In this piece, “Uncovering Value: Equity Commonwealth (NYSE:EQC),” John shares his take on EQC which was front and center in our letter.

Q1 2021 hedge fund letters, conferences and more

Commonwealth Equity: Ready to Swing

With no called third strikes in investing, value investors are well served to wait patiently for the best pitches to hit. That's what real estate investor Sam Zell is doing with Commonwealth Equity – Chris Pavese suggests joining him.

They’ve been around for a long time, but special-purpose acquisition companies are all the rage today. Celebrated (and notso- celebrated) executives and investors raise a large pile of cash and then look to buy something, most often a private company eager to go public. It’s a pure bet on the acumen and skill of the sponsors.

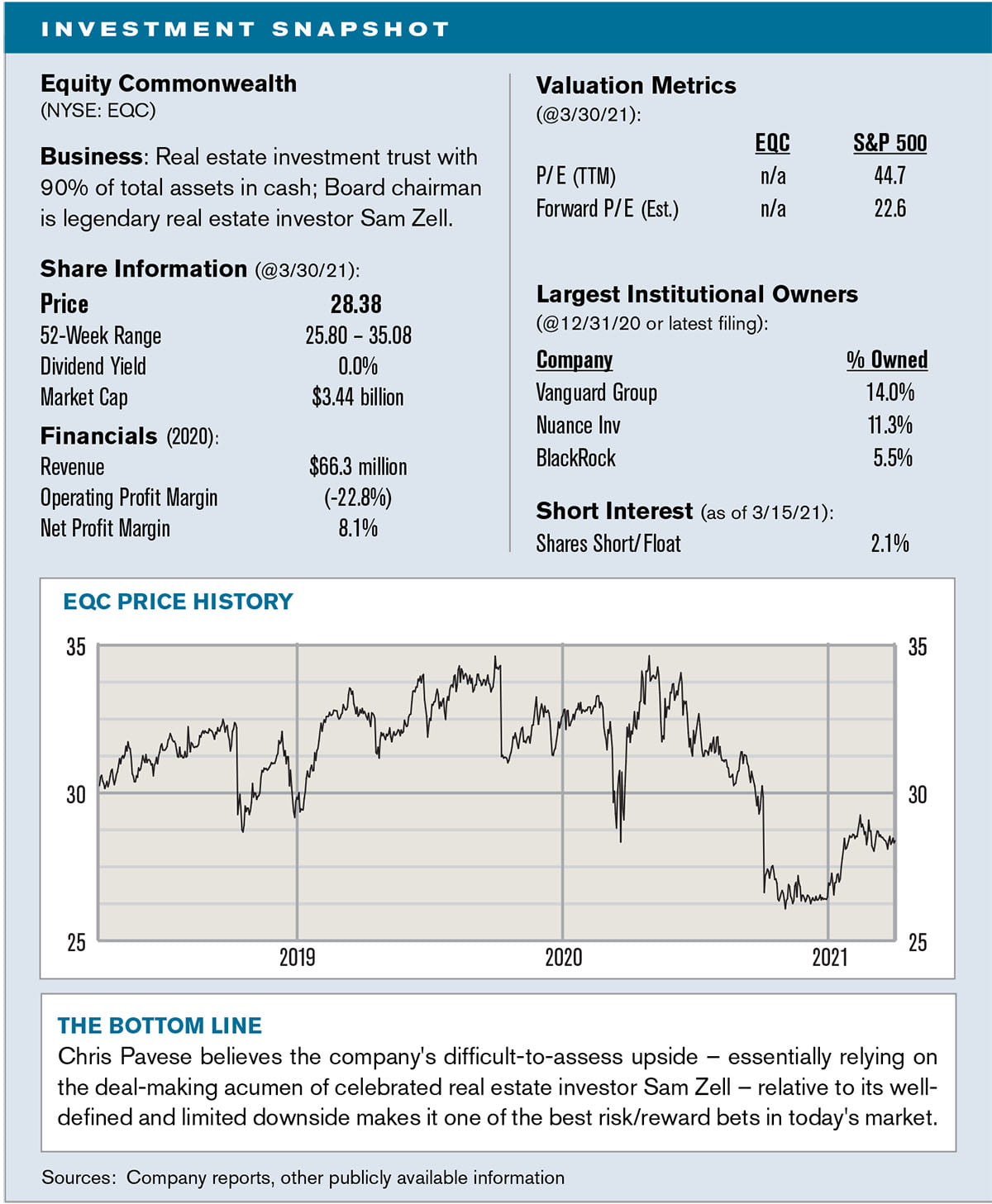

A similar opportunity exists today in the shares of real estate investment trust Equity Commonwealth. The firm’s management over the past six years has sold most of its portfolio of commercial office buildings, raising $7.6 billion that's been used to pay off all debt, buy back shares and make large shareholder distributions, leaving it today with a pile of cash totaling $3 billion. The “sponsors” in this case are Sam Zell, the legitimately celebrated real estate investor who serves as the firm’s chairman, and his two long-time lieutenants, CEO David Helfand and COO David Weinberg. Tried-and-true value investors, they’re on the hunt for things to buy, in this case commercial real estate rather than private companies.

In contrast to the rapt attention the market is giving to SPACs, Zell and company are toiling in relative obscurity with Equity Commonwealth. Two sell-side analysts follow the firm, not terribly surprising given that it’s sitting on cash and management has been upfront about the fact that if they can’t put the cash to work, they'll just give all the money back to shareholders. The stock, recently trading at around $28.40, trades for almost exactly the cash on hand – worth $24 per share – plus the undepreciated book value of the four remaining properties owned, says Chris Pavese of Broyhill Asset Management. “It's rare to see downside that is so well-defined," he says.

Commonwealth's Interest In Out-Of-Favor Office And Hospitality Sectors

While less defined, Pavese believes the upside could be substantial. Deal-making in commercial real estate tends to cease in the early phases of economic distress, as it takes time for sellers to accept that their properties may not be worth what they thought. But as stress like that imposed on many landlords by the pandemic persists, bids and asks are more likely to come into line. Pavese says that Commonwealth management’s recent messaging indicates they are actively engaged in conversations targeting a large portfolio or platform investment in the out-of-favor office and hospitality sectors.

To arrive at how this might benefit shareholders, Pavese estimates – under base, best and worst-case scenarios – how much cash, with leverage, the firm might put to work, the cap rate at which it's able to invest, the net operating income the invested capital can produce, and the normalized cap rate at which the resulting property portfolio would ultimately be valued. With those inputs he believes the shares within two to three years can be 50-100% above their current level. “If you believe things return more or less to normal," he says, "given the people involved and the margin of safety, this is one of the best risk/rewards I’ve found in a market that is pretty short on opportunity.”

Article by Broyhill Asset Management