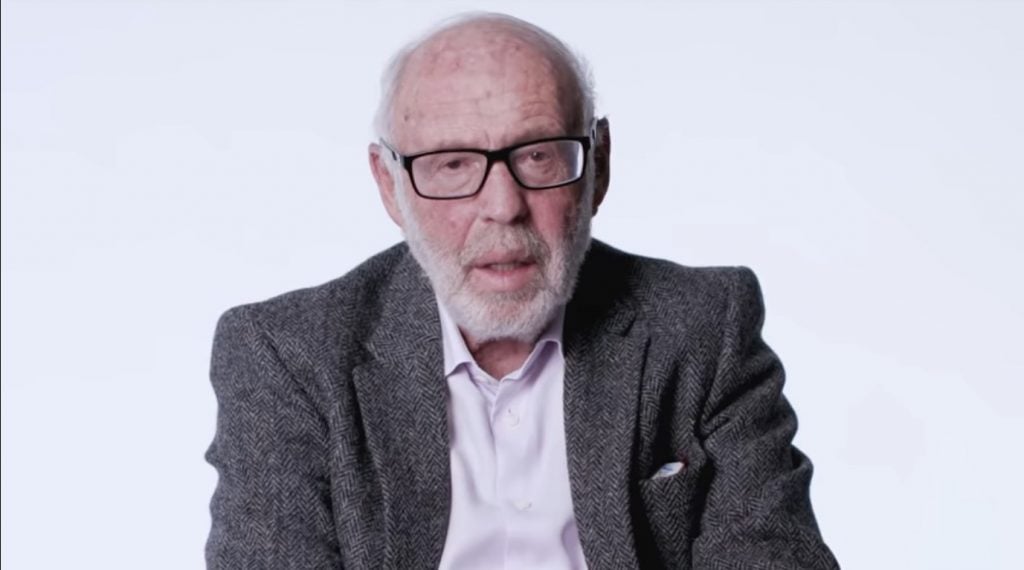

Jim Simons is one of the greatest investors of all time and is known as the “Quant King.” He founded one of the most successful quant funds in the world, Renaissance Technologies (in 1982). The company is famous for its Medallion Fund, which is open only to Renaissance’s owners and employees. This fund has generated an average annual return of 71.8% between 1994 and mid-2014. Simons is a prize-winning mathematician and was also a codebreaker for the U.S. during the Vietnam War. Forbes estimates his net worth to be more than $24 billion. Let’s take a look at the top ten picks of Jim Simons.

Q2 2021 hedge fund letters, conferences and more

Top Ten Picks Of Jim Simons

We have referred to the latest available 13F filing to come up with the top ten picks of Jim Simons. Following are the top ten picks of Jim Simons (as of March 31):

-

Franco-Nevada

Founded in 2007, it is a gold-focused royalty and streaming company. The company owns a diversified portfolio of precious and base metal royalties. Simons owns 4,837,390 shares of Franco-Nevada, representing about 0.75% of his portfolio. The shares of the company are up more than 20% year-to-date and over 12% in the last three months. Franco-Nevada is headquartered in Toronto, Canada.

-

Kroger

Founded in 1883, this company operates supermarkets and multi-department stores. It owns many household brands, including Heritage Farm, Big K, Simple Truth Organic, Check This Out, and more. Simons owns 17,174,071 shares of Kroger, representing about 0.77% of his portfolio. The shares of the company are up more than 18% year-to-date and over 1% in the last three months. Kroger has its headquarters in Cincinnati, Ohio.

-

Palo Alto Networks

Founded in 2005, this company provides network security solutions to government entities, enterprises and service providers. Palo Alto Networks works through the following geographical segments: Asia Pacific and Japan; Americas; and Europe, the Middle East, and Africa. Simons owns 2,063,130 shares of Palo Alto Networks, representing about 0.83% of his portfolio. The shares of the company are up more than 8% year-to-date and over 12% in the last three months. Palo Alto Networks is headquartered in Santa Clara, Calif.

-

Baidu

Founded in 2000, this company offers internet services. Some of its popular products and services are: Baidu Search, Baidu Post Bar, Haokan, Quanmin, Baidu Encyclopedia, Baidu Feed, Baidu Knows, and more. Simons owns 3,204,791 shares of Baidu, representing about 0.87% of his portfolio. The shares of the company are down more than 15% year-to-date and over 19% in the last three months. Baidu has its headquarters in Sydney, Australia.

-

Atlassian Corporation

Founded in 2002, it is a holding company that designs, develops and offers software hosting services. Some of its popular products and services are: Trello, Sourcetree, statuspage, JIRA software, Service Desk, Confluence and more. Simons owns 3,341,420 shares of Atlassian Corporation, representing about 0.88% of his portfolio. The shares of the company are up more than 15% year-to-date and over 20% in the last three months. Atlassian is headquartered in Sydney, Australia.

-

Target Corporation

Founded in 1902, this company owns and operates general merchandise stores. It procures and sells food assortments, including dairy, frozen items, perishables, and dry grocery. Simons owns 3,586,059 shares of Target Corporation, representing about 0.88% of his portfolio. The shares of the company are up more than 40% year-to-date and over 21% in the last three months. Target Corporation has its headquarters in Minneapolis, Minn.

-

Monster Beverage

Founded in 1990, it is a holding company that develops, markets, sells and distributes energy drinks, beverages and concentrates. The company has the following business segments – Monster Energy Drinks, Strategic Brands, and Other. Simons owns 7,956,760 shares of Monster Beverage, representing about 0.9% of his portfolio. The shares of the company are down more than 1% year-to-date and over 3% in the last three months. Monster Beverage is headquartered in Corona, Calif.

-

Zoom Video Communications

Founded in 2011, this company offers video-first communications platform. It provides products for meetings, phone systems, video webinars, chat and more. Simons owns 2,520,863 shares of Zoom Video, representing about 1.01% of his portfolio. The shares of the company are up more than 16% year-to-date and over 18% in the last three months. Zoom Video has its headquarters in San Jose, Calif.

-

Verisign

Founded in 1995, this company offers internet infrastructure and domain name registry services. It primarily offers security, stability and resiliency of key internet infrastructure. Simons owns 4,868,314 shares of Verisign, representing about 1.2% of his portfolio. The shares of the company are up more than 7% year-to-date and over 13% in the last three months. Verisign is headquartered in Reston, Va.

-

Novo Nordisk A S

Founded in 1925, this company deals in the research, development, manufacture, and marketing of pharmaceutical products. Novo operates through the following business segments – Biopharmaceuticals and Diabetes & Obesity Care. Simons own 24,846,671 shares of Novo Nordisk, representing about 2.08% of his portfolio. The shares of the company are up more than 23% year-to-date and over 24% in the last three months.