The age of irrational exuberance termed by Alan Greenspan has been replaced by the age of Idiocy. Souki could be a case at the HBS and how could investors not see him coming?

Q2 2021 hedge fund letters, conferences and more

Tellurian Follows The Same Pattern As Enron

Tellurian Inc (NASDAQ:TELL) is bleeding red but follows the same pattern as Enron: costs, commodity contracts, financing, cash-flows, everything is fake and been falsified on a forward-basis.

In the last 3 months Octavio Simoes has been caught and Tellurian has been forced to reveal that they are technically under. The reason is that their project is not financeable.

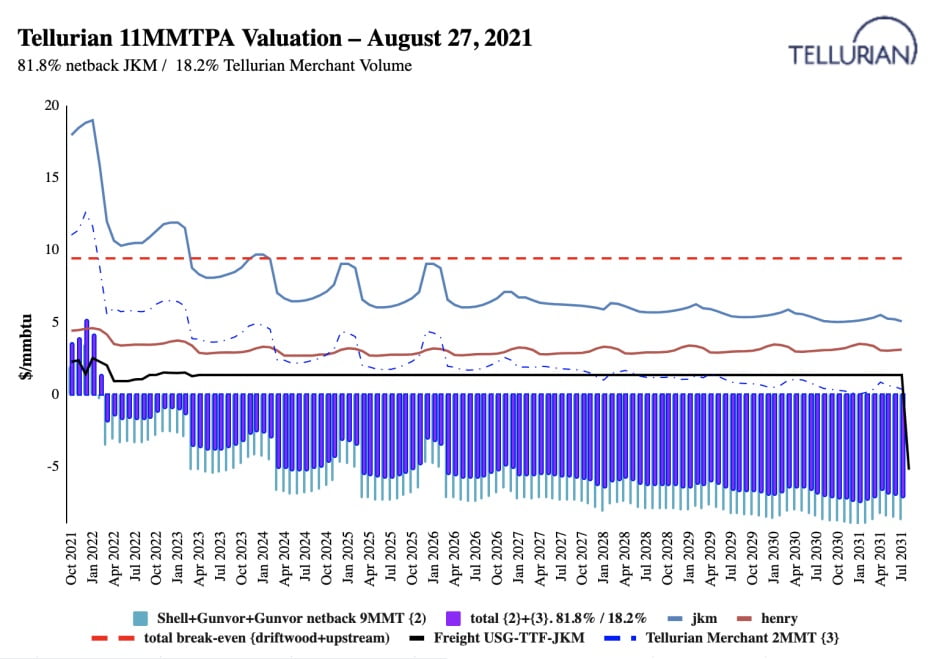

Evaluation of the contracts signed by Tellurian at the current market inputs.

They have signed LNG SP&A contracts at a deep economic loss with Gunvor, Vitol and Shell but Tellurian has chosen the sleazy way.

To present Driftwood LNG to the investors they use a 1 year curve to assess lng contracts signed on 10 years and this resulted also in fake cash flows figures, which Charif Souki is still trying to bamboozle gullible BBG journalists as investment in a LNG terminal construction.

Group seeking the expose the Truth on Driftwood LNG false accounting and misrepresentations to the investors

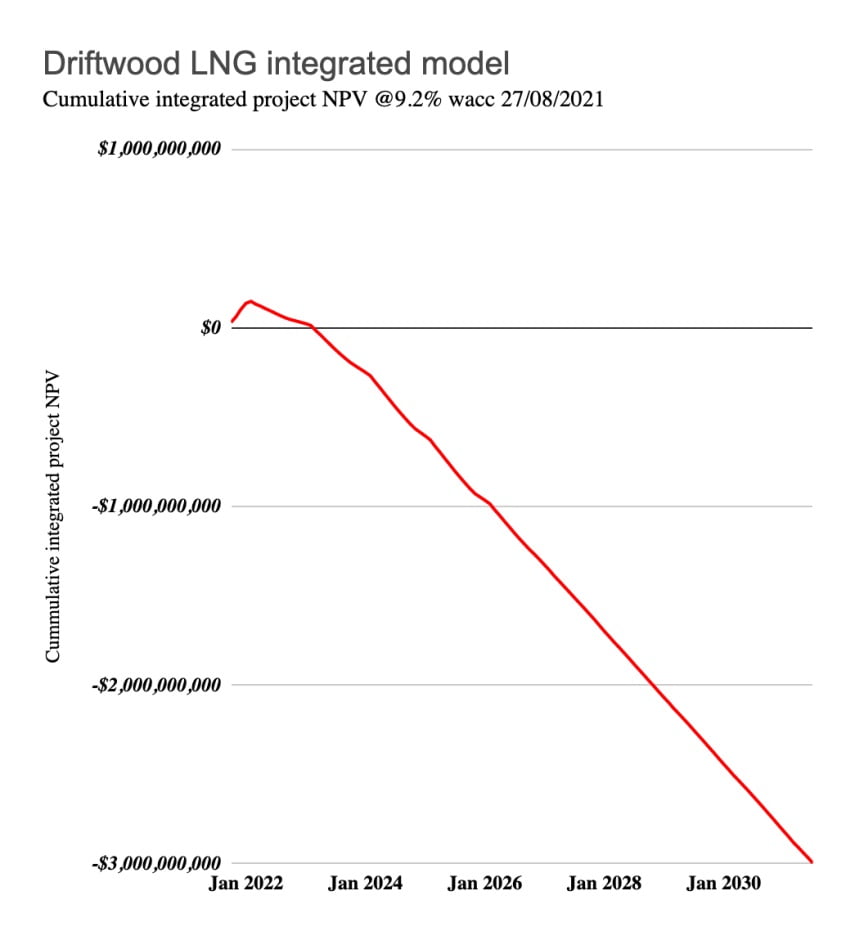

Tellurian inc has understated both its Driftwood LNG CAPEX and cost of capital (WACC).

-The recent equity raising by Tellurian suggests a cost of equity of 40%.

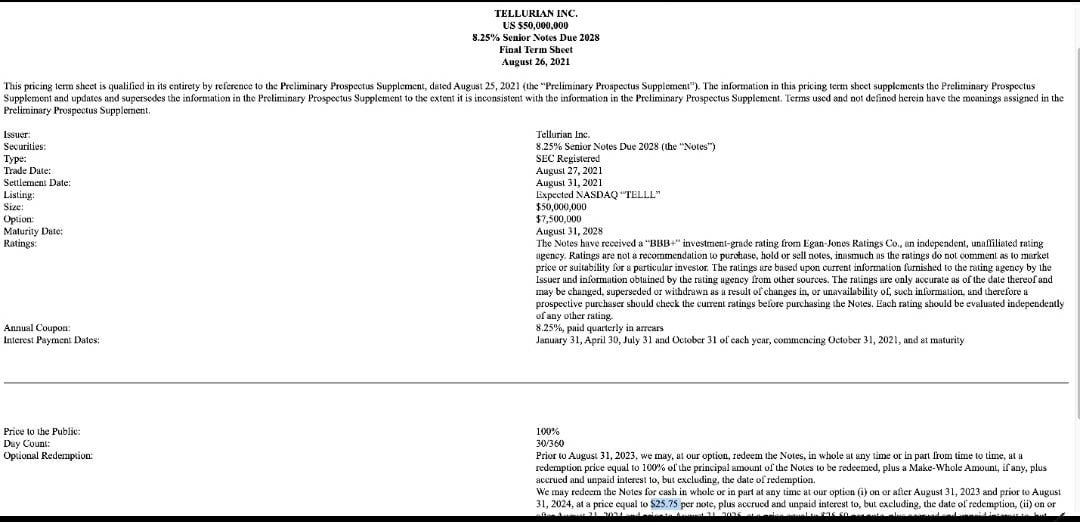

Tellurian Announces Pricing of Public Offering of Senior Notes

Bond Offering

Credit markets are often better than equity markets at gauging the probability of default, financing capacity and the general odds of success of a company. At least with the debt, the dilution is paid in full.

The credit market has chided Tellurian, so much that Tellurian IR had to break the announcement in two parts; first releasing Tellurian Announces Public Offering of Senior Notes on August 25, 2021 and then releasing the same exact news with the Pricing of Public Offering of Senior Notes 24 hours after.

The callable notes have been priced at 33.99% YTC (yield to call) or at a 16.9428% effective annual interest rate.

It means that below 34% return no one was ready to underwrite debt to Tellurian.

At 30% recovery rate* the market prices a 48.56% 2-year probability of default on Tellurian.

Credit Spread (bond) = (1 – RR) * (Default Probability)

We now know Tellurian’s WACC in the real world. At a 80/20 debt equity, Tellurian most recent cost of capital is 21.55% which is +72% higher than in the Tellurian Corporate Tellurian

At a 33,99% yield to call the recent note looks to us more like a cash-transfer than a borrowing.

Tellurian inc is out of merit for a merger.

Souki’s team inflated their Driftwood project profitability by a factor of 17X. Tellurian is not credible in natural gas business and it would dilute any acquired company

In Going For The Gold Like Enron, we have showcased the discrepancy between the upstream assets pricing in the Haynesville at the current market inputs vs Tellurian cost presentations (and its FP&A omissions).

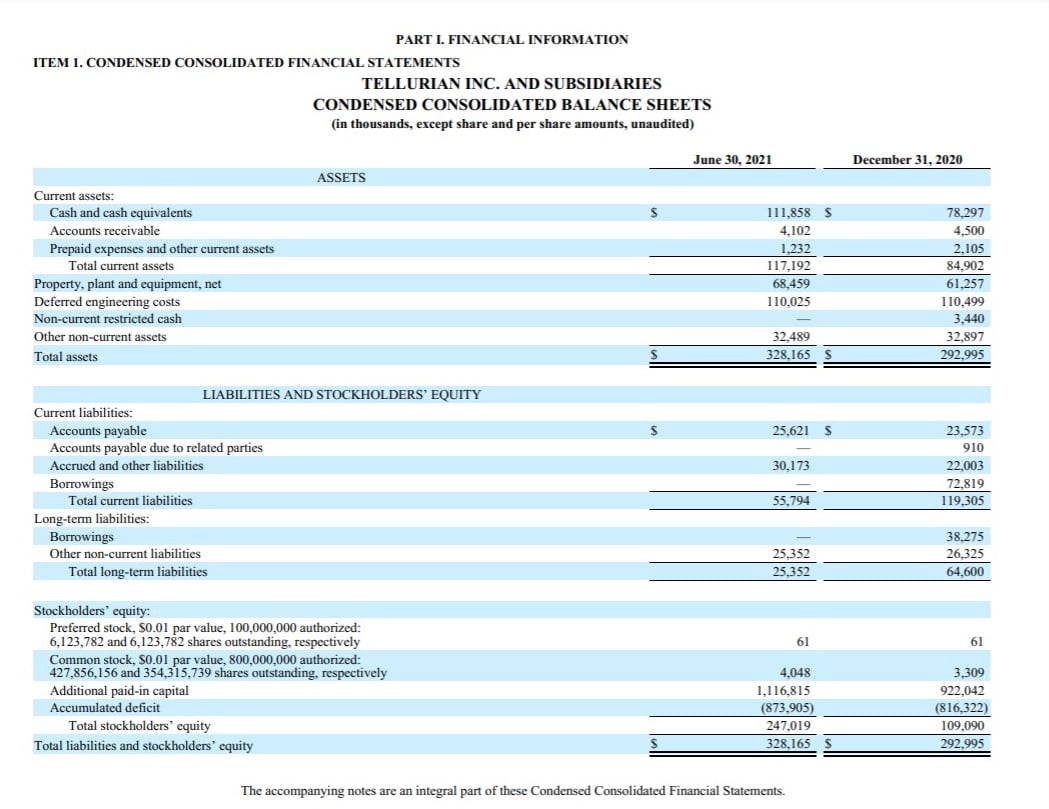

Balance-Sheet H1-2021

At 22.55% wacc and with negative cash-flows Tellurian has legibly no capacity to finance its existing commercial agreements. Therefore it will not tender the FID (Final investment decision) to Bechtel for Driftwood LNG.

***

Driftwood LNG is a cost-center made for and paid by the investors.

Tellurian has $112M in cash.

The $110M capitalized under assets-deferred engineering costs cannot be financed so has no resale-value. Therefore it is not an asset and it has to be written-off.

As of June 30, 2021 Tellurian net worth is $187M when we subtract the debt from the balance-sheet.

+$100.80M equity raising

+50M note issuance.

minus $66.95M (total debt plus interest to redeem in 2023)

minus $100M times 2 years of corporate expenses by the suits.

Tellurian liquidity headroom is -130M in 2023

***

All it wants is to entertain surfacey talks about acquisitions in order to maintain its share price long enough to raise more equity and pay the $100M average annual expenses and fees that they charge to the company to maintain their seats.

“The Company intends to use the net proceeds from this offering for general corporate purposes, including the potential acquisition of upstream assets.“

Tellurian in its bond offering doesn’t mention its off-balance sheets liabilities.

“Executing the plan“

KIAN GRANMAYEH CFO has a juicy executive bonus plan to execute: As of June 30, 2021, unrecognized compensation expenses, based on the grant date fair value, for all share-based awards totaled approximately $201.3M… “It sounds like a plan”.

- Tellurian has announced their LNG netbacks contracts and one by one they were losers.

- Tellurian is bleeding red but follows the same pattern as Enron: costs, commodity contracts financing, cash-flows, everything is fake and been falsified on a forward-basis.

- If Driftwood had to be built the loss would be more than-$6.72 per share.

Souki and the captains playing in the Tellurian litter (Big TEAGUE Keith, Khaled Sharafeldin, Martin Houston, Siddharth ROY, Jean Abiteboul, Diana Derycz, Daniel Belhumeur, GRANMAYEH KIAN and Octavio Simoes are now on a rogue mode.

Since our first disclosure on Value Walk hedge fund letters on June 1st, the company share price has declined -38% and we predict that at the FT pundits will get interested in Charif Souki’s dealings once the market reaches a -50% threshold.

Article by The Driftwood 22 DISCLOSURE Project

Disclaimer

The author may have short position in stock.