Crescat Capital’s commentary for the month of July 2021.

Q2 2021 hedge fund letters, conferences and more

Crescat Precious Metals Fund's July Performance Update

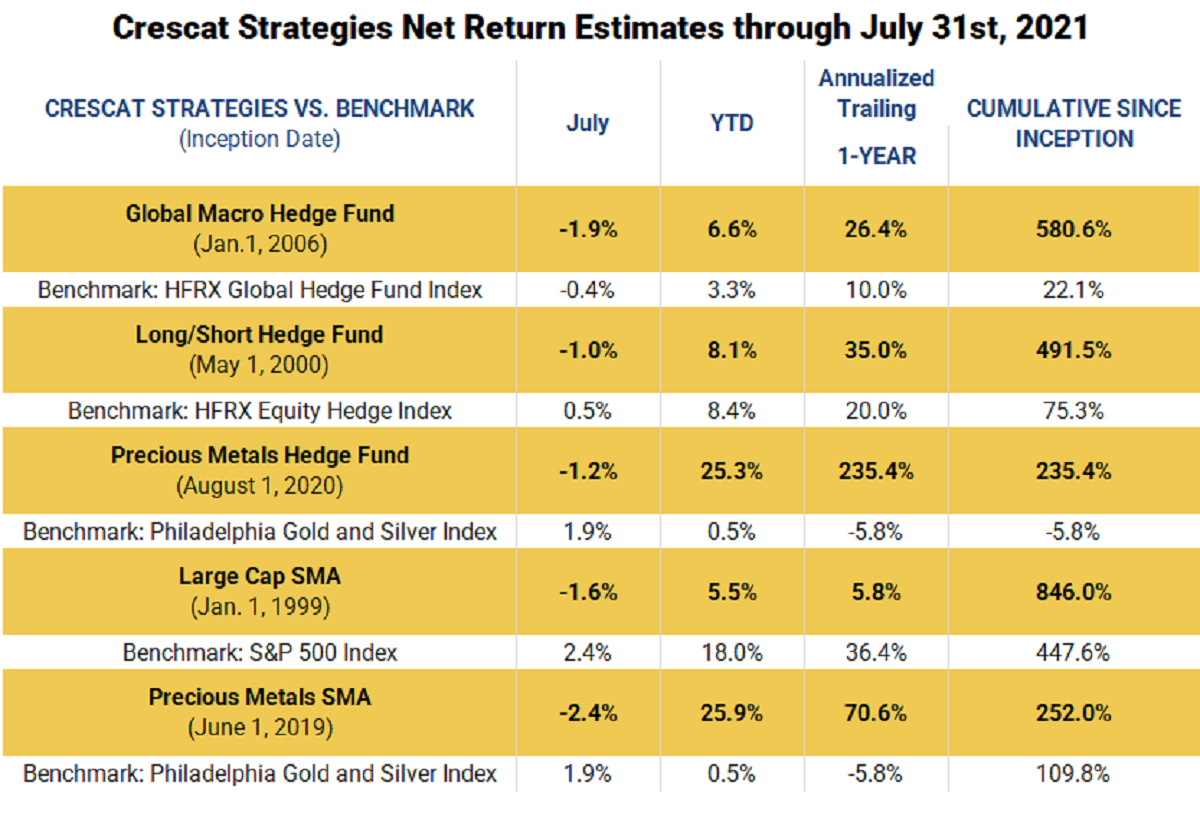

We are excited to report that Crescat’s newest hedge fund, the Crescat Precious Metals Fund just finished its first full year with exceptionally strong results.

The Crescat Precious Metals Fund was up an estimated 235.4% net in its debut year compared to a 5.8% decline for the benchmark Philadelphia Gold and Silver Index. Spot gold was down 8.2% over the same time frame, while silver was up 4.5%. Thanks to our friendly-activist exploration focus, we were able to create significant value from a predominantly diversified long portfolio even in what turned out to be merely a consolidating precious metals market. Based on our macro analysis, as we have laid out in our recent research letters, we think the macro backdrop is exceptionally bullish for precious metals for the next several years.

The Dawn Of The Great Rotation

Moreover, from a macro investing standpoint, we think it is the dawn of the Great Rotation. Rising inflation is the catalyst for a rotation out of historically overvalued long-duration equity and fixed income assets, and into undervalued inflation hedge assets in high demand including scarce resource stocks in the materials and energy sectors. Our analysis shows that rising inflation is likely to be persistent, not a transitory problem. It is a consequence of years of reliance on ever greater monetary and fiscal stimulus as the primary policy tools in attempts to solve economic problems.

The other consequence of these policies is that we are faced with truly historic financial asset bubbles in equities and fixed income securities today which pose substantial economic and financial risks of their own. To illustrate the extent of the gulf today between the value opportunity in scarce resource stocks and the overvalued stock market at large, if gold and silver miners were considered a sector, it would be the only one that generates a higher free-cash-flow yield than inflation. This table illustrates the motivation behind the Great Rotation today.

With the major and mid-tier gold and silver producing companies gushing free cash flow today, our analysis shows that the real opportunity is on the exploration side of the industry.

We are leading the charge to fund exploration and discovery of the new, large, high grade precious metals deposits in the best mining jurisdictions around the globe. As we have shown in the last year, by helping to fund major new discoveries, we can create substantial value even in a tepid overall gold and silver market. But because the producers have not been replacing their reserves, they are facing a production cliff beginning in just four years. Permitting new mines takes several years. So, the industry leaders will also need to start allocating capital soon to the best projects out there in the hands of the junior mining segment if they want to continue their growth. We believe a new M&A cycle will be ramping up soon as the majors and mid-tiers will be looking to Crescat’s portfolio companies as acquisition targets to capture future growth in the burgeoning secular bull market for precious metals. This is an exciting potential kicker to our portfolios that we haven’t even seen yet but we believe is just around the corner.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

303-271-9997

Cassie Fischer

Client Service Associate

(303) 350-4000

Linda Carleu Smith, CPA

Member & COO

(303) 228-7371

© 2021 Crescat Capital LLC