1.33 | $2.08 | $4.37 | $2,762,773.89 | $2,647,238.37 | 211,306,235.38 |

| Dec 2026 | $5.19 | 6.925 | $1.33 | $2.51 | $4.42 | $3,327,549.28 | $3,186,234.38 |

-The Driftwood 22 DISCLOSURE Project

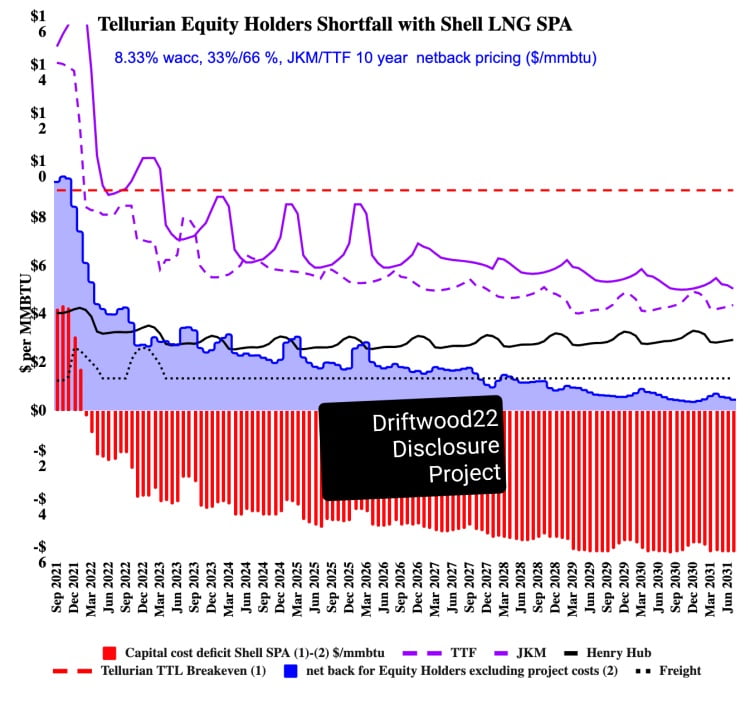

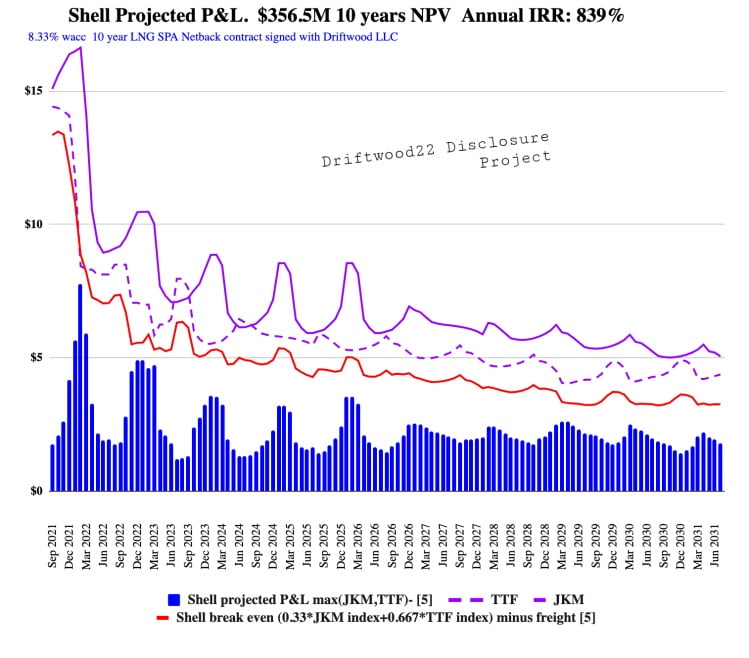

Shell NA LLC doesn’t make any overvalued investment in the Tellurian equity model, their only initial outlay is a minor lawyer fee plus doesn’t pay any a fixed tolling fee. Their obligation is strickly limited to pay a floating price of the JKM and TTF index and it’s Tellurian paying them the freight net to the gulf coast.

-The Driftwood 22 DISCLOSURE Project

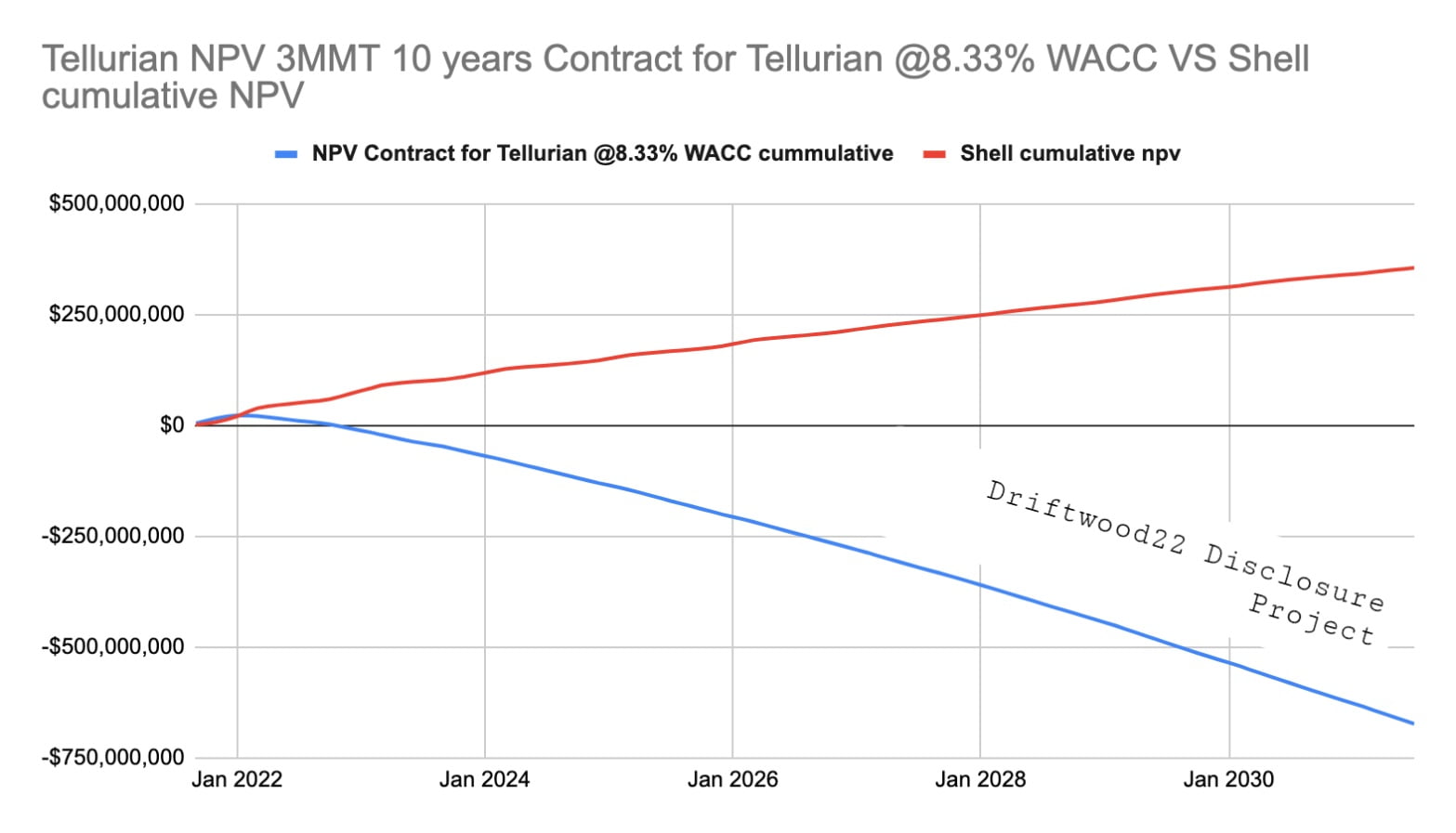

At the current market inputs Shell’s long netback buyer is accretive at a positive NPV of $356.5M on 10-years.

Tellurian Losses vs Shell Profits

Shell position is the inverse of the Tellurian’s seller side.

Tellurian stands to lose –672M while Shell stands to win $356.5.

The primary reason is that Shell is excluded from the Tellurian capital cost/opex equation while Tellurian must pay the costs of building and operating its Driftwood (the gas fields, the pipelines, liquifaction plants, storage tanks, marine terminals).

The other aggravating reason is that Tellurian is at a deep loss is that it does not charge any fixed tolling fee to Shell in the formula, which is yet a standard in export financing.

Furthermore, it is also in line with the other two LNG SP&A signed with Gunvor and Vitol (6MMT on 10 years) without a tolling fee or an equity investment backup…

Tellurian does not intend to return its capital.

Accounting for all the contracts signed by Tellurian, Driftwood lng phase 1 has a projected net asset value of -$2,77B for a total cost of $12.06B.

In the last two months Octavio Simoes of Tellurian has signed LNG SPAs for a total of -$6.76 nav/share which is in line with our -6.72 free-cash flows per share estimate published on June 21th.

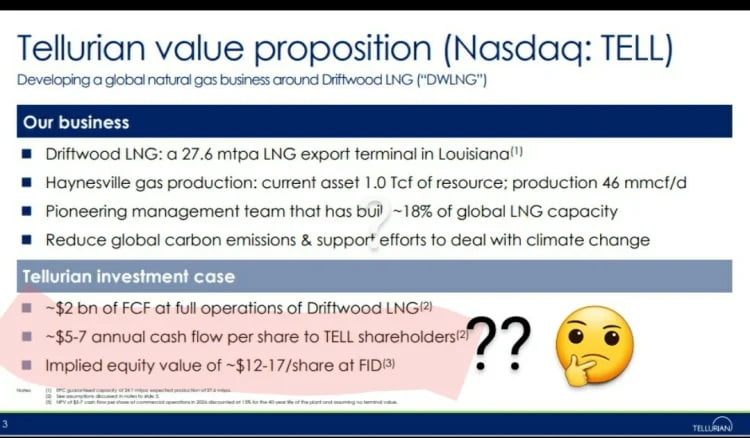

Under the maths proposed to their investors, Tellurian is “a global natural gas business” producing $5-7 of annual cash-flows (per year).

9MMT of contracts signed at a loss doesn’t seem an effective strategy to get a start. Which banks would participate and underwrite bonds in their gimmickry ?

Tellurian is in a process in which they are forced to reveal that their annual $5-7 annual cash flow per share was a patent lie.

If Tellurian signs contracts at a loss, all other things being equal, what must go lower ?

Since our first disclosure on Value Walk hedge fund letters on June 1st, the company share price has dropped by 27%.

We had the economics right and now the market has turned in our favor.

What’s the point of fronting money to Tellurian if the company is going under even before its first shovel in the ground ?

The insight we know is that these contracts will bleed them.

Based on their actions, do they really think they are going to build or just raise a little more money and play a game pretending to do so ? We will let the reputed analysts answer this final question…

Article by The Driftwood 22 DISCLOSURE Project

Disclaimer

The author may have short position in stock.