Symmetry Invest A/S commentary for the second half ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

In this newsletter, we will take a closer look at the effect of optimizing work processes and how to use social media as an advantage instead of a disadvantage. In addition, we will look at how we believe a management's ability to allocate capital should be assessed in a growth company.

H1 2021:

As always, returns and portfolio updates are sent out to shareholders monthly via the website.

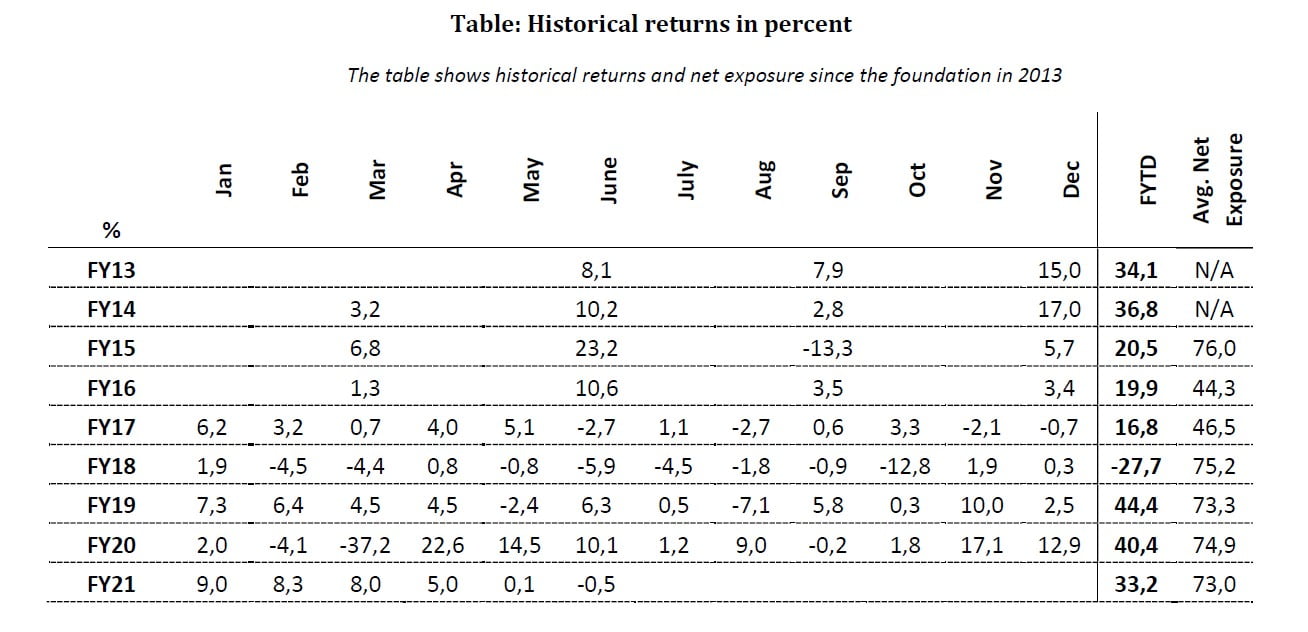

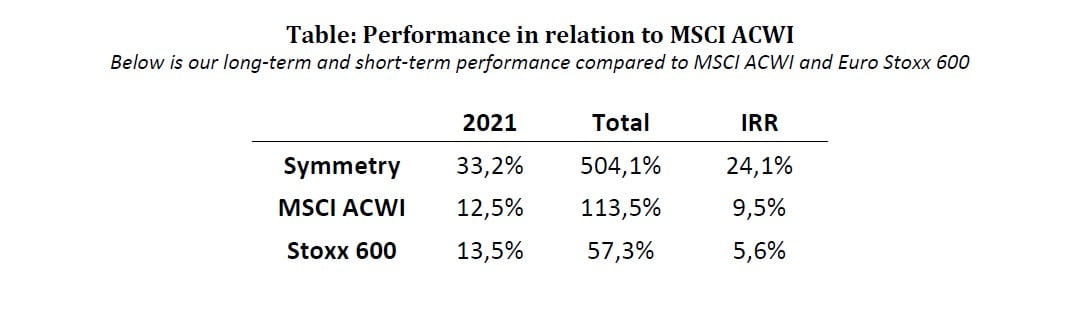

Our returns in the first half of 2021 were once again very satisfactory. Both in absolute and relative terms, compared to the rest of the market. Even more satisfying is the fact that our returns stemmed from a wide range of equities, and not just a few good outliers. The most important factor for our returns has been our adaptability. In the middle of last year, and towards the end, we made solid returns from our bet on online companies, but as the autumn drew closer, we shifted over more and more to classic value stocks, such as Cambria Automotive, Protector Forsikring, etc. As we also noticed that inflation could become a problem, we chose to buy commodity contracts as a hedge. We are not macro experts at Symmetry, so our goal is not to time the market based on the overall picture. We try to keep an eye on market trends and continuously rebalance and hedge our portfolio considering the scenarios we see unfold. As I’ve mentioned earlier, we try to create an “all-weather” portfolio that can perform in most market conditions. It also means that we never went all-in on eCommerce last year, that we have not gone all-in on the green agenda or have completely switched to classic value stocks such as banks etc. We try to always have a little of each in the portfolio and rebalance when we see significant shifts. In this way, we hope to be able to perform well under most market conditions.

Deep work:

Throughout the spring, I had the pleasure of reading Carl Newport's fantastic book "Deep Work". As I consider myself a constant student, I always work on finding ways to optimize my daily life and make Symmetry's and my own productivity greater. As can also be seen from our work and research on Franklin Covey, "human behavior" is an area we spend a lot of time studying.

In our H1 2020 newsletter (Q2 2020 Newsletter) I reviewed how sleep, exercise, diet and a good family life could be a strong reason to improve the productivity at work. In addition, I reviewed some initiatives that could help with productivity improvements during working hours. After reading "Deep Work" I have been able to take this to a whole new level.

Deep Work is fundamentally a book about the importance of being able to do in-depth work with high concentration and solid output by focusing 100% on specific tasks and removing all outside noise.

”…this understanding is important because it provides a neurological foundation for why deliberate practice works. By focusing intensively on a specific skill, you’re forcing the specific relevant circuit to fire, again and again, in isolation. This repetitive use of a specific circuit triggers cells called oligodendrocytes to begin wrapping layers of myelin around the neurons in the circuits – effectively cementing the skill. The reason, therefore, why It’s important to focus intensely on the task on hand while avoiding distraction is because this is the only way to isolate the relevant neural circuit through useful myelination. By contrast, if you are trying to learn a new complex skill (say, QXL database management) in a state of low concentration (perhaps with Facebook open), you’re firing to many circuits simultaneously and haphazardly to isolate the group of neurons you actually want to strengthen.”1

The investment business is one of the most dynamic out there. Share prices are moving like crazy on a daily basis and there is an almost constant flow of news, opinions and new data that can influence things. This can lead to the feeling of never wanting to miss out, i.e., constantly being up to date with everything. But by constantly seeking new input to already specified ideas, not enough space is given to seeking out new ones. One of the things I have done far more of is to focus exclusively and intensively on one individual tasks at a time. Previously, I could listen to a conference call while building an excel sheet. I thought that I could kill two birds with one stone and complete the tasks faster. But the end result was often that it took longer to make the excel sheet and I did not listen properly to the conference call.

Today I make sure to have several hours where I only focus on specific areas such as reading 3-5 annual reports for a new company back-to-back, listening to a lot of conference calls in a row etc.

Another solution I use is to turn off ALL the push notifications on my phone. That included email, apps, social media and even text messages. If people want my attention, straight away, they will have to call me. Otherwise, I have to actively choose to access the various channels to use them.

The book also puts great emphasis on the use of social media and the way it distracts us in everyday life:

If you can find some extra benefit in using a service like Facebook – even if it’s small, then why not use it? I call this way of thinking the any-benefit mindset, as it identifies any possible benefit as sufficient justification for using a network tool. The problem with this approach, of course, Is that it ignores all the negatives that come along with the tools in question. These services are engineered to be addictive, robbing time and attention from activities that more directly support your professional and personal goals. The use of network tools can be harmful. If you don’t attempt to weigh pros against cons, but instead use any glimpse of some potential benefit as justification for unrestrained use of a tool, then you’re unwittingly crippling your ability to success in the world of knowledge work”. 2

Those who know me know that I am a big fan of twitter in terms of networking, finding potential investment ideas and sharing news about Symmetry. However, I can easily recognize and agree with Carl Newport's point about the tendency to defend the use of various apps by the positive qualities they have, without regarding the negative ones. If you do a proper cost/benefit analysis, most people will probably find that most of the time is a pure waste of time.

“But part of what makes social media insidious is that the companies that profit from your attention have succeeded with a masterful marketing coup. Convincing our culture that if you don’t use their products, you might miss out”. 3

This is one of the reasons why it’s so hard to turn off the apps. What if I receive an important email? What if there’s news on Twitter that I miss? What if my friends are writing something on Facebook that I would like to see? The feeling that someone might have information that you don’t, or that something is going on that you don’t know of is anxiety-provoking for many. I have solved this by explaining to people in my close circle of friends, my investors etc. that if they need me immediately, they must call me. Otherwise, they should expect it to take up to 24 hours before I respond. Other "tricks" I can recommend are:

1) As mentioned, turn off all push notifications.

2) Turn off/hide bookmarks. My initial idea behind having them on my favorite bar was that I would save time by more easily reaching my email, trading platform etc. But in reality, they constantly entice you to access them every time you use your browser to search for relevant information you need for a research project. By hiding them away, you must actively click 2-3 times to access them, which significantly reduces this tendency and allows you to focus on more important tasks.

3) Set a time window in which it’s OK to use social media. As mentioned before, I’m a big fan of Twitter, and therefore I don’t want to shut it down, nor do I think it makes sense for Symmetry to do so. Instead, I have times during the day where I can use the service. Usually I will check the news, email, company updates, twitter feeds, and PMs etc. from 7-9 in the morning before the market opens. This assures me I’m up to date on things that are important to our portfolio. Then I will focus my time on active research and other projects that require my focus. At noon (often around or during lunch) I will skim my emails again. I will also usually do the first check of stock prices around this time. If there is nothing important that requires my immediate focus, I will go back to research again in the afternoon until I go home. When my wife and kids are asleep at night, I will usually take an hour or two answering the day’s emails, read through my twitter feed for important news, answer any PM I might have received during the day, etc. I will also check the closing prices for the stock market to see how the day has gone and whether I should email my broker with trading orders the following day. These procedures have personally helped me free up significant time (6-8 hours daily) to carry out real research and analysis. This has worked for me, although it might not work for everyone. Besides, I'm still not perfect. I still sometimes get to check twitter outside of the set time slots for example, but I have made great progress. And the direction is the important part.

4) Focus on reading, listening, and learning during the morning hours. Personally, I spend this time of day reading reports, financials, analysis, listening to conference calls and taking notes. While in the afternoon I’m usually more engaged in building spreadsheets, talking on the phone, holding online meetings, etc. It has worked well to use the mornings, when the brain is most alert, to absorb information.

5) Take advantage of other activities such as exercising or walking the dog. I often use my jogs or walks with the dog to listen to podcasts or in some cases conference calls. However, it is worth noting that if you do not feel you can take in the information in the meantime, you should not do it.

Another important point from the book is that it is okey to get bored. Said another way; take time to reflect. I have previously mentioned in my newsletter that I think one of the most important edges one can have in the market nowadays is not informational (who has the most data/information) but rather an analytical or in particular a behavioral edge. I therefore agree with Carl Newport about the idea of taking the time to reflect on available information, instead of constantly seeking new information. To give the brain the peace it needs to process information impressions and draw conclusions is an important basis for making the right investment decisions.

In 2013, the British TV licensing authority surveyed television watchers about their habits. The twentyfive- to thirty-five-year-olds taking the survey estimated that they spend somewhere between fifteen and sixteen hours per week watching TV. This sounds like a lot, but it’s actually a significant underestimate. We know this because when it comes to television-watching habits, we have access to the ground truth. The broadcaster’s audience research board, places meters in a representative sample of households. The meters record, without bias or wishful thinking, exactly how much people actually watch. The twenty ive-to-thirty-five-year old’s who thought they watched fifteen hours a week, watched more like twentyeight hours or close to double up”. This bad estimate of time usage is not unique to British television watching. When you consider different groups self-estimating different behaviors, similar gaps stubbornly remain. In a Wall Street journal article on the topic, business writer Laura Vanderkam pointed out several more such examples… Another study found that people who claimed to work sixty to sixtyfour hours per week were actually averaging more like forty-four hours per week…the examples underscore an important point. We spend much of our day on autopilot – not giving much thought to what we’re doing with our time. This is a problem. It’s difficult to prevent the trivial from creeping into every corner of your schedule if you don’t face, without flinching, your current balance between deep work and shallow work, and then adopt the habit of pausing before action and asking, “What makes the most sense tight now”. 4

It’s rather eye catching. People spend on average 15 hours more than they think watching TV, while at the same time working 20 hours less than they think. No wonder many people have no idea where their time is going? When I read this, I made up an example that readers can try on themselves. On a piece of paper, I wrote down how many hours I think I have used my phone over the last 7 days. For those with an iPhone, you can check this by clicking on “screen time”. It was almost shocking how much I underestimated my own use of the phone. Fortunately, I have also changed this greatly, as I will explain later.

On a different topic, the same is true for my kids’ use of iPads. They spend (spent) far more time on them than me and my wife thought. Most parents agree that their kids should not spend too much time on their iPads and computers, and most of them do not think that the kids do. Today we use parental controls that will lock the screens on our kids iPads when they have used up their time. This way they can learn to utilize their assigned time over their days.

I have personally been able to cut down on my screen time with 60-80% over the last few months by a few easy methods:

1) As mentioned before, I turn off all push notifications, i.e., things that attract you to the phone.

2) While in the office, I always keep the phone on a 3–5-meter distance from my workspace. Since I do not receive any notifications (beeps, sounds or vibrations) from text messages or apps, I have no reason to grab it unless someone calls me. Hence, most of the time during work (while in the office), I only use the phone when someone calls me.

3) When I get home, I actively chose to leave my phone in the car. I only have my iWatch (without any apps or email installed) on me, so I can answer potential “emergency” calls. This means that I can have 100% focus on being present with my family when I’m home, and not be tempted to “just take a look at the phone”. It also allows me to justify coming home a little later (and thus freeing up time in the office where I can do real work) because I am actually home when I am at home.

4) Do not put your phone on the bedside table when you go to bed. If you do not have your phone lying at your bedside you will not be tempted to take it. As I brought up in my H1 2020 newsletter, Matthew Walker also mentions this technique in the book “Why We Sleep”, as a way to achieve better sleep. Your subconscious is drawn towards the phone even when you are sleeping if it is right next to it, tempting you to check news in the middle of the night, etc.

Do i sometimes look at the phone while playing with the kids? For sure. Do i sometime have my phone close to my bed? For sure. But have I become significantly better at not doing it? For sure. Investing is all about constant improvements. As the head of Evolution Martin Carlesund would say” we just want to be a little bit better every single day and extend the gap to competition”.

Internal capital allocation

One of the things we increasingly spend time on while investing is studying the companies’ capital allocation. And we don’t think of capital allocation in a traditional sense. Usually, the conversation concerns how the company should work with M&A, buy-backs, dividends, and internal investments. These decisions are of course very important and can be the difference between an 8% or 14% yearly return. What we have found however, is that almost all the companies we invest in always have the best opportunity for capital allocation internally. It is therefore rarely a question of whether they should pay dividends or invest internally. Instead, it is more important for us to understand whether the companies know how to allocate capital internally in the best possible way. The companies we invest in often have opportunities to allocate capital to a 30-100% internal ROIC. We therefore spend time talking to management about their priorities and thoughts on this.

Naked Wines is a great example. They really have 3 areas in the company which they must constantly assess in terms of capital allocation. As Naked Wines grows, they achieve economies of scale in their business. This constantly increases their contribution margins. They must therefore assess how they should relate to these growing margins:

1) Should they keep these increasing margins within the company, deploying the cash internally

2) Should they lower prices on their wine to create a better experience for their Angels, giving them more value for their money

3) Should they raise the price paid to their suppliers, incentivizing them to produce more and better wine for Naked’s platform?

Once they have on their contribution margin, they generate capital to invest. This capital can be invested in getting new Angels to the platform. In sales and marketing, they have many different channels, such as insert marketing (vouchers), digital platform (Facebook etc.), influencers, refer a friend programs, and more. WINE should therefore constantly focus on investing their marketing budget in areas with the highest potential return. Their goal is to invest as much as they possibly can within an LTV/CAC of approximately 2x (5 years). They therefore constantly seek to invest as much as they possibly can as long as they can reach the payback they are targeting. This is regardless of how these investments affect their performance in the short run.

On the other hand, they must assess how much they should invest in fixed expenses. This could be better IT, website development, better customer support etc. These expenses are of course the most difficult to measure ROIC on because they help to improve the overall experience for the business.

But WINE should not only assess ROIC in these areas, they also must understand how decisions in one single area interacts with another. For example, if they choose to lower the prices of their wine or invest in better IT, they will have less money available to acquire more customers. Conversely, it will also make it easier to acquire more customers cheaply when investing in your product. Similarly, investing in more customers will increase the scale of their network, which in turn will free up more money to invest. WINE must constantly assess how they can strengthen these network effects and create the strongest ROIC based on the available capital. At the same time, they must continuously determine if they have so many opportunities in all areas that it would be wise to raise extra capital from shareholders.

We have spent a long time discussing this with CEO Nick Devlin and other people from WINE. Based on this, and our external due diligence in this area, we are 100% convinced that Nick and the team fully understand this. Otherwise, we would not have allocated such a large portion of our capital to WINE.

”There is nothing new on Wall Street or in stock speculation. What has happened in the past will happen again and again. This is because human nature does not change, and it is human emotion that always get in the way of human intelligence”5

Portfolio Update:

Our holdings have, overall, continued to perform well in 2021 which of course also will be reflected in our performance.

We recently made public our latest investment in JDC Group AG. JDC is a stock we expect very much from the coming 3-5 years. We can see a future where this company becomes a multi-bagger. We are super happy to have partnered with Sebastian and Ralph. Below is a link to our Q&A with the management.

https://www.symmetry.dk/wp-content/uploads/2021/06/zoom_0.mp4

And to our news email about the stock:

https://preview.mailerlite.com/g8c2b2

Another stock we mentioned for the first time in H1 2021 was Franklin Covey where we published a report in February. The report and presentation can be found here:

Galleri - Symmetry

Franklin Covey has already done well with a return of approx. 40% in just 4 months. Our investment case was most recently confirmed when Franklin Covey reported their Q3 financial statements:

The Q3 report was what I would call a blowout quarter. It was significantly better than what everyone had dared to hope for. People can read my analysis where I estimate that the shares are worth $80, and where I estimate an EBITDA of around 22 in 2021. The current guidance is around 26-27, so it is already markedly ahead of my optimistic dreams. We believe that Franklin Covey has the potential to become a home-run investment. One can see that their unit economics are super strong, and they are firing on all cylinders in terms of hiring new client partners to accelerate sales, making acquisitions to strengthen their platform (Strive) and continuously add more content which strengthens their network effects. We look forward to updating on the case after their Q4 report in November.

Of the other shares in our portfolio, we still have large shareholdings in Gaming Innovation Group Inc (STO:GIGSEK), Naked Wines (LON:WINE), Protector Forsikring ASA (FRA:PR4) and Kambi Group PLC (FRA:7KB).

We were super happy with Kambi's Capital Markets Day they held a few weeks ago. We have always been a little critical of the management's tendency to always underplay themselves too much. It was therefore wonderfully refreshing to see them be more positive about the future. At the same time, they provided a very in-depth review of their technology and why they should have lasting competitive advantages and why they should be able to continue to take market share.

Naked Wines was at first traded down quite heavily on their annual report. The reports were, as we already knew, good, but the company’s guidance for FY22 disappointed the market initially. Since then, the stock has rebounded strongly. This is most likely because people have been able to dig deeper into the case. First of all, we think they are guiding conservatively as they do not know how their customers will react after a full reopening (although the first signs look super good). Secondly, their trading update for the first 2 months was actually very strong. There is thus a 30% growth in sales to existing customers despite very difficult comparative figures. When you also include a currency headwind, it is not hard to imagine that Naked Wines will deliver 15-20% CC growth in FY22 despite very difficult comparative figures. Against this backdrop, their long-term guidance for 20% annual growth does not look strained either. In our opinion, several UK analysts and investors do not properly understand the company. They are disappointed with the high costs, but we see the company's costs as investments that will strengthen the company in the long run.

We still think GiG is way too cheap. This is despite the fact that the stock has already had a nice upturn since our analysis last November. It is therefore still one of our largest holdings. Their Media business is running excellently and growing rapidly, and their platform business is starting to capitalize on the regulatory changes that are happening all around the world while at the same time being profitable. Based on the current share price of around NOK 18, GiG is trading at 8x 2021 EBITDA and 5x 2022 EBITDA. It is absurdly cheap for a company with high organic growth in a structural growth industry.

Protector Forsikring recently presented their Q2 report which again showed that they have good momentum in the business. They managed to maintain a high revenue growth (+20 % organic), an exceptionally strong combined ratio, and a good investment result. At the same time, they are now paying dividends because they are overcapitalizing. They maintain good risk management on their investments and are disciplined to sell when the shares reach fair value. We have a hard time seeing why Protector is still trading at a normalized6 P/E of 6-7 with double-digit organic growth and a dividend yield of approx. 8-10%. Protector could appreciate 100% from here and still trade at a discount to competitors.

The reason that capital markets are, have always been, and will always be inefficient is not because of a shortage of timely information, the lack of analytical tools, or inadequate capital. The internet will not make the market efficient, even though it makes far more information available, faster than ever before, right at everyone’s fingertips. Market is inefficient because of human nature – innate, deep-rooted, permanent. People don’t consciously choose to invest with emotion – they simply can’t help it”7

I wish you all a continued good summer.