“As the world emerges from the COVID-19 pandemic we are observing a new era of deal-making, which is setting records across industries, regions and deal structures. Over the course of 40 years of tracking mergers & acquisitions, we’ve never seen deal-making at this pace, by value and volume. What’s most interesting is that each of the hallmarks of previous M&A cycles are present today and are evolving, with record levels of tech M&A this year, an all-time record for private equity buyers and a new, closely watched phenomenon that’s helping push volumes ahead, SPACs. As fiscal, monetary and regulatory policies become clearer over the course of the second half of the year, deal-making will have to adapt, but conditions seem favorable for the current momentum to continue,” comments, Matt Toole, Director, Deals Intelligence, Refinitiv

Q1 2021 hedge fund letters, conferences and more

The below Refinitiv Deals Intelligence full quarter end 21Q2 reports analyze global M&A, Capital Markets and Syndicated Loans activity along with a special supplemental overview of the SPAC market. Top highlights below.

Record First Half For Worldwide Deal-Making

- M&A Financial Advisory Review

- Global M&A (view report here)

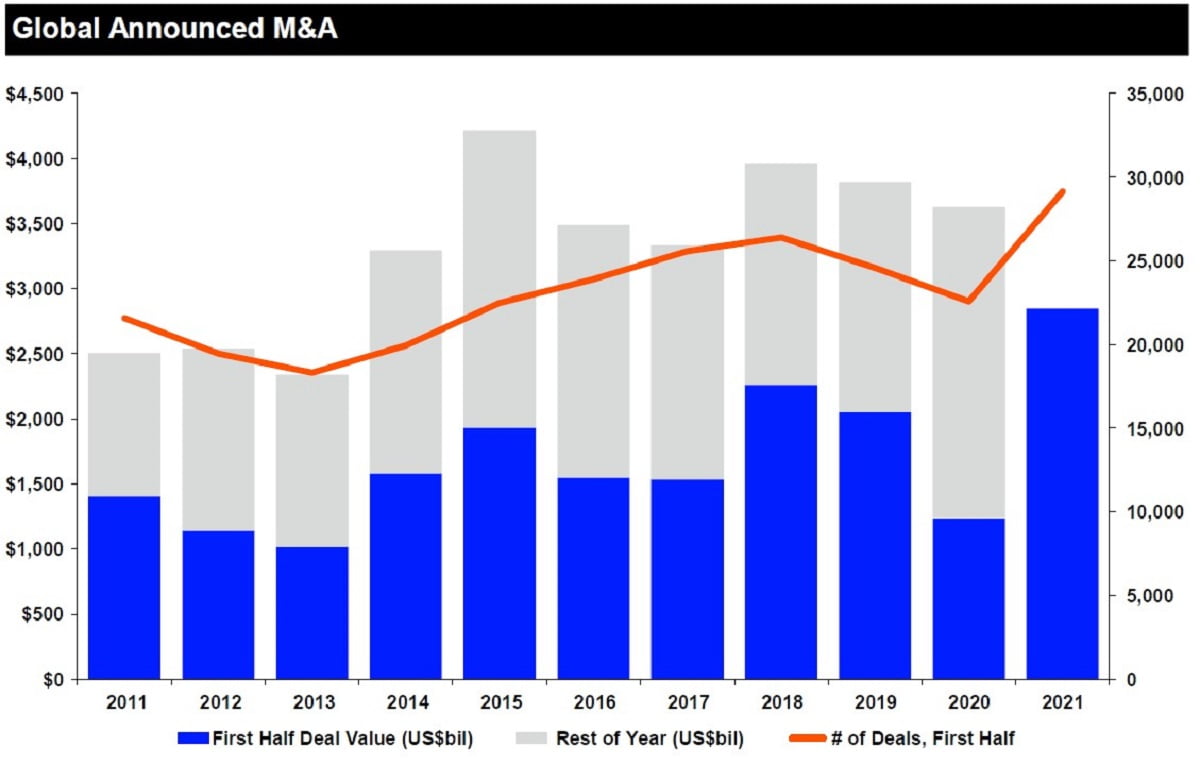

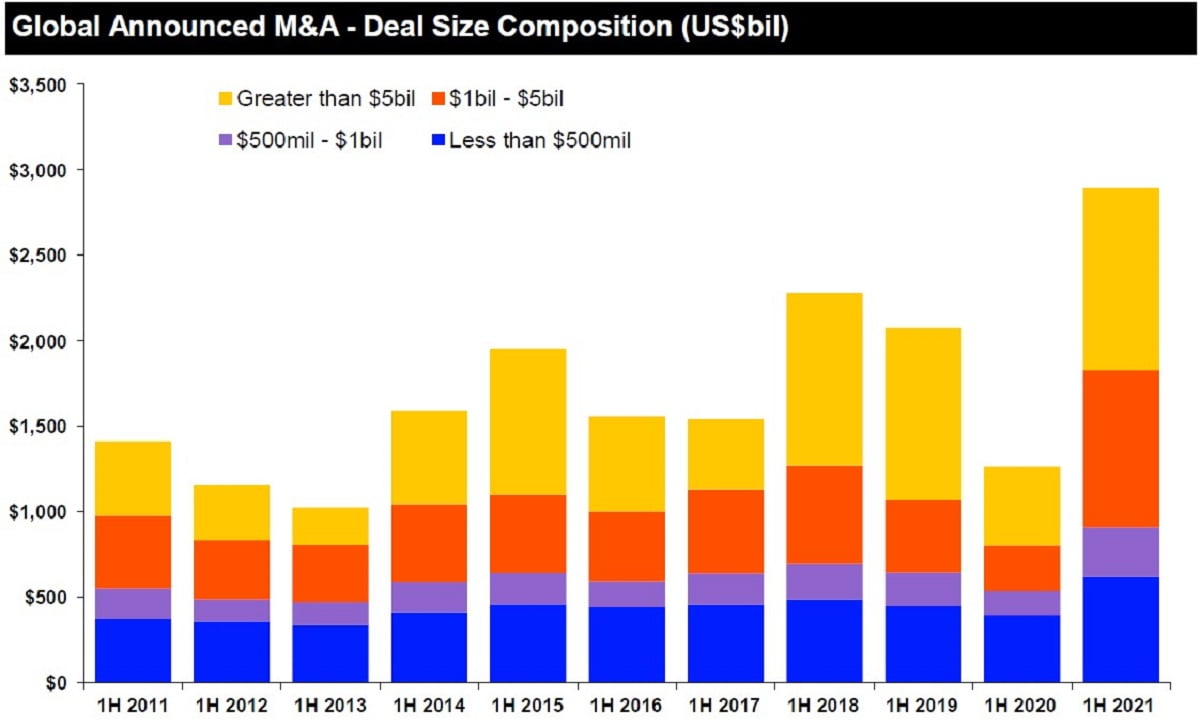

- Worldwide Deal Making Reaches US$2.8 Trillion For Record First Half

- Private Equity Backed M&A Hits All-Time High; SPACs Account For 14% of Value

- All-Time Record For Tech M&A

- Emerging Markets M&A (view report here)

- Emerging Markets Deal-Making Up 36% to All-Time High

- China, Brazil & India Drive 57% of Emerging Market M&A

- Mega Deals Account for 27% of Announced Emerging Markets Value

- Global M&A (view report here)

- Global Equity Capital Markets Review (view report here)

- Global ECM Activity Up 50%; Hits All-Time First Half Record

- Global IPO's Top $200 Billion For Record First Half

- Nearly 2,400 Secondary Offerings Come To Market in H1; All-Time Record

- Supplemental overview into the SPAC Market for the first half of 2021

- Global Debt Capital Markets Review (view report here)

- Global Debt Capital Markets Activity Down 8% To US$5.3 Trillion

- Investment Grade Corporate Debt Issuance Falls 18%

- Global High Yield Debt Pushes Past $400 Billion for First Half Record

- Global Syndicated Loans Review (view report here)

- Global Syndicated Lending Up 22% to Three-Year High

- Acquisition-Related Financing Surpasses US$500 Billion, Up 75%

- Technology and Healthcare Lead Advancing Industries

Find out more information about Deals Intelligence, M&A Data, League Tables and Capital Markets Insights.