When Tellurian Inc (NASDAQ:TELL) signs 10-years contracts with Gunvor and Vitol they are not winners. It is obvious that the contracts were signed below their economic costs at a level non-accretive for the shareholders base.

Q1 2021 hedge fund letters, conferences and more

- Contracts were signed regardless of Driftwood’s base-costs.

- The netback formula used transfers 100% of Driftwood’s economic risk to the equity shareholders.

On June 2, 2021, Driftwood LNG LLC (“Driftwood LNG”) has entered into an LNG Sale and Purchase Agreement (the “LNG SPA”) with Vitol Inc., a Delaware corporation (“Vitol”). Subject to certain adjustments set forth in the LNG SPA, Vitol’s annual contract quantity (“ACQ”) of liquefied natural gas (“LNG”) will be 156,510,000 million British thermal units (MMBtu).

The price for LNG sold under the LNG SPA will be a blended average price based on the Platts Japan Korea Marker (“JKM”) index price and the InterContinental Exchange Dutch Natural Gas Title Transfer Facility (“TTF”) futures contract price, in each case minus a transportation netback. The term of the LNG SPA is ten years from the date of first commercial delivery in respect of Plant 1 or Plant 2 of the Driftwood terminal.

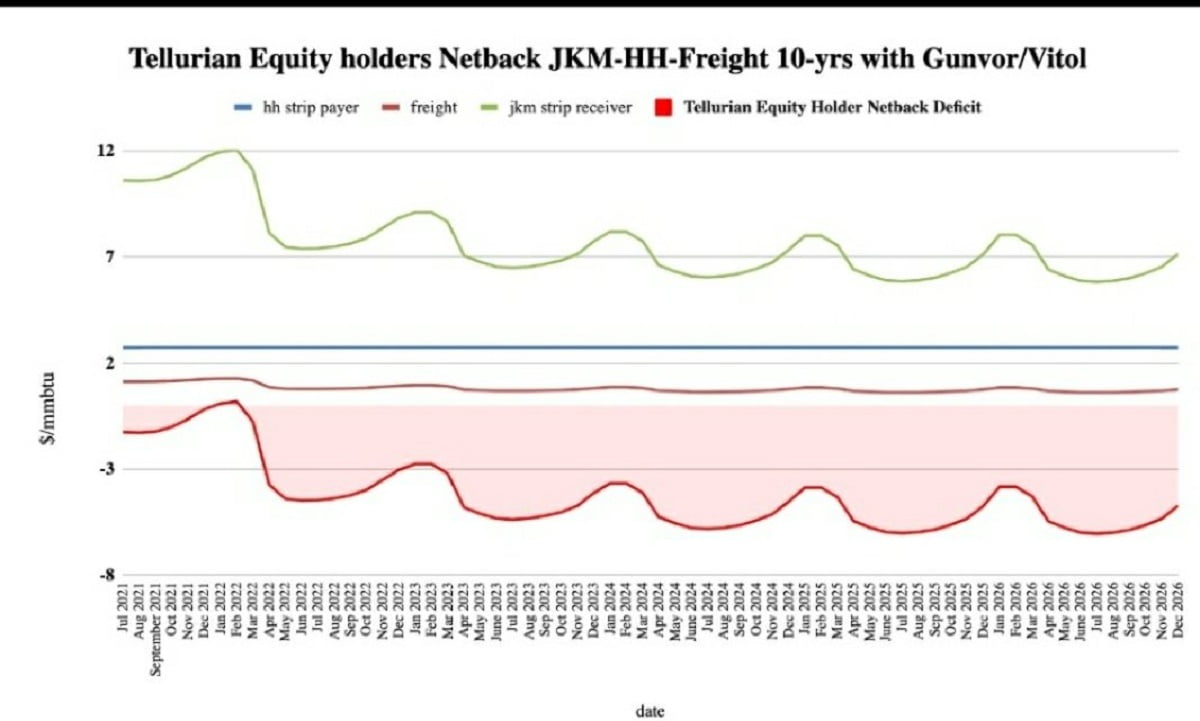

Formula : (JKM+TTF)/2 – freight -hh – fixed cost= netback

The netback pricing used by to sign contracts demonstrates that Driftwood LNG is at a deficit.

Based on the material definitive agreement releases and using the back the envelope pricing formula @16.6MMT, 10 year, Tellurian as a JKM receiver would lose more than $6,000,000,000.

The company floats a $14 or $15 of cumulative free-cash flows per share but Driftwood cumulative economic value is negative by more than $6 per share.

While the market initially reacted positively to two commodity contracts agreements no one has adressed Tellurian inc.’s underlying logic. If a contract generates $12B in sales but returns below the cost of capital would any bank accept to finance billions in project’s finance debt ?

Sinkies

It sounds like Tellurian signs blockbuster deals below their costs. What are these guys up to these days ? Are they raising capital?

The more you look at Tellurian the more you will find the ” big picture“.

Article by The Driftwood 22 DISCLOSURE Project