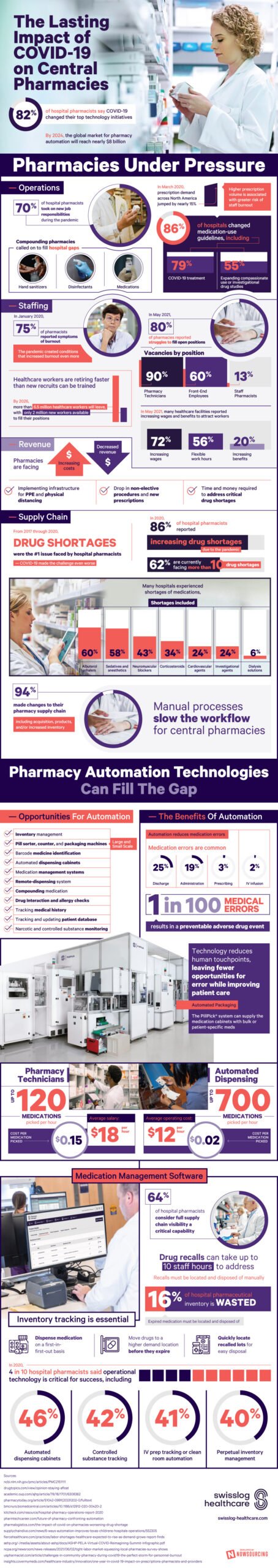

The COVID-19 pandemic has changed the role of hospital pharmacies. 70% of hospital pharmacists say they’ve taken on new job responsibilities during the pandemic. The vast majority of hospitals changed medication-use guidelines to account for COVID-19, be it direct treatment for the disease or greater degrees of compassionate use of investigational drug studies. Implementing prevention measures like PPE have increased costs for the pharmacy. Meanwhile, drops in elective procedures have led to lower revenues, a dangerous combination for any organization.

Q3 2021 hedge fund letters, conferences and more

The Problems Faced By Central Pharmacies

At the same time, staffing shortages already present in the industry grew worse. Burnout drives people away from pharmacy jobs. By May 2021, 80% of pharmacies reported struggles to fill open positions. The most common vacancies were pharmacy technicians (90%) and front-end employees (60%). These positions are high stress and (relative to other healthcare positions) lower-paying. Increasing wages and benefits are necessary, but they alone are not enough to fix labor shortages. Healthcare workers are currently retiring faster than new recruits can be trained. By 2026, more than 6.5 million healthcare workers will leave the field, but only 2 million new workers will enter. That leaves a gap of over 4 million positions.

From 2017 to 2020, drug shortages were already the #1 issue faced by hospital pharmacists. Supply chain complications arising from the pandemic intensified the issue. In 2020, 86% of hospital pharmacists reported increasing drug shortages due to COVID-19. 62% are currently facing shortages in more than 10 drugs. The most common shortages affect crucial, even life saving medications like albuterol inhalers, neuromuscular blockers, and cardiovascular agents. These medications could prevent patient deaths were they available to the pharmacy for use. 94% of pharmacies made changes to their supply chain to address this issue, but said changes take time and can slow workflow in already bustling locations.

The problems faced by central pharmacies have led some to see pharmacy automation technology as the answer to their woes. Some opportunities for automation within the industry include automated dispensary machines, inventory tracking, and controlled substance monitoring. All 3 allow pharmacies to keep better track of their resources while allowing for fewer people to work to keep the doors open. Some of the 4 million healthcare worker vacancies could be filled by machines instead of people. By 2024, estimates say the global market for pharmacy automation will reach nearly $8 billion. Hospital pharmacies will operate differently in the post-pandemic era.

Infographic source: Swisslog Healthcare