Horos Asset Management commentary for the second quarter ended July 31, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear co-investor,

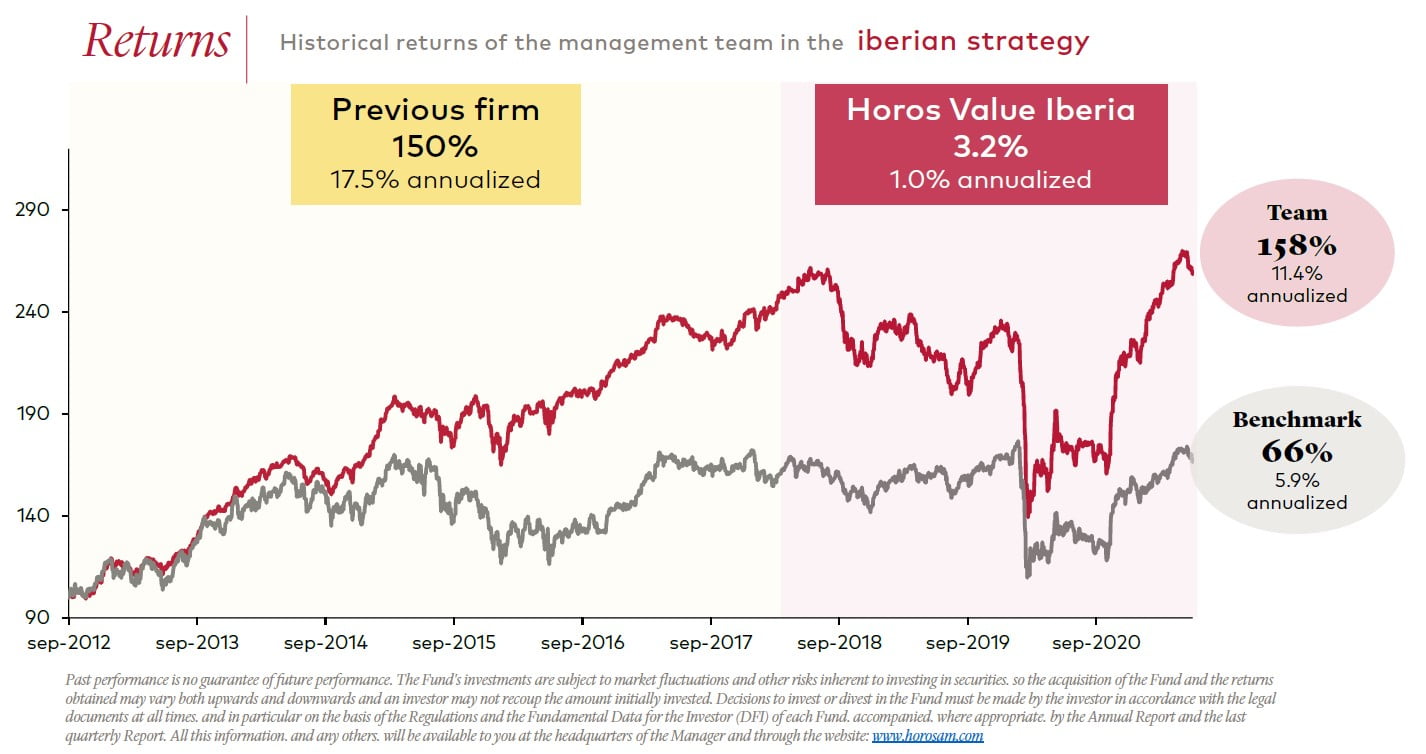

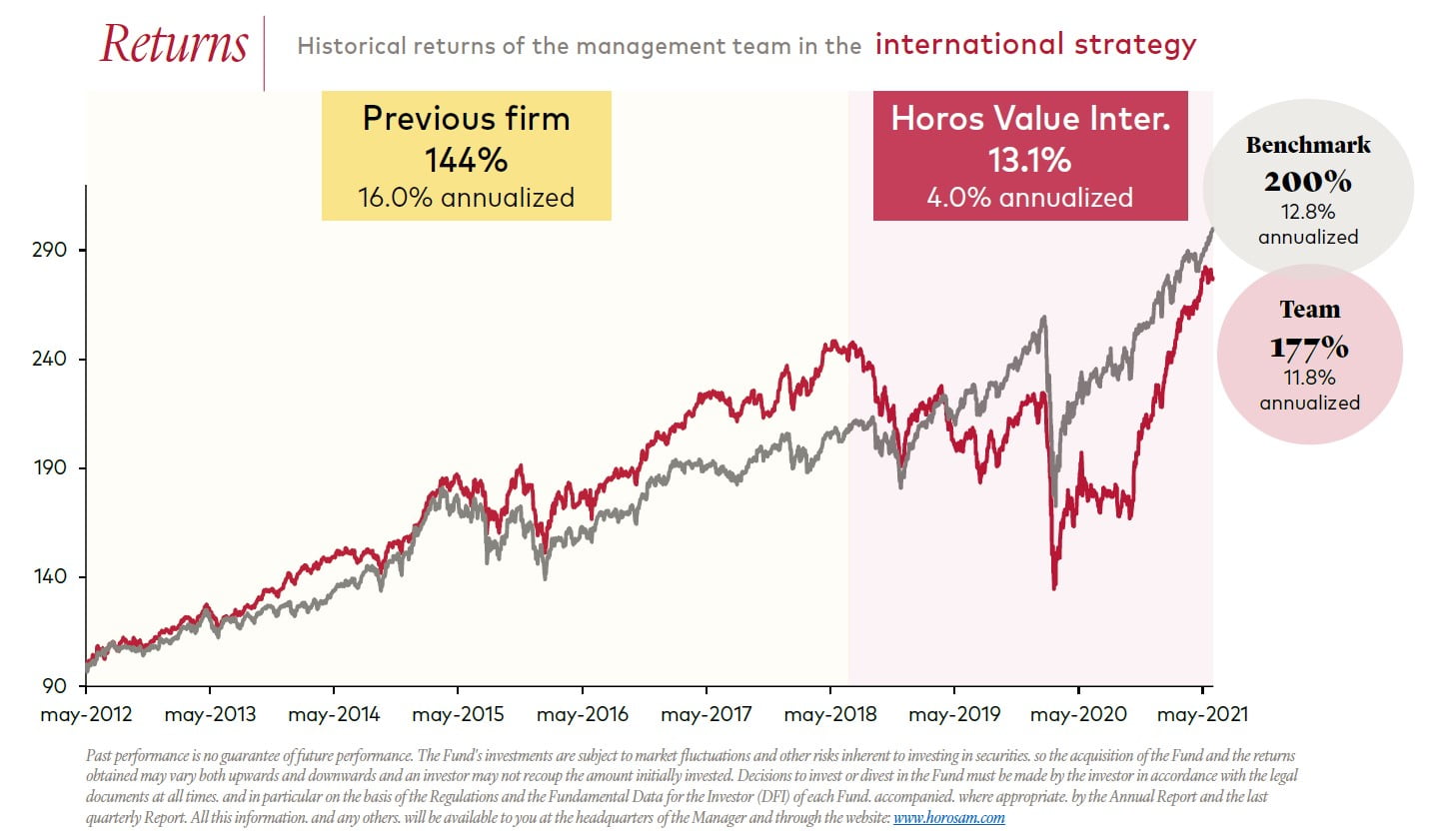

In the second quarter, the positive performance that started in November 2020, with the announcement of the launch of coronavirus vaccines, continued. In this "new" environment, value investing has performed well, proving that patience and short-term losses are often essential ingredients for reaping the rewards over the long term. Our funds, of course, attest to this. Horos Value Internacional gained 6.3% over the quarter, compared to 6.4% in its benchmark index, while Horos Value Iberia returned 4.8%, beating the 4.2% rise of its benchmark. Since inception of the Horos funds (May 21, 2018), Horos Value Internacional has returned 13.1% and Horos Value Iberia 3.2%. Since 2012, the international portfolio has gained 177%, while the Iberian portfolio 160%, compared to gains of 200% and 66% in their benchmark indices, respectively.1

As we have just pointed out, value investing often goes through periods, of varying lengths, when it seems to stop working. We do not have to go very far to find one of these moments. However, this underperformance is needed for us to be able to obtain attractive returns in the years ahead. Although it may sound paradoxical or inconsistent, it will often be necessary to lose in order to be able to (aspire to) gain more, taking advantage of what is known as intertemporal arbitrage. Given the relevance of this idea, we will devote this quarterly letter to explaining what it consists of and how we can make the most of it.

Thank you for your confidence.

Yours sincerely,

Javier Ruiz, CFA

Chief Investment Officer

Horos Asset Management

Executive Summary

Investing is a business where you can look very silly for a long period of time before you are proven right. - Bill Ackman

One of the main problems with value investing is its time inconsistency in delivering excess returns to those of us who subscribe to this investment philosophy. However, as we argue in this quarterly letter, this characteristic becomes essential to aspire to sustainable and satisfactory returns over the long term. Why? Precisely because the worst-performing periods tend to coincide with the best planting times, which will eventually bear fruit if the research is right. For this reason, we must have an objective process to help us navigate and take advantage of these situations, as well as to try to maximize the upside potential of our portfolios and invest heavily when the risk-return trade-off is the most attractive we can find. We will devote the first part of the letter to explaining these ideas.

In addition, we will discuss the most significant changes that we have made to our portfolios. Among others, we can highlight that at Horos Value Internacional we exited our position in Brookfield Property Partners, following the improved takeover bid received from Brookfield Asset Management. On the other hand, we initiated five new stakes in the quarter. Specifically, we invested in the Hong Kong financial services company Sun Hung Kai & Co, the Chinese restaurant firm Ajisen China Holdings, the US financial company MBIA, the Italian holding CIR and the copper miner Atalaya Mining. At Horos Value Iberia, we added the Portuguese paper manufacturer The Navigator Company, as well as Grupo Prim, a medical supplies and orthopedics company.

The Harsh Reality

I hate reality but it's still the best place to get a good steak. - Woody Allen

In our previous quarterly letter (see here) we tried to explain the difficulties that the value investor usually faces in his professional journey. In particular, we highlighted the role that emotions and the external environment play in the potential returns we can obtain in our investments. This has been especially true in recent years when, as we also mentioned, this investment philosophy has experienced, whichever way you look at it, its worst-performing period in history. For example, in a recent study by Vanguard, the authors concluded that almost all the funds that beat the market over the long term had periods of one, three and five years in which they underperformed their benchmark indices and peers. In fact, even more painfully, nearly 80% of these funds were in the worst 25% of their category over these periods.2 Of course, this inconsistency of performance puts the most patient of humans to the test.

However, as paradoxical as it may seem, this harsh reality is a necessary condition for active managers (in our case, practitioners of the value investing philosophy) to deliver satisfactory returns, provided our research is right. When I think about this, I cannot help remembering the chapter in the wonderful book Hedge Fund Market Wizards dedicated to the legendary value investor Joel Greenblatt, in which he commented on the lack of consistency of his “magic formula”:

If I wrote a book about a strategy that worked every month, or even every year, everyone would start using it, and it would stop working. Value investing doesn’t always work. The market doesn’t always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn’t work. And that is a very good thing.

As we always say, nobody has a crystal ball that allows us to achieve excess returns year in, year out. If such thing existed, believe me, I would not be writing these lines right now. However, we can look for investment strategies that allow us, as we also like to emphasize ad nauseam, to obtain satisfactory and sustainable returns in the long term. In the case of value investing, this philosophy rests on a pillar that few are willing to take advantage of: patience or, to put it more technically, intertemporal arbitrage.

The most important attribute for success in value investing is patience, patience, and more patience. The majority of investors do not possess this characteristic.

The Tao Of Value Investing

We arbitrage time horizons. Our time horizon is long while for other investors it's short.

When they are panicking, we must not panic. - Chuck Royce

Undoubtedly, one of the managers who has taken this practice of arbitraging intertemporal horizons to the extreme when it comes to investing is Mark Spitznagel. For those (many) who do not know him, Spitznagel was a colleague of Nassim Taleb at Empirica Capital, a hedge fund founded in 1999 with the aim to profit from tail events incorrectly valued by the market. Indeed, these are the black swans that Taleb would later explain and expand on in his popular books. Two years after Empirica shut down in 2005—partly because Taleb wanted to devote himself to his work as a “scholar and writer”—Spitznagel founded Universa Investments following this same investment strategy. Roughly speaking, the hedge fund acquires hedges (through put options) that benefit it enormously if the market suffers severe declines. The downside? Such market downturns, although they always come, occur infrequently, so the fund takes continuous losses on the cost of the hedge, until the "D" day materializes, which Spitznagel waits with great patience listening to classical music.6 Interestingly, it has been shown that Spitznagel's fund achieved returns in excess of 4,000% in the first quarter of 2020 during the sharp market declines.7

If you have a position that can lose 1 to make 100, like Universa’s tail hedge at any point in time, you don’t care about your timing of a market crash, you just don’t want to miss it.

This approach to investing is explained, at least philosophically, in his recommended book The Dao of Capital, in which the American investor tells us about what he calls Austrian investing (as related to the Austrian School of Economics) and why the value approach is included in it.9 Without further analyzing this aspect, I would like to highlight two essential ideas from the book that will help us understand why intertemporal arbitrage is so attractive when it comes to investing.

The first one is the roundabout concept. According to this idea, it is much more profitable to follow an investment strategy that leads to losses in the short term but maximizes our potential long-term return.

Rather than pursue the direct route of immediate gain, we will seek the difficult and roundabout route of immediate loss, an intermediate step which begets an advantage for greater potential gain.

We have already lost count of the times when, shortly after initiating a new stake for our funds, a company's share price begins to decline, resulting in losses for several months or, in the worst-case scenario, even years. However, this is not something to worry about, as long as the correction is occurring for the wrong reasons (e.g., market sentiment) and not because our investment thesis has deteriorated. This initial loss, which does not always occur, is inevitable and beyond our control. Trying to minimize it through strategies that seek to optimize the timing of buying a stock, in our humble opinion, only tends to work on paper or in hindsight, and is rather a recipe for failure in our goal of achieving satisfactory and sustainable returns over the long term.

However, despite the evidence being on our side, few investors are willing to do this (painful) exercise of patience or intertemporal arbitrage. The reason? Due to our human nature, we suffer from what is known as time inconsistency when it comes to making decisions. Basically, although we all know that a little effort today can yield great benefits over time, our (imagined) future selves always do better in fulfilling the most desirable behavioral pattern (e.g., “next week I'll start running”). Obviously, the same thing happens to us when it comes to making investment decisions and taking that long-term view. As I like to remind myself from time to time: we are all value investors, until the knives start falling. That is why it is so important to have an objective and solid process that takes us away from the instant gratification we might get from selling those investments that have started off performing poorly and, additionally, helps us to stay true to an investment strategy that allows us to take advantage of those intertemporal arbitrage opportunities that the market is constantly offering us.

But how can we measure these intertemporal arbitrage opportunities? Well, as many of you may have already guessed, through the upside potential of the stocks in our portfolios. The greater the upside, the greater the arbitrage opportunity and, therefore, the greater the reward for being patient with our investments.

What If The Long Term Never Comes?

The two most powerful warriors are patience and time. - Lev Tolstói

John Maynard Keynes, the famous (and sadly) go-to economist for many politicians, used to say that, in the long run we are all dead. Of course, a very legitimate question for an investor to ask is what happens if the desired long run never arrives and the supposed intertemporal arbitrage opportunity does not materialize. However, we believe that the evidence is on our side and, for one reason or another, if the investment thesis is correct, the theoretical upside potential is eventually transformed into returns.

That is one of the mysteries of our business, and it is a mystery to me as well as to everybody else. But we know from experience that eventually the market catches up with value.

We do not need to go far to see that this is the case. As you well know, since we started our Horos journey in May 2018, until the announcement of the coronavirus vaccines in November last year, our funds performed poorly both in absolute and relative terms versus their benchmarks. However, this short-term pain (the roundabout or indirect route) was a necessary evil to take advantage of a never-before-seen intertemporal arbitrage opportunity. Thus, the upside potentials of our portfolios rose quarter after quarter, reaching 265% for Horos Value Internacional and 195% for Horos Value Iberia at the end of March 2020, both of which were record highs. What happened since then? Well, the opportunity began to materialize, with gains of 105% for Horos Value Internacional and 85% for Horos Value Iberia from the lows of March last year to date. Therefore, the sowing, as hard as it was (let's not forget that this has been the worst-performing period on record for the value investing style), eventually paid off. Patience ALWAYS pays off in the end.

However, one might ask whether this excellent recent performance of our funds has left our co-investors without any opportunity for intertemporal arbitrage. The answer is a resounding NO. At the end of June, our funds had an upside potential of 125% (Horos Value Internacional) and 90% (Horos Value Iberia). Although these levels are far from the astronomical figures of the beginning of last year, they are still at historically high levels.12 Again, we do not have a crystal ball to know whether these potential gains will crystallize sooner or later, but it is clear to us that the opportunity remains very clear for those who want to invest—in addition to their savings—their patience and time with us.

To conclude this first part of the letter, before moving on to the changes to our portfolios, I would like to touch on another very important factor that can make a big difference in the investment returns we can obtain: portfolio weight, that is, the percentage of the portfolio that is held by the individual stocks.

Maximizing Upside Potentials Or Intertemporal Arbitrage

It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong. - George Soros

To understand the relevance of portfolio weight, I would like to draw on an anecdote often told by Stanley Druckenmiller, arguably one of the greatest investors in history.13 Specifically, Druckenmiller says that one of the highlights of his career was working for George Soros (yes, also one of the greatest ever). When he joined Soros’ asset management firm, he was hoping to learn as much as he could about macro investing, i.e., what variables drive which currencies, what affects the price of commodities, and so on. To his surprise, he soon discovered that his knowledge of this type of strategy was very similar to Soros', if not superior. So, what was so special about Soros to achieve his extraordinary returns? Betting heavily when the situation was very favorable.

For example, once Soros retired to pursue philanthropic work, Druckenmiller took over management of the Soros' well-known Quantum fund, as well as continued in charge of the portfolio of his own Duquesne fund, while Soros managed a personal portfolio without spending too much time on it (in fact, 90 percent of the ideas he invested in were Druckenmiller's). Well, Soros consistently outperformed Druckenmiller, simply because he was betting more heavily on the ideas that Druckenmiller himself was proposing.

[Soros] continued to beat Duquesne and Quantum while I was managing the money. And again, it’s because he was taking my ideas and he just had more guts. He was betting more money with my ideas than I was.14

However, the trade that put these two investors on top was the bearish bet they made in 1992 against the pound sterling. While we will not discuss the rationale of the investment, we want to draw attention to the conversation that Druckenmiller and Soros had before deciding to make this famous bet:

Druckenmiller: “George, I’m going to sell $5.5 billion worth of British pounds tonight and buy deutsche marks. (…) that means we’ll have 100 percent of the fund in this one trade”

Soros: “That is the most ridiculous use of money management I ever heard. What you described is an incredible one-way bet. We should have 200 percent of our net worth in this trade, not 100 percent. Do you know how often something like this comes around? Like one on 20 years. What is wrong with you?”15

Therefore, when we see a clear investment opportunity, where the certainty of the upside potential is at its highest, we should invest heavily. However, we must not forget the other side of the coin: what risk are we taking when we invest in a stock? Our criterion for choosing the weights of our investments should be to concentrate the portfolio on those ideas that offer the best risk-return trade-off and not the greatest upside if the thesis holds true. This is why we decided last year, at the stock market lows, to make Catalana Occidente the main bet of our two funds. Being conservative, we thought that the company was worth three times more than the market value at the time and, more importantly, with a negligible risk of loss. We simply could not find a more favorable opportunity in the market (probably one of the most obvious investments I have come across in my professional career).

Now, will this investment approach help us to maximize our returns in every situation? No, that is impossible. It will simply allow us to meet our goal of (yes, you guessed it) sustainable and satisfactory returns over the long term. A clear example of this can be found in our uranium thesis, which has already been discussed several times. As you know, we have been invested for years in two investment vehicles (Yellow Cake and Uranium Participation) that buy physical uranium for storage, thus giving us exposure to the evolution of the uranium price. Well, since we invested in this sector, the uranium price has risen by about 38%, with very similar performance of our vehicles (excluding position rebalancing which has added to the returns). However, uranium mining companies, especially those furthest away from production (mines under development and undeveloped deposits), have posted impressive gains in recent months, with returns reaching 80% in the case of Cameco, 100% in the case of NexGen Energy and close to 200% in Paladin Energy, to name but a few, over the same period. Does this mean that we have made a mistake in our approach to this investment theme? In our view, nothing could be further from the truth.

Again, our goal is to maximize the risk-return trade-off in our portfolios. In the case of uranium, the way to expose ourselves to this chemical element that best met this requirement was through the Yellow Cake and Uranium Participation vehicles. The reason? The risk of loss if the thesis was not fulfilled (or took too long to be fulfilled) was very limited, while the upside was (and still is) very high. However, investing in mining companies, or worse, in mines under development or undeveloped deposits, was more akin to a binary option. If we were right with our uranium thesis, these stocks could do much better than the investment vehicles that store uranium. But, in turn, if the thesis was delayed in time, they would be forced, for the most part, to go to the capital markets to keep their business afloat, causing large losses or a very significant decline in the potential returns for their shareholders.

With hindsight, we all know how to pick the winning horses. However, reality does not work that way. The only way to fulfill our role as investors, over many years, is to invest in those situations with the highest risk-adjusted returns. This is what the great investors of today and of all times have always done and, of course, this is what we will try to do at Horos.

Rule number one: never lose money. Rule number two: never forget rule number one.16

Main Changes To Our Portfolios

When nobody wants something, that creates an opportunity. - Carl Icahn

The following is a summary of the most significant changes to our funds’ portfolios:

Horos Value Internacional - Stake Decreases & Exits:

Financials

Exposure increased from 20.9% to 26.3%

Holdings discussed: Semapa (ELI:SEM) (4.6%), AerCap (NYSE:AER) (3.9%) and Catalana Occidente (BME:GCO) (3.1%)

There is little to comment on these weight cuts. In all three cases, we trimmed our position to use the proceeds to invest in new ideas, which offer a more favorable risk-return trade-off and which we will discuss below.

In the case of the Portuguese holding Semapa , it is important to note that, as we suspected and wrote about in our previous quarterly letter, the minority shareholders, including ourselves, have also rejected the improved takeover bid launched by the Queiroz Pereira family. What can we expect from here? Time will tell. What is evident to us is that the value of this holding is much higher than its current market capitalization, which is why we maintain it among the top positions of our two funds.

Other

2.7% of the fund

Holding discussed: Brookfield Property Partners (NASDAQ:BPYPP) (exited)

As with Semapa, Brookfield Property Partners ("BPY") was involved in a takeover bid process launched by its controlling shareholder, Brookfield Asset Management. Likewise, BPY also saw an improvement in the price offered by the company. However, in this case, as the IPO price was more reasonable (a discount over NAV around the historical average) and as we found new and more attractive investment ideas, we decided to liquidate our position during the quarter.

Stake Increases & New Stakes: Financials

Exposure increased from 20.9% to 26.3%

Holdings discussed: Sun Hung Kai & Co (HKG:0016) (3.0%), CIR (BIT:CIR) (2.6%) and MBIA (NYSE:MBI) (2.3%)

Sun Hun Kai & Co ("SHK&Co") is a Hong Kong financial group controlled by the Lee family (c. 73%) through the Allied Group. SHK&Co was established in 1969 and has been listed on the Hong Kong Stock Exchange since 1983. Under the leadership of the Lee family, the group has been transformed to become one of the leading non-bank financial institutions in Hong Kong and with significant relevance in China, following the acquisition of United Asia Finance (c. 63% stake) in 2006 from Allied Group itself and the sale of the brokerage business Everbright Securities between 2015 and 2020.

Specifically, SHK&Co has three distinct divisions. The first one is the financing division, which in turn encompasses consumer finance, mortgages and specialized financing. In consumer finance, the company is the leader in Hong Kong, where the business is already mature and has maintained stable returns on loans (c. 30%) and delinquency rates (less than 5%) over time. It is also present in China, where it has undergone a major restructuring of its business model in recent years. On the one hand, the sector has been going through a tough time since 2015, because of a few years of excessive credit growth without strong risk controls. On the other, for some years now the Chinese population has been migrating towards online platforms, with the result that SHK&Co has been closing physical branches at a high rate (83% of the total since 2015) to adapt to this new environment. Added to all this is obviously the negative impact of the pandemic on the economy and SHK&Co's consequent decision to adjust the risks taken and loan growth. All in all, we expect a gradual return to normalization in this subdivision, as well as in mortgages and specialized financing.

In addition, SHK&Co has a second division dedicated to the management of its financial investments. This area, set up in 2015 following the sale of Everbright Securities and the subsequent internal restructuring of the group, has assets under management worth close to 15 billion Hong Kong dollars. These assets are concentrated in three different themes (alternative investments, equities and real estate) and have yielded average returns close to 12% per annum. The company is devoting more and more resources to this division, so we expect it to continue to grow in the future.

Finally, SHK&Co has just started a third division, dedicated to fund management, which will focus on independent third-party platforms with significant growth potential.

But why have we invested in SHK&Co? First, because we think we are investing in the financing business at a low point in the cycle. Second, because the management team is fully aligned with the interests of the rest of the shareholders and has a good track record of capital allocation—unlike other Asian companies, shareholders are rewarded with the excess cash generated by the business, both by paying dividends and buying back shares. Third, because we are buying SHK&Co at a very attractive valuation, where the value of the company's investments alone is ostensibly higher than its market value.

The second addition to the portfolio to be discussed is the Italian holding company CIR, a company we already invested in during our previous professional stage, and which has undergone major changes that make it a very attractive investment. CIR was founded in 1976 by Carlo de Benedetti and its current activities are carried out in three different sectors.

First, the health sector through KOS, a company founded by CIR in 2002 and in which it controls 59.5%. Specifically, KOS operates three divisions. The most important one is long-term care which encompasses, on the one hand, the ownership and management of nursing homes, where KOS is the sector leader in Italy (Anni Azurri) and has a significant presence in Germany following the acquisition of Charleston in 2019. Obviously, this division has (sadly) suffered very directly from the impact of the coronavirus pandemic. On the other hand, this first division also has psychiatric and functional rehabilitation facilities, group therapies for mental health treatment and day hospitals (Santo Stefano and Neomesia subsidiaries). The second division of KOS is diagnostics and cancer care under the Medipass brand. KOS has 17 centers in Italy, 3 in the United Kingdom and 15 in India. Finally, the company offers acute care services at the Suzzara Hospital.

CIR has also exposure to the advertising sector through GEDI, of which CIR owns 5%, following the sale of c. 44% to another Italian listed holding company (Exor) in December 2019 for more than €100 million. GEDI is the Italian publishing group that owns the newspapers L'Espresso, la Repubblica or la Stampa, among others. This is a very unattractive business due to recent trends, hence CIR's exit strategy.

Finally, CIR has a presence in the automotive sector, specifically through its 56.8% stake in the automotive components manufacturer Sogefi. The company was founded by CIR in 1980 and is listed on the Milan Stock Exchange. Sogefi operates in 23 countries and specializes in the design, development and manufacture of components for suspension, air, cooling and filtration systems. It is a business that has been badly hit by the stock market in recent years, as have most of the companies in the sector. However, at current prices at which Sogefi trades, the market value of this stake is not significant for CIR.

In addition to its businesses, it is important to highlight the actions being taken by the management team to uncover and generate value for its shareholders. CIR merged in 2019 with Cofide, the vehicle (also listed) through which the De Benedetti family controlled 46% of CIR, thus simplifying a corporate structure that contributed to increase the typical discount at which these holding companies usually trade. Furthermore, it has implemented several programs and offers to buy back its own shares over time, taking advantage of the discount at which the company trades over the value (NAV) of its holdings. All this, together with an eventual recovery of KOS and the holding's solid financial position, which also supports CIR's valuation (net cash, plus investments in private equity and others, represents c. 73% of market capitalization), has led us to reinitiate a new stake in the Italian holding.

The last addition to this financials theme is MBIA, a US company well known in the value investing community for being, at the time of the credit bubble at the beginning of this century, the bearish bet that catapulted the brilliant manager Bill Ackman to fame.17 But what does MBIA do? Basically, the company has two subsidiaries: National Public Finance Corporation ("National") and MBIA Insurance Corp ("MBIA Corp"). These subsidiaries were spun off in 2009, when MBIA decided to clearly delineate the "good" business of National from the troubled business of MBIA Corp. Both are currently in run-off mode, i.e., they are not accepting new business volume, for the reasons discussed below.

In the case of National, the firm provides financial guarantee insurance to investors in bonds issued by state and local governments to fund essential services or infrastructure, as well as other entities. This is a business that, historically, was very profitable, as government defaults were (and are) very infrequent. The reason? Ultimately, they could always squeeze the taxpayer a little more in the form of higher taxes or public spending cuts on other items. Basically, this a business with very low risk, given that, to a certain extent, the taxpayer is the one who is actually insuring the debt. Given this, why take out insurance with National or any other insurance company in this market? Because it helped lower the cost of financing. By having insurance to back up the potential default, the rating agencies gave higher ratings to these municipal debt issues, so investors were willing to accept a lower return for them (a higher rating is associated with lower risk).

However, the last few years have not been great for National. On the one hand, since the Great Recession of 2008, central banks' low (or negative) interest rate policies, as well as their balance sheet expansion measures, have made the cost of funding for public debt issuers much cheaper, thus greatly reducing the potential savings from insuring their debt. On the other hand, the rating downgrade suffered by the United States a few years ago triggered a consequent downgrade in these entities, so that their financial capacity (at least in the market perception) was also diminished, thus limiting their capacity to insure the public debt of their potential clients. The final straw for National was the bankruptcy of Puerto Rico in 2017, one of its insureds and the largest municipal bankruptcy in U.S. history—several times larger than Detroit's 2013 bankruptcy. All of this led National to go into run-off mode and let its business continue to shrink as insured municipal issues mature.

As for MBIA Corp., it also provided financial guaranty insurance, but in this case in the structured finance market (such as the well-known CDOs). This business, very lucrative at the time of the credit bubble, became a nightmare when it burst. However, more than thirteen years have passed since that crisis and MBIA Corp. has a reduced balance sheet, has not been generating new business for years and the structures that remain insured, as well as the pending litigation, will not have a significant impact—either positive or negative—on its parent company.

Why invest in a company with two subsidiaries that do not generate new business? For two reasons. On the one hand, its valuation is very attractive, even under a conservative scenario. Taking into account the annual cash burn of National (remember that it does not generate new business), the corporate expenses of the parent company and putting a zero value on MBIA Corp, MBIA should be worth more than three times what it is trading at today's price. However, we are aware that this valuation only makes sense if some entity acquires the company and takes advantage of cost synergies to take over the asset portfolio, so we do not expect MBIA to reach that theoretical valuation and prefer to apply a significant discount to it. In fact, this is not something we are assuming. The management team itself has been very clear about this and expects, once the Puerto Rico bankruptcy process is over, a possible corporate transaction (there have been similar transactions in the past).

On the other hand, the management team, in addition to being aligned with the rest of the shareholders (they control 12.5% of the shares), is playing their cards to maximize the value of the company in view of this potential sale, carrying out aggressive share buybacks since 2014 below NAV and using National's excess capital to do so. This share buyback is currently somewhat limited by regulatory capital requirements, so once the Puerto Rico situation is clarified (it should not extend beyond 2022), a special dividend from National is to be expected.

In short, this is a company that today has limited and well-defined risks (Puerto Rico), although with a business in decline, trading at a very attractive valuation and with a management team doing its best to maximize value.

Hong Kong

Exposure increased from 16.8% to 22.0%

Holdings discussed: Kaisa Prosperity Holdings (HKG:2168) (5.2%), Sun Hung Kai & Co (HKG:0016) (3.0%) and Ajisen China Holdings (HKG:0538) (1.0%)

This quarter we materially increased our exposure to companies listed on the Hong Kong Stock Exchange. As we have emphasized in the past, we go where we find the best investment opportunities, regardless of sector or geography, as long as the companies meet our investment criteria. In this case, we added to our position in Kaisa Prosperity and initiated a new stake in Sun Hung Kai & Co (discussed above) and Ajisen China Holdings ("Ajisen").

In the case of Kaisa Prosperity, the company presented a business plan for the next three years with growth numbers substantially higher than we assumed in our valuation. The latest results published by the company support this growth plan and, although we have more conservative numbers, we believe that the company's upside potential justifies this increased weight in our portfolio.

Ajisen is a family-owned company (Poon Wai, CEO and founder of the company, controls c. 47.5% of the shares) that operates restaurants under the "Ajisen Ramen" brand in China and Hong Kong, specializing in soup ("ramen") and other Japanese dishes, adapted to the tastes of the Chinese population. However, Ajisen originated in Japan in 1968, when Koji Shigemitsu opened the first Ajisen ramen store in that country (the Shigemitsu company today holds c. 3% of Ajisen's shares and is present on its Board, charging royalties to the company for the sale of its products). Although more residual, the company also has a source of income from the sale of noodles in supermarkets, which the company plans to develop in the future.

Ajisen has 722 restaurants in 176 cities and provinces in China, in addition to a couple of restaurants in Europe (airports in Italy and Finland). Unlike our other Hong Kong restaurant company (Tang Palace), Ajisen has a product and service concept more like fast food, with lower prices. That said, its online sales are still not very relevant, although showing very significant growth and increasingly leveraging on online sales platforms such as Meituan or Ele.me. All in all, this is a very competitive sector, where Ajisen has seen its business profitability fall, in addition to the significant impact that the coronavirus pandemic has had on the sector in the last year and a half.

What do we like about Ajisen? As happened with our former investment in The One Group Hospitality and is happening with Tang Palace, we think the market has discounted a very negative scenario for the next few years in Ajisen's business. As the situation normalizes and the management team implements profitability-enhancing actions—such as closing unprofitable restaurants, launching new formats or investing in remodeling existing restaurants—we believe that the company's strong free cash flow generation capacity will become evident again. In addition, the margin of safety of the investment is very high. Ajisen has a significant cash position, including financial investments and real estate assets, which are worth more than the company's current market capitalization. The company also pays out the bulk of the cash generated by the business as dividends (between 5% and 10% yield at current prices).

Commodities

Exposure stable at 22%

Holding discussed: Atalaya Mining (LON: ATYM) (1.1%)

The last change to our International portfolio is the new stake in Atalaya Mining ("Atalaya"), the copper mining company with assets in Huelva (Riotinto mine). We have already explained the investment thesis when it became part of our Iberian portfolio, so we will not elaborate on that aspect. But we would like to point out that, despite the significant rise in the share price in recent months, its valuation is still very attractive at this time. It is worth noting that, although this is not our base case scenario, at current copper prices, Atalaya is valued by the market at a multiple much lower than those of the sector, for reasons unrelated to the company's current performance and business expectations (capital flows and illiquidity). In other words, its stock price implies future copper prices that are much lower than the current levels and, given the expected supply and demand dynamics for the sector, are totally unjustified.

Horos Value Iberia - Stake decreases & exits:

Financials

Exposure stable at 20%

Holding discussed: Semapa (7.6%)

As in Horos Value Internacional, we trimmed our exposure to the Portuguese holding Semapa, once the outlook for the improvement of the takeover bid launched by the Queiroz Pereira family became clearer. We used the proceeds to initiate new stakes and add to others that are currently more attractive.

Other

2% of the fund

Holding discussed: Altia Consultores (BME:ALC) (1.9%)

Although we continue to see upside in the Galicia-based consulting firm Altia Consultores and we are convinced that we are in the hands of one of the best management teams, in addition to having a chairman who is fully aligned with its shareholders (Tino Fernández controls 81% of the shares), we slightly trimmed our position in the company given that we think there are better investment alternatives at the present time.

Stake Increases & New Stakes:

Financials

Exposure stable at 20%

Holding discussed: Alantra Partners (BME:ALNT) (3.6%)

The increase in the weight to Alantra Partners is exclusively because at the end of the previous quarter we were still in the process of building our position in this company.

Other

1.3% of the fund

Holdings discussed: The Navigator Company (ELI:NVG) (1.0%) and Prim (0.3%)

This quarter we initiated a stake in Prim, a family-owned healthcare company that operates in the medical supplies and orthopedics sectors. In the former, the company commercializes and installs third-party equipment, while in the orthopedics segment, it designs, manufactures and sells both its own and third-party products.

Prim is a company with more than 100 years of history and more than 60 years of experience in the introduction of medical technology products. It is worth mentioning that more than 40 multinationals have entered the Spanish market through this company, relying on a wide distribution network built up over the years, as well as on the training that Prim provides to its customers on the medical products sold by third parties.

We think the recent changes in the company's management team and the new strategic plan could be an important catalyst for the business, uncovering a good investment opportunity at current prices. Specifically, with the new business plan, we expect a notable expansion of operating margins thanks to greater scale, derived from both organic and inorganic growth, as well as growth in niches where the current presence is limited. While we prefer to be more conservative on the achievement of the strategic plan's profitability targets, we believe that the company's net cash position, family ownership (c. 63% owned by the Board) and its strong cash generation justify an investment at current prices.

Regarding The Navigator Company ("Navigator"), it is the leading manufacturer of uncoated printing and writing paper in Europe, with a market share of 19%. In addition, it produces and sells pulp—the main raw material for paper—and tissue paper, used in the manufacture of napkins, handkerchiefs, toilet paper and kitchen rolls. Navigator is overall the most efficient paper company in Europe, excellently managed by the Queiroz Pereira family and with a high cash generation capacity, which makes it a very interesting choice to benefit from the expected rise in paper prices.