New S&P Analysis: IT sector stays top choice of US PE/VC investors in Q3, but volume dips

Q3 2020 hedge fund letters, conferences and more

Information technology (IT) remained the most attractive sector among private equity and venture capital dealmakers in the Q3 despite the impact of Covid-19.

Key highlights from the analysis tracker include:

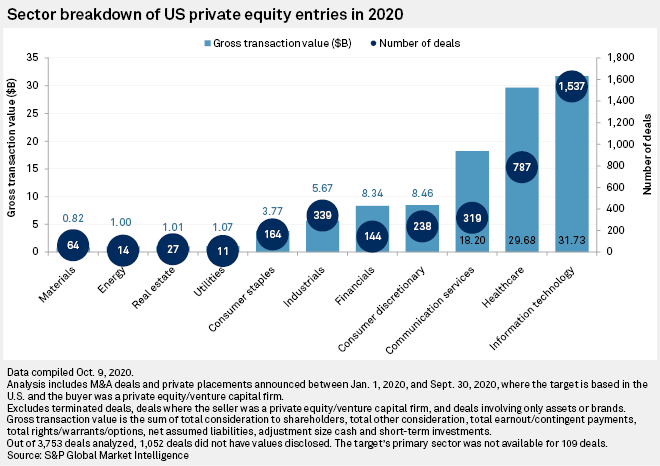

- In the third quarter, the total number of deals in IT surged ahead of other sectors, reaching 1,537 entries for the year to Sept. 30.

- Technology-focused assets have seen particular demand during the coronavirus pandemic as consumers look for online solutions.

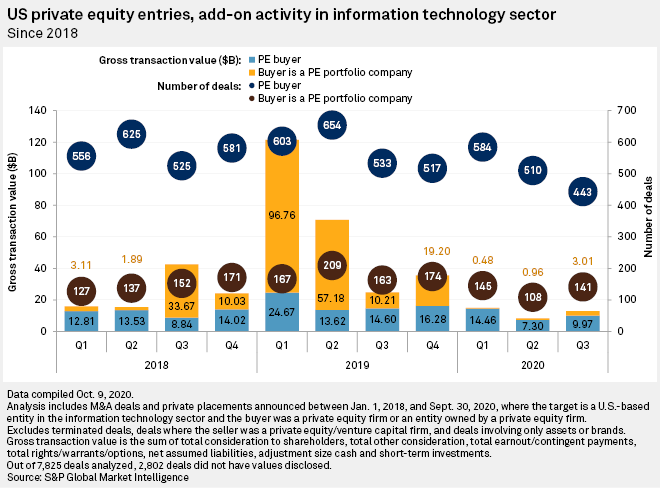

- In terms of year-on-year figures for the IT sector, private equity's overall cautious approach to dealmaking in 2020 is evident. Entries dipped by 17% to 443 in the third quarter for the most popular sector from 533 deals across the same period in 2019. Announced aggregate gross transaction value for IT entries in the third quarter was $9.97 billion, down by 32% year on year.

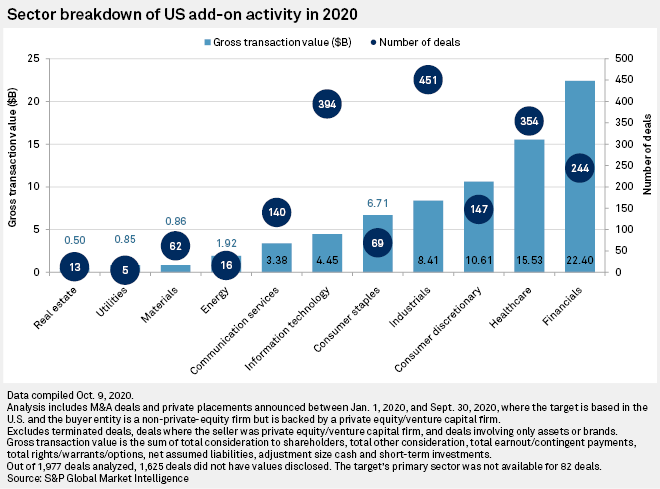

- Total activity for the IT sector in 2020, including add-on transactions, hit 1,931 deals with a gross transaction value of $36.18 billion.

IT sector stays top choice of US PE/VC investors in Q3

However, in terms of year-on-year figures for the IT sector, private equity's overall cautious approach to dealmaking in 2020 is evident. Entries dipped by 17% to 443 in the third quarter for the most popular sector from 533 deals across the same period in 2019. Announced aggregate gross transaction value for IT entries in the third quarter was $9.97 billion, down by 32% year on year.

Total activity for the IT sector in 2020, including add-on transactions, hit 1,931 deals with a gross transaction value of $36.18 billion.

Some big IT deals concluded during the third quarter. Bain Capital Pvt. Equity LP's investment of $750 million in convertible notes in enterprise cloud computing company Nutanix Inc. was the largest IT entry, according to S&P Global Market Intelligence data.

Read the full article here by S&P Global Market Intelligence