Black Bear Value Partners LP commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

“I am certain there is too much certainty in the world.” - Michael Crichton

To My Partners and Friends:

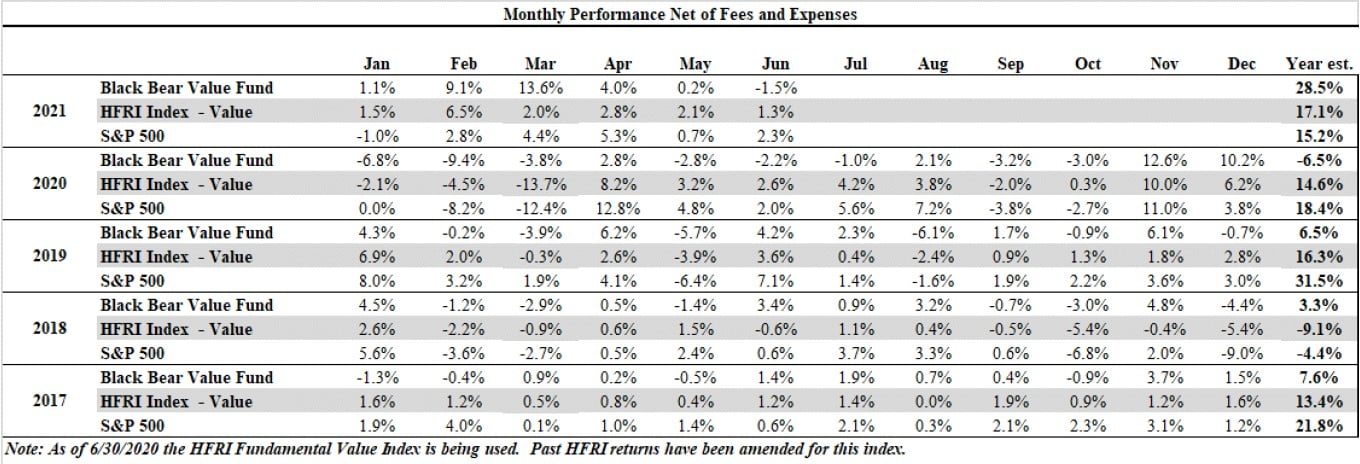

- Black Bear Value Fund, LP (the “Fund”) returned -1.5%, net, in June, +2.7% for the 2nd quarter and +28.5% YTD.

- The S&P 500 returned +2.3% in June, +8.3% for the 2nd quarter and is +15.2% YTD.

- The HFRI index returned +1.3% in June, +6.2% for the 2nd quarter and is +17.1% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

As you know, we own concentrated positions in a handful of businesses. This runs counter to investing in the “market” which invests across many businesses (note that in the S&P 500, one has a top-heavy concentration in large-cap tech). I focus on the prospects of what we own versus pontificating on the overall direction of “the market”. As valuations across the various indices continue to rise, it becomes increasingly important to be able to analyze individual businesses and opportunities if you want to perform well in a lower-return environment. At current market valuations it seems likely that future returns in “the market” will be lower over the next 5-10 years than the past 10 years. This is an opportunity for us as we are invested in specific companies that have better prospects than the market as a whole though are at cheaper prices. Our prospects seem encouraging as our businesses possess pricing power, healthy balance sheets and high-quality managers running them.

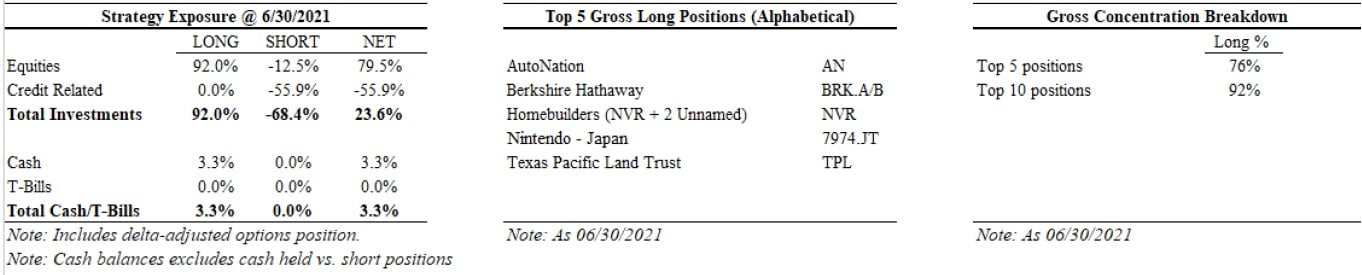

As described below we have a newly disclosed position in Japan as well as three homebuilding related businesses. Quite often, quality investing is learning a lot and doing nothing. While we have new disclosed positions (due to increased size) much of what we own are long-held investments.

Top 5 Businesses We Own (Alphabetical)

Brief descriptions of the top 5 long positions follow as of 6/30/2021 in alphabetical order,

AutoNation (same summary as Q1)

AutoNation has been a long-term holding for us dating back to the first year of the Fund. Management continues to make prudent decisions both investing in growth and shrinking the share count at cheap prices.

Most would not expect a global pandemic to benefit AutoNation, but the industry experienced a record year. Dealers have been able to increase profit margins due to a variable cost operating model and lower inventories. AutoNation has been able to materially reduce their operating expenses over the last year which will continue to benefit the business going forward.

Management will invest an incremental $200MM in used car supercenters (AutoNation USA) over the coming 3 years. Their ability to self-fund growth without a need for dilutive equity raises and/or debt raises is an enormous competitive advantage that is still not recognized appropriately by the market.

My estimates for FCF have increased as I have more confidence in their ability to permanently cut operating expenses out of the business. AutoNation can generate a range of $6-$8 in free cash flow per year. This implies a 7-9% yield to us presuming limited growth. Additionally, if AutoNation achieves modest levels of success with AutoNation USA it could add another $5-$10 of per share value to the business. Note that at current prices, very little in the way of AutoNation USA success is priced in.

Berkshire Hathaway (same summary as Q1)

Please see Q1 letter for our Berkshire on a Napkin investment exercise. We have written on it extensively and will save your eyeballs from extraneous writing.

While Berkshire’s operating businesses saw their profits decline by ~10% in 2020, their long-term positioning at the cross-section of American business remains intact if not stronger. Berkshire is very cheap for owning such high-quality businesses and will continue to grind higher and compound value for us.

Homebuilding Basket (Included NVR Inc and 2 other unnamed companies).

I would point you to our Q1 letter to read our discussion of NVR. We own 3 homebuilding related names which comprise a healthy chunk of the portfolio. Given the concentrated nature of the portfolio I am going to keep the names of the remaining 2 companies out of this discussion. 2 of the 3 companies are homebuilders while the 3rd is in an adjacent business line supplying the homebuilding industry.

There is a long-term fundamental supply/demand imbalance in housing inventory. This is a direct result of underproduction of new homes amid a challenging mortgage financing environment over the last 10+ years since the Great Financial Crisis. Looking forward we should have increasing housing demand from millennials as they enter the family-phase of life and desire more space. Rates are still near historic lows and people are desiring more personal space as remote work becomes more acceptable. Many investors are focused on short-term projections of homebuilding supply/demand and affordability and trade the news. This seems like a futile endeavor for me and am staying focused on the long-term dynamics and direction of these businesses and industry.

Our first homebuilder, NVR is capital-light as land developers own the land during the entitlement/pre-build process. The result of this is higher returns on capital as the land entitlement/development process can take a while, thereby reducing your overall return (your investment dollar gets tied up for a longer period). NVR trades at a premium to other builders because of this structural difference in their business model though I still find it undervalued in absolute terms. If the fundamental tailwinds described above are true than we own a business at a ~6+% FCF yield with healthy growth prospects and would expect to compound our capital at 10-15% per annum for 5+ years. If I am wrong and the growth does not happen, we still stand to compound in the high single digits.

Our 2nd homebuilder is a small cap company with unique ownership/board who takes a more land-heavy approach. The benefit of being smaller is the ability to be nimble. The downside is that you cannot be as capital efficient as the 10,000 lb. gorilla (NVR) and get options on land as easily. As I’ve gotten to know the management team and fellow owners at Company #2 I am confident in their business strategy and areas of the country they are focused on. They are focusing more on the 1st time and 2nd time homebuyers in areas with rapid demographic expansion. I think we own this business at a 10-15% steady state free-cash flow yield with extremely high growth prospects. Currently the company is reinvesting their cashflow back into the business which means their net cash available to shareholders looks low. So long as they are reinvesting into high IRR projects this is a great use of cash. With the shareholders/board members and management team currently in place I think the odds are in our favor to do well over the next 5-10 years as shareholders of this business.

Nintendo (Japan)

Nintendo is a Japanese consumer electronics and video game company that was founded in 1889. Many of their characters and intellectual property are well known around the world (Mario and Luigi, Zelda etc.) Historically the video game business had very high peaks and very low lows. As new consoles would come to market there would be a rush to purchase them along with new games to play. As those consoles got older the demand would decline and the companies would enter a fallow period until their new batch of consoles/games came out. As a result, many analysts/investors tried predicting and investing based on their forecasts of console/game sales over the short term. This seems like predicting the unpredictable. However, this kind of cyclical boom/bust hit-driven business model had very little appeal to me, and I harbored much of that negative bias as I began to poke around the idea. As I discovered, some things have changed and improved for Nintendo.

The biggest and most durable change is the increase in digital adoption. The physical hardware market is low margin…digital is the opposite. As customers start using more and more of their digital product the margins increase dramatically. This could be morphing into a very high-margin razor/razor blade model as customers continue to purchase new games digitally on a more mature console. The net result of this is higher and more stable earnings. Add in the possibility for more of a subscription model to gaming and you could have a much more enduring high-margin business model as opposed to a boom-bust console driven business model.

Other areas of potential upside include using their IP for non-gaming ventures such as Super Nintendo World at Universal Studios in Japan. Nintendo also has underlying equity interests in businesses that are on their balance sheet but not accounted for on a free-cash-flow valuation basis (Pokemon).

Nintendo earns 20+% returns on capital, has no debt and a healthy amount of cash. We own it somewhere around a 6-8% cash-flow yield with a lot of upside levers working on their behalf. The strength of their balance sheet allows us to sleep at night in the meantime.

Texas Pacific Land Trust (same summary as Q1)

We continue to own TPL as it still looks reasonable to me with asymmetric upside if energy inflation takes hold.

Some people have asked why own this if the Biden administration is making it more cumbersome for energy companies and making a push towards renewables? Please note we are very supportive of a renewable future and a lower associated carbon footprint. As we have discussed before, to get to a renewable future we need hydrocarbons to bridge the gap. This is many decades in the making. Additionally, as permits on federal lands are reduced, the demand remains and will migrate to the areas where it’s still possible to operate (the Permian).

As a reminder TPL is a royalty company with 100% of their acreage located in the Texas Permian Basin. In a nutshell they make money when drilling activity occurs but DO NOT have the capital needs. The incremental amount of work on TPL’s part is minimal as the extraction and movement of the oil/natural gas is undertaken by others. They are merely a toll collector with Returns on Capital of 80+%.

In an inflationary environment, businesses that have lower capital intensity both in capital assets and people stand to benefit. In other words, if oil goes up a lot, the incremental cost to TPL is close to 0 so it is all incremental profit. This is a business that should benefit in a massive way if we have energy inflation. In the meantime, we likely own it at a 3-4% free cash flow yield with massive upside.

Certainty and Doubt

We have had a good start in the first half of 2021 with a fair amount of outperformance year-to-date. While I would like to believe that a shift towards more rational/fundamental investing is underway, the power of low-interest rates is a real headwind to the value/fundamental investor. When rates are low, people take more risk (whether they realize it or not) and many mistakes can get bailed out by accommodating financial markets. This environment does not last forever and is not how we make our investment decisions. We will remain focused on businesses with durable competitive advantages, run by quality management teams and with solid balance sheets. It seems inevitable that central banks flooding the world with dollars will result in unexpected outcomes. Preparing for these outcomes could punish the prudent in the short-term. Nonetheless I think it is of paramount importance to worry about the downside when risks are underappreciated and be mindful of the uncertain path things can take. Until then, those who are less sure of things stand to look like worrywarts. I can live with that appearance.

As said in previous letters over the long haul our prospects look promising and we will continue to remain patient, rational, and disciplined with a focus on the underlying fundamentals of our businesses.

General partnership business

BTIG recently had a capital introduction event for several family offices and other potential investors. We presented and discussed our investment philosophy and some high-level discussion about some of our portfolio ideas. Most importantly, we spent a lot of time discussing one of our biggest competitive advantages: YOU, our LP’s. Having a patient and long-term minded investor base is a huge advantage as it allows me to think about our portfolio on a multi-year horizon. This requires trust and patience on your end, and I am thankful that you extend that courtesy to me. So again, thank you. If you would like to see the presentation let me know and I can send your way.

We have welcomed in new quality LPs in 2021 as well as some add-on investments from our existing high-quality LP base. I am hopeful that once COVID passes we can have an investor get-together in Q1 2022.

Thank you for your trust and support.

Black Bear Value Partners, LP

www.blackbearfund.com