The gold price broke though a key resistance level

November 23, 2020 Update: Following the news about AstraZeneca’s COVID-19 vaccine, the gold price tumbled to $1,832 an ounce before bouncing, although it bounced back above the key resistance level it broke by falling to $1,832. Credit Suisse analysts noted that gold was back in its consolidation range from August, but they flagged the key support level at $1,837 to hold further weakness. That’s the 38.2% retracement of the March rally.

Credit Suisse analysts said the gold price would need to climb back above $1,966 in order for $2,016 to be in sight, followed by a retest of the $2,075 August high. An eventual move higher would see resistance at $2,175 and then $2,300.

Since the yellow metal fell below $1,837, albeit briefly, the Credit Suisse team warns of a deeper but still corrective setback to the 200-day average at $1,790 and possibly as low as $1,726.

Gold could be heading for a retest of $2,075

October 23, 2020 Update: The gold price has extended its consolidation after moving to Credit Suisse’s base case of $2,075 and $2,080 in August. However, the firm’s analysts add that it still is holding flagged support at $1,837, which is the 38.2% retracement of the March rally.

Credit Suisse analysts expect this to continue holding and the sideways range to continue ahead of a break above $1,993 for a new look at $2,075. Eventually, they expect the gold price to resume the core bull trend and see resistance at $2,175, followed by $2,300. However, they also believe that this won’t happen until next year.

If the gold price falls below $1,837, Credit Suisse analysts think it could fall all the way to $1,765 and possibly even $1,726, but they expect it to hold there.

Gold price holding the $1,900 support level

October 6, 2020 Update: The gold price slumped as the U.S. dollar stabilized, and Federal Reserve Chairman Jerome Powell didn’t provide much support for the metal either as he called on Congress again to deliver more stimulus. Even though there was a record surge in ETF holdings, gold seems to be consolidating as Wall Street starts to price in calmer markets around the election.

Edward Moya of OANDA doesn’t expect gold to have an easy ride back up.

“Gold will have a choppy ride back above [the] $2,000 level as positive news with both coronavirus treatments and vaccines will unwind some safe-haven flows,” he said in an email. “Investors can’t deny the economy is about to see a lot more stimulus, the question is how much and if it will be accompanied with an easy path of massive infrastructure spending.”

Gold price rises despite better-than-expected jobless data

October 1, 2020 Update: The gold price rallied to rise back above $1,900 an ounce as unemployment claims declined more than previously expected. The Labor Department said today that 837,000 Americans filed initial jobless claims last week, which is a decline of 36,000 from the previous week, which was revised up by 3,000 to 870,000.

This is the smallest number of jobless claims since the pandemic routed the U.S. economy. Economists had been expecting to see 850,000 initial jobless claims last week. Although the data on the labor market was better than expected, that hasn’t had a negative impact on the gold price.

Commerzbank analysts said in a note this week that the bull market in gold probably won’t end any time soon. They said there are just too many problems for the economy right now, including soaring national debt, unchecked money printing by central banks, ultra-low interest rates and political risks.

Further, ETF investors are still boosting their holdings of gold as inflows to gold ETFs reached 54 tons last month and 240 tons in the third quarter.

September 10, 2020 Update: The gold price ticked higher today as first-time unemployment claims came in worse than expected at 884,000. The four-week moving average for new claims fell to 970,750, while continuing unemployment claims increased to 13.385 million for the week ending Aug. 29.

Inflows to gold ETFs slowed in August

The gold price declined as the market digested this data, and it’s looking more and more like the tear the metal has been on this year may be slowing. The gold price ended August down 0.38% for the first time in five months.

Data from the World Gold Council reveals that inflows to gold-backed exchange-traded funds slowed to 39 tons. It was the ninth straight month of inflows, but it was the slowest pace of growth so far this year. So far this year, global net inflows to gold ETFs are up 938 tons.

North America saw continued strong inflows in August with holdings rising 41 tons. Asian-listed gold ETFs saw an increase of 7 tons during the month. The gold price reached a new record high in early August as trading volumes spiked, but the World Gold Council noted that it remains far below the inflation-adjusted record high of $2,800 an ounce.

The organization believes gold prices could move higher due to continuing expectations of low interest rates and higher inflation allowances. The overbought conditions observed in early August have mostly passed as the Relative Strength Index fell from extreme levels close to 90 down to the neighborhood of 50, which is more neutral.

Gold price rallies after last week’s correction

August 17, 2020 Update: The gold price was holding at $2,000 an ounce, but it pulled back sharply on Friday in a deep correction that reset the markets. However, analysts say that correction was just temporary, and the yellow metal resumed its climb today. It couldn’t go much past $1,990 an ounce, but more upside could be ahead.

RBC Managing Director George Gero told Kitco News in an interview that the selloff last week presented a much-needed reset for the gold price, which he said was in an unsustainable rally. He added that the gold market “has shaken out some of the hot money” and that value investors are now “paying attention.”

Gero said that although last week’s correction was strong, the marketplace sentiment remains bullish. He said the correction was technical as investors in gold-backed exchange-traded funds took profits after the push over $2,000 an ounce.

Craig Erlam of OANDA agrees that the outlook for the gold price is still bullish.

“The outlook remains bullish though unless the dollar can stage another strong fightback, but that will require real US yields to rally much further,” he said in an email. “They’re off the lows for now but, despite last week’s occurrance [sic], few have changed their views. It seems people are just as bullish as ever about gold, they’ve just been reminded that it is a two-way trade and one way is typically far more aggressive than the other.”

Dollar pressures gold price, but it holds on to $2,000

August 10, 2020 Update: The gold price has been on a tremendous tear, but the rallying dollar took some of the shine off. Some analysts warn there could be a correction in the yellow metal, although last week it notched its ninth straight week of gains despite Friday’s correction, according to analysts at Commerzbank.

Commerzbank analysts had warned about the extremely high Relative Strength Index last week and said a correction could be on the way. The gold price topped $2,000 for the first time ever. Analysts at OANDA say a test of $2,000 “would be very interesting,” given that it has become a key psychological support level for the metal.

“A break could exacerbate any move to the downside and see $1,980 support quickly put to the test,” analyst Craig Erlam said in an email. “That could all depend on the dollar which is forming a double bottom of its own. A break above last Monday’s peak could trigger a bullish corrective move in the dollar, back towards the June/early July support zone and put considerable pressure on gold prices.”

Gold backs off from record high as demand falls

July 30, 2020 Update: The gold price hit a new record high this week, although today it’s on track for its first decline in 10 trading sessions. Despite the decline, the gold price is holding firmly above $1,900 an ounce.

The World Gold Council reported today that demand for the yellow metal was down 6% during the first half of the year at 2,086 tons. Demand in the second quarter declined 11% year over year to 1,015.7 tons, more than offsetting the gain recorded in the first quarter.

The organization said the coronavirus pandemic was again the biggest factor impacting the gold market during the second quarter. It significantly reduced consumer demand, although it did provide support for investment demand.

Central banks’ and governments’ responses to the pandemic have taken the form of interest rate cuts and sizeable liquidity injections. The World Gold Council said the response fueled record flows of 734 tons into gold-backed exchange-traded funds.

Those flows boosted the gold price, which was up 17% in U.S. dollar terms in the first half of the year while hitting record highs in many other currencies. Total coin and bar investment demand dropped sharply during the second quarter, resulting in a 17% year-over-year decline in demand for the first half of the year.

Investor behavior diverged between East and West. Most Asian and Middle Eastern Markets saw investments slow, while Western investors boosted demand. Jewelry demand tumbled 46% as prices remained high and lockdowns kept buyers at home.

Central bank buying of the yellow metal also slowed again during the second quarter, although it’s up against a record quarter from last year. Inflows into gold ETFs accelerated during the quarter, boosting first-half inflows to a record 734 tons. That beat the 2009 full-year record of 646 tons.

Gold price tops $1,900 an ounce

July 24, 2020 Update: The gold price soared above the psychological $1,900 an ounce level today, although it is struggling to hold that level. After peaking above $1,900, gold is now bouncing off that price and trading in the high $1,890 an ounce range.

The yellow metal is on its longest winning streak since 2011, according to the Financial Times. This week also marks the first time since 2011 that the gold price has climbed above $1,900 an ounce. Investing.com Senior Commodities Analyst Barani Krishnan says it’s more a matter of when gold reaches $2,000 an ounce rather than if it will reach that level.

“There are lots of push-and-pull factors in the backdrop of this rally though,” Krishnan said in an email. “You have stimulus expectations worldwide after the EU $750 billion coronavirus relief plan, even as Congress goes back and forth on its own CARES 4.0 package for Covid-19 that should bring another $1 trillion into the mix. The dollar continues to break down, pushing precious metals higher, though simmering U.S.-Chinese tensions are supporting the greenback from a complete meltdown.”

When the gold price does reach $2,000, volatility is expected at the top. For now, a new record high in gold futures is possible at $1,912.

Gold on track to hit new record high

July 23, 2020 Update: The record high gold price is $1,920.70, set in 2011. The yellow metal is still meaningfully below that, but after a five-day run, it looks set to test it. Meanwhile, the U.S. dollar continues to slump while concerns about the coronavirus are still rising.

Tensions between China and the U.S. are also intensifying. In an email, Edward Moya of OANDA said because of how many risks there are to the global outlook, the gold price might not struggle to hit the psychological $1,900 an ounce level this week.

“If Asia continues to see steep rises with infections, their [sic] will be little hope that the US and Latin America will get the virus under control,” he said. “Gold is also benefiting from a surge of retail interest that remains fixated on rising stimulus bets and as real yields fall deeper into negative territory. The 2-year TIPS rate finally broke below -1.0%.”

He added that the gold trade is overcrowded, but fundamentals support an increase in the gold price to a new record high within the next month. He said the big risk for the yellow metal right now is if one of the top vaccine candidates has strong Phase 3 trial results. However, that won’t happen for several weeks because the trials are just getting started.

Are bulls or bears in control of gold?

July 15, 2020 Update: The gold price is hanging on to $1,800 an ounce, which could be both bullish and bearish, depending on your view of the situation.

“On the one hand, the yellow metal broke through $1,800 with relative ease despite its historical significance and has, broadly speaking, spent plenty of time above here since. That must be encouraging for gold bulls,” Craig Erlam of OANDA said in an email. “The flip side is that, rather than seeing an explosion of buyers on the back of the breakout, it’s looking a little tired.”

He noted that this same situation has occurred repeatedly over the last month, so things may or may not be different this time around. He said if the gold price breaks through $1,820, bulls will be reinvigorated, putting the next resistance level at $1,840. On the other hand, if the yellow metal falls below $1,790, bears will take control.

Gold prices top key $1,800 an ounce resistance

July 8, 2020 Update: Gold prices climbed past $1,800 an ounce for the first time in almost nine years on Tuesday, and they remain above that key level 24 hours later. Record inflows and risk-off sentiment have been driving gold prices amid a slowdown in the stock market’s momentum and a fresh jump in the number of COVID-19 cases.

The World Gold Council said this week that gold ETFs closed the first half of the year with a record $40 billion of net inflows. Inflows for this year hit record levels in both tons and U.S. dollar terms. June was the seventh straight month of positive flows for gold ETFs, which added 104 tons, amounting to $5.6 billion or 2.7% of assets under management.

Global net inflows for the first half of the year reached 734 tons, which is much higher than the highest level of full-year inflows. Gold ETFs recorded 646 tons of inflows in all of 2009 and $23 billion in inflows in all of 2016.

Further, the World Gold Council said inflows to gold ETFs in the first half of the year are even a lot higher than the multi-decade record level of central bank net purchases seen in 2018 and 2019. The organization expects gold ETF inflows to absorb a comparable amount of about 45% of global gold production in the first half of the year.

Gold price: new resistance level at $1,800

June 24, 2020 Update: The gold price climbed to its highest level in almost eight years after passing $1,776 an ounce, but as the day has gone on, the price has fallen into the red. Investors have been concerned about a second wave of the coronavirus, and that has supported the safe haven metal.

Craig Erlam of OANDA said in an email that the U.S. dollar’s strength has weighed on the gold price as the day wore on.

“Gold was doing quite well out of the shift away from risk, that was until the dollar came back into favour in the run up to the open on Wall Street,” he said. “Now the yellow metal finds itself back in the red, just as it appeared to be embarking on an ambitious run at $1,800. The last time we were talking about this level was 2012, when a third failed run at it in just over 12 months saw gold fall out of favour. That could make it quite the resistance level in the weeks ahead.”

Although the gold price can’t seem to top $1,800 an ounce, Dan Oliver of Myrmikan Capital told Kitco that his new forecast for the yellow metal is $10,000 an ounce. He said the Federal Reserve’s balance sheet could be devalued, and if the underlying assets fall, gold will start “rising to a price that balances the Fed’s balance sheet,” he said.

Gold price beats resistance level at $1,730

June 19, 2020 Update: Bulls seem to have taken control over the gold price back as the yellow metal climbed above its key resistance level of $1,730. The next key level is $1,745, and gold is already testing that level as well. Technicians will now be watching to see if the gold price can breach the new resistance level and head toward multi-year highs.

Ole Hansen of Saxobank noted that gold’s range-bound trend of sticking around $1,700 an ounce entered its ninth week as it struggled to find anything to carry it higher or lower. He said hedge funds reduced their speculative longs in the futures market due to the recent weakness in the dollar, lower real yields, and the lack of positive response to more central bank stimulus.

On the other hand, gold-backed exchange-traded funds have remained strong. Bloomberg data indicated that total holdings by gold ETFs have climbed 565 tons to 3,138 tons year to date. ETF purchases of gold have more than offset the decline in physical demand due to the pandemic and lockdowns in Asia.

Demand for gold ETFs has also been on the rise as nine banks told Reuters that they were all advising their ultra-wealthy clients to boost their gold allocations. In the short term, Hansen expects gold to be a key portfolio diversifier, and in the long term, he expects the gold price to rise as the dollar weakens, inflation rises and real yields fall.

Gold in recovery mode

June 8, 2020 Update: Gold prices started to recover today, but they remain below $1,700 an ounce. Investors are betting that there will be another round of stimulus from the world’s central banks, which would be bullish for the yellow metal.

“Gold prices are shrugging off the last week’s decline on hopes the Fed will not tap the breaks in supporting the US economic recovery, Edward Moya of OANDA said in an email. “After a brutal week, gold prices are starting to show signs of life again as investors become skeptical that the US equities will struggle to climb much after recapturing all their losses this year.”

Other experts also expect the bull case for gold to remain in play for quite some time, especially through non-physical vehicles like IRAs, according to one self-directed IRA custodian.

“With global markets experiencing record volatility due to the pandemic, the demand for safe-haven assets such as gold and other precious metals has increased sharply,” said Equity Trust Company CEO George Sullivan said. “We’ve seen interest in precious metals IRAs surge to company-record levels, as daily account volumes have increased over 100 percent since mid-March.”

Gold price falls back below $1,700 an ounce

June 5, 2020 Update: The gold price tumbled back below $1,700 an ounce after the jobs report showed that the U.S. economy added 2.5 million jobs last month. That number came out far ahead of consensus estimates as economies had been expecting 7.75 million jobs to be cut from the economy. Unemployment is now down to 13.3% after forecasts suggesting it would surpass 20%.

Edward Moya of OANDA said in an email, “It will be hard for the Fed to remain extremely accommodative if the world’s largest economy is already in recovery mode. Gold might not get much more support from the Fed, but geopolitical risks, second wave concerns, and an eventually weaker US dollar should keep the longer-term bullish outlook intact.”

Gold demand goes beyond safe-haven demand

May 29, 2020 Update: Gold prices are holding steady above $1,700 an ounce amid new fears about tensions between the U.S. and China. Beijing’s move to impose a security law on Hong Kong only deepened the tensions. Stocks rallied earlier this week, and gold prices came under pressure amid signs of the economy reopening. However, gold demand is tied to much more than just investment demand.

Collin Plume, president and CEO of Noble Gold, told ValueWalk in an email that gold prices will continue to rise, no matter what happens to safe-haven demand.

“This pandemic has taught us some important things, such as the importance of eCommerce and the urgency of developing ecofriendly machines and equipment,” he said. “All of these technologies, including computers, phones, servers, manufacturing equipment, cars, etc. require metals like gold, silver, palladium and platinum because of their unique composition, which makes them durable and efficient energy conductors. There are also new medical discoveries where gold is being used for things like cancer treatment, and even in aerospace, where NASA has used a solid gold box to produce oxygen on Mars.

“Despite all of these use cases, we have very limited supply of these metals. Gold can’t be made in a lab like diamonds now can. Gold can only be produced by the Earth, and with new applications and increased economic activity, gold prices are inevitably continuing to rise.”

Gold price falls below $1,700 an ounce

May 27, 2020 Update: The gold price fell below $1,700 an ounce again, but the lower price wouldn’t stick. Shares rebounded above $1,700 again not much later, but investors’ risk appetite is up, which means stocks are up and gold is down.

Some are now questioning whether the run in gold prices is now over without a touch at $1,800 an ounce like some were expecting. The gold price is down for the fourth trading session out of the last five.

The New York Stock Exchange reopened its trading floor, although with new restrictions. Investors cheered the return to some level of normalcy by piling into stocks, which climbed to their highest level in nine weeks.

The shift toward risk-on sentiment has hurt safe-haven demand for gold, although at least one firm expects the bullish trend in the gold price to continue. U.S. Bank Asset Management Group said in a recent note that money printing by central banks should support gold prices in the near term.

They said all that money printing creates the potential for inflation, which should be good for gold. The firm also said economic data suggests the recovery will be “more drawn-out” and that there could be “a more permanent hit” to economic growth. The firm’s analysts also expect additional stimulus from the Federal Reserve and Congress.

Gold prices climb on retail sales plunge

May 15, 2020 Update: Gold prices finally brought out of their range today after the announcement that U.S. retail sales plunged 16.4% in April. The decline comes after March’s revised number of an 8.3% decline in retail sales, according to data from the Commerce Department. Economists had been looking for a decline of 12% in retail sales for April. This is the largest decline in retail sales since the beginning of data collection. March holds the previous record.

In a note today, strategist Ole Hansen of Saxo Bank said gold prices have been range-bound for more than a month, staying around the $1,700 an ounce level. Today brought renewed weakness in the stock market and a warning about the economic outlook from the Federal Reserve. Meanwhile, the number of people filing unemployment claims continues to rise.

FXTM analyst Han Tan told Kitco News that it’s “just a matter of time” before gold prices touch $1,800 an ounce. Gold for June delivery climbed to its highest level in three weeks at $1,748.90 an ounce last night. Tan noted that exchange-traded funds added to their holdings for 15 days in a row to bring their holdings to almost 100 million ounces, the highest in 12 months.

Paul Tudor Jones on gold prices

May 8, 2020 Update: Paul Tudor Jones sees gold prices potentially rising to $2,400 an ounce, although in an extreme situation, he said they could even rise as far as $6,700. He said in his recent letter to investors, which was reviewed by ValueWalk, that the yellow metal is a “very attractive hedge” against inflation and the possibility of a renewal of the U.S.-China trade tensions.

Looking at the ratio of the value of gold to global monetary inflation, he said it could rise to $2,400 before its valuation is consistent with the lowest of the last three peaks in the valuation metric. If gold prices rally to the 1980 extremes, they could rise to $6,700.

“One thing is for sure,” he said. “These are going to be incredibly interesting times.”

Gold ETF holdings reach another record high

May 7, 2020 Update: Gold continues to outperform this month despite the traction gained by stocks and bonds. Holdings in gold-backed exchange-traded funds hit new record highs this month, recording a 5% increase in net inflows at $9.3 billion, according to the World Gold Council.

Assets under management in gold-backed ETFs hit a record high of $183 billion. AUM has increased 80% over the last 12 months. North American funds led the increase in AUM, rising 8.3% to add $7.8 billion to the total. European funds added $1.1 billion, amounting to a 1.4% increase. Asian funds, mostly in China, increased 3.9% to $206 million in AUM. Funds in other regions increased 5.8% to $172 million.

Global trading volumes averaged $140 billion last month. That marks a decrease from the global trading volume in March, but it’s about in line with last year’s daily average. World Gold Council Research Head Juan Carlos Artigas said it’s not surprising that investment demand for gold is strong because the yellow metal has repeatedly shown to be an effective hedge during market downturns like the global financial crisis and the COVID-19 pandemic.

“Gold has outperformed most major asset classes and is up 11% year-to-date – we expect this trend to continue as investors navigate ongoing market and social uncertainty and the impact of central bank intervention.”

Gold prices fall below $1,700 an ounce despite high unemployment

April 30, 2020 Update: Gold prices have been holding steady above $1,700 an ounce, but they fell below that key level this afternoon as inflation pressure eased. FX Street reports that an Elliott Wave pattern could signal a downside move toward $1,600 an ounce.

The Federal Reserve and the European Central Bank signaled that their quantitative easing measures will continue as long as needed. The markets seem focused on the fact that state economies will be reopening soon. Stock indices are in the red this afternoon as equities fall alongside gold prices.

U.S. unemployment rose to 3.8 million, which is worse than the 3.5 million that had been expected.

Paul Singer: gold is one of the most undervalued assets today

April 22, 2020 Update: In his April 16 letter to investors, which was reviewed by ValueWalk, Paul Singer of Elliott Management said the COVID-19 crisis offers the “perfect environment for gold to take center stage.” He noted that essentially all of the central banks in the world are debasing their currency, interest rates are falling extremely low, and shutdowns are impacting gold mine operation and extraction.

He describes gold as “the most basic of all money and stores of value.” He believes the fair value of gold is “literally multiples of its current price.” He noted that the yellow metal has increased in value somewhat, but he still sees it as “one of the most undervalued investable assets existing today.”

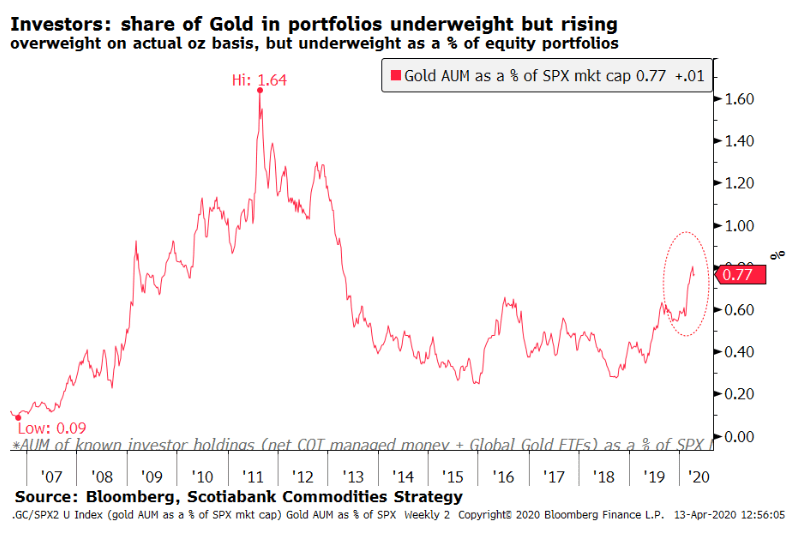

Singer believes gold is just beginning its uptrend and noted that it is extremely under-owned by institutional investors, which he added “is astonishing to us in light of the obsessively inflationary policies being pursued by central banks around the world.”

He wrote: “Gold today, despite its modest run up in recent months, is the answer to the question: Is there an asset or asset class which is undervalued, underowned, would preserve its value in a severe inflation, and is not adversely affected by COVID-19 or the destruction of business value that is being caused by the virus?”

Gold prices could top $1,800 in the coming weeks

April 16, 2020 Update: Gold prices have been in the green most of the day, but they have since fallen into the red. However, they remain above the key level of $1,700 an ounce.

Edward Moya of OANDA said in an email that although gold prices will struggle to surpass $1,800 this week, that could change in the coming weeks.

“Gold gave up a big chunk of its gains after weekly jobless claims came inline with expectations. The morning data was bad, but investors have grown to expect that and used it as an excuse to lock-in profits. Calls for fresh record highs (in dollar terms) are growing as Newmont CEO Palmer calls for gold to break above the $2,000 level over the next five years. Gold will struggle to top $1800 this week, but that should not pose a problem over the next few weeks.”

Short-term headwinds hold back gold

April 15, 2020 Update: Gold prices saw technical selling pressure today following strong gains on Tuesday, a fourth consecutive session of gains. Despite the pressure, the yellow metal remained above the key $1,700 an ounce level after approaching $1,750 on Tuesday.

The run in gold prices has been driven by central bank liquidity injections aimed at reducing the impact of the coronavirus on the global economy. Gold has also been serving as a safe-haven asset and lifeline of last resort amid the pandemic. Commerzbank analysts said in a note this week that they expect the gold price to reach $1,800 an ounce by the end of the year.

They also noted that the U.S. dollar remains strong, which normally weighs on gold prices. However, investors are seeking safe-haven investments in both gold and the dollar amid significant uncertainty about the COVID-19 crisis.

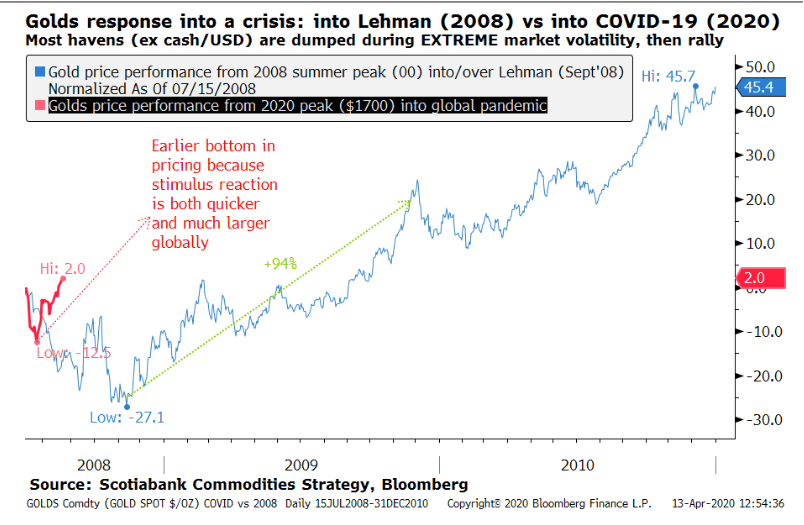

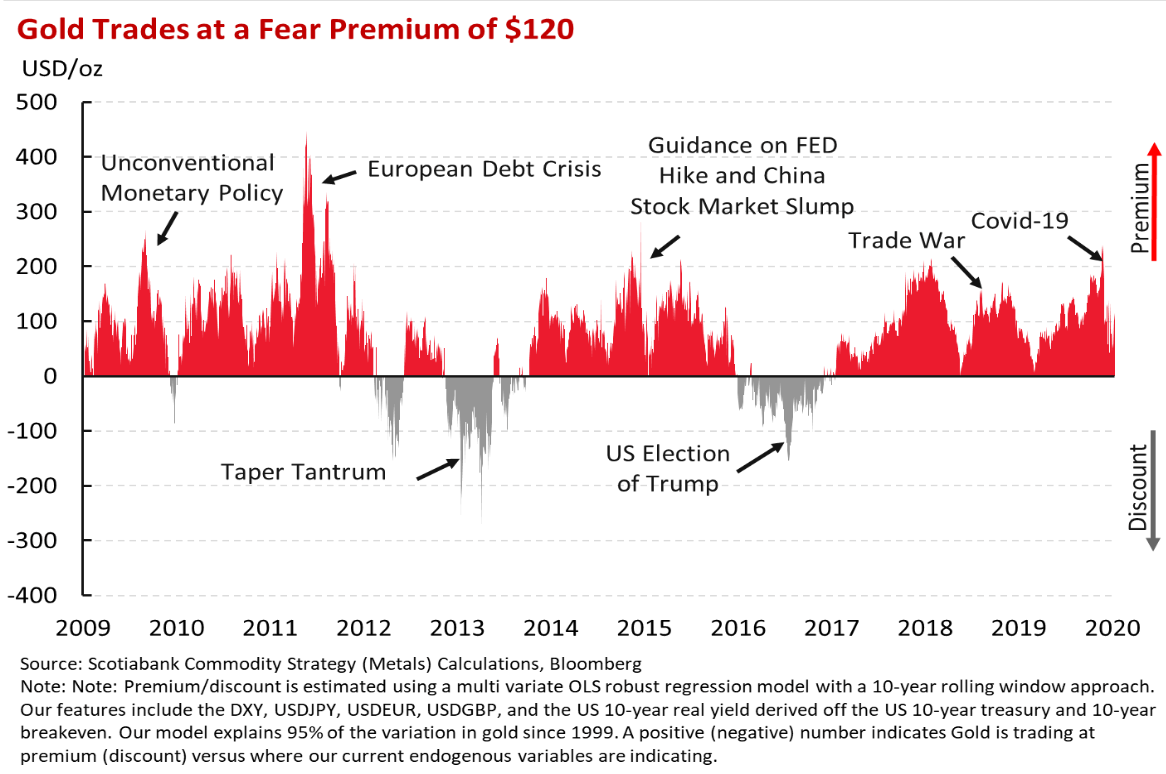

Scotiabank strategist Nicky Shiels said in a note this week that a deflationary demand crisis, supply chain crisis, labor market crisis and energy price crisis are all driving the markets right now. Shiels also noted that monetary and fiscal stimulus have started earlier and ramped up faster than at any other time in history.

She believes gold has found its post-crisis floor and pointed to continuing wide dislocations between paper and physical gold prices following some sizable margin-related selling. Shiels also believes the trajectory for gold prices is more bullish now than it was during the 2009 to 2012 cycle.

She noted that the macroeconomic backdrop of lower and slower growth and unprecedented stimulus have never been better for the yellow metal. She said investors’ share of gold in their portfolios is overweight on an ounce basis but underweight as a percentage of equity portfolio.

However, she added that short-term headwinds like liquidity weak demand for physical gold in Asia and inactive bullish activity among central banks will keep a ceiling on gold prices. She said that for now, gold is trading at a “fear premium of $120.

Gold spikes as a hedge against future inflation

April 9, 2020 Update: The gold price continued to climb this morning after the Federal Reserve announced a $2.3 trillion loan program for businesses affected by the coronavirus pandemic. Spot gold was up to $1,680 an ounce, while gold for June delivery climbed as high as $1,723 an ounce.

Multiple analysts have pointed out that the world’s central banks are pouring liquidity into their respective economies, which is good for gold prices. Kitco Senior Technical Analyst Jim Wyckoff said this latest infusion of money into the financial system in the U.S. will “cannot help but produce worrisome price inflation down the road. He believes metals traders recognize that inflation is just around the corner, so they’re purchasing gold and other hard assets as a hedge against it.

Gold prices rattle around amid weak economic news

April 3, 2020 Update: Gold prices initially climbed on the report that the U.S. lost more than 700,000 jobs in March, while economists had only been expecting 100,000 jobs to be lost. That brought unemployment to 4.4%, which is must worse than the consensus of 3.8%. However, gold prices flipped into the red not long after the report.

Edward Moya of OANDA expects demand for the yellow metal to rise.

“Gold’s outlook was tarnished this week after it lost some central bank support, but demand is likely to be strong over the coming weeks as refiners urgently talk to their local authorities about restarting production,” he said in an email. “Gold prices initially rallied following the worse-than-expected nonfarm payroll report, but that quickly faded.”

He expects volatility in the gold price to remain high in the next few weeks. Although this week the metal is in the red, he sees support for it as the coronavirus impact gets stronger around the world.

“Fiscal and monetary stimulus will likely need to remain in place a lot longer and that should ultimately be the backbone of gold’s bullish stance,” he wrote.

Outlook for the gold price is bullish

March 30, 2020 Update: The gold price was lackluster today, sliding a bit but remaining above $1,600 an ounce. The spread between physical gold and gold futures remained wide, although it did fall by more than $10 to $1,644 an ounce.

“Gold prices are steadying following its best week since the financial crisis,” Edward Moya of OANDA said in an email. “Gold’s supply chain for the physical metal was disrupted over the last 10-days, but that has now settled and taken away any momentum for higher prices. Gold’s outlook remains bullish as world adjusts to never-ending promises of monetary easing, but the next rally may be more of an escalator ride than elevator one.”

Gold up on soaring jobless claims

March 26, 2020 Update: Gold prices could bring an end to a two-day slide today. The yellow metal reversed course as investors awaited key economic reports that are expected to offer more insight into the severity of the coronavirus’ impact on the economy.

Unemployment claims soared to a record high of more than 3 million, shattering the peak seen at the height of the Great Recession, which was 665,000 in March 2009. The previous record high was set in October 1982 when jobless claims reached 695,000. Analysts reporting to Dow Jones had been predicting that jobless claims would reach 1.5 million for last week, although individual analysts were predicting higher numbers than that. The week before last, there were 282,000 jobless claims, which also beat the consensus estimate.

Kitco News reports that some of the rise in gold prices is driven by safe-haven demand, while some is driven by chart-based buying.

Gold price soars amid Fed’s unlimited stimulus

March 23, 2020 Update: The gold price is up nearly 5% at more than $1,550 an ounce as the Federal Reserve rolled out unprecedented stimulus measures for the U.S. economy. The central bank said it will aggressively purchase securities, including corporate bonds and mortgage-backed securities.

It will also open Main Street lending. The Fed said it will spend an “unlimited” amount of money to try to keep the economy on track. St. Louis Fed President James Bullard warned that unemployment could reach 30%, while GDP could fall 50% for the second quarter.

Gold bears have had the technical advantage, although the price did soar past the resistance level of $1,550, indicating a bullish tilt during morning trading today.

Gold rallies with stocks

March 17, 2020 Update: Gold prices rallied today, climbing back above $1,500 an ounce and showing no signs of reversing course again. Meanwhile, stocks also rallied as the S&P 500 was up 56 points and still gaining, while the Dow Jones Industrial Average was up 125 points and still gaining.

Blue Line Futures President Bill Baruch told Kitco News on Monday that there will be “a tremendous buying opportunity” when gold and other asset prices stabilize. He believes the yellow metal will hit a new record high in the next year or year and a half.

Investors have been selling off gold to support losses in other asset classes, reducing its effectiveness as a safe-haven asset.

Gold price falls below $1,500 an ounce amid global selloff

March 16, 2020 Update: The gold price fell below $1,500 an ounce for the first time this year as investors sold assets to cover the losses they racked up in stocks and other asset classes. According to The Street, stocks have given up over $14 trillion in value in just the last month alone.

The decline in gold is surprising given its status as a safe-haven asset during times when other assets are enduring significant pressure. However, margin calls have been a constant issue for the gold price as investors decide to sell profitable or liquid assets to meet those requirements.

The Federal Reserve surprised the markets again on Sunday with another 100-basis-point cut in the target for the federal funds rate, bringing the range to between 0% and 0.25%. The central bank is scheduled to hold its regular meeting Tuesday and Wednesday. The Fed also announced that it’s starting its quantitative easing program back up with at least $700 billion in purchases of mortgage-backed securities and bonds in the coming weeks.

The oil price war could be holding gold back

March 11, 2020 Update: Another selloff in the U.S. equity market would usually be good for the gold price, but the yellow metal slipped again today, falling alongside stocks. Gold soared to a more than seven-year high on Monday, the same day as a major rout in U.S. stocks. In fact, it was the worst day for equities since the 2008 financial crisis. Additionally, the yield on the 10-year Treasury fell to a record low of 0.318% the same day, but the gold price didn’t soar to $1,900 or $2,000 an ounce like some are calling for.

Blue Line Futures Chief Market Strategist Phillip Streible told Kitco News that gold might not be rising despite the pull back in stocks because investors aren’t giving up on stocks yet. He said they may simply be waiting for the right time to jump back into the stock market, so they could be holding onto their capital in the meantime.

There are plenty of other possible reasons for the gold price to pull back despite weakness in other assets. Scotiabank strategist Nicky Shiels noted in a recent report that gold is a commodity in addition to being a safe-haven asset. She added that the yellow metal had already been doing better than other commodities because of economic weakness and increasing stimulus from the world’s central banks.

However, she believes the recent crash in oil prices is holding the gold price down. She looked at the days before and after oil prices plunged by more than 10% in a single day. On average, gold is down 0.8% seven days on and down 1.5% 50 days on, which she said confirms “that it will be tough for prices to really break out as the general ‘commodity brand’ loses its luster on oils capitulation.”

Gold price retreats as equities rally

March 10, 2020 Update: The gold price tumbled in early-morning trading today as stock indices rebounded and risk-on sentiment ticked higher. The yellow metal briefly touched $1,700 on Monday before retreating, although it remained in the green until signs of recovery in the equity market and oil prices started to appear this morning.

Despite the recovery in oil prices, the price war signals more trouble ahead for the commodity—and more support for gold prices. FXTM analyst Han Tan told CNBC that he wouldn’t be surprised if gold hits $1,700 an ounce again. More signs of the coronavirus outbreak worsening or hard data confirmation that the world’s economies are weakening due to the outbreak could provide more support for the yellow metal.

Bloomberg Intelligence strategist Mike McGlone expects the gold price to remain range-bound between $1,600 and $1,700 an ounce for now as it builds a sold base to work off. In his March update, he described the metal’s uptrend as a “stair-step rally,” explaining that it could require some “base building” to form the next step of the rally. He added that negative real yields, especially in the U.S., provides “an underlying bid for the quasi-currency.”

Holdings in the SPDR Gold Trust climbed to 30.99 million ounces, which is the highest level in more than three years. Meanwhile, the gold-silver ratio reached a record high above 100, matching the previous record set on Feb. 25, 1991.

Gold reaches highest level since December 2012 before falling

March 9, 2020 Update: Gold prices surged past $1,700 an ounce briefly before pulling back, although demand for safe-haven assets remains in play. Risk assets like stocks sold off in bulk, with the Dow Jones off more than 1,000 points and the S&P 500 off more than 100 points. Both indices were down more than 4% by midday. In fact, gold was the only asset in the green, although even it is struggling as it offers the only place investors can take profits.

Concerns about economic fallout due to the coronavirus continue to weigh on sentiment. Spot gold rose as high as $1,702.56, the highest level since December 2012, before falling back below the $1,700 threshold. The gold price is highly volatile today, as it had climbed by as much as 1.7%, although it now struggles to remain in the green.

The Federal Reserve cut interest rates by 50 basis points last week. All eyes now turn to the European Central Bank, which is set to meet on Thursday. The ECB is widely expected to loosen policy in the Eurozone, following the tone set by the Fed and other central banks that have loosened monetary policies to address the coronavirus outbreak.

Gold is the only precious metal that’s seeing solid performance today. Silver is down by about 2%, while platinum has fallen by about 3%.

March 6, 2020 Update: The gold price appears to be range-bound today between about $1,650 and $1,690 an ounce. The yellow metal soared in early trading, approaching $1,690 an ounce but hovering just below that level as coronavirus fears continue.

Risk aversion continues to drive stock indices lower and prices of safe-haven assets like gold higher. The yield on the benchmark 10-year Treasury dropped under 0.8%, reaching yet another record low. Market watchers are starting to fear that a recession is taking hold of the global economy.

In the U.K., some factories are only working for days a week out of concern for the coronavirus. Some automakers in Germany and the rest of the Eurozone have taken to hoarding important parts and materials.

As the gold price looked on track for the sharpest one-week climb since the 2008 financial crisis, it pulled back suddenly following a surprisingly strong jobs report for February. The U.S. added 273,000 new jobs last month, which significantly beat the consensus of 175,000.

It’s important to note that the February report was taken before any serious impact from the coronavirus was felt in the U.S. However, March will include impacts from the virus as the effects of the outbreak start to weigh on corporate profits in the U.S. The number of coronavirus infections worldwide swelled to 100,000, including more than 230 cases in the U.S.

The gold price has also found support in the U.S. dollar, which has weakened this week, falling more than 2% based on the ICE U.S. Dollar Index. The weaker the dollar becomes, the more attractive assets in dollars become to foreign investors. Gold is just one of the assets that can be purchased by foreign investors in U.S. dollars.

Gold trades back above $1,650 an ounce

March 5, 2020 Update: The gold price soared above the resistance level of $1,650 an ounce, and the new resistance appears to be set somewhere around $1,660 an ounce. Sentiment remains risk-off as concerns about the coronavirus continue to swirl.

Meanwhile, jobless claims in the U.S. came in about as expected. The Department of Labor said jobless claims fell 3,000 week over week to 216,000, which was what the consensus was predicting. The four-week moving average for new jobless claims declined to 213,000. Continuing jobless claims stood at 1.729 million for the week ending Feb. 22, marking a 7,000 increase from the week before.

Economic data hasn’t been having much of an impact on gold prices since the Federal Reserve surprised the markets by cutting interest rates by 50 basis points in between meetings. Instead, the market seems more focused on the continuing concerns about the coronavirus.

Gold formed an inverse head-and-shoulders pattern on the four-hour charge earlier today, FXStreet noted. The bullish pattern required confirmation of the breakout with a rise above the neckline at $1,651. The pattern has now been confirmed, signaling that bulls are in control. Analysts say that theoretically, the gold price could move toward $1,750 with that break above the neckline, although FXStreet predicted that it would pause around $1,690 an ounce before going higher.

Gold price pops amid wait for central bank news

March 4, 2020 Update: The gold price is up 3% today but just can’t seem to get past $1,650 an ounce. The resistance level seems to be set just below that level. The Federal Reserve’s interest rate cut due to the coronavirus outbreak boosted gold on Tuesday, and the markets are now watching to see if other central banks follow suit.

The Reserve Bank of Australia and the Bank of Canada have already followed the Fed with rate cuts of their own. The European Central Bank is also expected to loosen monetary policy at its meeting next week. Commerzbank economists look for the ECB to temporarily double the amount of bonds it purchases every month and trim the deposit rate by 10 basis points.

Like the Fed, the Bank of Canada cut rates by 50 basis points, lowering its overnight rate to 1.25%. The central bank said before the coronavirus outbreak, the global economy was starting to stabilize. However, the virus is now a significant health threat to more and more people as the number of countries affected by it continues to rise.

Stock indices rallied today, moving in step with the gold price once again as the markets praised the Fed’s move to cut the federal funds rate target. If stocks start to move lower again, as many expect, the gold price could struggle as investors sell it to cover margin calls.

Gold boosted by a surprise Fed rate cut

March 3, 2020 Update: A surprise intra-meeting rate cut from the Federal Reserve boosted the gold price firmly above $1,600 an ounce, a level it has been struggling to hold these last few trading days. The Federal Open Market Committee cut rates by 50 basis points, moving the target for the federal funds rate to between 1% and 1.25%. Today’s rate cut marks the first time the Fed has slashed rates so much since the financial crisis in 2008.

The Fed rate cut follows a largely disappointing statement from the Group of Seven finance ministers, who offered no guidance for dealing with the coronavirus outbreak. U.S. stock indices tumbled from overnight highs following the disappointment. Today the S&P 500 and the Dow Jones Industrial Average remain volatile, bouncing just above and below last night’s closing numbers.

Before the rate cut was announced Chantelle Schieven of Murenbeeld and Co. told Kitco News at the Prospectors and Developers Association of Canada conference that a rate cut was what the gold price needed to receive a boost. She added that she is more bullish on the yellow metal than she has been in quite some time.

Consumer sentiment has been weakened by the coronavirus outbreak, and central banks have been considering further easing measures to give it a boost. Schieven predicted that the gold price would rise as soon as the Fed moved in response to the coronavirus outbreak. She thought the rate cut would come at the next meeting later this month, but the Fed chose not to wait until then to cut rates.

She added that recessions are negative for the gold price initially. It isn’t until after the policy response from central banks that the gold price hit record highs. She added that if there is a recession without any policy response, the gold price could decline until central banks respond.

Gold prices rise on interest rate bets

Mar. 2, 2020 Update: Gold rallied today, climbing more than 2% to rise back above $1,600 an ounce, The metal failed to hold that level, although it remained just below it as of the time of this writing. Friday’s pullback was the yellow metal’s largest one-day decline in almost seven years. Investors poured funds into gold on the expectation that the Federal Reserve will cut rates again to reduce the coronavirus’ impact on the nation’s economy.

The gold price tumbled more than 4.5% on Friday, marking the largest one-day decline since June 2013. Investors took profits from the market to make up for their margin calls in other asset classes.

Fed Chairman Jerome Powell said on Friday that the central bank will “act as appropriate” to support the U.S. economy as the coronavirus outbreak impacts global markets. Murenbeeld analyst Chantelle Schieven told Kitco News at the Prospectors and Developers Association of Canada conference that she believes the Fed will indeed cut rates

Commerzbank analyst Eugen Weinberg told CNBC that the market is pricing in about three interest rate cuts this year. As a result, the dollar has been pressured, marking a return to the traditional negative correlation between the dollar and the gold price. Weinberg said futures suggest that the markets are looking for the Fed to cut rates by 50 basis points at its March 18 policy meeting.

Gold price pressured despite stock plunge

Feb. 28, 2020 Update: The carnage continues on Wall Street today with more steep declines for the S&P 500, Dow Jones Industrial Average and other stock indices. Usually, that would mean great things for the gold price. However, just as gold was rising along with stocks, now it is falling alongside stocks.

The gold price hasn’t been able to hold the $1,650 an ounce level and has plunged all the way down into the $1,580s and shows no signs of stopping. Kitco News cites forced selling as the source of the pricing pressure, saying that traders and investors are “using gold like an ATM machine.” Traders and investors have been raking in losses across the market, so they are likely selling gold in order to raise money to cover losses in other markets and meet margin calls.

Kitco News also pointed out in a separate post that consumer demand is another driver of the gold price. China is one of the world’s biggest consumers of gold, and the Chinese will be buying less of it as the coronavirus outbreak has been squeezing their economy.

Gold’s run isn’t over yet

Feb. 27, 2020 Update: The gold price climbed back above the key $1,650 an ounce level today but then fell to a lower low closer to $1,640 an ounce. The decline comes despite the downward spiral major stock indices remain in, which means that once again, gold and stocks are moving in step with each other despite their typical negative correlation.

Goldman Sachs analysts said in a note this week that if the fallout from the coronavirus lasts into the second quarter, the gold price could reach $1,800 an ounce. Analyst Mikhail Sprogis boosted his 12-month price prediction for the metal. He said the growing number of coronavirus cases around the world, low real rates and election risks in the U.S. are driving the gold price.

He pointed out that the yellow metal has been outperforming the yen and the Swiss franc. He was previously looking for $1,600 an ounce by the middle of this year. With his increased projection, he now expects gold to reach $1,700 in three months and then rise to $1,750 in six months.

Weak consumer demand weighs on gold

Feb. 26, 2020 Update: Today is another difficult day for the gold price, which tumbled closed to $1,628 an ounce before bouncing. Today’s decline follows the largest one-day decline in almost four months.

Kitco argues that investors are starting to be more concerned about weak consumer demand for the yellow metal, so it’s weighing on the price despite continuing fears about the coronavirus. China has been hit especially hard by the coronavirus, and the nation is one of the top consumers of the metal in the world.

Home sales climbed 7.9% in January to reach a seasonally adjusted annualized rate of 764,000 homes, according to the U.S. Commerce Department. It was the highest level in 12 and a half years. Economists polled by Reuters were looking for sales of 710,000 units for January. The Commerce Department also revised home sales for December up to 708,000 homes from 649,000 units.

The strong surprise in home sales appears to be having little impact on the gold price, which is holding fairly steady after bottoming out earlier this morning.

Gold price falls below key $1,650 level

Feb. 25, 2020 Update: Gold prices had been holding at the new support level of $1,650 an ounce after falling below them early this morning. However, they have veered back under that key level of $1,650, suggesting that the $1,700 price so many have been looking for may not happen—at least not yet, anyway.

UBS analyst Joni Teves said in a note that gold could reach $1,700 an ounce, but she has set her three-month target at $1,650 an ounce. She said since many speculators were already bullish on the metal, there was a risk of a pullback, and that’s exactly what we’re seeing today, even as the equity market continues to decline.

The early-morning hours brought a bit of relief for stock indices and weighed on gold prices, but now both asset classes are in decline. Disappointing consumer confidence data didn’t appear to affect the yellow metal at first, as the early-morning decline reversed course. However, investors may be rethinking their strategy.

According to the U.S. Conference board, the consumer confidence index returned a reading of 130.7 for this month, which was little changed from last month’s reading of 130.4. Economists had been expecting February’s reading to come in at 132.6.

New resistance at $1,688?

Feb. 24, 2020 Update: The gold price soared again early this morning, but it appears as if the new resistance level is around $1,688. The yellow metal’s price bounced off that level twice in early trading this morning, although buying activity remains strong as fears about the coronavirus reach new heights. For now, the next psychological level for the gold price will be $1,700 an ounce, but the price will have to beat that $1,688 level first.

Meanwhile, stock indices are getting pummeled this morning as concerns about a global pandemic drive a strong risk-off sentiment. Investors are responding to the growing number of reports about the coronavirus in countries other than China.

Many investors are now expecting other countries to cut their interest rates in response to the outbreak now that it’s showing signs of worsening outside China. Italy in particular is in the crosshairs as the nation essentially quarantined about 50,000 people in and around Milan, where a local outbreak has occurred. More than 150 people in Italy have been infected.

More than 77,000 people in China have been sickened by the coronavirus, which has killed over 2,400 people there.

Gold prices continue to power higher

Feb. 21, 2020 Update: The gold price is up nearly 2% today, approaching $1,650 an ounce. The yellow metal has reached its highest price in seven years after the largest weekly increase in over six months. The S&P 500, Nasdaq Composite and Dow Jones Industrial Average are all in the red today, as is the U.S. Dollar Index. Thus, for today at least, it seems like the traditional negative correlations between gold and other assets are back in place after weeks of in-step upward momentum across assets.

Today’s gold price increase is driven not only by coronavirus fears but also disappointing manufacturing numbers from the U.S. IHS Markit’s Purchasing Manufacturers Index (PMI) for this month slipped to 50.8 from last month’s reading of 51.9. Consensus suggested a reading of 51.5 for this month.

The firm said sentiment in the manufacturing sector has reached its lowest level in six months, while sentiment in the service sector is at its lowest level in over six years. Excluding the 2013 government shutdown, business activity in the U.S. contracted for the first time since the global financial crisis this month, according to economist Chris Williamson at IHS Markit.

Gold is overbought

Saxo Bank analyst Ole Hansen said today that the gold rally carried the metal into overbought territory on a short-term basis. His 2020 target for the gold price was $1,625, and since the yellow metal already achieved that target, he doesn’t see anything that can halt or pause the rally. He expects the coronavirus outbreak to continue driving prices higher and higher. Based on Fibonacci levels, the next target is $1,690 an ounce, while support is at $1,595.

Hansen said in another note earlier this week that holdings in exchange-traded funds backed by gold bullion increased by 1.3 tons per day on average in January. This month holdings have been rising by an average of 1.9 tons per day despite the strength in the dollar and recovering markets.

Gold price holds above $1,600 an ounce for a second day

Feb. 19. 2020 Update: Gold breached the key psychological level of $1,600 an ounce on Tuesday and is now holding steady above it a full day later. The recent uptick in the gold price has been widely attributed to growing concerns about economic impacts from the coronavirus. However, one firm argues that there are other reasons to be bullish on the yellow metal beyond the current outbreak.

Deutsche Bank analyst Michael Hsueh noted that trade protectionism continues. Additionally, central banks in emerging markets have been seeking an alternative to the U.S. dollar as a reserve asset, and they have found it in gold. He also sees risks from the “multi-polar geopolitical regime.”

He expects downside in spot gold prices to be limited by a possibility that the negative correlation with the U.S. dollar will appear again. He notes that the negative correlation between the two assets has fallen to a cyclical low. Gold prices are up while the U.S. dollar remains close to one-year highs.

Hsueh recommends a long gold, short volatility strategy in step with his year-end gold price target of $1,640 an ounce.

Other than the coronavirus, he also looks at the Federal Reserve’s review of strategy, tools and communications as the next most important point for the precious metal. He predicts the gold price will move even higher if there is any commentary suggesting upcoming reformulation of the inflation target methodology.

On the other hand, he said if the Fed turns hawkish, inflation strengthens sustainably, or global growth rises much higher than expected, it would be bearish for gold.

Gold rises more than 1% to surpass $1,600 an ounce

Feb. 18, 2020 Update: The gold price broke through a key psychological level today, smashing through $1,600 an ounce and then continuing on with a strong gain of more than 1%. The next major resistance level will be in the $1,610 to $1,614 range, but for now, bulls are controlling the price of the yellow metal. If the gold price falls back below $1,600, the support is estimated at around $1,589.

What makes today’s increase in the gold price particularly interesting is the fact that it comes the same day as strong data from the New York manufacturing sector. The New York Fed said its Empire State manufacturing survey climbed to 12.9 this month, indicating strength in business conditions in the industry. In January, the reading was only 4.8. Consensus had been looking for a reading of only 5.8. This month’s reading is the highest since May 2019.

Gold investors seem less focused on economic data and more focused on economic uncertainty related to the coronavirus. Global stock markets were weaker today as the S&P 500, Nasdaq Composite and Dow Jones Industrial Average were all in the red.

Gold prices headed to $1,800/ oz.?

Feb. 14, 2020 Update: The gold price could be heading to $1,800 per ounce in the next few months, according to one analyst. Midas Touch Consulting analyst Florian Grummes said in a report this week that the yellow metal rallied strong last summer but then entered a consolidation period between September and December.

More recently, the gold price spiked toward $1,610 an ounce, but then it entered another period of consolidation. He believes it won’t be long before gold surpasses $1,600 again and sees a pathway to $1,800 by spring.

He said the day before Christmas, gold broke out of its three-month consolidation, unleashing “unprecedented forces in the gold market.” Only a week after surpassing $1,480 an ounce, the gold price hit $1,530.

Then when U.S. forces took out Iranian general Qasem Soleimani, the metal approached $1,611 last month to hit its highest level in almost seven years. Since then, gold has been in an other consolidation period, which has already lasted five weeks, and Grummes sees $1,600 an ounce as an important psychological level for the gold price.

If the yellow metal does break out above that level successfully, it would give the bullish trend a boost. He believes surpassing that level will result in a sharp rally, carrying it to about $1,800 an ounce. He sees downside support at $1,550 an ounce and upside resistance at $1,590 an ounce.

“The back and forth between US$1,535 and US$1,600 now seems to be taking the form of a triangle,” he said. “… Overall, Gold will likely need more time within this triangle. However, at some point a breakout to the upside is much more probable as triangles usually resolves [sic] within the prevailing trend—which is obviously up.

On the other hand, he also said the five-week consolidation period could be an ABC correction. If that’s the case, then the gold price is in wave C, which should end a little below the January low of $1,535 an ounce. Anything below that price would call the bullish setup into question.

Whatever turns out to be the case, he believes the consolidation could last another one to three weeks. IF the price surpasses $1,590, he predicts a rapid rise to the neighborhood of $1,645 an ounce.

Feb. 13, 2020 Update: The flight to safety has begun a new as fears of the coronavirus have returned. Chinese health officials in Hubei province have changed the way they diagnose the illness, which has resulted in revised coronavirus numbers from the epicenter of the outbreak.

The number of new cases of the virus has increased sevenfold because of the change, reigniting concerns about the economic impact from it. The number of confirmed coronavirus cases increased 14,840, compared to an increase of only 1,638 the day before.

Chinese officials were requiring a positive lab test to confirm a patient as having the coronavirus. However, they have now expanded the definition to include a positive clinical test like via medical imaging. Data from a Hubei government website reveals that more than 13,000 of the new cases reported today in Hubei province were due to this loosening of the definition.

Other safe-haven assets, including the 10-year Treasury and the yen, all saw flows as sentiment shifted to risk-off. Edward Moya of OANDA also said some are concerned the trade war between the U.S. and China could flare up again if China fails to live up to its purchase commitments.

“Recession fears for China are likely to keep gold supported and wreak havoc with industrial metals,” he said in an email. “Copper prices are likely to fall under pressure and could remain stuck in at $5720-$5775 range until scientists are confident that the virus peak is nearing.”

Gold rises with equities

Feb. 10, 2020 Update: Gold prices ticked higher in morning trading today despite continued increases in the stock market. Fears about the coronavirus remain at the forefront of the markets today, supporting gold prices, although they aren’t quite serious enough to weigh on stocks yet.

The yellow metal continued to move higher, although data from the Commodity Futures Trading Commission shows that large speculators slashed their bullish positioning 17%. This could be good news for the gold market, however. According to Kitco, one bank said the lower level of bullish positioning means gold prices are less vulnerable to a large downside decline, which would happen if all the speculators started dumping the previous metal at the same time.

Saxo Bank strategists warned in a report on Friday that stock investors are underpricing the coronavirus risk on the world’s economy. Thus, they say investors should be watching the commodity prices more closely because lower prices suggest a warning that the world’s economy could experience a significant disruption.

Feb 7, 2020 Update: Gold prices pulled back initially after the latest U.S. jobs report was released. The numbers were stronger than expected as non-farm payrolls climbed 225,000. An increase of only 160,000 had been expected going into the report.

Despite the strong jobs report, gold prices bounced during the afternoon hours, climbing to nearly $1,572 an ounce. The yellow metal found support as major U.S. stock indices sold off. The S&P 500, Nasdaq Composite and Dow Jones Industrial Average were all in the red by Friday afternoon.

Macro data sinks gold

Equities may have been responding to the one negative part of the jobs report, which was the number of hours worked per week. At only 34.3 hours per week for the third month in a row, it’s clear that most Americans aren’t working a full 40-hour week.

Gold prices have also been supported by developments in the coronavirus situation. The number of new cases of the virus is slowing. However, gold is still a safe haven during the economic fallout that’s expected from the virus.

Feb. 6, 2020 Update: Gold prices rallied on Feb. 6, 2020 as fears about the coronavirus reemerged. RBC Wealth Management director George Gero said the yellow metal was supported by investors who were seeking bargains amid the pullback in gold prices, which coincided with soaring equity prices earlier this week. April gold climbed nearly $5 to $1,568 per ounce. Meanwhile the Dow Jones Industrial Average climbed more than 120 points, and the March dollar index was up 0.027 of a point at 98.185, according to Kitco.

Disease and precious metals

According to Gero, gold can’t be counted out just because stocks and the dollar index are higher. He added that buyers are looking ahead to the rest of this year and expecting the gold price to rise, so they’re buying the yellow metal in preparation of higher prices. He also said other investors are hedging their bets with gold in case stocks tumble from their high levels this week.

Feb 3, 2020 Update: The gold price pulled back slightly on Feb. 3, 2020 as U.S. stocks rebounded. Equities shrugged off the World Health Organization’s decision to declare the coronavirus an international public health emergency.

Given the strength of the equity rally, it is a bit surprising that gold didn’t drop more than it did, however. The gold price continues to hover just under multi-year highs.

Analysts from ActivTrades noted that the yellow metal continues to hold above its current support level of $1,570 an ounce. They expect the gold price to rebound as soon as there is any sign of another correction in the equity markets. They expect a rally above $1,600 if the metal climbs above the resistance level at $1,585 an ounce.

JPMorgan on gold price drivers

JPMorgan analysts said in their report on Feb. 3, 2020 that demand for safe-haven assets and declining U.S. Treasury yields have supported the gold price. The market is also pricing in an increased probability of the Federal Reserve cutting interest rates again in June.

Gold no longer has the benefit of the dispute between the U.S. and Iran to support it. JPMorgan analysts note that the yellow metal has been lagging Treasury yields recently, although they didn’t when the dispute with Iran was occurring. They said it seems as if gold’s valuation is normalizing against Treasury yields. The metal built up a $130 per ounce premium against Treasury yields last month, but the premium fell to approximately $94 an ounce.

Geopolitical concerns to drive bullion strength?

Worries about physical demand related to the coronavirus are also believed to be driving gold. The analysts say the price is probably discounting a significant hit on retail sales in Asia, which sees over 60% of the world’s demand for gold jewelry, coins and bars, including India.

Previously

Gold prices did well in 2019 as problems and worries swirled, but analysts generally expect continued strength in the yellow metal in 2020. Credit Suisse analyst Fahad Tariq said he expects the price to average $1,540 per ounce this year, peaking at $1,560 per ounce in the first half of the year before falling gradually to $1,525 per ounce by the end of the year.

This article will focus on developments in the gold price in 2019 and 2020 and factors that have been affecting prices over the last couple years.

Gold price tracker

In mid-to-late January, gold was trading at $1,582 an ounce, compared to $1,517 at the beginning of the month. The current gold price is the highest it has been in the years following the financial crisis. A black swan event which is driving traders to the metal is the virus emerging out of China. While it is unclear how bad the outbreak of coronavirus is, it already starting to impact the economy. CNBC is reporting that automakers are evacuating workers from China due to the outbreak.

Federal Reserve is a factor

Early in January, The price of gold was at its highest levels since 2013 at $1,588 an ounce, before settling at $1,567.7 for a spot ounce at the time of this writing. What will come next? No one is sure, although analysts are now turning with favor to the precious metal as prices raise. Stay tuned for further updates and see below for some prior commentary on how gold price trading works.

Following the Fed’s decision in December, spot gold inched up to $1,478 per ounce. The central bank chose not to cut interest rates again largely due to better than expected consumer prices. Analysts at OCBC Bank told Reuters that the global economy appears to have stabilized after more than a year of uncertainty.

Paul Schatz of Heritage Capital told Yahoo Finance that gold will continue to rise in the 2020s. It could go up to $2,500 or $3,000 per ounce from current levels. It’s not just gold ETFs and institutional investors driving up demand for gold. Wealthy individuals are also hoarding physical gold.

Who is buying gold

A positive surprise in the U.S. consumer confidence index weighed on gold prices on Jan. 28, 2020. The U.S. Conference Board said the index climbed to a January reading of 131.6, compared to December’s reading of 128.2. Economists had been predicting a reading of 128.2 for January as well. January’s reading is the highest consumer confidence reading in five months.

Here’s a look at where gold prices have gone over the last 100 years, courtesy MacroTrends.net.

Gold price outlook

The metal could face some challenges in 2020 if inflation goes up. Higher inflation could encourage the Fed to raise interest rates. The U.S.-China trade deal is still unpredictable, but a global economic stability could also hurt demand for safe haven precious metals such as gold. However, an analyst predicts that gold could jump to around $1,700 per ounce in the next 2-3 months.

Wolfe Research analysts John Roque and Rob Ginburg told investors in December that gold was “very overbought” in August-September, and it has corrected since then. Now it is set to make its next short-term move in January-February of 2020. The analysts predict the yellow metal could surge up to 15% in the next 75 days.

According to Wolfe Research, there have been seven “turns” in gold prices since 2015, and each time the metal has rallied around 15% over 75-80 days.

The U.S. Federal Reserve decided to keep rates unchanged following its meeting in December. The central bank also signaled that it’s unlikely to change the rates in 2020 amid low inflation. It is looking to change the interest rates once in 2021 and then in 2022. The Federal Reserve expects moderate economic growth in 2020.

What analysts are predicting

The gold price outlook for 2020 is not that clear. This is because there are mixed signals about the state of the U.S. and global economy. The U.S. job market remains resilient, and global equities continue to perform well. The S&P 500 is up nearly 25% this year. JPMorgan analyst Dubravko Lakos-Bujas expects the S&P 500 to rise 8% in 2020.

In the few months of 2019, there was a lot of noise about the inverted yield curve in the U.S. Historically, the yield curve inversion has been a sign of an impending slowdown. But private consumption remains robust in the U.S., showing the resilience of the world’s largest economy.

Leading European and Asian nations are planning to unleash fresh fiscal stimulus to counter the slowdown in trade, manufacturing, and consumption. The potential fiscal stimulus should help boost economic growth in the year ahead.

Iran and precious metals

Experts said the gold price would stagnate or go down as stocks soared; however, as of Jan. 6, 2020, this has not been the case. In just the last few days, geopolitical tensions have skyrocketed amid serious concerns about a potential conflict in Iraq and Iran. The assassination of General Soleimani (former head of the Iranian Revolutionary Guard) even if well deserved, brought back memories of the disastrous invasion of Iraq in 2013. Investors have flooded into safe-haven assets such as gold and even cryptocurrency. Oil prices have also soared amid concerns over disruption to supplies.

Factors affecting performance

The U.S.-China trade tensions, federal rate cuts, easier monetary policies all over the world, and massive gold buying by central banks all ensured that gold had an impressive performance in 2019. With only a few weeks left in 2019, most investors had an optimistic gold price outlook for the next year.

More problems typically mean higher gold prices, but despite the positive economic signs we’ve been seeing, there are still a number of reasons to believe that investors will be rushing to the safety of gold and other haven assets. The U.S.-China trade war was the biggest reason behind gold’s rally in 2019, and it will likely remain the biggest driver.

Trade deal coming?

Two of the world’s largest economies have agreed to a partial accord, and the phase-one of the trade deal could be imminent. But President Donald Trump has warned that if the trade deal is not signed by Dec. 15, the U.S. could impose tariffs on more Chinese imports, escalating the already complicated trade tensions.

The U.S. presidential elections will have a direct impact on the trade war, and indirect on gold. President Trump has signaled that he could wait until after the Presidential election to sign the trade deal with China. Given President Trump’s mood swings, I wouldn’t even attempt to forecast anything about the trade war.

Another reason is that the U.S. Federal Reserve has maintained a dovish stance on rate cuts. A series of rate cuts this year have prompted investors to shift a portion of their assets to safe-haven investments such as gold. Analysts at UBS Securities and Goldman Sachs expect gold prices to surge to $1,600 in 2020. They have also warned that the yellow metal could settle at around $1,400 by the end of next year.

Gold demand

If the global economy witnesses a slowdown in 2020 as several analysts and economists have predicted, the Fed will lower rates further, the equity markets will decline, and gold will become a safe haven investors will rush to.

Standard Chartered analyst Suki Cooper told Bloomberg that the gold rally in 2019 was largely driven by the U.S.-China trade war and central banks purchasing massive amounts of bullion. But gold will get its next push from “retail investors as risks remain skewed to the upside.” Cooper expects gold to hover around $1,570 toward the end of 2020. A similar trend was seen in 2011 when retail demand drove gold to a record high of $1,921.17 per ounce.

Ken Lewis, CEO of OneGold, commented in January 2020 on using gold as a hedge:

“During times of economic unrest or uncertainty, the world turns to precious metals as a safe-haven asset. In the past, this hedge was only available to those with connections, portfolio managers, or access to large funds. New technology is leveling the playing field, giving retail customers quick, cost-effective access to this wealth preservation safety net.”

Gold price calculator

Jan 28, 2020: Added new introduction and updated the price tracker section.

Jan 29, 2020: Live gold prices calculator added.