In his Daily Market Notes report to investors, while commenting on travel & leisure stock, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

Travel & Leisure Stocks Near New Highs

Reopening marching ahead, but with fits and starts. Google says hotel searches at a 10 year high in US. Increasingly companies are expecting employees back in the office by Labor Day. Projections of +6% economic growth might be optimistic but could spill into 2022.

Travel & leisure stocks near new highs. It remains to be seen how quickly people will fill ballparks and concert venues, but a relief rally is surely going to happen this summer.

The $5.3 trillion of economic stimulus calculated by the Peter G. Peterson Foundation, is Modern Monetary Theory (MMT) in action: Spending without consequences (yet). And now, an infrastructure bill will add $2.3 trillion. A new tax bill may (or may not) pay for part of this spending spree, but taxes will come nowhere near covering all the costs. We’re paying most bills with promises.

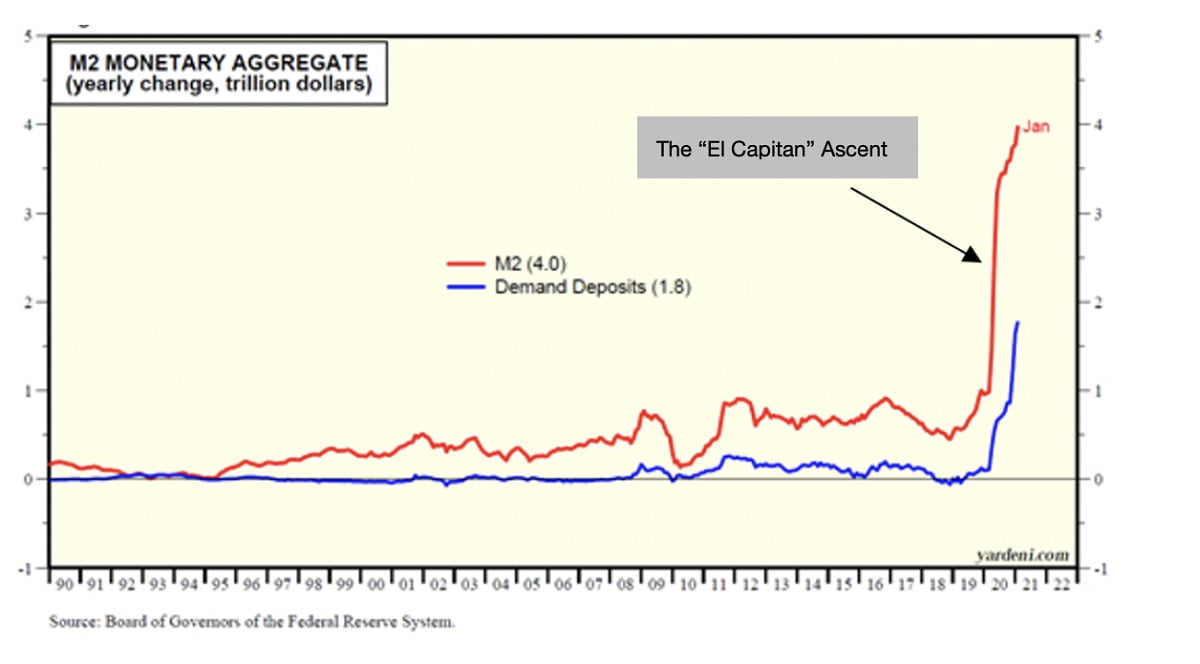

M2 Rising In An El Capitan Ascent

In the past 12 months (through January), our demand deposits (basically, checking accounts) have risen 112.5%, gaining $1,780.4 billion, while M2 has gained nearly $3,978.2 billion, rising in an almost vertical Eiger-like El Capitan ascent.

The most recent installment included $1,400 checks arriving in the accounts of tens of millions of us, further fueling the economy– unprecedented in American history. This fuel creates a “sugar high” in the economy, courtesy of Uncle Sam.

We are in the midst of “economic nirvana.” Five regional Federal Reserve Banks reported super-strong readings for their five regional economic indexes. According to MarketWatch, the Philadelphia index is now at its highest level in nearly 50 years (since 1973), while the five combined indexes (New York, Philadelphia, Richmond, Kansas City, and Dallas) are at their best reading since 2004. The Philadelphia region’s business index leaped from just 23.1 in February to 51.8 in March, its highest reading since 1973.

Manufacturing PMI Index Leaped To 64.7 In March

On top of that, we learned last Thursday that the widely-watched Institute for Supply Management (ISM) manufacturing PMI index of factory activity leaped to 64.7 in March, a 37-year high – the highest reading since December 1983, as the dawn was about to break on 1984, when GDP reached 7.2%, the most robust GDP growth rate of the last 60 years. (Any ISM reading above 50 indicates expansion, and 65 is red hot.)

The U.S. is not alone. Eurozone factory activity has picked up to reach its fastest growth rate in at least two decades, according to IHS Markit, whose PMI for Europe has risen to 62 in March, up from 57 in February. Global demand is just what the doctor ordered to help revive the lagging European economy.

On taxes, there remains a lot of infighting within Congress because the Biden Administration did not propose raising the state and local tax (SALT) deduction limit from $10,000, which hurts many higher income tax “blue” states that continue to suffer from an exodus to states with no income taxes, like Florida, Texas, Tennessee and Washington state. Raising federal income taxes without a higher SALT deduction will just increase the exodus to states with no income taxes. What really makes America great is that our respective states compete with each other for business, so I expect the pro-business states will continue to prosper!