In truth, Tellurian Inc (NYMARKET:TELL) was flimflam and Driftwood LNG has never been a commercial grade project.

Q3 2021 hedge fund letters, conferences and more

The investors who have trust and have put thousands of their life savings in Tellurian will get emotionally abused and hurt financially.

In Tellurian Missing LNG Cargo? We have explained to you that Tellurian inc has contracted an obligation of $105M under the carpet. It’s because Tellurian is under a long term SPA contract which obligates the company to buy one cargo each quarter (delivered on ship) based on then-prevailing JKM prices.

Now Tellurian is announcing a $200m equity raising– we believe- to cover this non-identified liability.

Tellurian also places a $200M bond with a 9.13% ytc (yield to call) in 2024 with B. Riley securities but the company burns $100M per year cannot pay back the bond in other way then by selling stock pieces of their mud cake.

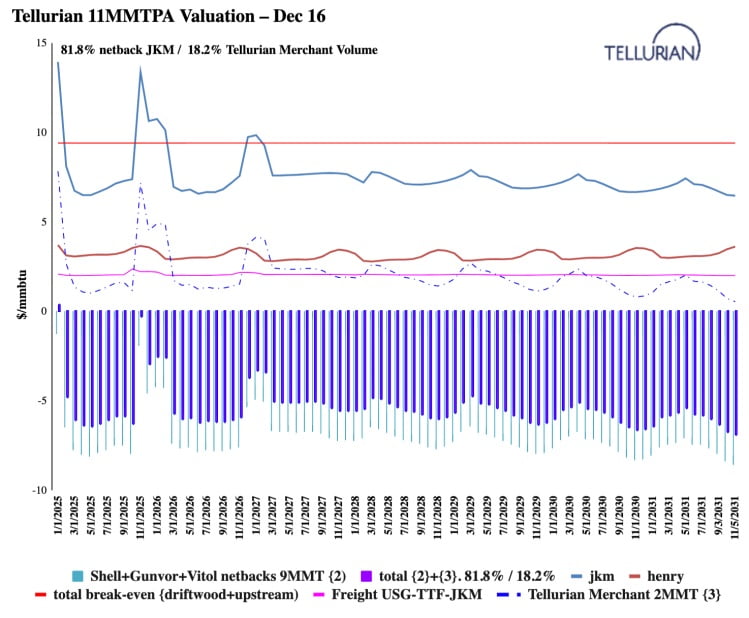

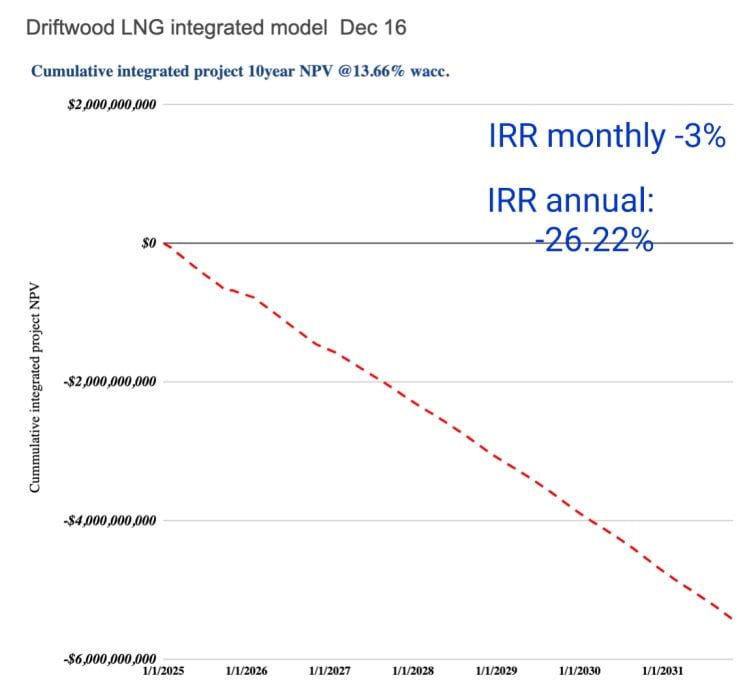

Valuation for a Tellurian delivering a FID notice in Q4-2021 and a terminal in Q1-2025

Run your spreadsheets with the contracts signed and the Driftwood timeline. Souki’s project IRR (internal rate of return) is negative.

Cumulative net project cash-flows for a Tellurian delivering a FID notice in Q4-2021 and a terminal in Q1-2025 indicate -26.22% annual internal return.

Something we can’t really explain is how a Platts, Argus or Natural Intel that we pay thousand in subscription fees can’t DO THEIR INVESTIGATIVE JOB and choose to not illuminate the investors by continuing to give attention to the mudcake).

The numbers presented by the company have been hugely exaggerated and sometimes blatantly falsified.

“Mudcake”

In this context Octavio Simoes Tellurian $200M equity raising with TW Winton Co is an orchestrated short on their investors.

Marking a mud cake: Sastha loger, youtube

The Scorpion bites.

In this maneuver, the pricing is pre-negotiated between shady counterparties, off the exchange.

The $0.01 common shares are being printed and the equity risk (difference between price issue and the market) is 100% liquidated in the open market.

The common shareholders are fully stomaching their losses and learn the painful lesson.

You just hope that they won’t go for the full $200M: The last equity raising has netted only $100.80M for a market cap. drop of more than $633M.

We provide you this convenience table:

| Equity amount raise in $M | Market Cap impact | Implied share price |

| $45 | -282M | $2.25 |

| $60 | -460M | $2.00 |

| $105 | –633M | $1.50 |

Even before this dilution, Tellurian is attracting the attention of the authorities.

Tellurian faces the significant risk of a delisting.

Article by The Driftwood 22 DISCLOSURE Project

Disclaimer

The author may have short position in stock.