RGA Investment Advisors commentary for the third quarter ended September 2021, titled, “looking inward and looking westward.”

Q3 2021 hedge fund letters, conferences and more

The third quarter concluded with the worst month for equity markets since March 2020. That said, the month of September was hardly worth comparing to the peak of the COVID-19 induced panic. We underperformed markets during the quarter, and one adverse event in a portfolio company inflicted more pain than markets at large. We spent considerable time reflecting on this situation, which is further discussed below.

While our aim is to hold positions for five years or more, there is no magical moment in time where we say “okay, this position is now a sell.” Rather, our process is dynamic and our sell decisions in successes tend to occur when either the position has 1) greatly overachieved what we view as its fair potential (via our constant re-underwriting process); or, 2) when the opportunity cost of the market environment leads us to make tough, force ranked decisions out of a position in order to open the door for a new, better opportunity. It can fairly be said that both catalysts bear some resemblance to one another.

With failures or disappointments, we have some more rigid policies. First, we formalized a “two-strikes and you’re out” rule whereby any company that clearly articulates a fundamental, falsifiable “truth” and reality proves that statement wrong twice, is sold in the most expeditious way possible. We are willing to offer one pass, given circumstances often change; however, we believe that when this happens more than once it is impossible to believe anything management tells you and therefore it is impossible to maintain conviction in the position. We will caveat that we do not blindly believe everything management tells us and practice “trust but verify.” The problem is that once two falsifiable truths do indeed prove false, there no longer is reason for any trust.

We spent considerable time reflecting on our selling strategy following our recent experience with Kambi Group. In our Q3 2019 letter, we first introduced our investment in Kambi Group.[1] We did considerable background work on the sports betting landscape and believed Kambi Group PLC (OTCMKTS:KMBIF) to be uniquely well positioned for success given a range of potential outcomes. We were disappointed, though hardly surprised when Draftkings Inc (NASDAQ:DKNG) decided to leave Kambi as their backend provider for an owned, integrated offering. This was a situation we closely monitored and incorporated into our underwriting, with the expectation that even were it to play out, the upside would exceed our hurdle rate of return. Although that day in December 2019 was miserable when Draftkings did indeed leave Kambi, we remained comfortable with the company’s aspirations to capture their own piece of the US market. Afterall, the leadership at Kambi are sharp individuals, who built an industry-leading product.

A second force we considered in underwriting the investment was how Kambi’s risk drivers in our portfolio would be uniquely esoteric. This is so because the company’s performance results would be driven by a combination of legalization and regulation, and success with customers present and future. There are few companies whose revenue roadmap exists entirely independent of macro forces, and perhaps even counter-cyclically so—thus, we believed that in a recessionary environment, states would be increasingly likely to legalize sports betting in order to buffer the pressures recessions place on state and local revenue budgets. Unfortunately, during the COVID recession, all sports came to a halt, something that was entirely unprecedented and unique for a recessionary environment. Even in the worst of the Great Financial Crisis, sports went on. Even still, we maintained our belief in the inevitability of legalization and regulation. Importantly, in our estimation, Kambi operated with a very low fixed cost base and a well-capitalized balance sheet. We were comfortable with the company’s capacity to weather the storm and come out of the crisis stronger than when it started. Sure enough, they did and the success when sports resumed was immediately realized by both the business and the stock.

We came into 2021 with Kambi’s stock as a significant winner, up between 3-4x our cost basis merely one and a half years earlier and a larger piece of portfolio by virtue of outperformance. We would hardly say we were complacent, and we regularly reassessed our expectations of the company’s prospects. We liked the roadmap for Kambi leveraging Penn Gaming as their anchor partner in the US, though were apprehensive about the cadence of Penn’s progress. The first true warning sign for us was when Fanduel paid Mohegan Sun in Connecticut considerable sums of money, including the entire amount Mohegan would have owed Kambi over the course of their contract together, to displace Kambi and offer Fanduel as casino’s sports betting product.[2] This was concerning because our margin of safety here was predicated on Kambi’s ability to win with local state champions, which include the Native American tribes who own valuable gambling concessions in key geographies. If Kambi could not keep a relationship like Mohegan Sun, and the industry concentrated around three to four key players who dominate over 80% of the market, then what room would there be for Kambi to play? The answer is unknowable to the exact degree, but what is clear is that not enough of the market would be up for grabs to justify the prevailing market valuation. In our framework, they needed at least 15% of the US market to justify prices in the 400+ Swedish Krona range.

Unfortunately, as we were debating the reality of the situation and considering an exit, even worse news hit the tape—Penn National Gaming, Inc (NASDAQ:PENN) decided to make a large acquisition of Score Media in an effort to own the entirety of their own tech stack.[3] Based on our industry calls, Score Media is minimally capable as the sports backend and barely competent compared to Kambi; however, that reality does not matter. As Draftkings has since proven with SBTech, the abundance of capital and imperative to fully verticalize is too strong for Kambi to make the case that the outsourced backend model is more profitable for the sports book today. The ambition is to scale and everyone in the industry will pursue it at all costs. It did not help that David Portnoy, the founder of Barstool Sports, owned in large part by Penn, seemingly held a grudge against Kambi for some downtime during the 2020 Super Bowl.[4]

Rather than suck our thumbs and weigh all these forces, we sold our shares as quickly as possible when Kambi resumed trading following a halt on the Penn news. It was obvious to us that our entire thesis was largely nullified and therefore even if the stock had the potential to bounce back, we could no longer hold any conviction.

Everything we have outlined here was well within the range of possible outcomes we considered in buying our shares. In terms of our return on the stock, our outcome was actually pretty good considering we commenced the position at good prices—we had nearly a double in two years. This gives us confidence that we underwrote the position soundly. The problem is that we made an egregious error in position management. Underwriting and position management are not the same, in any respect. Position management requires understanding the possibilities and the skew in a position. The way we see it, the skew went from incredibly asymmetric, whereby even in a worst-case scenario the returns in Kambi would be pretty good (and they were!!!), to a different structure whereby the skew entirely inverted and the possibilities were inherently adverse. Stated simply, Kambi went from priced for little success, such that merely modestly good outcomes would lead to outstanding returns to priced for tremendous success (success being a cut below “perfection”) whereby any hiccup would lead to considerable downside.

To further illustrate this point, it is helpful to reference Roku Inc (NASDAQ:ROKU), whose stock price also appreciated considerably since we commenced our position. Roku, in contrast to Kambi, is the beneficiary of success. We referenced a great Nick Sleep quote in our Q2 2020 commentary on the branches a business travels down and what it means for the next set of branches (possibilities).[5] It is worth reflecting on that quote now in comparing and contrasting Roku with Kambi. Every branch Roku has traveled down thus far has increased the company’s likelihood for future success, opened up new branches of opportunity and in a reflexive way increased the likelihood of good outcomes in the stock. While the skew is less asymmetric today than when we bought our first shares of Roku, the skew remained healthily asymmetric to the upside over the course of our positioning with the stock. Kambi, in contrast, exists in a box. The industry has a known pie of revenue and opportunity, with the main question being how it will be divided. This meant that success in the stock inherently whittled away at future potential successes. This is not like Roku where success creates new possibilities. Although this was a distinction we would draw in our analysis, we did not neatly synthesize this reality appropriately in our position and risk management framework and that became incredibly clear after the Kambi debacle. It is clear to us that in the future, when presented with a similar setup, we need not sell our entire position, but we do need to pare it back considerably. We will not make this same mistake again.

From the Mountains, to the Profits

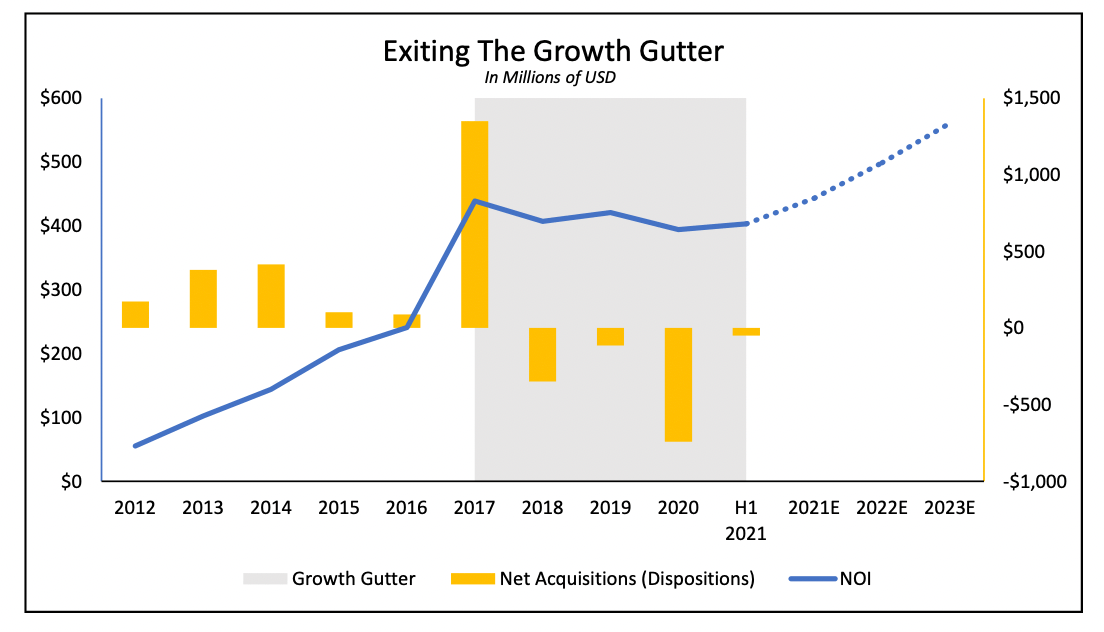

Kennedy-Wilson Holdings Inc (NYSE:KW) (“KW”) is a high quality, founder led, real estate investment firm that benefits from the continued population expansion of the Mountain States of the United States (Colorado, Utah, Nevada, Idaho, etc.). KW trades at a discount to NAV, despite a clear path to double-digit annual NOI growth, because NOI growth has stagnated for the last three years. The strategic transition of the portfolio away from expensive hotel, retail, and California multifamily properties largely towards attractive Mountain State multifamily properties has obstructed core NOI growth during this time. Going forward, KW is well positioned to return to consistent NOI growth.

The company was started in 1988 when William McMorrow acquired an auction company with ambitions to purchase real estate during economic hardships. The auction company’s brand was essential to establish relationships with banks looking to sell distressed properties. Finding attractively priced investment opportunities has always been a core element of KW’s DNA. In the wake of the Great Recession, KW IPOed as a real estate investment firm. Shortly after the 2009 IPO, the company began investing in Europe and by 2014 grew a minority investment into a 25% stake in Kennedy Wilson Europe, a public UK and Irish real estate asset management firm. With Brexit suppressing valuations in 2017, KW acquired the remaining ~75% of these European assets.

McMorrow strives to execute a contrarian approach to real estate investing, with a focus on opportunistically timing purchases at a mid-teen target cash-on-cash IRR. The typical deal is a low/mid five percent cap rate acquisition where they can add value and lever with debt priced at around 3.5%. The company recently completed a refinancing in August 2021 to lower the cost of debt portrayed in the table below.

Value is added by stabilizing and developing properties, improving facilities, raising rents, or extending leases. Facility improvements and new amenities justify the rising rents. Strictly focusing in growing markets provides an additional rent rate tailwind. Before COVID-19, same property performance consistently grew by mid-single digits each year (2015-2019). KW also purchases high yield real estate debt with the potential to ultimately own the associated properties if the owners default. The debt investment platform is mainly funded by partner capital and generates mid teen returns between KW’s portion of the yield and partner capital fees. The loans are underwritten in a manner where defaults lead to higher returns. Regardless of purchase method, the strategy revolves around accumulating high quality real estate at depressed prices.

The largest segment of KW’s real estate portfolio is the multifamily segment making up 46% of NOI. A prime focus is to acquire multifamily units in the Western United States to strategically invest along population demographic trends. They seek opportunities in growing markets unpenetrated by REITs, like the Mountain States, provide the primary hunting ground. KW is not structed as a REIT to ensure the flexibility to determine what portion of capital to deploy into growth initiatives. According to the 2020 census, four of the six fastest growing states by population are Mountain States. The company is the largest owner of apartments in Boise Idaho.

Since 2018, KW has been divesting its expensive California suburb properties to increase exposure to the Mountain States. Rising rents, extremely high prices, and taxes in the California suburbs contribute to drive population migration towards the more affordable Mountain States. Additionally, work from home flexibility is accelerating the demand for Mountain State properties. The portfolio rebalance is opportunistic, as the high prices for California multifamily properties provide attractive exit valuations. The other meaningful US multifamily initiative is within affordable housing. KW is scaling affordable housing as fast as possible to keep up with the rapidly growing demand in the Mountain States. Not only is investing in affordable housing socially responsible, it also is extremely capital light. The US government reimburses all invested capital with tax credits and municipal bond financing. US affordable housing makes up 15% of the multifamily NOI. Outside of the US, the company is aggressively investing in Dublin multifamily housing where a significant housing shortage is anticipated. KW differentiates its European properties through US style amenities and pet friendly policies.

KW’s second largest segment is office properties which makes up 36% of NOI. Outside of a few units rented to Microsoft and Costco in the Seattle area and a handful of strategic properties in California, the office portfolio largely consists of offices in London and Dublin. Dublin is the key focus for ongoing office property investments. Not only is Dublin a European tech hub, but it is also well positioned to grow as companies that want to relocate into the EU after Brexit find a new home.

The remainder of the stabilized portfolio consists of retail, industrial, and hotel assets. The retail portfolio (12% of NOI) is impacted by COVID-19 but improving. KW sold most hotel assets prior to COVID-19. Their only remaining stabilized hotel is the upscale Shelbourne. Ireland’s constitution was drafted in the Shelbourne making it historic, iconic, and likely to return to strong performance after COVID-19. The industrial portfolio is the smallest portion of NOI and is largely focused on e-commerce infrastructure in the UK.

In addition to the owned assets, KW manages and charges fees on $4.5 billion of fee bearing capital. This is an excellent, high margin, extension to the business model because the company gets paid to deploy additional capital alongside company investments. KW commonly partners with mid-tier insurance companies like Fairfax, which owns 9% of KW. Impressively, Axa utilizes KW for their Dublin investments despite having their own internal team. Singapore’s sovereign wealth fund is also a partner. The fee bearing capital segment expects to deploy an additional $3 billion over the next three years. Partner capital growth accelerates NOI growth because it expands acquisition opportunities and leverages KW’s core investment capabilities.

Since the onset of COVID-19, the multifamily and office portfolios have exhibited stable performance with collections of over 90%. Another example of stability is occupancy of “96% for our multifamily and 94% for office assets. And in our fast-growing industrial portfolio, occupancy was at 100% as of quarter end”.[8] The hotel and retail segments are in the process of recovering. Today, total NOI is within 5% of pre COVID-19 levels. The dislocation caused by COVID-19 has created an excellent opportunity for KW’s bargain hunting philosophy which is designed to take advantage of recessions and market dislocations. Although many opportunities do not typically arrive for roughly two years after the onset of a recession, the company is starting to see attractive deals in the market and will likely be selectively aggressive. An excellent example is the November 2020 purchase of an airport in Brighton England for £35 million which includes 270 thousand square feet of undeveloped commercial space for logistics developments.[9] Additionally, in June 2021, the company bought a 97% occupied London area office campus at a 7.7% cap rate.[10] Another UK office building was acquired in Q2 2021 “using proceeds from the sale of Friars Bridge Court, which sold in Q1 at a 3.5% cap rate”.[11] KW will continue to opportunistically drive long term NOI growth by investing FCF, borrowed money, and sale proceeds into buying new properties at attractive prices. The company also expects to grow NOI by developing and stabilizing properties that they already own. This is an extremely predictable path to growing NOI and intrinsic value.

Beyond redeploying capital, KW pays a 4% dividend and grows the dividend in correlation with NOI. Between 2012 and 2017, NOI grew at a 51% CAGR while the dividend grew at a 25% CAGR. NOI has stagnated since Q1 2018 (dividends have still grown at a mid/high single digit CAGR) as the company has focused on transitioning to more opportunistic assets. NOI mix has shifted away from hotel, retail, and California multifamily properties towards Mountain State multifamily properties and to a smaller degree, loans and industrial e-commerce infrastructure properties. The stagnation in growth was further amplified by Brexit fears and COVID-19. KW seems to be on the verge of returning to consistent annual growth. On the Q2 2021 earnings call, McMorrow stated:

We have a clear path to grow our recurring NOI at the rate of 10% to 15% per year over the next 3 years driven by strong organic NOI growth, new acquisitions and the completion of our construction. We also plan to grow our fee-bearing capital and resulting fees by 15% to 20% per year over the next 3 years. The combination of these factors should lead to significant growth in the net asset value per share over time.[12]

As illustrated in the graph above, KW has been in a growth gutter due mainly to timely property dispositions. As recently as Q2 2021, “continued strong demand for real estate has led to appreciating market values of our properties, as evidenced by our recent dispositions”.[13] Management has just signaled that the growth gutter is ending. This growth will come from “4,300 multifamily units, 2.4 million square feet of commercial and 1 hotel that, once completed, is expected to grow our estimated annual NOI by approximately $100 million over the next 3 to 4 years”.[14] An additional $100 million of NOI would increase current NOI levels of $403 million by 25%. There are additional tailwinds to NOI as retail properties and the Shelbourne continue to recover from COVID-19 alongside organic growth from positive same property performance. The final key to exiting the growth gutter is that the company aims to be a net acquirer of property over the next couple of years. With these factors combined, it is hard to imagine the company failing to return to robust NOI growth.

Management seems extremely confident in KW’s prospects going forward. McMorrow mentioned that “we view the stock to be a very compelling buy now. And as I said in my remarks, we plan to resume that buyback program now that we’ll be in an open window starting next week”.[15] The company has purchased about 10% of its float since 2018. McMorrow owns over 8% of the company and personally bought $2.1 million of equity on the open market in August 2021, shortly after the Q2 2021 earnings call.

Despite the imminent exit of the growth gutter, the company trades at a discount to NAV. There are three components to KW’s NAV: income producing properties, unstabilized or undeveloped properties, and fee bearing capital. The income producing properties make up the largest portion of the value. Based on conversations with real estate professionals, we used the following cap rate assumptions for the respective property types.

The Shelbourne was valued at a 7.5% cap rate on normalized earnings of $19.5 million (earnings level provided by management).[17] Earnings are temporarily softened from COVID-19 but given the historical significance of the hotel, earnings are expected to recover once travel recovers. The value of the Shelbourne can be corroborated with ~$1 million per key (for its 265 keys) which is modestly higher than the highest observed transaction based on recent transactions of less historic hotels.[18] Finally, the value of the loans in their portfolio is assumed to be the loan balance face value of $126 million. The loans yield 6.6% on average and have a 3.5 year average duration. These yields compare favorably to 5 year CMBS rates of 3.5%-4.5%. and “the credit quality of the borrower is not of substantial importance to our evaluation of the risk of recovery from such investments”.[19] [20] The “loans are underwritten by us based on the value of the underlying real estate collateral”.[21] Since KW can happily take over ownership of the collateral properties in a default scenario and increase returns by doing this, the company is able to safely obtain above market yields on loans. For all these reasons, intrinsic value of these loans, specifically in the possession of the company, are at least loan balance given the above market yields with upside in a default scenario. The total value attributable to income producing properties is $8.0 billion and represents a weighted average cap rate of 5.0% on current NOI.

The stabilized properties can be valued based on the future estimated NOI delivery from completion of development and future leasing. KW’s “development pipeline is building to a 6% to 7.5% yield on cost and will generate substantial value creation when valued at market cap rates which are significantly lower than our projected stabilized yields”.[22]

If we apply a 5.0% cap rate to 101M of estimated NOI, the future value of development and stabilization activities is $2.0 billion. This value must be discounted to today’s present value. Based on the timing estimates from the chart above, the weighted average duration until stabilization is two years, assuming NOI is recognized ratably throughout each year. Using a 10% discount rate, the present value of undeveloped and unstabilized assets is $1.7 billion.

The fee bearing capital segment can be valued based on a public comps analysis. Assets under management (“AUM”) are currently growing at an ~20% rate. If this continues, AUM should be just shy of $5 billion by the end of the year. Based on historic and expected future performance, KW will likely charge an average fee of 1% on AUM and earn 50% EBITDA margins. FY 2021E EBITDA for the fee bearing capital segment should be $25 million. Considering trading multiples of comparable public companies growing slower than KW’s fee bearing capital segment, 13x forward EBITDA is a fair multiple.

The NAV analysis leads to a value of ~$27.60 a share, or ~30% upside to the current price of $21.37 a share.[25]

Current value can be corroborated by applying the dividend discount model, assuming a 10% dividend growth for the next five years (compared to a 20% dividend growth CAGR between 2012 and 2020) with an exit multiple consistent with current trading levels.

The return to consistent NOI growth as well as aggressive share buybacks could aid in the closing of the discount to intrinsic value. Even without convergence to fair value, 10% annual growth combined with the 4% annual dividend and a share buyback yield north of 1% leads to a 15% IRR. There is additional upside if capital can be attractively deployed during turbulent times.

Given the stability of the core assets, it is difficult to envision meaningful downside to KW’s current valuation. Liquidity remains healthy with amply laddered debt maturities. The company prudently manages liabilities with a conservative capital structure. Impressively, KW has never needed to turn in the keys on secured properties. Despite management’s optimism on the return to annual NOI growth, 25% of NOI remains in California multifamily, retail, and hotel properties. Continued sales of these assets could represent a headwind to NOI growth.

We would like to extend a special thank you to our Senior Analyst Ari Lazar for the deep work he did on Kennedy-Wilson over the course of the last year and for his contribution to this letter in writing out our thoughts on the business.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice. Please call us directly to discuss this commentary in more detail – we are always happy to address any specific questions you may have. You can reach Jason or Elliot directly at 516-665-1945. Alternatively, we’ve included our direct dial numbers with our names, below.

Jason Gilbert, CPA/PFS, CFF, CGMA

Managing Partner, President

@jasonmgilbert

Elliot Turner, CFA

Managing Partner, Chief Investment Officer

@elliotturn

[1] https://www.rgaia.com/commentary/q32019-investment-commentary-kambi/

[2] https://www.legalsportsreport.com/53985/fanduel-sportsbook-confirms-mohegan-partnership/

[3] https://www.forbes.com/sites/willyakowicz/2021/08/05/penn-national-to-acquire-score-media-and-gaming-for-2-billion/?sh=68949f743583

[4] https://twitter.com/stoolpresidente/status/1423258082940006403

[5] https://www.rgaia.com/commentary/q22020-investment-commentary-the-tale-of-two-markets/

[6] KW Q2 2021 10Q and Form 8K filed August 23, 2021

[7] https://www.aarp.org/politics-society/government-elections/info-2021/census-2020-data-results.html

[8] Q2 2021 Earnings Call Transcript

[9] https://www.spglobal.com/marketintelligence/en/news-insights/videos/sp-capital-iq-pro-powering-your-edge

[10] https://www.businesswire.com/news/home/20210625005057/en/

[11] Q2 2021 Earnings Call Transcript

[12] Q2 2021 Earnings Call Transcript

[13] Q2 2021 Earnings Press Release

[14] Q2 2021 Earnings Call Transcript

[15] Q2 2021 Earnings Call Transcript

[16] Q2 2021 Investor Presentation

[17] Q2 2021 Earnings Call Transcript

[18] https://lwhospitalityadvisors.com/wp-content/uploads/2020/10/Q3-2020-Hotel-Sales.pdf

[19] https://www.commercialloandirect.com/commercial-rates.php

[20] Q2 2021 10Q

[21] Q2 2021 10Q

[22] Q2 2021 Earnings Call Transcript

[23] Q2 2021 Investor Presentation

[24] Based on data from Sentieo as of 9-28-2021

[25] As of 9-28-2021

Article by RGA Investment Advisors