According to a newly released analysis from S&P Global Market Intelligence, the total value of tech and telecom transactions announced around the plague-ravaged world in 2020 topped $602bn, according to 451 Research’s M&A KnowledgeBase.

Q3 2020 hedge fund letters, conferences and more

Thank you in advance for citing "451 Research, part of S&P Global Market Intelligence, should you choose to use any of this information in your reporting. If you have word count limitations, "451 Research, S&P Global Market Intelligence" works too.

451 Research is the enterprise and emerging technology research group of S&P Global Market Intelligence and was acquired by the division in December 2019.

S&P Tech M&A: A Record No One Saw Coming

By Brenon Daly

January 7, 2021

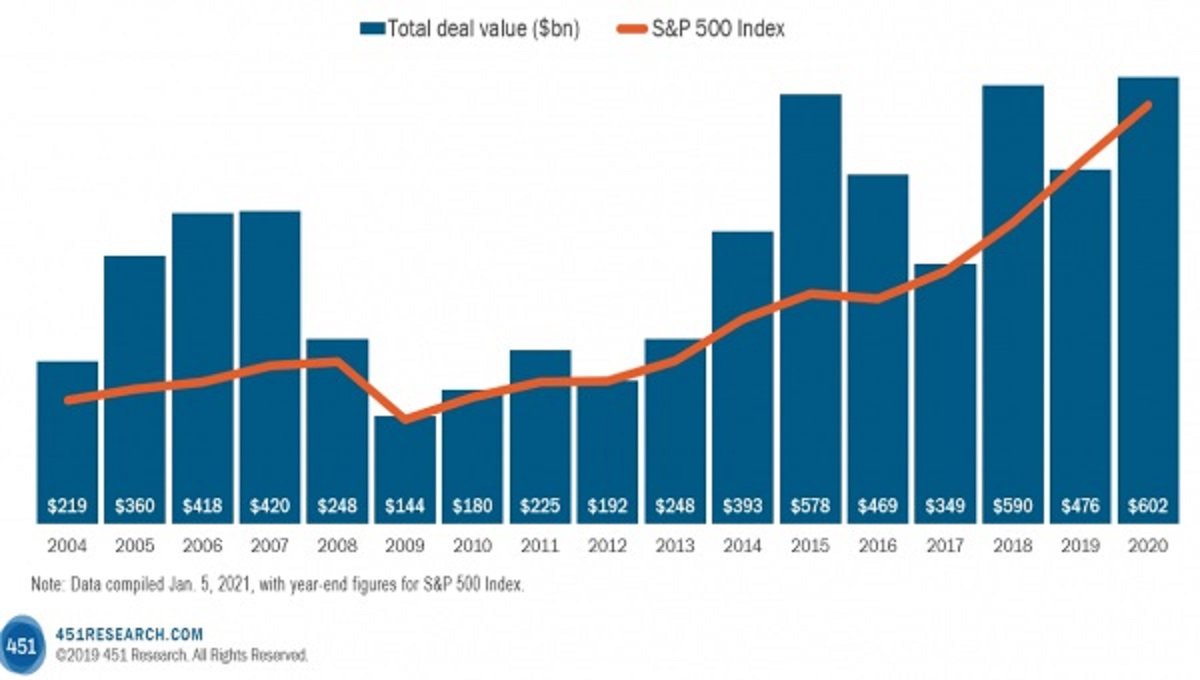

In a year dominated by a global health emergency that no one saw coming, 2020 also notched a record that virtually no one saw coming: Tech M&A spending last year soared to its highest level since the dot-com collapse. Astonishingly, almost impossibly, the total value of tech and telecom transactions announced around the plague-ravaged world in 2020 topped $602bn, according to 451 Research's M&A KnowledgeBase.

Last year's record performance came in a historically abrupt boom-bust cycle. A recession-led decline that typically grinds lower for years only knocked dealmakers out of the market for a few months in 2020. By summer, acquirers' pent-up demand -- combined with Wall Street's confidence in the tech sector to thrive, not just survive, during the pandemic – flooded into the tech M&A market:

- After spending on acquisitions in Q2 dropped to its lowest quarterly level in a decade, the average totals for both Q3 and Q4 came in more than six times higher than spring's slump, according to the M&A KnowledgeBase.

- Deal volume also picked up dramatically in the back half of the year, our data indicates. Acquirers in both the fall and winter quarters announced 40% more transactions than Q2, helping to make 2020 the busiest overall year for tech deals since 2016.

The against-the-odds recovery in tech M&A even outpaced the stunning bull market rebound on Wall Street. (On a total return basis, the S&P 500 climbed 18% in 2020, led by a 44% gain by the tech names in the benchmark index, according to S&P Global Market Intelligence.) Tech acquirers and investors enjoyed one of the few true 'V-shaped' recoveries in last year's otherwise ruinous COVID-19 pandemic.

Annual Tech M&A Spending vs. S&P 500 Performance, 2004-2020

Source: 451 Research M&A KnowledgeBase; S&P Global Market Intelligence