When you do your banking, do you do it in a building where you need to line up in a queue to talk to someone behind a window, or do you do it all on your phone, wherever and whenever you like?

Q3 2021 hedge fund letters, conferences and more

Three quarters of us now use banking apps for our everyday money tasks, a shift to the digital world that has been accelerated by the pandemic when banks had to close along with everywhere else. More than 90% of people over 60 used online banking for the first time during the pandemic.

In 2022 the number of Americans using digital banking is expected to break through the 200m barrier for the first time, rising to over 216m by 2025. Currently most of us use digital services from our traditional brick-and-mortar banks, but there are also increasing numbers of people who use digital-only banks.

These digital banks and neobanks currently have around 15.5m users in the USA, making up around 6% of US adults, though that number is expected to rise to around 11% by 2026. Digital banks are digital-only offshoots of traditional banks, while neobanks are those not associated with traditional banking services.

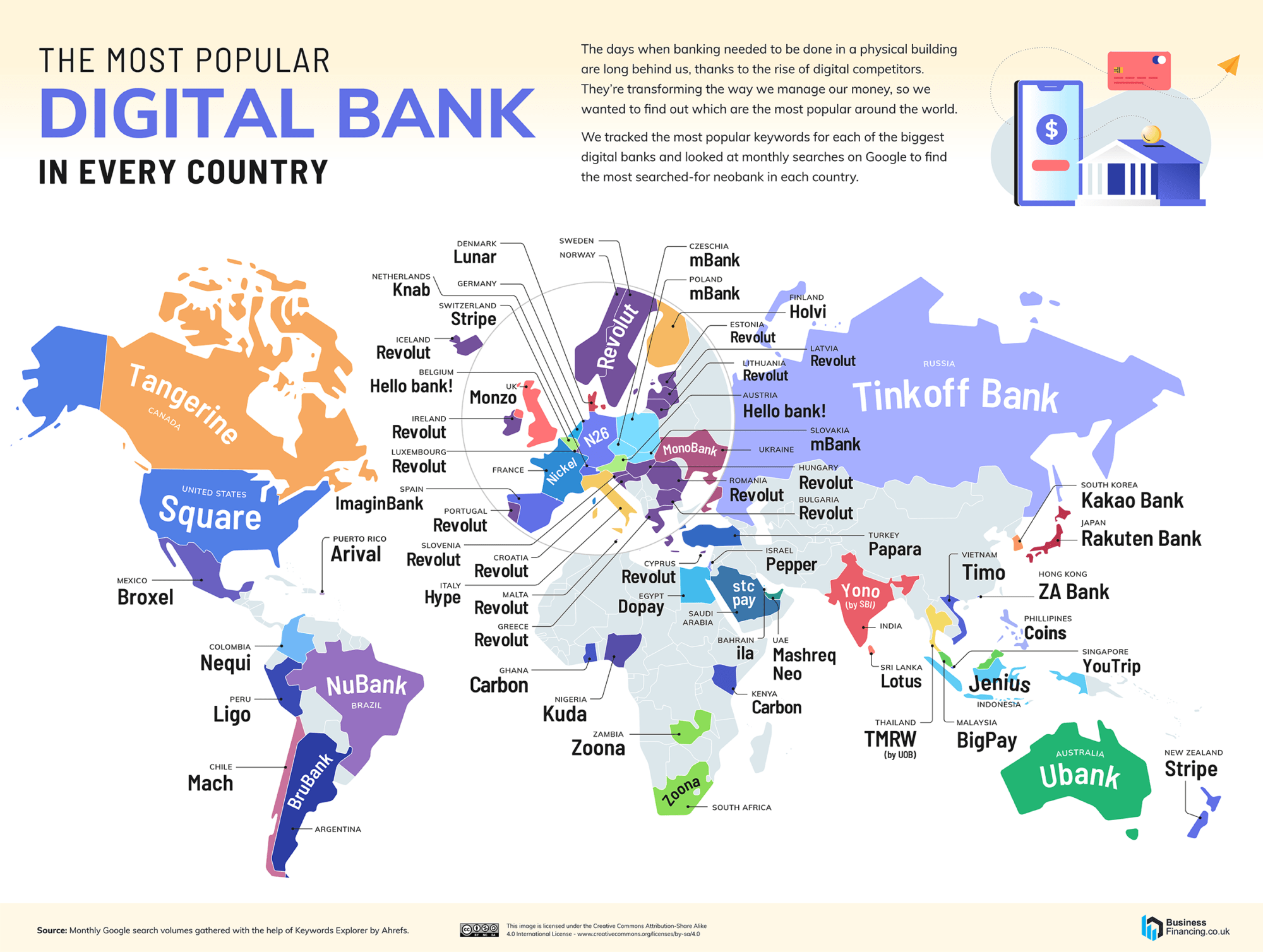

That’s the picture in America, but digital banks are making an impact on our day-to-day personal and business financial activities across the world, so Businessfinancing.co.uk has looked into which are the most popular digital banks in every country.

The Most Popular Digital Banks Around The World

As part of their research they analyzed Google search data to see which digital banks and neobanks were the most searched for. Square came out on top in the USA with 719,000 monthly searches, while Monzo was the UK’s favorite digital bank with 237,000 searches a month.

However, with many digital banks currently only operating in the country of their origin, only a handful of them dominate in multiple countries. The most widespread popular digital bank therefore is UK-based Revolut, which was the most searched-for in 17 different countries.

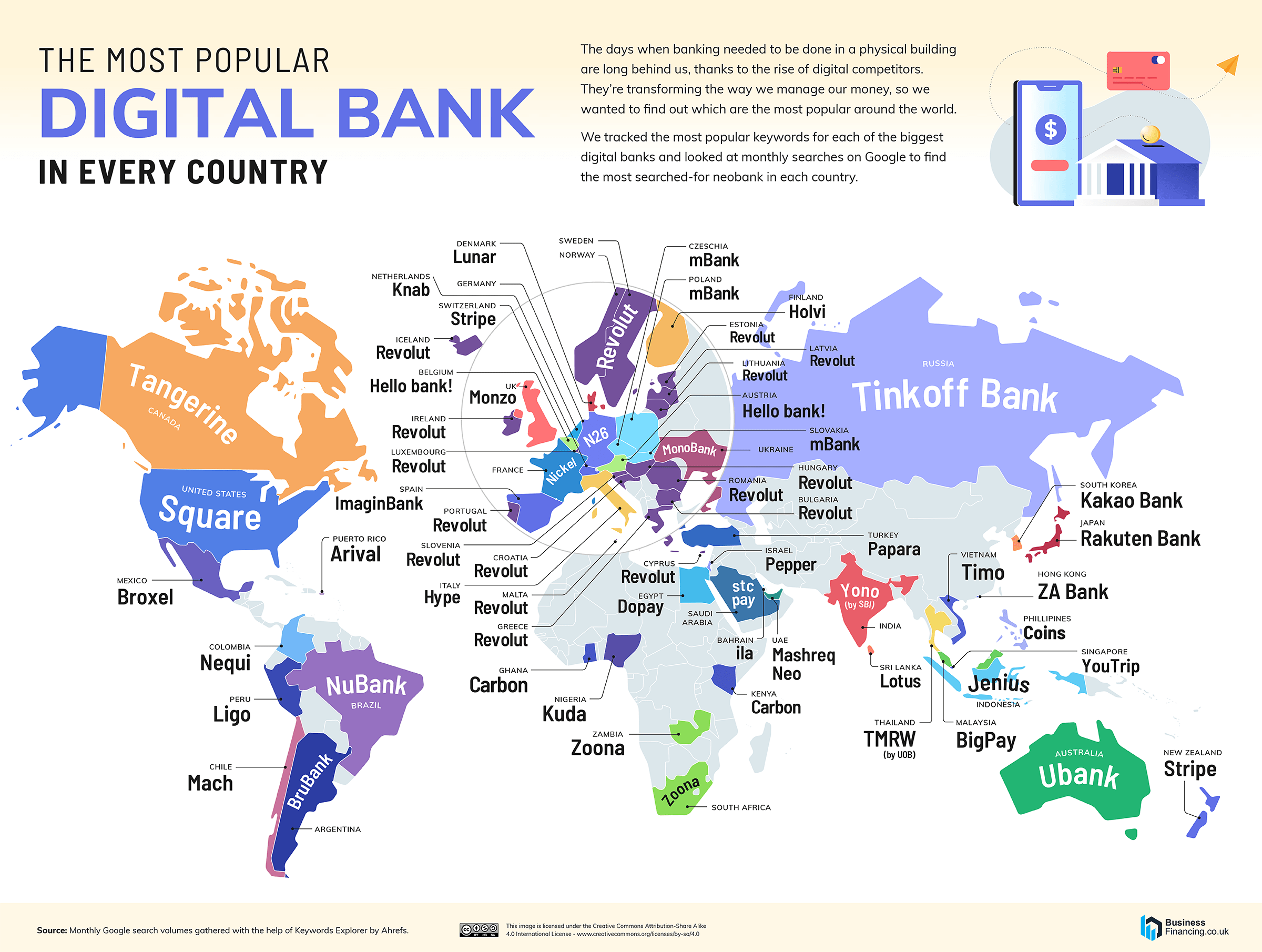

Europe’s Most Popular Digital Banks

Revolut certainly dominates the digital banking scene across Europe, coming out on top 17 times, meaning that it is most popular in almost half of the 35 markets it currently operates in, even if it only applied for the UK banking license in January 2021 and trails far behind Monzo in its own country.

Other digital banks that have cross-border appeal in Europe include mBank, which is number 1 in the Czech Republic, Poland and Slovakia, as well as Hello Bank! which is most popular in Austria and Belgium.

North America’s Most Popular Digital Banks

While European countries may share some of their favorite digital banks, North America sees a very different picture. Every country on this continent has a different most searched digital bank, with Square - founded by Twitter’s Jack Dorsey and worth over $100 billion - coming out on top in the USA.

In Canada the number one digital bank is Tangerine, which is a subsidiary of the more traditional Scotiabank and actually dates all the way back to the very early days of online banking in 1997, while Broxel is Mexico’s favorite and Arival is top dog in Puerto Rico.

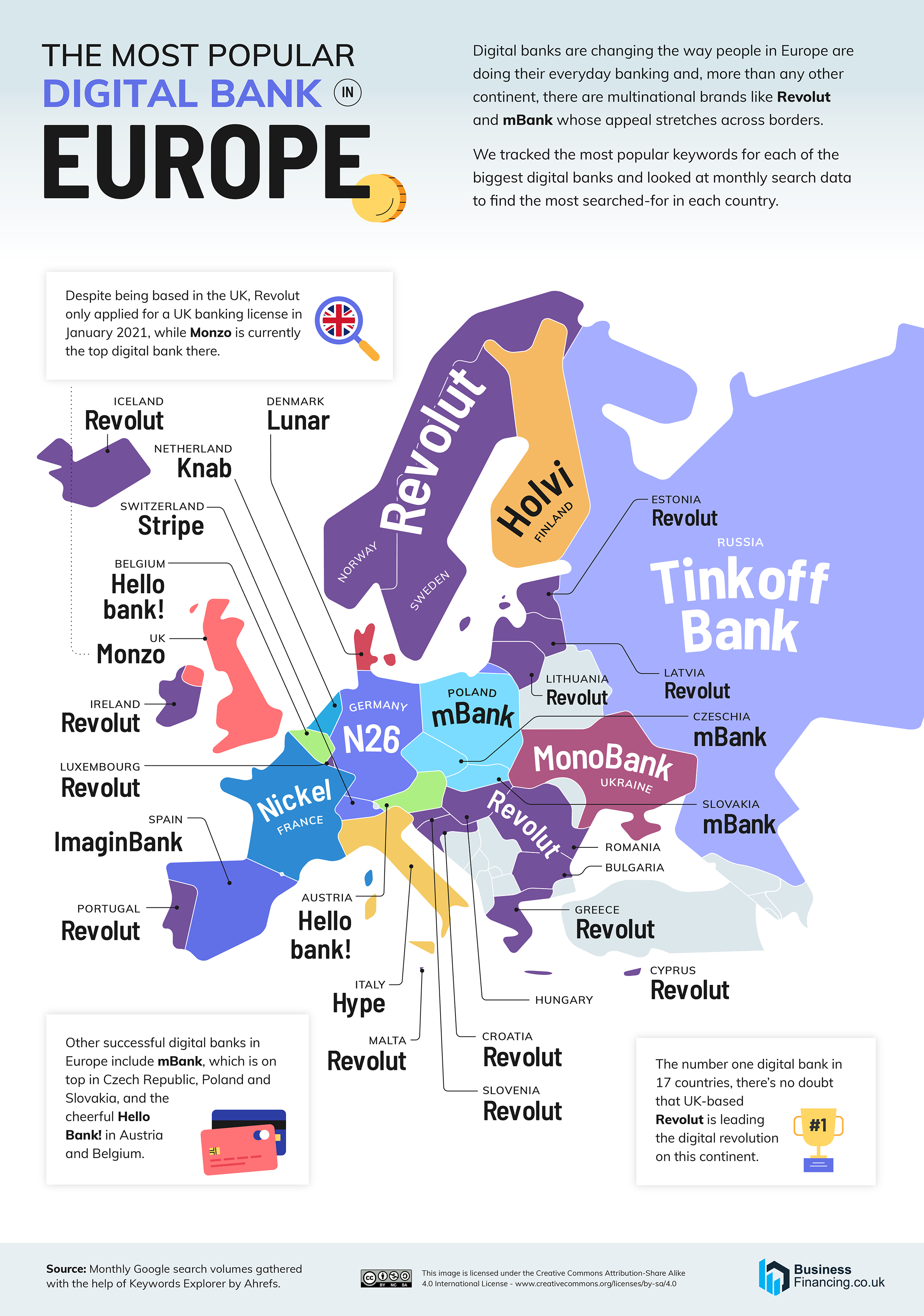

South America’s Most Popular Digital Banks

South America is another continent where each country has its own favorite digital bank, but with 38 million customers around the world, there’s no question about which is the biggest brand here. Brazil’s NuBank claims to be the biggest digital bank in the world and was the first Brazilian startup to reach the $10 billion mark.

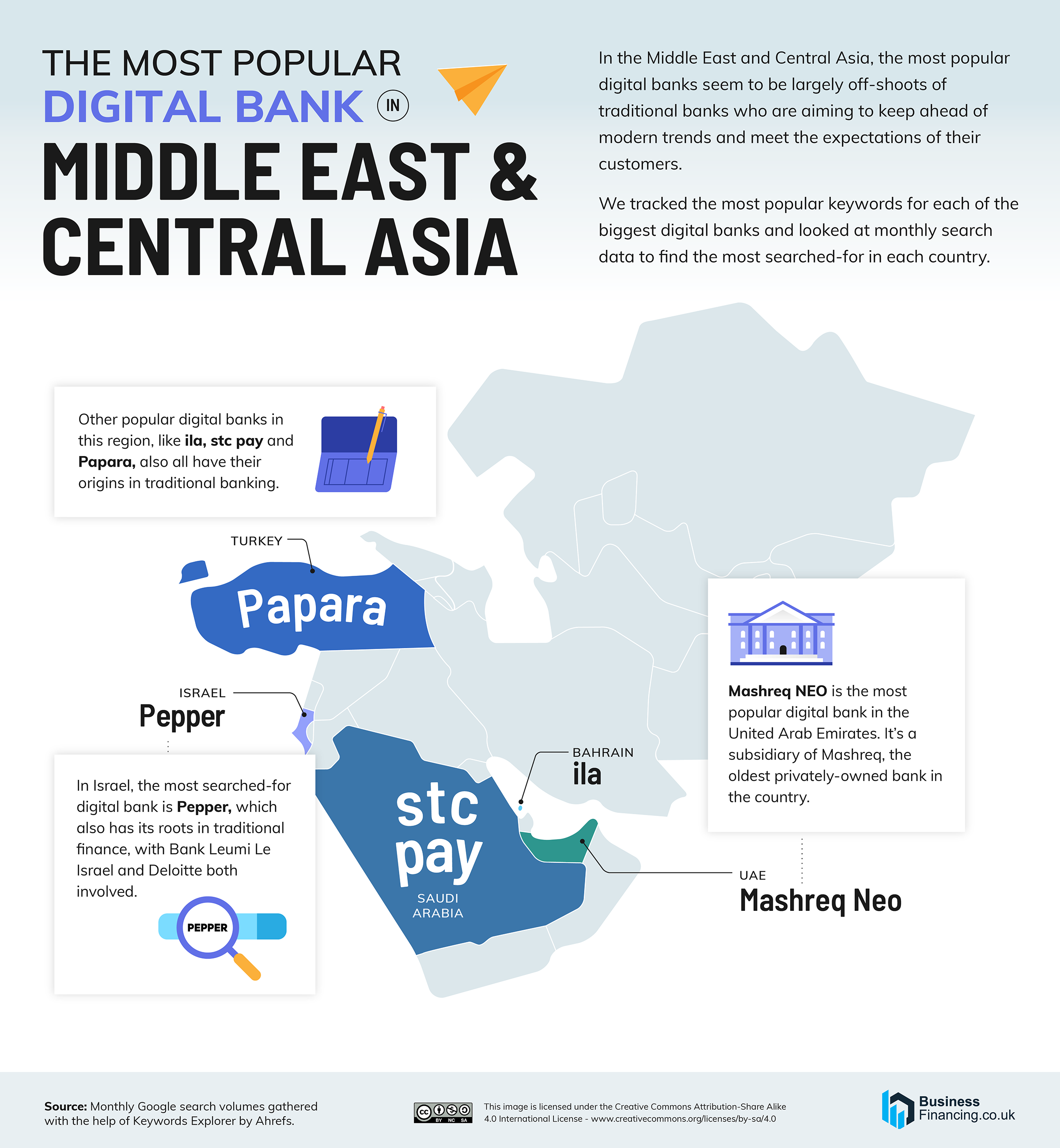

Middle East And Central Asia’s Most Popular Digital Banks

This region is so far dominated by digital banks that have come from traditional brick-and-mortar banks, like Mashreq Neo from the United Arab Emirates, which is an off-shoot of Mashreq Bank or Papara from Turkey, which has seen a big increase in digital users since the start of the pandemic.

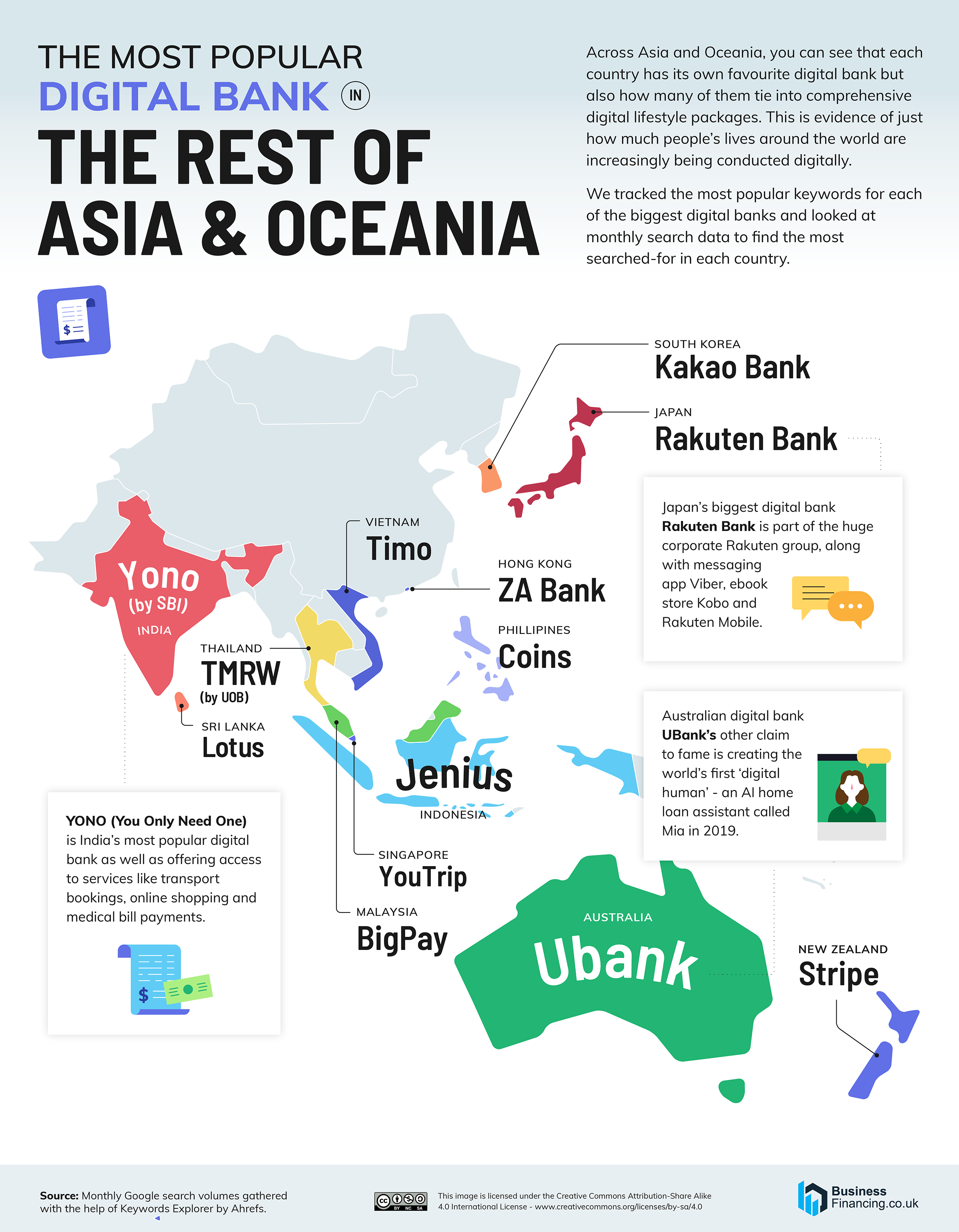

Oceania And The Rest Of Asia’s Most Popular Digital Banks

Another region where the big players in the digital banking sector are tied to the traditional banking systems, like Ubank from Australia, which was launched in 2008 by National Australia Bank, or Rakuten Bank, which is part of Japan’s massive Rakuten group, which also offers services like messaging app Viber and ebook store Kobo.

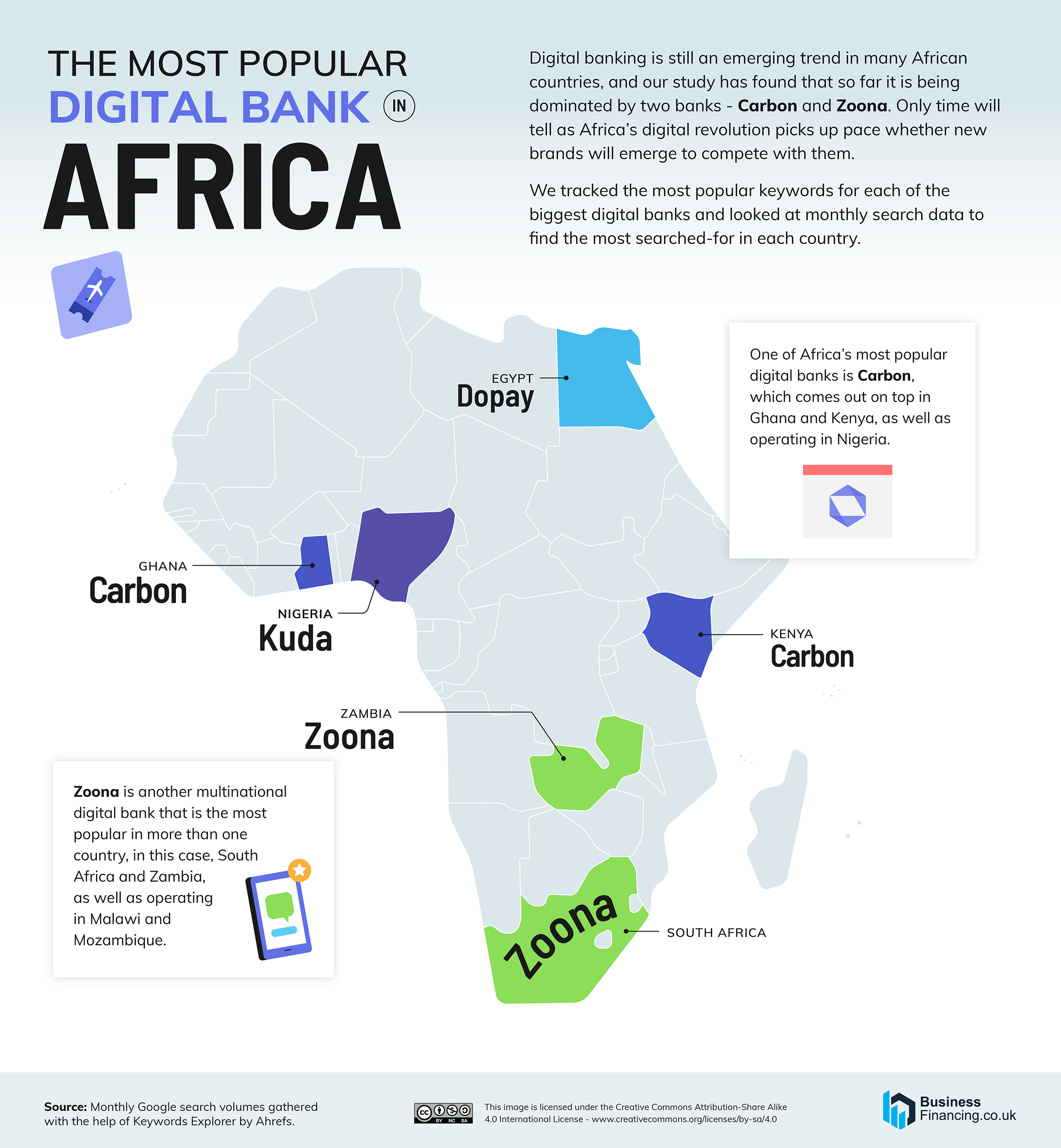

Africa’s Most Popular Digital Banks

Digital banking is still relatively new in many African countries, but there are emerging companies making a name for themselves in the Fintech markets, like Carbon, which is from Nigeria but is the most-searched-for in both Ghana and Kenya, while Zoona is the most popular in South Africa and Zambia.

Digital banks and neo banks have become an ever-more important part of our daily lives since the pandemic and the restrictions it placed on going to physical banks.

The results of this study show which companies are getting the most attention in Google searches as people around the world search for new ways of managing their money. Why not check out which is the most popular digital bank in your country?