Selecting between Crypto.com and Coinbase can present a significant challenge for potential cryptocurrency investors. While both platforms provide gateways to the dynamic realm of cryptocurrency, they cater to different user preferences.

Crypto.com boasts a more comprehensive coin selection and real-world spending options, while Coinbase prioritizes user-friendliness and established coins.

This article explores the strengths and weaknesses of each platform, aiding you in choosing the perfect crypto exchange for your trading needs.

Coinbase is a US-based crypto trading and investment platform designed for new crypto investors. It offers a user-friendly interface for buying, selling, and storing popular cryptocurrencies. They prioritize education with resources to help you learn about crypto. While fees are slightly higher, Coinbase makes it easy to take your first steps into crypto.

Crypto.com provides a comprehensive crypto ecosystem with Visa debit cards that reward crypto purchases, interest-earning options on various coins, and even their blockchain. While the interface is less intuitive, Crypto.com offers a wider range of coins, lower fees for frequent traders, and more ways to leverage your crypto holdings.

Who has more users?

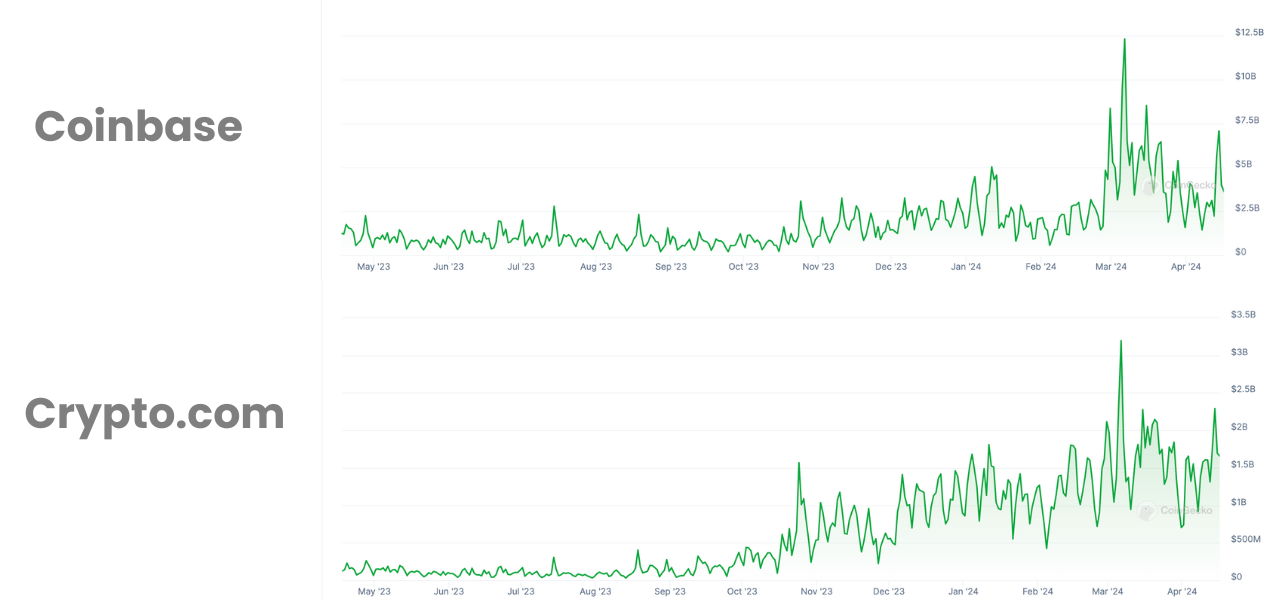

Coinbase currently boasts the larger user base, with estimates reaching around 108 million registered users, compared to Crypto.com’s roughly 70 million (November 2022).

A larger user base usually translates to platform stability and higher liquidity, which can result in smoother trades as there are more buyers and sellers to match orders.

| Coinbase | Crypto.com | |

| Category rank (According to CoinGecko) | 4th | 7th |

| 24-hr trading volume | $4,002,460,587 | $1,665,451,395 |

| Most active trading pair(s) | BTC/USD: $1,301,422,297 (24hrs) | ETH/USD: $531,926,403 (24hrs) |

| Monthly pageviews | 65.7M | 8.94M |

| X (Twitter) followers | 6M | 2.8M |

| Alexa’s global rank | 670 | 6957 |

Who is better regulated?

Both Coinbase and Crypto.com are considered to be well-regulated cryptocurrency exchanges, but there are some nuances to consider:

- Compliance: Both platforms adhere to Know Your Customer (KYC) requirements, which means they verify user identities to prevent fraud.

- Insurance: Coinbase offers FDIC insurance for USD holdings on the platform, while Crypto.com offers insurance against theft or crime for assets held in cold storage.

- Regulatory landscape: Crypto regulation is still evolving, so it’s important to stay updated. Both companies are likely to adapt their practices as regulations become more concrete.

Here’s a quick comparison:

- Coinbase: Publicly traded company in the US, subject to stricter regulations and oversight.

- Crypto.com is registered in Singapore, a region known for its openness to crypto but with its own regulatory framework.

Overall, it’s difficult to say definitively which is better regulated. Coinbase’s public listing and US location might suggest a stricter environment, but both platforms prioritize compliance.

In regulatory wins for crypto, Crypto.com becomes the first global crypto exchange to operate with fiat currency in UAE, while Coinbase secured registration as the first and largest international cryptocurrency exchange in Canada.

| Coinbase | Crypto.com | |

| Regulations | FinCEN, SEC, FINRA, FCA, ASIC, ESMA, CySEC & other global regulators | ASIC, FCA, FINRA, FCA, VARA and more |

| Availability | 100+ Countries | 100+ Countries |

| First incorporated | U.S. | Malta |

Who offers a better trading platform?

While both platforms offer access to the crypto market, they cater to different audiences and prioritize distinct features. Here’s a breakdown to help you pick the better option.

Coinbase: The established powerhouse

Coinbase boasts a user-friendly interface, making it ideal for beginners.

Their Learn and Earn program rewards users for learning about new crypto projects, fostering knowledge and engagement. As the first publicly traded crypto exchange, Coinbase offers a layer of security and trust, appealing to risk-averse investors.

Additionally, they boast a massive user base and high daily trading volume, solidifying their position as a major player. However, Coinbase’s fee structure can be complex and lacks transparency, making it difficult for new users to estimate costs accurately.

Furthermore, their coin selection is curated, meaning you won’t find all the latest meme coins or privacy-centric tokens.

Crypto.com: The feature-rich contender

Crypto.com shines with its real-world integration.

Their Visa debit card program offers attractive rewards and a seamless way to spend your crypto. They also cater to experienced users with advanced features like DeFi staking.

However, Crypto.com’s app-centric approach can feel restrictive compared to Coinbase’s desktop platform. Additionally, concerns linger about their security practices, particularly after a 2022 hack.

While potentially lower with their CRO token, their fee structure can be opaque and riddled with hidden costs.

Crypto.com’s US exchange remains elusive, leaving some users in limbo.

Who offers more cryptocurrencies?

Coinbase’s philosophy is to prioritize security in cryptocurrency selection. They meticulously evaluate each project before listing it, ensuring users can access established and reputable coins.

This focus on compliance means they avoid high-risk categories like privacy coins (e.g., Monero) and meme coins, which are susceptible to scams (“rug pulls”).

Crypto.com, in contrast, embraces a wider variety of cryptocurrencies. Their expansive list includes newer and less established projects, offering users more choices but potentially higher volatility and risk.

| Coinbase | Crypto.com | |

| Cryptocurrencies | 242 (260 on Coinbase Pro) | 344 |

| Pairs | 400 (300 on Coinbase Pro) | 562 |

Who offers more deposit methods?

Crypto.com provides a wider range of deposit methods, offering more flexibility for users with various preferences. However, the availability of specific methods might differ based on your location. Here’s a breakdown:

| Coinbase | Crypto.com | |

| ACH Bank Transfer | Yes | Yes |

| Wire Transfer | Yes | Yes |

| Debit Card Deposits | Yes | Yes |

| Credit Card Deposits | Yes | Yes (limited availability) |

| PayPal | Yes | No |

Overall: Crypto.com provides more deposit flexibility with a wider range of options, including debit/credit card deposits and potentially lower fees. However, Coinbase offers the convenience of using PayPal for deposits, which Crypto.com lacks.

Who offers better deposit fees?

While both platforms offer free deposits for ACH bank transfers, Crypto.com trading fees are often lower for other deposit methods. A comparison of Crypto.com vs. Coinbase trading fees is recommended.

| Feature | Coinbase | Crypto.com |

| ACH bank transfer | Free | Free |

| Debit card deposits | Fees vary depending on the amount deposited | None (However, administrative fees from the carrier may apply) |

| Credit card deposits | High fees (not recommended) | High fees (not recommended) |

| Wire transfer | USD wire transfer ($10) – USD only | Fees vary depending on amount deposited |

ACH is a U.S. financial network used for electronic fund transfers.

Explanation:

- ACH bank transfer: Both platforms waive fees for ACH deposits, the most common and cost-effective method.

- Debit card deposits: Crypto.com often charges lower fees for debit card deposits than Coinbase. However, both platforms can have significant fees associated with debit card deposits, so it’s generally not recommended.

- Credit card deposits: Due to high processing fees and potential risks, Coinbase and Crypto.com have hefty charges for credit card deposits. It’s best to avoid this method altogether.

- Wire transfer: Fees for wire transfers on both platforms can vary depending on the transfer amount. Be sure to check their latest fee schedules before using this method.

Overall: While Crypto.com generally offers lower deposit fees, especially for debit card deposits, it’s important to consider your preferred deposit method. Always check the latest fees on both platforms before making a deposit.

Who offers better withdrawal fees?

Determining the clear winner for withdrawal fees is difficult because it depends on several factors:

- Specific cryptocurrency: Withdrawal fees can vary significantly between different cryptocurrencies.

- Withdrawal method: Fees for sending crypto to an external wallet might differ from sending it to another exchange.

- Trading volume: Some platforms offer tiered fees based on your monthly trade volumes.

However, here’s a general comparison:

| Feature | Coinbase | Crypto.com |

| Withdrawal fee structure | Not entirely transparent, often incurs a fixed fee + network fee | Can be a fixed fee, % fee, or network fee, depends on the chosen cryptocurrency and withdrawal method |

| Generally higher fees | Yes | Potentially lower, especially with CRO token usage |

| Transparency | Less transparent | Can be more opaque depending on the chosen method |

Here’s an example to illustrate the dynamics of Crypto.com vs Coinbase:

Let’s say you want to withdraw $100 worth of Bitcoin (BTC):

- Coinbase: They might charge a fixed withdrawal fee of $10 + network fee (which can fluctuate).

- Crypto.com: They could offer a flat fee of 0.0004 BTC (currently around $8) or a percentage fee based on your withdrawal method. However, if you use their CRO token to pay the fee, it could be significantly lower.

Overall:

- Coinbase: Generally has higher withdrawal fees, with a less transparent fee structure.

- Crypto.com: Potentially, it has lower fees, especially with CRO token usage, but its fee structure can be more complex.

Recommendation:

For occasional withdrawals: Crypto.com could be a better option, especially if you utilize their CRO token for fee discounts. For frequent withdrawals: Coinbase’s flat fee structure might be simpler to manage, even if it’s slightly higher.

Who is more appealing to institutional traders?

Coinbase has an advantage over Crypto.com in attracting institutional traders. Here’s why:

- Regulatory compliance: Coinbase is a publicly traded company with a proven track record of regulatory compliance. This is crucial for institutions that prioritize a safe and secure environment. Crypto.com, while expanding globally, Crypto.com still lacks a US exchange and faces certain security concerns.

- Reputation and trust: Coinbase is the first publicly traded crypto exchange with a strong reputation and established name in the industry. Institutions value this level of trust when making large investments.

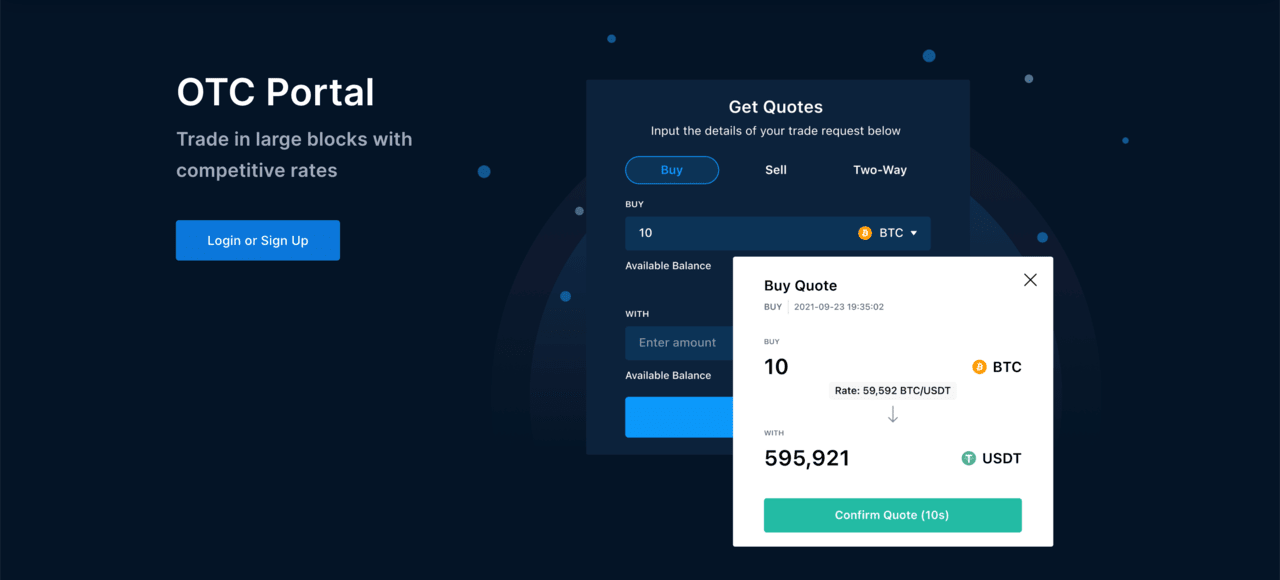

- Institutional-grade features: Coinbase offers features specifically designed for institutions, such as dedicated account managers, over-the-counter (OTC) trading desks, and advanced custody solutions. Crypto.com currently lacks these dedicated institutional services.

- Trading volume: Coinbase boasts significantly higher daily trading volume compared to Crypto.com. This deeper liquidity pool is essential for institutions executing large trades with minimal price impact.

However when it comes to Crypto.com vs Coinbase, Crypto.com shouldn’t be entirely discounted:

- Future potential: Crypto.com’s aggressive marketing strategy, including high-profile sponsorships like the 2022 World Cup in Qatar, the Ultimate Fighting Championship (UFC), Paris Saint-Germain football club, and the Aston Martin Cognizant F1 team, has significantly boosted brand awareness. This, coupled with their focus on feature development, positions them as a potential future player in the institutional cryptocurrency space. However, it must address regulatory concerns and build a robust track record.

- Emerging market focus: Crypto.com has made strides in securing licenses in key emerging markets like Dubai. This could be attractive to institutions seeking exposure to these regions.

In conclusion, Coinbase is the clear favorite for institutional traders due to its established reputation, regulatory compliance, and institutional-grade features. Crypto.com could become a contender in the future, but they need to overcome current limitations.

It’s worth mentioning that Crypto.com has an OTC (Over-the-counter) portal that is designed for high-volume traders. The portal allows traders to make large block trades directly with the exchange, bypassing the traditional order book. This results in faster execution times (in seconds), custom quotes, and potentially lower fees, especially for those who pay with their CRO token. Typically, the minimum trade size here starts at $50,000.

Users’ opinions on the Crypto.com vs Coinbase debate

Crypto.com vs Coinbase: Final verdict

Coinbase’s impact on the crypto industry is undeniable. Their user-friendly platform, educational resources, security focus, and curated asset selection have bridged the gap for mainstream adoption. Going public boosted crypto’s credibility and set a precedent for others. If successful, their legal battle with the SEC will further pave the way for the industry.

As custodian for several Bitcoin ETFs, Coinbase continues demonstrating its commitment to transparency and trust. The exchange also launched its own layer-2 chain BASE, which has attracted many users and developers.

While Crypto.com lacks a US presence, it offers the closest experience to a full-service crypto ecosystem. With continued development, one could envision a future where their offerings replace traditional banking for some users. This, of course, hinges on their continued adoption and utility of the CRO token.

It’s all about your needs

Coinbase excels for beginners seeking a user-friendly platform focusing on education and security. Experienced traders with an appetite for real-world crypto spending and advanced features may find Crypto.com appealing.

Ultimately, when it comes to winning the Crypto.com vs. Coinbase contest, the best platform depends on your experience level, investment goals, and preferred features.

Before making a decision, please read our other articles comparing Kraken & Coinbase and Binance & Bybit for a more comprehensive understanding of the available options.

FAQs

Crypto.com vs Coinbase, which one is better?

While reviews on social media and user sites tend to favor Coinbase, the best platform depends on your priorities. Do you value ease of use above all else? Or are lower costs and a wider range of options more important?

Which exchange offers a better platform for beginners?

Which exchange has more users?

Is Coinbase safe for trading cryptocurrencies?

Is Crypto.com a legitimate exchange?

Trying to decide between Crypto.com vs Coinbase?

Wondering about trading fees on Crypto.com vs Coinbase?

Sources

- https://www.fool.com/quote/nasdaq/coin/

- https://help.crypto.com/en/articles/5792178-crypto-com-app-geo-restrictions

- https://www.cnbc.com/2021/04/14/coinbase-to-debut-on-nasdaq-in-direct-listing.html

- https://www.cnbc.com/amp/2021/04/14/coinbase-to-debut-on-nasdaq-in-direct-listing.html

- https://www.coindesk.com/policy/2024/04/09/cryptocom-obtains-full-dubai-operational-license/

- https://help.coinbase.com/en/prime/trading-and-funding/supported-cryptocurrencies-and-trading-pairs