In the 5 seconds since you’ve opened this post Apple has made $8,800 profit, Microsoft $6,200 profit, and Google $5,400.

Q4 2020 hedge fund letters, conferences and more

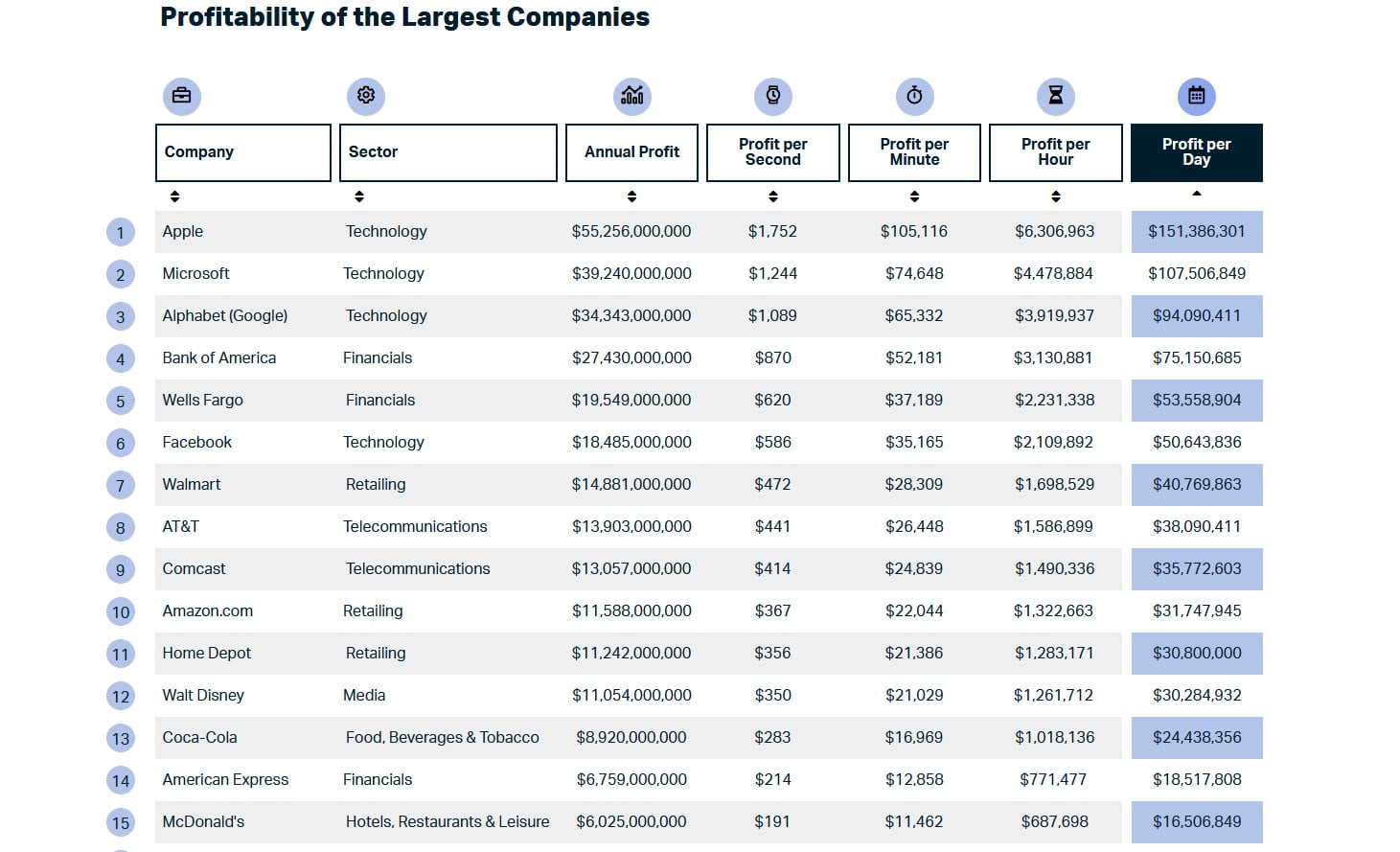

New research conducted by Tipalti reveals just how much profit the world’s biggest companies are earning per SECOND, with the most profitable company Apple making $1,752 a second.

The Top Ten Companies Earning The Most Profit Per Second

| Rank | Company | Annual Profit | Profit per Second | Profit per Minute | Profit per Hour | Profit per Day |

| 1 | Apple | $55,256,000,000 | $1,752 | $105,116 | $6,306,963 | $151,386,301 |

| 2 | Microsoft | $39,240,000,000 | $1,244 | $74,648 | $4,478,884 | $107,506,849 |

| 3 | Alphabet (Google) | $34,343,000,000 | $1,089 | $65,332 | $3,919,937 | $94,090,411 |

| 4 | Bank of America | $27,430,000,000 | $870 | $52,181 | $3,130,881 | $75,150,685 |

| 5 | Wells Fargo | $19,549,000,000 | $620 | $37,189 | $2,231,338 | $53,558,904 |

| 6 | $18,485,000,000 | $586 | $35,165 | $2,109,892 | $50,643,836 | |

| 7 | Walmart | $14,881,000,000 | $472 | $28,309 | $1,698,529 | $40,769,863 |

| 8 | AT&T | $13,903,000,000 | $441 | $26,448 | $1,586,899 | $38,090,411 |

| 9 | Comcast | $13,057,000,000 | $414 | $24,839 | $1,490,336 | $35,772,603 |

| 10 | Amazon.com | $11,588,000,000 | $367 | $22,044 | $1,322,663 | $31,747,945 |

Apple is one of the world’s most profitable businesses, generating over $151 billion a day, which equates to $1,752 every single second.

To put that into context, the average weekly wage in the US currently stands at $1,237, meaning that the average American doesn’t even earn the same amount that Apple earns in a second, after a full week at work.

Fellow tech giants Microsoft and Alphabet (the parent company of Google) also draw in more than a thousand dollars each second, which works out at around $100 million a day.

But at the other end of the scale, Uber Technologies (who trust Tipalti with their accounts payable automation software) made a huge loss of $8.5 billion, equating to $270 every second. Despite being the world’s largest ride-hailing app, Uber has famously never turned a profit.

The Top Five Industries Earning The Most Per Second

| Rank | Sector | Average Annual Profit | Average Profit per Second | Average Profit per Minute | Average Profit per Hour |

| 1 | Food & Beverages | $7,314,000,000 | $232 | $13,914 | $834,826 |

| 2 | Technology | $5,746,272,727 | $182 | $10,931 | $655,884 |

| 3 | Telecommunications | $4,781,500,000 | $152 | $9,096 | $545,764 |

| 4 | Financials | $4,158,736,264 | $132 | $7,911 | $474,681 |

| 5 | Health Care | $3,629,200,000 | $115 | $6,904 | $414,240 |

The research also looked at how the average profit per second breaks down for different sectors across the whole Fortune 500 list, with those in food and drink making the most, averaging $232 a second, over $13,000 a minute and over $20 million each day.

You can find the full research here.