What’s New In Activism – NextGen Healthcare Is Back With The Ex

Q2 2021 hedge fund letters, conferences and more

Irvine, California-based software company Nextgen Healthcare Inc (NASDAQ:NXGN) is facing an activist it knows well, and who knows it well in return – its former chairman, Sheldon Razin.

Razin and fellow director Lance Rosenzweig are part of a four-person minority slate running for election at the annual meeting in October, having accused current Chairman Jeffrey Margolis of “establish[ing] an anti-shareholder culture that is exacerbating corporate dysfunction, eroding margins and stifling organic growth.” Other criticisms included a lack of board diversity, a poor track record of acquisitions, and “apparent entrenchment maneuvers and manipulations of the corporate machinery.”

NextGen’s board isn’t pulling punches either, saying Razin conspired to try and sell the company in 2015 while hiding his efforts from fellow directors, as well as presiding over poor capital allocation with too little investment in the business, and a coddled management team. It also says Razin is paid too much and exhibited “insensitive and unprofessional” behavior during interviews with new board candidates.

Razin, who controls over 15% of the votes, has been reining in his demands but not his rhetoric, having previously demanded six of the nine board seats up for grabs. NextGen, for its part, is trying to hire a new CEO by the annual meeting.

Activism chart of the week

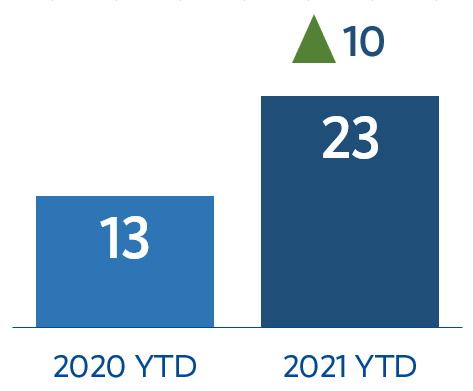

So far this year (as of September 9, 2021), activist nominees have won 23 board seats at Europe-based companies via settlement, compared to 13 in the same period last year.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting - More Substantive Commitments

The Interfaith Center for Corporate Responsibility’s (ICCR) 2021 proxy season review said that companies are providing “more substantive commitments” on environmental and social (E&S) issues when reaching withdrawal agreements with shareholder proponents.

In a “remarkable year” for environmental and social engagements, ICCR members filed 297 resolutions at nearly 200 publicly traded companies on a range of issues. Of these, 113 were withdrawn following an agreement between the company and the proponent, the report revealed. The most popular topic saw 37 withdrawal agreements centered around climate change involving ICCR members, followed by 21 on racial justice and diversity concerns.

The shareholder organization said proposals by the likes of SumOfUs, Trillium Asset Management, and As You Sow led to “key breakthroughs” in the financial sector, with a number of banks agreeing to target net-zero emissions by 2050 in return for the withdrawal of proposals.

Although companies were “more aggressive” in challenging shareholder resolutions with the Securities and Exchange Commission (SEC) this proxy season, fewer no-action relief requests were granted than in the previous season.

Proxy chart of the week

So far this year (as of September 9, 2021), S&P 500 companies have faced 34 shareholder proposals on social issues. This compares to just 24 over the same period in 2020.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts - FSCA Slaps Viceroy With A Fine

South Africa’s Financial Sector Conduct Authority (FSCA) slapped Viceroy Research with a 50 million rand ($3.5 million) fine for a 2018 short report that alleged Capitec Bank was a "loan shark" using predatory lending schemes.

On Wednesday, FSCA said in a statement that after analyzing the allegations made by Viceroy in its reports, it reached the conclusion that the short seller made “false and misleading” statements about Capitec. The watchdog added that Viceroy was also guilty of failing to “publish full and frank corrections” after “being made aware of what they had published was false.” The regulator also issued a note explaining its decision.

The short outfit has vowed to appeal the fine, arguing the watchdog’s investigation was biased and designed to protect Capitec from scrutiny.

The initial report caused a 25% intra-day plunge in Capitec’s share price, although the bank is now trading at more than double its level prior to the campaign.

Shorts chart of the week

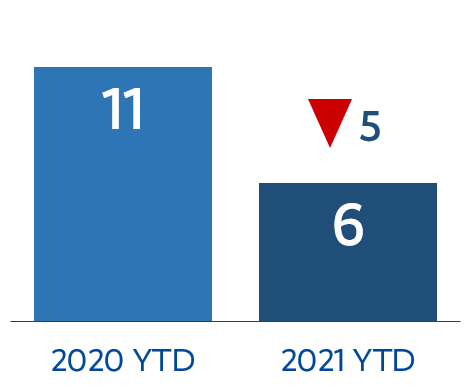

So far this year (as of September 10, 2021), six Canada-based companies have been publicly subjected to an activist short campaign, down from 11 in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote Of The Week

TCI founder Chris Hohn kicked off a proxy fight to overhaul Canadian National Railway and install Jim Vena with a long statement Monday, coincidentally and succinctly confirming analysis from our recent in-depth article about what the activist might want after breaking up the merger of CN and Kansas City Southern:

“CN should focus on getting better rather than bigger.” – Chris Hohn, TCI