Choosing the right cryptocurrency exchange for trading Bitcoin and tokens is crucial for any aspiring crypto trader. Two leading platforms, Coinbase and Kraken, constantly vie for user loyalty.

This analysis delves deep into the intricacies of Coinbase and Kraken, dissecting fees, features, security, and user experience. By the end, you’ll be equipped to decide which exchange best suits your crypto trading journey.

Our methodology: The analysis of Coinbase and Kraken that informed the development of this article

To deliver an unbiased and informative comparison of Coinbase and Kraken, we leveraged a variety of sources:

– Reputable cryptocurrency aggregator sites provided in-depth data on fees, supported currencies, and trading features.

– User review platforms offered valuable insights into user experience and customer satisfaction.

– Recent publications, news articles, and industry reports kept us updated on the latest developments and trends in the cryptocurrency exchange landscape.

This multi-faceted approach ensured we considered factors important to both beginner and experienced users, including:

- Fees (maker-taker structure, deposit/withdrawal costs)

- Security protocols (storage practices, authentication methods)

- Trading features (e.g., basic vs. advanced order types)

- Supported currencies (the variety of coins and tokens available on the exchange)

- User experience (ease of use, mobile app functionality)

By examining these aspects through a diverse lens, we aim to provide a comprehensive and unbiased assessment to help you choose the right cryptocurrency exchange platform for your needs.

Coinbase prioritizes ease of use with a beginner-friendly interface and educational resources. Compared to Kraken, it offers a limited coin selection but integrates seamlessly with its crypto wallet and debit card for convenient spending and management. Although its fees are slightly higher, its simplicity makes it a strong choice for new crypto investors.

Kraken caters to experienced traders with a robust platform offering margin trading, advanced order types, and lower fees. It boasts a vast selection of cryptocurrencies and superior staking rewards, but its interface might feel less user-friendly for beginners.

Source note: All figures and data used in this article were current and accurate at the time of publication.

Which exchange has more users?

In the head-to-head battle of “Coinbase vs Kraken,” Coinbase appears to boast a significantly larger user base.

Since exact user numbers aren’t available, we used monthly website visits and trade volume to understand user activity.

According to exchange data aggregator Coingecko, Coinbase is the world’s second most visited crypto exchange and third highest for 24-hour trade volume.

Kraken, on the other hand, is the 12th most visited and ranks 7th for trade volume.

With roughly 65.7 million visits in May 2024, Coinbase has nearly 4 times as many monthly website visits as Kraken, which had around 13.7 million.

| Feature | Coinbase | Kraken |

| Category rank (According to CoinGecko) | 3rd | 5th |

| Established | 2012 | 2011 |

| Registered | United States | United States |

| 24-hr trading volume | $2.39B | $965M |

| Most active trading pair | BTC/USD – $785M | USDT/EUR – $183M |

| Monthly pageviews | 65.7M | 13.7M |

| X (Twitter) followers | Over 1.2M | Over 1.5M |

Conclusion – Coinbase wins

While user numbers are not always publicly available, traffic estimates suggest Coinbase significantly outpaces Kraken.

Looking at traffic visits, Coinbase boasts millions more users than Kraken. This wider user base translates to a more liquid marketplace on Coinbase, potentially offering tighter spreads and faster trade execution.

Who is better regulated?

Choosing a cryptocurrency exchange hinges on several factors, and regulatory compliance is crucial. Both Coinbase and Kraken prioritize user security and adhere to various regulations. However, their approaches differ slightly.

Kraken positions itself as a global exchange operating in numerous jurisdictions. It prioritizes meeting licensing requirements and Anti-Money Laundering (AML)/Know Your Customer (KYC) standards set by each region.

This ensures user identification and helps prevent illegal activities. Additionally, Kraken actively engages with regulators to stay informed about evolving regulations, including those on staking programs, a relatively new area in crypto.

Coinbase, on the other hand, takes a more centralized approach to regulation. It prioritizes obtaining licenses in specific, well-established financial markets, which ensures a high level of compliance but may limit its availability in some regions.

Although Coinbase is considered the most secure crypto exchange, it has clashed with the US Securities and Exchange Commission (SEC) regarding its staking program, highlighting the ongoing debate about classifying certain crypto activities.

While sometimes seen as cumbersome, regulations are essential for a healthy cryptocurrency ecosystem. They protect users from fraud and promote market stability. KYC/AML standards help prevent money laundering and terrorist financing. Additionally, clear guidelines around token offerings and trading activities foster trust and encourage institutional investment in the crypto space.

| Coinbase | Kraken | |

| Regulatory Focus | Global compliance, regional licensing | Targeted licenses in established markets |

| Supported countries | 100+ | 176 |

| KYC/AML | Strict adherence | Strict adherence |

| Staking Regulations | ‘Engaging with regulators’ | ‘Public disagreements with SEC’ |

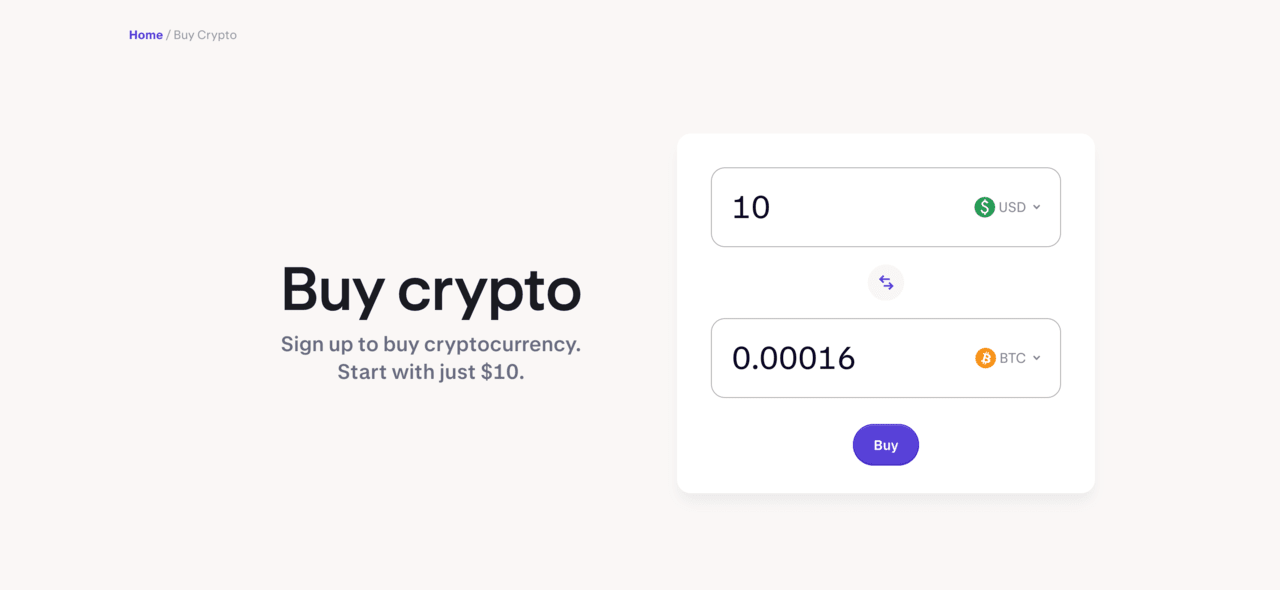

Who offers a better trading platform?

Choosing between Coinbase and Kraken depends on your experience level.

- Coinbase: Offers a user-friendly interface ideal for beginners. Their basic platform is simple, but fees are higher. Coinbase Pro unlocks advanced features like margin trading and order books, making it more competitive with Kraken.

- Kraken: Caters to both novice and experienced traders. Their standard platform offers more features than Coinbase’s basic version but with a slightly steeper learning curve. Kraken Pro boasts some of the lowest fees in the industry and advanced order types for serious traders.

Mobile Apps: Both platforms have well-regarded crypto apps mirroring the desktop experience. Coinbase’s app might be easier to navigate for beginners, while Kraken’s app caters well to power users on the go.

In essence, Coinbase might be better for a smooth entry into crypto. But Kraken shines because it offers lower fees and a wider range of trading tools, especially for experienced users. Consider your priorities—simplicity or advanced features—to decide which “Kraken vs. Coinbase” battleground emerges victorious for you.

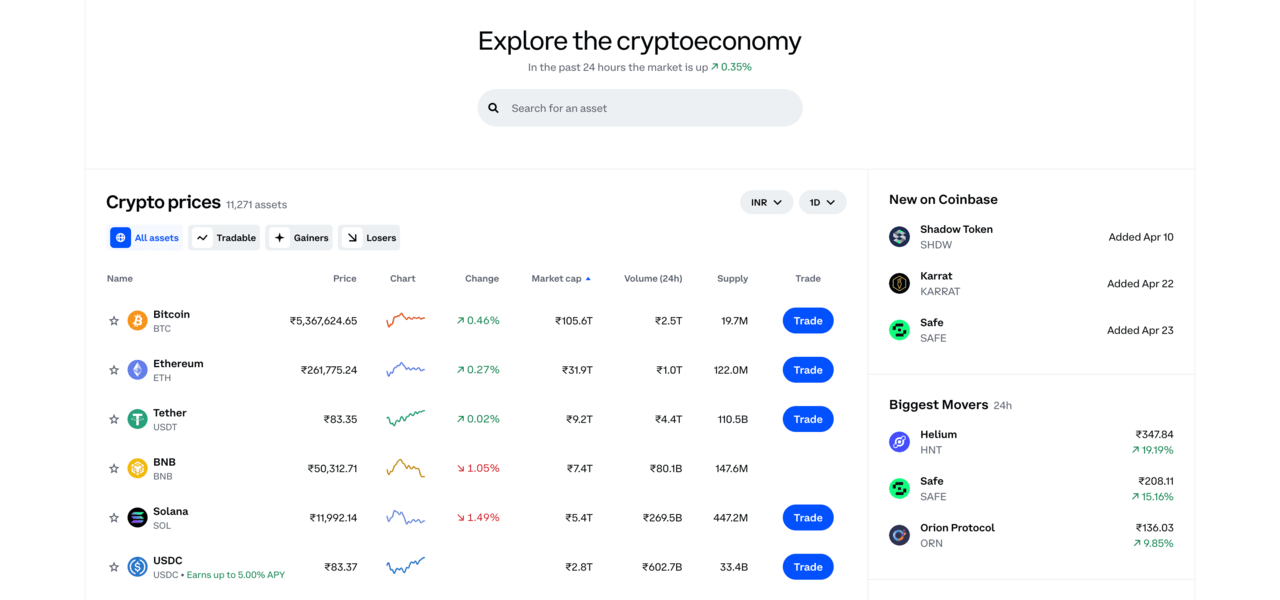

Who offers more cryptocurrencies?

Kraken and Coinbase are intensifying their competition as they strive to offer a diverse selection of cryptocurrencies for trading.

Here’s a breakdown that will help you determine which exchange provides more benefits.

| Coinbase | Kraken | |

| Spot Trading | 245 coins | 237 coins |

| Total tradable pairs | 403 pairs | 657 pairs |

| Margin trading | Only available on Coinbase pro | Not all 237 coins are supported |

| Futures | Requires Coinbase Advanced trading account | Available for select cryptocurrencies |

| Perpetuals | Requires Coinbase Advanced trading account | Over 200 perpetual protocol trading pairs are available |

Currencies breakdown

- Spot trading: Both platforms offer various cryptocurrencies for basic buying and selling. While Coinbase edges out Kraken by a handful in total coins, Kraken boasts a significantly higher number of tradable pairs, offering more options for diversified trading strategies.

- Margin trading: This advanced feature, allowing traders to leverage their holdings, is only available on Kraken for select cryptocurrencies. Note: Coinbase currently only offers margin trading for Coinbase Pro members

- Futures & perpetuals: Kraken offers futures and perpetual contracts on select coins for those seeking exposure to cryptocurrencies’ price movements without directly owning them. Coinbase, on the other hand, currently lacks these derivative products.

Choosing the right platform

- Trading style: If you’re a beginner-focused on spot trading, either platform might suffice. However, Coinbase’s user-friendly interface and listing options might be more appealing.

- Advanced features: If you’re an experienced trader seeking margin trading, futures, or perpetual, Kraken emerges as the clear winner.

- Specific cryptocurrencies: Do your research! If you have your heart set on a specific cryptocurrency, ensure it’s available for trading on your chosen platform (spot, margin, futures, or perpetual, depending on your needs).

Conclusion – Kraken wins

While Coinbase offers a slightly larger selection of spot trading coins, Kraken reigns supreme in overall variety. With margin trading, futures, and perpetual on select cryptocurrencies, Kraken caters to more advanced traders seeking diverse investment opportunities.

Who offers more deposit methods?

Choosing the right cryptocurrency exchange hinges on various factors, and deposit methods are a crucial consideration.

| Coinbase | Kraken | |

| Deposits include… | – Bank transfer (ACH, SEPA) – Free (for most) – Crypto deposits – Free – Debit card purchases (instant, high fees) – PayPal purchases (instant, high fees) | – Bank transfer (ACH, SEPA) – Free (for most) – Crypto deposits – Free – Wire transfer (fees apply) – Third-party payment processors (varies by region, fees apply) |

A breakdown of deposit methods for Coinbase vs Kraken

- Free deposits: Both platforms offer most users free deposits via bank transfers (ACH, SEPA).

- Crypto deposits: Kraken and Coinbase allow free crypto deposits, making it easy to transfer existing holdings.

- Traditional payment methods: Kraken and Coinbase are cryptocurrency exchanges but differ in their options for depositing fiat currency. Kraken allows wire transfers (with fees) but does not support debit cards or third-party processors like PayPal. On the other hand, Coinbase offers the convenience of instant purchases with debit cards and PayPal, but these options come with high fees.

Conclusion – Tie

There is no clear winner in the battle between Kraken and Coinbase regarding deposit methods. The decision depends on your preferences.

If you prioritize affordability and a broader range of deposit options, Kraken is the better option, as it offers more choices. However, if you want to make instant purchases using debit cards or PayPal despite higher fees, Coinbase is the way to go.

Who offers better deposit fees?

Deposit fees are crucial in escalating competition between Kraken and Coinbase. Use this breakdown to determine which exchange provides a more favorable deposit fee deal.

| Feature | Coinbase | Kraken |

| Bank Transfer | Free (ACH transfers and SEPA transfers) | Free (ACH transfers in USD only) |

| Wire Transfer | $10 – $25 fee | Varies depending on your bank |

| Debit/Credit Card | Up to 3.99% | 3.75% + $0.25 per transaction |

ACH is a U.S. financial network used for electronic fund transfers, while SEPA (Single Euro Payments Area) facilitates the standardization of electronic payments denominated in euros across Europe.

Conclusion – Kraken wins

For most users, Kraken emerges victorious in the deposit fee arena. ACH bank transfers in USD are free, making it an attractive option for frequent deposits. While both platforms offer free bank transfers for specific regions (ACH for Kraken, ACH, and SEPA for Coinbase), Kraken avoids fees for standard USD bank transfers.

Wire transfers are a different story. While both incur fees, Kraken’s cost varies depending on your bank, offering a slight advantage.

The real winner for budget-conscious users is Kraken with its debit/credit card deposits. Kraken and Coinbase charge hefty fees, but Kraken’s 3.75% + $0.25 structure might be marginally cheaper than Coinbase’s up-to-3.99% fee.

“Coinbase vs Kraken” and “Kraken vs Coinbase” are both valid searches for more in-depth comparisons of fees and other features. This analysis only scratches the surface, so keep digging to find the platform that best suits your crypto trading needs.

Who offers better withdrawal fees?

Choosing the right cryptocurrency exchange hinges on various factors, and withdrawal fees are crucial. Here’s a breakdown of how Kraken and Coinbase stack up in this arena:

| Feature | Coinbase | Kraken |

| Withdrawal Fee Type | Flat fee or spread fee | Fixed or tiered based on asset |

| Minimum Withdrawal | Varies by cryptocurrency | Varies by cryptocurrency |

| Bitcoin Withdrawal Fee | Network fee + potential spread | 0.0005 BTC |

| Stablecoin Withdrawal Fee | Network fee + potential spread | Varies, typically lower than BTC |

| Fiat Withdrawal Fee | 1% of transaction value | $5-$35 depending on withdrawal method |

Breakdown

- Fixed vs. Spread Fees: Kraken employs a mix of fixed and tiered fees depending on the asset. Coinbase, on the other hand, utilizes a flat fee or a spread fee, which can be less transparent.

- Minimum withdrawals: Both platforms have minimum withdrawal amounts that differ based on the cryptocurrency.

- Bitcoin Withdrawal: Kraken boasts a clear, fixed fee for Bitcoin withdrawals (0.0005 BTC), while Coinbase combines network fees with a potential spread, making it harder to predict the final cost.

- Stablecoin withdrawals: Kraken generally has lower withdrawal fees for stablecoins than Bitcoin. Coinbase again uses network fees and a potential spread.

- Fiat withdrawals: Kraken charges a fixed fee ($5-$35) based on the chosen withdrawal method (e.g., wire transfer). Coinbase hits users with a hefty 1% fee on top of the transaction value when converting crypto to fiat (like USD).

Conclusion – Kraken wins

For withdrawal fees, Kraken emerges victorious. Their transparent fee structure with fixed or tiered rates based on the asset makes cost calculation easier. Their lower fees for Bitcoin and stablecoin withdrawals and no hidden fees on fiat conversions make them the more cost-effective option in this category.

Coinbase vs Kraken fees

Who is more appealing to institutional traders?

While Kraken and Coinbase are titans in the cryptocurrency exchange arena, institutional traders seeking a robust platform will find distinct advantages in each.

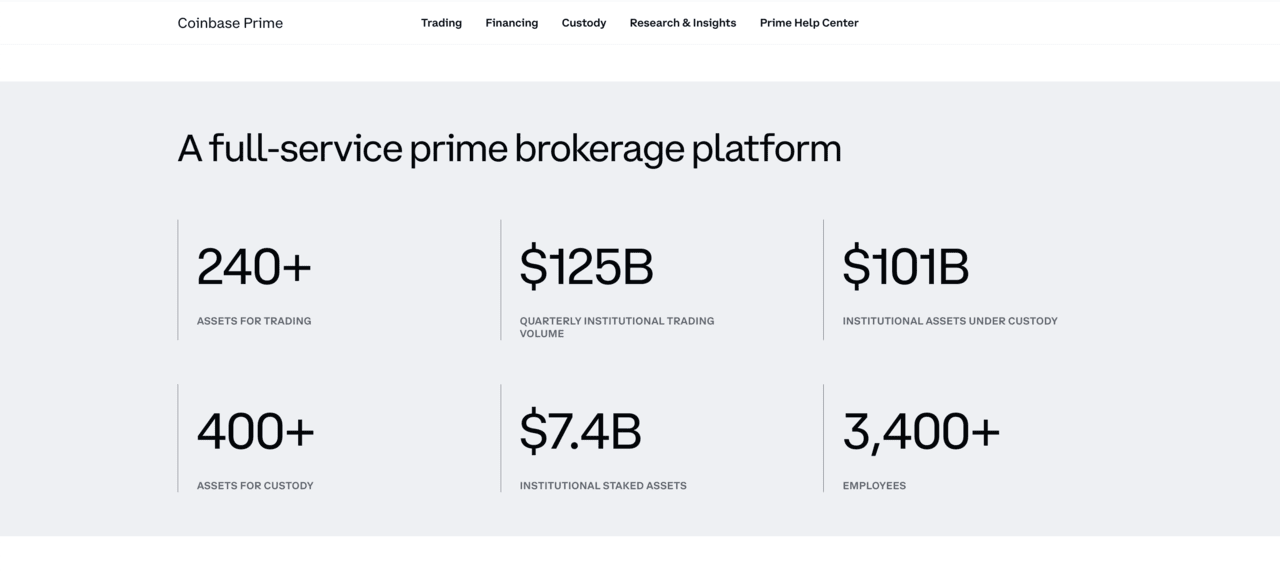

Coinbase, a publicly traded company with a user-friendly interface, boasts a well-established institutional arm – Coinbase Prime.

Coinbase Prime offers dedicated account management, advanced custody solutions (Coinbase Custody) for secure asset storage, and over-the-counter (OTC) trading for executing large block trades with minimal market impact.

This focus on user experience and security makes Coinbase Prime a compelling option for institutions venturing cautiously into crypto.

However, Kraken might be the more appealing choice for battle-tested institutions seeking a platform with advanced features.

Kraken has recently launched Kraken Custody, a specialized custody service for institutional investors. This puts Kraken in direct competition with Coinbase, which has already captured the institutional market for spot bitcoin ETFs. Kraken Custody provides a secure way to store, manage, and transfer digital assets, all through a single interface that benefits from Kraken’s robust security infrastructure.

Meanwhile, their OTC desk, Kraken OTC, caters to large order execution with minimal slippage, while their robust API integration allows for seamless trade automation and portfolio management. Additionally, Kraken emphasizes deep liquidity, a crucial factor for institutional trades, through its diverse client base and emphasis on spot and stablecoin markets.

Conclusion – Coinbase wins

Coinbase Prime excels with its secure custody solutions and user-friendly platform, which is ideal for institutions taking their first steps into crypto. Conversely, with its advanced features, deep liquidity, and OTC desk, Kraken caters more to experienced institutions seeking a powerful trading platform.

Users’ opinions on the Coinbase vs Kraken debate

We analyzed user reviews from Trustpilot, Apple, and Google app stores to better understand how everyday users feel about each exchange and what they like and dislike about each platform.

Based on user reviews from all 3 platforms, Coinbase scored an average of 3.6/5, while Kraken scored 3.46/5.

Note: Coinbase generally has a higher average rating across all platforms, especially when considering the much larger number of reviews. Trustpilot also tends to attract more negative reviews than other platforms. So, the lower rating for Kraken on Trustpilot might not be entirely representative.

User reviews of Kraken are from Trustpilot. Image source: ValueWalk

User reviews of Coinbase are from Trustpilot. Image source: ValueWalk

Trustpilot reviews – Coinbase

Coinbase offers a user-friendly platform for buying and selling crypto, especially for beginners. However, some users report issues with customer service being unresponsive or unhelpful when problems arise, particularly regarding account access and lost funds. Additionally, there have been concerns about limited functionality compared to other exchanges. While some users have had positive experiences, others report frustrations that could be dealbreakers for some crypto investors.

Trustpilot reviews – Kraken

Kraken receives mixed reviews from crypto users. While some praise its user-friendly interface, reasonable fees, and trustworthy feel, others report frustrating customer service experiences and account closure issues. Pro users often report better experiences, with some praising the platform’s responsiveness and professionalism. Security is a concern for a few users, with reports of suspicious activity and account closures without clear explanation.

Google play store reviews – Coinbase

Coinbase is praised for its user-friendly interface and educational resources, making it attractive to beginners. However, several users criticize recurring issues like slow app performance, limited payment options, and a lack of transparency regarding fees. While some find the fees acceptable, others feel the platform inflates prices and has hidden costs. The trading experience seems to be more positive for advanced users who appreciate the extensive options. Overall, Coinbase offers a user-friendly platform but may not be the most transparent or cost-effective option for all users.

Google play store reviews – Kraken

Kraken receives mixed reviews from it’s Google app’s users. While some appreciate its user-friendly layout (especially for beginners) and reliable customer service, others criticize its lack of advanced features, like easy portfolio tracking and direct wallet transfers via the app. ACH deposits appear to be a point of contention, with some users experiencing repeated errors. Overall, Kraken seems like a decent option for beginners who prioritize a simple interface and responsive support, but may not be ideal for those seeking a robust feature set for advanced crypto trading.

Apple app store reviews – Coinbase

Coinbase is praised for its user-friendly interface, ease of deposits, withdrawals, and trading, with some users even finding it suitable for beginners. However, concerns are raised about its high transaction fees and lack of transparency around these fees. Additionally, some users feel uncomfortable with Coinbase holding the private keys to their crypto, and others have had difficulty recovering funds lost to fraud.

Apple app store reviews – Kraken

Kraken receives mixed reviews on the App Store. Users praise the app’s uptime, smooth interface, and easy deposits/withdrawals. Customer service is generally considered helpful, although some report slow response times. However, a small number of users have experienced technical issues and frustrating customer interactions. Overall, Kraken seems like a solid option with some room for improvement.

Coinbase vs Kraken: Final verdict

In the “Coinbase vs Kraken” debate, the winner depends on your experience level and priorities.

- Coinbase offers a user-friendly platform, a larger coin selection for spot trading, and instant debit card purchases – ideal for beginners seeking a smooth entry into crypto. However, their fees can be high, and regulatory hurdles may limit their global reach.

- Kraken excels for experienced traders with lower fees, trading bots, margin trading options, and a wider variety of cryptocurrencies. It prioritizes global compliance and caters well to institutions seeking deep liquidity and advanced features. While its interface might be less intuitive, Kraken emerges victorious for cost-conscious users with its lower withdrawal fees and transparent fee structure.

Ultimately, the “Coinbase vs Kraken” victor is you—choose the platform that best suits your trading needs and experience level.

Our opinion: Kraken wins narrowly

While both Coinbase and Kraken are solid options, Kraken emerges as the stronger choice for many users. Here’s why:

- Security: Both platforms have had their fair share of legal issues. Still, Kraken boasts a spotless security record, unlike its competitors. This, coupled with their leadership by industry veterans, inspires confidence.

- Competitive Fees: Especially with Kraken Pro, their fees are some of the lowest. Plus, you can avoid conversion fees by directly depositing Swiss Francs (CHF).

- Transparency: Kraken prioritizes transparency, allowing users greater control over their crypto.

Coinbase offers a user-friendly platform, but Kraken’s well-rounded features, security, and focus on low fees make it a compelling choice for most investors. However, be sure to research both platforms’ SEC issues before making a decision.

To gain further insights, we recommend checking out our article comparing Crypto.com and Coinbase.

FAQs

Is Coinbase better than Kraken?

However, experienced traders may prefer Kraken due to lower fees, margin trading options, and a wider variety of cryptocurrencies.

Which one is better, Kraken or Coinbase?

On the other hand, despite a less intuitive interface, Kraken is favored by experienced traders for its lower fees, margin trading options, and broader cryptocurrency selection.

Which platform is better than Coinbase?

Which is cheaper, Coinbase or Kraken?

Which crypto exchange has never been hacked?

Sources

- https://www.kraken.com/features/fee-schedule

- https://help.coinbase.com/en/exchange/trading-and-funding/exchange-fees

- https://www.reuters.com/technology/coinbase-must-face-us-securities-regulators-lawsuit-2024-03-27/

- https://www.coindesk.com/business/2024/04/18/cryptocurrency-exchange-kraken-acquires-tradestation-crypto/

- https://www.theblock.co/post/289448/kraken-launches-self-custodial-mobile-wallet-and-releases-its-open-source-code

- Exchange numbers & Data

- User reviews

- https://www.trustpilot.com/review/kraken.com

- https://www.trustpilot.com/review/coinbase.com

- https://apps.apple.com/us/app/coinbase-buy-bitcoin-ether/id886427730

- https://apps.apple.com/us/app/kraken-buy-crypto-bitcoin/id1481947260

- https://play.google.com/store/apps/details?id=com.kraken.invest.app

- https://play.google.com/store/apps/details?id=com.coinbase.android