A much larger volume of filings last week lifted the 3rd quarter financial statement update to about 33% complete. Still too early to make any macro measurements but anecdotally we are seeing a large frequency of rising gross and operating profit margins at companies with negative and falling sales growth. That is the opposite of the last quarter when profit margins fell very broadly. We suggested back in July that layoffs were being delayed but this has now become reality as shown in the recent financial reporting.

Q3 2020 hedge fund letters, conferences and more

Companies are beginning to assess the longer term now as it looks like businesses will be disrupted for an extended period. A higher gross profit margin for a negative sales company means that costs are dropping at a faster rate than sales. That is layoffs of production labor are imminent. Similarly, the only way for costs to decline when sales are negative is to layoff salespeople, administrators, and management.

Companies in the healthcare, education and technology sectors that are benefiting from the shift are displaying very attractive attributes. These superior attribute companies should be owned at least until the industrial, energy, financial, travel and leisure industries begin to illustrate the shape of a recovery. Meanwhile growth is in a freefall with many companies now insolvent with negative cash flow.

Companies are starkly split between those that can thrive in the new world and those that cannot. Until we see some sign of recovery, invest only in exceptionally superior attributes companies. Maxim Integrated Products, Inc. is reporting strong fundamentals with attributes pointing in the right direction.

Maxim Integrated Products, Inc. $69.650 BUY this rich company getting better

Maxim Integrated Products Inc. (NASDAQ:MXIM) has been an exceptionally profitable company with persistently high cash return on total capital of 20.7% on average over the past 21 years. Over the long term, the shares of Maxim Integrated Products have declined by 7% relative to the broad market index.

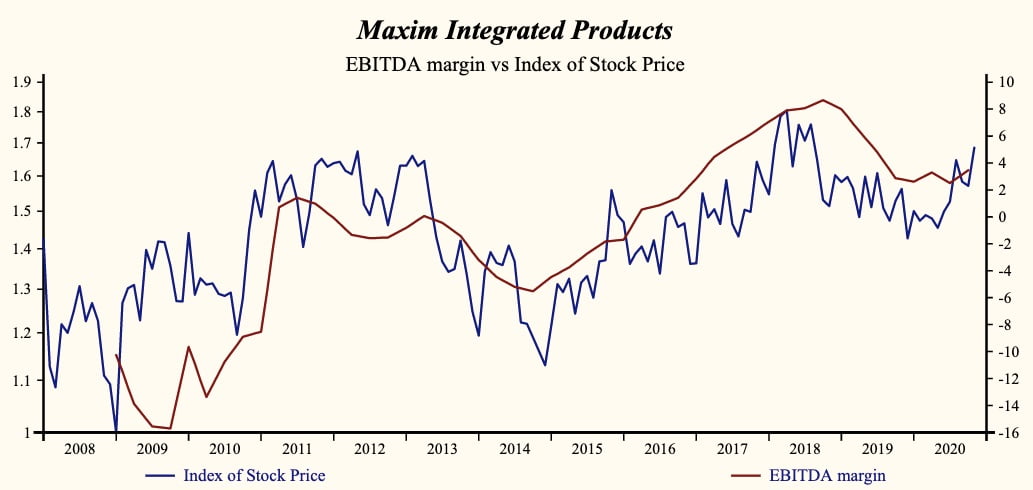

The shares have been highly correlated with trends in Growth Factors. A dominant factor in the growth group is the EBITDA Profit Margin which has been 84% correlated with the share price with a two-quarter lead.

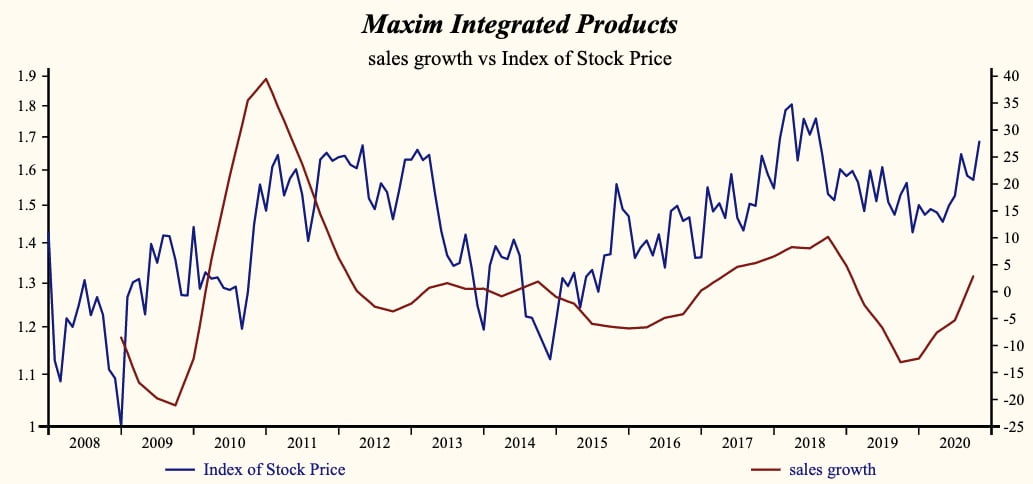

Currently, sales growth is 2.8% which is low in the record of the company but higher than last quarter and positive. Receivable turnover has been steady for the past 6 quarters reflecting a strong quality of sales.

Superior Quality Growth Trend

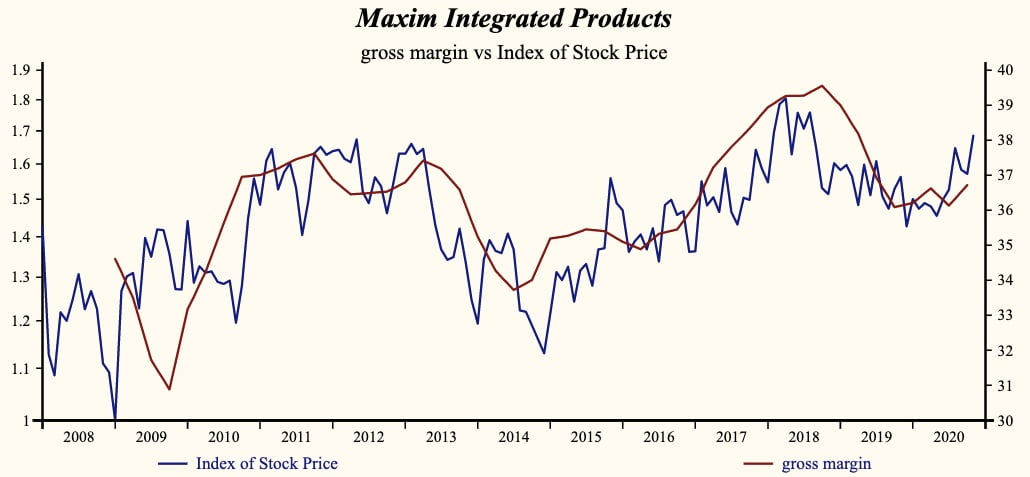

Maxim Integrated Products is recording a low and rising gross profit margin. Inventory turnover continues to fall indicating that products are not sitting on the shelf. Sales, General & Administrative (SG&A) expenses are low in the record of the company and falling. SG&A expenses are falling at a more rapid rate than the gross margin producing a rising profit margin.

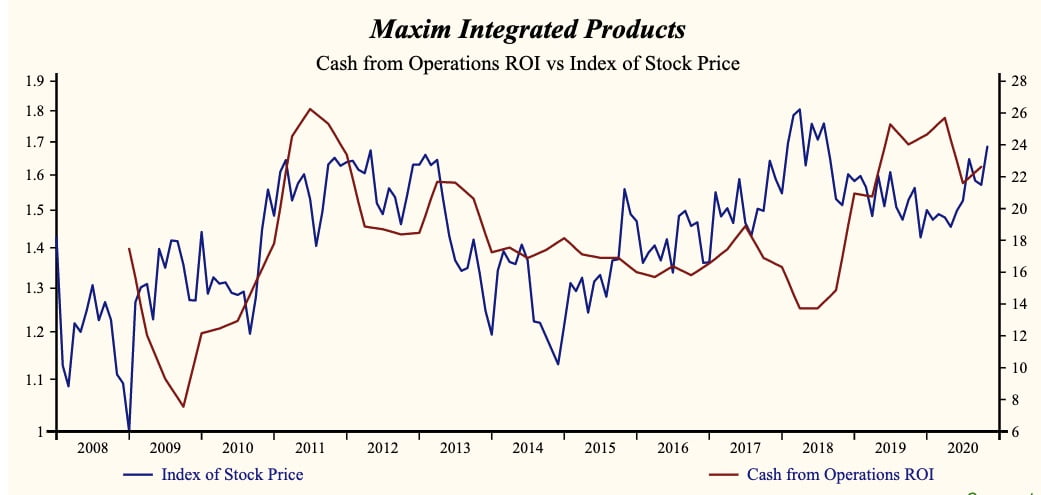

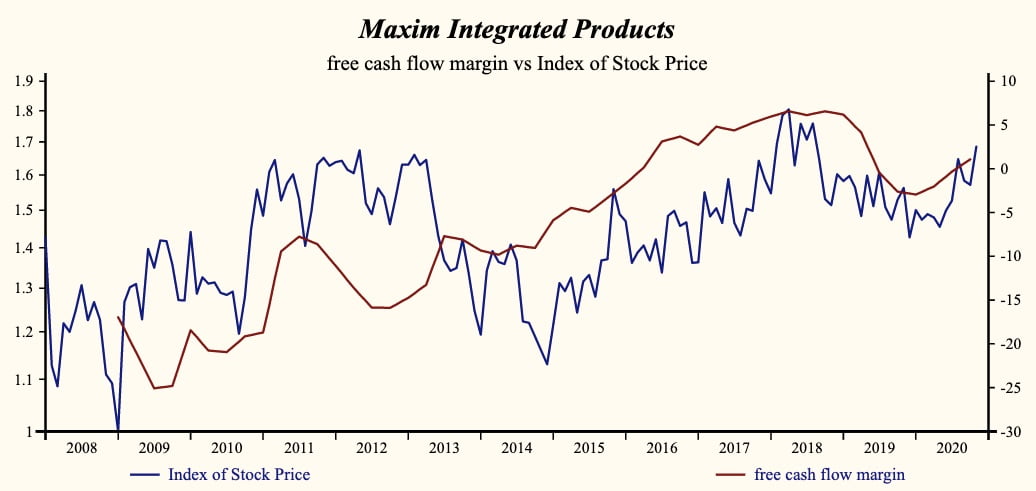

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have been supporting free cash flow since early 2019. However, a stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby keeping free cash flow growth up and positive.

More recently, the shares of Maxim Integrated Products have advanced by 16% since the November, 2019 low. The current indicated annual dividend produces a yield of 2.9%. Five-year average dividend growth is 14.0%. Current trailing operating cash-flow coverage of the dividend is 1.8 times. The shares are trading at upper-end of the volatility range in a 11-month rising relative share price trend.

Despite the extended share price, this provides a good opportunity to buy the shares of this evidently accelerating company.

Shift to active management now and maintain a portfolio of companies with high and rising profitability.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.