Bybit and Binance remain dominant players in the world of cryptocurrency exchanges, each with unique offerings.

With the ongoing evolution of the digital asset market, investors face a critical choice between these two options.

While Binance is currently the top crypto exchange regarding trading volume, Bybit is rapidly gaining popularity due to its user-friendly interface and emphasis on derivatives trading.

This detailed analysis compares Bybit and Binance, uncovering the intricacies that differentiate them and exploring which one might better align with your investment needs.

Defining Binance and Bybit

Binance: Renowned for its extensive range of cryptocurrencies, Binance offers trading services for both beginners and advanced traders. It boasts high liquidity, low fees, and a user-friendly interface, making it a popular choice among crypto enthusiasts worldwide.

Additionally, Binance provides various features, such as futures trading, staking, and its native token, BNB, which add utility and benefits to its ecosystem.

Bybit: Focusing primarily on perpetual contracts for Bitcoin and other major cryptocurrencies, Bybit has gained traction for its user-friendly interface, high liquidity, and advanced trading features such as leverage trading up to 100x.

The exchange prioritizes security and offers robust risk management tools to mitigate potential losses for traders. With its commitment to innovation and customer satisfaction, Bybit continues to attract traders seeking efficient and reliable trading platforms in the crypto space.

Source note: All figures and data used in this article were current and accurate at the time of publication.

Is Binance app safer than Bybit?

This section examines whether Binance or Bybit offers a more secure environment for digital assets. We compare their safety features and track records to help you decide which platform best protects your crypto.

Basic defenses

Binance and Bybit offer two-factor authentication (MFA) and comply with KYC/AML regulations. This secures your account and deters illegal activities.

Cold storage

Bybit surpasses Binance here. Bybit stores most assets in cold wallets, offering superior protection against hacking. Binance uses a mix of hot and cold wallets, increasing vulnerability.

Audits & Insurance

Both platforms undergo security audits. However, Binance boasts a Secure Asset Fund for Users (SAFU) – a financial safety net for user assets in emergencies. Bybit currently lacks such insurance.

Decision: It’s close. Bybit wins on cold storage, but Binance counters with SAFU. While CoinGecko user trust scores favor Bybit (10/10 vs. Binance’s 9/10), recent negative news about Binance’s founder’s legal troubles (Binance SEC) and hacking incidences may impact user perception.

Which exchange is regulated in the US?

Before we dive into the features, let’s settle on a key difference: regulations. Binance US operates as a licensed Money Services Business, while Bybit doesn’t have equivalent US licensing. Here’s a breakdown:

| Region | Binance Regulations | Bybit Regulations |

| United States | FinCEN-registered MSB (Binance US) | Not regulated |

| Europe | Registered DASP in France, Italy, and Spain | Regulated in Malta |

| Middle East | Dubai – VARA Specialist License, Bahrain – CBB License | Dubai – MVP License |

| Others | FCA (UK), ASC (Canada), Registered with AUSTRAC (Australia) | Registered with Seychelles FSA and Mauritius FSC (VASP) |

Binance also boasts a wider reach with regulatory approval in various regions, including:

- US (Limited): Binance US operates as a licensed Money Services business.

- Europe: Offers crypto-related services under regulations in France, Italy, and Spain.

- Middle East: Licensed in Dubai by VARA and Bahrain by CBB.

- Other: Registered with financial authorities in Canada, Australia, and Kazakhstan.

Bybit focuses on global operations but with a lighter regulatory footprint:

- Dubai: Holds a minimal viable product (MVP) license from VARA.

- Europe: Regulated by the Maltese authorities.

- Global: Registered with financial authorities in Seychelles and Mauritius.

Which exchange has better trading features?

Choosing the right crypto exchange hinges on transaction fees. This head-to-head between Binance and Bybit dissects their cost structures to help you pick the most cost-effective platform.

Spot trading fees

Binance boasts some of the lowest spot trading fees in the industry, with discounts for holding Binance Coin (BNB). Bybit counters with a competitive maker-taker fee structure.

Margin trading fees

Bybit takes the lead here. It offers lower margin trading fees compared to Binance.

Deposit and Withdrawal Fees

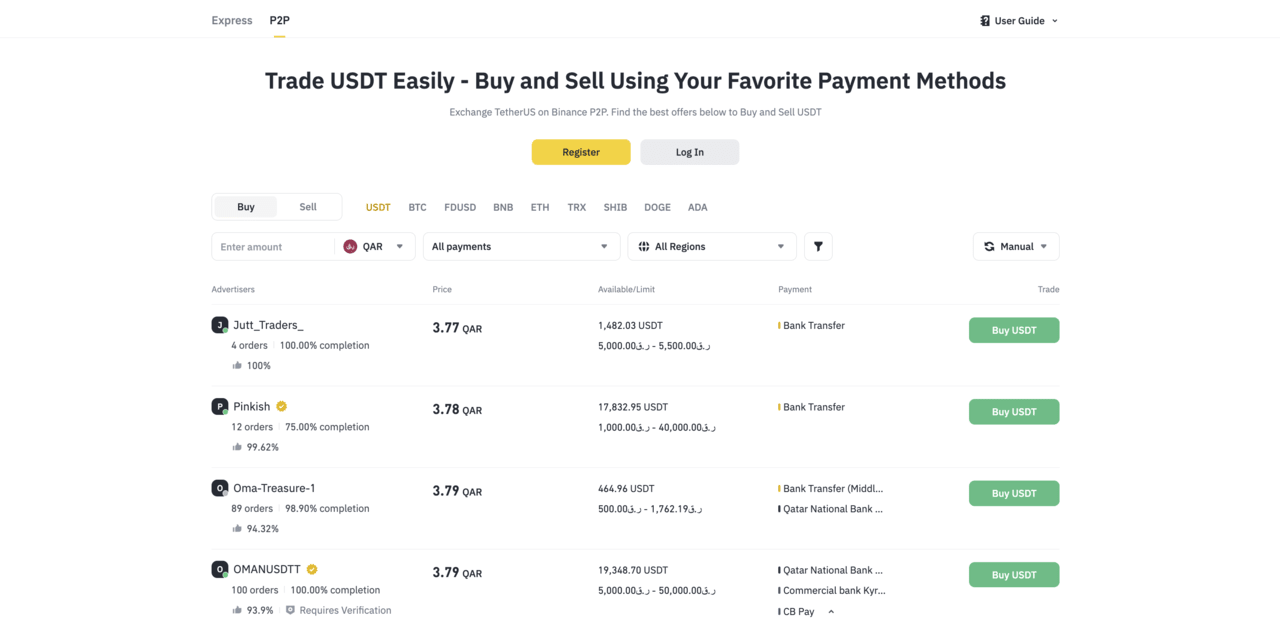

Binance and Bybit accept various deposit methods, but the associated fees may vary. Binance P2P allows traders to engage in peer-to-peer trading to reduce deposit fees. Bybit generally keeps the deposit fees for most cryptocurrencies at a minimum. However, withdrawal fees differ based on the specific coin selected.

KYC overview

Both Binance and Bybit offer different KYC verification levels. Bybit’s higher KYC levels unlock features like higher withdrawal limits. Binance news suggests they might introduce similar KYC-linked benefits in the future.

Mobile app

Both Binance and Bybit provide user-friendly mobile apps for trading on the go. Binance’s app is consistently rated among the best in the industry, offering a wide range of features and functionalities. Bybit’s app is known for its sleek design and ease of use, making it a good option for new traders.

The verdict

If you are interested in spot trading, Binance provides a great option with its low fees and BNB discounts. On the other hand, if you prefer margin trading, Bybit may be a better choice due to its lower margin fees. Before making a decision, it’s important to consider your trading style and preferred features. Both platforms also offer mobile apps for convenient trading.

| Feature | Binance | Bybit |

|---|---|---|

| Spot Trading Fees | Lower, with BNB discounts | Competitive maker-taker fees |

| Margin Trading Fees | Higher | Lower |

| Deposit Fees | Can vary, P2P option available | Mostly minimal |

| Withdrawal Fees | Vary by coin | Vary by coin |

| KYC Impact | Potential future benefits for higher tiers | Higher withdrawal limits for higher tiers |

| Mobile App | Available | Available |

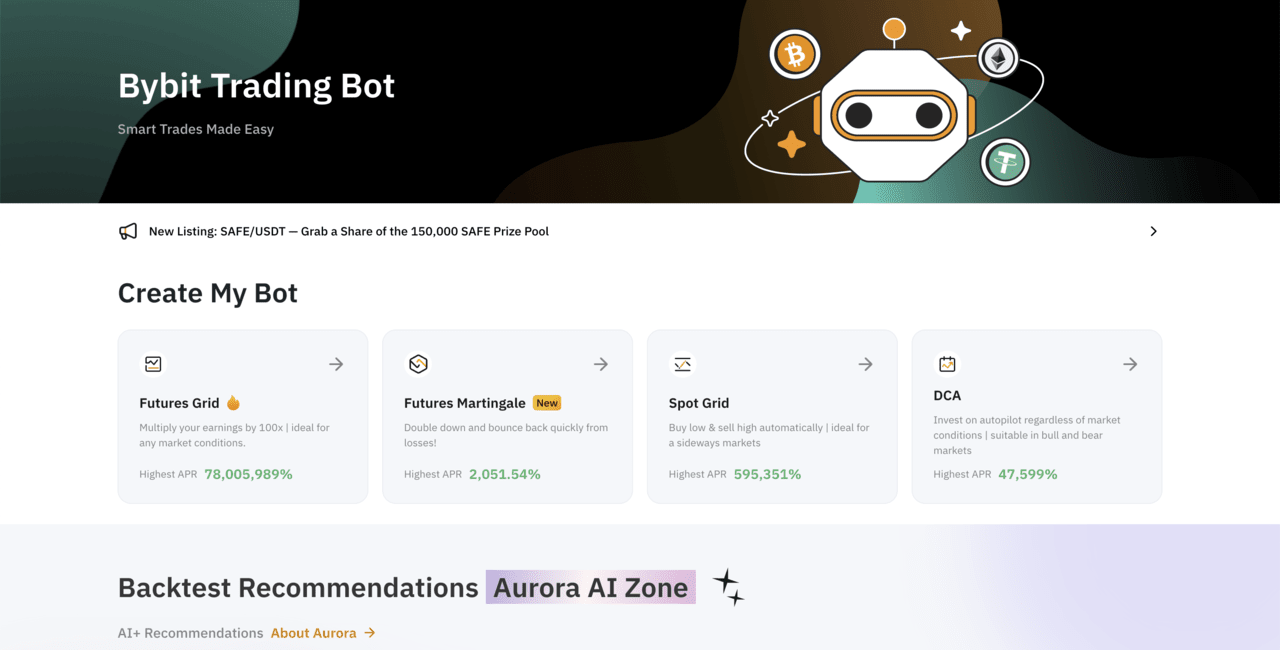

Which exchange is more innovative?

Regarding innovation in the cryptocurrency exchange space, both Binance and Bybit have made significant strides, each showcasing unique features and advancements.

Binance, one of the largest exchanges globally, has continuously pushed boundaries with its diverse range of products and services, including the introduction of Binance Smart Chain and its native token, BNB.

Bybit, on the other hand, has gained traction for its user-friendly interface and advanced trading tools, particularly in derivatives trading.

While Binance has a broader reach and more extensive offerings, Bybit has carved out a niche focusing on perpetual contracts and leveraged trading.

Recent news

Despite its history, Binance is constantly pushing the boundaries of innovation. Their new platform, Binance Megadrop, gamifies token launches by combining airdrops with Web3 quests.

Users can earn rewards from new projects before they hit the exchange. This unique approach educates users and fosters early engagement within the crypto ecosystem.

Bybit, however, focuses on refining existing features. Their upgraded Spot Grid 3.0 bot offers more flexibility and control. Users can now choose between three investment modes and a wider grid range, allowing for more nuanced trading strategies.

While Bybit innovates through improvements, Binance takes a bolder approach with entirely new platforms and experiences.

Which is better for trading Bitcoin futures?

Let’s break it down in a head-to-head format to make a clear comparison between Binance and Bybit for Bitcoin futures trading.

| Feature | Binance | Bybit |

|---|---|---|

| Fees | Generally lower | Slightly lower |

| Leverage | Up to 50x | Up to 100x (inverse) |

| Trading pairs | More diverse | Fewer, but includes XRP/EOS |

| User interface | Easier to navigate | Simpler, futures-focused |

| Fiat options | Yes (through Binance P2P) | No |

| Regulation | Varied by region | More centralized |

| KYC requirements | Required for most features | Required for all features |

| Mobile app | Available (Binance App) | Available |

| News & Analysis | Extensive | Limited |

Binance typically offers lower fees, a wider range of trading pairs, and a user-friendly platform. However, leverage is capped at 50x, and fiat on-ramp options require using Binance P2P, a separate service.

Bybit counters with the edge in leverage (up to 100x on inverse contracts) and includes XRP and EOS futures not found on Binance. However, Bybit has a more basic interface, lacks fiat deposits, and requires KYC for all features.

The choice between Bybit and Binance depends on your priorities. Bybit offers maximum leverage and specific coin futures, while Binance provides a broader offering, lower fees, and a user-friendly experience.

Trading volumes compared

Binance, the world’s largest crypto exchange, has seen its dominance challenged. According to Kaiko research, their share of non-US Bitcoin trading dropped significantly (from 81.3% to 55.3%) due to legal issues. This decline extends to altcoins (58% to 50.5%).

Meanwhile, Bybit has capitalized, expanding its Asian footprint and capturing a growing share (2% to 9.3%) of the non-US BTC market.

Binance still boasts a massive user base (128M) and sky-high trading volumes ($17.6 billion daily). Their BTC/USD futures pair sees over $4 billion daily trades. Binance also dominates its online presence with over 100 million monthly pageviews and a hefty Twitter following (11.6 million).

Bybit, though smaller (10M users, $3.8 billion daily volume), is a rising star. Their BTC/USDT pair thrives with over $1 billion daily trades. Bybit is user-friendly and caters to growth markets.

| Feature | Binance | Bybit |

| Category rank (by Trading Volume) | 1th | 3th |

| Established | 2017 | 2018 |

| Country of incorporation | Cayman Islands | British Virgin Islands |

| 24-hr trading volume | $17,943,178,243 | $4,190,860,868 |

| Most active trading pair(s) | BTC/FDUSD – $4,234,118,336 (24hrs) | BTC/USDT – $1,072,763,298 (24hrs) |

| Monthly pageviews | 101,4M | 39,1M |

| X (Twitter) followers | Over 11,6M | Over 3,27M |

Conclusion: Binance offers vast liquidity and established dominance. Bybit provides a strong alternative focused on growth and user-friendliness. Before moving, consider your trading needs, risk tolerance, and preferred platform features.

Trading fees compared

Binance boasts competitive trading fees of 0.10% per spot trade. However, users can reduce these fees by holding Binance Coin (BNB). Bybit counters have even lower base trading fees of 0.075%. This rate applies to makers and takers, making Bybit a potentially more cost-effective option for frequent traders.

For casual traders, Binance’s fee structure might be sufficient. However, Bybit’s lower fees have become increasingly attractive due to the higher trading volume. Remember, Bybit KYC verification unlocks their full suite of features.

| Binance | Bybit | |

| Spot Trading | 382 coins | 471 coins |

| Total Tradable Pairs | 1,264 pairs | 555 pairs |

| Margin Trading | Trade crypto pairs with leverage up to 50x | Specializes in futures contracts with up to 100x leverage on select pairs |

| Futures | 387 pairs | 450 pairs |

| 24hr open interest | $14,162,619,449 | $9,855,805,752 |

The amount of open interest signifies the total number of contracts that traders hold and are ready for trading.

Withdrawal fees (and deposit fees) compared

Both Binance and Bybit demonstrate strengths in terms of withdrawal fees. Binance’s extensive cryptocurrency support and transparent fee structure are commendable, while Bybit’s competitive fees and innovative P2P crypto withdrawal feature provide added convenience.

| Binance | Bybit | |

| Withdrawal Fees (Spot) | BNB 0.0005, BTC 0.005, ETH 0.001, LTC Free, NEO 0.01, QTUM 50, SNT 0.6, BNT 2, EOS 0.0005, BCC GAS Free 5, USDT 2, OAX 30, DNT 0.15, MCO 0.5, ICN 0.2, WTC 0.1, OMG 5, ZRX 0.1, STRAT 4, SNGLS 2, BQX 1, KNC 50, FUN 10, SNM 5, LINK 0.1, XVG 1, CTR 0.3, SALT Free, IOTA 0.5, MDA 0.15 | 0.0005 BTC |

| Withdrawal Fees (Futures) | N/A | BTC 0.0005, ETH 0.01, XRP 0.25, EOS 0.1 |

| Fiat withdrawals | Fiat withdrawals supported | Fiat withdrawals are facilitated via third-party integrations, while P2P withdrawals are exclusively for crypto |

Lower Withdrawal Fees: Bybit generally offers lower withdrawal fees than Binance. Binance charges a flat percentage, while Bybit charges a fixed amount per coin, which can be significantly cheaper for larger withdrawals.

Additional Considerations:

- Minimum withdrawal amount: Check the minimum withdrawal amount for each exchange before initiating a withdrawal.

- Network fees: Depending on the chosen coin and network congestion, Binance and Bybit might pass on additional fees.

Now let’s move on to deposit fees

Deposit Fee Comparison: Bybit vs. Binance

| Exchange | Deposit Fee (Crypto/Stablecoin) | Deposit Fee (Fiat) |

|---|---|---|

| Bybit | Free | Not Offered (Fiat deposits require 3rd party services with variable fees) |

| Binance | Free | Variable (depends on deposit method) |

- Both Bybit and Binance offer free deposits for cryptocurrencies and stablecoins.

- Bybit does not offer direct fiat deposits. Users need to utilize third-party services, which may incur variable fees.

- Depending on the chosen deposit method, Binance charges fees for fiat deposits (e.g., bank transfer or credit card).

Recommendation: Bybit generally has a simpler deposit fee structure, while Binance offers fiat deposits but with variable fees. However, when considering withdrawal fees, Bybit’s fixed structure might be more cost-effective, though Binance’s minimum withdrawal fees could be lower for very small amounts.

Unique features compared

Binance and Bybit offer core functionalities like spot trading, margin trading, and derivatives, but critical differences emerge in their unique features. Binance boasts a robust peer-to-peer (P2P) marketplace, Binance P2P, which allows users to buy and sell crypto directly with other users.

Bybit, on the other hand, emphasizes derivatives trading with innovative products and high-leverage options. Both platforms provide mobile apps (Binance app, Bybit app) for on-the-go trading. Still, Binance News offers a constant stream of industry updates and educational content directly within its platform.

Bybit takes a user-centric approach with its ‘Easy Options,’ a simplified options trading tool. It highlights popular options, key information, and one-click buying for effortless profit-seeking. This user-friendly feature caters to beginners and those who want to copy experienced traders, making the trading experience more accessible and less intimidating.

On the other hand, Binance counters with its innovative ‘Discover‘ feature for copy trading. This intuitive swipe interface allows users to easily explore and follow successful traders’ strategies.

The simple ‘right swipe to favorite’ and ‘left swipe to pass’ system streamlines discovery and instills confidence in users, making them feel in control of their trading decisions. Binance’s copy trading has seen a surge in participation and assets under management, solidifying its user-centric approach.

User Opinions on Bybit vs Binance

Final verdict, Binance or Bybit?

Binance reigns supreme as a one-stop crypto shop, boasting millions of users and catering to all experience levels. Its feature-rich platform offers everything a crypto enthusiast could desire. However, this abundance can be overwhelming, potentially confusing new users.

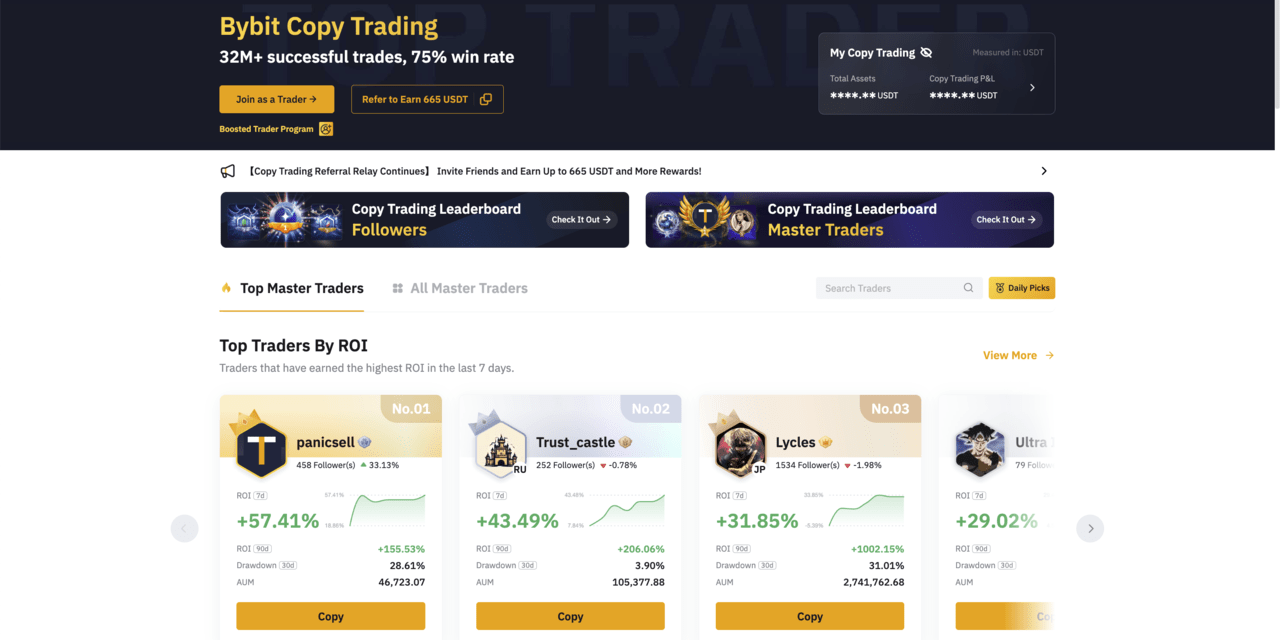

Bybit, with its streamlined interface and powerful trading engine, caters to serious traders. Its top-notch copy trading product attracts investors seeking to mirror successful strategies. While lacking Binance’s sheer variety, Bybit has carved a niche for itself, capturing market share with rapid project listings.

Binance is actively countering Bybit’s rise by strategically listing popular Bybit projects. This fierce competition benefits users by driving innovation and potentially lower fees. So, the choice boils down to preference: a feature-rich giant (Binance) or a streamlined platform with a strong trading focus (Bybit).

You may also find it helpful to read our other comparison articles, highlighting Kraken and Crypto.com.

FAQs

Is Binance in trouble?

Is Bybit banned in Asia?

Is Binance a good option for beginners?

Why is Bybit popular?

Bybit also shines in its focus on perpetual contracts, a popular derivative product that allows traders to speculate on price movements without expiry dates.

This focus translates to competitive fees specifically tailored to perpetual contracts. Bybit sweetens the deal with a robust loyalty program that rewards users for their activity on the platform.

Is it safe to keep your money on exchanges?

Although some exchanges provide insurance against security breaches, transferring your cryptocurrency to a personal wallet for long-term storage is generally considered safer.

Personal wallets give you more control over your cryptocurrency and minimize the risk of loss in case of an exchange hack.

How to decide which exchange is better for my needs?

Binance offers more coins but has a steeper learning curve. Bybit is simpler but focuses on derivatives. Research both platforms (Binance app, Bybit KYC) and fees before deciding.

Sources

- https://www.dlnews.com/articles/regulation/asia-crypto-crackdown-expands-to-thailand/

- https://www.cryptotimes.io/2024/02/08/bybit-launches-spot-grid-3-0-to-enhance-automation-in-trading/

- https://www.newswire.ca/news-releases/simplify-options-trading-bybit-launches-new-easy-options-feature-827537626.html

- https://financefeeds.com/bybit-web3-launches-industrys-first-bitcoin-layer-2-airdrop-campaign-paving-the-way-for-a-new-bitcoin-era/

- https://www.binance.com/en/support/announcement/binance-launches-megadrop-a-token-launch-platform-with-airdrops-and-web3-quests-748b7181f5d14d6fb2add4048374d646