Greenhaven Road Capital commentary for the fourth quarter ended December 31, 2018.

Dear Limited Partners,

We have now concluded the first full year of results for Greenhaven Road’s Partners Fund. With just thirteen months of performance under our belts, it is too early to tell how we are doing. Our level of success will be determined over multi-year timeframes in alignment with our long-term investment strategy. For 2018, the Partners Fund returned approximately -14.3%, bringing inception to date performance to -10.9% since December 2017.1 While this year’s performance was disappointing, we continue to believe that our underlying managers are talented, underappreciated, and well-positioned for long-term success. Funds of funds have different performance characteristics than individual strategies do, but as a point of reference, back in 2011 (its launch year), Greenhaven Road’s Fund 1 lost -10.6% when the Russell 2000 gained +4.2%, yet overall the fund has outperformed all relevant indices since inception even with a “slow” start.

Q4 hedge fund letters, conference, scoops etc

Given the concentrated nature and idiosyncratic holdings of the funds that we are invested in, the returns of the underlying funds can have a wide dispersion. Add Q4’s high market volatility to this set-up, and certain underlying funds outperformed or underperformed the Russell 2000 by more than 30% in 2018. One of our largest investments was in one of the funds down more than 30% for the year. Has the manager just lost it? Are the negative returns just the beginning of a reversion to the mean? I speak to this manager almost daily – I know his entire portfolio: the what and the why. I respect how he thinks and his ability to both do nothing for very long periods of time and to act very decisively when he judges the time is right. I think the negative returns are a reflection of the “lumpiness” that comes with concentration. Here are a couple of data points that may provide some comfort. Even after last year, this manager has still compounded at over +20% for the last 7 years and the fund is up more than +20% YTD in 2019. We did not redeem a penny from this investment. Time will tell.

It certainly would have been ideal to have invested less in the underperforming funds and invested more heavily in the “winners.” Fortunately, through long-term compounding, we will pursue that strategy. Over time, the impact of a single fund manager compounding at very high rates should more than compensate for the funds that fail to produce positive returns. I do not plan to actively rebalance funds amongst managers, which means that over time, our best performers will get bigger and our worst performers will get smaller. The Partners Fund will be capped at 100 investors so we will not have infinite capital flowing in. Over time any large winners should eclipse those that perform less well.

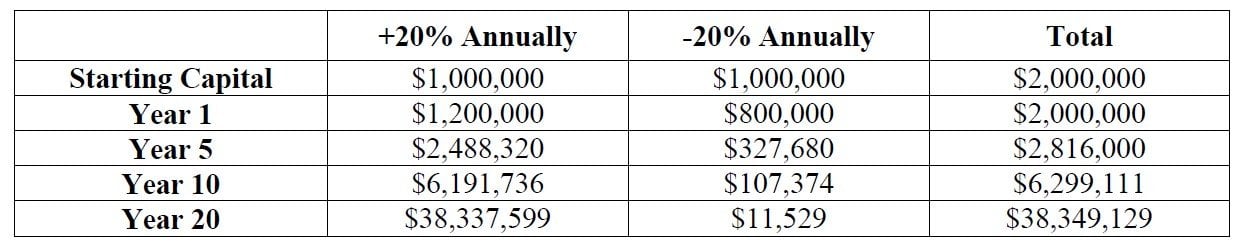

As a simple math exercise, take two funds with $1M invested in each – one goes down -20% per year and the other goes up +20% per year. In the first year, this produces essentially zero return as the gains and losses offset each other. Over time the one gaining +20% produces extraordinary economics while the losing fund 20% per year trends to zero. The impact takes time to reveal itself and the results go from boring to extraordinary.

While we are patient capital, of course we would not actually endure twenty straight years of negative 20% returns from a manager. This chart just demonstrates how a great manager can offset one that loses money. The question is, can we find great managers?

Our managers have what I believe are the necessary ingredients:

- One-person investment committee

- Concentrated holdings

- Reasonable amounts of capital (AUM)

- Significant personal investments (“skin in the game”)

- Original thinking

- Mindset: getting rich is not the point

This does not mean it will be easy or preordained. Our success or failure will be determined over a multi-year timeframe – perhaps more than a decade – and not any twelve months.

Seeding Update

In the last letter, I alluded to the fact that we were in the process of trying to seed a manager. Unlike a typical LP investment, a seed investment will allow us to share in the fee revenue of the underlying manager in addition to participating in the fund’s performance. Fortunately, we have the strategic and operational support of Stride Capital Group, whose team is solely dedicated to seed investing (in fact, they seeded Greenhaven Road and continue to operate our back office). They have been through the process several times, and this is another example of how we are leveraging the relationship. If all goes according to plan, I will send out a supplemental (intra quarter) letter with details on the manager and the opportunity for the partnership.

Going Forward

What can you expect in the next year? There are two traps that I am trying to avoid. The first is having so many underlying funds that on a look through basis the Partners Fund is effectively the market. If we were to invest in 50 funds that each held 15 companies, we would be exposed to 750 companies – that is a complicated and unnecessary way to recreate the market. We want to limit the number of managers. The second trap is churning managers. Given the concentrated nature of the funds in which we are invested, one or two years is too short of a time period over which to judge relative performance. Barring any unforeseen circumstances, we want to be patient capital. As a result, we will proceed slowly. As we are not likely to pull a lot of capital from existing managers, we will likely add only one or two additional managers and/or SPVs (special purpose vehicles) in 2019.

As a reminder, SPVs are typically funds that own a single stock. Managers may create an SPV when they feel they have identified a truly special opportunity and want to own more of a company than they can in their main fund. These can be very attractive risk-reward situations, and while not the purview of most funds of funds, I feel comfortable underwriting a single-security fund as that is effectively what I do for Greenhaven Road's main fund. Investing in an SPV also only increases our look-through company exposures by an increment of +1. There are far more funds than SPVs, so we may not find any we like enough, but our Limited Partners have some interesting personal networks. If you come across something you think is compelling, I would love to have a look.

Maran Capital

My favorite part of the work day is reading letters written by fund managers. I find they can be a good source of investment ideas… is a manager really going to use their letter to feature an idea they think is less than great? The letters can also be a way to find managers for the Partners Fund. Unsurprisingly, some letters disappoint. Generally, the letters that I find most disappointing are those that don’t discuss actual holdings – the what and the why.

In previous Partners Fund letters, I have discussed the manager attributes that we are looking for as well as our vision for portfolio construction (see the Q1 2018 letter for further discussion), but thus far I have dedicated scant letter space to individual managers. As Limited Partners, you should know what you own and why. So, in addition to attaching a rotating selection of letters from the underlying managers, going forward I will also feature individual managers with a focus on how we became invested in their funds. I will try not to cherry pick and select the managers with the best recent performance. Instead of just repeating the underlying manager’s investor presentation (Ally can coordinate delivery of those if you desire), I will focus on how I got to know the manager and what I believe are their strengths.

The first manager I will highlight is Dan Roller of Maran Capital. Our investors may remember Dan from last year’s dinner at the Harvard Club where he presented Turning Point Brands (TPB).

I first got to know Dan in 2015 at VALUEx Vail, an annual gathering of small managers. This three-day event is a combination of managers pitching individual stocks to the group and informal time hiking or hanging out. As geeky as it sounds, the first night I met Dan, we were in a small group that drank Guinness and played a version of 20 Questions where one tried to guess the company the other was thinking of based on a series of yes or no questions. Dan tried to stump me with CafePress (come on, Dan). I mean this in the most complimentary way: Dan’s stock nerdiness is very elevated. It is clear from spending time with Dan that he loves putting the puzzle together. He loves the hunt.

Dan also sticks out for his original thinking and his ability to articulate unpopular opinions and engage in a fact- based debate. At VALUEx Vail, each investor has to present an idea to the other 40 attendees. It is an astute crowd. People spend weeks preparing detailed presentations. Some participants choose non-controversial companies like Berkshire Hathaway – easy to present and sure to receive approving nods. I typically present an obscure Canadian company for which I am inevitably the expert in the room. The first time I saw Dan present, he pitched a company with a well-publicized short thesis and a very controversial CEO. He basically put a target on his chest and said “take your best shot – the facts are on my side.” Dan’s thesis was that you have to look beyond the negative headlines of the CEO and the pictures of his flashy car collection. There was in fact an operating history, a favorable incentive structure, a durable balance sheet, a history of opportunistic buybacks, and a compelling valuation. Dan was not trying to win a popularity contest. He was trying to make money.

Like many managers that the Partners Fund has ultimately invested in, I really got to know and understand Dan as an investor through our mutual ownership of a company. In this case, Scheid Vineyards (SVIN) (discussed in

Greenhaven’s Q4 2017 letter). Scheid Vineyards trades on the OTC market and is a “dark company,” meaning that while it is publicly traded, it does not file financial statements with the SEC. This means SVIN will not appear in any “screens.” It is off off off the beaten path.

Dan introduced me to the company, and together we visited the vineyards and production facility and met with management. We have also compared notes on just about every earnings release and interim piece of industry data that we come across. By processing data alongside Dan and seeing the conclusions he reaches, I have come to appreciate his analytical abilities. Dan knows his companies well. Here is a presentation that he prepared covering Scheid Vineyards: LINK.

I think it is worth pointing out that I don’t think other funds of funds conduct diligence on a manager by investing alongside the manager. I know that this is different… I think that it’s better.

Dan will often invest in growing “50 cent dollars,” where the he believes downside is protected by the assets, and one is getting the optionality of the growth for free. Maran’s portfolio typically consists of approximately 10 stocks spread across a variety of industries. As he is more concerned with generating returns than winning a popularity contest, Maran is more likely to have holdings with controversial management or products. I think it is highly unlikely that there is any overlap between Maran’s portfolio and the direct holdings of most of our LP’s. For example, does anybody else own Clarus (CLAR)?

Dan has a significant personal investment in Maran Capital and a history of making money for his investors. To read his old letters and get to know him better, you can reach out to Ally ([email protected]) for an introduction or go to marancapital.com.

NYC Event

With most of the Partners Fund investors also being investors in Greenhaven Road’s "main fund," I plan to hold both annual meetings on the same day or adjacent days in NYC next fall. Exact time, location, and logistics to follow.

Final Thoughts

As I said at the end of the last letter….Our fund of funds is going to be different. It will be smaller, the underlying holdings will be more esoteric, and I hope the managers will collaborate more over time. I believe that it will all be good different, but only time will tell. Thank you for joining me on this journey. I will work hard to grow your family capital alongside mine.

Sincerely,

Scott Miller

This article first appeared on ValueWalk Premium