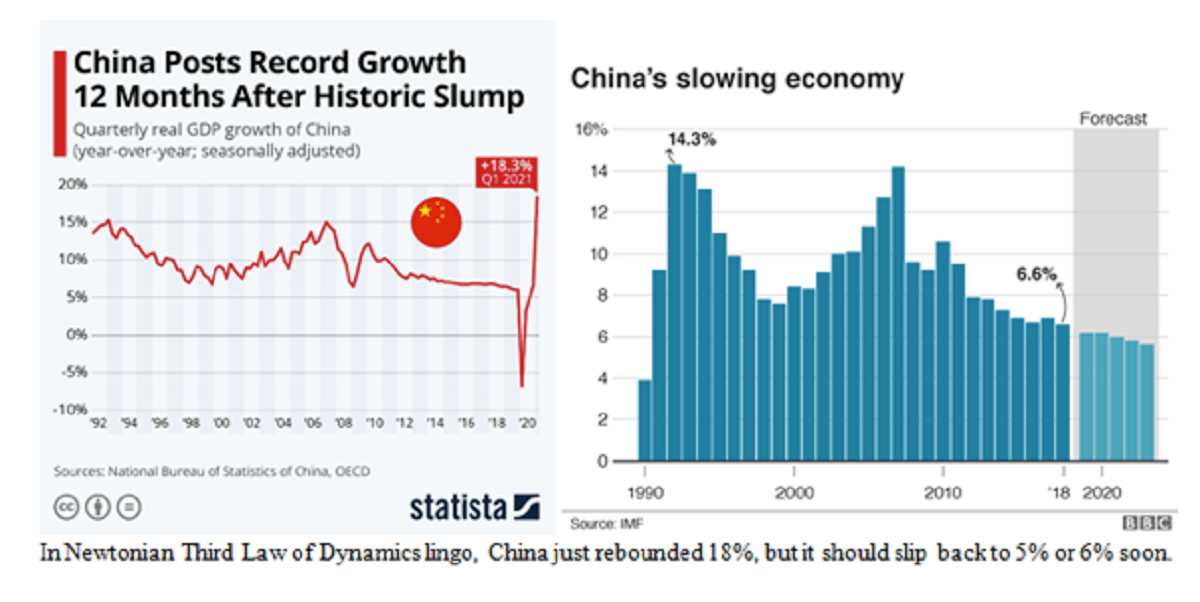

Now let me return to last week’s big question – Who will “win” the 21st century? When you compare raw numbers, you have to ask: What good does it do for America to grow 5% or 6% a year if China can grow 10% to 12% a year? It now seems certain that China will someday surpass the U.S. in GDP, but bear in mind that they have four times as many people – so their per capita GDP would still be 75% below ours.

Q1 2021 hedge fund letters, conferences and more

China vs The U.S.

These kinds of questions deliver a huge wave of “Déjà vu” to me. In the 1980s, it seemed like everyone was saying Japan would pass the U.S. by the year 2000. There was an essay written, “Japan’s Feet of Clay,” predicting their ultimate fall. Another article “Japan’s New Role in Asia,” before Japan’s rise, foresaw its fall, based on demographic flaws (few children, fewer immigrants), vertical (closed) corporate zaibatsu, and huge debt: Japan now has a 230% debt-to-GDP ratio, and an economy addicted to zero-interest loans.

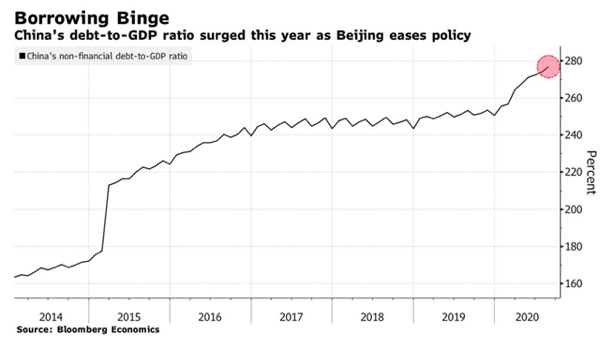

Will China fall to some of these same “feet of clay” flaws in the future? I think so. Like Japan, and our own growth recently, too much of China’s growth is financed by debt and an outpouring of cash from the central government. In fact, the government there is far more over-extended than ours, and they are skating on far more speculative ice when it comes to financing their state-owned enterprises (S.O.E.s).

China is flirting with a 300% debt-to-GDP ratio in an economy far more fragile than ours, especially since Xi Jinping launched the costly “Belt and Road Initiative” in 2013. Bloomberg has been charting China’s debt leverage since 2014: It has clearly risen during the pandemic of 2020 – its greatest surge since 2015:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

China desperately needs trade and growth to keep its debt machine fed. Think Bernie Madoff – “Must find new clients.” China’s trade has kept them growing. Every nation keeps a “balance of payments” account, and those accounts must balance across borders. For every Chinese export, there must be an equivalent import in some other nation. The same is true for internal consumption. Their new buildings and roads are clearly visible to any visitor, but are those structures used profitably and well? That is another question.

Annual Growth Rate

Also, I don’t think China will ever grow by double digits again. When China was smaller (like when I visited there in 1996), double-digit growth was almost easy. You can grow 10% a year from a base of $1 billion quite easily, but it’s much harder from a $10 billion base. In 2016, my friend and old China hand Robert Lawrence Kuhn wrote of the discontent in China when their annual growth rate slipped below 7%.

Ten years ago, in 2006, when China’s growth rate was a robust 12.7%, everyone was happy – count on China to drive world economic growth! Now everyone is on edge about China. But consider this: the GDP base is far bigger. In 2005, China’s GDP was $2.3 trillion, and 12.7% growth meant an increase of under $300 billion in 2006.

Fast-forward ten years. In 2015, China’s GDP was $11 trillion, and 6.5% growth would mean an increase of over $700 billion in 2016 – more than twice the absolute amount the economy grew in 2006 when the growth rate was that happiness-engendering 12.7%. And since China’s population in 2016 is only marginally more than it was in 2006, the absolute amount of GDP growth per capita will be well more this year than it was a decade ago.

–Robert Lawrence Kuhn, “Understanding China’s Economy,” CCTV, December 12, 2016

The same math is true in America, of course. The larger the economy, the more difficult it is to grow fast.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

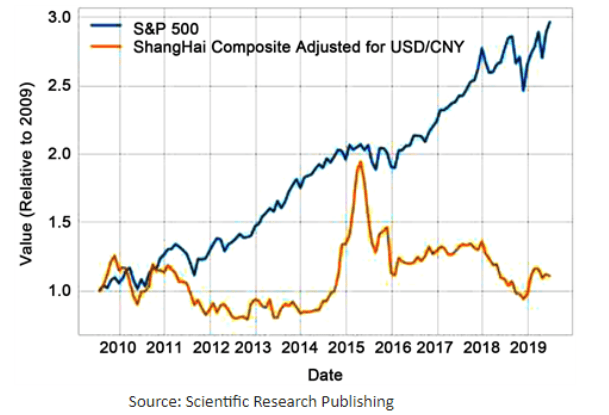

China's Stock Market Performance

Despite rapid GDP growth, China’s stock market performance has been nowhere near as impressive as the U.S. equivalent, reflecting the fact that the vast array of their companies are not organized as clearly for the benefit of the shareholder as are most U.S. equivalents – with notable exceptions, of course.

Here’s how the two markets compare in the decade from the Great Recession to the onset of COVID (mid-2009 to mid-2019). China’s market was flat, while the S&P 500 tripled, so investors must ask: What did all those double-digit annual economic gains do for most Chinese (or overseas investors in China)?

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

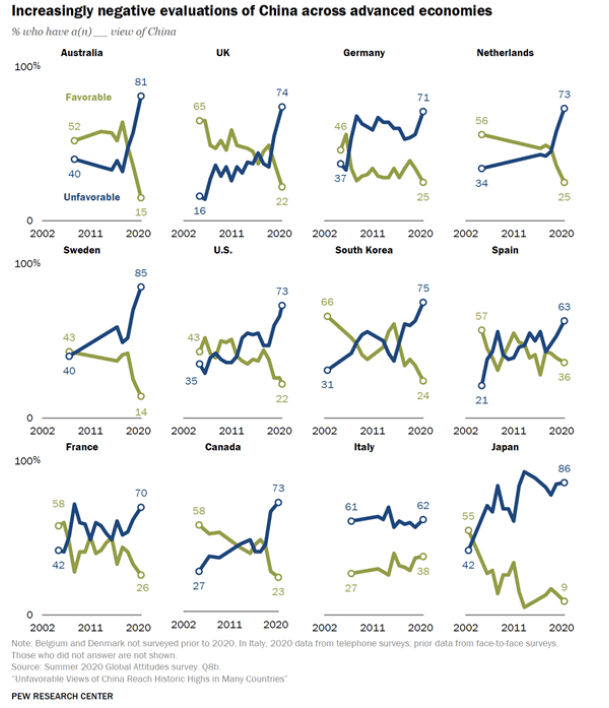

Who will win? We’re not in this world alone. We need allies. China is alienating almost everyone. We shouldn’t do the same. In 12 key nations, a single question was asked between 2002 and 2020. With few exceptions, there was a sharp rise in unfavorable views of China since 2015 (i.e., under Xi Jinping).

Who will win? In the end, it will come down more to the quality of growth than the quantity, and that includes the quality of life. China has cleaned up some of its cities, but it still has nine of the 25 most polluted air quality conditions among world cities. (India now leads with four of the worst five cities.) Each nation is home to 1.4 billion people. Overcrowding is a serious challenge, but having fewer children poses an opposite challenge – who will work to support the elderly? China is also still a command-and-control Communist economy with severe human rights abuses and ongoing fraudulent trade practices amid a growing military buildup, so the question of who will “win” takes on greater import. America has its challenges, too – do we really want to grow and stay #1? – but the world would be better off if we did.