Tellurian Inc (NASDAQ:TELL) schedules things; one, two, three pipelines make the news then de-schedule them.

Q2 2021 hedge fund letters, conferences and more

Tellurian Wants To Move A Rock Pile

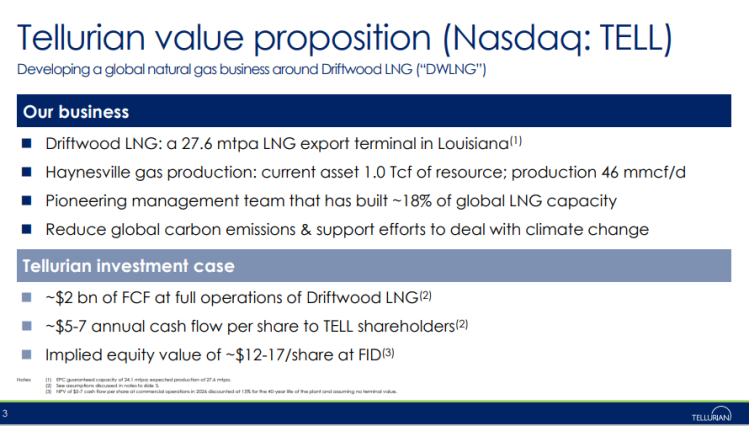

Tellurian has been selling Driftwood FID since 2017, promising billions of dollars in future free cash-flows. Yet Tellurian inc has experienced losses and the equity partners have quit one by one and Driftwood.

Now the Tellurian wants to move a rock pile, asks the State of Lousiana to enlarge an highway to possibly “accomodate more than 5000 workers”.

Tellurian can’t address any of our questions on Driftwood’s costs.

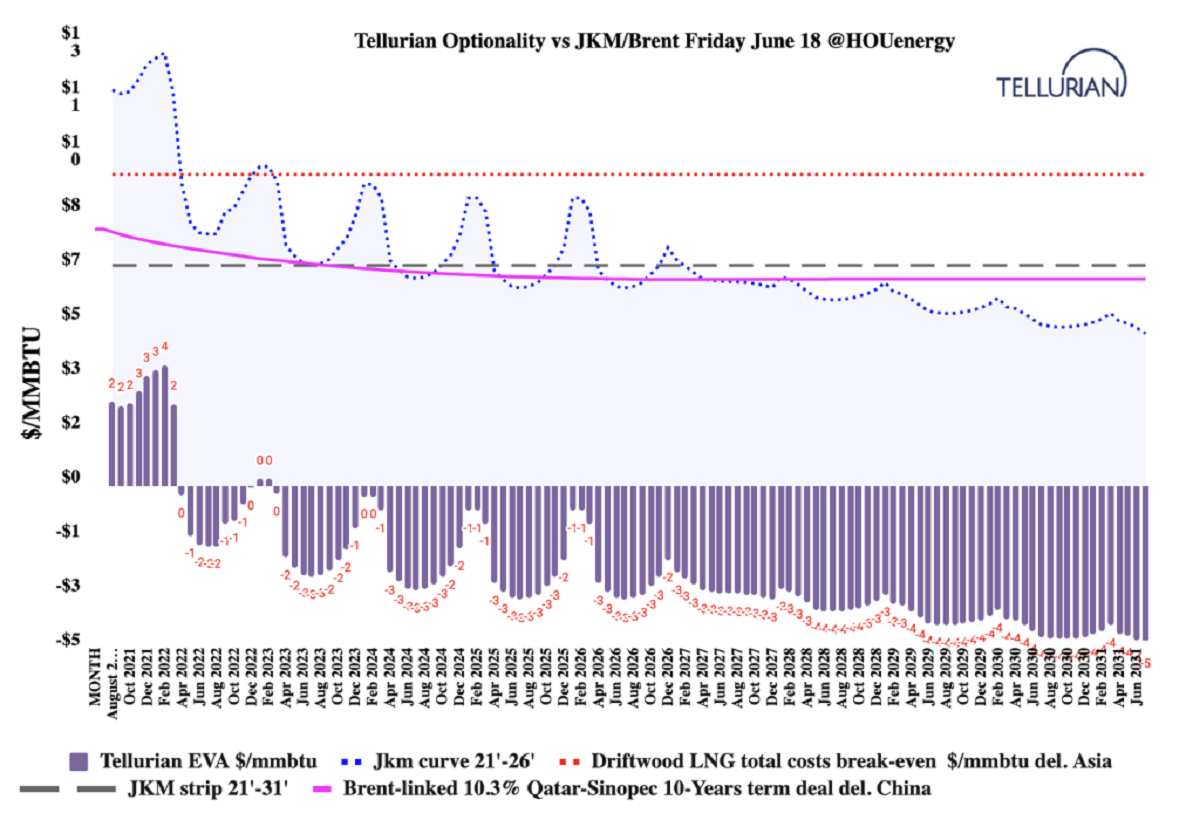

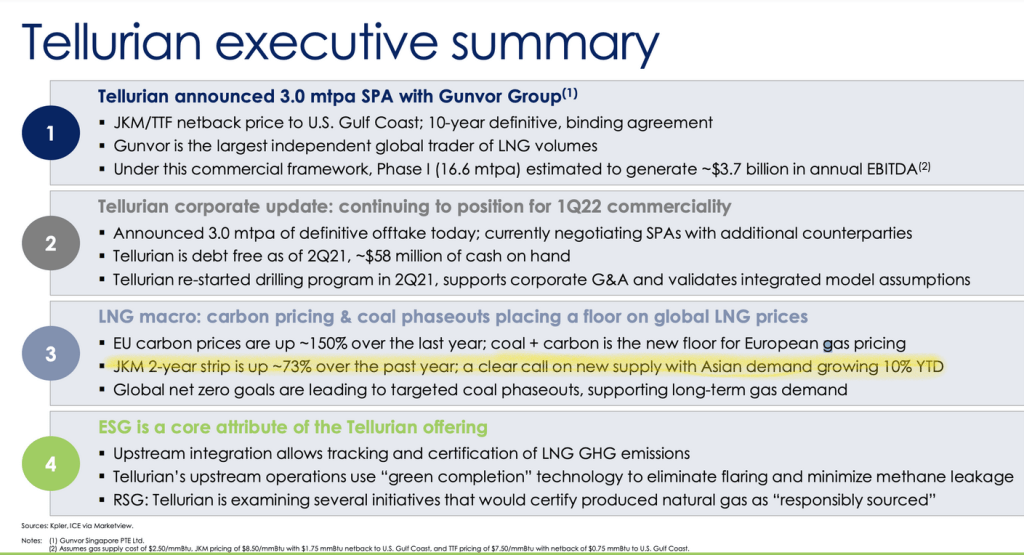

- Tellurian makes bold statements on the LNG market (while only taking into account 2 yrs of the curve.

The only slide pertaining to Tellurian’s financials is kept vague.

- How can Driftwood produce positive cash flows when the SPAs signed with Vitol and Gunvor are non on a 10 years basis ?

- Our calculation show that Tellurian has signed netback contracts below Driftwood’s break-even production cost.

- It has not announced any equity partners that can fill he void left by TOTAL and Petronet.

- Have they secured the debt financing ?

Tellurian continues to expect to give Bechtel a notice to proceed with full construction of the terminal by the end of the first quarter of next year, Souki said.

Sales And Purchase Agreements

After a two-year lull in firm commercial activity, Tellurian signed sales and purchase agreements — a week apart in late May and early June — with commodity traders Gunvor and Vitol for a combined 6 million mt/year of Driftwood supplies. Each of the deals cover a 10-year period, with the supply indexed to a combination of the Platts JKM and Dutch TTF, netted back for transportation charges. The LNG would be delivered on a free-on-board basis from Driftwood*

Tellurian’s only other firm commercial deal tied to Driftwood that has been announced to date is a 2019 agreement with France’s Total that covers 1 million mt/year of partner volumes and 1.5 million mt/year of marketing volumes. Total can back out of its Driftwood commitments if Tellurian does not declare a final investment decision by the end of June.

Souki told S&P Global Platts in May that the Total agreement is “not going forward in the present form”.

In an interview with Platts in March, Tellurian CEO Octávio Simões said the company planned to produce all the natural gas it will need to feed Driftwood and would not sanction the project until it had secured sufficient upstream reserves for the first phase.

In a typical Tellurian’s Renee Pirrong IR fashion, Tell announces news that have nothing new.

Tellurian Extends Driftwood Lease

It is well explained by the Houston Chronicle’s “Tellurian extends Driftwood lease, forges ahead as natural gas deficit swells.”

Tellurian has submitted no SEC filing because it was not a news; the long-term lease signed announcement with the Port of Lake Charles was only an extension of a previously signed agreement by Driftwood LNG LLC on 20 years.

Tellurian does everything without proceeding to the Driftwood EPC (engineering, procurement and construction) and we believe there is one simple reason to delay the project: Driftwood EPC is a loss-making value destroyer in 2022.

Tellurian maintains a total silence on their costs that have barely changed since 2017… In The Ugly Truth on Tellurian Driftwood LNG Economics and break-even costs we have updated Driftwood (2016) FID costs in 2022 terms.

Tellurian financial base is very superficial. Greenfield ideas popped almost each and every week. Now the plan is to continue entertaining some fluffs about drilling to investors on the summer, since it cannot proceed the Driftwood LNG project FID.

Tellurian is a circus. As a commercial/marketing organization they get smoked day/night. Company brags about having the combined experience in LNG and yet has burned cash money every single quarter and in every type of natural gas market possible. It has engaged in gas production before but the fact is that it was far from a success. –Houston Energy Analyst

It is a proof that they can’t call or control anything about LNG or even in the U.S Natural Gas Markets.

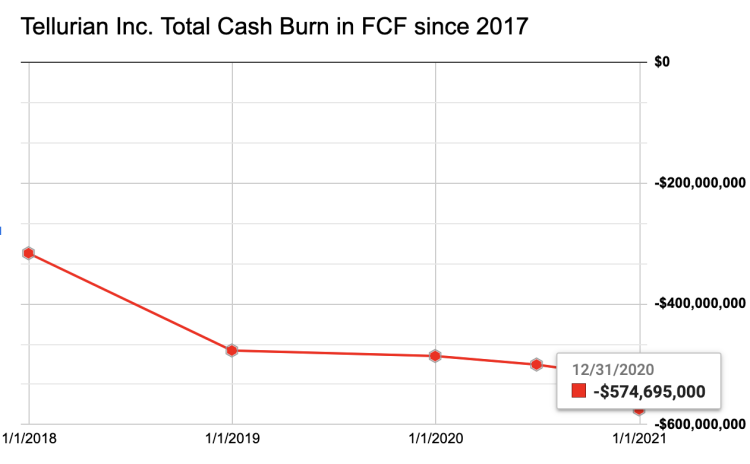

By H2021 we project that Tellurian inc will have spent more than $574,000,000 in the LNG fluff IR scheme.

The new round of Management executives are billing expenses and printing shares bonuses.

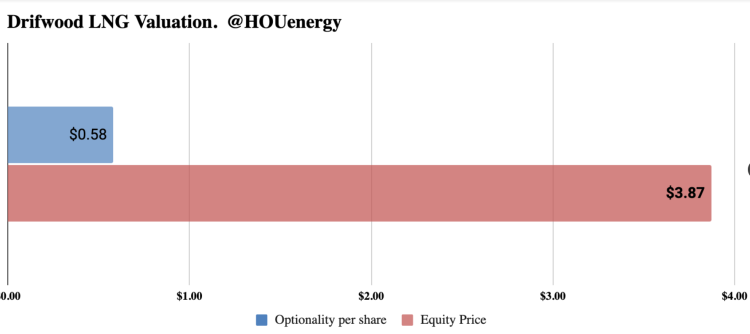

Investors are cautioned that Driftwood profitability is 95% overstated by Tellurian. We caught them.

Blue Collars should be waiting for them with the baseball bats.

The developer of the proposed Goldboro LNG project has missed a deadline to sanction the project June 30.,“Cost pressures and time constraints due to Covid-19 have made building the current version of the LNG project impractical.”

https://www.halifaxexaminer.ca/featured/the-goldboro-lng-plant-scheme-has-collapsed/

While Pieridae has made tremendous progress in advancing the Goldboro LNG Project, as of June 30, 2021, we have not been able to meet all of the key conditions necessary to make a final investment decision.

That said, it became apparent that cost pressures and time constraints due to COVID-19 have made building the current version of the LNG Project impractical.

“We will now assess options and analyze strategic alternatives that could make an LNG Project more compatible with the current environment. In addition, the Company will continue its work to further optimize the operation and development of our extensive Foothills resources and midstream assets, including our carbon capture and sequestration and blue power development”

Alfred Sorensen, Chief Executive Officer, Pieridae Energy.

Goldboro LNG unlike Tellurian Inc is a private company so can say the plain truth. They are unable to finance and they are unable to meet all of the key conditions necessary to make a final investment decision (FID) on their 10 MPTA project like Driftwood LNG.

Goldboro can’t secure financing but are not forced to tell equity investors enormities unlike some U.S promoters doing 2 minutes video capsules from their posh chalet in Colorado.

The management continues the smoke show while being incapable to commit Tellurian in a EPC final decision on Driftwood LNG.

- Driftwood costs are misrepresented by 50% to 70% by Tellurian inc.

- It makes the contracts signed with Gunvor and Vitol highly questionable.

They are the next LNG project collapse.

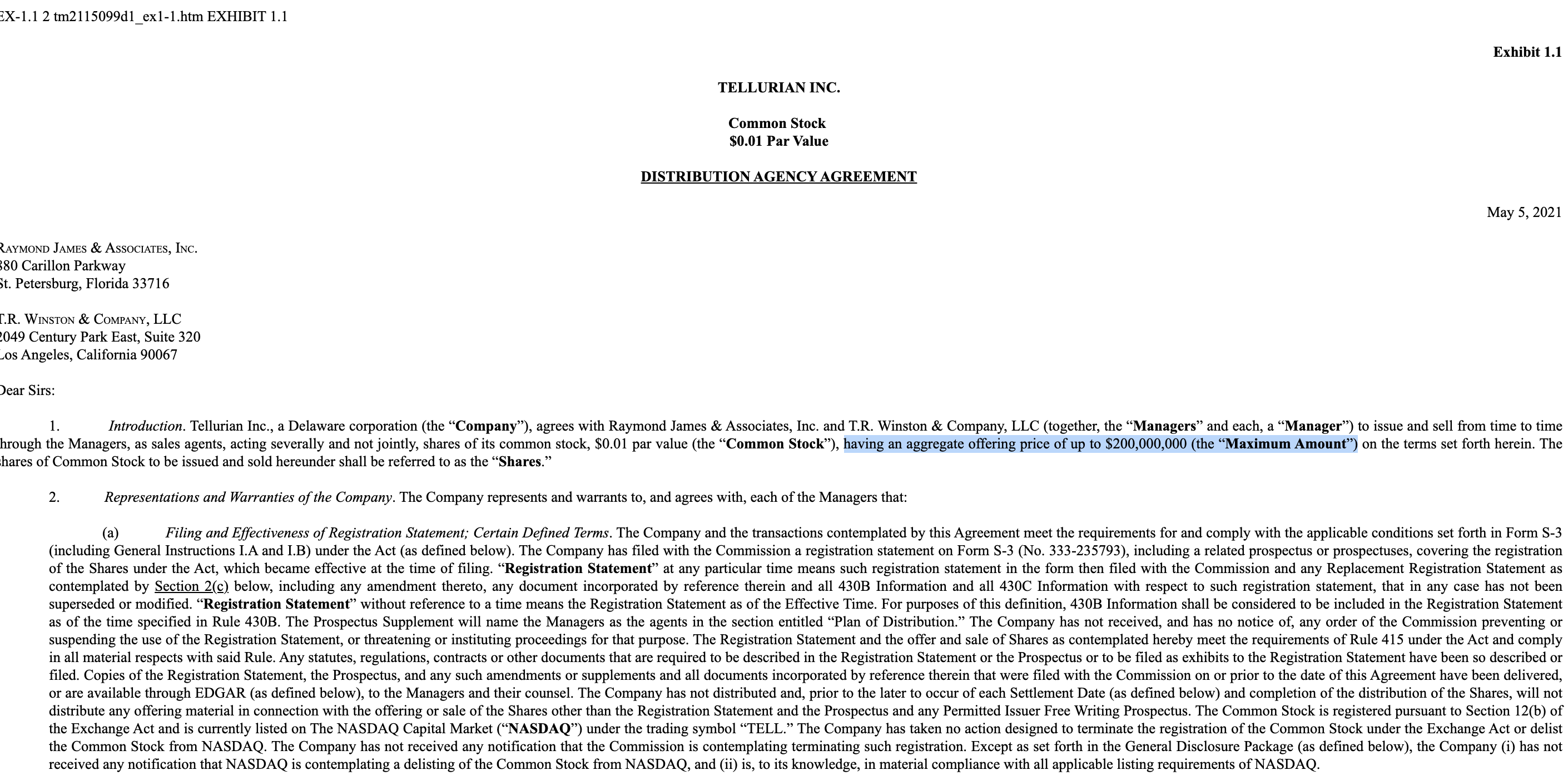

May 5, 2021 – 8-K: Current report document1.01 – Entry into a Material Definitive Agreement

They want us to leave them alone but their version of Tellurian building Driftwood is untrue.

Its Management plays investors. It does not do real things but talks to raise money.

Now it wants to raise $200M. It’s 18 months of money showers. A recent SEC filling seen by the Driftwood 22 Disclosure Project indicates Tellurian’s intentions to raise up to $200M with Raymond James & Associates.

“Moving rock piles from one place to another”.

Let’s see who is RIGHT. We have performed Tellurian’s sensibility to the volatility/price scenarios and view a gap between equity-driven expectations and commercial value by more than 8X…