Sullivan & Cromwell and Kirkland & Ellis were top M&A legal advisers by value and volume in North America for Q1 2021, finds GlobalData

Q1 2021 hedge fund letters, conferences and more

The Top M&A Legal Advisers In North America

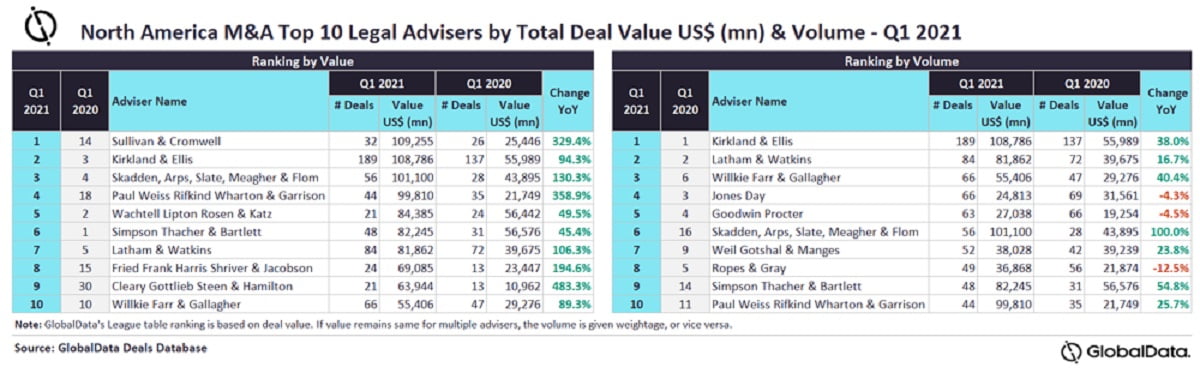

Sullivan & Cromwell and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in North America for Q1 2021 by value and volume, respectively. Sullivan & Cromwell advised on 32 deals worth $109.3bn, which was the highest value among all advisers. Meanwhile, Kirkland & Ellis led in volume terms having advised on 189 deals worth $108.8bn. A total of 3,927 M&A deals were announced in the region during Q1 2021, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and North America M&A Report Legal Adviser League Tables Q1 2021’, deal value for the region increased by 132.2% from $208bn in Q1 2020 to US$483bn in Q1 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was the only adviser to advise on more than 100 deals, and, apart from leading by volume, it also gave tough competition for top position by value. However, the firm lost top position by value to Sullivan & Cromwell by a very small margin and had to settle for second position.

Transaction Values

“Meanwhile, Sullivan & Cromwell advised on a much lower number of deals but saw higher-value transactions - helping it top by value. While the average transaction of deals advised by Sullivan & Cromwell stood at $3.4bn, it was just $576m for Kirkland & Ellis.”

Skadden, Arps, Slate, Meagher & Flom occupied the third position in terms of value with 56 deals worth $101bn, followed by Paul Weiss Rifkind Wharton & Garrison with 44 deals worth $99.8bn and Wachtell Lipton Rosen & Katz with 21 deals worth $84.4bn.

Latham & Watkins occupied the second position by volume with 84 deals worth $81.9bn followed by Willkie Farr & Gallagher with 66 deals worth $55.4bn, Jones Day with 66 deals worth $24.8bn and Goodwin Procter with 63 deals worth $27bn.

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, we have considered M&A including asset transactions, venture capital and private equity deals where advisors were involved.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.