2020 was the year of video games. Lockdown meant that we all had lots of time on our hands and nowhere to go, so why not travel to the incredible worlds available through our consoles?

Q2 2021 hedge fund letters, conferences and more

While we’re exploring new galaxies, battling robot armies or sailing with viking hordes, we don’t really think too much about the real world stories that are behind the making of those games, but they can often be almost as dramatic as what happens on screen.

This year alone we’ve seen turmoil at Activision Blizzard, the creator of the hugely successful Call of Duty franchise because of allegations of a toxic workplace culture of sexism and harassment. Will it have an impact on sales of the next game in the series? Only time will tell.

One thing for certain is that there’s a lot of money in video games and the pandemic certainly didn’t slow down how quickly the big businesses were spending it on acquisitions. Investors alone spent $43 billion across 1,500 transactions in the entertainment software sector in 2020.

Businessfinancing.co.uk has taken a deep dive into the history of gaming companies and the acquisitions they’ve made to grow, with the big fish buying up the little fish in a bid to be the biggest in the ocean. Here’s what they found:

The Biggest Gaming Acquisitions In History

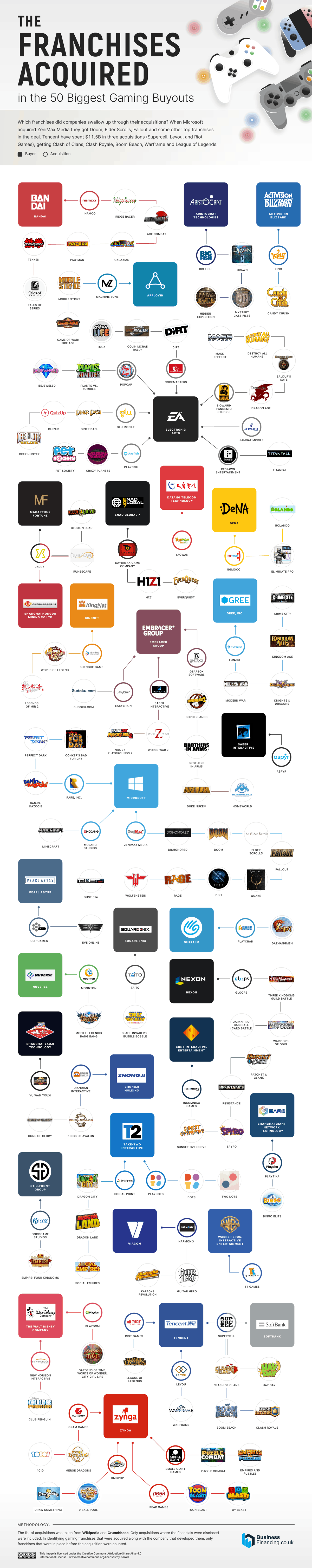

The two gaming companies to have spent the most money on acquisitions have both splashed out more than $11 billion. The biggest spenders are Chinese firm Tencent, who have paid $11.5 billion and that incredible amount has paid for just three other companies - Supercell, Leyou, and Riot Games.

These purchases have brought game franchises like League of Legends, Clash of Clans, Hay Day, Clash Royale and Gears of War under Tencent’s ownership as well as Leyou’s heritage in… poultry.

The second biggest spenders are Microsoft, who have paid out $11 billion buying ZeniMax Media, Mojang Studios, and Rare, Inc, earning the software giant control of lucrative franchises like Doom, The Elder Scrolls and Minecraft. For Microsoft, buying big developers has the added potential for moving big games to be exclusive to its Xbox consoles.

The third-placed company is some way behind the leaders, but Electronic Arts has still spent $7 billion on buying brands like Bioware and Codemasters, giving them ownership of franchises like Mass Effect, DragonAge, Plants and Zombies and TocaLife.

For each of these big companies, these purchases have helped bring into the fold successful games that have been developed elsewhere and can guarantee strong sales in the future. And they’re not the only firms doing this, with franchises like Borderlands, Candy Crush, Pac-Man, Duke Nukem, Ratchet & Clank, Spyro and Guitar Hero all having been bought by new owners over the years.

Gaming Acquisitions Through The Years

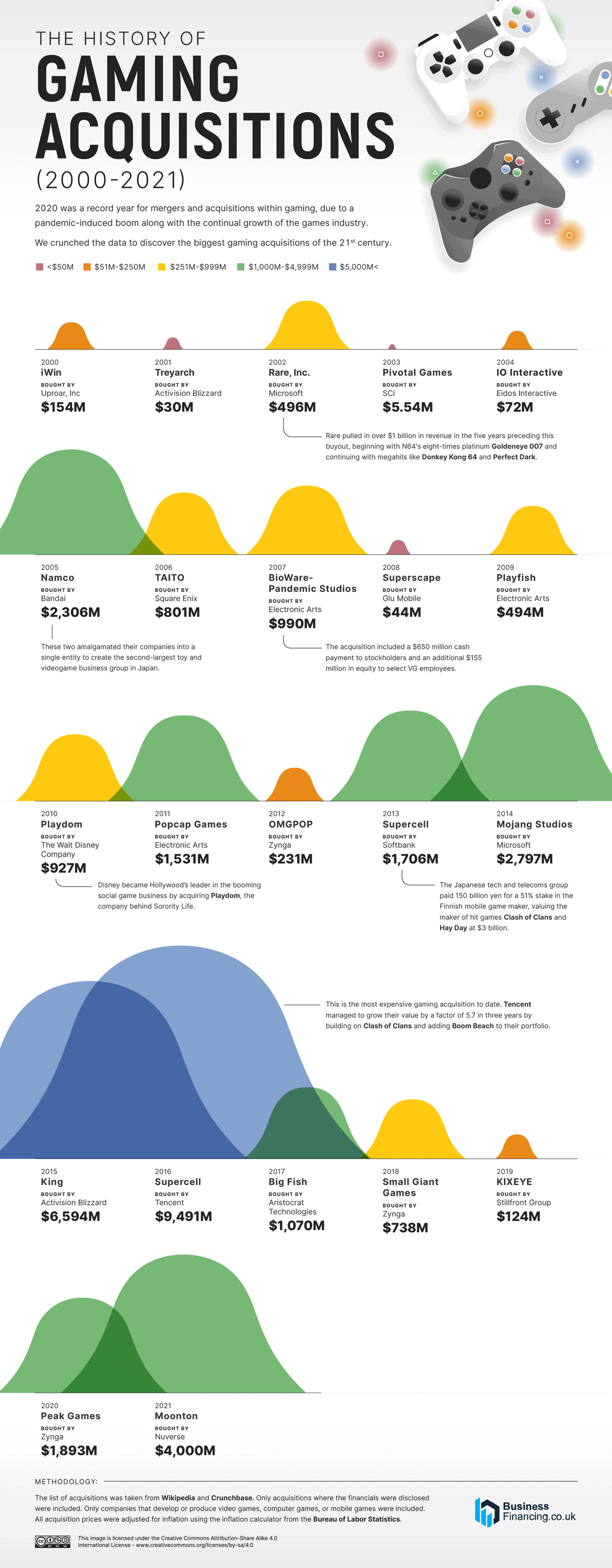

The study also looked at when the biggest acquisitions were made, from the $154m purchase of iWin by Uproar Inc in 2000 to this year’s $4 billion paid by Nuverse for Moonton. If Nuverse doesn’t ring any bells, you might know its parent company ByteDance best known for being the TikTok people, while Moonton’s claim to fame is creating Mobile Legends: Bang Bang.

Back in 2001, video game developer Treyarch cost Activision (now Activision Blizzard) just $30m, which is a bargain considering the huge success it has brought its parent company since with the Call of Duty franchise alone, as well as Spider-Man and James Bond games. The most recent Call of Duty game, Black Ops Cold War, earned Activision $678 million in its first six weeks in 2020.

The Biggest Gaming Acquisitions Ever

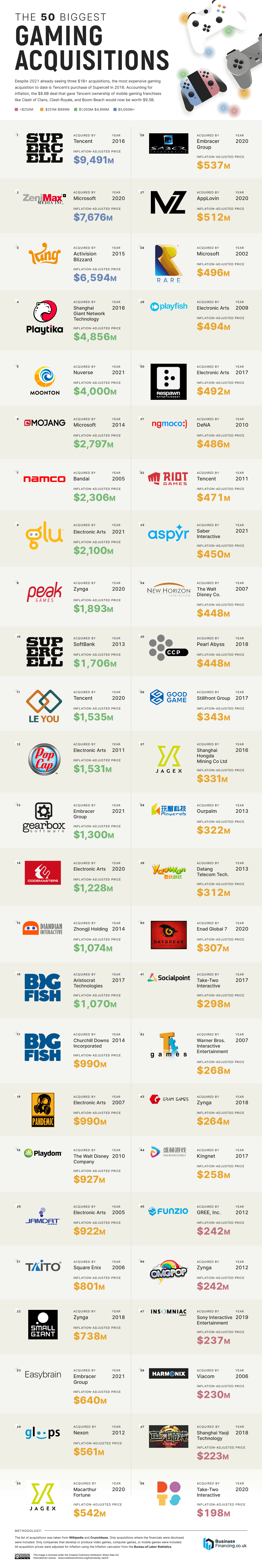

Over the years, the figures involved in gaming acquisitions have certainly increased since that purchase, with the biggest ever standing at $8.6 billion, which would be $9.5 billion today, accounting for inflation. That was Tencent’s 2016 purchase of Supercell, a Finnish mobile game developer responsible for huge hits like Hay Day and Clash of Clans.

The second biggest purchase was in 2020 when Microsoft added ZeniMax Media to its Xbox portfolio. ZeniMax had started out as the parent company of studio Bethesda, best known for its Elder Scrolls and Fallout franchises, but had added id Software (Doom and Quake), MachineGames (Wolfenstein) and Tango Gameworks (The Evil Within), giving Microsoft a whole host of big names for just under $8 billion.

The third-biggest acquisition shows again the strength in the mobile games market, with Activision Blizzard spending $6.5 billion in today’s money on King, the creators of the hugely lucrative Candy Crush games. Who hasn’t wasted some time playing those games on their phones, after all?

With no sign of these buy-outs slowing down anytime soon, the video game marketplace is likely to see many more big money acquisitions as the giant companies seek to consolidate their place with well-timed purchases of up and coming brands. The question, as always, for gamers is what these boardroom shenanigans will mean for the games that we know and love...