RGA Investment Advisors commentary for the year ended December 31, 2021.

Q4 2021 hedge fund letters, conferences and more

January 1, 2022 marked 10 years since Elliot partnered with Jason to kick off the RGA Investment Advisors reformation and entry into active management. When we started together we were young, hungry and humble, not knowing exactly what the future might bring though confident that the Great Financial Crisis created a unique opportunity to deploy capital. We encouraged existing and prospective clients alike that despite the pains of the past decade, investments in high-quality and reasonably priced equities were well-timed and would be rewarded in the years to come. In our very first commentary together we phrased the opportunity as follows:

From December 31, 2000 to December 31 of 2011, the earnings per share of the S&P 500 grew at a compound annual growth rate of 5.12%, or 73% total, while the S&P 500 itself registered a negative 0.36% annual loss, or a cumulative 3.8% loss. The contrast is striking. While S&P 500 earnings grew at an average in excess of 5% per year, the price of the S&P 500 itself declined ever so slightly. In order to fully grasp the significance of this fact, it’s important to discuss how exactly a stock is priced. There are many theories as to stock prices and fluctuations, but at the very least there are two points about stock ownership that everyone agrees to: first, a stock is a fractional ownership interest in a business’ earnings, and second, a stock price is the average present value of the aggregate of the company’s expected future cash flows. Relative to the year 2000, today you can buy far more in earnings, for a slightly lower price.

On a comparative basis, that is a bargain, and over the long-term, owning equities in such situations has proven exceptionally profitable. In fact, you can buy 73% more in earnings for a discount to the Y2k price. This is the same as saying the market’s multiple has contracted. To further hammer home that point, let us just add that from 2010 to 2011, the S&P 500 earnings grew at 16%, while the market ended the year pretty much exactly where it began.

If you recall our early commentaries, they were predominantly focused on big picture, macro questions–the trends with new home sales; what household balance sheets looked like; S&P P/E ratios and EPS growth trends versus historical norms and interest rates, etc. These were questions important to both you and us. For you, we understood these questions to be critical in rebuilding confidence in equities as a great investment vehicle following a decade of woeful results. This helped stay invested through numerous corrections along the way. For us, we invested both with a top down and bottoms up lens. The top down informed where we would hunt for bottoms up opportunities. Through this decade we have increasingly evolved our focus and therefore our commentaries to be almost entirely bottoms up. We still aim for a deep top-down understanding and scour that context for interesting and important themes for generating ideas, but our process of researching companies is much deeper, more robust and true to bottoms-up business analysis.

In all respects, we have advanced much farther in this past decade than we ever imagined. We are humbled and grateful for the chance you took on us coming into this incredibly challenging industry, without a long public track record. We have made one commitment from the very beginning and that was to spend a portion of every day ensuring we are better investors tomorrow than we are today. Although it would feel better to emphasize this particular point coming off of a great year, we think it is even more important and powerful coming off of our worst performance year relative to the S&P since we started. We say this with equal parts confidence and humility.

2021: Two Steps Forward, One Step Back

In our conversations with you heading into 2021, we cautioned that 2020’s results were unique and, in many respects, borrowed against future periods. Had you told us in early January of 2021 that we would end slightly down on the year, we would have said “that sounds about right” and felt quite good about it. Had you told us in February that the portfolio would be down slightly at year-end (when portfolios had been up over 20% on the year), we would have said “that’s pretty farfetched,” though we would have accepted the notion that a breather was both overdue and inevitable. Had you told us all this would happen alongside a market that persisted higher throughout the year with no true pullbacks, we would have asked ourselves “how is that possible?” We have always been cognizant in portfolio structure about diversifying factors, understanding where correlations lie, diversifying both the risks and rewards (the key revenue and margin drivers) our portfolio companies are exposed to and having companies that cover a range of valuations within the GARP spectrum.

We knew that our portfolios had a wind at their back and thus likely had benefited from a concentrated factor force in 2020 and spent the early part of the year trimming from areas of most extreme enthusiasm and allocating to areas largely removed from the driving factor. That said, each of our companies are incredibly unique from one another and while the market is treating each as the same, we strongly disagree with the notion that they are remotely similar. We were largely content with how the year was playing out until November, when suddenly even those stocks that had nothing to do with one another became correlated in the worst of ways. We ended up down double digits in a month where the S&P was down less than one full percentage point. While nothing truly excelled in our portfolios, we will discuss each of our five most impactful losers below (most impactful is a function of position size multiplied by magnitude of the move). Before doing so, we want to make one critical point that is true both within this bucket of specific losers and more broadly on the average stocks in our portfolio that weighed us down. Only one of the bad stocks in November had been purchased within the last year. Leaving that one recent purchase aside, our average holding period of our severe laggards (8 total stocks) in November was 3.75 years, with an average return on the month of -19.4%.

One thing we keep reflecting on, in order to have had a terrible second half of 2021, with our strategy, one would have to go back on average nearly four years and think “I know the worst stocks to own for November 2021.” Now perhaps this is overly simplistic considering the view of some that each day you own a stock is a day you are choosing to buy that stock; however, our strategy and process has tremendously benefited from this kind of long-term, low-turnover approach with a predisposition towards inaction rather than action. We are left with the question as to whether we are guilty of overstaying our welcome in a large chunk of our portfolio or whether these are the lumps that come with buying great companies and holding for the long-run. We think time will show that our group of companies are incredibly strong, but we must still meditate on the question. Sitting through periods of underperformance like this, while uncomfortable, is the price we must pay for aspiring to own great companies for an extended period of time.

The following company reviews will be structured from the worst performer in the month to the least bad. Incidentally enough, the worst was the newest one in the portfolios and the only one we no longer own at year-end. But first, let us discuss what we think happened.

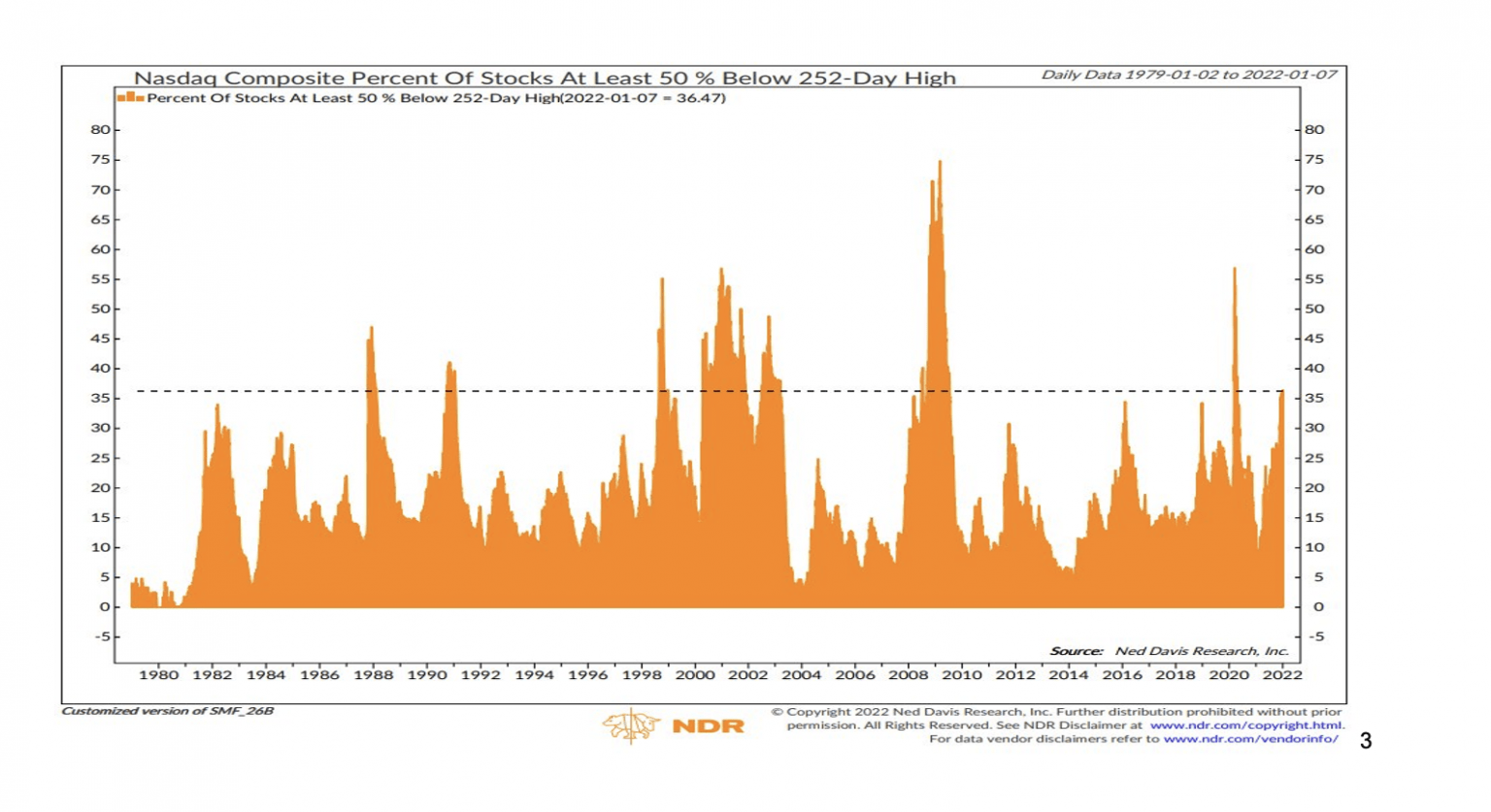

Although broader markets looked fine during the quarter, there was a darkness in the small and medium capitalization indices, in anything adjacent to technology and any company perceived as a COVID winner. To some degree, this was the market’s pursuit of normalization and grappling with what an “end of COVID” would look like, but in other ways, it was the market punishing areas of excess built up in the prior year.[1]

The carnage unfortunately has been especially acute in our portfolio. The selloff started long before there were any “excuses” in the market. Perhaps the initial wave began with profit taking and new buyers in these perceived COVID winners were harder to find with the obvious challenging comparables as these companies hit the toughest of year-over-year comparable growth rates and the enthusiasm for “reopening trades” gained steam. Fast money throughout the year drove several fast cycles of the pendulum swinging from “COVID winners” to “reopening plays.” This bifurcation of the market persisted through October, but in early November, pains became more widespread, and a new bifurcation emerged: value and size versus growth. Consequently, the indices remained firmly buoyed by mega-cap companies like AAPL, MSFT, NVDA, TSLA and GOOG and the highly cyclical energy and financial sectors. Fortunately, we own one of these large cap companies, and that helped some. One could however say that these stocks “sucked the air out of the rest of the market.”

The Inflation Boogeyman

There was one other underlying debate causing market tensions, with considerable ramifications—inflation and the imminent commencement of the first Federal Reserve rate hiking cycle in half a decade. The November CPI print raised eyebrows, as the fastest rate of price inflation since 1982! This begged the question as to whether supply chain tensions and tight labor markets were driving a transitory spike in inflation or a broader regime change in inflationary conditions was under way. It’s debatable whether inflation itself or the Fed policy change mattered more for markets, because inflation concerns hit the mainstream media and prices became a headline issue. Federal Reserve Chairman Jerome Powell initially emphasized the “transitory” angle but reversed course on November 30th while explaining the tools and communication strategy the Fed would deploy to corral inflationary pressures. Chairman Powell made a very interesting point in response to a question from Steve Liesman:

“You know, the question of long and variable lags is an interesting one. That’s Milton Friedman’s famous statement. And I do think that in this world, … the global financial markets are connected together, financial conditions can change very quickly. And my own sense is that…financial conditions affect the economy fairly rapidly…. But in addition, when we communicate about what we’re going to do, the markets move immediately [in response] to that...But financial conditions don’t wait to change until, until things actually happen. They, they change on the expectation of things happening. So I don’t think it’s a question of having to wait.” [5]

In some respects the rapidity with which communication flows through financial conditions has become a potent tool for the Fed. We first observed this in our November 2013 commentary surrounding the Fed’s tapering off of the Great Financial Crisis policy response in a section titled “The Pen (or Microphone) IS Mightier than the Sword). Communication is a very effective tool and to the extent that inflation might not be transitory, communication does accomplish key goals in stemming inflationary pressures even before actual action comes into play.[6] To the extent that inflation might not be transitory, we continue to be of the belief that the Fed’s policy toolkit at this juncture is asymmetrically better positioned to put a lid on inflation than it is to fight further deflationary pressures. Much like baseball teams today play the shift in the field against dead pull hitters, as the consequences of a power pull hitter beating you with a slapped single are far less than a double to the gap.

We remain firmly in the transitory camp. The fears first emerged when the “base rate” was lowest (i.e. 2020’s CPI prints were deflationary) and as the base rate effect has waned on headline numbers, supply chain bottlenecks kicked in with force. This sets the stage for a base rate effect in the opposite direction over the course of 2022. There is already proof supply chain bottlenecks that were exacerbated by inventory stocking for fear of supply chain problems (ie a self-fulfilling process), is now waning. There is one deeper force behind inflation, directly related to the changes wrought by COVID. As health-inspired restrictions have impacted our capacities to live our lives in ways we did before the pandemic, demand for goods has soared, replacing services. Think about your own life, where in lieu of a vacation, you may have purchased a new sofa and TV for your living room to spend that extra couch time on. A visual is quite powerful:

Our systems for moving goods were built to handle a certain volume of goods, growing at a steady state and that system was overwhelmed with households trading service spend for goods spend. During COVID there has been some investment in added capacity and that takes time to come online, but eventually things will normalize as the demand for goods and services respectively return to trend. When this happens, we suspect the inflationary pressures, which in their own right are largely confined to goods and to a lesser extent labor, will subside.

As for labor, we theorize that a decent portion of formerly lower paid service workers went from contract work in the services sectors to stable jobs in warehousing and fulfilment at the Amazon/ecommerce winners of the world, turning 1099s to W-2s with full benefits. These workers will not quickly return to the service sector, but what makes these forces transitory are the opportunities on both ends to invest in automation and the reemergence of a certain class of worker in the labor pool following generous unemployment benefits. To that end, we were surprised to see shares in Cognex trade with such weakness in the fourth quarter, as the foremost bottleneck to faster adoption of their machine vision offerings have been the prevalent supply of low-priced labor. We covered this in depth in our 2018 year-end commentary [8]. Moreover, even if labor remains tight, prices for it won’t rise nearly to the same extent as last year.

One overarching point must be emphasized here. While many are grappling with these questions about inflation and whether the Fed might put the economy into a recession in the second half, we are convinced of one important reality: as much as we would like to think policymakers’ control everything, we think where we sit today, the virus is almost entirely in control. What we mean by that is the idea that inflation might become pernicious from here and that the Fed might create a recession in the second half presupposes the virus will never recede to a less significant impact on our life. Meanwhile, not since February of 2020 has the path toward endemicity and a life no loner dominated by virus seemed clearer. Importantly, we will enter a post-pandemic life sooner or later and when we do so, households will emerge from nearly two years of restrictions with the strongest balance sheets we all have had in decades and pent-up energy to live life to its fullest. There still may be bumps in the path to getting there, but the light at the end of the tunnel is now shining bright.

The Opportunity Ahead:

Why is the market this weak, especially the underbelly of it? Here we think it comes down to two forces: 1) most funds lagged the market considerably in 2021 and had little tolerance for incremental risk into the close of the year, while those who theoretically should have tolerance (i.e. performed well) felt compelled to lock in their years. Both of these camps were degrossing for their respective reasons while driving crowded stocks down and leaving little bid for areas that should have been bought; And, 2) many, ourselves included, had stellar years in 2020 and realized sizeable capital gains in the early part of the year, while things were going well. As the end of the year approached and a good chunk of stocks were trading far from their year-to-date highs, harving tax losses and offsetting gains became increasingly appealing. This is the clearest reason for why the weakest stocks over the late summer were even moreso the weakest stocks as Fall turned to Winter.

When we look at the stocks we own, we focus intensely on the underlying fundamentals of the business. Is the company growing? Are they adding more value to their customers? Is the company positioned well versus competitors? Stock prices are often used as a proxy for business success, but the truth is that stocks over many shorter-term periods do not move in tandem with the true value of the business itself. As we sit here thinking about the performance of the underlying businesses in our portfolio, in contrast to the stocks themselves, we cannot help but feel pleased with the rates at which they’ve grown, the value these companies have delivered to their customers and the cash flow they have earned and invested in furthering their competitive advantages.

Stocks move with far more volatility to both the upside and downside than do the businesses themselves. Great businesses often go long periods of time without moving at all in the market, and then make large moves in very sudden fashion. Some people may try to anticipate exactly when these large moves will happen, but we think that is far more akin to astrology than sound business analysis. Our experience with PayPal, a stock we cover below, offers a nice illustration of this phenomenon:

We have owned shares in PayPal since the company was spun off from eBay in 2015. In aggregate, price has moved upward, quite powerfully during our tenure; however, this upside was essentially achieved in two somewhat brief pulses that cover less than half of our tenure with the stock. The rest of the time, price chopped around in ranges. These ranges are periods of tension, where the fundamentals continue to chug along but the stock price must digest. Some periods of tension are fairly quiet, while others include both steep up and down moves along the way. Some end up being brief resets, others might persist for two plus years. The key underlying truth is that if the business remains sound, and in the case of PayPal, we think it is incredibly sound, the journey of rising stock prices will once again resume when the stock is ready. We are not market timers and thus cannot be sure as to when a stock might be ready, but value is inevitably the force that operates on a company’s stock and that force cannot help but exert its will over longer periods of time.

Thus, as we sit here today, a new year brings new opportunities, and the forward return profile of our portfolio looks as strong as it has been in some time.

Here is our take on the five November drags:

Fixing A Hole (Stitch Fix):

Typically we give investments a year in order to truly judge whether they work or not. The reality is that markets have moved way too quickly in both directions over the past two years and thus we left ourselves in a quandary preferencing inaction when action should have been taken. One of the core tenets and intersections of our analysis and position management has held that we need one or two key variables to distill and simplify a thesis down to and follow as our North Star. When we wrote up Stitch Fix in our Q2 2021 commentary, we specifically said “We expect active client growth to be the foremost driver of the business growth, despite evidence that Direct Buy will drive growing wallet share.”[9] In each of the three earnings reports following our purchase of Stitch Fix, active client growth slowed sequentially while wallet share (revenue per active client) grew. In studying the company, rising wallet share was an important indicator that Direct Buy (now Freestyle) would not cannibalize the core business and help grow even with existing customers. We allowed this to slip into what is a solid, though not investable idea–the idea that rising wallet share would be a leading indicator of accelerating client growth, given two factors: 1) rising wallet share means higher LTVs, allowing the company to pay more to acquire customers at the same rates of return; and, 2) rising wallet share proved an enhanced value prop which validates the product direction.

However, while easy to say in hindsight, we know that logic is not sound and should be something we consciously avoid in the future. Put simply, our thesis was premised on Freestyle broadening the appeal of the company’s offering and leading to accelerating customer acquisition. Absent actual evidence of accelerating customer growth itself, even with rising wallet share, we should move aside and watch. In other words, our intrigue was worth keeping Stitch Fix as a company we watch actively, but not one we invest in. This is a mistake plain and simple. We have often spoken about the two kinds of wrongs in investing: overt mistakes of analysis versus those situations that end up in the wrong end of the return distribution. Stitch Fix was not an investment that ended up in the wrong end of the return distribution, but for the right reasons. It is an impairment of capital that we will have to find another way to earn back. We promise to you that this exact same mistake will not be repeated again (though we are likely to learn other humbling lessons along the way).

Streaming Still Buffering

Since we bought Roku Inc (NASDAQ:ROKU), no stock has contributed more to our returns and no stock has been more volatile in our portfolio. This is now our third drawdown in the stock of over 30% and our second of over 60%. Fortunately (or tactically) before the two 60% drawdowns we had trimmed our positions by at least a third, though unfortunately that meant we still held large slices of the stock on the way down. Despite the stock having soared too far, too fast and thinking it was due for a period of digestion, we believe over our timeframe even the former highs will be rewarded with a good result. We have often pointed out that volatility in companies like Roku is the market’s way of grappling with a really wide range of potential outcomes and that remains as true today as ever, though the range of outcomes continues to narrow for the better for Roku.

Roku today is trading at lower multiples than at any point as a public company, meanwhile its revenue and margin composition has evolved from majority hardware to vast majority platform–in other words, each $1 of revenue is much more valuable today than ever before for Roku. Roku today is a profitable company for the first time in its history. Roku today has a multitude of investment opportunities within its own platform that can drive considerable value. Early in 2021 at higher prices, one had to believe the company would grow accounts internationally to justify valuations. This was so, because the company has so quickly achieved substantial penetration of the US market with 56.4m reported household customers of the ~130m total US households, that further growth in the US household count will be challenging and because prices were so high. Today, one merely needs to believe that with around 60 million households (the expectation for the yet reported year-end 2021 number), ARPU has a strong enough growth tailwind to reach $100 within a reasonable time, without relying on any incremental account growth. For context, as of Q3 this year, ARPU was $40, up 49% year-over-year and we know it will be higher in Q4. Growth in ARPU is underpinned by the continuing migration of viewer hours to CTV. The sub-forces behind this are increasing the penetration of Roku devices within households (go from one Roku to TV to 2-4), increasing the hours that each house watches (getting from shy of 4 hours to the nearly 8 hours an average American household watches TV) and broadening the content on the platform, increasing the share of inventory with content companies and more hours (like live sports viewing) shifting from linear to CTV. We further believe the opportunity to become the bundler and/or hub of household content subscriptions is growing, as evidenced by the rise in credit card pings per user from 1 to 1.3 per month and its continuing ascension. In this respect, Roku has the right to win with their installed base, because the experience is exponentially better than legacy and competing offerings.

Today, the international opportunity comes completely free. While one no longer needs to believe in international to justify the valuation, we continue to believe Roku is likely to achieve success in some key geographies. Although no account growth is required to justify the valuation here, we do believe it will happen. Roku has an advantaged offering for each of their critical stakeholders, from the viewer to the TV manufacturers to content companies to advertisers.

The company has been operating with a goal of cash flow breakeven and despite that objective, this year will be trading at upwards of a 1% trailing free cash flow yield. Cash flow in high operating leverage businesses goes up fastest at the breakeven inflection. Although the company might choose to reinvest some incremental cash flow at a faster clip to seize the substantial opportunity in front of them, we still expect free cash flow to be up considerably over the next year and realistically think shares are trading at upwards of a 4% free cash flow yield looking two years out. This is incredibly fair for a business whose platform revenue will eventually look annuity-like and whose growth will continue well beyond two years hence.

Buy Now, Get Paid Later

PayPal Holdings Inc (NASDAQ:PYPL) is one of our longer-tenured holdings in the portfolio and its history is wrought with market tension. The stock had become increasingly boring over the past few years, until rumors that the company had made an offer to acquire Pinterest sent shares dropping during the fourth quarter. This rumor stoked fears PayPal would warn on their growth forecast for the year on an imminent earnings report, and soon after, they did just that. Not helping matters was a sharp drawdown in the payment sector generally. Many prevailing narratives today suggest sectors selling off are doing so because they don’t make money, or because of inflationary fears, yet payments generally and PayPal specifically completely disprove this notion. Payments are incredibly profitable, with lush margins and fair free cash flow yields. PayPal has been growing well into the double digits while reporting EBITDA margins upwards of 20% ever since its split from eBay. In PayPal’s early 2021 investor day they raised the bar on new user expectation and revenue growth, but they were far too overoptimistic in extrapolating COVID trends. Plus, there is essentially no sector more insulated from inflation than payments, where the cost structures of the businesses are fixed and rising average order values are charged a steady, toll-like percentage. In other words, to extremize with an example, a $100 order is more than twice as valuable as a $50 order, because if each is charged 3% and the cost to clear a transaction is $1, the $100 order returns $2 in margin, while the $50 transaction returns 50 cents. It is not exactly this perfect, as there is a variable component to cost, but the majority of cost is indeed fixed.

From day one with this stock, people have feared competition from the likes of Visa who formerly called PayPal a “frenemy,” Apple and a cadre of other upstarts, yet at no point has PayPal’s core inertia noticed these competitive threats. We do not therefore think it is competition that has hurt shares. Our best explanation for this route in PayPal is a function of resetting expectations and the market questioning its confidence in management. Despite this reset in expectations, the company has lapped robust COVID growth with very strong performance and is on the brink of delivering two of its 3 fastest growing years as a public company. 2020-2024 should easily be PayPal’s strongest 4 year stretch of growth, driven by the lapping of eBay’s migration to Adyen, thus closing the gap between ex-eBay growth and core revenue growth (ex-eBay growth has consistently been 5+% better than consolidated growth) and the resumption of travel and entertainment spending, formerly a very large contributor to PayPal’s volumes before COVID. Meanwhile operating leverage should continue to scale, with one of the most potent forces being the deepening engagement (as measured by transactions per user). As it stands today, PayPal’s customer base is much larger than it was before COVID, and as these cohorts increasingly engage with the platform, the value of the COVID bump will compound rather than whittle away. Although PayPal issued a challenging Q4 2021 report since the end of the calendar year, and shares remain under pressure today, at just more than 25x adjusted 2022 earnings, with top line finally converging with ex-EBAY TPV growth rates and a long runway for growth, we think shares have drastically over-corrected.

Dropped Ball

Dropbox Inc (NASDAQ:DBX) really let us down this quarter, not because they did anything wrong, but because during our entire tenure holding this stock, it outperformed in periods where long duration assets (aka higher growth) sold off. This time it did not. Despite people asserting this market bifurcation is about selling growth and buying value, Dropbox shares suffered one of their worst stock market quarters in recent years. It’s hard to identify a specific reason, though one story out there is how some investors thought the company could raise the bar on its 30% targeted operating margin upon achieving those levels. Along with the company’s earnings report, instead of raising the bar, they explained how there is more room to drive margin, but in the mean-time the preference at the company is for investing the potential excesses to drive further growth.

This year, the company will have repurchased nearly 9% of its diluted shares outstanding (perhaps more given the Q4 route in shares) and will have delivered a free cash flow yield upwards of 7.5% on its year-end stock price, while growing upwards of 12%. This is a potent recipe for outstanding returns, yet in a market that’s theoretically seeking cash flow, the stock was punished. We think this is one of the most nonsensical moves of them all and find Dropbox to be an especially compelling opportunity heading into 2022. The top line is certainly growing, as the company continues to withstand competition from Microsoft, Google and Box. Plus management continues to make smart tuck-in acquisition, showing what may emerge as a scalable, repeatable recipe for deepening their relationship with existing customers, thus driving down churn and setting the stage for prolonged ARPU growth. This potential strategy started with HelloSign, and is further validated with the acquisition of Docsend.

At today’s valuations, Dropbox simply needs to retain their existing customer base for seven years in order to return 100% of its market cap. The company has two key drivers in doing so: they can lower churn of existing customers or acquire more new customers by converting free users to paid users. Today, driving down churn is the most potent lever and that is happening naturally as retail customers who relied on the service for simple storage (like for photos) leave and SMBs who rely on the service for business workflow stay behind. Another way to think about this is that there are a cohort of customers who are incredibly sticky and another cohort who are less so. As the less sticky customers churn off, you are left with a base of incredibly loyal customers to drive value. The price hikes in recent years helped accomplish this by self-selecting for the highest value customers. That said, while we think reducing churn will be a powerful driver here, we still think there is a great opportunity to acquire new users. Dropbox is in many respects an orphaned stock. One need not believe they hit their $1b 2024 cash flow target in order to achieve strong results from here. A high single digit free cash flow yield (7.5%), combined with high single digit growth (8%) and a mid single digit share (5%) repurchase yield multiply out to very strong returns, assuming our exit multiple equals today’s starting multiple.

Wings Clipped

Twitter Inc (NYSE:TWTR) had an eventful quarter. The company started the year seemingly ready to fly for the first time as a public company. Consensus estimates for 2023 revenue started the year at barely north of $5b and by the end of the year were just shy of $7.5b, a target the company offered at their first investor day in years. Unfortunately, it was a second target offered at that same investor day that did them in: 330 million mDAUs by the end of 2023. Typically stocks follow revenues, but mDAUs became the noose around the stock, and perhaps even Jack Dorsey’s tenure as CEO. With each quarter reported following the investor day, the mDAU target became increasingly harder to achieve as the userbase grew below the run-rate required to get there in straight-line fashion. Although the company stated this would happen, investors were left wondering how an already lofty target could be achieved with a higher hurdle. Importantly, however, the revenue target continued to look increasingly achievable with each passing quarter. Taking a step back, people came into the year convinced Twitter had a monetization problem, but exited the year focused on their user base growth.

As always, the Street is incredibly myopic about the company, but we are far more sanguine. The user base will exit the year growing at what we thought was a more appropriate quarterly run-rate (6-7 million quarterly new users), consistent with the acceleration that began before the COVID-induced bump in Q1-Q2 of 2020. As it stands today, Twitter is trading near its lowest multiples as a public company (on both EV/S at ~4.5x forward and EV/EBITDA at ~18x), at a time when it will report its fastest growth rate as a public company and over the next two years is expected to report two of its next three fastest growing years. Altogether, the years 2021-2023 should be the company’s fastest three-year CAGR period by a lot, meanwhile the last time Twitter traded at multiples this low was in 2017 when revenue actually contracted 3.41% during the year. There is little that can actually justify such a disconnect where the company’s growth is as swift as ever, but its multiple is consistent with negative growth periods. Twitter remains drastically under monetized, has a long runway of opportunity ahead on both the user growth side and monetization, and has optionality in pursuing subscription, data and/or service extensions of the core offering.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice. Please call us directly to discuss this commentary in more detail – we are always happy to address any specific questions you may have. You can reach Jason or Elliot directly at 516-665-1945. Alternatively, we’ve included our direct dial numbers with our names, below.

Jason Gilbert, CPA/PFS, CFF, CGMA

Managing Partner, President

O: (516) 665-1940

M: (917) 536-3066

Elliot Turner, CFA

Managing Partner, Chief Investment Officer

O: (516) 665-1942

M: (516) 729-5174

[1] https://twitter.com/bespokeinvest/status/1470388254780309508

[2] https://twitter.com/edclissold/status/1480602081455222793

[3] https://twitter.com/ZorTrades/status/1466196875019698181

[4] https://twitter.com/ZorTrades/status/1466196875019698181

[5] https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20211215.pdf

[6] http://rgaia.com/wp-content/uploads/2013/12/November-2013-Investment-Commentary.pdf

[7] (https://www.whitehouse.gov/cea/written-materials/2021/10/26/bernsteins-beat-throughput-at-the-ports/)

[8] http://rgaia.com/wp-content/uploads/2019/01/Easy-come-easy-go_2018_Final-1.pdf

[9] https://www.rgaia.com/wp-content/uploads/2021/08/Q2-2021-Investment-Commentary_Final.pdf

Past performance is not necessarily indicative of future results. The views expressed above are those of RGA Investment Advisors LLC (RGA). These views are subject to change at any time based on market and other conditions, and RGA disclaims any responsibility to update such views. Past performance is no guarantee of future results. No forecasts can be guaranteed. These views may not be relied upon as investment advice. The investment process may change over time. The characteristics set forth above are intended as a general illustration of some of the criteria the team considers in selecting securities for the portfolio. Not all investments meet such criteria. In the event that a recommendation for the purchase or sale of any security is presented herein, RGA shall furnish to any person upon request a tabular presentation of: (i) The total number of shares or other units of the security held by RGA or its investment adviser representatives for its own account or for the account of officers, directors, trustees, partners or affiliates of RGA or for discretionary accounts of RGA or its investment adviser representatives, as maintained for clients. (ii) The price or price range at which the securities listed.